Introduction

DeFi has seen a significant drop across most metrics since the end of the bull market in 2021. Based on data from Defillama, the total TVL of DeFi has dropped from its highs of ~$180b at the end of last year, to $55.5b at the time of writing. The 70% decrease could be attributed to negative macro conditions, series of hacks and less attractive yields in DeFi such that liquidity has flowed back to other risk-averse alternatives.

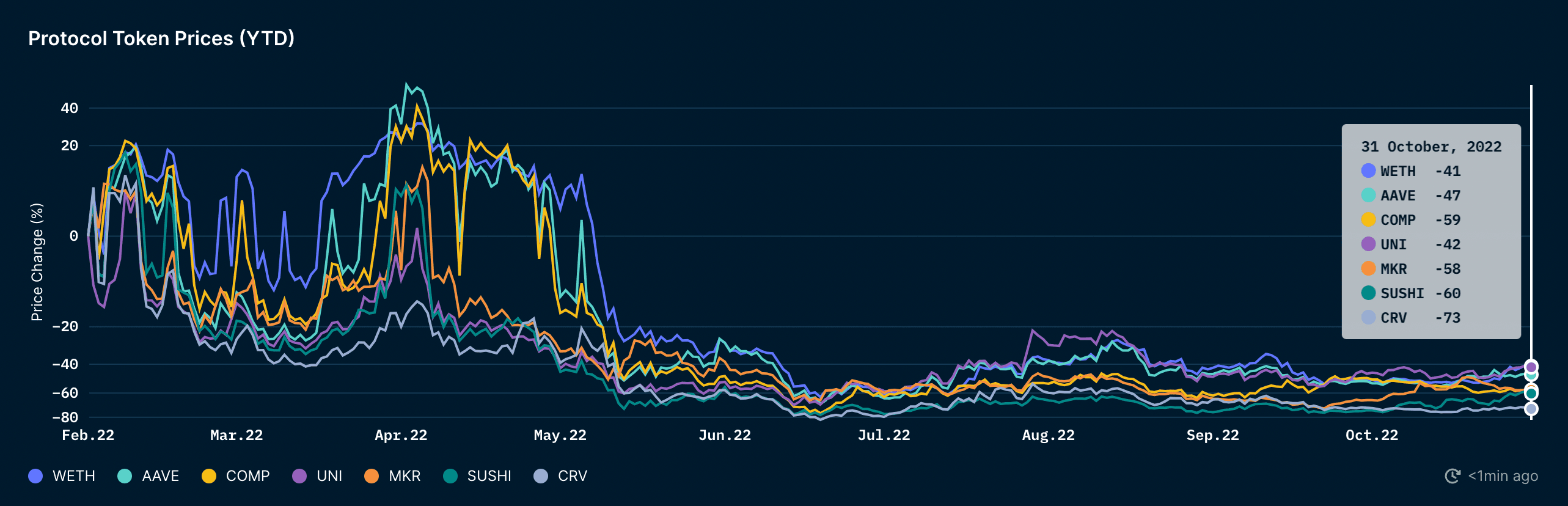

Slower activity has also resulted in a drop in most of the token prices, even for OG DeFi protocols that represent a significant share of today’s DeFi activity such as Aave, Compound, MakerDAO, Uniswap, Sushiswap and Curve - which we will cover in this report. Token prices for these protocols have dropped over 40- 75% from February, including ETH. The only token close to outperforming ETH would be UNI, with its token price facing a 42% drawdown from February, just 1% lower than ETH.

This report aims to cover what some of these OG DeFi protocols have been doing in the bear - such as product updates, metrics and future catalysts to some of these protocols. Some metrics to look at include volume and fees/revenue that these protocols generate. For future catalysts, the report will look at new product updates that could change the landscape of DeFi and how these protocols stand to compare with competing protocols.

Lending

Aave

Aave is a protocol that facilitates lending and borrowing between users with the usage of liquidity pools. Users can deposit assets into pools to earn interest through the overcollateralized loans that the protocol lends out. Aave is live across various L1 and L2 chains - namely Ethereum for Aave v2 and Arbitrum, Avalanche and Optimism for Aave v3.

Product Updates

Aave v3 launched in March 2022 and was deployed on 6 chains. The key differentiators between v2 and v3 include:

- Portals

- allows for liquidity to flow across Aave v3 networks easily by burning aTokens on origin network and minting them on the destination network immediately

- This services cross-chain protocols such as bridges (power to leverage on the Portal feature is subject to a governance vote) by allowing them to tap into Aave liquidity which also increases streams of revenue to Aave

- Bridges that have passed the governance vote to be whitelisted for Portals so far include deBridge and Connext

- Risks for Portals include the vulnerability of whitelisted bridges which may in turn become an attack vector for Aave. A framework has been proposed to ensure standardization across bridges that want to be whitelisted which would help to mitigate the risk but does not eliminate it fully

- allows for liquidity to flow across Aave v3 networks easily by burning aTokens on origin network and minting them on the destination network immediately

- Efficiency Mode

- allows users to achieve maximum borrowing power of their collateral supplied for similar underlying assets (eg. stablecoins)

- Different categories of assets will have different risk parameters which allows users who for example, have stablecoin debt to have a higher threshold on health factor before being liquidated

- allows users to achieve maximum borrowing power of their collateral supplied for similar underlying assets (eg. stablecoins)

- Isolation Mode

- reduces risks on newly supplied assets enabled as collateral by not allowing users to borrow against it/only borrowable in isolation mode for which debt needs to be repaid back in full before exiting the mode

- So far, utilization of the isolation mode seems rather low as there are only a few of these assets on each chain - namely USDT on Arbitrum, Avalanche and Polygon as well as other stablecoins such as EURS and FRAX

- Supply of these assets are rather low since its a tradeoff for users who want to supply multiple assets and hence, overall utilization volume is low as well

- reduces risks on newly supplied assets enabled as collateral by not allowing users to borrow against it/only borrowable in isolation mode for which debt needs to be repaid back in full before exiting the mode

- Other risk management factors include borrow and supply caps which reduce attack vectors for riskier assets such as over-minting and price oracle manipulation.

- Aave utilizes the Chainlink price oracle which is a off-chain price oracle

Aave v3 is also set to be deployed onto Ethereum mainnet soon, following a governance vote to deploy a new v3 environment.

Aave has also proposed the launch of their own stablecoin - GHO. It will follow a mint and burn mechanism whereby users deposit collateral to mint GHO, which will be burned when users repay their loans or when they get liquidated. As compared to using other stablecoins, GHO will allow Aave to direct all interest paid by borrowers straight to the treasury, without the need to split the proceeds for yields to suppliers. While a lot remains to be seen, the successful adoption of GHO as an alternate stablecoin on Aave could drastically increase Aave’s revenue. More details about GHO has been teased by the Aave team and its implementation could be live in the coming weeks

Metrics

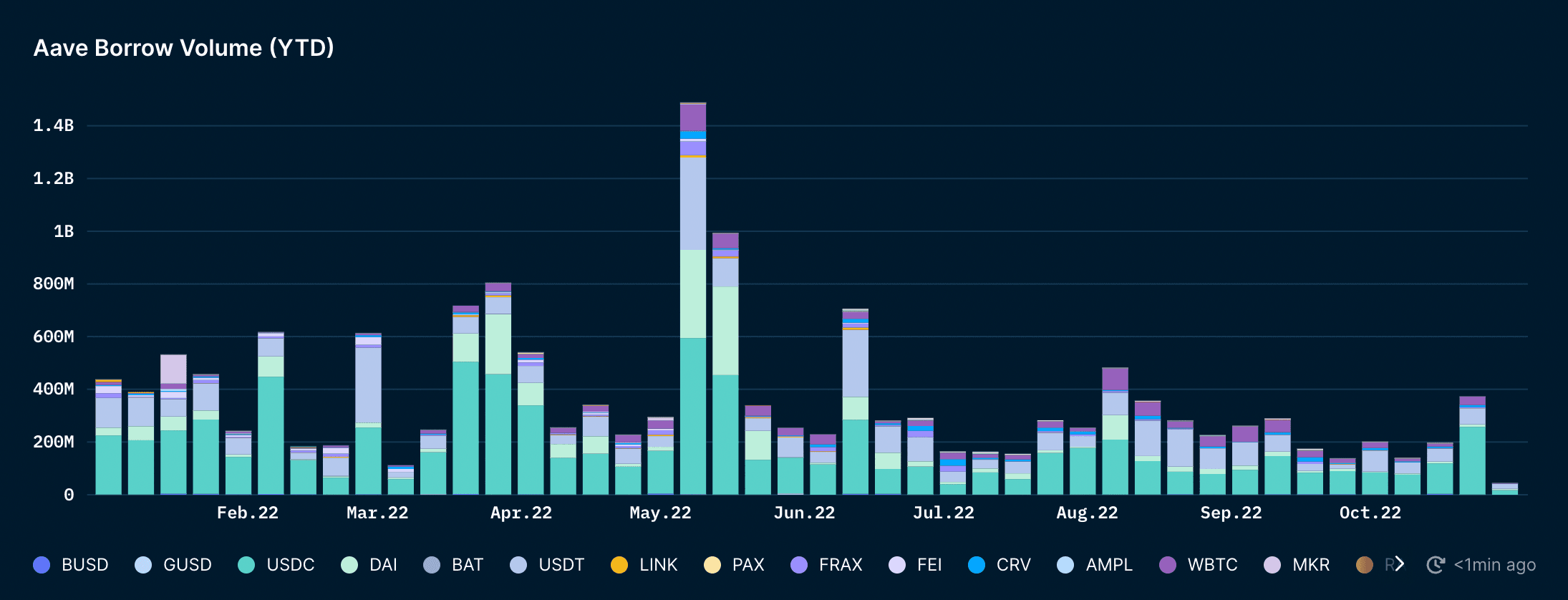

Looking at the weekly borrowing volume for Aave YTD (non-cumulative) on Ethereum, it shows that over 80% of volume week-on-week is denominated by stablecoins - USDC, USDT and DAI. This means that stablecoins are huge revenue streams for Aave. Therefore, GHO represents a huge opportunity for Aave in terms of increasing revenue significantly - as the protocol can absorb 100% of the interest from GHO loans. Currently, Aave has to give 90% of interest paid by borrowers to lenders, which is a large amount of revenue lost. However, this is ultimately dependent on the adoption of GHO - which would likely experience high demand at the start with token incentives.

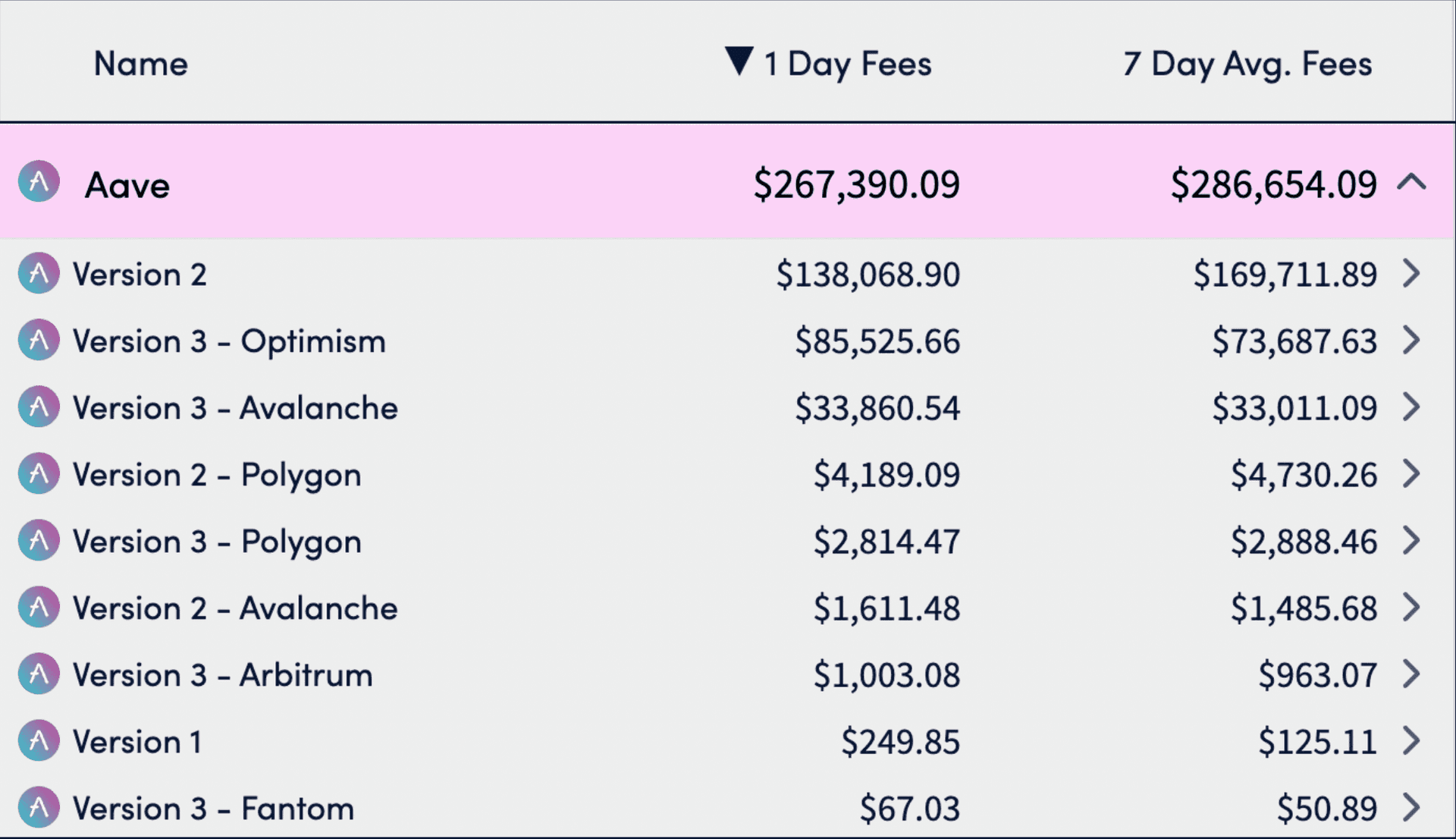

Aave’s main source of revenue comes from interest paid on loans. Revenue goes back to holders who stake AAVE as reward for governing the protocol. The current emissions stand at 1100 AAVE per day, roughly $92k at current market prices. The 7 day average fees generated from Aave currently stand at $286k of which 10% is revenue. This means that the protocol is actually not profitable based on the amount of AAVE emissions.

All things constant, the current APY for staking AAVE is 6.44% APR which is far from impressive. 30% of users’ AAVE can be taken away in the event of a blackswan event, which is the main risk of staking. The current incentive for holding AAVE would be staking and control over the treasury and protocol decisions. The implementation of GHO could also draw higher demand for AAVE, since the AAVE DAO will hold the power in determining interest rates and onboarding of facilitators. Coupled with speculated discounted mint rates for AAVE stakers as well as increased revenue which a part of it will go to stakers, demand for AAVE will likely increase.

Catalysts

Aave has built an ecosystem of products that is able to cater to the needs of different user profiles, including institutional clients through Aave ARC. The launch of the RWA market in partnership with Centrifuge also pushes DeFi towards more real-life adoption with Aave at the forefront.

The team at Aave is also moving towards creating infrastructure for a decentralized social media. Led by Stani (founder of Aave), Lens Protocol is building towards that vision by being the foundation for developers to build on top of the social network. Besides the network effect for developers (easily connecting to other dApps), users also get to own their content and receive greater value shared back to them. Lens can be utilized by users who managed to sign the open letter before 5 May 2022, and those users can claim their handle here. There are dApps already being built on the network, with the most prominent one being Lenster - the social media platform for Lens. The app is currently in beta and has managed to gather over 80k unique monthly visitors, which is continuously growing. Usage of the network has also been growing steadily, which could see greater growth once access is granted to the general public.

Lens could also open up a new paradigm for Aave with the possibilities of undercollateralized lending through verifiable, on-chain credentials that could determine a user’s reputation score - which Stani also mentioned during an event at ETHCC. This could be huge since the undercollateralized lending space is still largely untapped - with the only notable protocols such as Maple Finance and Goldfinch which are focused on institutional lenders as well as the newly launched dAMM Finance. There is also speculation that GHO would be integrated with Lens as a form of payout for creators, providing utility and demand for the stablecoin.

Compound

Compound is very similar to Aave in terms of their lending and borrowing model, with minor differences in the parameters that guide them. The difference lies in:

- Interest Rate Model: Compound only offers variable interest rates while Aave offers both variable and stable interest rates

- LTV: Compound allows users to borrow up to 66.6% of their collateral while Aave allows for 75%

- Price Oracle: Compound uses both the Uniswap v3 TWAP oracle as well as Chainlink with the former being a backstop in case of issues with Chainlink (given that its off-chain and the multisig is rather centralized) while Aave only utilizes Chainlink

Product Updates

With Compound III, the protocol introduces changes to the borrowing model and will be expanding to other EVM chains. The main change would be that users can only borrow the base asset and no longer earn interest from supplying collateral. This allows for the creation of different markets with different risk levels that can cater to different types of users across different chains. This also reduces the risk of the protocol being vulnerable to a single asset since separate markets could be created for riskier assets. An example of how the current model where users can borrow any asset turned out to be disastrous was when Cream Finance added AMP to the platform and was eventually exploited for $80m due to a loophole in the contract. Most protocols such as Aave still utilize this model, hence, Compound’s move away from it will help to reduce contagion risk drastically.

With this move, governance will also be crucial as holders get to decide on borrow, supply caps and rewards distribution. A proposal for COMP rewards to shift from Compound II to Compound III has already passed, incentivizing liquidity on the new market.

Metrics

Borrowing volume for Compound has dropped significantly since the end of last year - marking a 85% decrease YTD. Even with the roll out of Compound III and COMP incentives, utilization of the platform only increased slightly. The larger market is still cautious and most people are sidelined, which could explain the slowdown of activity in general.

Catalysts

Besides the Compound III launch, there is not much in the pipeline for Compound. While its multi-chain strategy has yet to be rolled out, the competitive landscape of lending protocols on other chains would make it hard for Compound to make an impact as well.

However, Compound could have an edge in offering to institutional investors who have lower risk profiles. Having a market with a single borrowable asset (USDC) reduces the risk of liquidation since user’s supplied collateral cannot be used by other borrowers. Lower risk of liquidation means that collateralization ratios can be adjusted to allow users to borrow more, enhancing capital efficiency. This would also allow Compound to increase the yield on USDC since all yield will be accrued on that asset. This would be favorable for institutional investors looking to get yield while minimizing risk, especially in current market conditions. Compound Treasury also offers 4% APR on deposits and now allows for borrowing of USD/USDC at a fixed rate of 6% APR for institutions.

This may not work well on retail users since having collateral that does not earn yield could be a huge trade-off. Especially if the markets resume greater activity, users would likely seek riskier plays that could earn higher yield elsewhere.

Overall, Compound’s product is still focused on its core purpose and by not expanding to other complementary markets - it simplifies the protocol a lot more, which helps in reducing possible attack vectors.

MakerDAO

Maker allows users to deposit collateral into Maker vaults to mint DAI, which can then be used to take out Collateralized Debt Positions (CDPs). Interest to lenders is also known as stability fee which varies according to the collateral used to take out the loan. Maker also has a Peg Stability Module (PSM) which is another revenue stream for the protocol. It allows users to trade DAI 1:1 with USDC, USDP and GUSD with zero price impact, while Maker earns from the fee charged to execute the swap. Maker has over $4b in stablecoins on its balance sheet, which has attracted many institutions especially in the bear market. Many proposals have been put out in recent months for these companies to utilize funds from Maker.

DAI’s stability is maintained by CDPs who can arbitrage the price difference when supply exceeds demand and vice versa.

Product Updates

Maker is diving deeper into Real World Assets (RWA) with the $100m HVB vault which went live in August and a recent governance vote on a proposal to invest $500m in US treasuries and corporate bonds for diversification of its balance sheet. Such diversification also allows for alternate revenue streams for Maker which will allow it to have a greater runway and withstand volatility in the market. The vault allows for new collateral types to be provided on Maker while expanding the utility of DAI. The HVB is also the largest RWA vault to date, placing Maker at the forefront of DeFi and real world adoption.

Coinbase has also put out a proposal - offering yield to Maker by utilizing USDC in the PSM to be held in Coinbase's custody under Coinbase Prime. The proposal went under a vote and has passed with majority. Gemini has also put out a similar proposal, with the difference being that GUSD will remain in Maker’s PSM, which helps to reduce custodial risk. If implemented, Maker could stand to earn significant yield with rather low risks - a huge boost for the protocol given that revenue from borrowing/lending has slowed significantly.

Metrics

Maker’s borrowing volume has remained within a smaller range in the past year, experiencing less of a drawdown as compared to other protocols on average. However, revenue has decreased sharply, attributed to lower volumes and volatility in the market. Hence, Maker turning to RWAs and PSM partnerships will help it to better withstand the crypto winter, as it acts as another revenue stream for Maker.

Catalysts

Maker is well-maintained to withstand the obstacles that crypto may face in the upcoming years. Besides having sufficient runway and constant revenue streams even in a bear market, Maker’s partnerships with traditional companies allow it to gain favorable sentiments in the eyes of regulators. Maker has also detailed plans for the future which strengthens the confidence in the longevity and viability of the protocol.

Maker’s co-founder Rune has put out a proposal with what it calls - Endgame, whereby it aims to make DAI as decentralized as possible. Firstly, Maker governance will be split into MetaDAOs - essentially smaller DAOs that each serve a specific purpose. Secondly, DAI will slowly lose its 1:1 peg to USD, with its price responding to the target rate which is essentially based on demand and supply to make DAI stable. This is part of the plan to reduce reliance on USDC (which DAI is currently backed by for around ~50%) to prevent potential regulatory matters down the road. The Maker Vault will also be used to stabilize DAI’s peg, similar to FEI’s PCV. Rune also proposes a move to have the majority of the Maker treasury to be held in ETH, with the proposal of creating EtherDAI (ETHD) - an asset that will aggregate top staked tokens for ETH. It can also be used as collateral for DAI, which is part of the Endgame’s assumption that regulatory crackdowns will come in the near future and hence, the creation of such assets will help to reduce the possible impact of regulations on Maker.

The Endgame will take around 10 years to play out, starting with Pregame which will entail the launch of ETHD and MetaDAOs liquidity mining program.

Competitive Advantage

Roadmap

With Maker’s Endgame roadmap, it seems well prepared to withstand the test of time with preparations being made in advance of potential regulations. Aave is also moving towards being more self-sufficient with the planned implementation of GHO, which would help them to reduce reliance on other stablecoins that could be regulated.

Compound’s development seems to pale in comparison, given that Compound III did not introduce many significant changes with the exception of the protocol moving away from the pooled risk model. Although risk is an important factor, it is unlikely to be much of a concern for most retail users given that they are mostly focused on the best yields. Aave still utilizes the pooled risk model but with v3, the Isolation Mode can help to mitigate the risk by having restrictions on newly supplied/riskier assets. Thus, Compound’s model could even be disadvantageous for them given that users can only earn interest from supplying the base asset (unlike Aave whereby users can still earn interest on other collateral) which reduces the options that users with different risk profiles have. Besides offering incentives, it may be hard for Compound to gain market share given that Aave offers a larger number of assets across more chains, and will likely remain the top choice for users with a greater risk appetite.

Institutional Strategies

Aave and Maker would be close competitors in terms of their offerings for institutional clients and RWA. Aave ARC aims to be the bridge between institutional clients and DeFi, and has already been successful in onboarding prominent funds since its launch last year. Aave has also launched a RWA market late last year, with the current market size standing at around $8.2m. Maker has been increasing the amount of RWA exposure in the past year, which is a good way to boost revenue in the current market as RWA-backed loans on Maker have increased by over $100m in the past few months, mostly attributed to the HV Bank vault. While RWAs have been a good way to diversify given the growth of it in the past year, protocols take on additional risk when integrating a rather new form of collateral. It might not be a problem now given the small size of the market with respect to the size of the protocol, but it would be a point to consider when it grows bigger - especially with Maker’s plans to integrate more RWAs.

DEXs

Uniswap

Uniswap is one of the oldest and largest DEXs in DeFi. It is available on 5 chains - Ethereum, Celo, Arbitrum, Optimism and Polygon. Being a pioneer in the space, the protocol has grown tremendously and has managed to maintain its growth, having one of the deepest liquidity in all of DeFi today. Uniswap is able to retain liquidity because all fees collected on the protocol are directed back to the LPs. This mitigates the risk of loss for LPs from IL as they receive LP fee revenue, which is the key to Uniswap’s competitive position with LPs.

Uni v3 launched in May 2021, with main features such as allowing users to decide on a range of prices they wish to provide liquidity to without compromising on the fees earned. Combined with flexible fee tiers and range orders, it provides LPs with more advanced options that other DEXs do not offer. Furthermore, Uniswap introduced a 1bps fee tier late last year on stable pairs (USDC-USDT, USDC-DAI) which is the lowest among all DEXs, making it more price competitive than Curve which offers 4bps for stablecoin swaps. Since then, the 1bps fee tier has been introduced to Uniswap on Polygon and Optimism as well, following an increase in volume on Ethereum with the implementation of the fee tier.

Product Updates

Uniswap has not had much of a product update this year. The only significant move would be the announcement of acquiring Genie in June, with aims of integrating it into the Uniswap platform itself.

The protocol recently announced a $165 million Series B round led by Polychain Capital, with aims of moving into mobile and provision of at least $60 million in grants to community projects in the next few years.

Metrics

Looking at the trading volume for Uniswap, the ATH volume was on the day when Terra imploded. Since then, overall daily volumes have decreased by over ⅔ on average, with the daily average volume for October being around $700m on Ethereum. Another chain which generates the 2nd most weekly volume would be Polygon, which has faced a similar drawdown but continues to have an average daily volume of $60m. Interestingly, the number of active users on Uniswap has been on the rise since July. This could be in relation to the deployment of 1bps fee tier on Optimism which helped to increase the volume generated by over 100%.

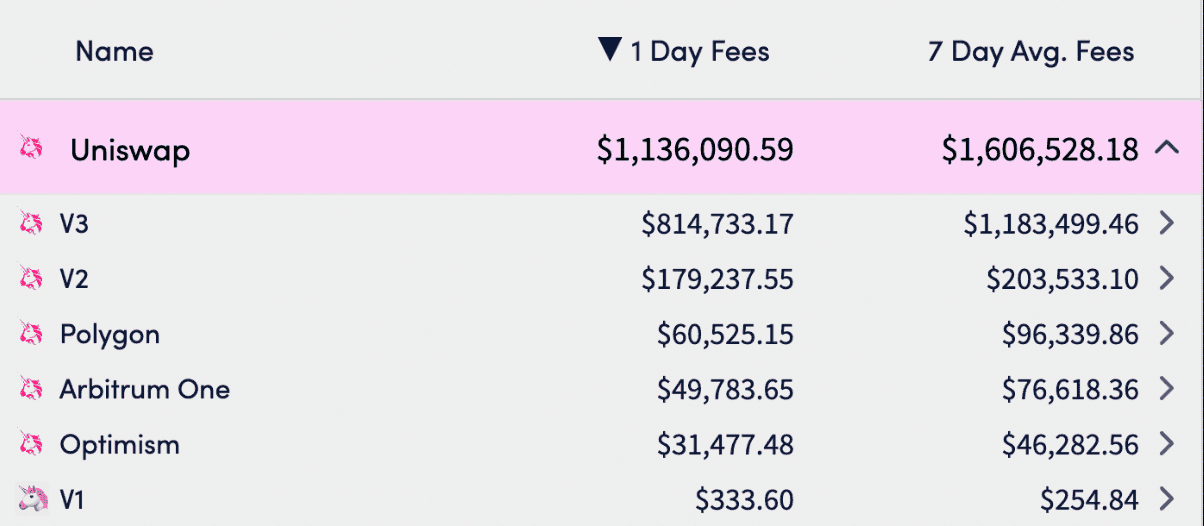

Uniswap is one of the top fee generating protocols across all dApps on different chains. 100% of the fees go back to LPs, which means that UNI holders do not directly benefit from the growth and performance of the protocol.

Catalysts

Uniswap has become the defunct DEX to trade on for many due to the availability of most pairs as well as deep liquidity which ensure better rates. Despite not having many updates in the year, Uniswap has managed to maintain a good market share of total trading volume for DEXs through expansion to L2 chains and the introduction of the 1bps fee tier. Governance has recently voted to deploy Uni v3 on zkSync as well, in line with the upcoming mainnet launch and further expanding its L2 market share.

Uniswap is unique from other DEXs in the way that revenue share does not go back to holders. There was a proposal to change this, by engaging a “fee switch” for several Uni v3 pairs through a pilot test, which will allow 10% of the fees to go back to UNI holders. However, there are differing opinions on whether this would be beneficial for the protocol - as there is a high possibility of LPs leaving for other competing protocols given that research shows even with current fee revenues, around half of the LPs on Uniswap v3 are losing money to IL. This could eventually lead to a negative feedback loop as less LPs supply liquidity across specific ranges, which causes users to move away from Uniswap due to worse execution which would generate less fee revenue and result in more LPs leaving. However, one can argue this is just the free market playing itself out - only the most sophisticated/profitable LPs will survive and the end user wins. It would be interesting to see how the pilot goes and whether it could actually be implemented once it goes through the full governance process.

Sushiswap

Sushiswap is an AMM-based DEX that is available across 17 L1/L2 chains. It also boasts an ecosystem of products ranging from lending, yield vaults and auctions.

Product Updates

Sushi launched various updates to different products in the last year. The update is also known as Sushi 2.0 - with some features already live at time of writing:

- SushiXSwap (live) - integration of a cross-chain DEX built on Stargate on Sushiswap; allows for swaps between assets across chains without bridges

- Trident (live) - a consolidated base framework for AMMs to allow for quick deployment of new pool types across different chains

- The four initial pool types are listed here

- The product is currently available on Polygon, Optimism and Metis

- “Franchise” pools are in the pipeline - aimed at institutional clients as a way for them to access the Sushi DEX while complying with KYC/AML requirements

- Furo (live) - a payments protocol built on top of the BentoBox allowing for projects/DAOs to stream salaries or carry out vesting contracts through it

- Complementary to the MISO launchpad for projects looking to launch their tokens

- Shōyu

- the marketplace built with Sushi’s inhouse NFT indexer featuring gas efficient contracts and social features

- Part of the platform fees will go back to xSUSHI holders

- The product has yet to go live with no estimated date in the pipeline

- the marketplace built with Sushi’s inhouse NFT indexer featuring gas efficient contracts and social features

Metrics

Sushi has several revenue streams - namely swap fees and interest on loans from Kashi. Swap fees are set at 0.30% of every transaction, with 0.05% going to SUSHI stakers. Daily trading volume for Sushi has been trending downwards significantly since the bull market last year, marking a more than 95% decrease from the ATH of $3.36b to the lows in September and October 2022. Part of the peak in trading volume and users towards the end of last year could also be attributed to SUSHI incentives. As incentives began to decrease, so did volumes and the number of users.

Despite lower fees on some pairs, Uniswap on Ethereum (v2) generates more fees on average as compared to Sushiswap across all chains. Uniswap has significantly higher TVL as compared to Sushiswap for the same pools, coupled with its concentrated liquidity model - it offers better swap rates across different pairs. Hence, there is no inherent advantage for using Sushiswap other than token incentives or better execution where applicable. Complementary products of Sushiswap also have low utilization - such as Kashi which only has $337k borrowed at the time of writing - hence, the Sushi ecosystem is not sticky enough for users to remain on the platform.

Catalysts

As of now, Sushi does not really have any products in the pipeline that would likely be a catalyst for volume to return to the protocol. Sushi’s revenue streams are limited to swaps on the platform, given that Kashi has really low volume. Apart from SushiXSwap which sets it apart from Uniswap, the complementary products of Sushi are weak and do not get much usage. There is also no date as to when Kashi would be revamped on Sushi 2.0, alongside Shoyu which has been delayed for several months. Leadership struggles could have contributed to the slowing of Sushi’s development - with core team members such as 0xMaki and Joseph Delong leaving just under a year ago. Furthermore, resources seem fragmented due to simultaneous building of many different standalone products at once, resulting in under-delivery.

Sushi recently appointed a new head chef - Jared Gray, based on a community vote that was slightly controversial given that two entities - Cumberland and GoldenTree made up 8.1m of the 13m votes in total. Interestingly, GoldenTree recently purchased SUSHI as the first public investment of their new crypto fund and also stated their interest to be involved with the protocol in terms of tokenomics redesign and strategies moving forward. The result of the appointment of Jared was mixed, given that many people brought up his background in projects that were involved in some form of controversy. There are also mixed responses to the involvement of such VCs but it would be interesting to see if any significant change can be developed given that SUSHI’s tokenomics does not allow for much value accrual at the moment. Therefore, with new leadership and backing, Sushi’s growth in the next few months would be the one to watch - although a lot remains to be seen.

Curve

Curve is a DEX that mitigates slippage between exchange of assets with similar value (i.e. stablecoins, similarly pegged assets). Curve’s governance token - CRV is used to incentivize liquidity with staking rewards (50% of trading fees) and voting power when users lock it up for veCRV. Curve was the pioneer of the “ve” tokenomics which helped it to gain a lot of traction in 2021, especially during the narrative of the Curve Wars. The ability to vote on LPs to receive the most rewards was a huge incentive for protocols to accumulate veCRV and bribe veCRV holders to vote on their pools - which created a flywheel that allowed CRV to surge in price.

Product Updates

There have not been any updates on Curve for the past year. The team released a GitHub repository on the protocol-issued stablecoin - crvUSD. There are many speculations of the utilities of crvUSD and updates that could be introduced with its launch, but nothing concrete has been determined by the team yet. More details about the possible updates can be found here.

Metrics

Curve has been one of the main DEXs for stableswaps since its invention. It boasts stable pools with the deepest liquidity, including the 3pool which allows Curve to be the most efficient route for aggregators due to its capital efficiency.

Trading volume on Curve has decreased pretty significantly in the past few months, with the exception of the large spikes during UST’s collapse in May as well as stETH’s peg deviation from ETH in June. Given that Curve’s primary revenue stream comes from trading volumes, such a decline would be a cause for concern given that revenue share for holders are also decreasing. Curve also has the lowest 7 day average fees generated among the DEXs mentioned in this report, which is concerning given that users locking up their CRV has been major backstop for CRV emissions. Bribes for veCRV holders provide additional incentives for users to lock CRV, but it may not last if Curve continues to experience lower volumes and TVL.

Catalysts

There is not much information regarding crvUSD yet, but it would be interesting to see how it will be utilized in the Curve system to have a greater flywheel effect. Similar to how Aave has GHO, crvUSD aims to bring about greater revenue share and utility for veCRV holders.

veCRV has been huge in dealing with the inflation of CRV tokens - over 60% of CRV is locked for an average of around 3 years. However, CRV inflation has become of concern lately with the market drawdown. Current emissions stand at around 500k per day, which is more than what the protocol earns from trading fees. While Curve has a sizable treasury, such inflation will not be sustainable in the long run. Hence, the implementation of crvUSD will be crucial for the future of Curve and its sustainability.

Competitive Advantage

Comparing these 3 protocols - Uniswap and Sushiswap are direct competitors of each other, given that Sushiswap was a fork of Uniswap itself. Curve is differentiated from these 2 protocols by focusing on stableswaps and having a vote-lock tokenomics mechanism that allowed it to experience exponential growth during the bull market. However, with the launch of Uniswap v3, Curve and Uniswap becomes a close competitor with each other due to similar trading fees on stable pairs. Both protocols differ in terms of their liquidity model - while Curve relies on a large TVL to offer better trades, Uniswap utilizes a concentrated liquidity model which allows for more capital efficiency with a smaller TVL.

Uniswap vs. Sushiswap

Looking at YTD trading volumes, Uniswap has almost 10x the volume as compared to Sushiswap and has done so without the need for token incentives. One reason why is probably because of Uniswap’s concentrated liquidity model which allows for deeper liquidity within a price range that traders choose to allocate their funds to, which allows for better swap prices within that range. For Sushiswap, 0.05% of each trade goes back to stakers while all fees on Uniswap are directed back to LPs. However, this also means that UNI holders do not get to directly benefit from the growth of the protocol, as they do not receive any share of the fees, unlike SUSHI stakers. The Uniswap “fee switch” pilot proposal on a few Uni v3 pairs passed with majority back in August but has yet to be implemented so far. Given that the pairs selected are part of the top 15 pairs on Uniswap, the amount of fees generated would be significant. Regardless, Uniswap still manages to be on top of Sushiswap, signaling that revenue share may not be that much of an incentive for most users.

Uniswap v3 offers a more sophisticated LP mechanism that Sushiswap does not. Furthermore, Uniswap's acquisition of Genie could also open new avenues for Uniswap to gain exposure to the NFT markets. Unless Kashi is able to achieve tremendous success, there is little separating Sushi from its counterpart in terms of its DEX functionality. Therefore, despite the lack of revenue share for holders, Uniswap is still able to remain way ahead of Sushiswap in terms of trading volume.

Uniswap vs. Curve

Comparing Curve v2 to Uniswap v3, the trends show that Uniswap has been taking market share from Curve for stableswaps especially after the 1bps fee tier implementation. While Curve volume was still more significant during the UST de-peg due to the 3pool with UST, Uniswap has slowly stabilized its growing market share in the past few months.

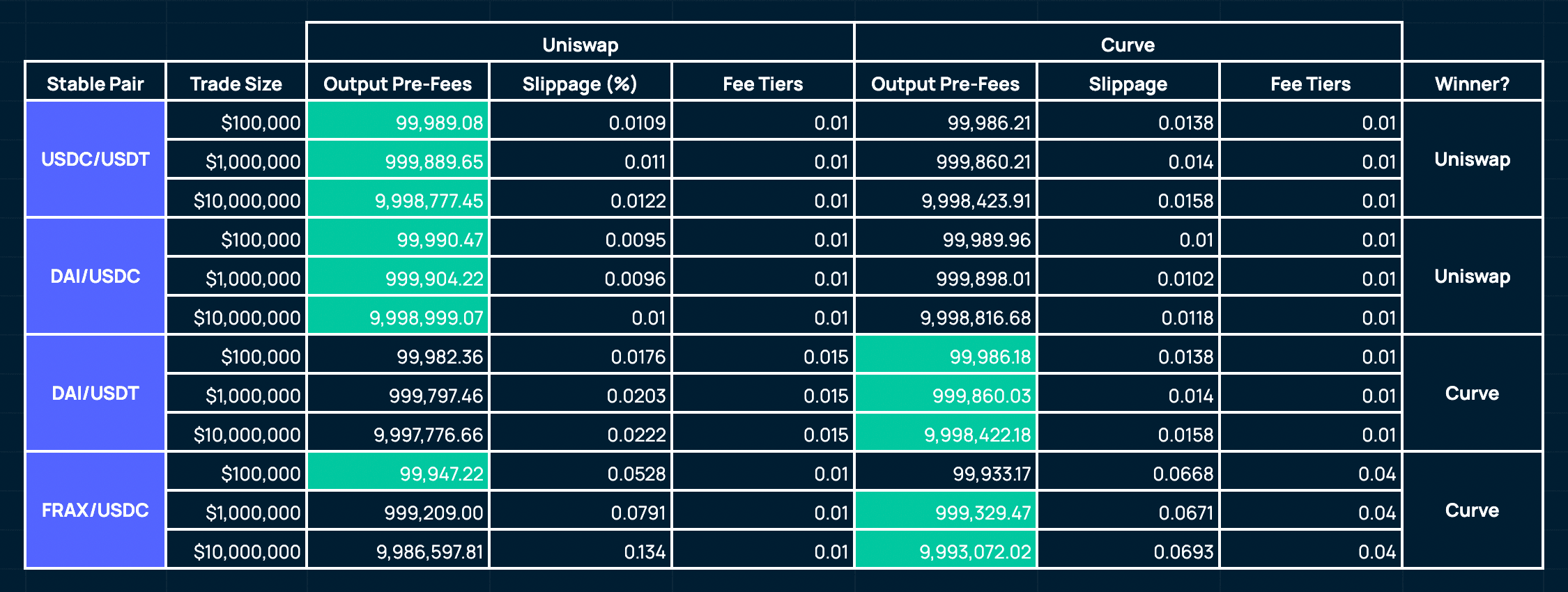

The image below shows the efficiency of trades carried out on Uniswap and Curve on stable pairs as of 25 October, 2022. Overall, Uniswap edged Curve out by a small margin in terms of offering better trades. However, price differences between certain pairs are rather close, such as USDC/USDT for 100k and 1m trade size. These prices tend to fluctuate day by day and with such small margins it would be hard to determine a clear winner. Pairs with a large price difference would be DAI/USDT and FRAX/USDC on 10m trade size, whereby Curve would be the clear winner over Uniswap in that instance. In general, Curve tends to offer better trades for large trade sizes probably due to its higher TVL.

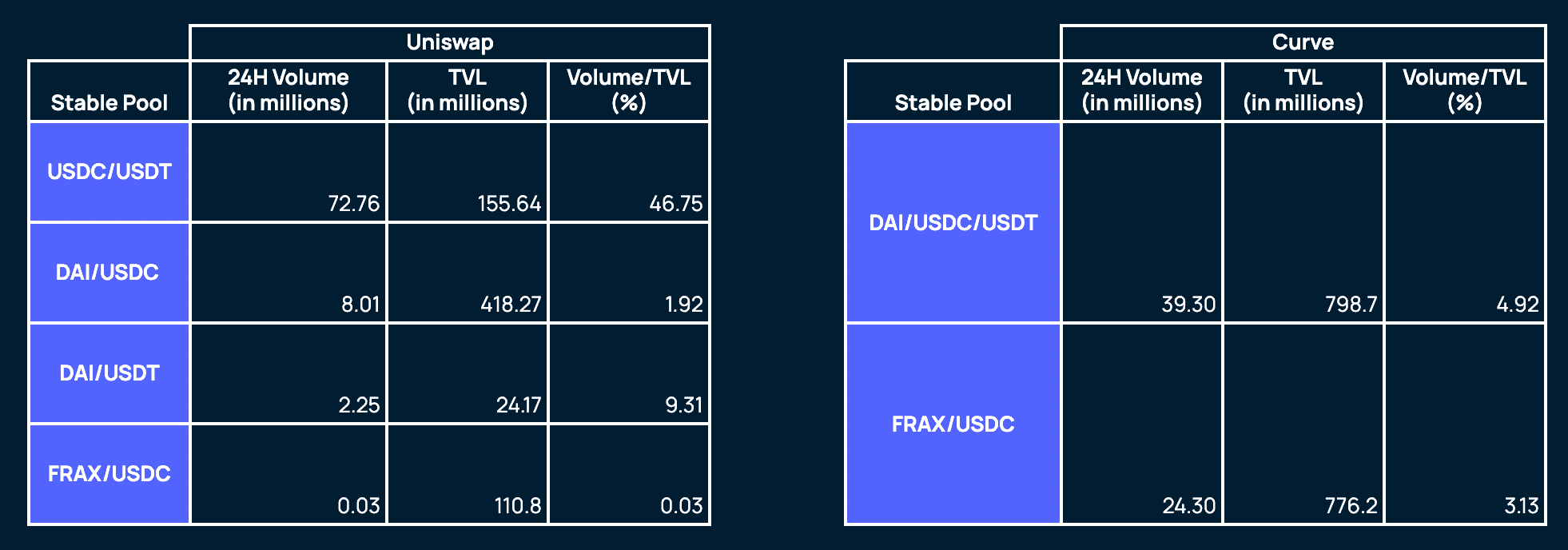

Looking at the daily volumes and TVL of stable pools on Uniswap and Curve, Uniswap actually has much better utilization rates than Curve in general. This suggests that the concentrated liquidity model is more capital efficient as compared to deep liquidity, since better swap prices could be achieved with lesser liquidity.

Uniswap has higher daily volumes as compared to Curve on average. This may suggest that aggregators such as 1inch, could have started to switch their route to go through Uniswap instead, which signals its ability to offer better rates. Uniswap also fares better for non-stable pairs, with trading volume that is significantly greater than Curve pools.

Overall, both Uniswap and Curve have aspects that they specialize and do well in based on today’s volumes. Uniswap is more well known in terms of having a robust ecosystem (AMM, acquisition of Genie, Uniswap Foundation) while Curve is still mainly focused on its core purpose of stableswaps. However, Uniswap’s dominance in the stablecoin market share has slowly been increasing, probably attributed to the introduction of 1bps fees which makes it competitive to Curve. The introduction of crvUSD in the near future could be a starting point for Curve to expand beyond their current offerings, and it would be interesting to see how it develops.