Introduction

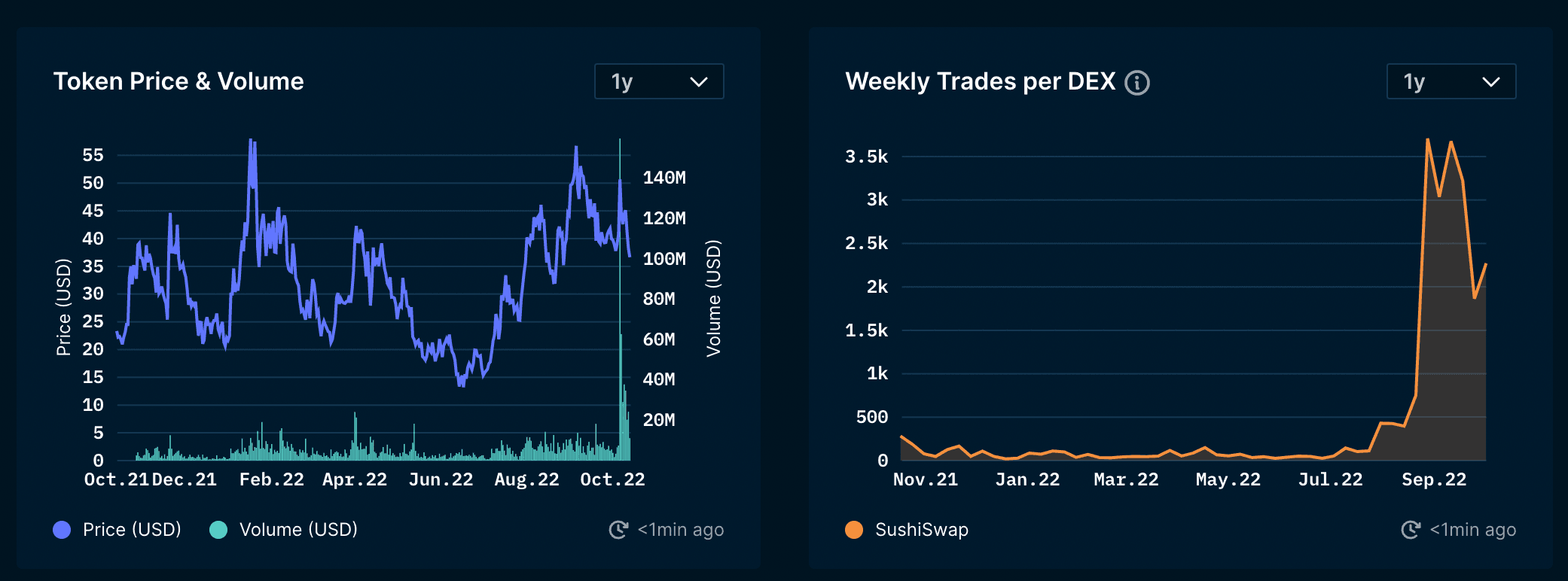

GMX has continuously proven to sustain itself and attract sufficient liquidity, despite an ongoing sideways market. According to CryptoFees, GMX is one of the most profitable protocols, generating over $337k daily in fees even surpassing Bitcoin, Aave, Curve, and majority of its counterparties. Value accrual to the GMX token remains extremely strong, as 30% of the platform fees are redistributed back to GMX stakers. This is a major incentive for GMX stakers to continue staking their tokens and to receive a decent yield in return. With the majority of alt-tokens hitting ATLs due to worsening market conditions, GMX has outperformed and managed to break new highs. More recently, GMX was also listed on FTX and Binance spot. GMX has built an incredible moat with new partnerships with Rage Trade, BreederDODO, Jones DAO, TreasureDAO, and many others.

In light of GMX’s successes over the past few months, we’ve decided to partner with our attributions team to come up with an Early GMX Staker tag. This tag refers to the top 100 addresses ranked by the amount and time spent staking GMX within the first month of GMX’s launch. The goal for this label is to identify and front-run any new narratives and trends “Early GMX Stakers” may be involved in.

Methodology

- “Early GMX Staker” refers to the top 100 addresses ranked by the amount and time spent staking GMX within the first month of GMX’s launch.

- This label was built to capitalize on the GMX narrative and help users surface some alpha on Arbitrum, given that GMX constitutes 39% of Arbitrum’s TVL.

- Additionally, the goal of the label and report is to also identify other farms that Early GMX Stakers are currently investing in.

When picking the parameters for the yield farms we want to investigate further, we set benchmarks following GMX’s performance.

Parameters for yield farms

Age of contract: ≥ 10 months (GMX launched about a year ago) Avg TVL: ≥ 100M (GMX had an average TVL of 150m for the past 2.5 months) Avg APY: ≥ 20% (GMX had an average APY of 20% for the past 2.5 months) Audits: Yes

Other things to consider:

- Our query tracks sbfGMX (receipt token for staking GMX), which takes into account all staking and unstaking events to calculate the sbfGMX token holdings.

- This might differ slightly from the data on Nansen Portfolio or our wallet profiler feature on-chain. We chose to include sbfGMX in our results to get the actual value of GMX the users have staked. sbfGMX that is sent for vesting is also important as they continue to earn rewards and users are technically still utilizing the platform - whether actively or passively.

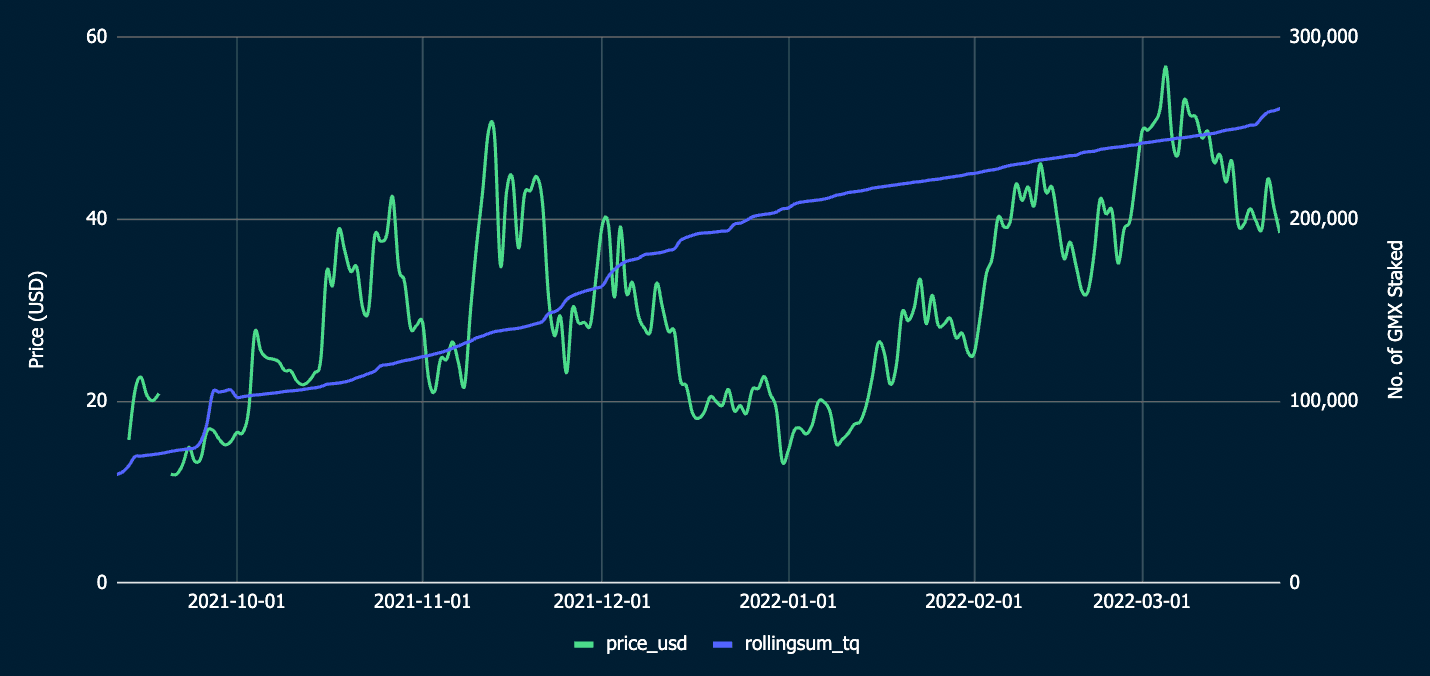

How many “Early GMX Stakers” are still staking their GMX?

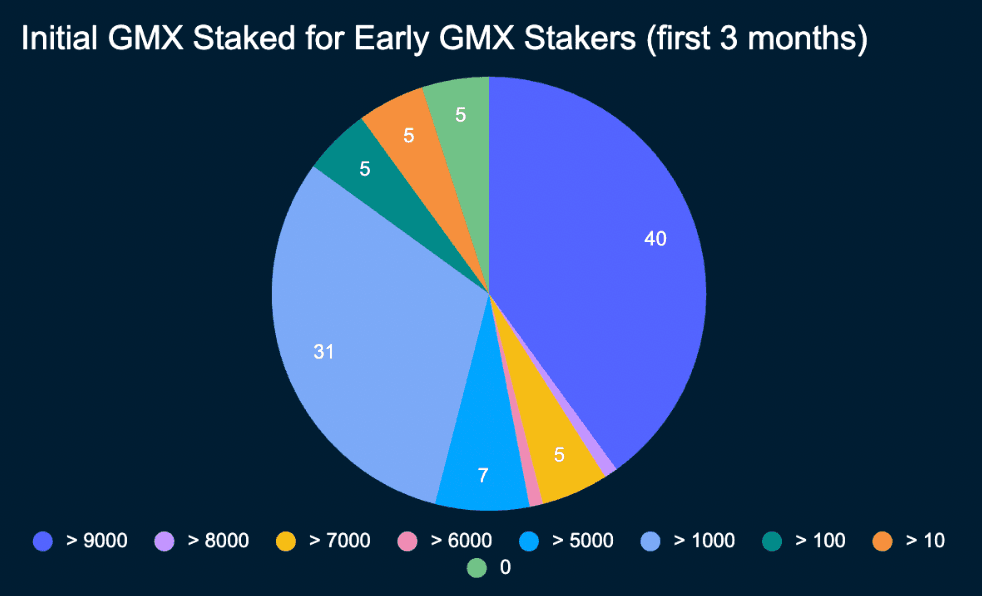

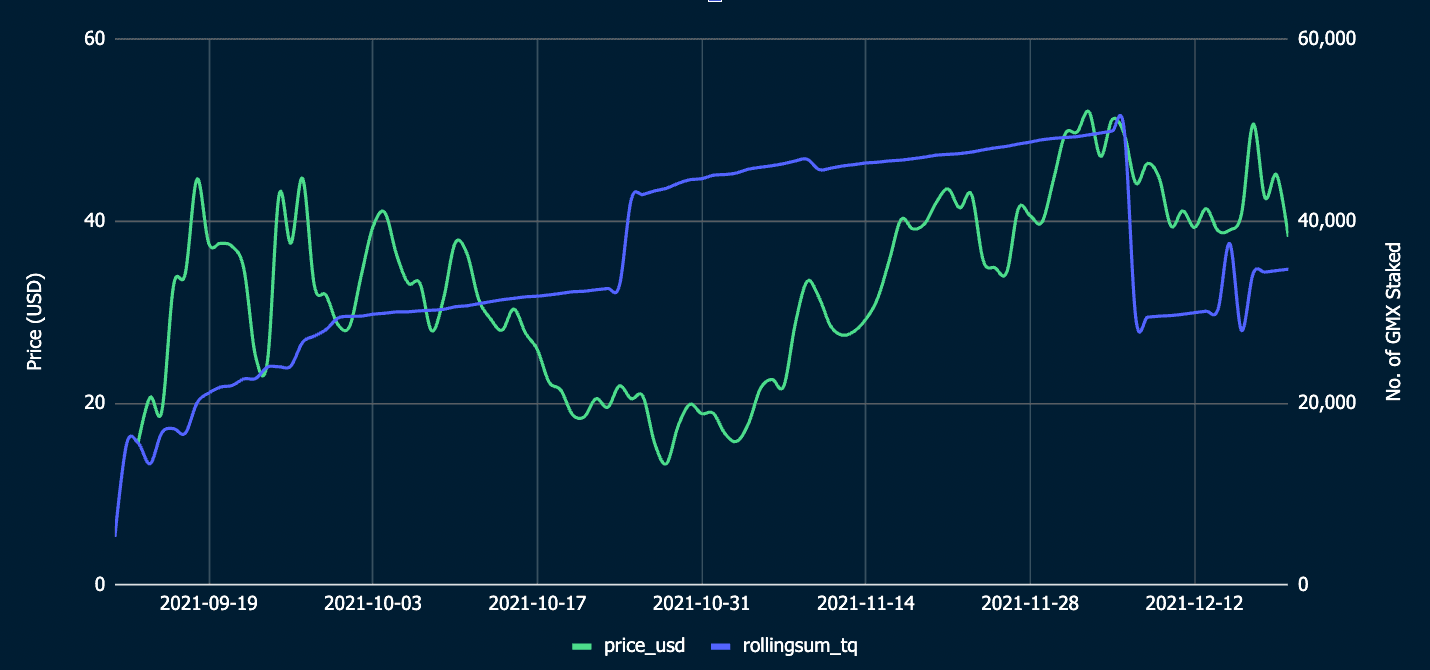

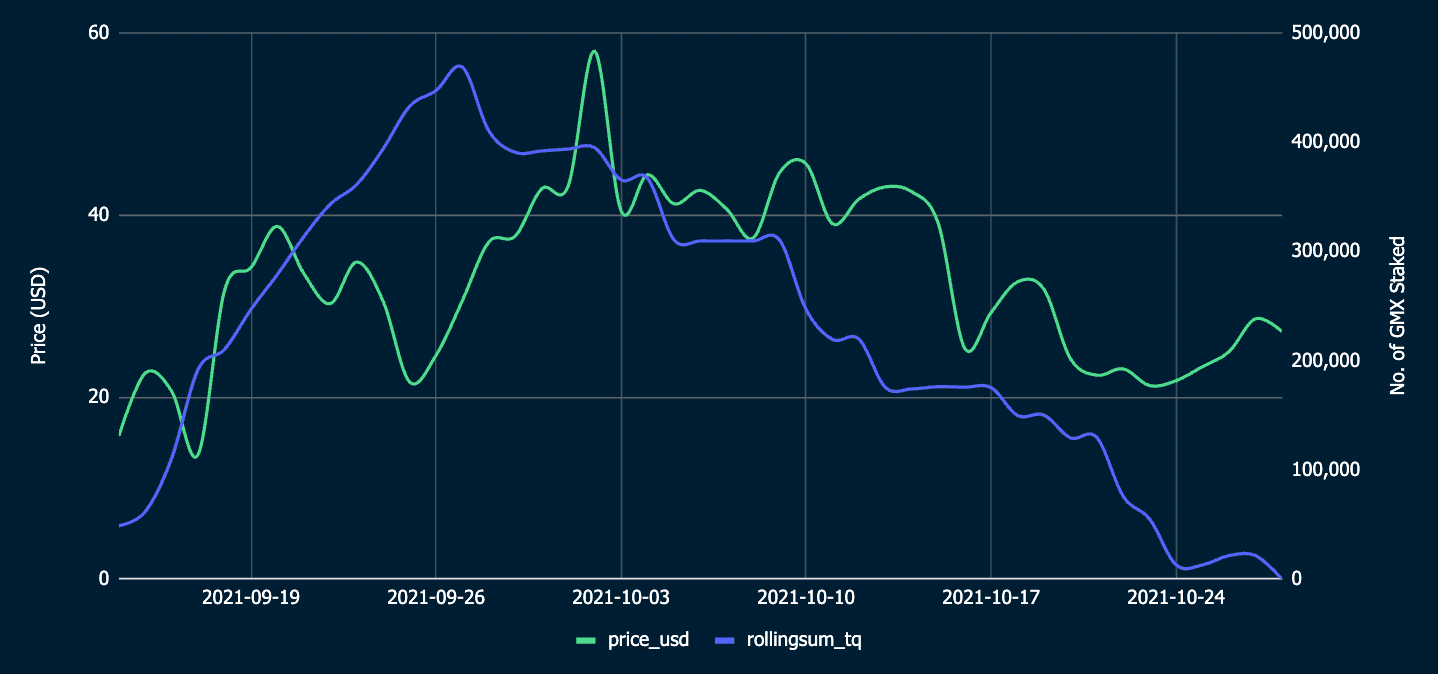

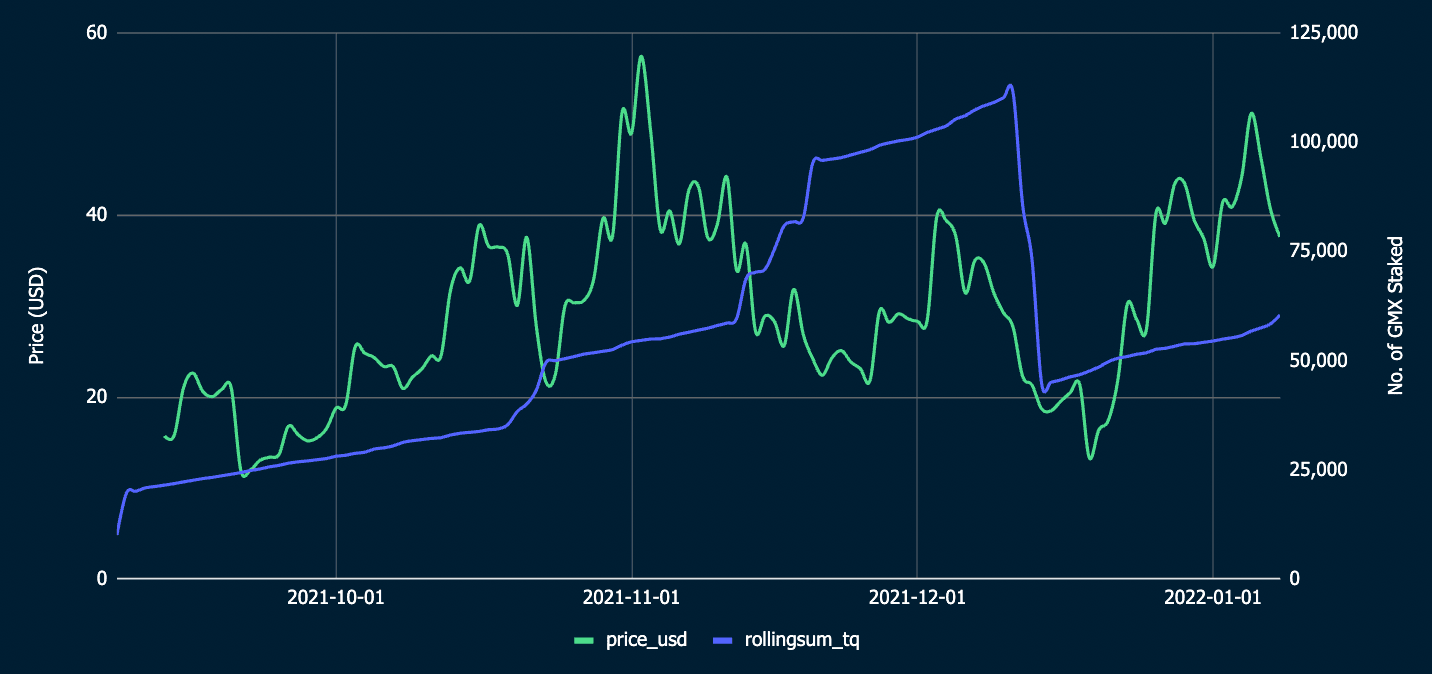

To understand how many “Early GMX Stakers” are still staking their GMX, a snapshot was taken between 21 August 2021 to 6 October 2021 on the amount of GMX staked by “Early GMX Stakers”.

40 addresses were staking >9000 GMX when the snapshot was taken. 31 addresses were also staking between 1000 and 5000 GMX. The rest of the addresses were spread out between lower values.

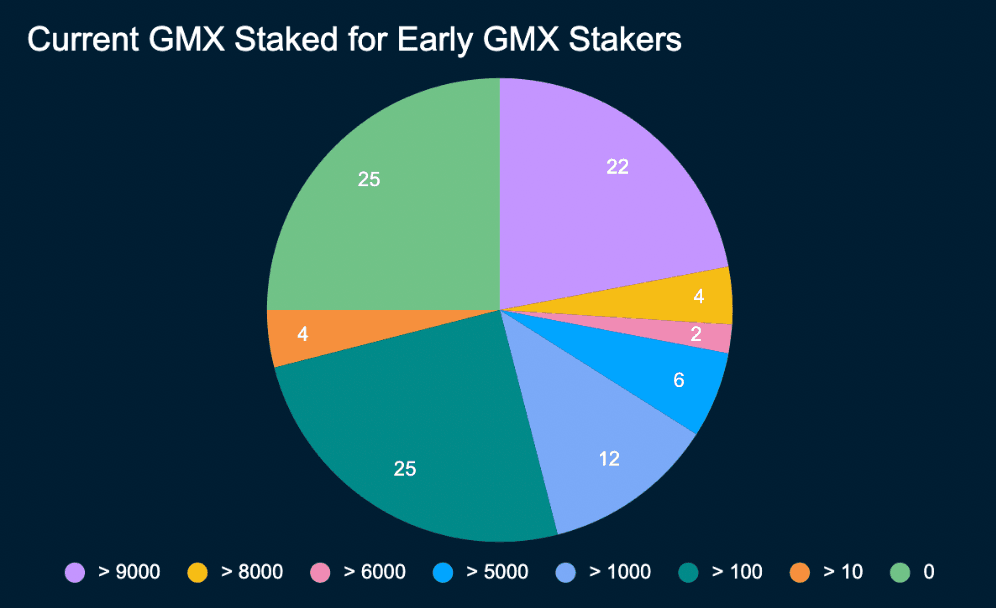

As of 15 Oct 2022, 25 addresses completely exited their staked GMX position. Compared to the previous snapshot of 40 addresses staking >9000 GMX, the pool has been reduced to 22 addresses. This could imply that most of the early GMX Stakers still have relatively high conviction on the long-term successes of the protocol. Compared to the previous snapshot of 31 addresses staking between 1000 and 5000 GMX, the pool has also decreased to 12 addresses as of now.

25 addresses have 100-1000 GMX staked, which implies that most of the Early GMX Stakers are still holding on to their GMX despite derisking their initial staked position.

Largest current holdings from “Early GMX Stakers”

- This section accounts for some of the top “Early GMX Staker” addresses with the biggest GMX holdings as of writing.

- The purpose of this section is for users to discover, track, and analyze some of the biggest diamond hands for GMX.

Below, the team scoped out a list of addresses with some of the largest staked GMX positions:

| Address | Label on Nansen |

|---|---|

| 0xf731f4c74eae61dfa88e0b6a13f9d2624bf2b16f | Smart Dex Trader |

| 0x18a209d21c7316c4d678170787aae15a5a2c2720 | NFT Collector |

| 0xd4ad5d62dce1a8bf661777a5c1df79bd12ac8f1d | Smart LP |

| 0x8d3c2279aaddeaf54e70fb28c5d7eedd7674d9c6 | n/a |

| 0x8003facaa0a0a669feb60a6362908ce5e720eb53 | Medium DEX Trader |

| 0x226bf1ee0bb0cf647f6a9f0d8b380d6ab56de3cb | Medium DEX Trader |

| 0x4e968d77aec3e74aa0884ac3cf13c3f98c570f38 | “BiggieM” on Opensea |

| 0x16f037a3ddf53da1b047a926e1833219f0a8e1fc | tybg.eth |

| 0xd03d26b36642c8137c77ae8fe91e205252db1095 | Blue Chip NFT Holder |

| 0x0fa8797eec1fdc55ad43f1843cac9d35724c1271 | n/a |

| 0x46d5d2a3229b0f6d3efee8567f6b63e1610cd2dc | “Zaiaz” on OpenSea |

| 0xd6484a997129938709fab588fd6f55b0a684ab56 | emeta.eth |

| 0x034302c77dcc0d8168a2d2c0c13c36becae21d11 | DEX Trader |

| 0x681ada67950d96dcc9f2951d32353663ed6e59c9 | Smart DEX Trader |

| 0x9aef7c447f6bc8d010b22aff52d5b67785ed942c | threediamonds.eth |

| 0xf672c51eaca83796c35da65074fb6a01ef14f29f | DEX Trader |

| 0x6f5eea1e20e69c5db953db53267d0ab99b98bb03 | Blue Chip NFT Holder |

| 0xd9a11e21e5ee82e2beadab268da69ce1b03a55db | Medium DEX Trader |

| 0x49f329ca3eab5dfd6fcc4bfe05bc366bd108a68e | n/a |

| 0xa0a6dc36041fb386378458006fecbddd02555ddd | GRT Distribution Participant; Elite DEX Trader |

| 0x834bd42d09717b4840c904ed712a7d57c100f5bb | doxxmyass.eth |

Notable On-Chain Behavior of Specific Wallets

- Wallet 0xf731f4c74eae61dfa88e0b6a13f9d2624bf2b16f (🤓 Smart Dex Trader)

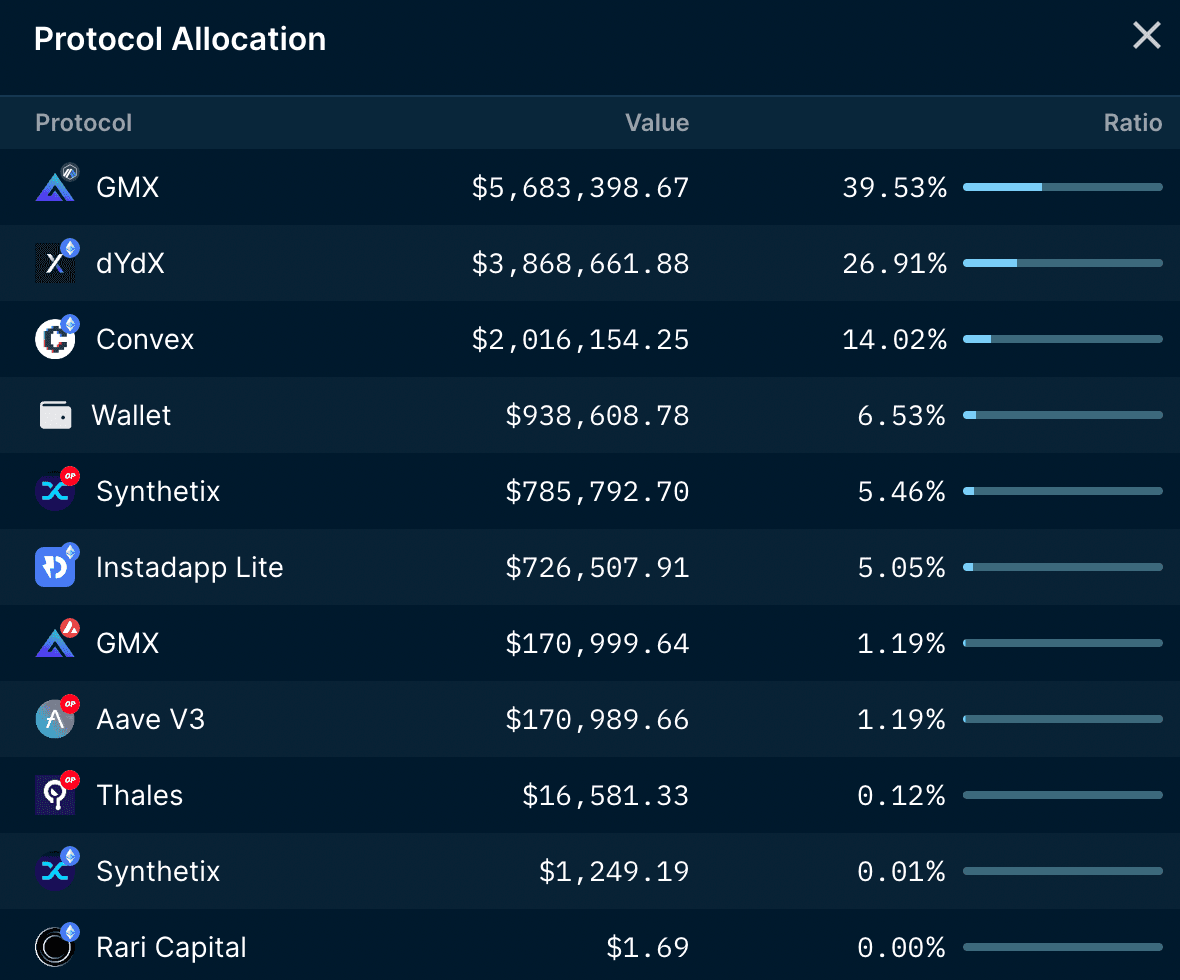

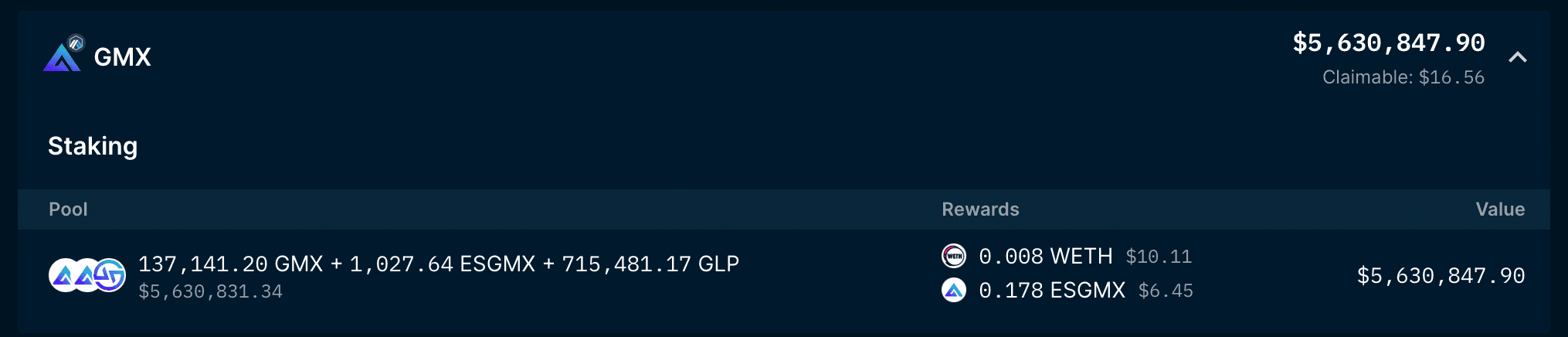

Wallet 0xf73 (🤓 Smart Dex Trader) has been an active GMX staker since 11 September 2021. Despite the volatility in GMX prices, this address continues to hold its GMX position with extreme conviction. Currently, Wallet 0xf73 (🤓 Smart Dex Trader) is holding a $5.6m position on GMX. This address is also an active farmer in various protocols which will be covered below.

Besides GMX, Wallet 0xf73 is staking $3.8m USDC on dYdX, which represents 26.9% of its overall portfolio. This address also has a large position in Convex relative to the total portfolio size. Specifically, this user is farming on the SCURVE pool, receiving rewards in CRV, SNX, and CVX. Interestingly, this user also has a relatively small position in Thales Market (on Optimism).

- Wallet 0x16f037a3ddf53da1b047a926e1833219f0a8e1fc (tybg.eth)

Wallet 0x16f has shown a perfect example of buy low sell the top for GMX. This user caught the near bottom of GMX earlier this year in June, and sold the local top in mid-September.

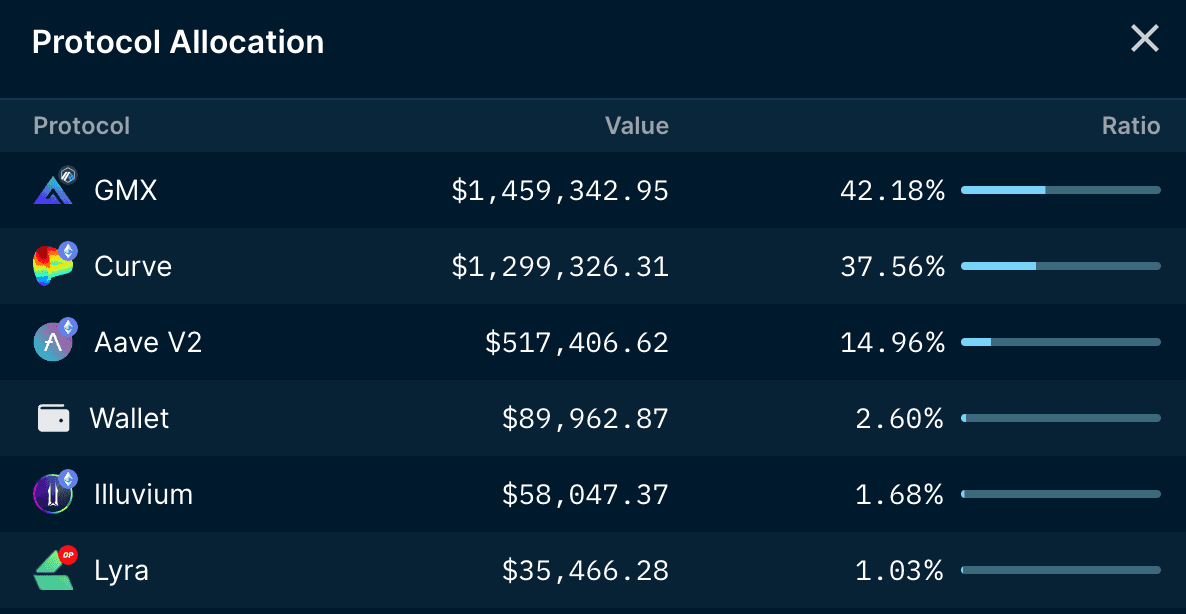

Despite Wallet 0x16f selling off almost 50% of their staked GMX holdings, the token still represents 42.18% of their overall protocol allocation (~$1.4m). Besides GMX, this address is also diversified into Curve, Aave v2, spot assets, Illuvium, and Lyra.

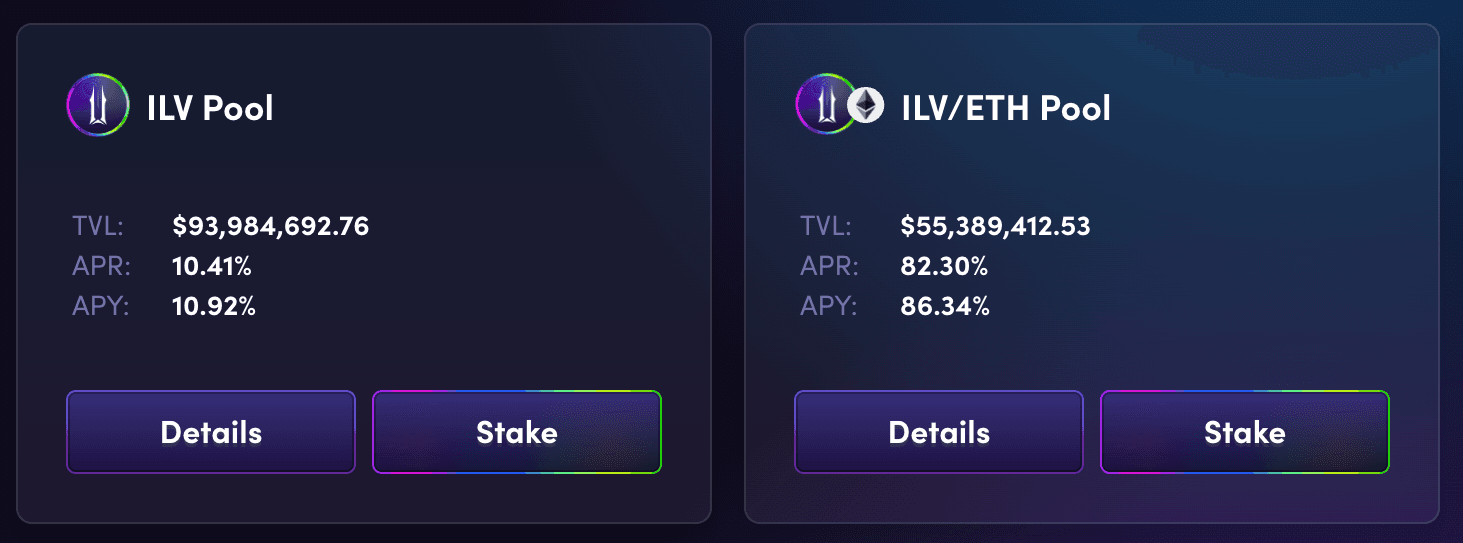

Interestingly, this address has a $58k USD position in staked Illuvium. There are two core pools in the Illuvium protocol, both pools offer a minimum lock of 1 month and a maximum lock of 12 months.

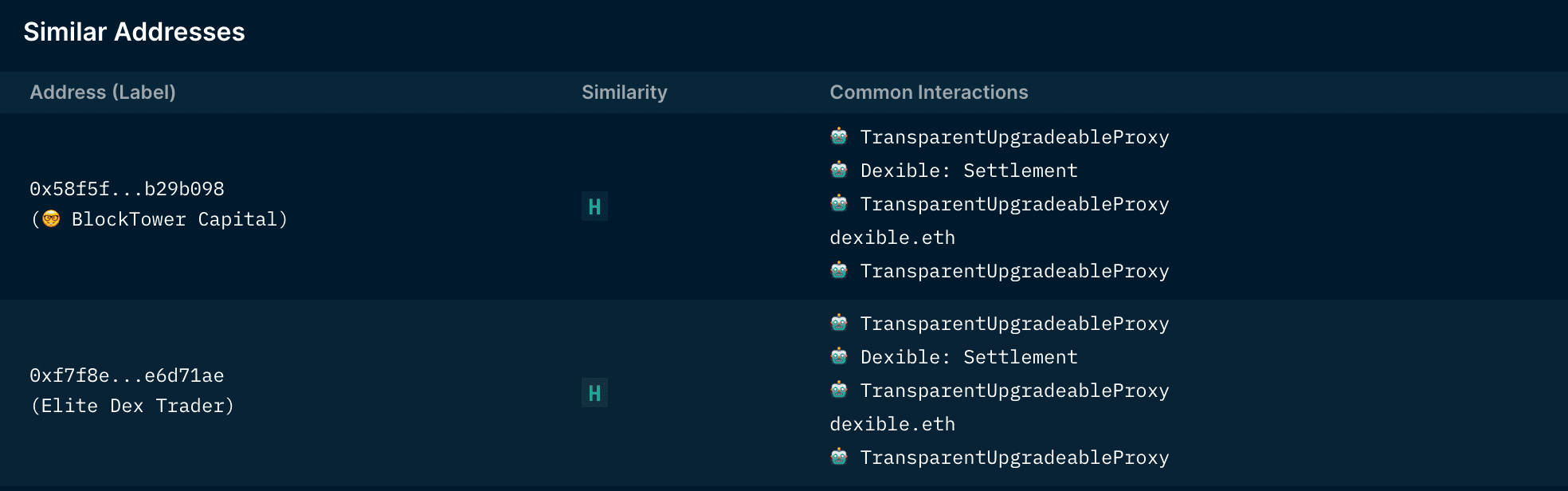

- Wallet 0x5a27dbbff05f36dc927137855e3381f0c20c1cdd ( 🤓 "barbellcap.eth" on Ethereum)

Wallet 0x5a ( 🤓 "barbellcap.eth" on Ethereum), also labelled as a smart money wallet address has made quite a decent profit trading GMX.

Although this wallet is no longer an active wallet address, there are a couple of similar addresses that may or may not be associated with 🤓 "barbellcap.eth" on Ethereum. Check it out here.

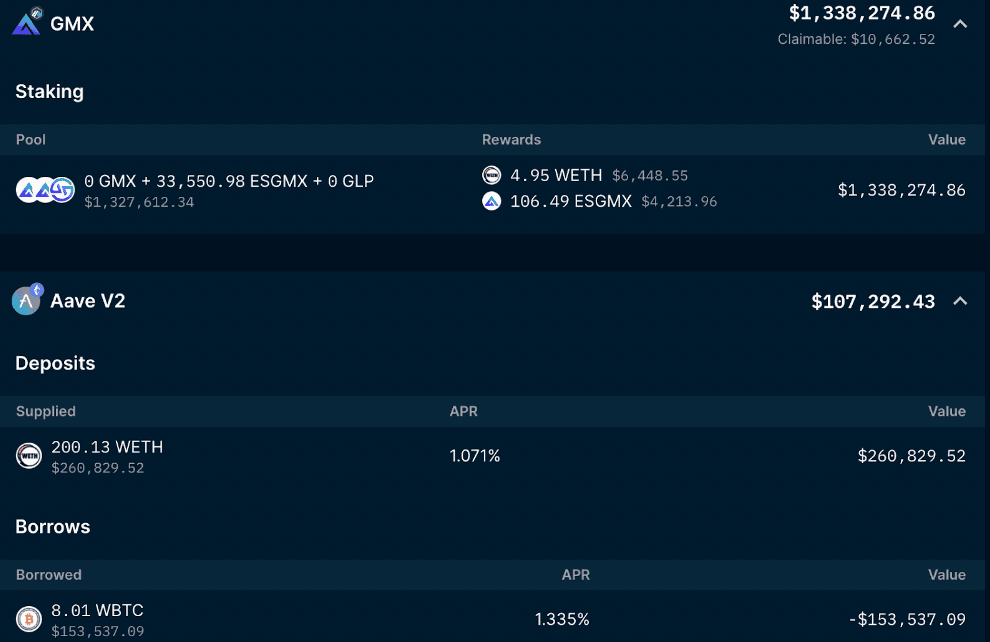

- Wallet 0xd4ad5d62dce1a8bf661777a5c1df79bd12ac8f1d (🤓 Smart LP on Ethereum)

This Smart LP address has been accumulating staked GMX up to 4 May 2022. From 4 May to 19 May, this address sold more than 50% of its staked GMX position. Despite selling over 50% of their position in May, this user started accumulating a small position of staked GMX across various time periods when the price of GMX started picking up. The Smart LP address sold most of its position during the local lows of the GMX price YTD. As of 14 Oct 2022, Smart LP address is still staking $1.33m worth of GMX, primarily vesting their esGMX.

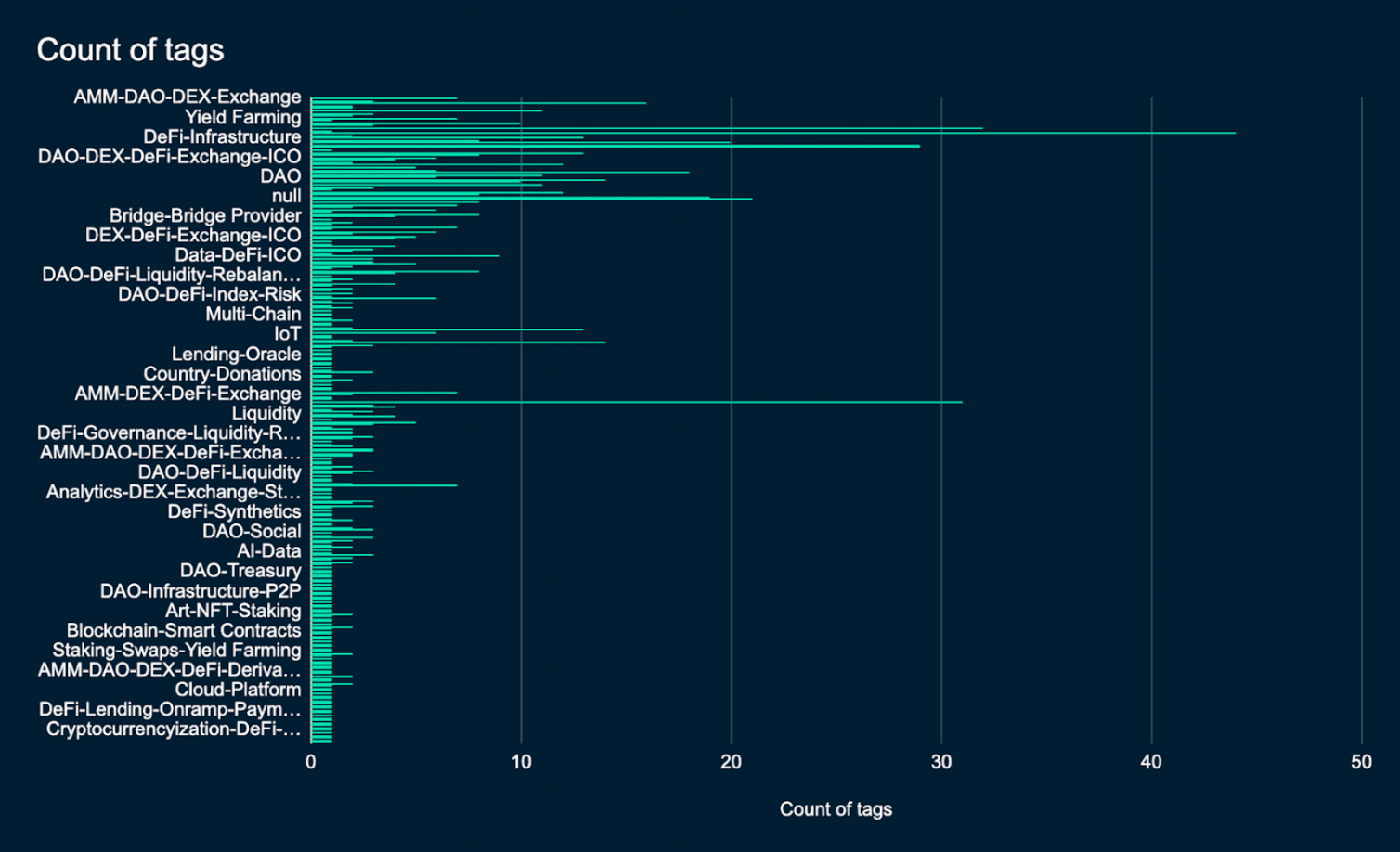

Top Verticals Interacted with by “Early GMX Stakers”

- Majority of the other verticals that “Early GMX Stakers” tend to interact with are DeFi protocols (41 tags).

- This is followed by CEX exchanges (32 tags), NFT (31 tags), Bridges, DAOs, NFT Marketplaces, etc.

- Generally, based on our analysis of the top verticals interacted with by “Early GMX Stakers”, these addresses are quite holistic when it comes to their interactions and investments.

- As expected, DeFi protocols take up the majority of the interactions with “Early GMX Stakers”. These DeFi protocols are most likely associated with farming and staking opportunities, which we will dive further into later.

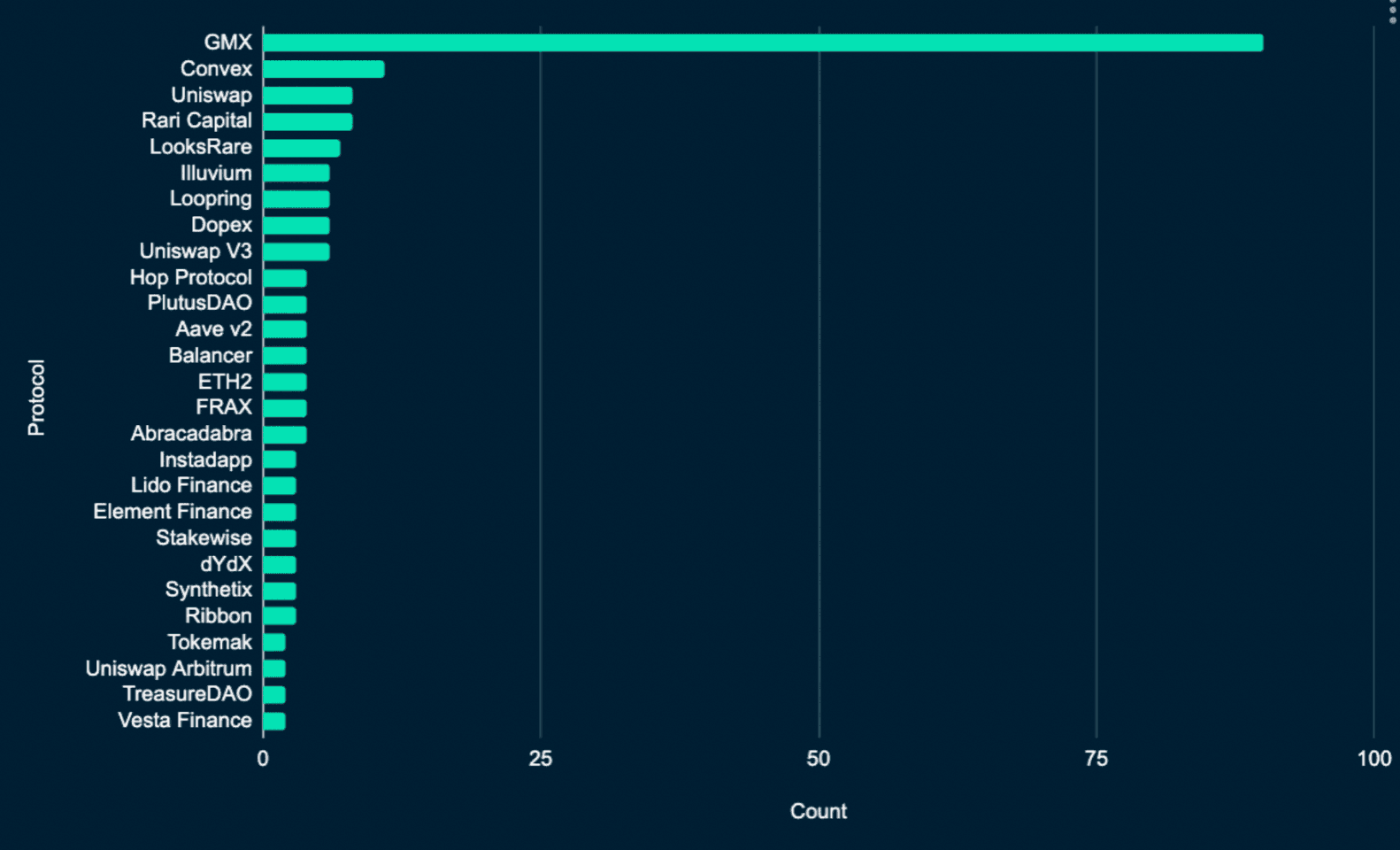

Farming Opportunities

- Based on our analysis, an overwhelming majority of the initial GMX stakers still continue to stake on the GMX platform a year after GMX’s inception.

- Besides GMX, a large portion of these addresses are diversified across blue-chip farms. Some of the top protocols are Convex, Uniswap, Rari Capital, LooksRare, Illuvium, Loopring, Dopex, Hop Protocol, PlutusDAO, etc.

- Discounting GMX, Convex represents the top protocol in which “Early GMX Stakers” are depositing in currently.

| Protocols | # of Addresses |

|---|---|

| Convex | 11 |

| Uniswap | 8 |

| Rari Capital | 8 |

| LooksRare | 7 |

| Illuvium | 6 |

| Loopring | 6 |

| Dopex | 6 |

| Uniswap V3 | 6 |

| Hop Protocol | 4 |

| PlutusDAO | 4 |

| Aave v2 | 4 |

| Balancer | 4 |

| ETH2 | 4 |

| FRAX | 4 |

| Abracadabra | 4 |

| Instadapp | 3 |

| Lido Finance | 3 |

| Element Finance | 3 |

| Stakewise | 3 |

| dYdX | 3 |

| Synthetix | 3 |

| Ribbon | 3 |

| Tokemak | 2 |

| Uniswap Arbitrum | 2 |

| TreasureDAO | 2 |

| Vesta Finance | 2 |

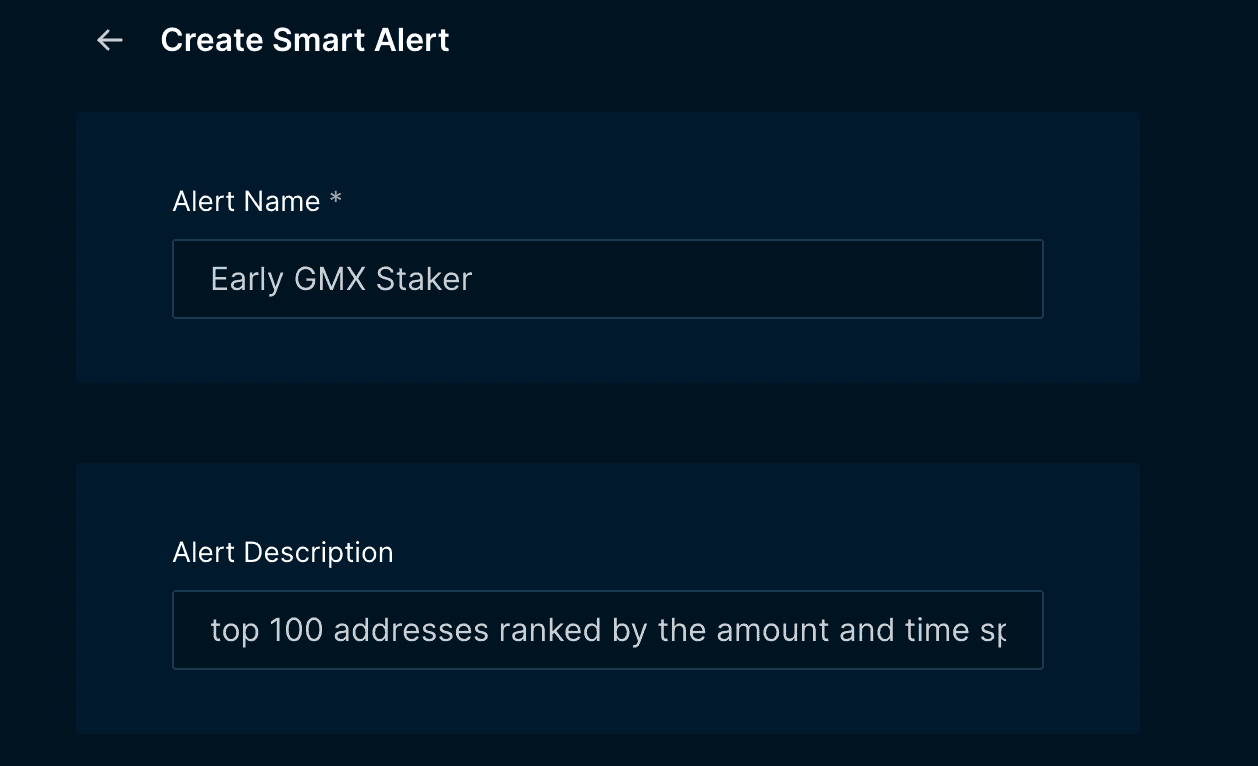

Setting up Smart Alerts for “Early GMX Stakers”

- Go to Smart Alerts section on Nansen

- Add our newly launched “Early GMX Staker” label

- Set parameters (min. USD value, token transfers, exclude specific addresses, etc.) and you're all set!