Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche network is a smart contract platform designed with a focus on scalability. To execute this vision, Avalanche provides a multichain framework consisting of Subnets that scale the network, with the most notable being the primary network, comprising P, X, and C chains. The popular C-chain on Avalanche Primary Network is EVM-compatible. Within Avalanche’s P-Chain, application-specific blockchains can be spun up in the form of Subnets. Subnet, which stands for subnetwork, represents a set of validators who achieve consensus on the state of the network. A Subnet can be thought of as the bottom layer of the stack, and many blockchains can compose on top of a single Subnet.

Similar to Avalanche’s Subnets, the concept of application-specific blockchains was adopted by many other chains to support the massive growth of its dApps, such as Polkadot’s Parachains and Cosmos’ Zones. Generally, all of these application-specific blockchains provide builders with the ability to customize multiple layers of their stack, such as their security model, execution logic, fee regime, and consensus mechanism. However, Avalanche’s Subnet architecture offers faster finality and support for any custom Virtual Machine, number of Subnets created, and validator count. This gives a wide range of configuration parameters to builders for their Subnet.

In this quarterly report, we will look into the performance of the Avalanche network, particularly its C-chain, in Q4 2022 and lay out the key developments implemented by Avalanche and its ecosystem. Although the crypto market landscape has been challenging, Avalanche and its ecosystem remained steadfast in building new products and releasing new features.

Check out Nansen’s previous reports on Avalanche and other chains here.

Key Developments: Q4 2022

Avalanche Updates

- AvalancheGo upgrade, Banff 5, went live on Dec 23. The upgrade introduced seamless native communication between Subnets, dubbed Avalanche Warp Messaging. The new feature would allow Subnets to share data and crypto assets with each other in an effort to make the Avalanche blockchain ecosystem more useful for developers and users.

- Ava Labs released Rust VM SDK, the second SDK for building on Avalanche Virtual Machine, as an alternative to using Golang. This would allow developers to use Rust to launch their own blockchain on an Avalanche Subnet.

- Valtz, an Avalanche community project, created a dashboard featuring a network map of Avalanche Subnets and validators, enabling users to track the economic security of the Subnets.

- Numbers Protocol launched on Avalanche Subnet on Dec 1. Moving away from the third-party blockchains of the past, Numbers Protocol would be able to define its precise networking, security, execution logic, and fee structure by building on a Subnet. This move would empower Numbers Protocol to fully realize its vision of creating trustworthy web media.

Core App

- Core is a project developed by Ava Labs, which was designed to enhance interoperability in crypto, flatten the learning curve for users, and drive adoption for more Web3 applications.

- As part of its efforts in creating a seamless experience for users to explore web3 space, Core released two new product suites this quarter, Core Web on Oct 20 and Core Mobile Wallet on Dec 13.

- Core Web is a free, all-in-one command center giving users a more intuitive and comprehensive way to view and use Web3 across the Avalanche network, Avalanche Subnets, and Ethereum.

- Core Mobile is a free multichain mobile wallet suitable for experts and those new to crypto while keeping crypto assets and digital collectibles safe under self-custody.

- On top of these products, Core released support in multiple languages, 10 at the time of writing, with more on the way.

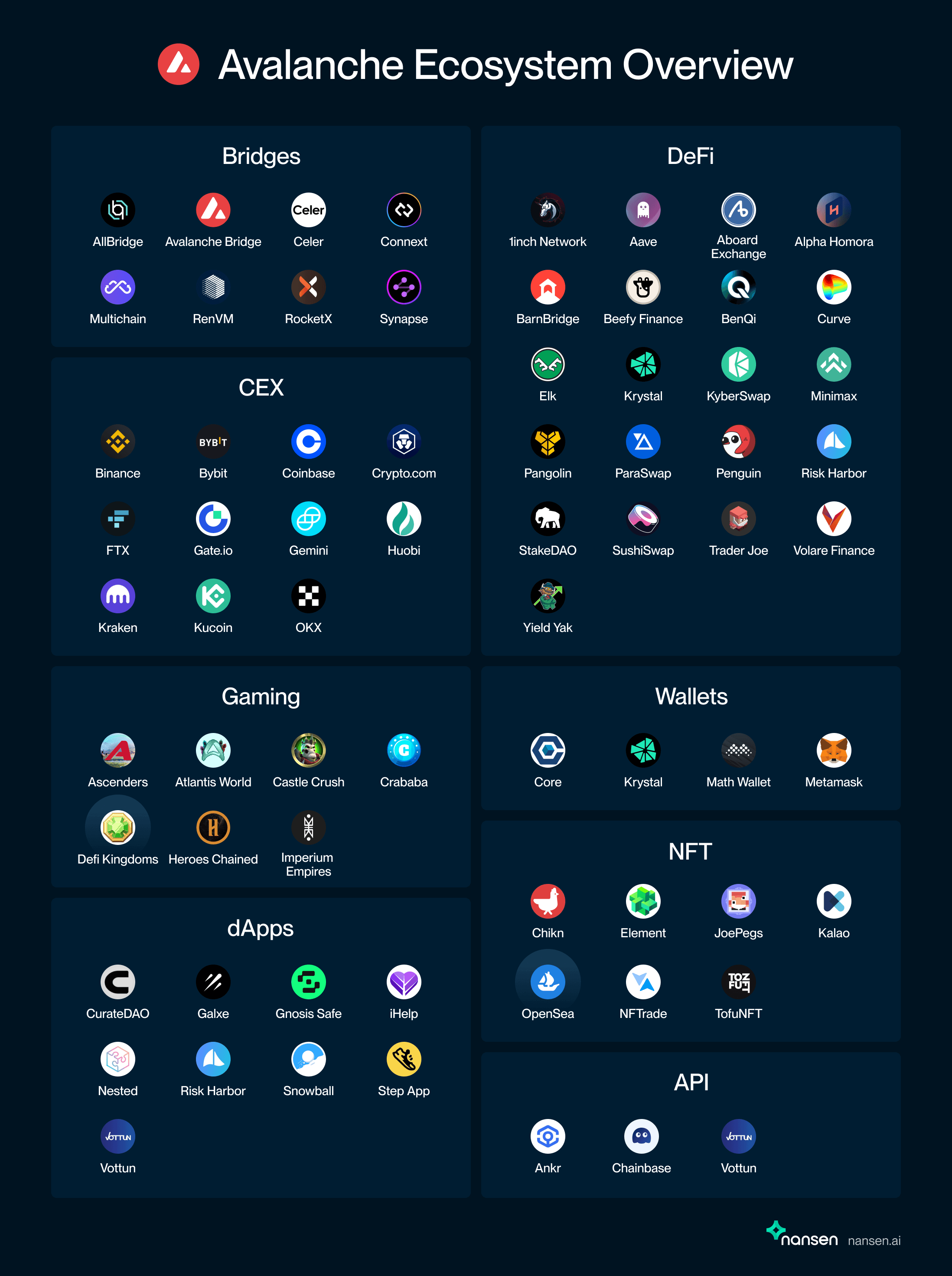

Ecosystem

Avalanche hosts a thriving ecosystem of dApps and protocols on its C-chain and Subnets, which users can explore on the Avalanche Ecosystem page. In Q4 2022, there were many exciting updates from Avalanche ecosystem projects and protocols, most notably:

- DeFi

- GMX, the permissionless protocol to trade spot and perpetuals, joined Avalanche Rush on Nov 7 and offered $4m worth of AVAX in trading rewards. The GMX protocol was deployed to Avalanche on Jan 6, 2022, and has since facilitated more than $16bin volume.

- Trader Joe, a decentralized exchange on Avalanche, has launched Liquidity Book, a new design for its automated market maker (AMM) with the goal of improving capital efficiency, reducing slippage, and minimizing the impact of impermanent loss.

- The Acumen, a microfinance dApp that provides financing for small and medium-sized enterprises (SMEs) and entrepreneurs in emerging markets, went live on Avalanche mainnet in November. Through Acumen, users are able to receive a real yield on their assets and one that’s decoupled from the volatility of cryptocurrency markets. On the other side, the protocol aims to help enable greater financial inclusion through democratizing access to capital.

- Lode brought tokenized gold and silver to Avalanche on Nov 24. Recent months saw an increase in focus on bringing real-world assets on-chain, including commodities. Real-world assets can offer a way to diversify pure crypto exposure in that they can be less correlated and generally less volatile. Lode’s tokens can be bought on Avalanche DEXes such as Trader Joe or Pangolin.

- BTC.b, a token representing Bitcoin on Avalanche and automatically bridged in Core, expanded into an Omnichain Fungible Token (OFT) that can be quickly, securely transferred to and from Avalanche and various chains supported by LayerZero such as Ethereum, Polygon, Arbitrum, and others.

- Aboard Exchange, an order book derivatives DEX, announced on Oct 12 that it went live on Avalanche C-Chain. Their development plan includes supporting AVAX and other Avalanche native tokens, Core wallet support, integrations with Avalanche protocols, and launching its own Subnet.

NFTs & Gaming

- OpenSea, a leading peer-to-peer marketplace for NFTs, launched natively on Avalanche on Oct 11. On Avalanche, OpenSea users benefit from the shortest time to finality for NFT trades, consistently low transaction fees, and access to Avalanche’s robust NFT communities.

- GREE, a well-known Japanese media company, announced that it plans to build web3 games and run nodes on Avalanche. Ava Labs will provide comprehensive, 360-degree support to GREE subsidiary, BLRD.

- Monsterra announced on Dec 15, that it will expand to Avalanche. Monsterra is one of the highly anticipated games to launch on Avalanche, after becoming a big success in another chain where 50m battles were fought in the first 3 months. The move further cements Avalanche’s status as the gaming chain, with a number of live and forthcoming titles from established Web2 publishers and rising Web3 studios.

- Toonstar’s Web3 Animated Show, The Gimmicks, released its second season on the Avalanche blockchain. The new season premiered on Oct 27 at Avalanche Creates, a Bay Area event hosted by Ava Labs.

- FIDE, the governing body of the international chess competition, announced a partnership with Ava Labs on Dec 23 to bring chess into Web3. FIDE plans to use Avalanche blockchain to tackle challenges in chess and create operational efficiencies for players and federations, improve game integrity, onboard new generations of players, and power innovation.

- Shrapnel, the world’s first blockchain-enabled first-person shooter (FPS) game that’s currently building on Avalanche, won the GAM3 Awards Most Anticipated Game 2022 in a category filled with strong contenders including Illuvium: Overworld, Star Atlas, The Treeverse, and Ember Sword.

- One of the two biggest commercial aircraft manufacturers in the world, Airbus, chose Avalanche as its home for digital collectibles on Dec 20. Its first collection,RACER by Airbus, was painted by a revered French artist, Celine Manetta, and was made to celebrate the 30th anniversary of its Airbus Helicopters with nearly 130,000 employees.

Enterprise

- The world's largest financial derivatives exchange, CME Group, launched three new cryptocurrency reference rates and real-time indices on Oct 31, which includes AVAX. The rates and real-time indices are calculated and published daily by CF Benchmarks. CME CF Reference Rates and Real-Time Indices are based on robust methodologies that have regular expert oversight and are designed to meet the growing need for transparent, regulated, and round-the-clock pricing.

- World’s leading financial investment and trading platform, Robinhood, launched its first learn-to-earn campaign featuring Avalanche on Dec 14. This campaign gives users an opportunity to earn $AVAX while exploring Avalanche.

- In early October, Gemini started listing and accepting inbound transfers of AVAX. The listing will increase the accessibility of Avalanche to a broader set of users.

- INX Group, a broker-dealer and inter-dealer broker, announced in early December its plans to fully integrate the Avalanche Blockchain with its platform INX.One. The platform is the world’s first and only fully-regulated, end-to-end platform for listing and trading both SEC-registered security tokens and cryptocurrencies.

- On Dec 16, the leading cryptocurrency custodian firm, BitGo, started offering clients the first and only Avalanche staking solution from qualified custody. BitGo has previously supported custody for AVAX C-chain, as well as assets built on the Avalanche chain. In addition to expanding client access to the DeFi ecosystem, BitGo now offers a secure and simple AVAX staking solution for institutional and enterprise partners.

Nansen On-chain Data

Cumulative Transactions

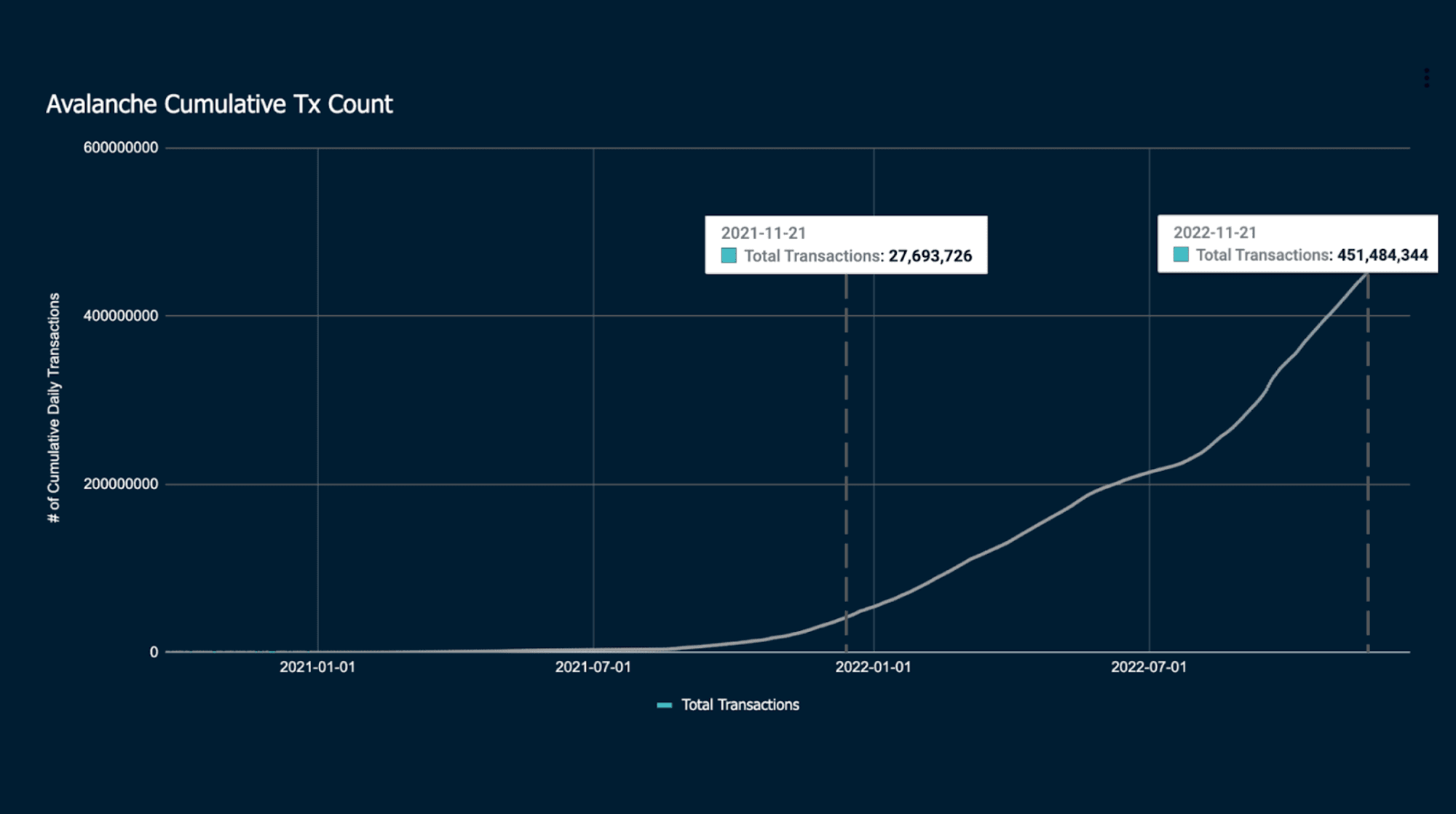

Despite the bearish market, Avalanche’s overall cumulative transaction count broke 450m transactions on Nov 21. A year prior, the network processed only less than ~28m transactions, marking a 1,507% year-over-year increase. This significant increase in transactions could be attributed to the activities from the Subnets, most notably DeFi Kingdom’s DFK Subnet which reached 200m transactions on Nov 13, 2022.

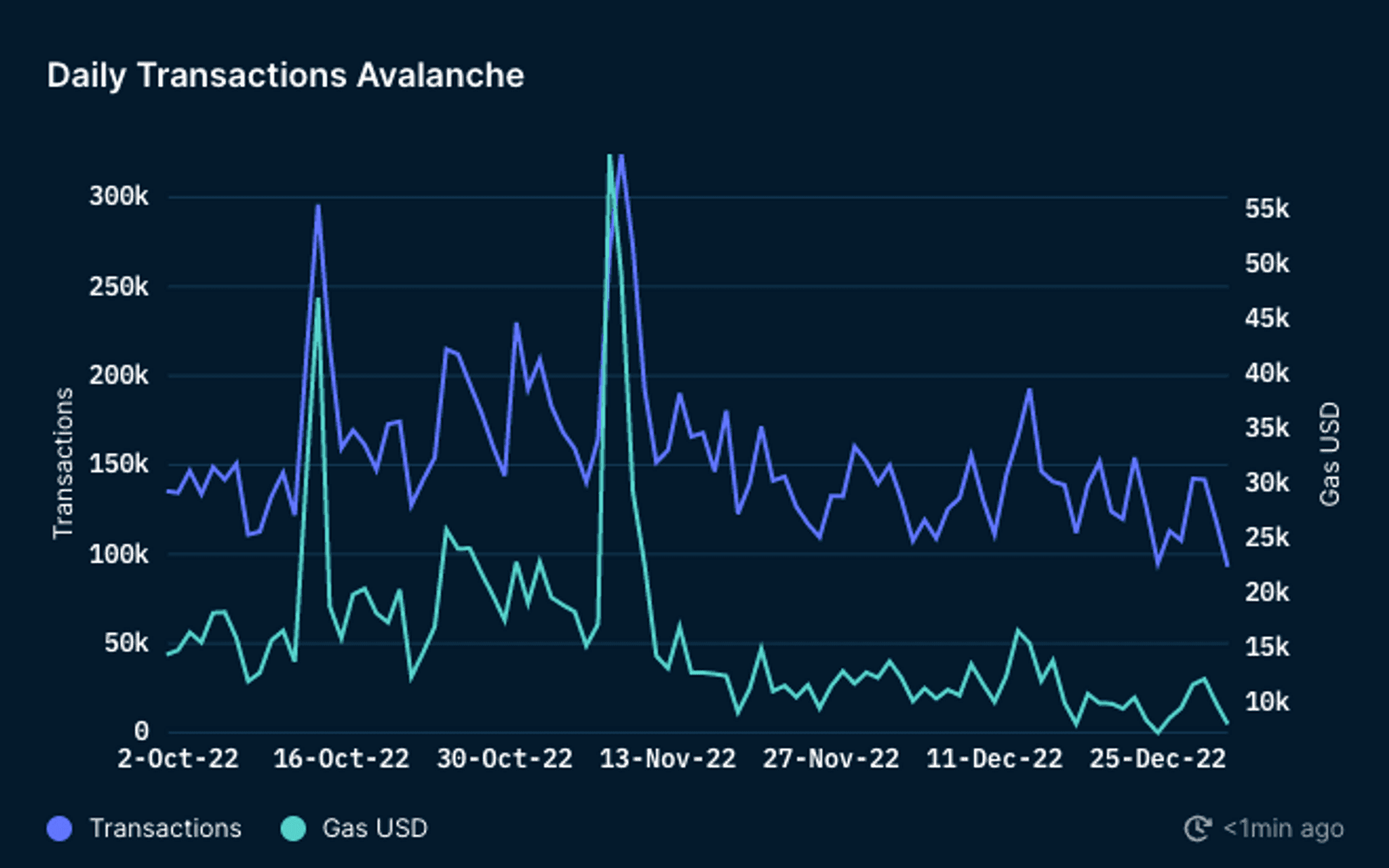

Daily Transactions on C-Chain

Daily transaction count on Avalanche C-Chain was volatile throughout Q4 2022, ranging between ~100k-230k transactions except for two spikes on Oct 14 and Nov 9. The transactions count shot up on those two days to ~295k and ~324k. The average gas paid followed the same trajectory as the transactions.

On Oct 14, 2022, around a third of the transactions came from XEN Crypto, a community project that gives people free tokens to interact with the contract. While on Nov 9, most of the transactions came from Trader Joe, which was likely due to the FTX bank run and its subsequent collapse. This led to high activity within Avalanche C-Chain caused by mass panic and speculations surrounding the event.

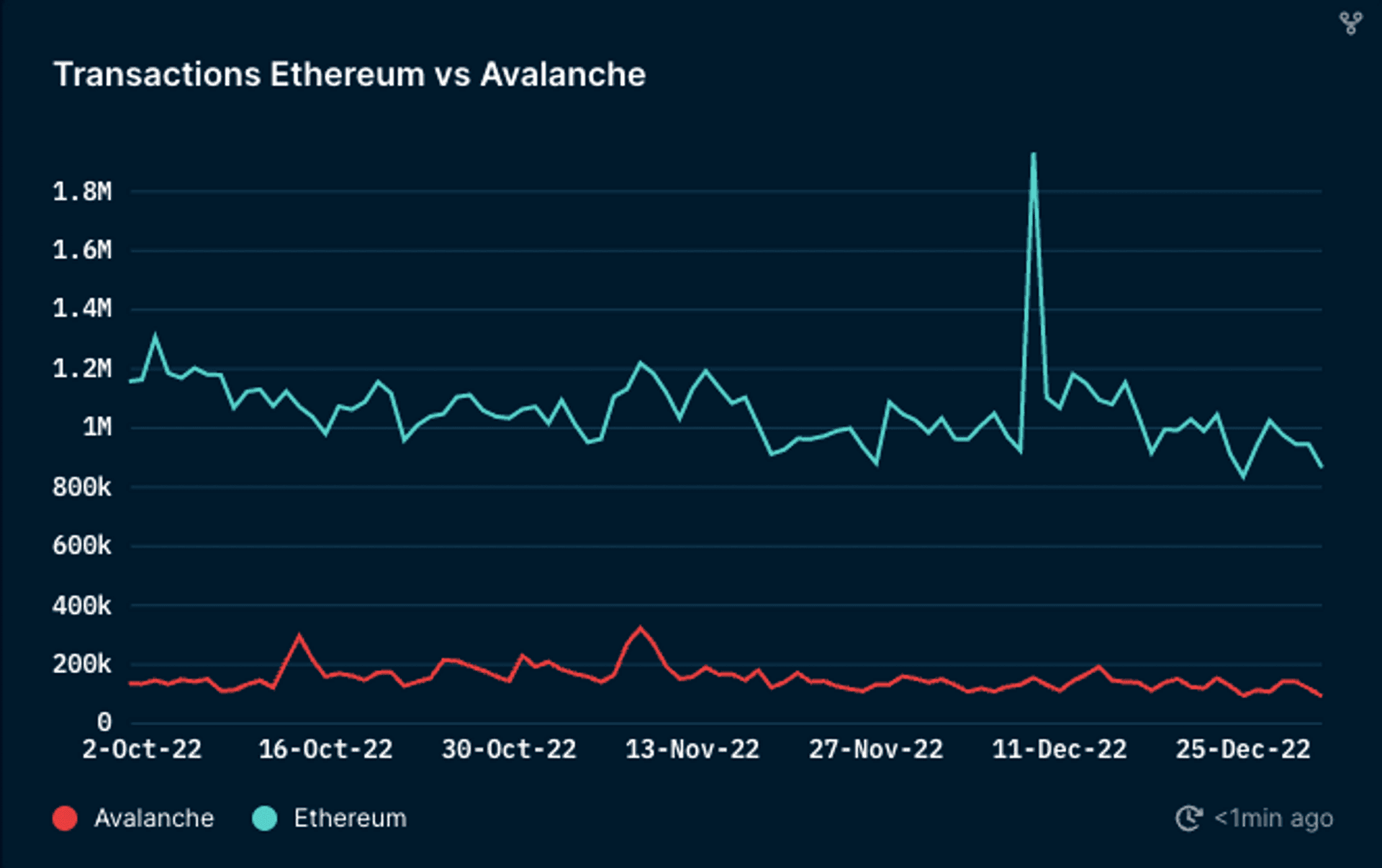

Daily Transactions (vs Ethereum)

Compared to Ethereum, Avalanche C-Chain’s transactions looked relatively stable except for the two spikes mentioned in the previous section. There was an uptick on Ethereum on Dec 9, which surpassed 1.8m transactions, of which around half the transactions were interacting with Binance. This was likely caused by the concerns surrounding Binance’s liquidity, which came after the FTX collapse.

Top Entities by Users and Transactions

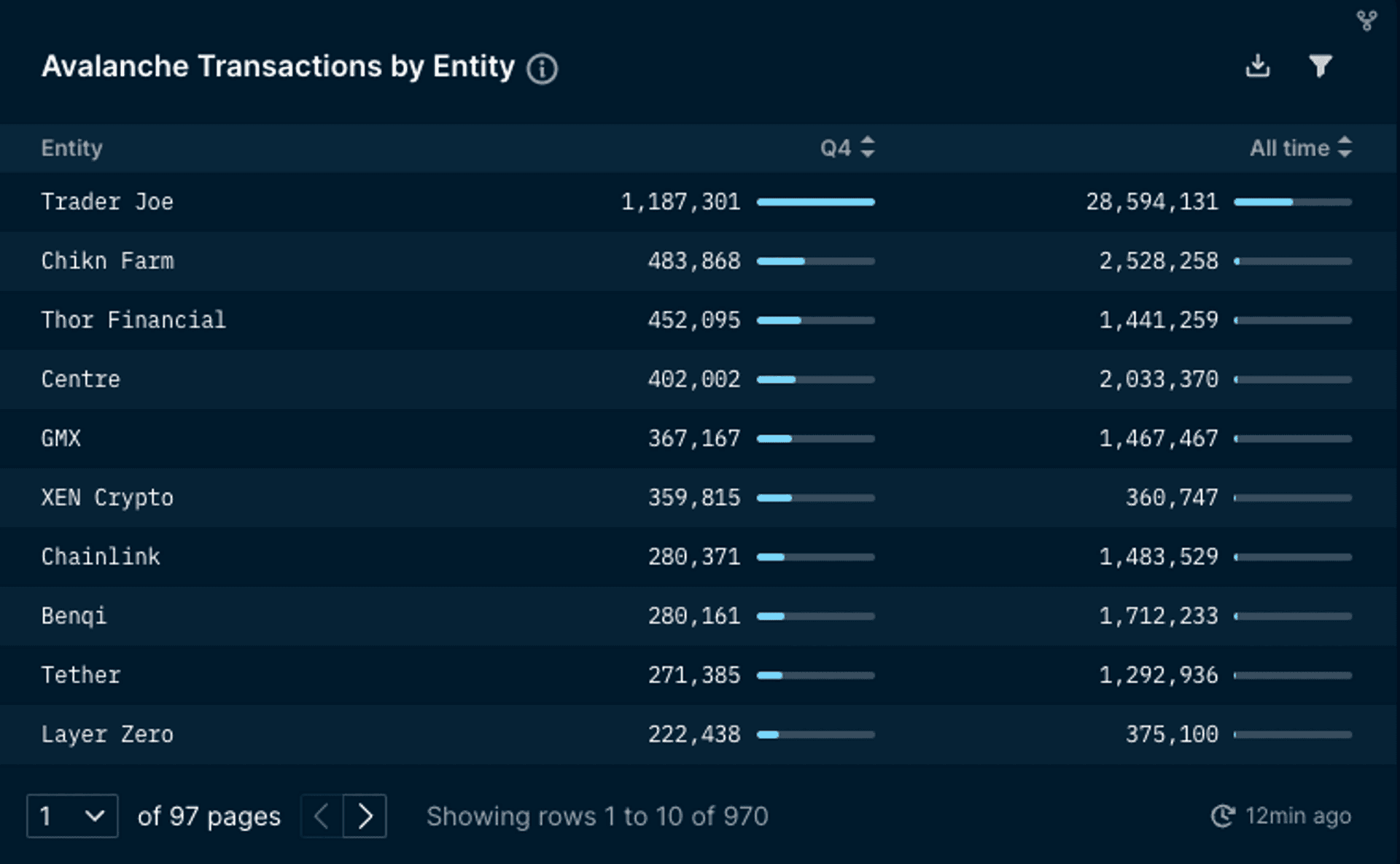

Using Nansen’s comprehensive list of labels, one could analyze the top entity interactions based on the number of users and transactions on Avalanche. Trader Joe was overtaken by XEN Crypto this quarter with nearly double the amount of users, even though it’s still dominating the number of transactions.

Other notable entities in terms of users are the stablecoins (USDC and USDT), Galxe, and Binance. Meanwhile, the transactions from Thor Financial and Chikn Farm both surpassed 500k transactions, followed by GMX, USDC, and XEN Crypto.

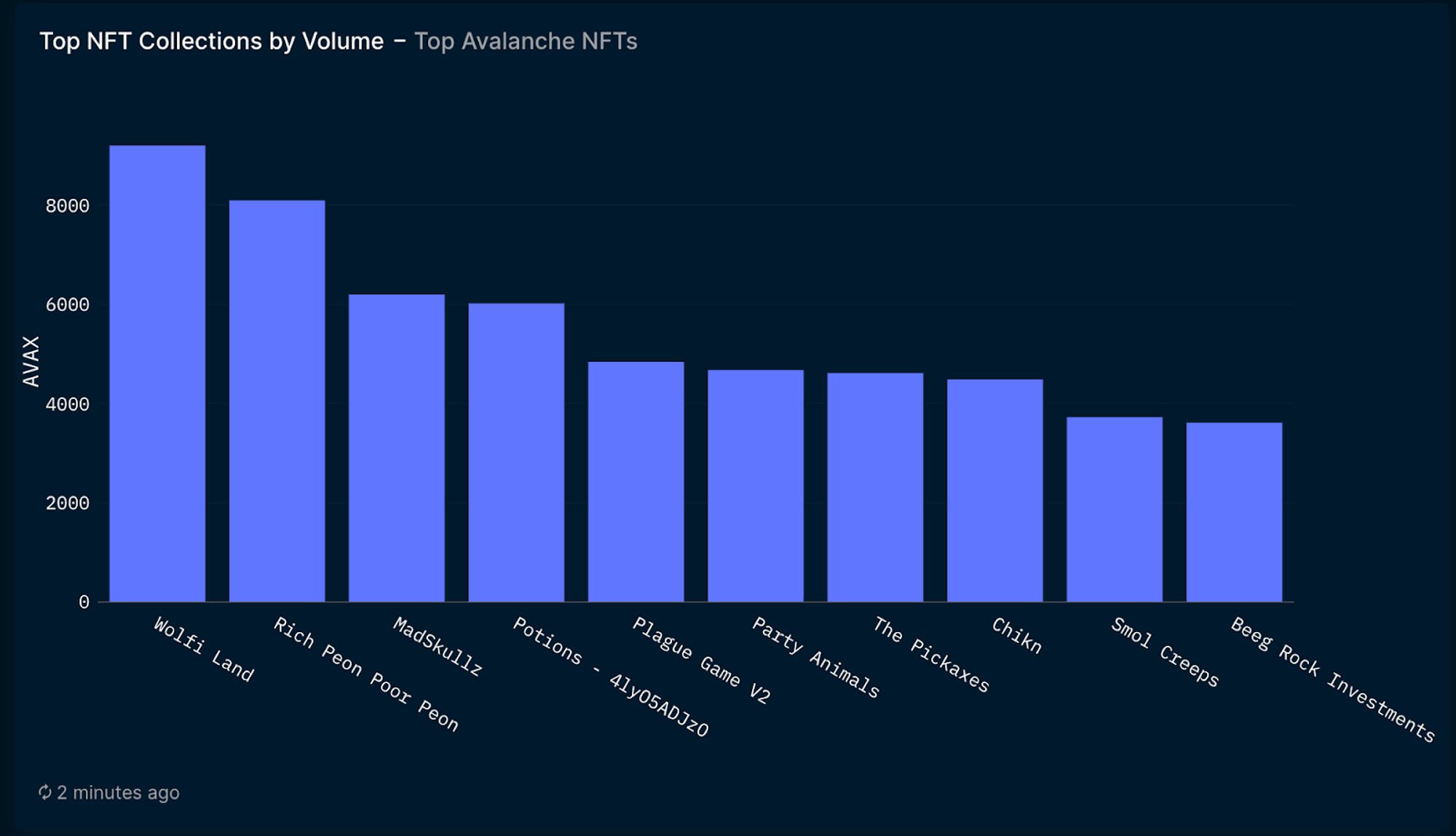

Top NFT Collections by Volume

In Q4 2022, one of the most exciting sectors in Avalanche was the NFT sector. With OpenSea announcing its expansion into Avalanche and targeted marketing efforts, NFT volumes started to pick up in October despite the bearish market condition. Wolfi Land was the top NFT collection on Avalanche in Q4, with a volume above 9000 AVAX. Check out this page to see the rest of our Avalanche’s NFT data coverage.

Notable Projects in Q4 2022

JoePegs

- JoePegs is an NFT marketplace built by Avalanche’s leading DEX, Trader Joe.

- Since its launch in May, it has grown rapidly to be the largest NFT marketplace on Avalanche with over $3.4m in secondary NFT sales and 12k users.

- JoePegs has an in-house production unit, Joe Studios, as well as an NFT Launchpad, which has onboarded over 50 projects to the Avalanche ecosystem.

GMX

- GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero-price impact trades, which are supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees, and leverage trading.

- GMX has a native token called GMX, which functions as a governance, utility, and value-accrual token for the GMX protocol. Users can stake GMX tokens and earn a portion of GMX’s protocol fees, plus benefit from other incentives.

- Its dynamic pricing is supported by Chainlink oracles and an aggregate of prices from leading volume exchanges.

Closing Thoughts

There were many events that caused mass panic and hysteria throughout Q4 2022, notably FTX’s Bank Run and its subsequent collapse. This gave the general perception that we are still in the middle of crypto winter. In contrast, as can be seen in the number of overall transactions, Avalanche clearly solidified its user base, particularly on its Subnets. Ava Labs and Avalanche ecosystem continued building useful products and launching new Subnets for its users. With the launch of Core Web and Mobile this quarter, users can now easily navigate through Avalanche network and other chains with just a single product, improving the user experience for new and veteran users.