Introduction

Blur is an NFT marketplace and aggregator. The platform has managed to take significant market share from its competitors since its launch, mainly driven by its rewards system and zero marketplace fees.

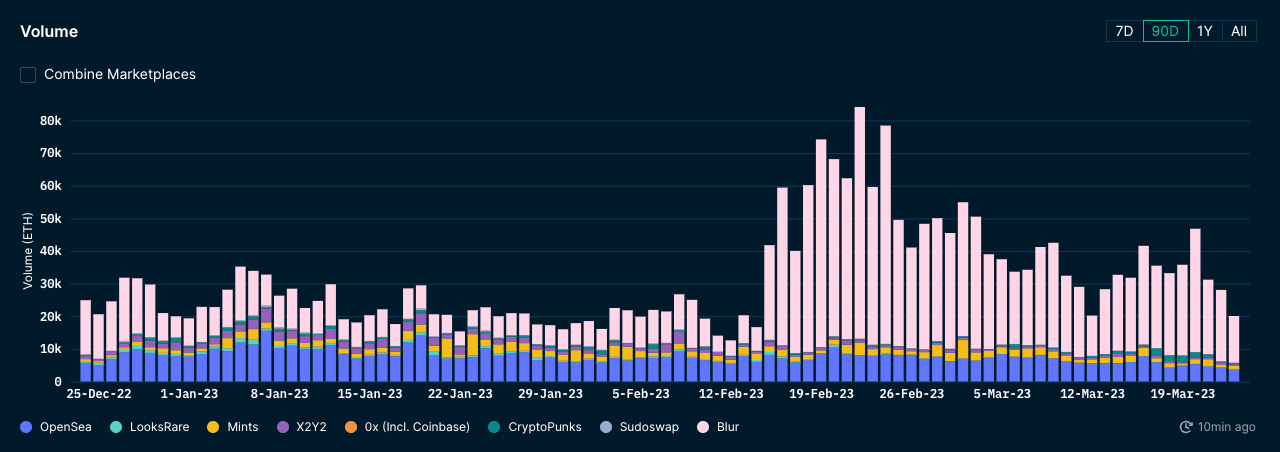

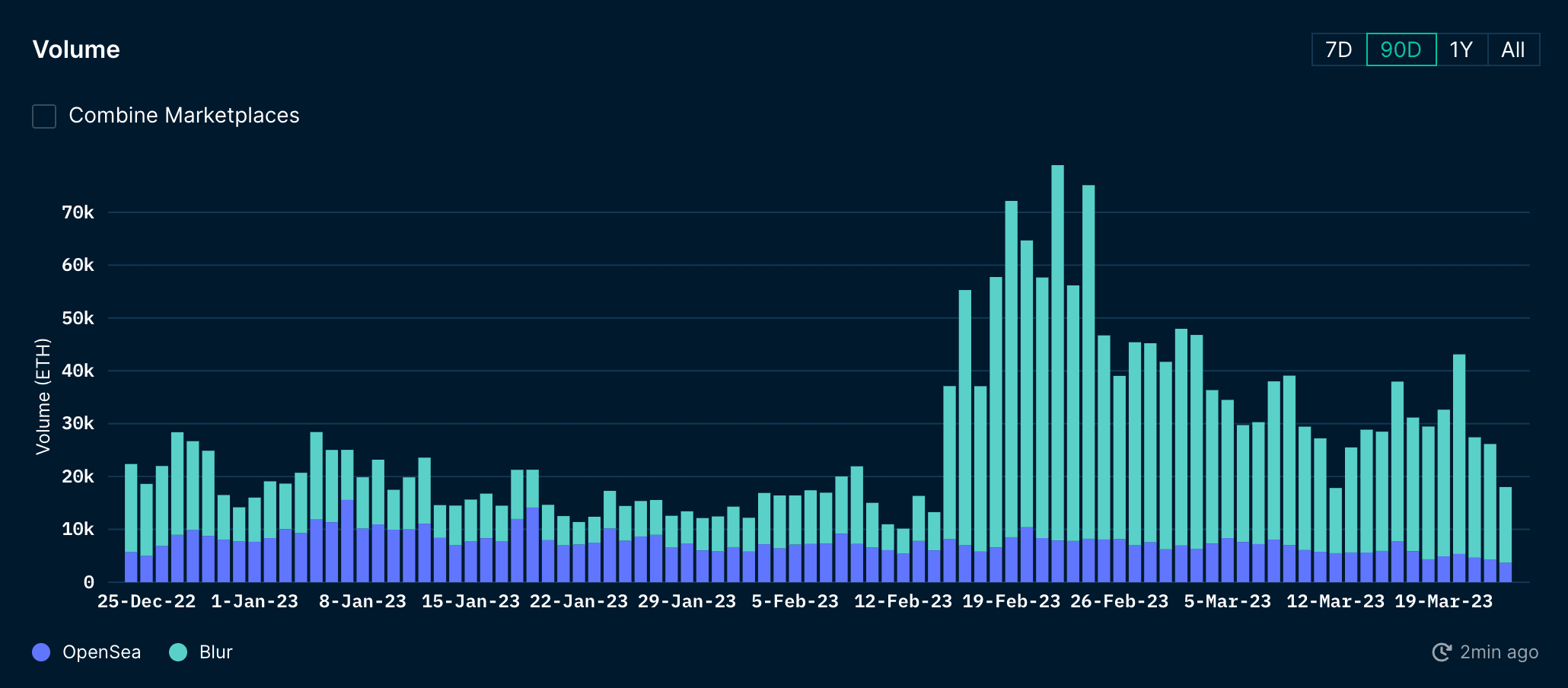

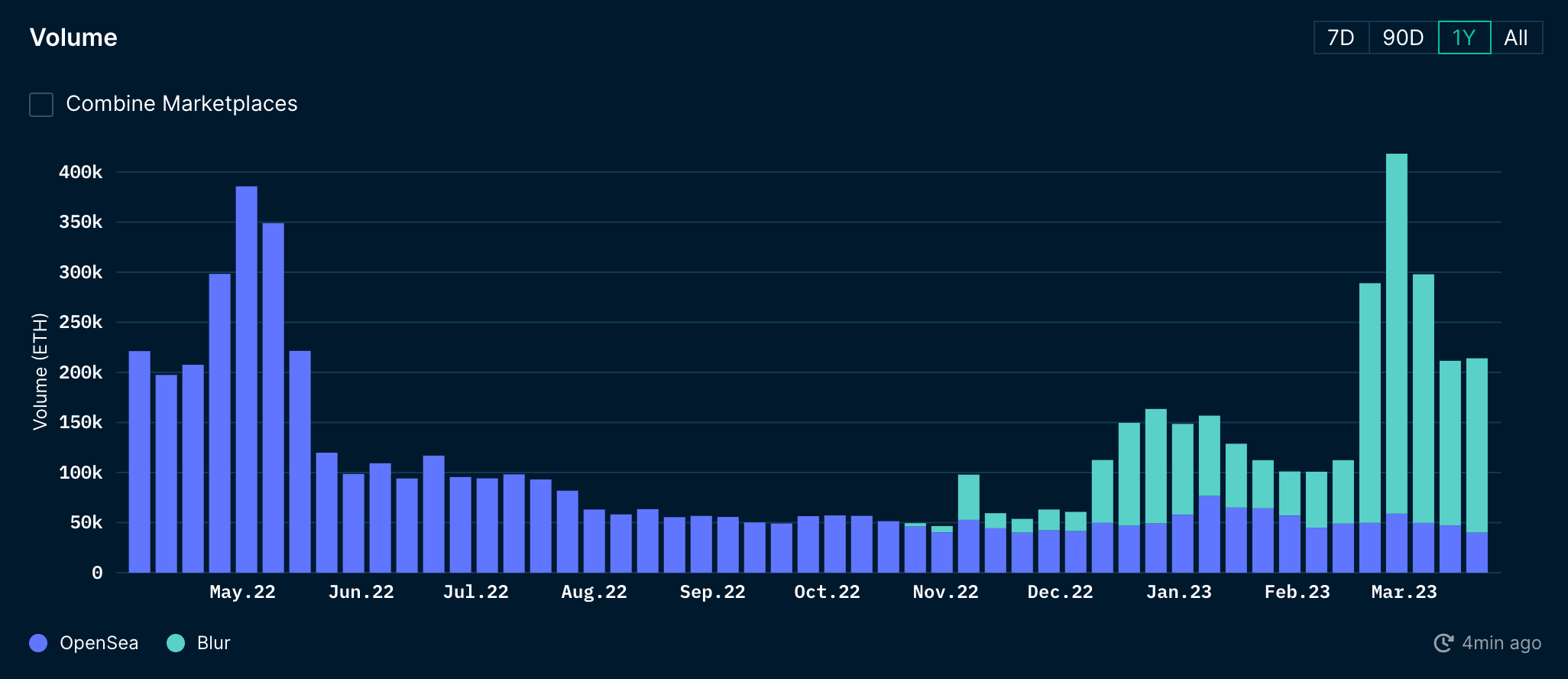

Volume Breakdown

The platform’s volume has been growing steadily since its launch and experienced an exponential surge after the first season of airdrop rewards which occurred on February 14, 2023. The first season of airdrop delivered a lot of value back to users of the platform, which incentivized these users to increase their interaction in preparation for the second season.

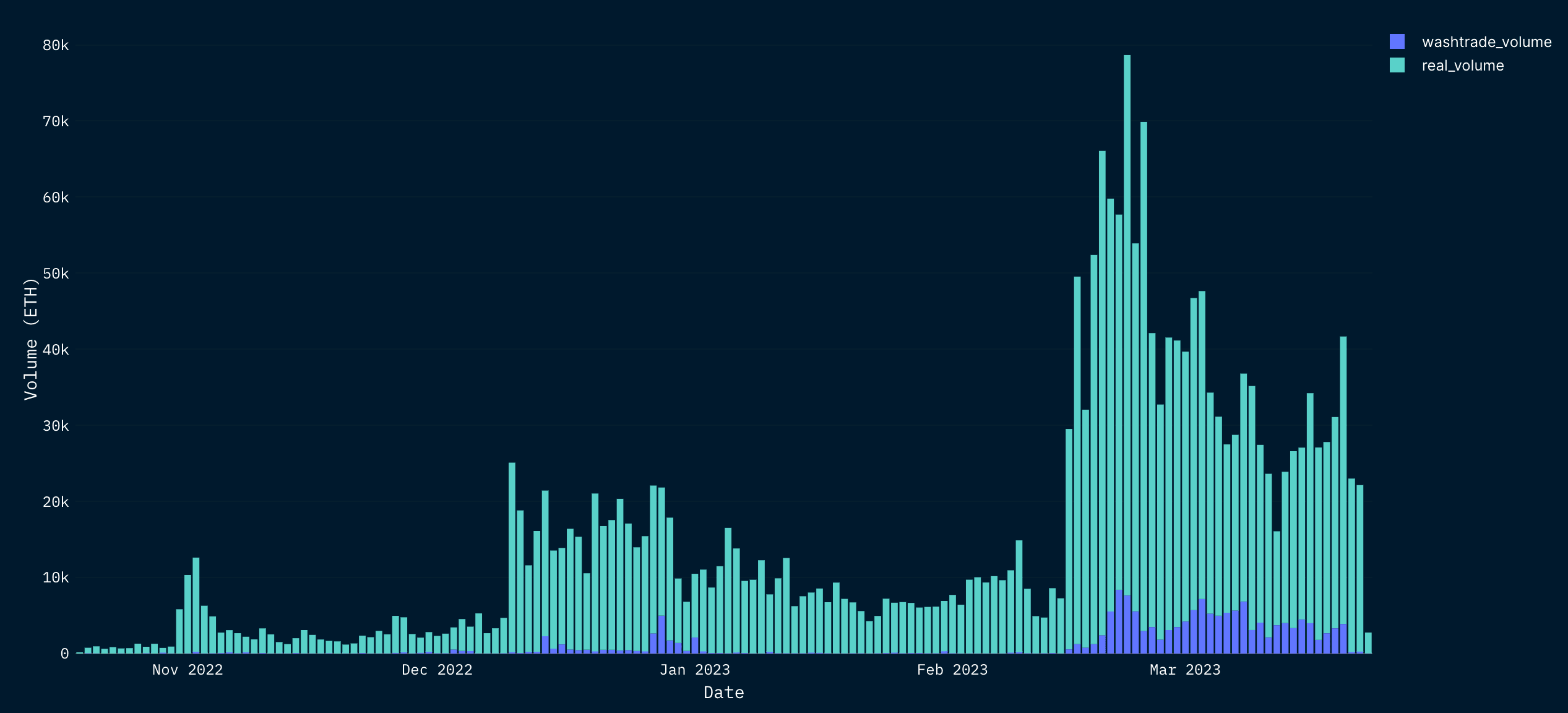

However, as a result of these rewards, much of the activity on the platform has been driven by washtrading as users try to gain more points. This is backed up by the fact that washtrading volume has hit all-time highs following the first season of airdrop rewards. Although washtrading volume contributes to Blur’s overall activity and usage statistics, the platform’s real volume excluding washtraded volume still exceeds that of OpenSea’s.

Washtrading Volume vs. Real Volume

There are a total of 16,687 distinct wash traders on Blur, compared to a total of 213k distinct users on the platform since its inception. While the percentage of wash traders is small compared to the number of users, the volume they generate is much larger than that of normal users. As a result, they have had a significant impact on the platform’s success.

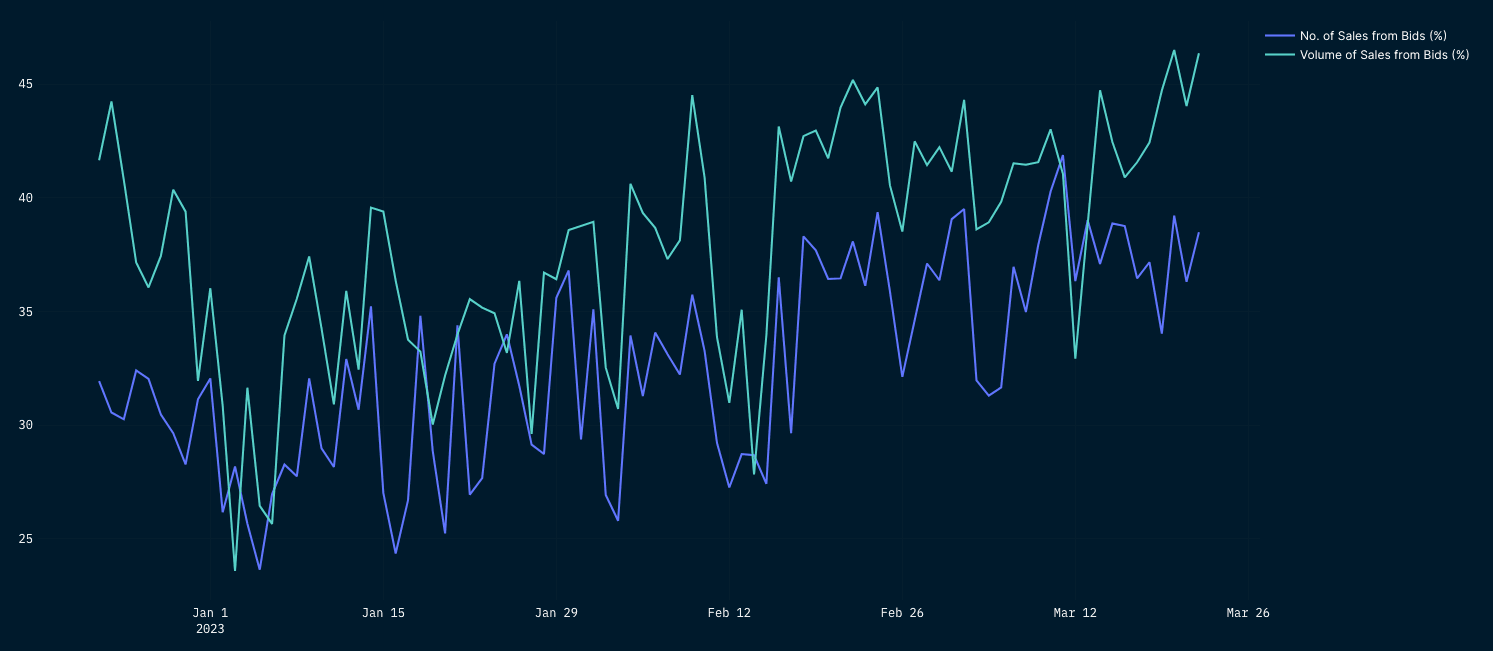

Given that bids is a key way for users to earn points for airdrop farming, the percentage of sales that come from bids in the last 90 days shows that the number of accepted bids has been slowly trending up on average since February 14, suggesting that the strategic liquidity and orderbook incentivization model for airdrop farming subsequently lead to more trading volume. Interestingly, the divergence between volume and number of sales has also increased in recent weeks. This would mean that sales from bids mainly come from more expensive collections, indicating that whales are behind such activity given that they have more capital.

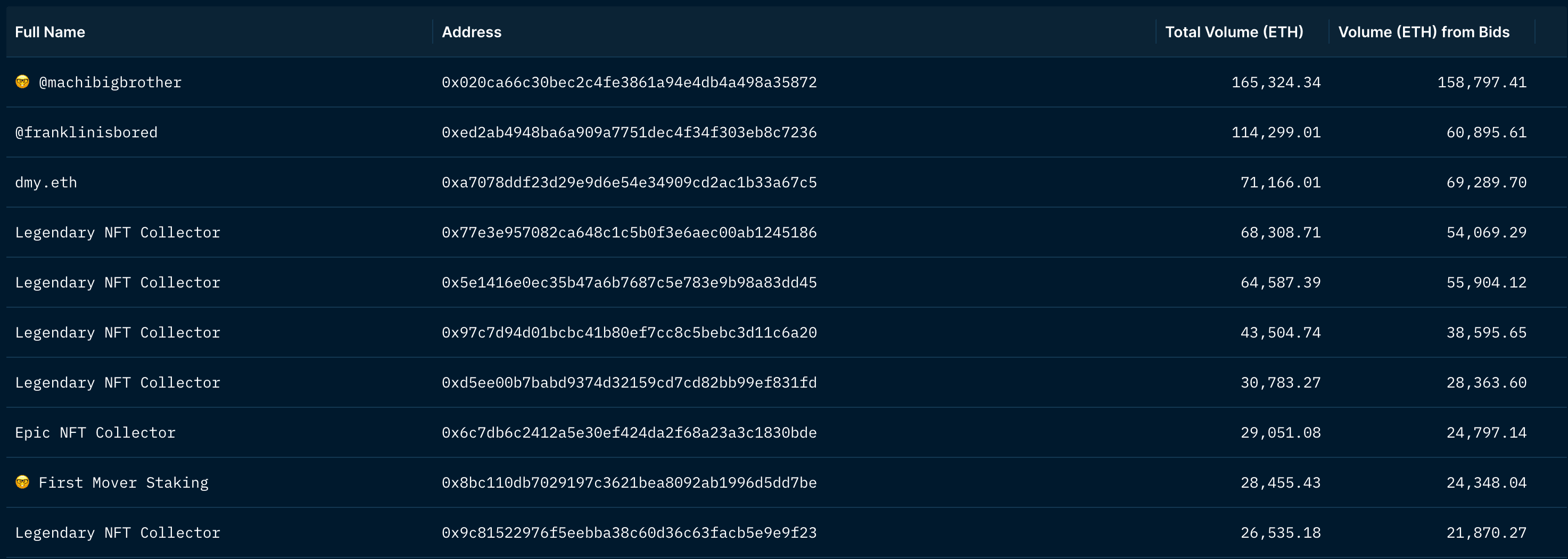

The table below shows some of the top wallets on Blur in the past 90 days. Whales like machibigbrother and franklinisbored are market makers for NFT collections on Blur, especially for blue-chip. While they enhance liquidity, their activity helps them to farm airdrop points for BLUR rewards. Coupled with other top wallets, they generated over 642k ETH in 90D volume, equivalent to 36% of the 90D volume on Blur.

Hence, washtrading as a result of Blur’s rewards system could be detrimental to the platform in the long run despite increased volumes. The platform may face a drop off in volume and users when the rewards system is no longer in place since activity now is incentivized by rewards. Furthermore, the rewards system mainly benefits whales as they have sufficient capital to manipulate the market in their favor. The large allocation of BLUR tokens for these whales will likely result in the token being offloaded as well.

Fundamental Metrics

This section of the report will cover some of the fundamental metrics for Blur, including tokenomics, airdrop season 2 criteria, vesting schedules for the different cohorts, protocol valuation, and sustainability.

Tokenomics

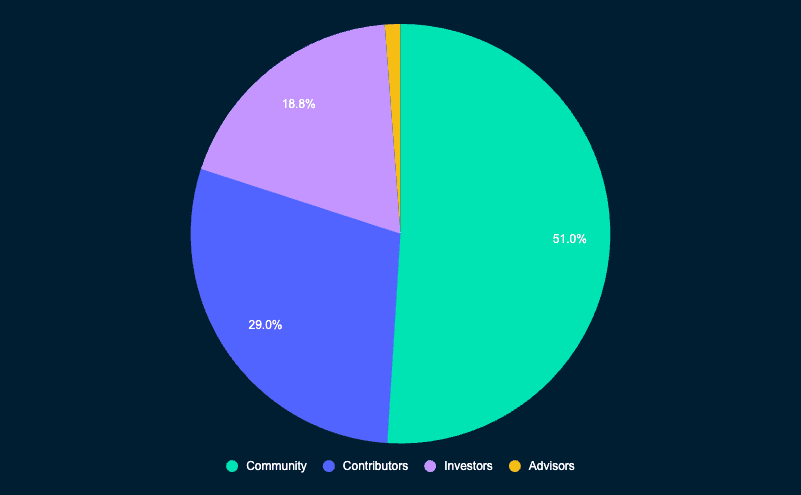

Currently, BLUR is only used for governance and bootstrapping its ecosystem. Its maximum supply comprises 3 billion tokens minted at genesis, which will be fully vested within the next 4-5 years. BLUR's token distribution is as follows:

- 51% (1,530,000,000 BLUR) allocated to the community

- 29% (867,601,888 BLUR) allocated to the core team and contributors

- 18.8% (565,633,826 BLUR) allocated to the investors

- 1.2% (36,674,286 BLUR) allocated to the advisors

BLUR's tokenomics was modeled after Uniswap's UNI token, which distributed 60%, 21.51%, 17.8%, and 0.69% to its community, team, investors, and advisors, respectively. The main difference is BLUR's additional cliffs and expanded vesting schedule for its advisors.

Community Allocation

12% (360m BLUR) out of the 51% token supply allocated to the community treasury was instantly claimable for users and creators, along with Care Packages, during airdrop season 1 from October 19, 2022, to February 14, 2023. Although airdrop season 1 has ended, 10% of the supply (300m BLUR) has been allotted to airdrop season 2 to incentivize the platform's liquidity and activity further. The remaining 29% (870m BLUR) of the community treasury will be distributed to the community through grants, community-driven initiatives, and other incentive programs over time.

Airdrop Season 2 Criteria

Similar to airdrop season 1, users can qualify for airdrop season 2 by listing and bidding NFTs on the platform. Blur uses a point system as its airdrop distribution model, where users are rewarded for providing liquidity and filling up the orderbook. In other words, higher bids and lower asks earn the vast majority of points.

Other factors, such as bidding and listing on more active NFT collections (based on 24H volume) and blue-chips, and the duration of the bid will also translate to more points. Additionally, the top 100 bidders will receive boosts up to 2.5x, and the leaderboard resets on a rolling basis every 24H.

However, Blur's airdrop season 2 will reward users who contribute to the protocol's success via its loyalty metric rather than measuring solely by the number of bids or listings alone. To incentivize platform loyalty, users who only list their assets on Blur will receive a 100% loyalty score, which boosts the chances of obtaining a Mythical Care Package, supposedly worth 100x more than Uncommon Care Packages.

Vesting Schedule

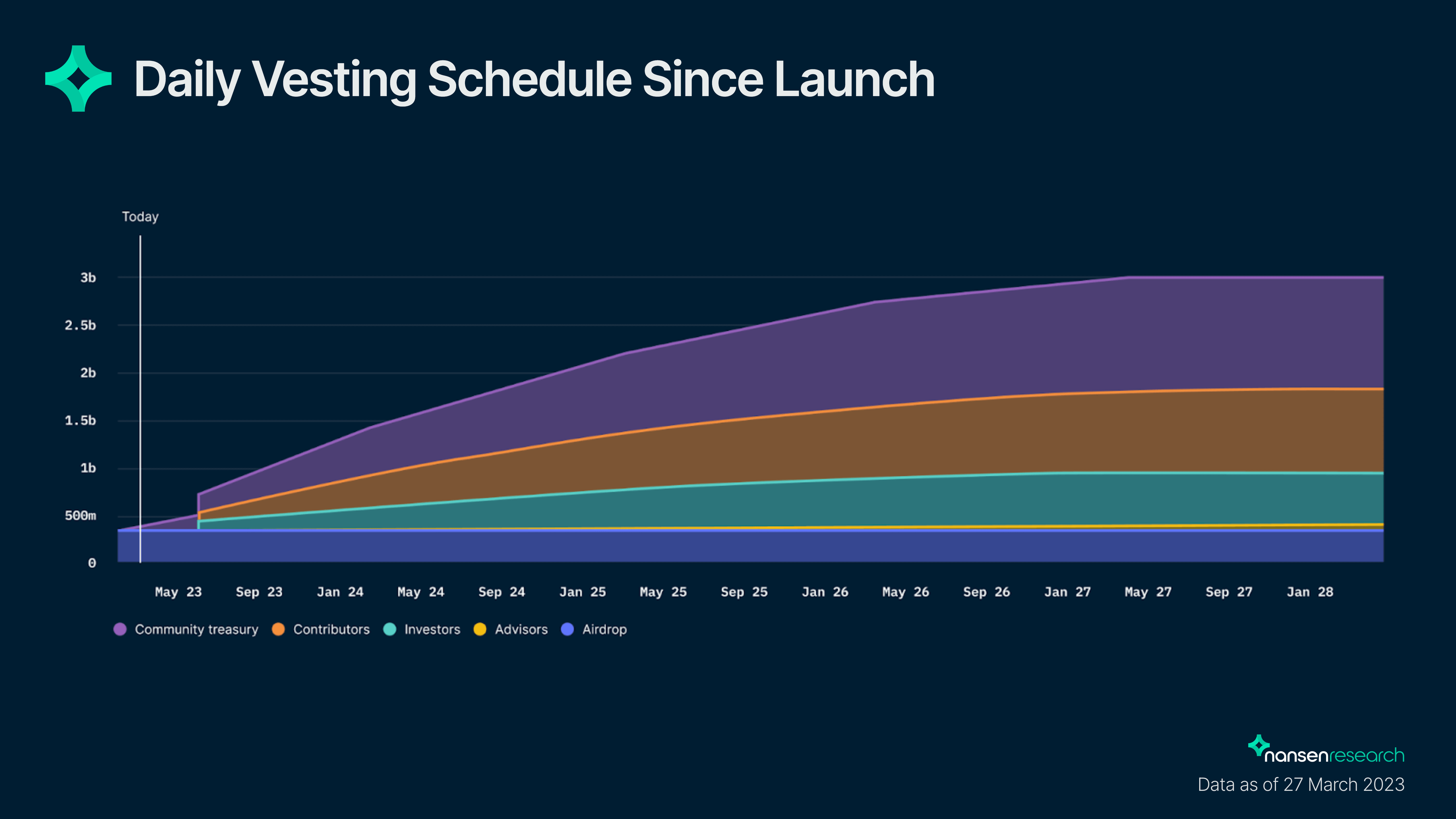

The vesting schedule for BLUR is as follows:

| Category | Details |

|---|---|

| Community | ~51.1% (828m BLUR, including 660m BLUR for airdrop seasons 1 & 2, fully unlocked), ~23% (351m BLUR), 15.3% (234m BLUR), and ~7.6% (117m BLUR) distributed in years 1 to 4, respectively. |

| Core Contributors | 4-month cliff ending on June 14, 2023, followed by a 4-year vesting schedule with daily unlocks until February 14, 2027. |

| Investors | 4-month cliff ending on June 14, 2023, followed by a 4-year vesting schedule with daily unlocks until February 14, 2027. |

| Advisors | 4-to-16-month cliff, followed by 48-to-60-month vesting with daily unlocks until February 14, 2027. |

At the time of writing, there are approximately 420.7m BLUR tokens in circulation, 360m of which came from airdrop season 1. Over the next few months, another 300m tokens are expected to come into circulation from airdrop season 2, in addition to the end of the cliff period for contributors, investors, and advisors.

Valuation

Blur operates on a zero trading fees and revenue model (currently). Comparatively, OpenSea’s revenue model is based on the 2.5% fees they generate. Despite the initial 2.5% fee that they charged per transaction, they dropped their fees to 0% for a limited time period.

Blur started trading at $5 post-airdrop launch, but the price quickly dropped to ~$0.5. The initial price meant that the token had a FDV of ~$15b. Currently, the price has stabilized at around $0.5, meaning a MC of $212m and FDV of $1.5b.

Blur is consistently performing 4-5x of OpenSea’s volume (wash trading has been removed in this chart). Take March 22, 2023, for example, where Blur has done a total of 22k ETH in volume vs. OpenSea’s 4.2k.

In terms of weekly volume, Blur has been consistently faring higher compared to Opensea. Since Blur’s launch in October, they’ve made significant strides to dethrone OpenSea in terms of trading volume.

Can Blur Sustain its Explosive Growth?

Volume

- Currently, there are 16,687 distinct wash traders on Blur, compared to a total of 213k distinct users on the platform since its inception. This number is arguably insignificant for the protocol and suggests that there is also a significant amount of organic trading volume.

- Volumes spiked to ATHs when airdrop incentives were announced as seen in the chart above, and started to wear off after early March.

Fee-switch Model

- LooksRare attempted to challenge OpenSea's monopoly in the NFT market. Unfortunately, LooksRare did not achieve a product-market fit and failed to capture a significant market share from OpenSea.

- Despite the short-lived successes of LooksRare, the revenue/ fee-switch model was the first of its kind. Based on the volume for LooksRare itself, its total volume elapsed when emissions started to decrease.

- Although Blur's trading volume is largely dominated by whale activity and wash-trading driven by airdrop incentives, it is worth keeping an eye on whether Blur can maintain its current volume and make an impact on OpenSea's market share.