Overview

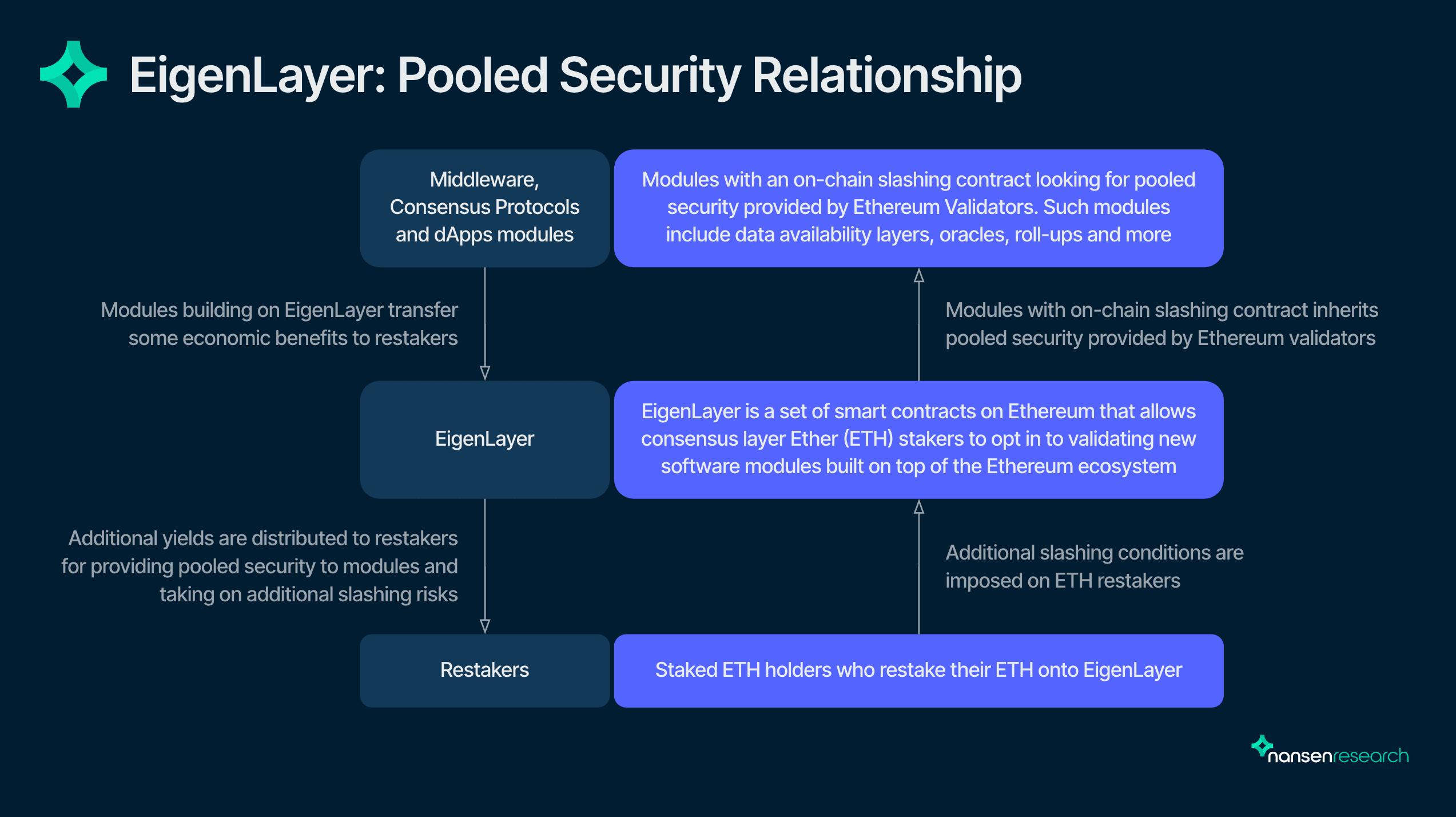

EigenLayer introduces restaking, which is a mechanism that enables users to rehypothecate their staked ETH to get additional yield. By doing so, users can extend the underlying security of their staked ETH to applications integrated with EigenLayer. In short, restaking allows applications to access shared security from Ethereum.

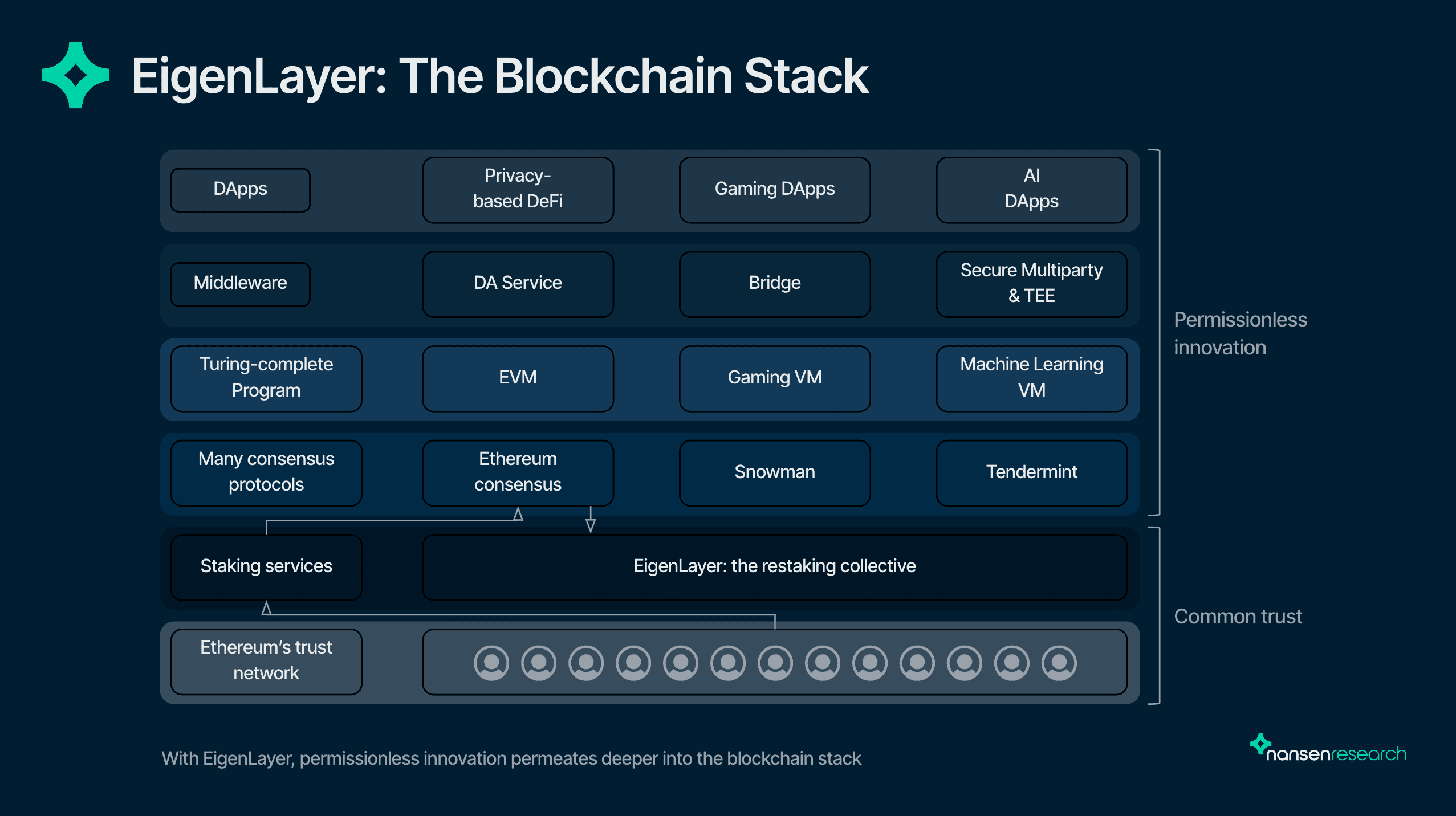

There are a number of applications that can benefit from EigenLayer. Some of which include data availability layers, oracle networks, bridges, new consensus protocols, and of course blockchains. Other implementations will also be discovered over time so the design space is quite large.

Target Addressable Market

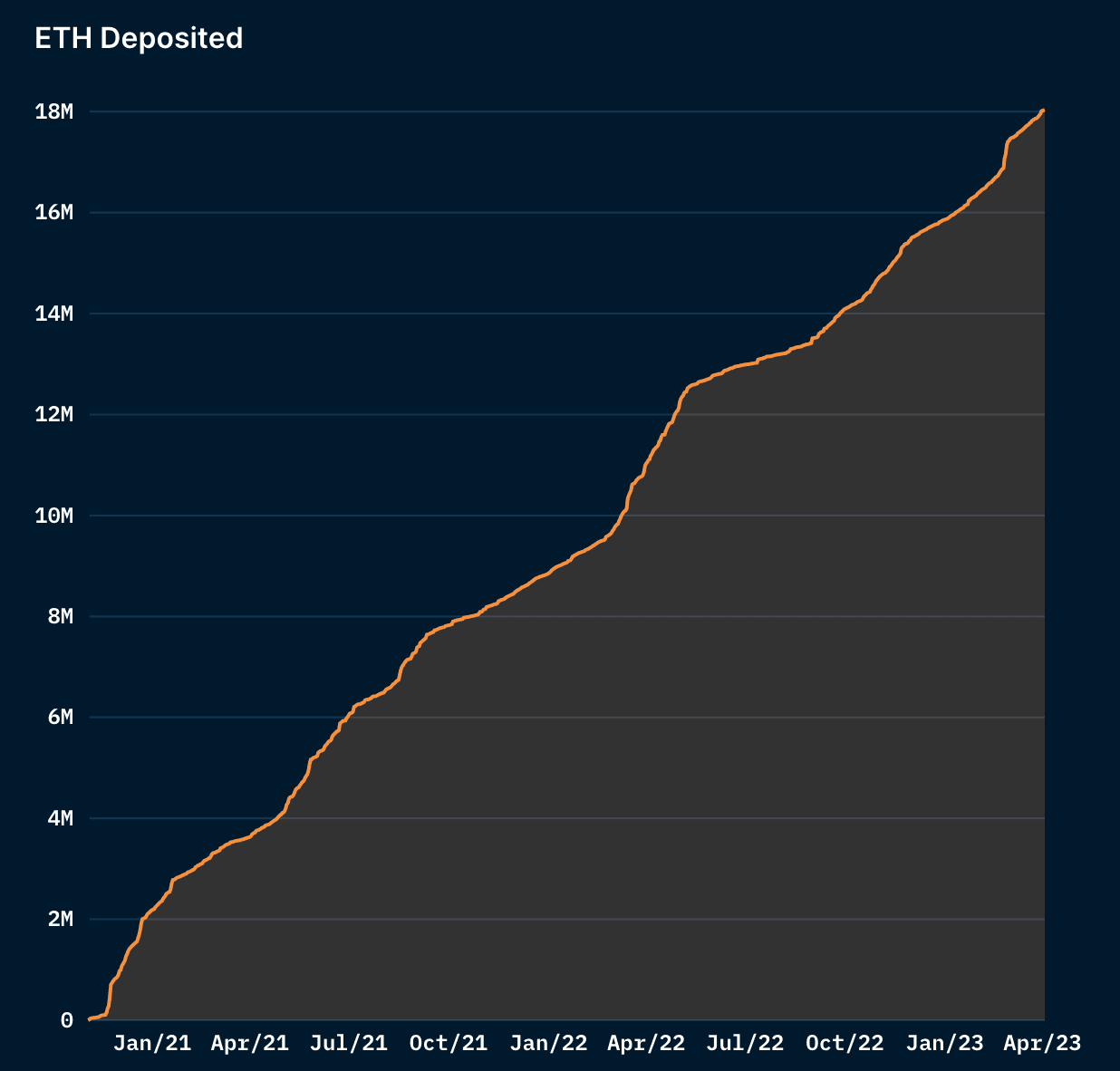

As of April 2023, the total value staked in Ethereum surpassed $34 billion, with 18m Ether (ETH) staked and over 500,000 active validators supporting the network.

Beyond Ethereum, oracles and bridges alone secure a total value of over $37 billion. These blockchains and services could potentially have their security reinforced by restaked ETH through EigenLayer, highlighting its significant market potential.

Lower Cost for Securing Projects

Smart contracts and dApps mostly depend on middleware, like oracles and bridges, not secured by ETH. Thus, their true security cost is the minimum of all dependencies.

In addition, the security budget for staking networks is extremely expensive. For example, if the expected return is 5%, a project with $10b stake securing it will need to pay out the equivalent of $0.5b per year to adequately compensate stakers. This is inefficient and in most cases unsustainable. Securing with EigenLayer would be much cheaper, and leverages the security of Ethereum.

Restaking Mechanism

Restaking is centered around two core ideas: pooled security and a marketplace to facilitate those willing to risk their ETH for additional yield.

How Pooled Security Works

Ethereum validators opt into new applications (smart contracts) on EigenLayer and set their beacon chain withdrawal credentials to its smart contracts. Applications impose additional slashing conditions on validators' staked ETH, and in return, validators earn extra revenue for providing security and validation services.

EigenLayer will provide a market where validators can select which application(s) they would like to restake to depending on their preferences and risk appetite.

EigenLayer for Projects

Enabling new applications

EigenLayer allows any blockchain application with on-chain slashing to be secured with restaked ETH. This allows developers to focus more on product development rather than bootstrapping security.

Among these applications are oracles secured directly by ETH PoS, data availability layers, decentralized sequencers for managing MEV in rollups, light node bridges to Ethereum, and more.

Leveraging Differences in Computing Power

EigenLayer seeks to enable projects to avail of differences in computing power to increase block space by creating opt-in validation tasks that can only be performed by higher-capacity nodes. This is currently under development. Developers can ask more of their validators in the form of customized hardware requirements to create fundamentally new product features that otherwise couldn't have been done on Ethereum. Currently, this dynamic is playing out with dYdX which is having its validators run in-memory order books to create a decentralized and scalable order book exchange. However, this requires them to build out an entire layer-1 chain and introduces a lot of additional security risks, including bootstrapping a new validator set to contribute to economic security.

This new relationship means building on EigenLayer makes your application a ‘first-class citizen', given the validators are working specifically for the application. This is in stark contrast to Ethereum or any permissionless chain, where upgrades are not made for any specific application but for general purposes. Thus, applications do not need to wait for a specific EIP or have their contracts broken. Instead, they can be more iterative and work with validators to ultimately build features that make a better product.

Multi-Token Governance

EigenLayer allows projects to have more autonomy by allowing the issuance of their own tokens. Apps gain more autonomy by determining their governance weight among various stakeholders, including the team, validators, and users. For instance, an app can set a maximum governance power to ‘restakers’ and still offer sustainable economic alignment via MEV capture and transaction fees as a form of payment. This is a clear example where EigenLayer can provide flexibility for projects to bootstrap their own token as a utility token and accrue value to its protocol without enshrining sell pressure for restakers to redeem their yield.

EigenLayer in Practice

Decentralizing Rollups

An interesting potential application of EigenLayer is decentralizing sequencers of rollups. Decentralizing sequencers is a key painpoint with rollups today. EigenLayer proposes that sequencers can be built on EigenLayer with ETH stakers which can be a single, decentralized sequencer quorum for multiple rollups.

The Case of Oracles: Chainlink

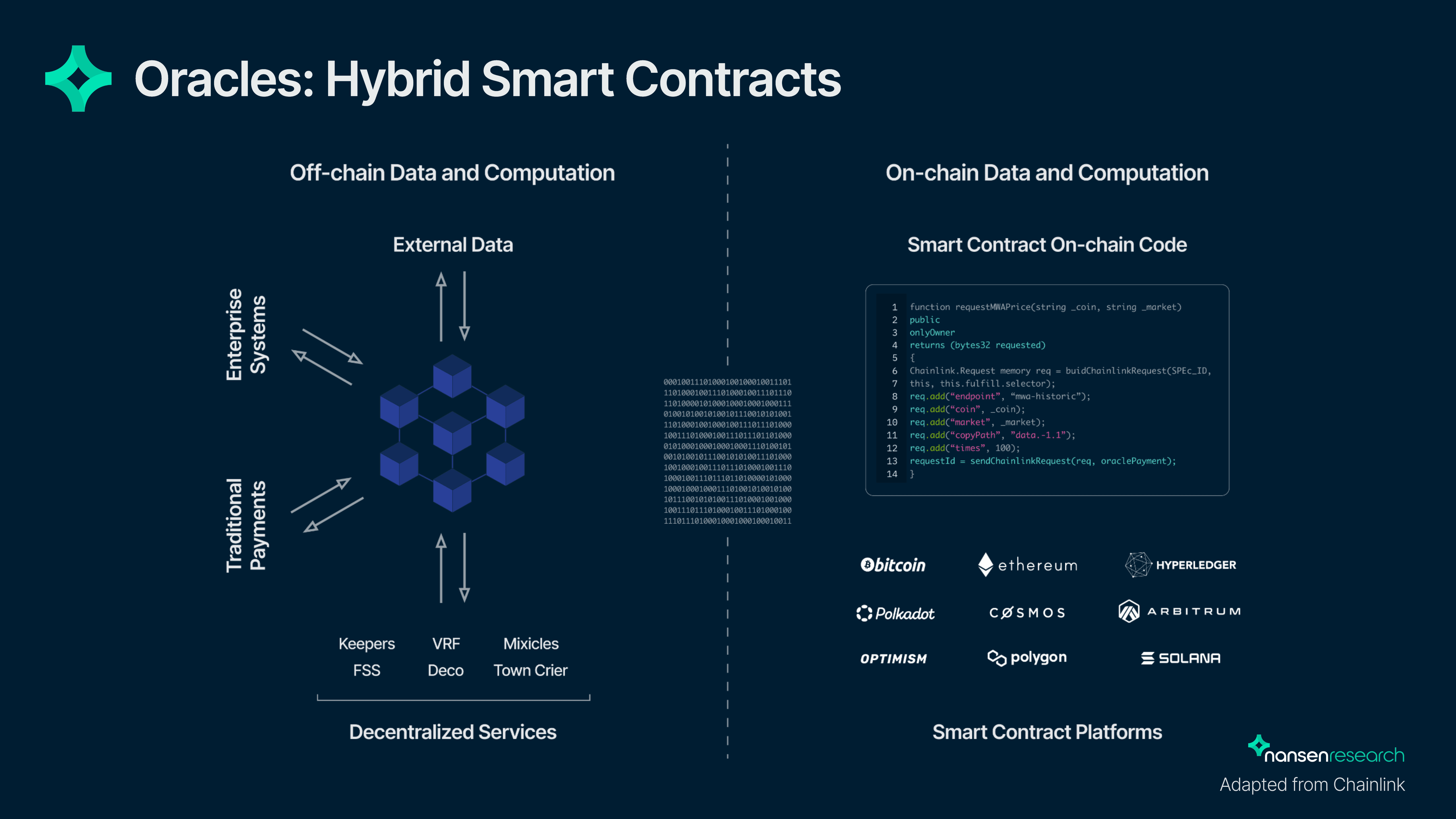

Oracles are an example of middleware that can benefit from EigenLayer’s staking mechanism. Currently, oracles enable smart contracts to combine code running on the blockchain (on-chain) with data and computation from outside the blockchain (off-chain) provided by decentralized oracle networks. Take the example of Chainlink:

Currently, Chainlink staking enhances the security and reliability of its oracle services, requiring LINK tokens to be locked with a penalty of slashing for any misbehavior. To be clear, this is not a proof-of-stake mechanism, but more specifically a slashing mechanism with a decentralized alerting capability that serves as an incentive for Chainlink nodes to consistently provide accurate oracle reports.

According to DefiLlama, Chainlink currently secures $12.1b in DeFi TVL, while having a market cap of $3.5b. This opens up a potential avenue for misbehavior, such as liveness attacks on Chainlink’s slashing mechanism. One example of Chainlink’s significance is that many of the money market protocols rely on it which poses a large risk as they need to carry out efficient liquidations to avoid bad debt from accruing. Thus, Chainlink going down would pose an existential risk to one of the key components of DeFi today.

Tapping into the security of staked ETH could make Chainlink more secure and difficult to corrupt. Given the value secured, this is extremely important. Although EigenLayer provides additional security benefits to Chainlink, it does not solve all potential attack vectors for oracles. For example, Chainlink uses a small multi-sig managed by the team, causing much of DeFi to depend on a few individuals.

Data Availability: Mantle

In addition to oracles, data availability is also a relevant middleware layer that could be built on EigenLayer.

Mantle is an Ethereum L2 network and the first confirmed project to leverage EigenLayer. A list of testnet applications on Mantle is found here.

EigenLayer (through EigenDA) allows nodes to provide data availability services to the Mantle network. This can ensure block data completeness and correctness on the Mantle execution layer while tapping into L1 security.

EigenLayer also enables nodes to take part in Mantle's economic model by staking BIT (Mantle’s native token) along with restaked ETH through a dual-token governance model. This maintains the staking and governance value of BIT while still leveraging the security of restaked ETH.

EtherFi

Ether.fi is another project that is also planning on integrating EigenLayer for their node services layer. Ether.fi is a liquid staking derivatives (LSD) project that allows users to maintain control of their keys.

EigenLayer for ETH Stakers

Staked ETH now has relatively standardized yields across various liquid staking derivatives (LSD) protocols. As always, the appetite for higher yields exists in crypto and EigenLayer offers a new mechanism to make ETH more capital-efficient. Furthermore, it enables ETH stakers to reuse their staked ETH to support projects they believe in.

EigenLayer will offer several restaking options, including:

- Native restaking: restake ETH

- LSD restaking: restake with LSDs e.g. stETH

- ETH LP restaking: stake the LP token of a pair that includes ETH

- LSD LP restaking: stake the LP token of an ETH/LSD token e.g. (stETH-ETH LP token)

Note that the projects using EigenLayer can select what is restaked e.g. if the project considers LP tokens as too risky, they can only enable native/LSD staking.

Comparison of EigenLayer to Other Security Providers

As blockchains continue to scale, there are many teams building out ways to scale to the masses. The two major categories fall under the monolithic path and the modular path. This report will focus strictly on the modular one and highlight the major players today.

Current Modular Landscape

Much of the modularity movement revolves around shared security and the ability to scale in a decentralized fashion. There are many implementations of shared security today and they vary slightly on how they do it and what they aim to solve:

- Layer-2s inheriting security from a common settlement layer (ex: Ethereum)

- Inherit programmable security from Eigenlayer - apps or chains subject themselves to additional slashing mechanisms

- Inherit security from a shared DA Layer (ex: Celestia)

- Interchain Security (Cross-chain validation) - consumer chains use the producer chain validators for security (ex: Cosmos Hub)

- Checkpointing mechanism (Babylon) to Bitcoin to prevent a specific attack vector of PoS chains (long-range attacks) and securing large value transactions

- Cross-staking via Mesh Security - staked capital is subject to validator level slashing conditions

From the above, it is clear there are many implementations trying to solve similar problems such as shared security, DA and many others. However, it is clear that EigenLayer’s intended scope is the broadest currently. Whereas interchain security, mesh security, and Babylon’s timestamping mainly focus on the security aspect of sovereign L1 PoS chains (as of now).

Mesh Security and EigenLayer

Although the problems they are tackling may differ, the actual mechanisms are very similar. The ‘restake’ primitive from EigenLayer and the cross-staking mechanism from Mesh Security are doing the same rehypothecation of staked assets to fulfill another utility for users - taking on slashing risk to earn more yield. This risk is primarily at the validator level via Mesh Security or at the smart contract level with EigenLayer. There are abilities to customize governance on both, so that you can limit those ‘restakers’ and ‘cross-stakers’ from undermining governance of a specific application or chain.

The major difference between Mesh and Eigenlayer is that cross-staking is bi-directional. In Cosmos, there is Interchain Security v1 (cross-chain validation) that allows for a producer chain (security provider) to provide security to the consumer chain, the chain being secured. However, this is one-way security where the consumer chain depends on the producer chain but doesn't provide it security from its own market cap. With Mesh security you can have two sovereign chains secure one another, bi-directionaly. For example, if 100% of the OSMO stake opted to secure Juno Network and 100% of the JUNO stake opted to secure Osmosis, then they would both get the security of the joint market caps of the 2 chains, while remaining sovereign chains. You can now imagine this across multiple chains that would create a ‘mesh’ of shared security. Of course, the delegated stakers to these validators would take on slashing risk for each new chain it chooses to validate and there are a lot of governance-related questions to work out but this is still very early. However, EigenLayer and Mesh Security can also work together in the future to bring Ethereum into this 'mesh' of security.

EigenLayer and Celestia

There are additional key distinctions between EigenLayer and Celestia. One of the main being that there is a difference in the quorum that secures the DA layers. While Celestia's quorum comprises Celestia validators, EigenLayer's quorum consists of restaked ETH. Therefore, there is more alignment with the Ethereum community to start. This can be seen as more aligned rather than whoever the validators of Celesita might be. However, this does not include Celestia's light clients that use data availabiity sampling to secure the network, which if there are enough light clients, it can successfully checkpoint the Celestia validators from misbehavior.

Additionally, most of the liquidity in DeFi is within the Ethereum ecosystem - mainnet and L2s - so using a Celestia-native rollup will introduce a barrier to entry (use a bridge to get there).

End Game for Modular Security Provider

All of the providers mentioned above are not live, showing that there are many details to be figured out for all of them. For the scope of this report, we strictly focused on the mechanisms of each and their similarities/differences between them, but what might a world with all these providers actually look like in a few years?

We are not sure, but there is a reality where chains such as Ethereum can secure other layer-1 chains via EigenLayer, while also being secured itself via cross-staking from any N number of Cosmos chains. As for Babylon Chain, they are able to address key security concerns with PoS such that they can help reduce bonding times of staked capital (down to just a few hours). Their current focus is on Tendermint chains for now, but they can expand to include other PoS chains like Ethereum. Protect against long range attacks, while also reducing bonding times for the end user.

All of these modular security providers will still need interoperability between all of them. One of the main contenders to be the glue that ties together all of these siloed ecosystems is Inter Blockchain Communication (IBC). The actual implementations are beyond the scope of this report but Polymer Labs, a team bringing IBC to other ecosystems, lays out the implementations. IBC is known for being related to Cosmos but it is inherently chain agnostic, and many teams like Polymer Labs, Composable Finance and Landslide Network are bringing it to Ethereum, layer-2s, Polkadot, NEAR and many more.

Thus, the end game for these modular security providers is is very positive sum. Ethereum, bitcoin and many sovereign layer-1 chains can be working together to secure one another, while also being interoperable in a very trustless manner.

Key Considerations

Implications for Project Native Tokens

Alignment

A main consideration for projects looking to build on EigenLayer boils down to alignment. A key question remains - how to best economically align ETH stakers who bootstrap these networks with the projects building? Of course, there may be token inflation via staking yield that can accrue to restakers, but that also incentivizes selling to achieve this yield (it comes from validators selling the native token of project 'X' for more ETH).

However, there are other ways of economically rewarding restakers, while not creating downward pressure on the native token. MEV revenues and transaction fees can provide a much more sustainable way to reward stakers instead of diluting token holders. Of course, a lot of this scales with activity, volume, TVL and more. Essentially, these apps or chains would still need real user activity to have these forms of value capture be significant. Additionally, they are still leaking value to EigenLayer restakers, which highlights one of the main benefits of app-chains being able to internalize all of their MEV and distributing it to stakers.

Centralization Risks

If ETH validators need to validate data of extra chains and services, a potential concern is that state will bloat further which could centralize the network due to higher hardware requirements. A tale as old as time: bigger blocks = more centralization. But how does EigenLayer address these concerns while still achieving more throughput without sacrificing decentralization?

Horizontal Scaling

EigenLayer proposes that projects leverage “horizontal scaling” to avoid this. Projects can avoid centralization issues by dividing the computational workload among all operator nodes for a given service. They term this “horizontal scaling”. Therefore, a project can achieve high performance by aggregating the workload across many nodes.

In typical blockchains that lack horizontal scaling, validation can be done by a single operator. However, in a horizontally scaled network, a centralized operator would need to perform different validations per key, reducing its earnings.

In short, many smaller nodes may participate in additional AVS that may support high throughput services (i.e data availability) without increasing their own hardware requirements significantly. Whereas, it is not as straightforward for larger validators who want to maximize revenue by utilizing their advantage of additional hardware and resources. For example, a large well known entity may control many individual Ethereum validators but the additional validation cost of each validator cannot be amortized by a central operator. Thus, this given entity must perform validation per key and it may act as an inhibitor to a few entities controlling the network.

Lightweight Services

Another factor EigenLayer considers are services they categorize as ‘lightweight’. These are services that require low computation and a lower cost to partake in. Some examples EigenLayer mentions are running oracle price feeds, running light nodes, and verifying zero-knowledge proofs, among others.

Variance in Resources Across Nodes

Despite the advanced and lightweight services, some nodes naturally have more computing power. High throughput services needing extra resources will be validated by fewer, resource-rich nodes. This results in a smaller, more centralized group of validators involved in 'restake'. However, since a single entity can control multiple Ethereum validators, assessing liveness and censorship risks is difficult. To address this, EigenLayer plans to use Ethereum mainnet to reduce liveness and censorship risks, similar to how rollups work currently.

Project Vetting

Projects seeking to build on EigenLayer must be admitted by the veto committee. This will require security audits and other diligence, including checking the system requirements for validators. The veto community serves as a "hand-holding" start, with the expectation that project audits will be decentralized in the future (although this is unlikely in the short to mid-term).

EigenLayer’s two lines of defence are:

- The security audit.

- The ability to veto slashing events via a governance layer made up of prominent members from both communities who can veto via a multisig. This is a reputation-based system, as the veto community has to be trusted by participants.

Overall, EigenLayer's process ensures a certain level of due diligence and risk management in admitting new projects to its platform. However, it remains to be seen how well this will work in practice and limits the growth of EigenLayer to a trusted committee.

EigenLayer aims to offer an attractive proposition - providing stakers access to additional yield and enabling projects to inherit Ethereum's security.

It has the potential to create great value for the space by enabling applications to leverage Ethereum’s security. The case for application-specific chains is strong, and it can greatly facilitate their deployment, as well as any other application within the blockchain stack with a slashing mechanism.

Although there are only a few commitments to use EigenLayer currently, the project remains in its infancy. If it is able to prove itself to be secure and working as intended, the potential market is vast. The viability of these additional yields depends on strong projects and use cases developed on EigenLayer over time.

It is arguably one of the most innovative projects in the blockchain space with the potential to make an enormous impact in addressing security issues and allowing developers to focus on building products that bring more people and capital into this space.