Introduction

With the launch of many new chains and protocols in the past year, news surrounding airdrops on CT have been rife - such that it has become a narrative for users to follow. However, speculations for retroactive airdrops on protocols/chains are typically not backed by on-chain data. When assumptions are not backtested, this normally results in noise. This report intends on providing a data-driven approach to playing airdrops to maximize potential profits.

From our previous report on utilizing Nansen’s ‘Airdrop Pro’ label, some of the top contracts that the ‘Airdrop Pro’ wallets have interacted with have carried out or announced their airdrops in the past few months, including Euler, Gnosis, Genie and Across Protocol. These airdrops mostly ranged from a few hundred dollars, up to a thousand dollars for the latest Genie airdrop. Hence, using on-chain data to find out what some of these wallets have been interacting with in the past few months will be helpful in surfacing airdrop alpha.

The Nansen ‘Airdrop Pro’ label is curated by filtering for wallets that have met these conditions:

- Having >$100k in airdrop profits (Airdrops are valued based on 30D average after the distribution starts)

- The profits were made over 3 or more unique airdrops

- The last outgoing transaction of the wallet must be later than 1 Jan 2022 (To filter for active wallets)

Hence, these wallets have demonstrated the ability to identify and fulfill the criteria of airdrops such that they were able to receive significant amounts in USD value, which is what this analysis will try to emulate. The report will cover the top wallets that have received significant airdrops in the past few months, as well as the top interacting contracts with Airdrop Pro wallets.

Methodology

In the past few months, prominent airdrops that have occurred mainly came from L2s and newer chains, as well as the protocols on these specified chains. Larger airdrops that went live since our last report include Optimism, Evmos and Canto. Bridges were also a prominent airdrop narrative with protocols such as Hop Protocol and Across Protocol announcing their airdrops in the recent months.

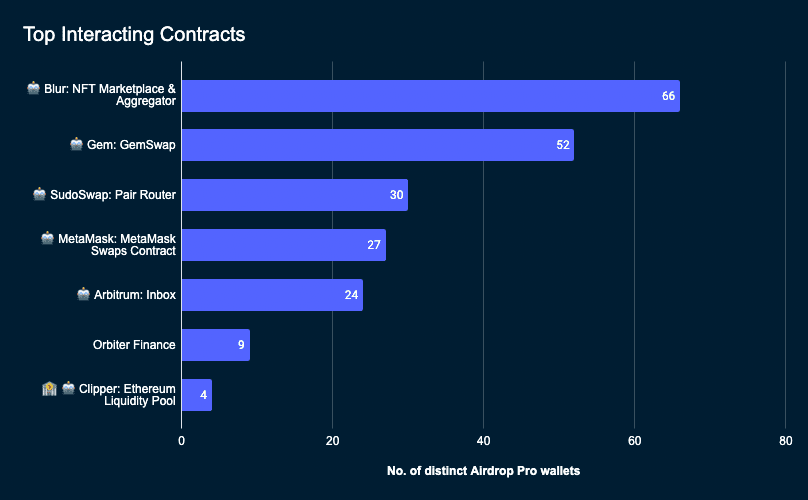

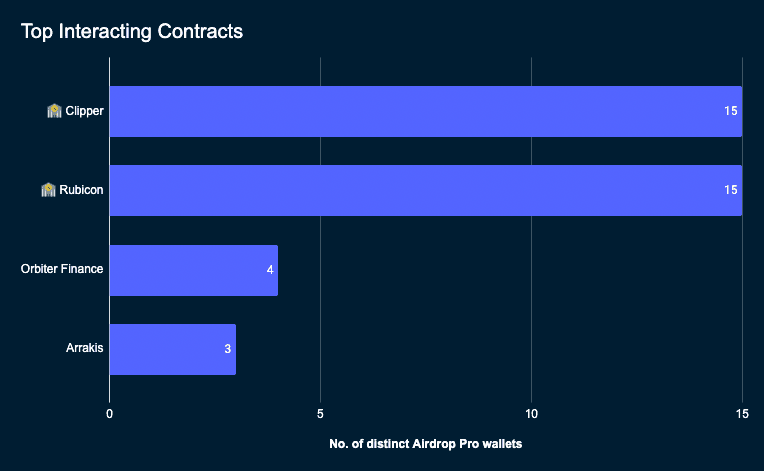

With this data backing our original hypothesis of 'Airdrop Pro' wallets interactions leading to potential airdrop opportunities has proven to be a leading indicator of some airdrops. Although not perfect, it is a baseline to go off of. With this in mind, we looked at the top interacting contracts for ‘Airdrop Pro’ wallets in the last 3 months on different chains, filtered for protocols that have not released a token. The number on the charts shows the distinct number of ‘Airdrop Pro’ wallets who have interacted with the contract.

Ethereum

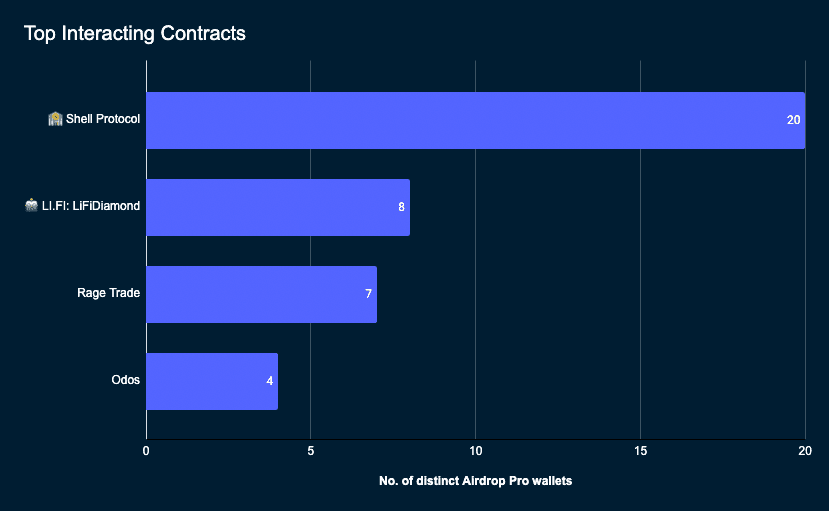

Arbitrum

Arbitrum has had a lot of activity in the past few months, largely due to the Arbitrum Odyssey event. The number of daily transactions have been steadily increasing, up by over 3x on average since August. This could signify the success of the Odyssey event as well as the ability to retain users even after that. The event brought the spotlight to its ecosystem with more airdrop rumors around a significant number of tokenless protocols. Looking at the chart below, there are a few potential airdrops that could occur for some of these protocols in the next few months.

Optimism

Optimism is another chain that has had increased activity in the past few months due to retroactive airdrops of its token - OP. Despite transactions falling from its peak during the first wave of the OP airdrop, the ecosystem has been gaining traction as seen in the daily transactions which have increased 3x on average from August, similar to Arbitrum. This is despite Optimism having less than half the number of active addresses on Arbitrum on average, signaling that Optimism users are transacting more than Arbitrum users. For many new protocols that have been launched on the chain, they each had their own airdrops as well. Other prominent protocols that have had significant interaction with Airdrop Pro wallets are shown below.

Potential Airdrops

Based on the data gathered, the list below shows a number of protocols/chains that are likely to have airdrops in the next few months:

1. Blur

Blur is an NFT marketplace and aggregator with tools such as sweeps and a portfolio tracker all on a single platform. It also boasts zero fees and is faster than other aggregators such as Gem. The protocol raised $14m from investors such as Paradigm and has confirmed the airdrop of the BLUR token which will go live in January 2023. Allocation for the BLUR token will be determined by ‘Care Packages’ which can be claimed when users use the platform. The first wave of ‘Care Packages’ have been given out but users can still qualify for the second wave by listing their NFTs on Blur. Users can also increase their chances of receiving a package with more tokens by increasing their loyalty score, which is determined by a user’s utilization of Blur vs. other NFT marketplaces. More details about the second wave can be found here.

2. Arbitrum

Following Optimism’s airdrop in the last few months, there has been strong speculation that Arbitrum will be next in line. The Arbitrum Odyssey event was assumed to be the criteria for getting the airdrop given that it involves a series of tasks interacting with various Arbitrum dApps. The list of protocols involved in Odyssey can be found here. However, the event was paused indefinitely after gas fees on the network shot up significantly to exceed mainnet fees during the 2nd week, probably attributed to the large inflows of new users. While it seems like Odyssey will not be resuming anytime soon, it is probably still worth exploring the chain nevertheless.

Besides Arbitrum One, a new chain built on Arbitrum’s AnyTrust technology launched back in August - Arbitrum Nova. The key difference between Nova and One is that transaction data is not posted on-chain and it does not inherit the security of the L1. This is because Nova has its own Data Availability Committee (DAC) which allows the chain to have its own security assumptions. This allows for lower fees and greater security. Many speculate that activities on Nova will be counted towards the future airdrop as well, hence, it would be beneficial to simply bridge some funds over to interact with Nova dApps. Bridges that support Nova include the Arbitrum Bridge, Connext, Multichain and Orbiter. Connext and Orbiter currently do not have a token, hence, using them to bridge over could be ‘killing two birds with one stone’. A list of dApps available on Nova can be found here.

3. Orbiter Finance

Orbiter is a cross-chain bridge focused on facilitating transfers between EVM rollups. It utilizes a Sender and Maker mechanism to facilitate transfers, whereby users do not interact with the contract address as funds are sent directly to the Maker’s EOA address. Therefore, fees on Orbiter include a withholding fee, which is used to pay for the Maker’s gas fees when they transfer to the user’s destination network. This is on top of a transaction fee of 0.2-0.3% of every transaction.

Based on information in the Discord, the team has confirmed that there will be a token but its release date has yet to be confirmed. Orbiter’s tweet about allowing users to join a guild to get roles in their Discord has led to a lot of speculation that the roles will have a part to play in determining a user’s airdrop allocation. While nothing is concrete yet, it will be good to complete some of the actions to obtain roles in the guild since it involves interacting with the bridge which will most likely be used to determine whether users will qualify for the airdrop.

4. Shell Protocol

Shell Protocol is a DeFi protocol built on Arbitrum which aims to become the base for projects to deploy their liquidity pools on Shell v2. This could build a strong liquidity network that will allow users to swap across different projects with ease and lower fees. The protocol also allows for multi-token swaps in a single transaction for greater efficiency.

The team has confirmed the existence of a SHELL token but details surrounding the mechanics and when it will be airdropped has yet to be revealed. Based on information in the Discord, it seems like Toucan holders will get to vote on the airdrop mechanism. The Toucan NFTs can be purchased here and currently sits at a price of 0.018 ETH. Holding the NFTs will allow users to have a higher quota on Shell points and vote on governance, which could also be a determinant for the airdrop. Otherwise, users can just wrap their tokens (ETH, USDT, USDC, DAI and WBTC) to Shell-wrapped tokens and provide liquidity to the DAI-USDC pool to earn more points. Do note that you will need a quota to start earning Shell points - which are given to users who have provided liquidity in v1, hold a Toucan NFT or you may purchase Expanders from here to get a quota. More details on how the different NFTs work can be found here.

5. LI.FI

LI.FI is a multichain bridge aggregator that allows users to receive the best swap rates for bridging. It also incorporates DEX aggregators with certain bridges that may not support certain tokens, making it an easy process for users as the process remains ‘one-click’.

The team has confirmed the existence of a token in the future, but mentions that the main priority will still be product development. The main speculation to qualify for the airdrop is to utilize the bridge. Given that the Hop Protocol airdrop criteria was to have a minimum of 2 transactions totaling 1000 USD, it could be beneficial to use these figures as a benchmark to potentially qualify for the airdrop in the future.

Others

| Protocol | Distinct Airdrop Pro Users | Contracts | Steps to maximize Airdrop |

|---|---|---|---|

| Blur | 66 | Blur: NFT Marketplace/Blur: Aggregator | Article |

| Gem | 52 | Gem: GemSwap | Use the platform to buy/sell NFTs |

| Sudoswap | 30 | SudoSwap: Pair Router | Thread |

| Metamask | 27 | MetaMask Swaps Contract | Thread |

| Arbitrum | 24 | Arbitrum: Inbox | Utilize Arbitrum dApps/Nova dApps |

| Shell Protocol | 20 | Shell Protocol | Thread |

| Orbiter Finance | 13 | Orbiter Finance | Article |

| LI.FI | 8 | LI.FI: LiFiDiamond | Thread |

| Rage Trade | 7 | Rage Trade | Thread |

| Odos | 4 | Odos | Thread |

| Arrakis Finance | 3 | Arrakis | Thread |

Even though Clipper Finance and Rubicon were part of the top interacted contracts for Airdrop Pro wallets, the protocols have confirmed in the discords that there is no token in the pipeline yet. Hence, they were not included in the table.

For Sudoswap, the airdrop criteria has been announced and the only way to qualify at the moment will be to lock XMON for 3 months when the lockdrop event goes live or be a 0xmons holder. For Gem, many speculate that there will not be a token given that they have been acquired by OpenSea. However, the latest update from the team in Discord mentions that ‘tokens are not out of the question’. Hence, it still may be worth playing around with the platform for a potential airdrop in the future. For Arrakis Finance, the team has confirmed a token - SPICE, whereby the lockdrop of GEL was one way to get the airdrop. The team has not clarified on whether the lockdrop of GEL is the only way to get the SPICE - which has led to much speculation on CT that engaging with the protocol will still grant users a share of the airdrop, given that the SPICE token has yet to go live.

Bridges

Apart from interactions with contracts, bridges have also seen an increase in volumes in the past year - attributed to numerous new chains popping up with speculated airdrops. These chains often experience large spikes in transactions and volume during certain periods, mostly from users that try to sybil these airdrops for “free money”. Some of the past airdrop criteria have been pretty simple for users to “game” since it just involved users bridging a small amount of funds over and executing several swaps. However, this results in a lot of mercenary capital as these users enter and leave the ecosystem quickly and are likely to dump the tokens once airdropped. This is harmful for the ecosystem as rewards for true users are diluted by these sybillers.

The Optimism airdrop was one of the first among L2s, and a relatively easy criteria meant that over 260k addresses qualified for the airdrop. The recent Aptos airdrop required users to submit an application for the incentivized testnet and mint the Aptos: Zero Testnet NFT which reduced the number of eligible addresses, which was around ~120k. Hence, airdrop criteria is constantly changing in response to past airdrops, as protocols/chains try to weed out airdrop hunters by introducing criteria that would be hard to fulfill using bots, etc.

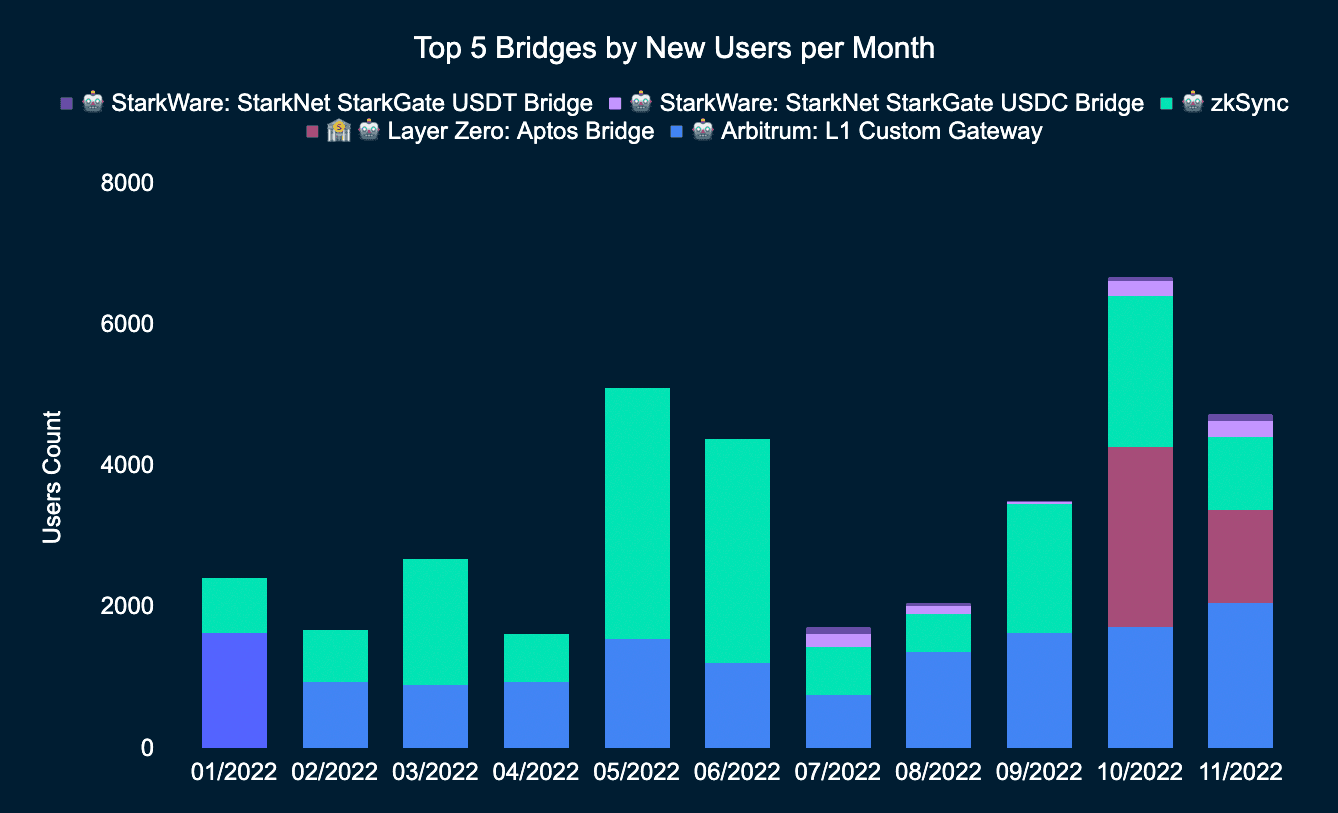

The chart below show new users monthly growth from the top bridges in the past year, filtered for the prominent chains that are rumored to have airdrops in the near future.

Note: The StarkWare and Layer Zero bridges do not have full data YTD since these bridges launched at the start of their respective dates in the chart below.

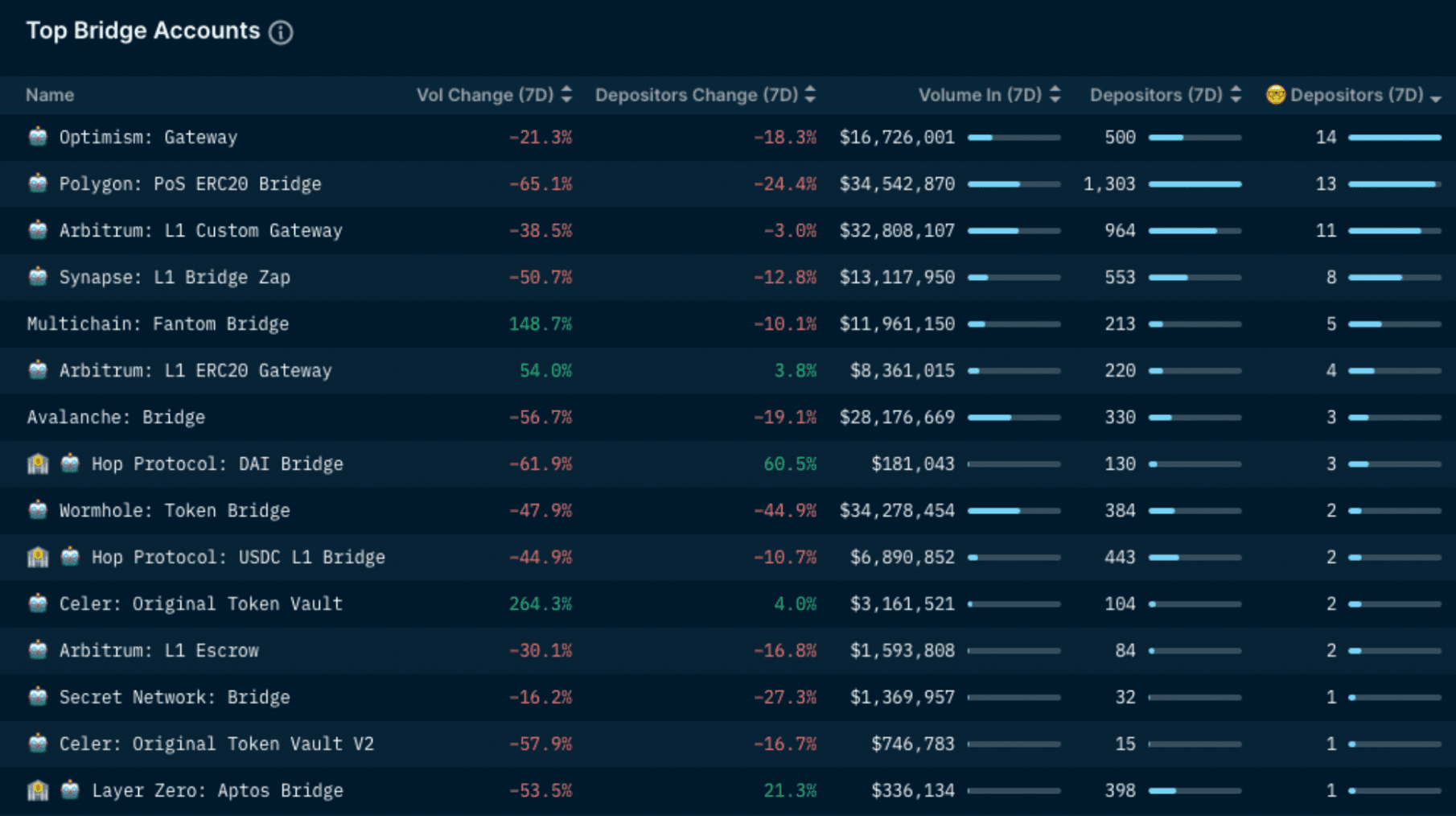

The number of new users interacting with the bridges is generally a good indicator of potential airdrop opportunities. New chains tend to experience a spike in numbers as the ecosystem grows and users bridge over in a bid to be ‘early’ and qualify for airdrops. Arbitrum: L1 Custom Gateway, Layer Zero: Aptos Bridge, zkSync, StarkWare: StarkNet: StarkGate USDC Bridge and StarkWare: StarkNet: StarkGate USDT Bridge are the top five bridges ranked by number of new users yet to have an airdrop.

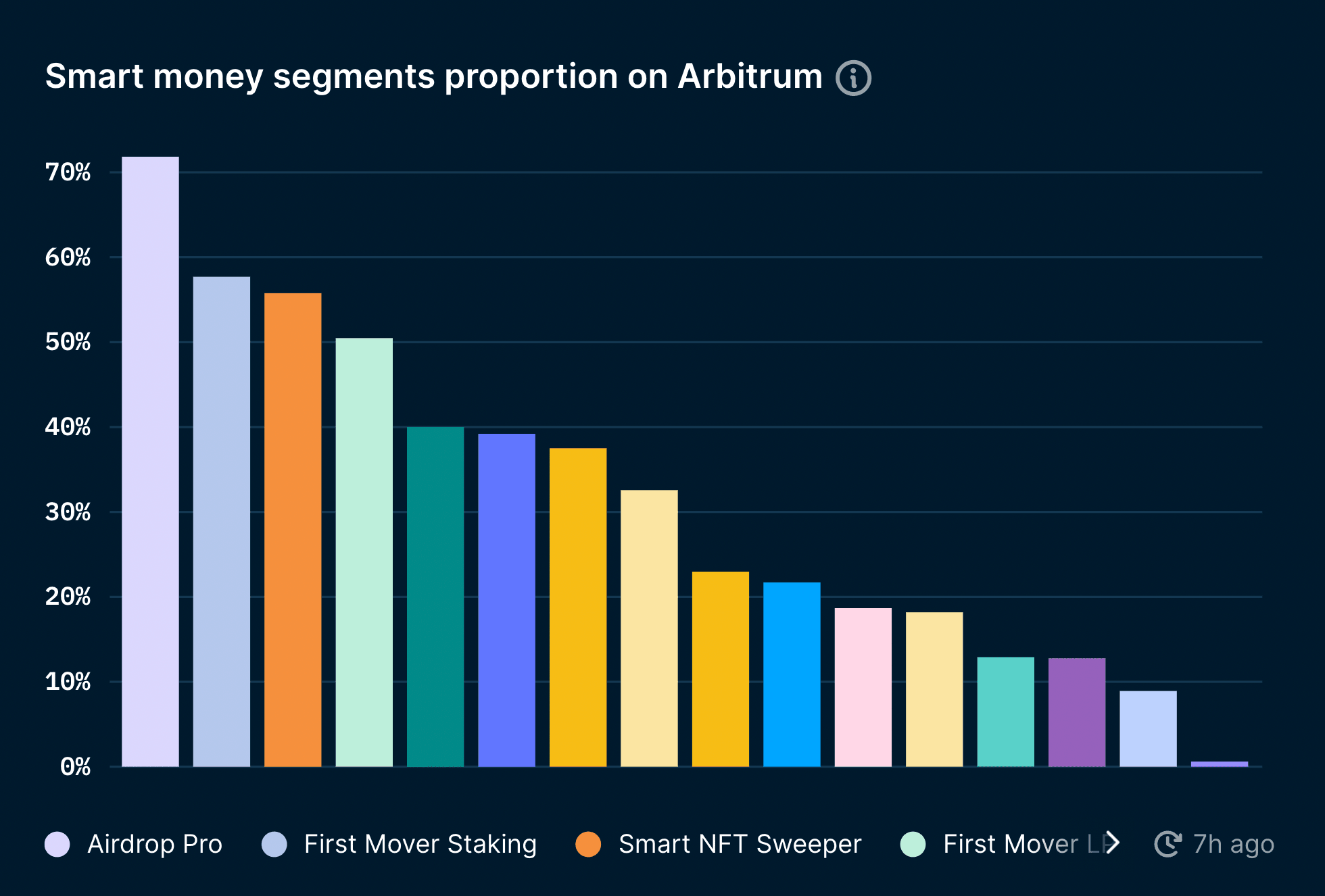

1. Arbitrum: L1 Custom Gateway

Interestingly, Arbitrum: L1 Custom Gateway had an overall upward trend in new users growth YTD. This Arbitrum bridge is used to transfer ETH and other ERC-20 tokens from Ethereum (Layer 1) to Arbitrum (Layer 2). Since July 2022, it has witnessed a huge uptick and now reaching ATH YTD at 2,051 new users as of November 2022. In addition, Arbitrum dashboard shows that about 70% of Nansen labeled Airdrop Pro users are on Arbitrum. This high conviction demonstrated by the number of new users using this bridge and Airdrop Pro wallets on-chain suggests that Arbitrum is touted to be the next chain to airdrop their token. Off-chain narratives support this view as well, given that the Arbitrum Odyssey event is largely thought to be the prelude to the release of the governance token. Even though the event has been paused indefinitely, many still believe that an airdrop is more or less confirmed and thus, will be worth it to bridge some funds over to play around in the ecosystem.

2. zkSync

Another bridge that has quite a number of new users on it is zkSync. The number of new users peaked in May and June of 2022 when there were high speculations of a zkSync airdrop given that Optimism had just airdropped their OP tokens around that time. zkSync is also an L2 scaling solution but it differs from Optimistic rollups such as Arbitrum and Optimism in terms of the types of proofs used. zkSync utilizes validity proofs to confirm transactions while optimistic rollups utilize fraud proofs. zkSync documentation shows that a token has been confirmed and the founder has also mentioned that the network will be ‘community-owned’. This article guide describes some strategies that can help qualify for potential upcoming airdrop in the near future.

3. Layer Zero: Aptos Bridge

Layer Zero received a lot of attention since its launch in October as shown by the impressive amount of new users on its Aptos Bridge, with 2,547 new users during October and 1,324 new users as of late November. Also shown in the Nansen Bridge Builder dashboard, there are 398 depositors and 1 Smart Money Depositor in the past 7 days. Note that only 16 out of the 222 Nansen-labeled bridges contain at least 1 Smart Money Depositor. Among the 16 bridges, only Arbitrum and Layer Zero bridges are tokenless bridges. Many other prominent network or protocol bridges such as Optimism and Hop Protocol already had their airdrop. Note that the Arbitrum: L1 Custom Gateway bridge discussed earlier has received 11 Smart Money Depositors in the past 7 days!

For Layer Zero: Aptos Bridge, users can move USDC, USDT, and ETH into Aptos from Ethereum, Arbitrum, Optimism, Avalanche, Polygon, and BNB Chain. More detailed instructions on using the bridge can be found in the article released by LayerZero Labs. Layer Zero is also speculated to have airdrops and by using the bridges and interacting with the protocols on the protocols can potentially qualify users for an airdrop if they launch their own token. Some step-by-step airdrop strategies can be found in this article and thread.

4. StarkWare: StarkNet StarkGate USDC/USDT Bridge

StarkWare is another L2 chain using validity proofs that aims to improve the scalability of Ethereum. The quantity of new users on the two StarkWare bridges is lesser than the other bridges mentioned above, probably due to the fact that StarkNet is still in testnet. Nonetheless, the bridges have experienced a strong upward trend in users growth since September. According to the Nansen Bridge Builder dashboard, the number of depositors in the past 7 days for the two bridges are relatively high (152 depositors for the USDC bridge and 69 depositors for the USDT bridge). The airdrop for StarkWare was confirmed back in July and the StarkNet token was recently deployed on Ethereum, potentially signaling an imminent airdrop. There is still a good opportunity to qualify for the airdrop by using the bridges. Here are some threads: #1 and #2 on how to maximize the chances of getting StarkWare’s STARK token airdrops.

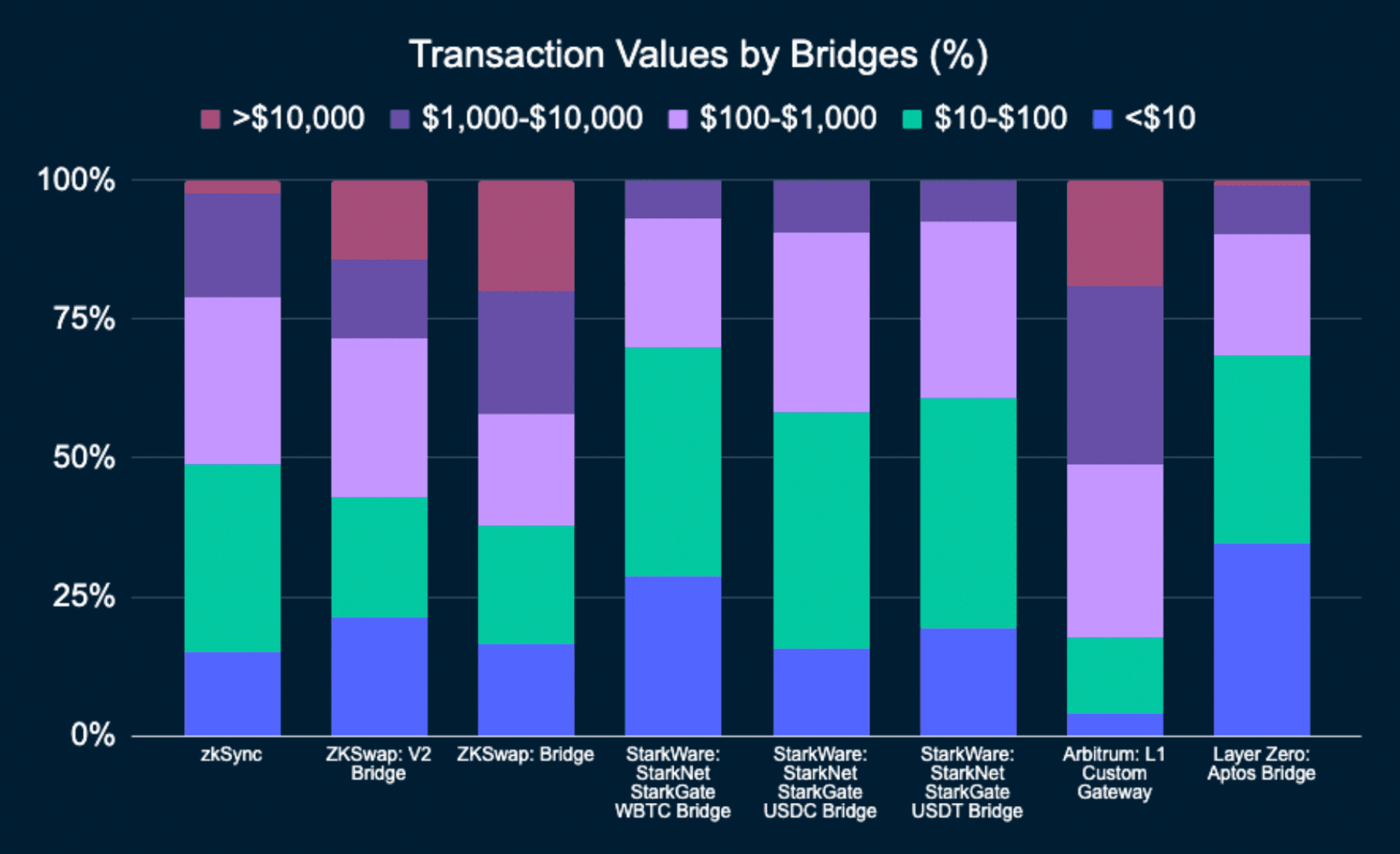

We also looked at the value of transactions going into the top bridges to see if there are certain trends or what amount bridge users in general are transferring in with upcoming token airdrop speculations. The transaction values of the bridges are divided into five categories with each represented by five different colors: <$10, $100-$1,000, $1,000-$10,000, and >$10,000.

Each stacked bar displays the percentage of transaction values for a specific bridge. Across all the bridges, it looks like most people are transferring anywhere between $10 and $100 values or between $100 and $1,000 values. The majority of the bridges have around half of their transactions valued at less than $100, with the exception of Arbitrum. This could signal that there are more ‘real’ users for Arbitrum who transfer in larger amounts to actually use the chain and its ecosystem. As for Layer Zero: Aptos Bridge, 34.6% of transactions are less than $10 in value, signaling a high amount of sybillers for the Aptos airdrop.