Key Takeaways

- The APE Staking Contract went live on December 5, with pre-deposits available at launch. Reward accrual will only start on December 12.

- There are 4 staking pools, each with a different commitment and APE participation limit per asset committed.

- 100m APE tokens, equivalent to 10% of the token supply, are allocated to the staking program in the first year across all available pools and are taken from the portion of the ecosystem fund allotted to the DAO treasury and resources (totaling 47% of the total supply).

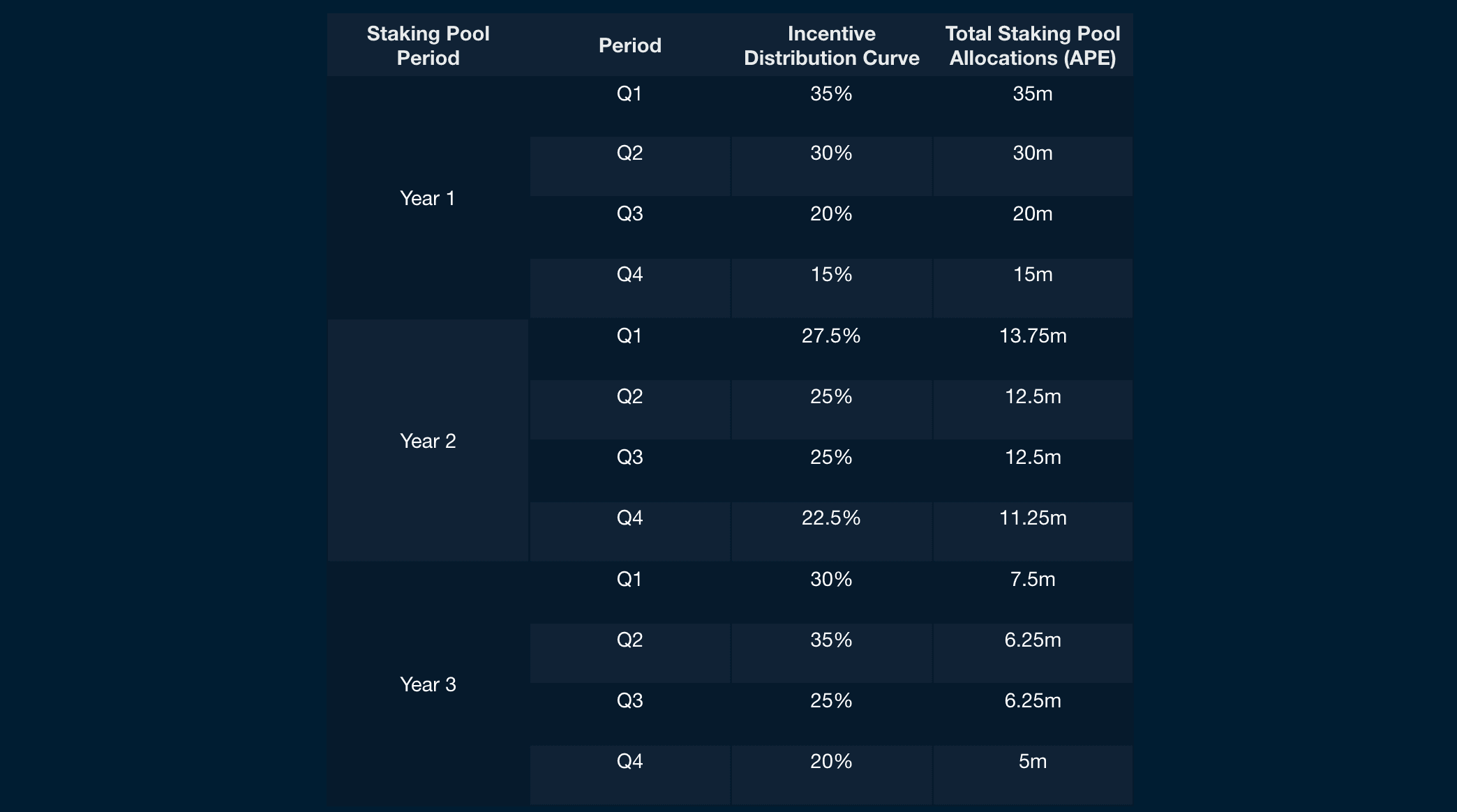

- The reward system is structured such that the incentive distribution curve declines every quarter throughout the three-year duration.

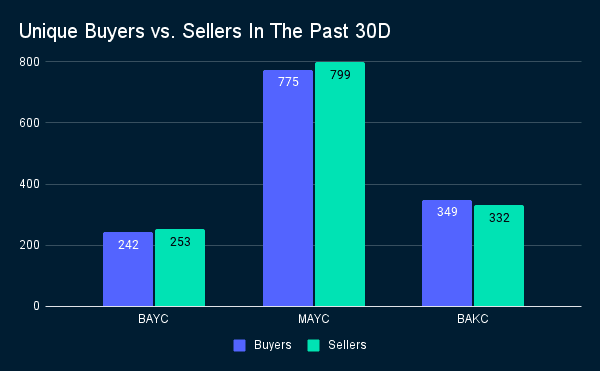

- In the past 30 days, there have been more unique sellers than buyers for both BAYC and MAYC collections.

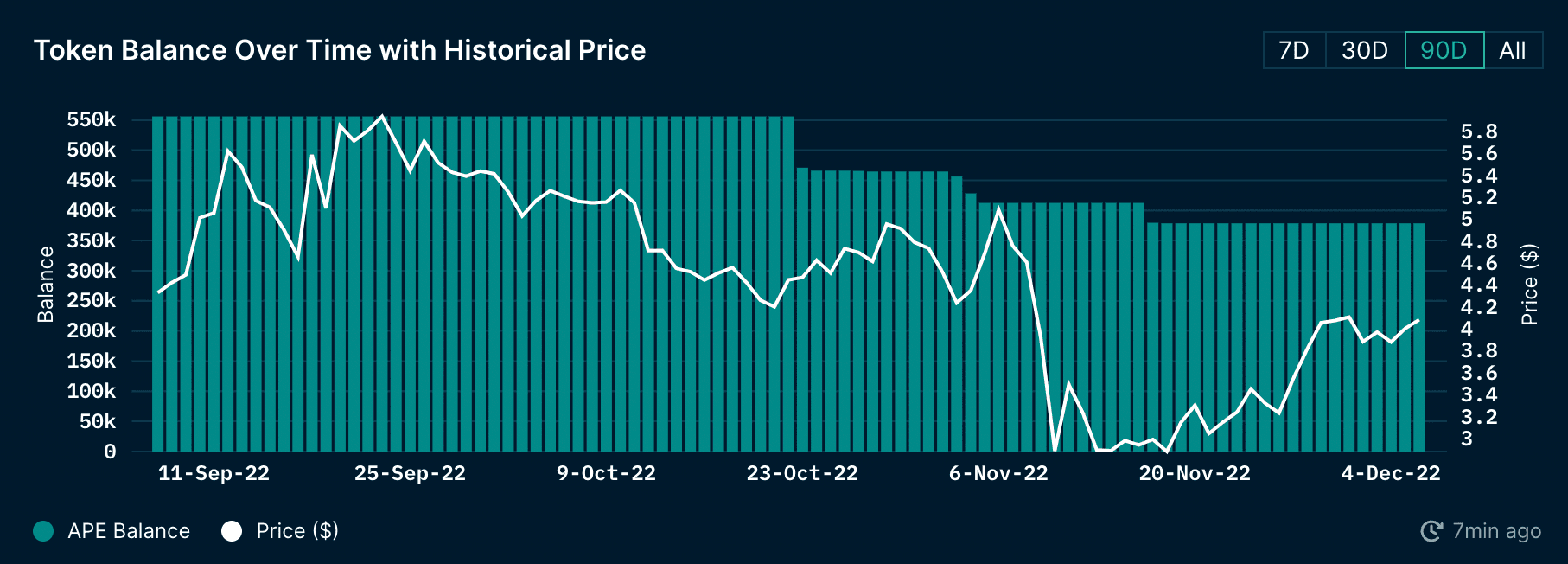

- Smart Money balance for APE tokens has been trending downwards since inception, with the peak at 12m APE distributed across 200+ Smart Money wallets. As of December 7, the total APE balance amongst SM holders stands at 5.3m APE, distributed across 239 wallets.

- Only 12 Smart Money addresses are currently in the APE staking pool, with a cumulative value of 364k APE (~$1.4m). As of December 7, there is 8.3m APE (~$34m) in the APE Staking Contract.

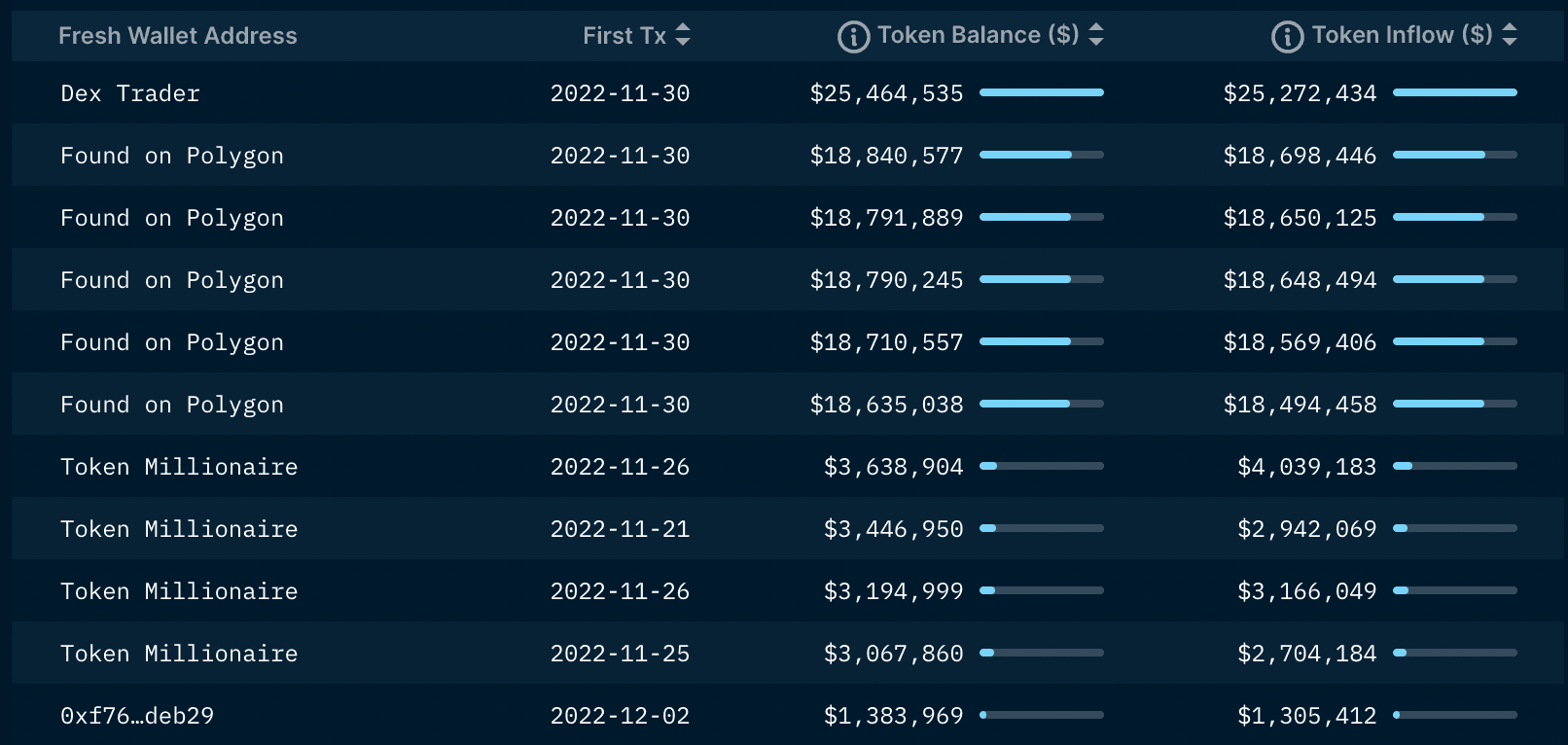

- In the last 15D leading up to the APE staking event, there were a few notable fresh wallets that were funded with millions worth of APE.

Introduction

ApeCoin is the native token for the Yuga Labs and the Bored Ape Yacht Club ecosystem, launched earlier in March of this year and was airdropped to BAYC and MAYC holders, respectively. The goal of APE is to serve as the central utility token for the Yuga Labs franchise, from purchasing merchandise to community-led governance. The ApeCoin DAO has been instrumental in pushing for development and improvement ideas for the Bored Ape Yacht Club ecosystem, such as budget allocation, newsletter, and more.

Since the token release, ApeCoin holders have been asking for a staking program to earn yield on their APE tokens. The proposal was drafted and voted on at the end of April via AIPs-21 and 22 on the ApeCoin DAO forum. In July, the Ape Foundation selected Horizen Labs to oversee and implement the staking system according to the specifications outlined in the AIPs. In return, Horizen Labs will receive grant money to execute the task. Although, some DAO members have recently commented on the forum that the smart contract code is not gas-optimized. The documentation regarding gas optimizations was updated via the Horizen Labs Twitter account on December 4.

Horizen Labs and the Ape Foundation have announced that the APE staking contract will go live on the mainnet on December 5, with pre-deposits available at launch. However, reward accrual will not initiate until December 12. The purpose of the pre-deposit period is to ensure fair participation as the amount of rewards distributed to a staker is relative to their position size within a staking pool and alleviates gas wars. The pre-deposit period was shortened from two weeks to one week to maintain the target December 12 staking contract launch due to the delays from the bug bounty program, announced via Immunefi on November 11.

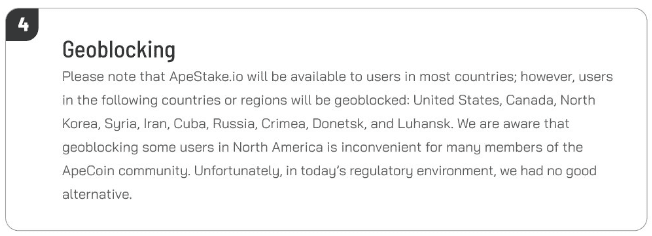

Horizen Labs and the Foundation have received some backlash from the community after notifying that APE holders in North America (US & Canada) will not be eligible to stake their tokens due to regulatory restrictions. Horizen Labs have stated that there was "no good alternative" to this predicament. Consequently, Horizen Labs' ApeStake.io website will be geoblocking users from restricted areas.

In addition to the ApeStake.io website, which is open-sourced, Horizen Labs has also encouraged third-party developers and the DAO community members to deploy their own front-end staking UI. Some have already been released, including this open-sourced lightweight client UI by a DAO community member, which can bypass geoblocking at the UI level, and ApeCoinStaking.io, developed by Alex McCurry and the Solidity.io team in partnership with NF3. Some centralized exchanges, such as Binance, have recently announced that they will also offer the staking service directly through the exchange.

Staking Pools and Requirements

There are four pools in total, each with a different commitment and APE participation limit per asset committed. The pools and their respective constraints are as follows:

| Pool | Commitment | APE cap per commitment |

|---|---|---|

| APE | APE | None |

| BAYC | BAYC | 10,094 |

| MAYC | MAYC | 2,042 |

| Paired | BAYC/MAYC + BAKC | 856 |

Note: For the Paired pool, the BAYC/MAYC ID does not have to match the BAKC ID to be eligible to stake.

Since the pools are independent, a BAYC used to stake in the BAYC Pool is still eligible for the Paired pool, equivalently with MAYC. The NFT assets simply act as a key to unlocking the staking position. Thus, the NFTs are still tradable as staking does not require NFT lock-up, and Horizen Labs takes no responsibility for the custodial risk of assets. However, the fact that the NFT is still tradable means that the owner has to claim their unclaimed staking rewards prior to the sale of that asset. Otherwise, the new owner is entitled to unclaimed staking rewards.

Edge case: The Paired pool consists of two NFTs paired as a key for eligibility. But as the NFTs are not locked in the contract, the owner could sell one of their assets. For example, an individual owns a BAYC and BAKC and decides to stake in the Paired pool but lists the BAKC up for sale later on. Once the BAKC is sold, either involved party (BAYC owner and new BAKC owner) can withdraw from the staking contract. The BAYC owner is entitled to the staked amount, whereas the new BAKC owner can claim any unclaimed rewards associated with the staking position.

Reward Structure

100m APE tokens, equivalent to 10% of the token supply, are allocated to the staking program in the first year across all available pools and are taken from the portion of the ecosystem fund allotted to the DAO treasury and resources (totaling 47% of the total supply). The staking program will be active for three years, and a 50% reduction in allocated funds for the staking pool after each year, meaning that 50m and 25m APE will be allotted to years 2 and 3, respectively. Hence, 17.5% of the entire supply will be available to stakers throughout the staking period. Of the tokens reserved for the ecosystem fund, 117.5m tokens were unlocked at launch, with ~7.34m APE unlocked monthly throughout 48 months.

Pool Allocation Breakdown (maximum APE allocated to each pool) For Year 1:

| APE Pool | BAYC Pool | MAYC Pool | Paired Pool | |

|---|---|---|---|---|

| Q1 | 10,500,000 | 16,486,750 | 6,671,000 | 1,342,250 |

| Q2 | 9,000,000 | 14,131,500 | 5,718,000 | 1,150,500 |

| Q3 | 6,000,000 | 9,421,000 | 3,812,000 | 767,000 |

| Q4 | 4,500,000 | 7,065,750 | 2,859,000 | 575,250 |

The reward system is structured such that the incentive distribution curve declines every quarter throughout the three-year duration. In other words, fewer APE tokens will be available for staking rewards after every quarter after launch. The distribution of available rewards for all three years is as follows:

Even though the reward structure is designed such that the annualized yield reduces after every quarter, 17.5% of the token supply (almost half of the current circulating supply of 36.1%) coming into the market over the next three years will likely significantly impact the token's price action. The sustained selling pressure on the APE tokens will be prominent, even if some choose to compound their rewards with the ApeCoin pool.

Bored Ape Ecosystem NFT Trading Activity

In light of the staking contract going live, evaluating the trading activity around the Bored Ape ecosystem NFTs (excluding Otherdeeds) can provide valuable insights into the sentiment of current holders and market participants looking to enter the ecosystem. Specifically, the key questions to be answered include:

- Are market participants generally buying or selling Yuga Labs NFTs?

- What has Smart Money been doing with their BAYC-ecosystem NFT assets?

- For those that have recently bought, have they also purchased APE during the same period?

- How many of the current set of holders for each collection own enough APE to qualify for their respective staking pools?

In the past 30 days, there have been more unique sellers than buyers for both BAYC and MAYC collections. BAYC registered 242 unique buyers, while 253 sold their assets, and 316 BAYC traded overall, totaling 23,835 ETH in volume. MAYC saw 775 distinct wallets buying, while 799 offloaded their NFTs and 1,142 MAYC exchanged during the period, accounting for 14,570 ETH in volume over the past 30D. This suggests that the percentage of unique owners has slightly decreased and gone into fewer hands. It could also mean that notable holders are buying more to extract as many APE rewards as possible since the first quarter presents the highest staking yield. On the other hand, BAKC saw more unique buyers than sellers this past month, with 349 buyers compared to 332 sellers, trading 449 NFTs and 2,257 ETH in volume.

Of the 242 unique BAYC and 775 MAYC buyers, 156 and 456 are still current holders of their purchased assets, respectively. This equates to approximately 60% for both collections. However, there may be holders who have not sold but instead transferred it to another wallet. Thus, the ratio is likely to be higher in reality.

Smart Money Buyers vs. Sellers

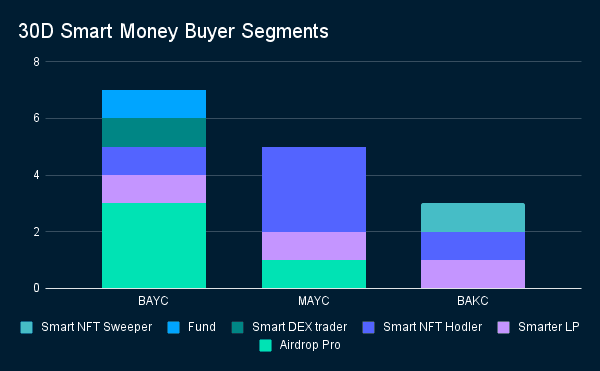

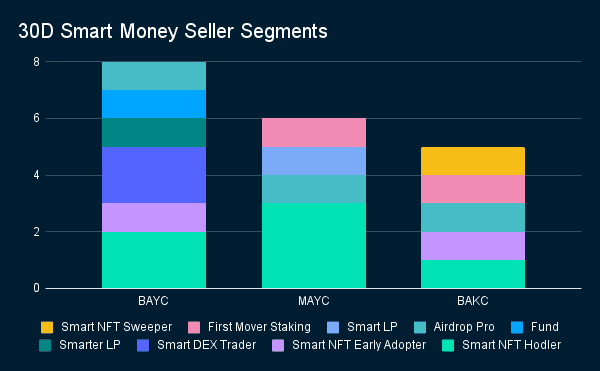

As seen from the charts above, there have been more Smart Money sellers than buyers for all three collections. Specifically, there were 7, 4, and 3 Smart Money buyers, compared to 8, 6, and 5 Smart Money sellers in the past month for BAYC, MAYC, and BAKC, respectively.

However, BAYC Smart Money buyers picked up a total of 15 Apes in relation to the 10 Apes sold by 8 Smart Money sellers. Although, BAYC and BAKC saw more NFTs sold off by Smart Money sellers, with 9 and 16 assets sold, respectively.

On the sellers' side, Smart NFT Hodlers is by far the most significant cohort that has been offloading their assets. Most notably, SonnyF90, a Smart NFT Hodler, sold two BAYCs and one MAYC. In addition, machibigbrother, a First Mover Staker, was the biggest seller in terms of quantity, selling an aggregate of 4 MAYCs and 8 BAKCs.

On the other hand, Jimmy McNelis, one of the largest BAYC holders, purchased 8 BAYCs this past month, overtaking JRNYCrypto as the fifth-largest holder of the collection. He now possesses 64 Bored Apes in total.

Breaking Down The Correlation Between NFT Buyers And APE Holdings

Diving deeper into the data, we can measure the correlation between those who have bought NFTs and APE tokens, which indicates that their intent is most likely to stake.

BAYC Buyers

87 of the 156 BAYC buyers who bought in the past 30D and are still holding the NFTs within the same wallet have either received, bought, or sold APE tokens before. The remaining wallets do not have a transaction history with APE. 23 have been accumulating in the past 30D, and 55 currently have an APE balance greater than 0, meaning that they are eligible for the BAYC staking pool.

MAYC Buyers

As for MAYC, 258 of the 456 MAYC buyers in the past month who still have the asset in the same wallet have interacted with APE tokens, while the rest do not. 87 have also been buying APE during the same period, and 156 have a non-zero APE balance, meaning they are eligible for the MAYC staking pool.

Estimation Of Baseline APY Based On Eligible Stakers For Each Pool

BAYC Pool

There are currently 6,462 unique Bored Ape holders, and 3,053 are eligible for the BAYC staking pool. In other words, these addresses have a non-zero APE balance. These individuals own 5,076 Bored Apes and ~28.3m APE between them. Hence, 5,572 APE per Bored Ape, which is less than the deposit limit for the pool.

According to the official website, ApeStake.io, released by Horizen Labs on November 5, there is ~181k APE available for rewards daily. Therefore, assuming ~28.3m APE is deposited into the BAYC pool, the resulting baseline APY will be approximately 233% during Q1 post the staking launch. Note that the yield will be lower if all eligible Bored Ape holders deposit the maximum 10,094 APE allowed as opposed to their current average holdings. At the time of writing, there are 4.34m APE tokens staked in the BAYC pool, which gives an annualized yield of 1,524%.

MAYC Pool

Meanwhile, there are 12,995 distinct owners of Mutant Apes, with 5,618 qualified to stake in the MAYC staking pool. These holders own a sum of 9,156 Mutants and 25.7m APE, equating to 2,810 APE per Mutant.

73.3k APE tokens are available for daily rewards. Although each qualified Mutant owner owns 2,810 APE per Mutant on average, the maximum cap per Mutant is 2,042 APE. If we assume that all eligible Mutants will be used to stake, then 18.7m APE will be deposited into the MAYC pool. Thus, the baseline APY for this pool will be 143% APY at saturation throughout Q1 post-launch. At the time of writing, there is ~1.54m APE staked in the pool. Thus, the current annualized yield sits at 1,746%.

Paired Pool

There are 5,609 unique owners of BAKC. 4,225 of those individuals also own a BAYC, MAYC, or both. Although, only 2,392 have a non-zero APE balance, which makes them qualified to stake in the Paired pool. These eligible participants own 4,786 Kennels, 3,149 Bored Apes, 4,361 Mutants, and 20.9m APE in total, translating to 4,361 APE per Kennel.

However, the maximum capacity to stake per BAKC + BAYC/MAYC pair for the Paired pool is 856 APE. Assuming that all 4,786 qualified Kennels will be used to stake, the pool size for this pool will be 4.1m APE. Hence, the baseline APY is 131% at saturation for Q1. Presently, there is only ~313.5k APE staked in the Paired pool, suggesting that the current annualized yield sits at 1717% APY.

ApeCoin Pool

There are 2.71m APE tokens deposited into the ApeCoin pool. With ~115k APE daily rewards available, the current yield is 1,552%. However, we cannot compose a model to project a baseline APY for the ApeCoin pool since there is no NFT requirement or maximum cap to stake. Despite that, it is likely the case that this particular pool will become saturated much quicker than the other pools because there are no barriers to entry, and stakers in the other pools will compound their accrued rewards into this pool, depleting the yield over time.

APE Smart Money Movements

Macro Outlook: Are there Visible Changes in Smart Money Behavior?

General Token Distribution for APE

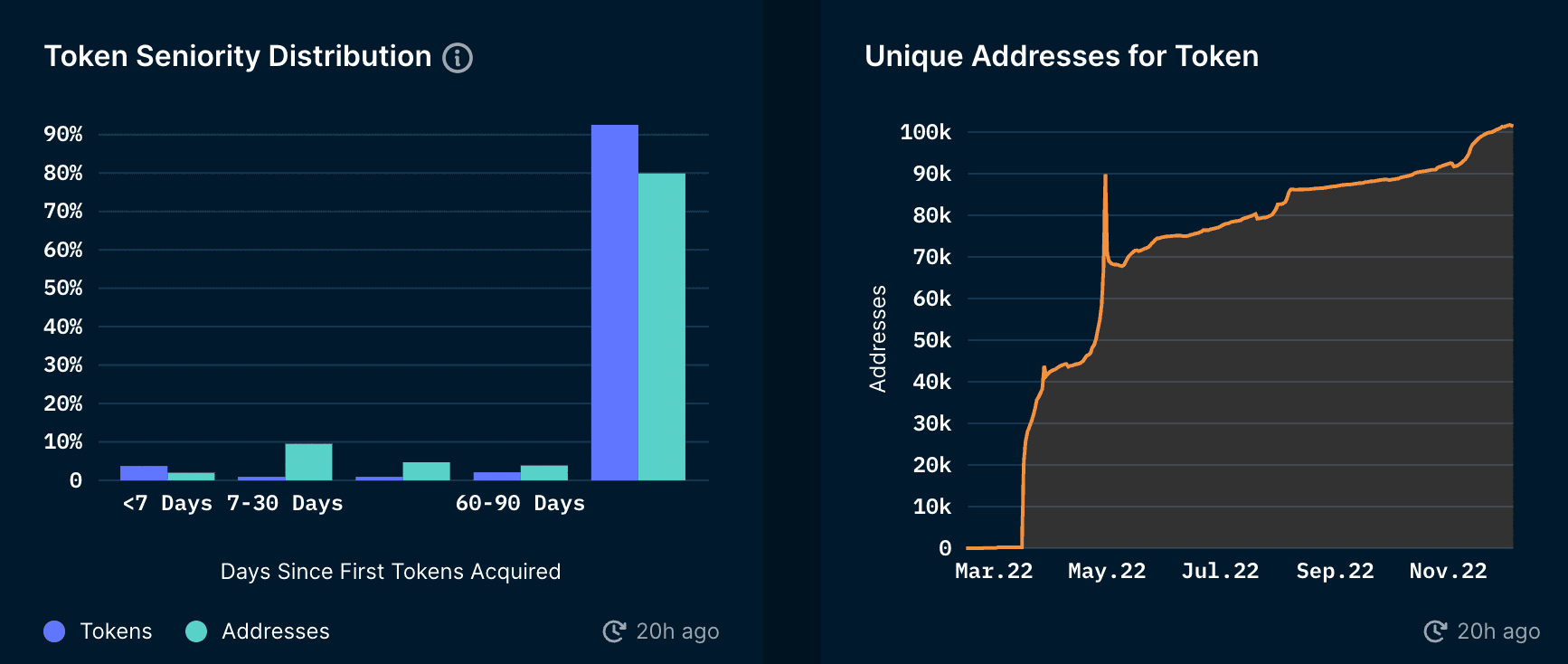

The token seniority distribution shows the percentage of tokens held by users at different time horizons and bands of ownership. Particularly for APE, most of the token holders have held their APE tokens between 90-365 days. On-chain data on token seniority distribution hints that the majority of APE token holders are loyal, and presumably have received their tokens from the initial airdrop or bought it early on. The number of unique addresses for tokens has also been on an uptrend since March, signaling a continuous wave of new interest.

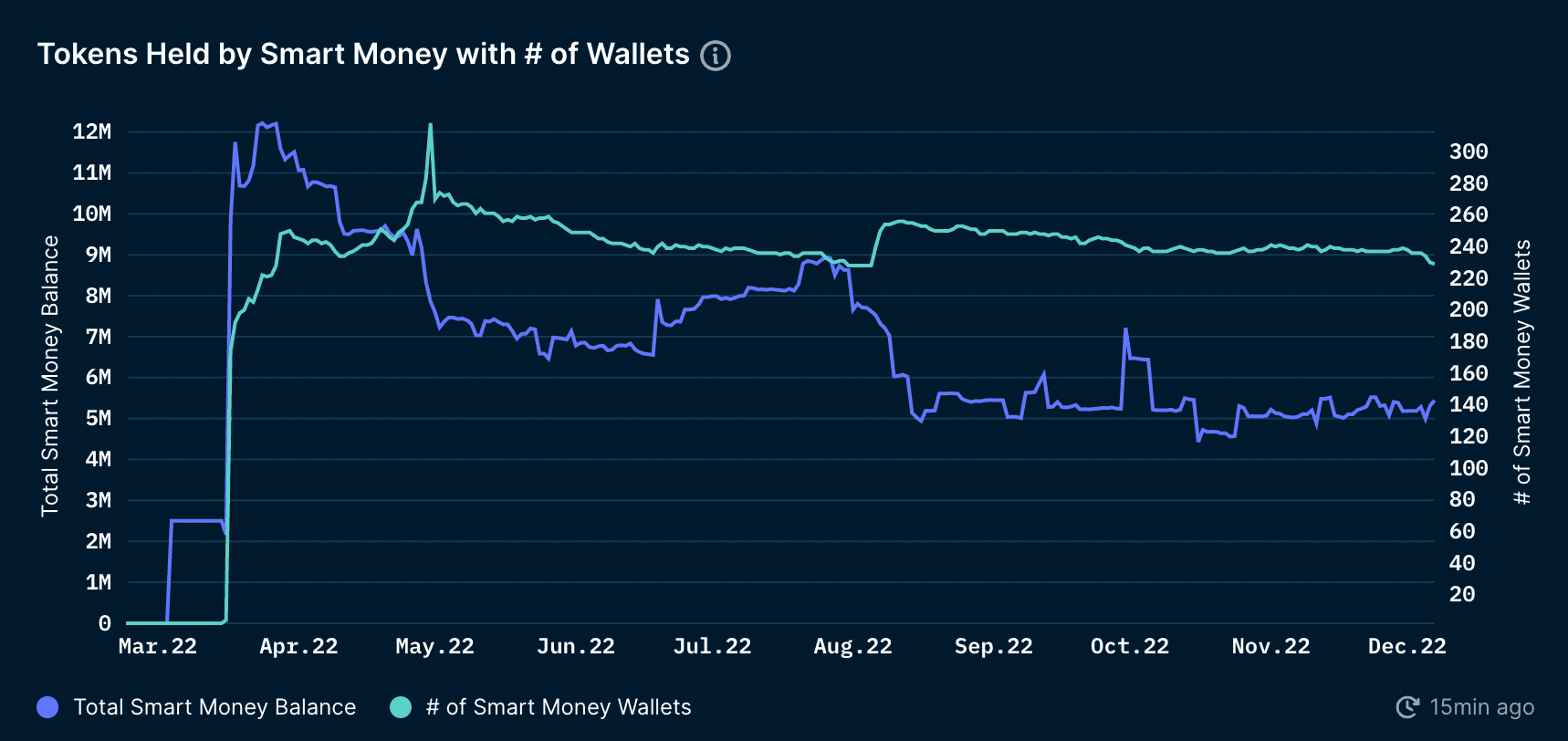

Tokens Held by Smart Money with # of Wallets

Smart Money balance for APE tokens has been trending downwards since inception, with the peak at 12m APE distributed across 200+ Smart Money wallets. As of December 7, the total APE balance amongst SM holders stands at 5.3m APE, distributed across 239 wallets.

Ape Staking Pool: Which Smart Money Addresses are Currently Staking?

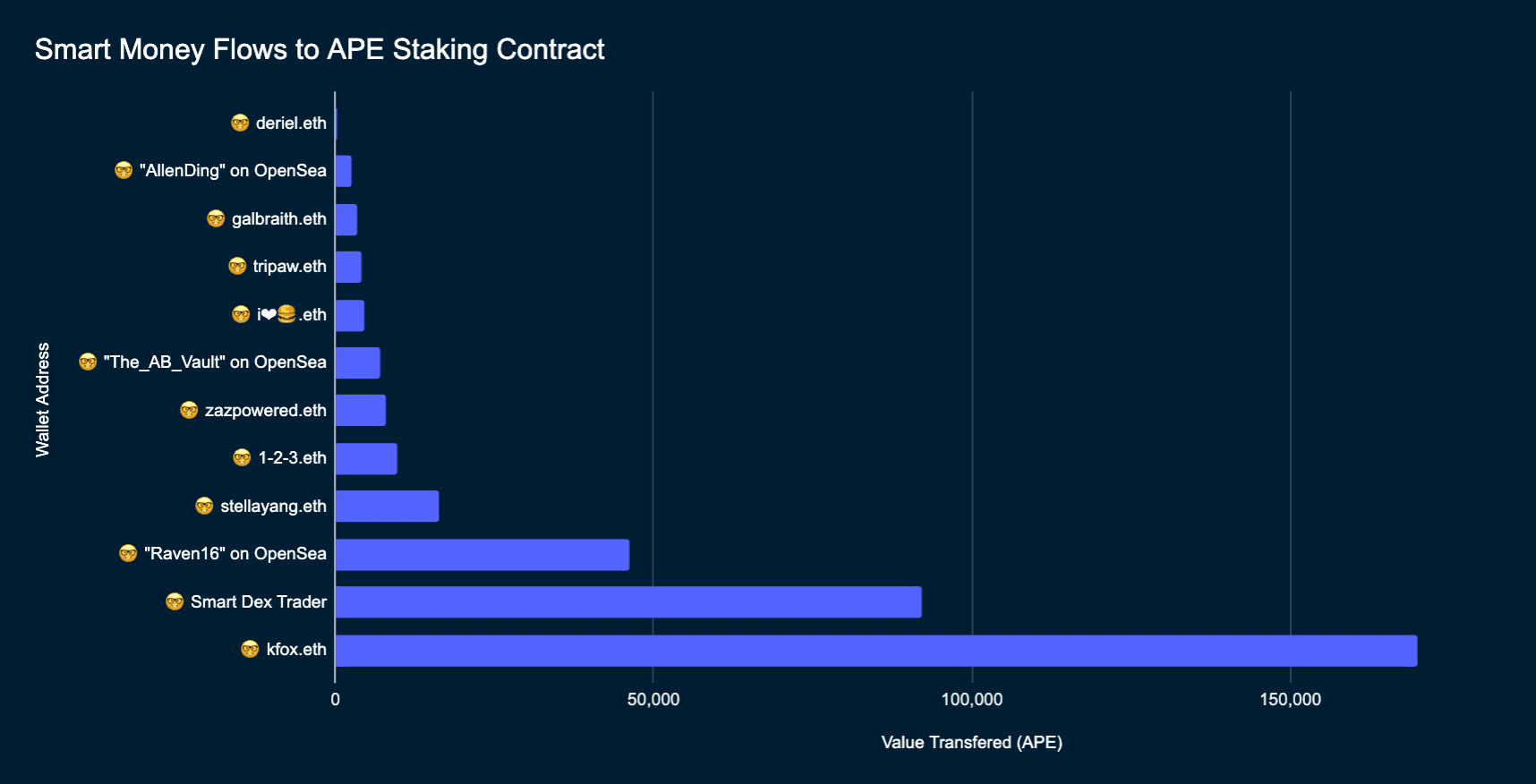

- kfox.eth is currently the largest Smart Money address that is staking in the APE staking contract, followed by Smart Dex Trader, “Raven 16” on Opensea, and stellyang.eth.

- Only 12 Smart Money addresses are currently in the APE staking pool, with a cumulative value of 364k APE (~$1.4m). As of December 7, there is 8.3m APE (~$34m) in the APE Staking Contract.

- It will be interesting to monitor if more smart money addresses will start depositing in the APE staking contract over the next few days.

Largest APE holders: Are they Staking?

- The addresses below are the largest APE holders (prior to APE staking launch). The snapshot was taken on November 4, 2022.

| Name | Token Balance (APE) | Balance ($ USD) |

|---|---|---|

| 🤓 Genesis Trading: OTC Desk | 1,018,030 | 3,939,777 |

| 🤓 Wintermute Trading | 493,068 | 1,908,172 |

| 🤓 dingaling | 378,535 | 1,464,930 |

| 🤓 Sandbox | 360,756 | 1,396,126 |

| 🤓 @JRNYcrypto | 259,749 | 1,005,229 |

| 🤓 Mechanism Capital: 0x947 | 223,930 | 866,611 |

| 🤓 "CollectiveVision" on OpenSea | 188,976 | 731,335 |

| 🤓 kfox.eth | 154,330 | 597,258 |

| 🤓 apeofpoland.eth | 139,464 | 539,724 |

| 🤓 @niftynaut | 131,632 | 509,416 |

| 🤓 own.eth | 106,638 | 412,689 |

- Based on the snapshot taken before the APE staking deposit contract went live on November 4, only 2 addresses on this list had a change in token holdings over the past 30D.

- kfox.eth, whom we highlighted above, is currently the largest Smart Money staker in the APE staking contract. As the APE staking contract went live, this address deposited all of its APE holdings into the staking contract.

- dingaling, the Top 3 APE Smart Money holder, after Genesis Trading: OTC desk and Wintermute Trading, is marked as an influential BAYC collector. This address first received his APE tokens through the APE claim contract, of 1.4m APE (~$12.2m) and swapped a majority of his tokens to WETH. His wallet balance had about 500k+ APE before he started initiating a sell-off between October to November. Currently, he is still holding 378k APE (~$1.55m) and has not interacted with the staking contract.

- niftynaut sent 131k APE to another wallet address, labeled “Bluechip NFT Holder”, who proceeded to stake their assets on the staking contract. This wallet is holding a balance of 10 BAYC, 10 MAYC, and 12 BAKC, which was all sent from the niftynaut wallet 33 hours ago.

- The remaining 8 addresses on the list above have not interacted with the APE staking contract yet. Moreover, none of their APE assets have been moved over the last 30D period. The lack of Smart Money participation and APE token movements is likely attributed to the fact that those located in North America are prohibited from staking.

Interesting Fresh Wallets Funded with APE

- A significant inflow in fresh wallets funded with APE:

- In the last 15D leading up to the APE staking event, there were a few notable fresh wallets that were funded with millions worth of APE.

The question ultimately lies in whether they were funded from CEXes in order to stake on-chain when the staking contract goes live, or whether these funds are sent to fresh wallets to obfuscate on-chain footprints.

To play around with the fresh wallet flows and to view where the APE tokens are funded from, check out the “Fresh Wallet for Token” dashboard on Token God Mode.

Conclusion: To Ape or Not to Ape?

Since the APE staking contract only went live on December 5, it is still too early to deduce whether the majority of Smart Money APE holders are bullish or bearish. If members are interested in staking in any four of the pools, it will be important to monitor how Smart Money and the BAYC ecosystem NFT holders position themselves in the trades as December 12 approaches.