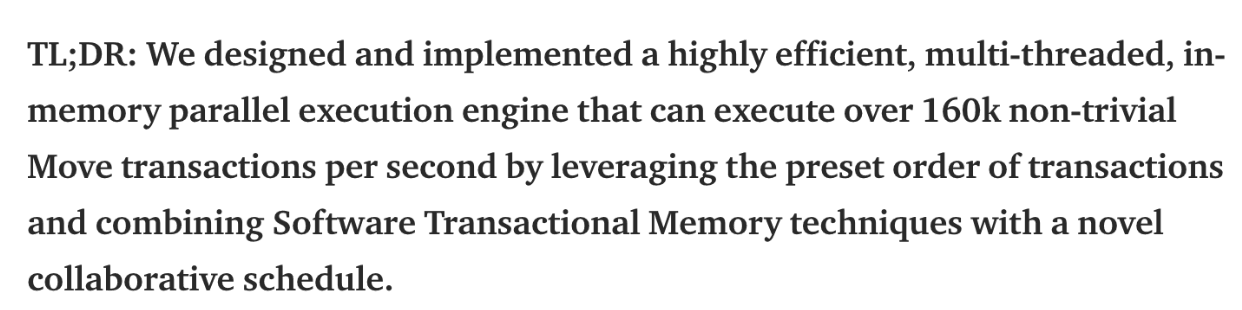

TLDR

Similar to Sui, Aptos was developed by former employees at Meta who were the original builders of Diem, Meta’s original blockchain initiative that was abandoned in January.

Aptos focuses on maximizing network capacity in a manner similar to Sui and Solana, but with some key distinctions.

Aptos processes transactions in parallel by leveraging on the Block-STM engine, which optimistically executes batches of transactions in parallel and validates them post-execution, thus maximizing parallelism given a particular ordering.

Aptos blockchain natively integrates and internally uses the Move language which aims to enable fast and secure transaction execution, allowing developers to better protect their offerings from malicious entities.

Aptos claims that its redesigned state sync protocol allows clients to validate and sync over 10,000 TPS with sub-second latency, and that Aptos is on track to hit 100,000 TPS soon.

Registration for Aptos incentivized testnet 3 will begin on August 19.

Key Terms

| TERM | DEFINITION |

|---|---|

| Byzantine Fault Tolerance (BFT) | Byzantine fault tolerance (BFT) is the property of blockchain consensus that enables the network to reach consensus even when some of the nodes are faulty/malicious. |

| HotStuff | A leader-based Byzantine fault-tolerant replication protocol for the partially synchronous model. Once network communication becomes synchronous, HotStuff enables a correct leader to drive the protocol to consensus at the pace of actual (vs. maximum) network delay--a property called responsiveness--and with communication complexity that is linear in the number of replicas. The AptosBFT is a derivative of Hotstuff. |

| Move | Move is the new programming language based on Rust that implements all the transactions on the Aptos Blockchain. |

| Move Virtual Machine (MVM) | The MVM executes transaction scripts written in Move bytecode to produce an execution result and it is part of the validator. |

| Merkle Accumulator | It’s an append-only Merkle tree that the Aptos blockchain uses to store the ledger. Merkle accumulators can also provide proofs that a specific transaction was included in the chain. |

| Move Module | Defines the rules for updating the global state of the Aptos Blockchain. It's commonly known as a smart contract. |

| Resources | Data that can be accessed according to the procedures declared in a Move module. Move resources can never be copied, reused, or lost. This protects programmers from accidentally or intentionally losing track of a resource. |

| Block-STM | Block-STM is a parallel execution engine for smart contracts, built around the principles of Software Transactional Memory. It helps to accelerate smart-contract execution, originating from the Diem project and further developed by Aptos Labs. |

Overview

Aptos is a new layer-1 blockchain founded by Mo Shaik and Avery Ching, both former Meta developers who worked on the Diem project. It focuses on maximizing network capacity in a manner similar to Sui and Solana, but with some key distinctions.

Vision

To deliver a blockchain that can achieve mass adoption and achieve mainstream adoption to web3 through utilizing decentralized applications to resolve real-world problems. Aptos focuses on blockchain reliability, safety and performance through its flexible and modular architecture.

Key Features

- Swift and secure execution via the Move smart contract programming language.

- High throughput and low latency through a parallelized approach to transaction processing.

- New parallel transaction processing that supports multiple operations in a single logic entity through Block-STM.

- Stake-weighted validator rotation to optimize for performance and decentralization.

- Modular design that aims to have appropriate threat modeling and seamless deployment to ensure security and reliability of operations as well as upgradable and configurable design principles to progress with the evolution of the Aptos project based on the latest technology through its modular architecture.

- Sharding concept for horizontal throughput scalability while seeking to reduce complexity for node operators

Move Language

Like Sui, Aptos also uses Move as its programming language.

Challenges with other existing blockchain languages

- Indirect representation of assets: Assets on other blockchains are encoded as integers, this makes it easy for developers to make mistakes when writing programs that interact with these assets.

- Scarcity is not extensible: Programmers find it difficult to create custom assets, as these new custom assets need to have “scarcity” such that no one can create new tokens out of thin air.

- Access control is not flexible: It's fairly complicated giving owners the ability to protect their assets with access control policies.

Move allows developers to define custom resource types with semantics inspired by linear logic, which allows the creation of flexible customized access controls and custom resources that adhere to the concept of scarcity. These resources refer to anything that stores value such as tokens.

Move’s resource safety seeks to ensure that resources can never be copied, reused or lost, only moved between program storage locations. This prevents malicious individuals from duplicating existing assets or creating new assets without permission. Even Meta’s now-defunct Libra currency was implemented as a custom resource with no special status in the Move language. With these safety guarantees, it makes it easier for developers to build without having to be troubled by the need to ensure security and scarcity, since the Move language has it already built in.

AptosBFT Consensus Mechanism

AptosBFT is the network’s BFT consensus algorithm, a variant of the battle-tested HotStuff consensus protocol (leader-based BFT replication protocol). AptosBFT can validate transactions and commit blocks in as few as 2 network round trips (faster than the many rounds of voting other consensus mechanisms require to securely validate transactions). The protocol also aims to achieve sub-second finality coupled with Aptos’ automatic leader rotation optimization which analyzes the on-chain state and automatically updates leader rotations to adjust for non-responsive validators without any human intervention. This makes it well suited for decentralized environments.

Parallel Transaction Execution

Aptos uses parallel execution which allows more transactions to be processed at any given time. This design is similar to Sui, which was also founded by ex-Meta employees.

Aptos’ parallel execution leverages the Block-STM engine, which optimistically executes batches of transactions in parallel and validates them post-execution, thus maximizing parallelism given a particular ordering. When conflicts arise, unsuccessful transactions are re-executed, with all higher transactions being revalidated as well.

Unique to Block-STM is its ability to optimize its parallelism architecture from any workload, thus making it support more complex transactions simultaneously. This design offers low latency and costs for users.

In a time where rollups and sharding are all the hype, people often forget about the second-order problems associated with these methods, such as higher transaction latency and lack of composability. This is where Aptos could shine by offering most of the functionalities that rollups and sharding supposedly bring to the table without issues such as higher latency and lack of composability.

Block-STM Advantages:

No need to commit transactions individually: Avoids synchronization cost of committing transactions individually. Block-STM simply lazily commits all transactions in a block with light synchronization.

VM provides safety for optimistic memory access: Transactions are specified in smart contract languages such as Move and Solidity, and run in a virtual machine that encapsulates their execution and ensures safe behavior. This separates the abstractions nicely and allows Block-STM to avoid handling the aftermath of inconsistent states during the parallel speculative execution.

Pre-defined order reduces synchronization: The final outcome is guaranteed to match a sequential execution of transactions in a fixed, preset order, and this reduces the amount of synchronization required during execution.

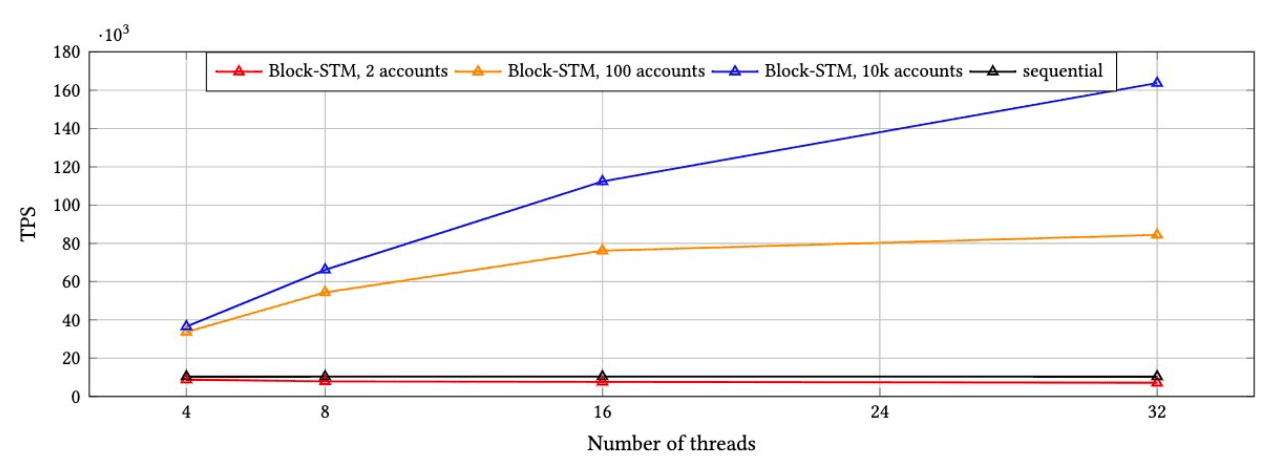

Looking at the test results above which compares Block-STM performance against a sequential execution of a block, with 32 threads working in parallel, the network is able to handle a staggering 160,000 TPS with low latency and time to finality.

So now it begs the question, how does Aptos aim to achieve this kind of performance? It’s really thanks to its collaborative scheduler and its multi-versioning technique which helps the network to increase its efficiency.

Collaborative scheduler helps by:

Preventing duplicate efforts: Although every aborted transaction is re-executed, the same transaction is never executed concurrently by more than one thread.

Ensuring Security: If a transaction is re-executed, then all higher transactions must be revalidated. As a result, the same transaction execution might be validated concurrently by different threads, but at most one can abort it.

Proper ordering: A transaction that encounters a dependency is resumed after the dependency is resolved.

Aptos’ parallel execution engine could potentially change existing MEV techniques, since transactions are now ordered, or re-ordered across one or more blocks to optimize concurrency for parallel execution.

Security Advantages of Move vs Solidity

There have been many hacks and vulnerabilities to blockchains that have utilized the programming language Solidity. Solidity is susceptible to vulnerabilities such as re-entrancy, arithmetic over/under flows and others.

Move is built for safe resource management and modularity. The Move programming language allows for security features such as:

- Move Prover which is able to verify functional correctness

- Defined custom resources that can’t be forked or discarded

| Comparison | Aptos Move | Solana Sealevel | EVM |

|---|---|---|---|

| Data Storage & Ownership | Stored within owner’s account | Stored within the account associated with the smart contract | Stored within the owner’s account associated with a program |

| Parallelization | Capable of inferring parallelization | Requires specifying within the transaction of all accounts and programs accessed | Serial |

| Transaction Safety | Sequence number | Transaction uniqueness and remembering transactions | Nounces, similar to sequence numbers |

| Type Safety | Module structs and generics | Program structs | Contract types |

| Function Calling | Static dispatch not on generics | Static dispatch | Dynamic dispatch |

Data Storage & Ownership

As data storage and ownership is stored within the owner’s account for Aptos Move, the owner can ensure that malicious programming modules will be unable to modify the owner’s assets. A standard orderbook structure and interface would not let applications built on top of Aptos gain backdoor access to an account and its assets.

State Sync

State sync between nodes can be CPU intensive for high throughput networks like Aptos. This factor has been often overlooked in blockchain design and is something that projects rarely discuss.

To enhance the performance of the network, Aptos has redesigned its latest state sync protocol which the team claims can validate and sync over 10,000 TPS with sub-second latency, with the network on track to hit 100,000 TPS soon.

Given that validators already execute transactions and attest to the resulting blockchain states through Merkle proofs, nodes can rely on the state deltas produced by the validators and skip transaction execution (heavy lifting) which allows them to directly update the ledger state. This method, however, does come at the cost of increased network usage (about 2.5x).

A key feature that enables Aptos to achieve such results is its usage of a Merkle accumulator for synchronization. This accumulator provides proof that specific transactions are included in the chain, which prevents nodes from having to download the entire transaction ledger. Trusted waypoints also enable faster syncing for nodes to catch up as well. Obviously, being an off-chain mechanism there is no way to “prove” a waypoint, the nodes must trust waypoints in order to jumpstart.

Now… Why is State Sync important?

Affects Time to Finality (TTF): The faster the blockchain data is replicated across the network, the lower the TTF.

Keeping validators up to speed: If state sync cannot process transactions as quickly as they are executed by consensus, crashed validators will never be able to recover.

Decentralization: Yes, this still exists. Faster state sync offers more rotations between validator sets, which allows the network to choose from more validator sets. More validator sets = less centralization.

Data correctness: State sync helps avoid malicious entities manipulating the network (e.g. censorship, modifying, etc).

Building blocks of Aptos State Sync Protocol

Persistent Storage: Aptos uses RocksDB to ensure data is safe during unexpected machine crashes and failures.

Verifiable blockchain data: Aptos uses Merkle trees over committed transactions and the resulting chain state as well as having validators sign the Merkle roots for authentication.

Root of trust: Given that Aptos supports dynamic validator sets, peers need to be able to identify the current validator set from a verified history of the Aptos blockchain. Aptos does it by using (i) a genesis blob authenticated by Aptos, which identifies the first validator set and initial blockchain state S⁰; and (ii) a recent trusted waypoint (e.g., a hash of the current validator set and blockchain state Sⱽ). Together, the genesis blob and waypoint form a root of trust allowing peers to synchronize the real Aptos blockchain and prevent attacks. In simple form, Aptos provides a trail of evidence to make it obvious for peers to identify the real chain.

Function Calling

Move utilizes Static dispatch which is supported by both value types and references types while EVM utilizes Dynamic dispatch which is only supported by reference types. What this means is that for Dynamic dispatch, the implementation is chosen at runtime instead of compile-time which causes it to be more expensive. Static dispatch on the other hand the compiler knows at compile-time which implementation is to be called and the compiler can thus execute swiftly whilst being optimized. This gives Move an advantage over EVM as transactions can be done faster and more efficiently.

Key Management Service

“Not your keys, not your coins”.

Aptos accounts support key rotation and hybrid custodial models. For example, a user can delegate the ability to rotate the account’s private key to one or more custodians and other trusted entities.

The user can set this up by using a Move module to rotate the key under specific circumstances. Such key recovery services can significantly reduce private key compromises or losses.

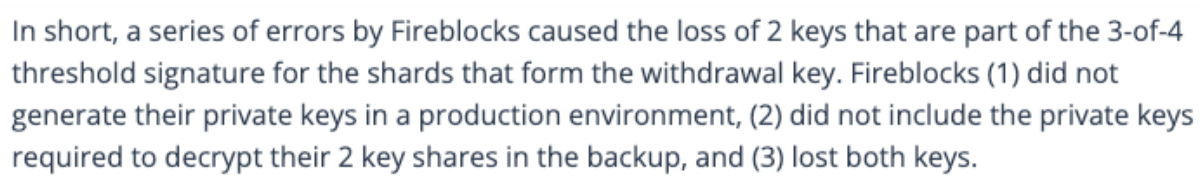

This function would have been great to have at the time of the Fireblocks-Stakehound controversy, when Fireblocks was said to have failed to backup a customer's private keys, resulting in losses of $75 million in ETH.

State Sharding - Horizontal throughput scaling

Aptos will be launched with a single ledger state; however, in the future, to improve scalability, it will transition to multiple sharded ledger states while maintaining decentralization. Each of these shards will provide a homogenous API and regard sharding as a first-class concept.

Data may be transferred between shards through a bridge, somewhat similar to how the beacon chain in Ethereum facilitates communication between shards by sharing transaction data. With this scheme, each node only needs to store the state data allocated to it, and can obtain other state data it needs from other nodes. Developers are free to select the sharding method that best suits their requirements. To maximize the effectiveness of intra-shard connections, developers can, for instance, suggest creating a new shard or grouping users into a single shard.

This design allows developers to program with a single universal state across shards and enables wallets to easily incorporate sharded data for their users.

Ongoing Testnet

Unfortunately, registration for the Aptos Incentive Testnet 2 (AIT2) already ended as of May 19th. But, Aptos Incentivised Testnet 3 (AIT3) registration will begin on August 19th.

AIT2 saw 225 community nodes spread across 44 countries and 110 cities around the world. The requirements for running a node (probably similar for AIT3 for those that are interested) are as follows:

- Perform required objectives on time such as joining validator set within 24 hours and exiting upon conclusion

- Node liveness defined by metrics push data >= 95%

- Participation defined by one consensus proposal per hour >= 95%

- Vote in at least 25% of consensus round

Selected participants were rewarded 500 Aptos tokens for meeting all criterias above, 300 for those who achieve at least 50% liveness and participation along with other criterias. 200 tokens bonus was given for the top 10% of nodes that upgraded at least once, operators that kept nodes in remote regions and operators that helped identify critical issues and significant contributions. Do note that only non-US participants can be given Aptos tokens and tokens will be subjected to a one year lockup period.

Anyone can now run a node on Aptos in just 15 minutes thanks to the partnership between Aptos Labs and Google Cloud. It's important to note this because it shows that the network can grow without being constrained by burdensome hardware requirements. However this also introduces a possible single point of failure, if Google Cloud was to go down. The added centralized nature of Google and its mandatory compliance requirements in the US is also a good point to take note of.

DApps and Airdrops

Similar to other decentralized applications, it is rumored that airdrops will likely be based on activity during the various testnets. Besides being an incentivised validator, to stand a chance for a possible airdrop of the APTOS token or other tokens in the Aptos ecosystem, users should try out the various applications below with all their functions. Do note that some dApps are still in the process of building and this list is not exhaustive.

Wallets

Fewcha Wallet Fewcha Wallet is a web3 wallet that unlocks a universe of applications in Aptos blockchain. It allows users to securely store, send and swap tokens and NFTs. It also allows web3 connection for dApps builders to integrate into the Aptos ecosystem. Fewcha is audited by Verichains Lab to ensure safety and security and they focus on privacy where a user is in control of their own wallet and funds at all times.

Martian Wallet Martian Wallet is a testing wallet built on the Aptos blockchain. It allows users to create and import wallets, deposit & send transactions, view wallet history as well as view NFTs. It is backed by Aptos, Mo Shaikh (Co-founder of Aptos) and Toy Ventures.

Pontem Pontem Wallet is the bridge into Aptos and the rest of web3. Users are able to access Aptos web3 apps directly from their browser extensions. Users can create and manage their private keys to access their cryptocurrency tokens such as the APTOS token and USDC. Pontem is backed by Aptos, Mechanism Capital, Alameda Research, Delphi Digital, Animoca Brands, Kenetic and others.

Onto Onto is a multi-chain wallet that allows users to manage all their assets with a single private key. Onto has a built in native cross-chain bridge & multi-chain exchange which allows users to swap & bridge with low fees.

Decentralized Exchanges, AMMs and Central Limit Order Books

Empo Empo aims to build the most secure decentralized exchange on Aptos. No other information released yet.

Econia Econia is an on-chain order book for the Aptos blockchain. Its newest features allow for delegated custodian capabilities and standalone swaps. With its newly delegated custody paradigm, it allows margin trading platforms to safely connect lenders, borrowers, buyers and sellers. Other decentralized applications are also built using Econia’s functionalities and open-source codes.

Laminar Markets Laminar markets is building a spot DEX on Aptos.

Pontem Network (Potential Airdrop) Pontem Network is building a decentralized exchange on the Aptos blockchain. Its liquidswap DEX is modeled after Uniswap and Curve for stable and unstable pairs. To engage with Pontem, simply swap tokens on their liquidswap DEX and utilize their Pontem Wallet.

Explorer

- Aptos Explorer The Aptos Explorer is the Etherscan equivalent on the Aptos blockchain. It is currently very simple, with limited functionality other than having simple transactional data.

Aggregators

- Hippo Labs Hippo Labs is building an aggregation layer for the Aptos ecosystem. It optimizes an aggregation mechanism by leveraging a friendly user-facing frontend which provides users direct access to the most optimal pricing and lending rates across multiple DEXs and money markets.

Lending and Borrowing

- Vial Protocol (Potential Airdrop) Vial Protocol is built on the Aptos blockchain to allows users to permissionlessly deposit collateral and borrow assets. Vial is the autonomous, algorithmic liquid protocol that utilizes pooled interest rates. Users can engage with Vial protocol by lending/borrowing assets and getting WBTC and USDC testnet tokens for possible airdrops in the future.

Derivatives Platform

Aries Market Aries Market is a margin trading protocol on Aptos. It allows users to lend, borrow and trade with margin via a fully on-chain order book.

Tsunami Finance Tsunami Finance is a derivatives platform that allows users to trade spot and perpetuals with 0 slippage and up to 30x leverage. It also allows users to receive liquid sustainable yield.

NFT Marketplace

- Topaz Market (Potential Airdrop) Topaz Market is the NFT marketplace built on the Aptos blockchain. It allows users to discover art, culture & digital expression. To explore the NFT marketplace to the fullest, users can buy or create an NFT on the platform for higher engagement and possibility of airdrop qualification.

Yield Farming & Liquid Staking

Seam Money Seam Money is a multi-chain distributed yield solution for stablecoins. It is designed in a simple ETF-Style to provide risk adjusted yield framing returns.

Zaptos Zaptos Finance is a liquid staking protocol on the aptos blockchain. It will allow users to earn yield on their staked APTOS with possible further use cases for staked APTOS.

DAO & Payments

- Paymagic Paymagic automates DAO rewards and payments through their API and is secured via Gnosis Safe. Payouts and payments for teams can be triggered via Github/Notion/etc. Bounty and grants can also be automated to the community and milestone-based payments can also be scheduled to compensate contributors.

Name Services

- Aptos Name Services (Potential Airdrop) Aptos Name Services is the composable identity layer for Aptos. It is a smart contract that maps a name to an Aptos address. Simply get an aptos name tagged to your wallet for possible airdrop chances in the future.

Oracles

- Switchboard Switchboard is a customizable oracle protocol for general-purpose and high performance data feeds from any API.

Investors

Even as VCs in the space have been cooling down on their investments causing projects to raise at lower valuations, Aptos has managed to more than double its valuation from its seed round in March this year. Many of the same investors, including a16z and FTX Ventures, have invested in both Sui and Aptos. It's intriguing that FTX Ventures has investments in both projects because one might argue that Sui and Aptos compete effectively with Solana. The world of high throughput and highly optimized layer-1s may not be zero-sum, there can exist a world with few highly optimized layer-1s that fulfill their niche markets.

Aptos Seed Round

- Raised $200m

- Valuation >$2b

- Round led by a16z

- Notable participation from Coinbase Ventures, FTX Ventures, Tiger Global, Multicoin, 3 Arrows Capital, ParaFi

Aptos Series A

- Raised $150m

- Valuation: >$4b

- Round led by FTX Ventures and Jump Crypto

- Notable participation from a16z, Apollo, Griffin Gaming Partners, Superscript by Temasek, Franklin Templeton, Multicoin and Circle Ventures

Team

Similar to Sui, much attention has been drawn to Aptos because of its “all-star” team. The Aptos team consists of former Meta employees who were working in the crypto research and development division of Meta (Novi, developing the Diem stablecoin as well as the bytecode language Move) as well as an impressive group of PhDs, researchers, engineers, designers and strategists.

Mo Shaikh Co-Founder & CEO: Prev Head of Partnerships at Meta, Consensys, BlackRock, Boston Consulting Group

Avery Ching Co-Founder & CTO: Prev Principal Software Engineer having led Meta’s internal Blockchain solutions, Apache GIraph, Yahoo

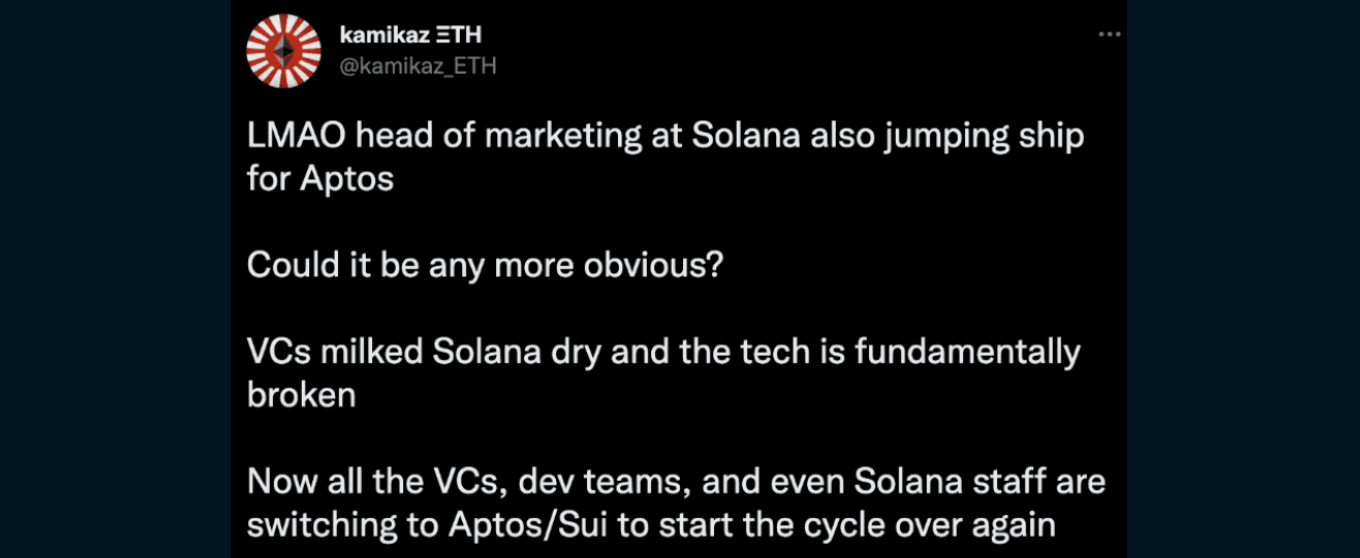

The Aptos team has recently engaged in aggressive hiring, most notably by bringing on board a number of Solana employees, including Austin Virts, the former head of marketing of Solana. This speaks volumes as these employees find it more enticing and promising to leave Solana for Aptos.

Roadmap

| Date | Activity |

|---|---|

| 19 August 2022 | Aptos Incentivised Testnet 3 Registration |

| 25 August 2022 | Code Freeze |

| 30 August 2022 | Aptos Incentivised Testnet 3 Launch |

| 9 September 2022 | Aptos Incentivised Testnet 3 End |

| Q3 2022 | Mainnet Launch |

| Q4 2022 - Q1 2023 | Aptos Incentivised Testnet 4 & Aptos Upgrades and Features Release |

In AIT3, Aptos plans to deliver on-chain voting and governance as well as lightweight state synchronization through backup and restore technology. Achieving this is crucial as it would allow Aptos to move forward with performing a decentralized network upgrade via on-chain governance as well as support new validators joining the network via their backup and restore technology.

In AIT4, Aptos plans to support as many validators as possible and provide validator DDoS protection. This is crucial for greater decentralization as well as validator evaluation to prevent malicious attacks.

The Good stuff:

Promising developer activities

More than 100 projects, including Potem Network, Martian Wallet and Solrise Finance, have been onboarded and have started building and testing on the network since Aptos launched their devnet in March. Like any other projects that are first starting out, grants provided by Aptos are also likely to attract more projects and developments to its ecosystem.

Note that quite a few Solana projects like Solrise Finance and Saber protocol are building on Aptos as well.

It would be good to keep an eye on the growth rates of both Aptos and Sui to see which one prevails, keeping in mind how comparable they are to one another in terms of both their basic offerings and testnet / launch timelines.

Sassal from Ethereum, he revealed in a tweet that he firmly feels the Solana builder community is one of the strongest in the field, coming just behind Ethereum, which obviously ranks #1. He has, however, acknowledged that in recent weeks, this "strong community" has begun leaving its Solana mothership for Aptos.

The Obstacles Ahead:

Strong competition

The competition in the L1 space is tremendous, with the likes of existing powerhouses such as Solana and Ethereum. Moreover, upcoming projects with strong teams and backers such as Sui & Celestia are also major L1 bets for the future. With Sui having similar technology and also similar investors, it is crucial for Aptos to build up a community to attract both developers/builders as well as retail users.

As mentioned earlier, there are many projects and dApps that have been building on the ecosystem, with many already being announced and tested during its incentivised testnets. Aptos has onboarded more than 100 projects and with the launch of their Aptos Grant Program in late June, it is likely that many more projects are coming to build in the Aptos Ecosystem.

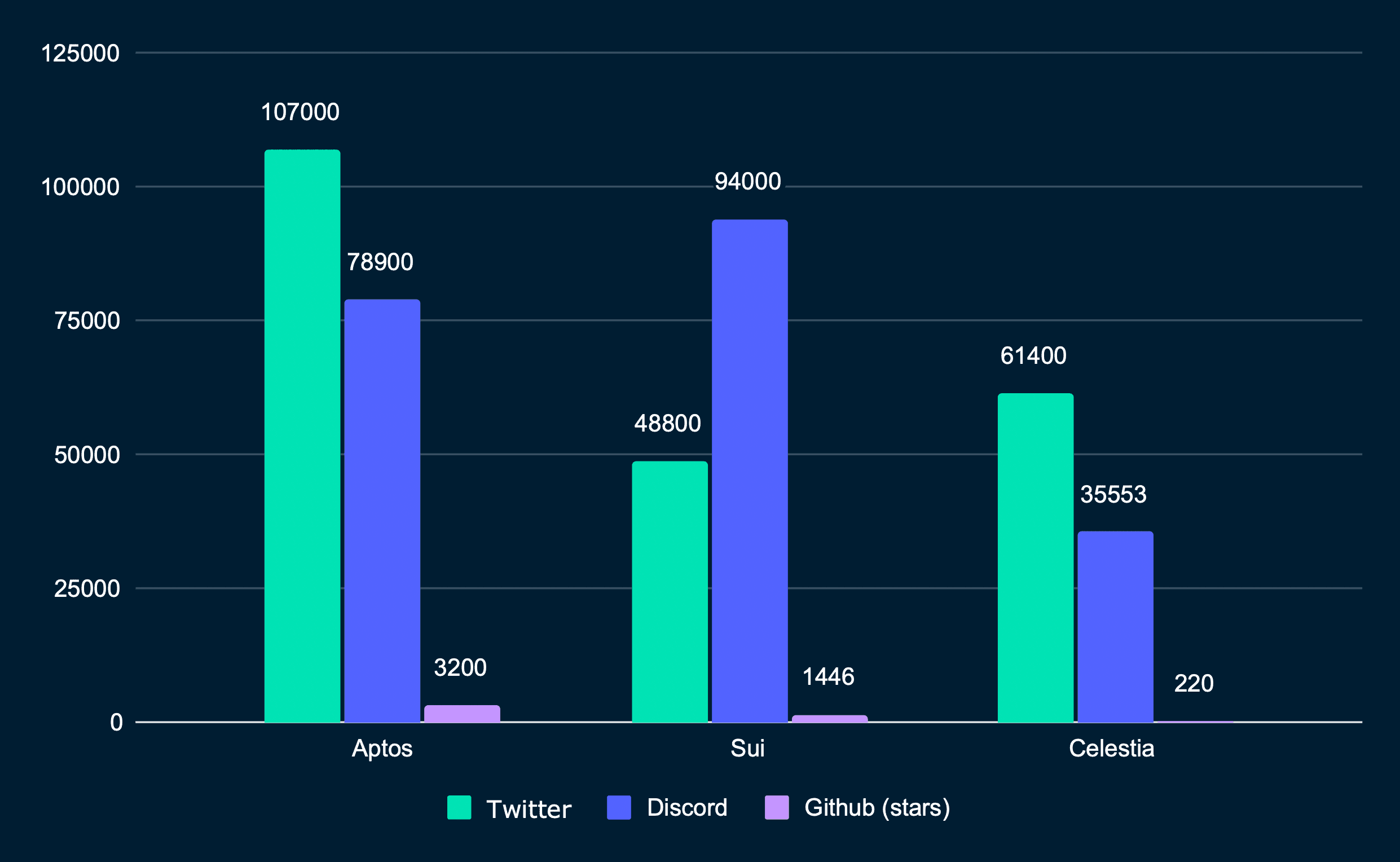

Moreover, Aptos has been quite successful in building up a community through its Discord, Twitter and GitHub. This can be seen in the chart below, which contains the social metrics of the early-stage/new L1 competitors.

Heavy VC Backing

It's no secret that numerous VCs are investing in both Aptos and Sui as a strategy to cover the high-throughput / maximizing network capacity segment. This is why there are common investors in both Sui, Aptos and Solana. Big name investors on the table such as a16z, Multicoin, ParaFi, Tiger Global and others have a long and successful history in crypto investments and have often chosen big winners in the space. Their influence and value add can help such projects.

However, there has also been increasing amounts of online chatter about whether investors are just jumping on the bandwagon with hopes of making a quick buck. This is in reference to how large-scale venture capital-backed projects frequently fail.

It is also precautionary to note that at the same stages of funding, Aptos is valued at a much much higher valuation compared to competitors such as Solana. For example, in the Seed Round, Solana raised only $3.17M at $0.04/SOL (~15.9% of the initial supply), thus a valuation of ~$20M in Apr 2018 as compared to the $200M raised by Aptos at a >$2B valuation. The seed round valuation of Aptos is already greater than the Public Auction Crowdsale which gave Solana an FDV of $110M in March 2020. Given the elevated valuation of Aptos, there might be a risk-off event when early investors off-load their vested tokens in order to lock-in profits. This greatly depends on the public sale valuation and based on previous projects, price would be propped up much higher initially for higher returns for early investors.

How you could participate right now

Spend 15 minutes setting up a node to participate in the incentivized testnet.

- You will need to KYC and pass a sanction screening process.

- Everyone can register and set up a node. However, only those who get specifically selected are rewarded. (Reward of 500 Aptos tokens)

- Criteria for being selected for testnet 3 are still not out yet, however, these were the criteria for testnet 2.

- Diversity (Geographic/hosting provider)

- Reputation

- Protocol success alignment

- Technical competency

Create an Aptos wallet.

Interact with Aptos DApps in different verticals.

- E.g. Pontem Network for Dexes / Solrise Finance for fund management / Vial for liquidity markets. Potential airdrop opportunities are highlighted above.

Aptos Grant Program (Builders)

- The Aptos grant program offers builders non-dilutive funding to accelerate and encourage the building of applications on the Aptos blockchain.

- There are various grant categories such as developer tooling, SDKs, open source & public goods, Applications (DeFi, NFTs, Gaming, DAOs etc) and many others. There are various criteria and proposal guidelines that can be found here.

Key Takeaways

It is important to be mindful that technical superiority alone almost never wins. This is why it will be worth keeping track of the growth stages of Aptos, and how it competes with its “close-sibling”, Sui. The speed of shipping and following its current roadmap targets whilst building up a strong community is crucial for Aptos given the strong competition in the space where technical differences might not be the differentiating factor to onboard the masses. Despite the fact that project valuations have fallen to new lows due to the present market conditions, it is remarkable that Aptos Labs was able to raise at such astonishing valuations. Perhaps the Layer 1 narrative is still very much alive and kicking.