TLDR

Arbitrum is an Optimistic Rollup and the dominant Ethereum L2 by TVL and developer activity. There are a number of high quality dApps being built on Arbitrum’s ecosystem, despite the fact that there are no token incentives (yet). Arbitrum has managed to reach multi-billion dollar TVL without these incentives which is a testament to the network effects of Ethereum and the ease of deployment and developer confidence in the Arbitrum L2 network.

| TERMS | DEFINITION |

|---|---|

| Verifiers | Verifiers play a crucial role in verifying the integrity of transactions before they are confirmed on L1. |

| Validators/Operators | Validators in Arbitrum are the parties who take responsibility for ensuring the correctness of the Arbitrum chain. |

| Sequencers | Sequencers are responsible for ordering transactions from L2 bundles that are then committed at L1. Arbitrum has 1 sequencer - operated by Offchain Labs (Arbitrum team). |

Introduction

This year, Vitalik Buterin stated that Ethereum fees will grow worse and that Ethereum is already in the process of shifting from a Layer-1 (L1) centric ecosystem to a Layer-2 (L2) centric ecosystem. This came as a surprise to many, after the multi-year expectation of a scalable Ethereum 2.0. Vitalik envisions Ethereum primarily being a settlement layer for L2s, rather than users. This places the focus firmly on the nascent L2 ecosystem that has exploded over the last year.

L2s: Rollups

Rollups can be simply broken down into three characteristics:

- Transaction execution occurs outside L1.

- Data/proof of transactions is recorded on L1.

- There is a rollup smart contract on L1 that can enforce the correct transaction execution on L2 by assessing the transaction data posted on L1.

Rollups essentially move transaction execution off-chain, while retaining L1 security by posting the transaction data on L1 where it can be validated. Posting data on-chain enables anyone to verify the validity of the transactions being recorded.

Optimistic Rollups In optimistic rollups, transactions get submitted without any proof, however, anyone can check if transactions are valid - if they are proven to be incorrect, the fraudulent transactions will be reverted, the dishonest validator will have their stake slashed, and the watcher rewarded. This incentivises honest behavior.

Enter Arbitrum

Most notable of the L2s is Arbitrum. Arbitrum is an Optimistic Rollup, as described above. Arbitrum has a thriving ecosystem of dApps and a TVL of ~$3b (figures vary), which would put it within the top-10 blockchains by TVL.

Nansen Data

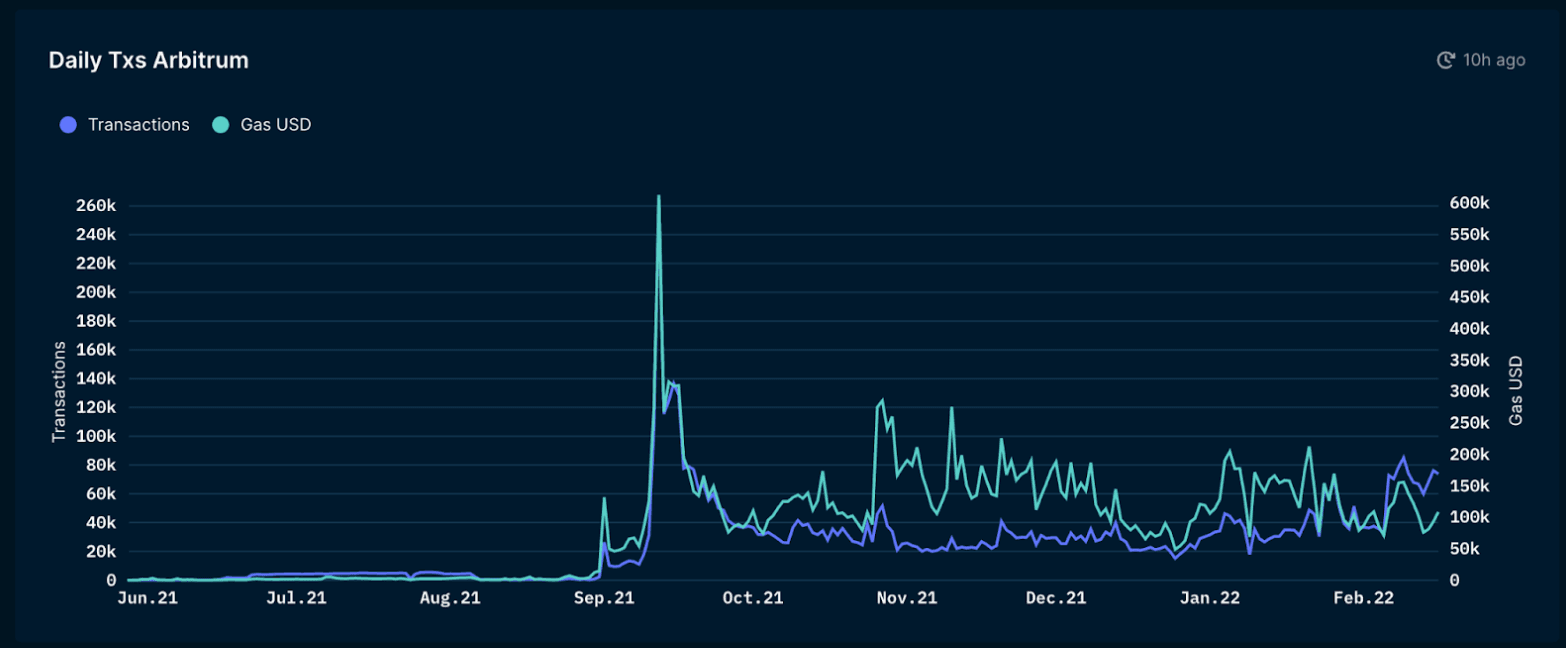

Daily Transactions

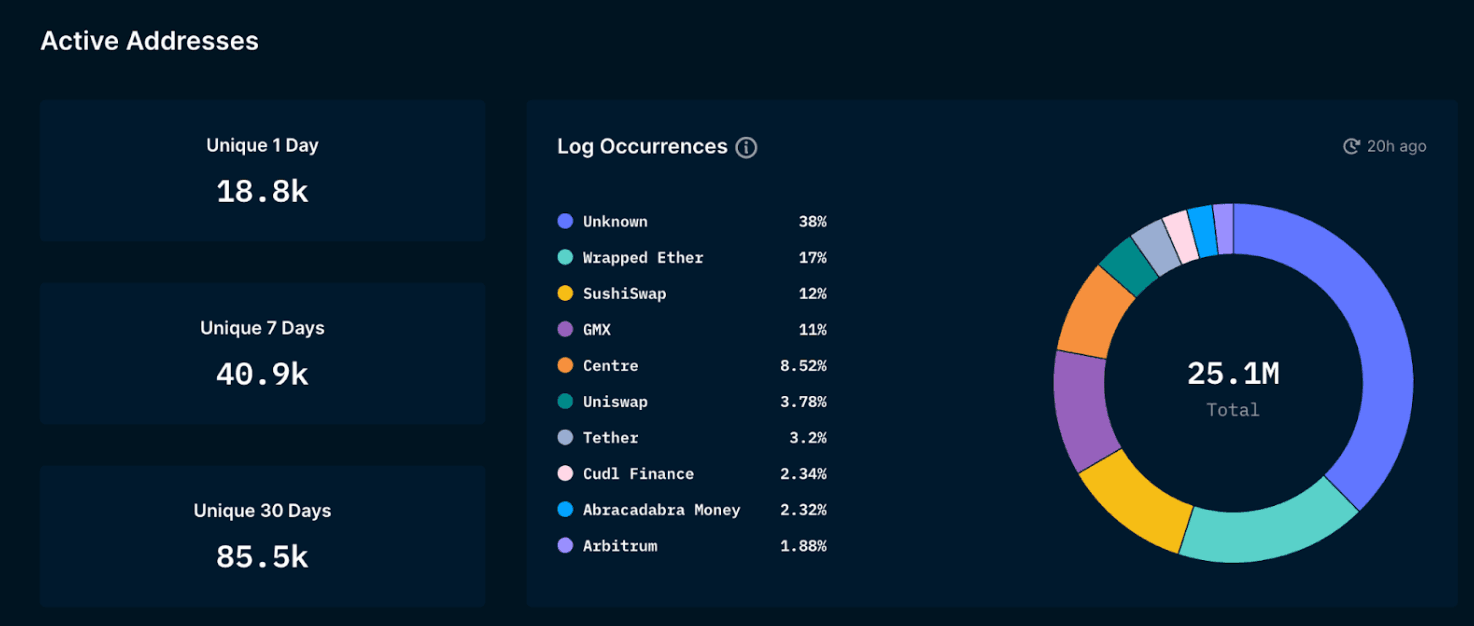

Arbitrum Acitivity

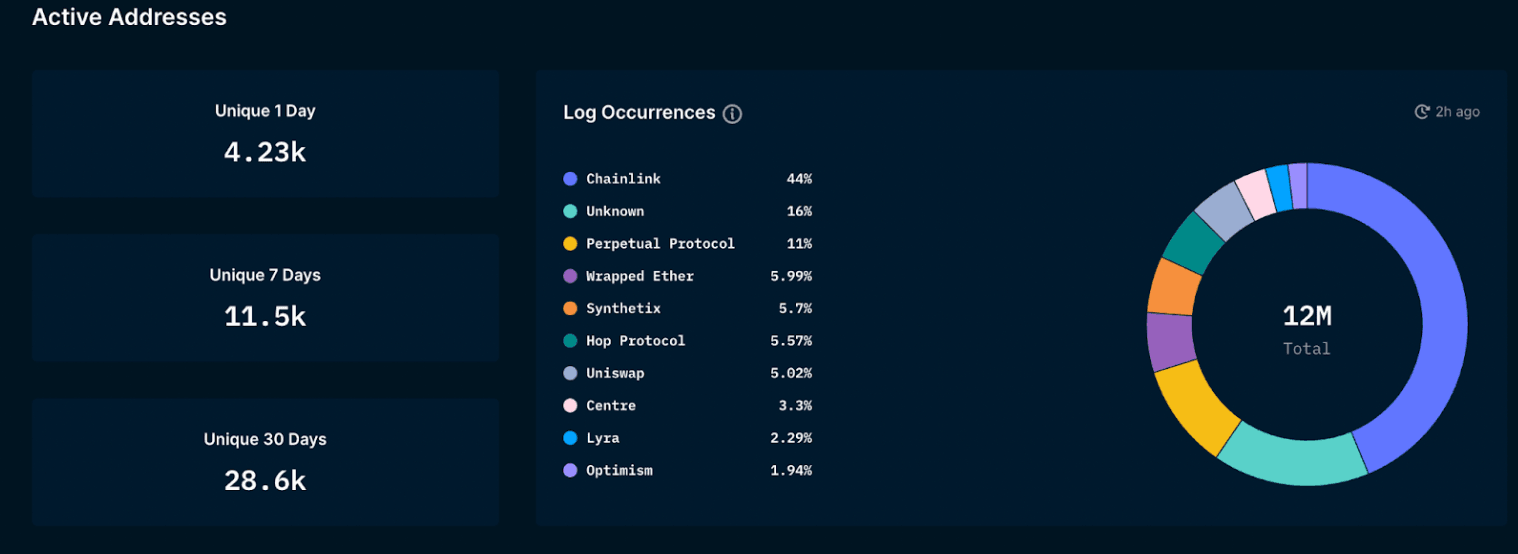

Optimism Activity

The Nansen data shows that Arbitrum has significantly more activity than Optimism (~4x) in terms of active addresses. This is a good indicator (when combined with additional information) of activity on a network and demonstrates Arbitrum’s current L2 dominance.

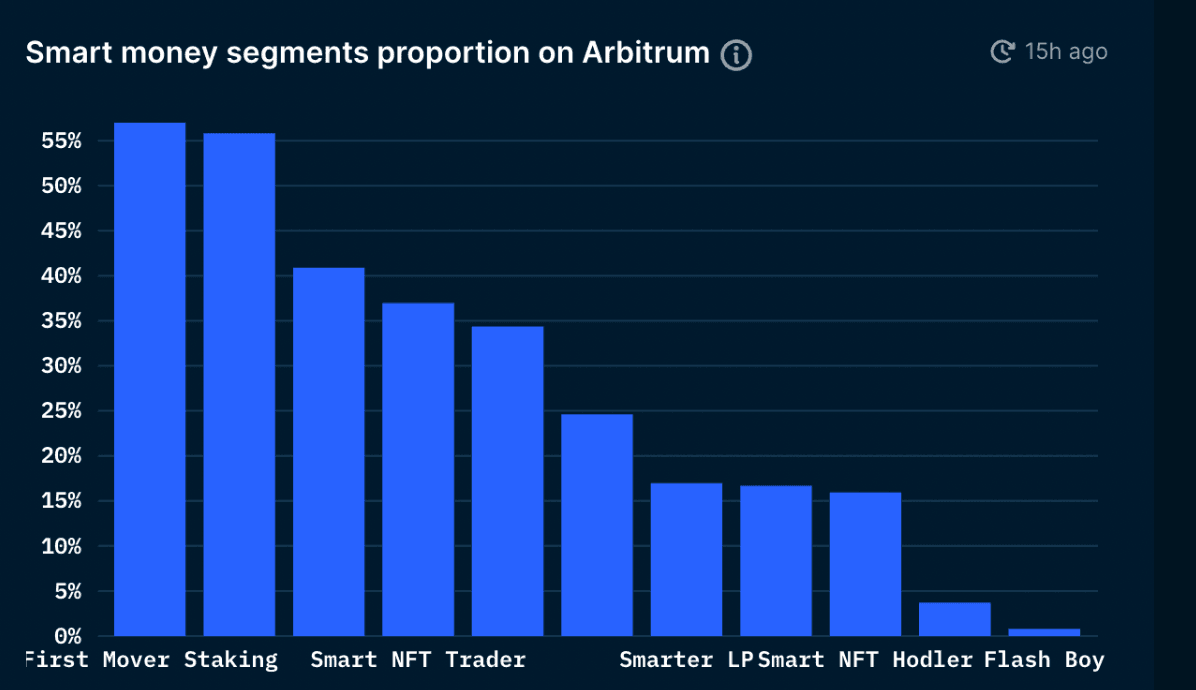

Ethereum Smart Money % on Arbitrum

Source: Nansen.ai (as of February 18 2022)

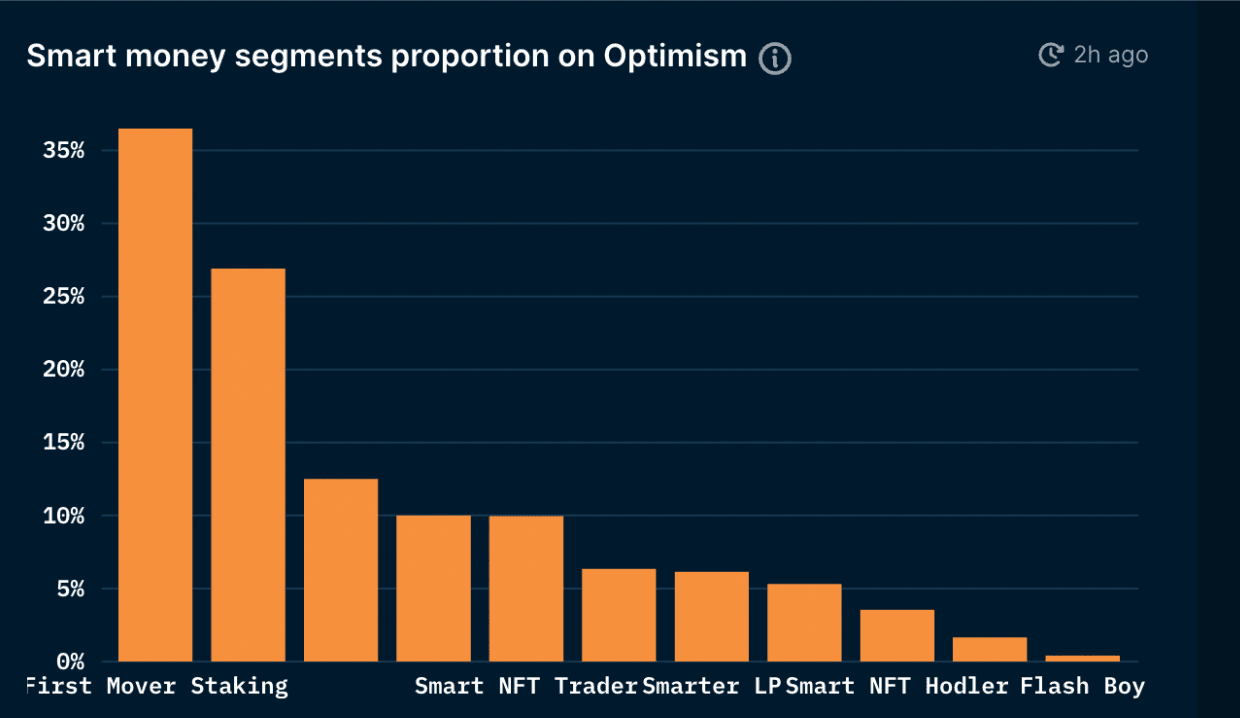

Ethereum smart money % on Optimism

In addition, there is a significantly larger proportion of smart money participating on Arbitrum vs Optimism. This is another indicator of the quality of Arbitrum and Smart Money’s confidence in the ecosystem.

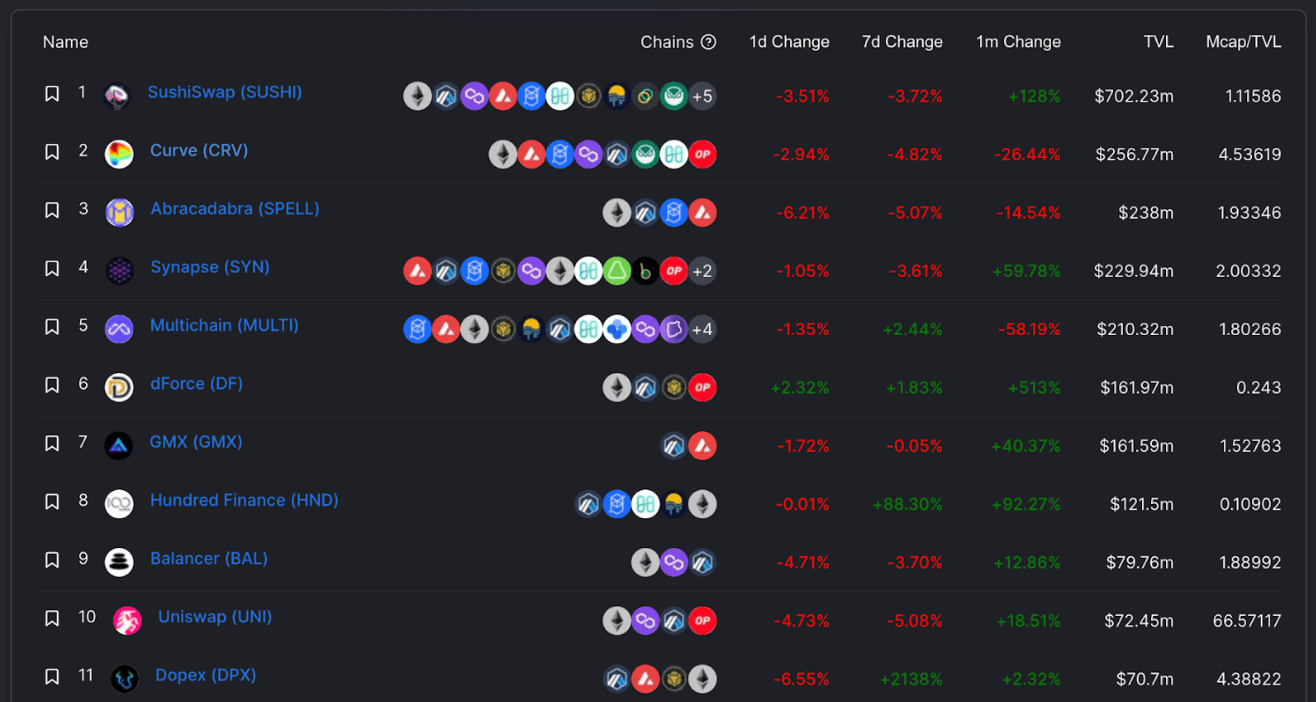

High Quality DApps A number of blue-chip DeFi protocols have moved and established significant liquidity on Arbitrum, including Curve, Balancer, SushiSwap and Uniswap. More interestingly, some DeFi 2.0 protocols are choosing to build on Arbitrum, such as Abracadabra, GMX, and Vesta Finance.

What makes the deployment of top-tier applications on Arbitrum and their attraction of TVL impressive is that there are no token incentives on Arbitrum as of yet. Successful L1s have attracted the majority of their users and TVL through aggressive ecosystem funds and liquidity mining schemes. Arbitrum has managed to reach multi-billion dollar TVL without these incentives which is a testament to the network effects of Ethereum and the ease of deployment and confidence in the Arbitrum L2 network.

It is interesting that projects such as Vesta Finance are launching on Arbitrum first, rather than migrating there from an L1. Vesta is backed by some of the most influential people in the industry, and its decision to be Arbitrum-first is a strong validation of the network.

More applications are looking to deploy on Arbitrum, such as Bancor, and it is likely that this will accelerate if (when) a token is announced.

Top applications by TVL

Source: DefiLlama (as of February 18 2022)

CEX Integrations On January 15th 2022, Binance enabled users to deposit and withdraw ETH to and from Arbitrum. On February 8th 2022, FTX enabled direct withdrawals of ETH to Arbitrum. Coinbase is also widely expected to integrate soon.

Reddit Arbitrum was selected by Reddit for its community points tokens. Reddit stated that Arbitrum is “the most promising scaling technology for Community Points".

Here is Reddit’s reasoning for selecting Arbitrum:

It’s decentralized. Arbitrum derives its security and finality from the base chain. No centralized actors or bridges, which means users are always the ones in control of their Community Points and other blockchain assets, not anyone else.

It’s developer-friendly. Arbitrum supports the same Solidity smart contracts and the same toolchain as Ethereum. Developers can launch apps on top of Community Points on this network as easily as they can on Ethereum.

It has broad ecosystem support. Many large projects are launching on Arbitrum, outside of us. A big ecosystem brings together the tools and infrastructure to keep things growing even further.”

Key Considerations

Despite its impressive growth, there are risks that users should be aware of. Many of these risks arise from the current centralization of the network.

- If none of the whitelisted verifiers review transactions, incorrect and fraudulent transactions will be posted on-chain and funds can be lost.

- It is widely considered highly unlikely that this will happen.

- Only one honest verifier is required.

- If the centralized validator fails, new block production will be halted and funds will be frozen.

- Note that this will not result in funds lost.

- The centralized operators could front-run transactions and therefore extract MEV.

- Regulators could order the team to shut down the L2 network.

- Polyna argues that this can be avoided by a multisig form of community distributed across the world.

The rationale for the team retaining control over the network is so that the network is carefully managed in its infancy before it is ready to decentralize. For example, the Arbitrum team holds the private key to a proxy contract that can change many of the system’s key contracts.

These include:

- Rollup contracts on Ethereum

- The Ethereum token bridge

- The sequencer contracts.

In addition, Arbitrum’s transaction capacity has been deliberately limited - with a ‘speed limit’ put in place. The purpose of this is to ensure validators have the time and resources to check transactions. This has resulted in gas fees that are higher than alt L1s and will rise in the future with increased demand. However, the speed limit will be raised as the network stabilizes and capacity will increase over time.

Ultimately, a single entity has control over the network including the ability to shut it down. This makes Arbitrum centralized, but in reality, this level of control is desirable for fast upgradeability and stability early on. Once stability has clearly been established, controls will be phased out and Arbitrum will become more decentralized. At present, block sequencing is controlled by the Arbitrum team, but in the future, the team plans to transition to decentralized block sequencing.

Does Block Production Centralization Matter?

Ethereum rollups are interesting in that their centralization logically should not be a problem. This is because rollup’s on-chain data availability means that transactions can be easily and transparently reviewed. Rollups can only submit transactions to L1 - which can be overturned if they include any fraudulent/incorrect transactions. This results in the block producer being penalized. Therefore, there is no point for the block producer to include invalid transactions - they will not be accepted and the block producer will be punished.

Centralized block production is not necessarily a bad thing as rollups would still maintain the security and decentralization of the L1 which will invalidate fraudulent/incorrect transactions.

This results in a scenario where:

- Block production is centralized

- Block validation is decentralized

Vitalik argues that this will give rollups satisfactory decentralization.

Capacity It is important to note that Arbitrum is not infinitely scalable and remains constrained by Ethereum. This is because Arbitrum needs to store each transaction on Ethereum mainnet through call data. This means that there is an upper limit on Arbitrum, which can only be breached when Ethereum scales through sharding. Ethereum sharding ‘should’ happen sometime in 2023. This makes the scalability of Arbitrum tied to that of Ethereum.

EIP-4488 Vitalik submitted a proposal to reduce transaction costs for rollups -EIP-4488. Vitalik expects that this upgrade would reduce costs of rollups by approximately 5x. However, there is some dissent among core Ethereum developers and it will likely be a long time before we see EIP-4488 implemented, if at all.

Comparison Table of L2s

| L2s | Arbitrum | Optimism | Metis | zkSync 2.0 |

|---|---|---|---|---|

| Type | Optimistic | Optimistic | Optimistic | ZK-Rollups |

| Data Availability | On-chain | On-chain | IPFS | ZK-Proofs and On-Chain |

| Architecture | Arbitrum Virtual Machine (AVM) - proof-of-stake tree where disputes are settled on Ethereum. Arbitrum also uses ArbOS - an operating system that runs at L2 | Optimistic Virtual Machine (OVM) - a sidechain whose finality is derived from Ethereum solely | Metis Virtual Machine (MVM) – computing and storage are completely decoupled | Custom VM based on LLVM (Low Level Virtual Machine) -> has two compilers: Yul and Zinc. Validity-proof systems which makes it impossible to include invalid transactions, making it more capital-efficient. |

| Fraud-Proofing | Interactive fraud proofs (minimal work required from any L1 contract). The idea is to show that most work can be done off-chain. | Re-runs the entire disputed transaction on the Ethereum main chain. | Similar to Optimism’s architecture where Metis will re-run the entire disputed transaction on Ethereum main chain. | As opposed to fraud proofs, zkSync 2.0 posts a cryptographic proof that each state transition was correctly computed |

Arbitrum User Experience

The Arbitrum user experience is far better than that of Ethereum L1, with fast transaction speeds and far lower transaction costs. That said, transaction costs remain significantly higher than alt L1s like Fantom, Avalanche and Solana, and side chains like Polygon. Arguably, the transaction fees on Arbitrum price out many users still - with swap fees frequently costing approximately $10.

Why would a user use Arbitrum instead of an Alt-L1?

People and projects with strong conviction in Ethereum are likely the primary user base for Arbitrum. As stated above, Arbitrum transactions should inherit the security of Ethereum. Under the ‘blockchains are cities’ mental model - Ethereum is New York and Arbitrum is a suburb - remaining relatively expensive due to its ties with Ethereum L1. This arguably justifies the slightly higher transaction fees. Many top Ethereum projects and high-quality Arbitrum-first projects are deployed on Arbitrum, arguably giving it one of the strongest ecosystems in crypto. This is particularly pertinent when one considers the lack of token incentives for doing so compared to most alternative L1s.

Why Wouldn’t You Use Arbitrum?

It is increasingly easy to bridge to EVM blockchains such as Avalanche and Fantom whose EVM compatibility gives a familiar user experience to that of Ethereum. Both Avalanche and Fantom have lower transaction fees, fast transaction times, and thriving ecosystems. Many people would rather use these blockchains rather than Arbitrum. In addition, the native tokens of these ecosystems logically have higher upside potential than ETH.

This highlights the importance of Arbitrum launching a token as a further incentive for network growth.

Arbitrum Ecosystem

The following projects have focused much of their development on Arbitrum.

GMX (website/twitter) GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades. Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees and leverage trading.

Vesta Finance (website/twitter) Vesta Finance is a lending protocol on Arbitrum that offers borrowers interest-free lending with low collateral requirements. Users deposit collateral to mint VST (Vesta stable) - a USD-pegged stablecoin. Initial collateral on the platform will be ETH, renBTC and gOHM - however, more collateral types will be added in the future. Vesta v1 is a fork of Liquity, with key differences such as community governance, additional collateral types, and L2 focus.

Dopex (website/twitter) Dopex is a decentralized options protocol. Dopex seeks to maximize liquidity while minimizing losses for option writers and maximizing gains for option buyers. This is done in a passive way for all liquidity providing parties. Anyone can earn a passive yield by providing liquidity to option pools. Dopex pricing model replicates volatility smiles in order to optimize option prices.

Abacus (website/twitter) Abacus is an Arbitrum-based NFT protocol that enables users to value NFTs through a voting system. This seeks to enable better price discovery for individual NFTs rather than using floor prices.

Future of Arbitrum

Offchain Labs Team announced Arbitrum Nitro, the next iteration of Arbitrum, which replaces the custom-designed AVM (Arbitrum Virtual Machine) with a Web Assembly (WASM) target that will take care of fraud proofs. This will make the system even more compatible with EVM. Additionally, the EVM-emulator is also replaced by Geth which is the most run Ethereum client today. The last piece of the stack is a slimmed-down version of their ArbOS component, which provides the rest of what’s needed to run an L2 chain, which will bring in more features like cross-chain communication, new and improved batching and compression system to minimize L1 costs. Arbitrum expects a 20-50x increase in execution speed and a sizable decrease in costs.

Arbitrum Going Forward

Current challenges faced by Arbitrum and how they are planning to overcome them in the near future include:

Problem #1: Fragmentation of liquidity between the different rollups

Solution:

- A key challenge for L2s is the need to accrue more liquidity to cross-L2 AMM structures like distributed AMMs (dAMM).

- dAMM is a cross L2 AMM that shares liquidity across layers and allows the same liquidity pool to be used across multiple L2s asynchronously to prevent fragmentation of liquidity.

- LayerZero (if it lives up to its promise) may improve the issue of L2 liquidity fragmentation.

Problem #2: Challenges integrating with Arbitrum

Solution: As explained above, Arbitrum Nitro replaces the Arbitrum VM with a WASM target that will take care of fraud proofs. This will make the system more compatible with EVM - making it even easier to deploy on Arbitrum. As mentioned above, the EVM-emulator is also replaced by Geth which is the most popular and well-used Ethereum client today.

Problem #3: Security risks of trusted bridges vs long withdrawal periods of trustless bridges - up to 7 days

Another important key point to mention for Arbitrum and L2s in general is the bridge security. Generally, bridges fall into 2 types of categories: trusted and trustless bridges.

Trusted bridges: depend upon a central entity or system for their operations, whilst Trustless bridges: security is dependent on the underlying blockchain (in this case Ethereum L1).

For instance, the Wormhole Bridge incident resulted in a loss of 80k ETH. Suddenly, all this ETH on Solana is backed by nothing. This is a concrete example of why trustless bridges are incredibly important. Despite the long withdrawal times/fees to transact on Arbitrum’s native bridge, some would argue that it is justifiable due to its guaranteed security layer.

Solution:

- Liquidity bridges like Hop Protocol, Synapse and Connext enable withdrawal in minutes. However, issues persist around cross-chain bridges and their security. These will need to be addressed and improved upon to avoid significant security issues in the future.

- In addition, a significant reduction in the time to move funds back from L2 → L1 using trustless bridge(s) would greatly benefit the user experience.

Problem #4: Centralized Sequencer Arbitrum has one block sequencer - run by the Arbitrum team. Recently, Arbitrum experienced sequencer downtime, which made the Arbitrum One network temporarily unavailable. The core issue for the Sequencer downtime was a hardware failure in their main Sequencer node. As a result, the Sequencer stopped processing new transactions.

Solution: Arbitrum is working on decentralizing block sequencing going forward. It is clear that further decentralization is required, especially as the total value locked continues to grow. However, it is unclear when this can be feasibly implemented.

Arbitrum Token When Arbitrum is sufficiently developed, it is highly likely they will launch a token. If so, it will likely cause a significant uptick of activity on Arbitrum, bringing more users, more developers, and liquidity.

Key Takeaways

Alt-L1s effectively addressed the pain points of using Ethereum - specifically transaction costs and speed. Despite this, some believe that they fail to achieve the level of decentralization and security offered by Ethereum. Ultimately, users and dApps will select a chain that best suits their needs, and those aligned with the Ethereum community will likely opt for Ethereum and its rollups which should inherit its security.

That said, there are clear downsides to Arbitrum like its current sequencer centralization and long offboarding time. However, it has a very strong team and clear plans to address this. A bet on Arbitrum is a bet that the team will resolve these problems.

Arbitrum is widely expected to launch a token. However, a possible launch date is uncertain. It is likely that the team will manage the development of the network further in order to prepare it for the increased traffic this would inevitably bring. Arbitrum is taking a long-term sustainable approach to development and should not be expected to impulsively launch a token quickly to attract short-term liquidity.

Arbitrum is particularly impressive in that it has a thriving ecosystem of dApps and a TVL of $3b without token incentives. If the token launches, expect significantly increased activity on Arbitrum. A viable strategy could be to use Arbitrum for both the benefit of its high quality dApps and the chance of qualifying for a future token airdrop.

Ultimately, it is clear that one can not confidently state as of yet that rollups and alt-L1s are definitely better than one another. There is likely room for both, depending on the user/developer preference.