Ethereum Staking Today

Since Ethereum's successful migration from Proof-of-Work to Proof-of-Stake, the liquid staking derivative (LSD) narrative has consistently been gaining traction. Ethereum bulls have continued to deposit their ETH into the staking contract to earn staking yields, even though withdrawals will only become available after the Shanghai upgrade, which is scheduled for March of 2023.

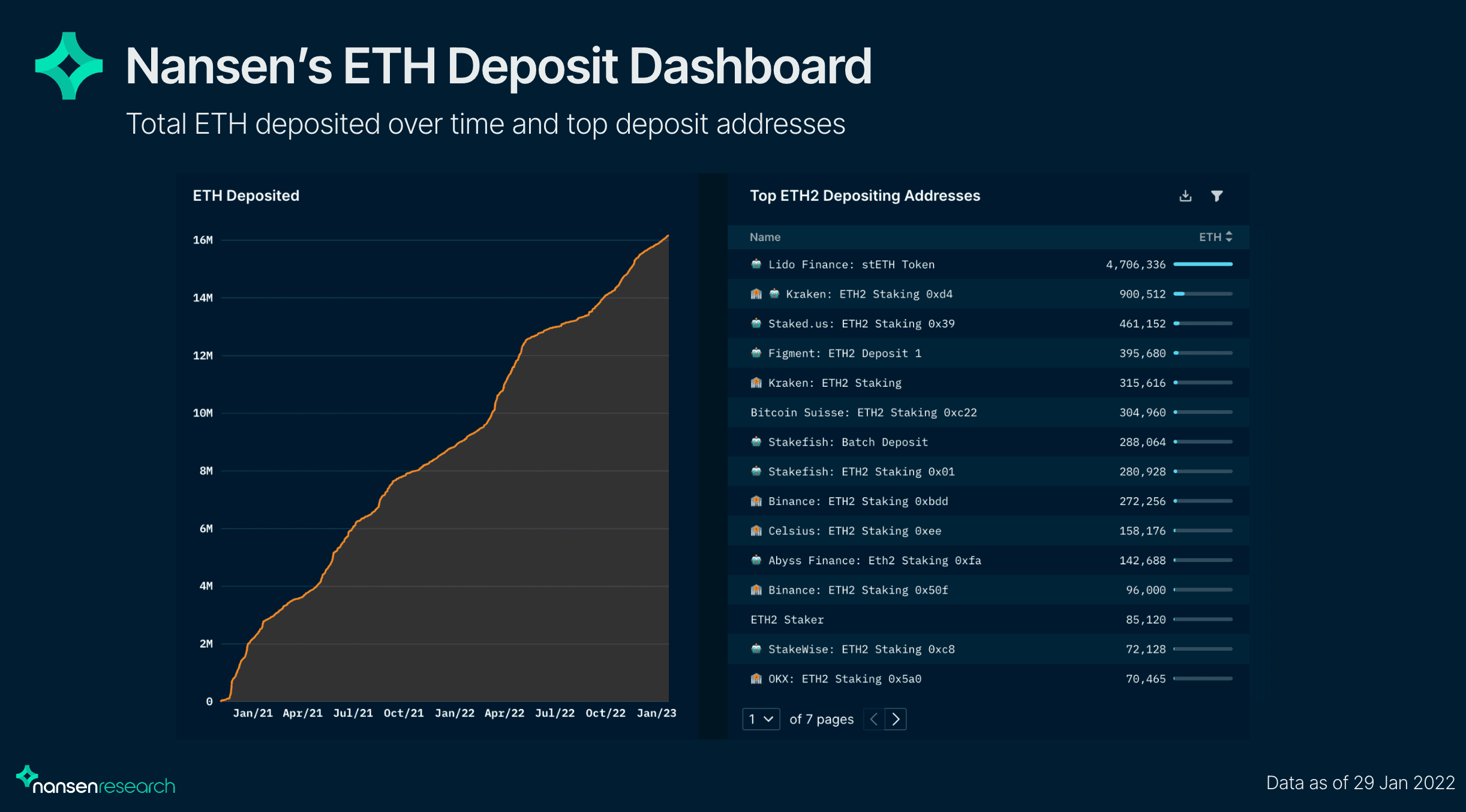

Today, approximately 16.2m ETH is staked by over 94k unique addresses, accounting for ~13.3% of the total supply. These statistics are expected to grow over time after withdrawals are enabled (although we may also see some significant selling pressure leading up to and shortly after Shanghai).

In our Ethereum Merge report, we found that the vast majority of staked ETH is currently out-of-profit (~71%) as of September 9, 2022. 18% of all staked ETH belongs to illiquid stakers that are currently in-profit - these are arguably the category most likely to sell when withdrawals are enabled at the Shanghai upgrade. You can check out the latest profitability of ETH Stakers in this custom Nansen Query dashboard, developed by our Research team.

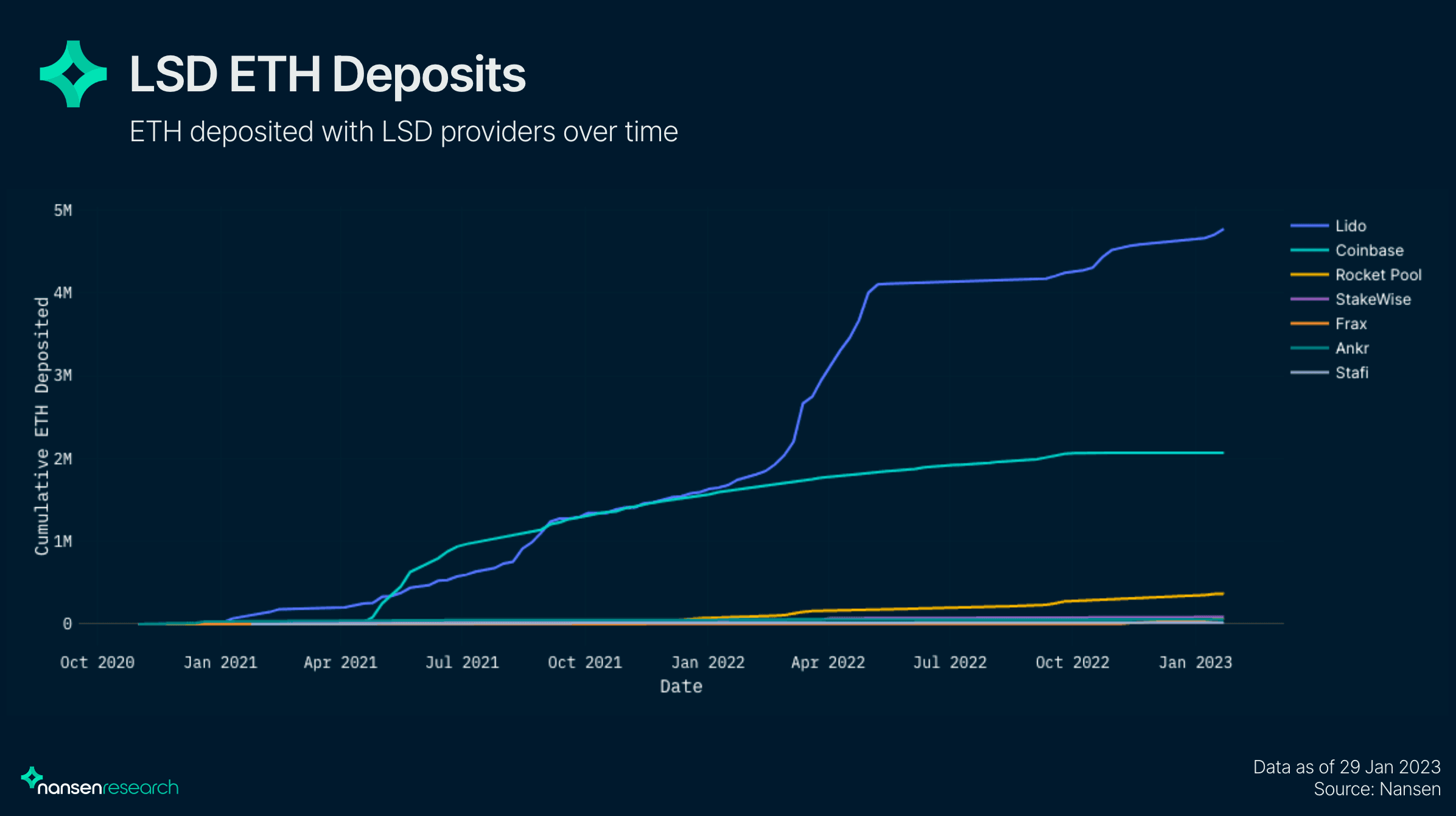

As seen from the list of notable addresses above, Lido is currently the largest depositor to the ETH staking contract, with ~4.7m ETH, equivalently 29% of all staked ETH, deposited into the protocol. However, with the continued interest from ETH holders to earn real yield, especially after withdrawals are enabled, the liquid staking derivative landscape has been heating up with the emergence of new participants such as Frax Finance.

frxETH Overview

frxETH is an ETH liquid staking derivative, the latest product launched by the Frax Finance team. It’s aim is to extract the maximum yield on ETH staking in a simple and DeFi-native manner while leveraging the Frax ecosystem. Even though it is a new entrant into the LSD game, Frax Finance has the experience and is capable of developing and maintaining a robust stablecoin. The introduction of frxETH, if successful, could help propel Frax Finance to achieve its goal of becoming a one-stop shop and liquidity hub for all DeFi activity on Ethereum.

frxETH Token Design

Frax Finance has opted for a two-token design for their liquid staking derivative solution; frxETH and sfrxETH.

frxETH

frxETH is the stablecoin pegged 1:1 to ETH. frxETH can be minted by depositing ETH to the frxETHMinter contract, which will return the same amount of frxETH as the amount of ETH sent. frxETH is fully backed by AMOs on top of ETH itself. Note that frxETH does not accrue staking rewards.

sfrxETH

sfrxETH is the staking vault token that accrues validator rewards plus tips and MEV. In other words, it is the yield-bearing version of frxETH. As validators earn ETH, it will be swapped to frxETH and added to the vault. Thus, the ratio of sfrxETH to frxETH increases over time. To earn staking rewards, frxETH holders must stake to convert it into sfrxETH.

The two-token mechanism allows for more efficiency of the ETH staked with Frax and eliminates the risk associated with rebasing, which simplifies DeFi integrations. This design choice makes frxETH easy to integrate into the suite of products offered by Frax Finance, including FraxSwap, FraxLend, and FraxFerry, while sfrxETH stakers accrue rewards. Hence, frxETH has added utility (and therefore value) as an ETH-pegged stablecoin. Moreover, similar to Frax's partnership with Curve to create the Frax Base Pool (BP), a frxETH Base Pool is already in the works, according to its founder Sam Kazemian.

The FRAX BP comprises a 50/50 split between FRAX and USDC, which will rival Curve's native 3pool, and enables the protocol to have deep liquidity and gives that liquidity to other tokens that pair against it. In turn, this benefits FRAX by giving the stablecoin more utility and demand. Similar to the vision for FRAX to eventually become the central liquidity hub for USD stablecoins, frxETH will serve the same purpose for ETH pools. Their goal is to be the go-to base pair for other liquid staking derivatives looking to deploy on Curve. To achieve this, they must have deep liquidity and boosted yield incentives.

frxETH Flywheel Effect

frxETH’s flywheel effect has enabled Frax to offer higher APRs than other protocols, leading to impressive liquidity growth, and bringing about positive knock-on effects for the greater Frax economy.

How does Frax achieve higher APRs than other protocols?

In short, because of the dual-token design, frxETH holders have the option to:

- Deposit frxETH into the vault in return for the yield-bearing sfrxETH, equivalent to staking ETH.

- Provide liquidity to the frxETH-ETH Curve pool and earn CRV and CVX emissions, FXS, and trading fees.

Assuming that all frxETH holders choose to deposit their frxETH into the vault for sfrxETH, the baseline APR for sfrxETH is the same as the Ethereum validator rewards, comparable to other liquid staking derivatives. But because of the dual token mechanism, some frxETH holders may decide to provide liquidity to the frxETH-ETH Curve pool. Therefore, all ETH converted to frxETH will be staked, but not all frxETH are converted to sfrxETH.

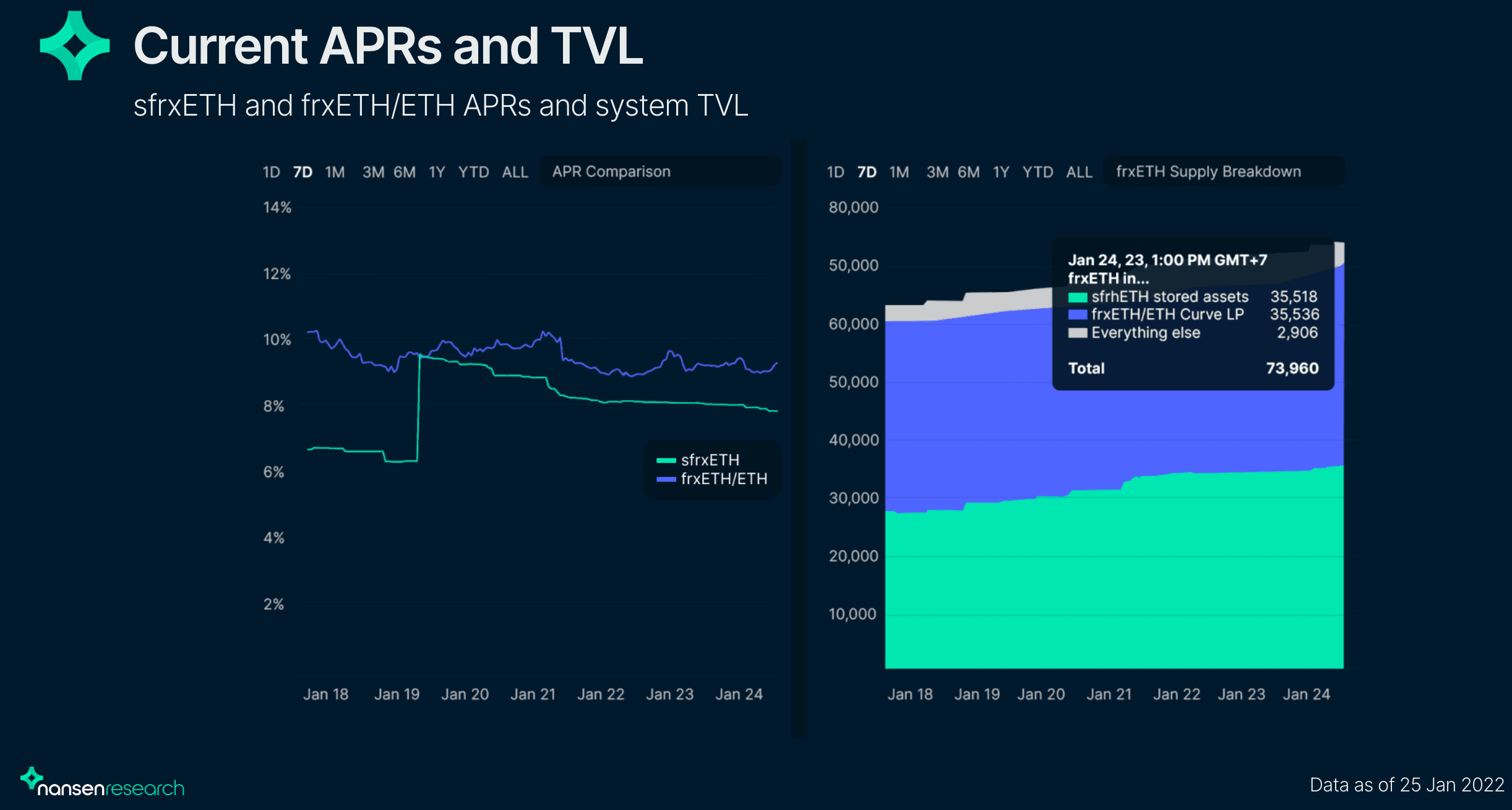

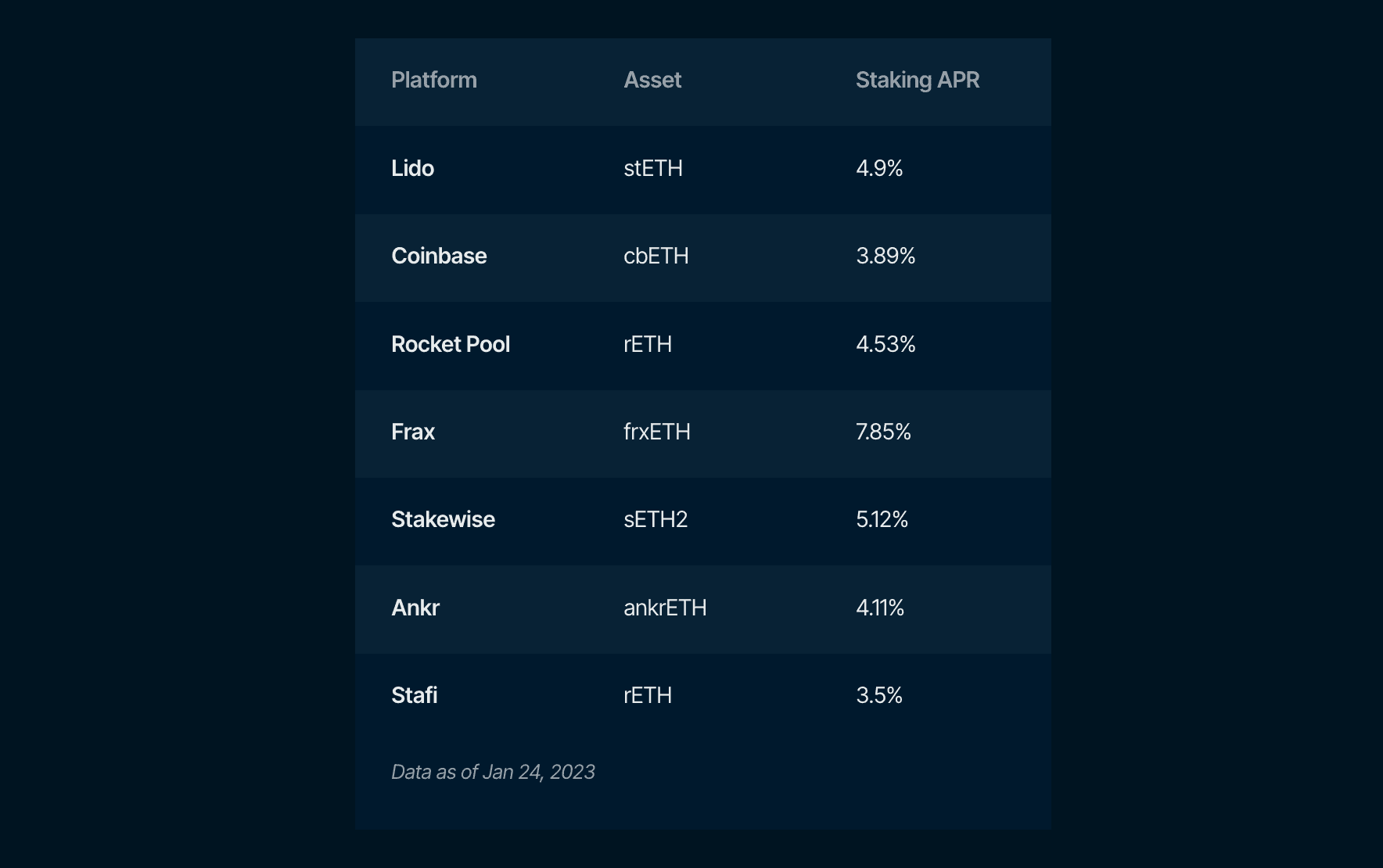

Check out the live dashboard here. Thus, Frax Finance is able to offer higher staking rewards for sfrxETH holders. At the time of writing, the sfrxETH APR is 7.85%, significantly higher than any other liquid staking derivatives. This is because 35,518 frxETH were converted to sfrxETH, while the total supply of frxETH is 73,960, translating to 48% of all frxETH minted. As a result, the staking rewards from the remaining ~50% of frxETH holders who chose to supply liquidity to the Curve pool go to sfrxETH holders.

Frax Finance is currently running 1,860 active validator nodes and 23 pending nodes. As the number of frxETH minted increases, the validator node count will also naturally grow over time.

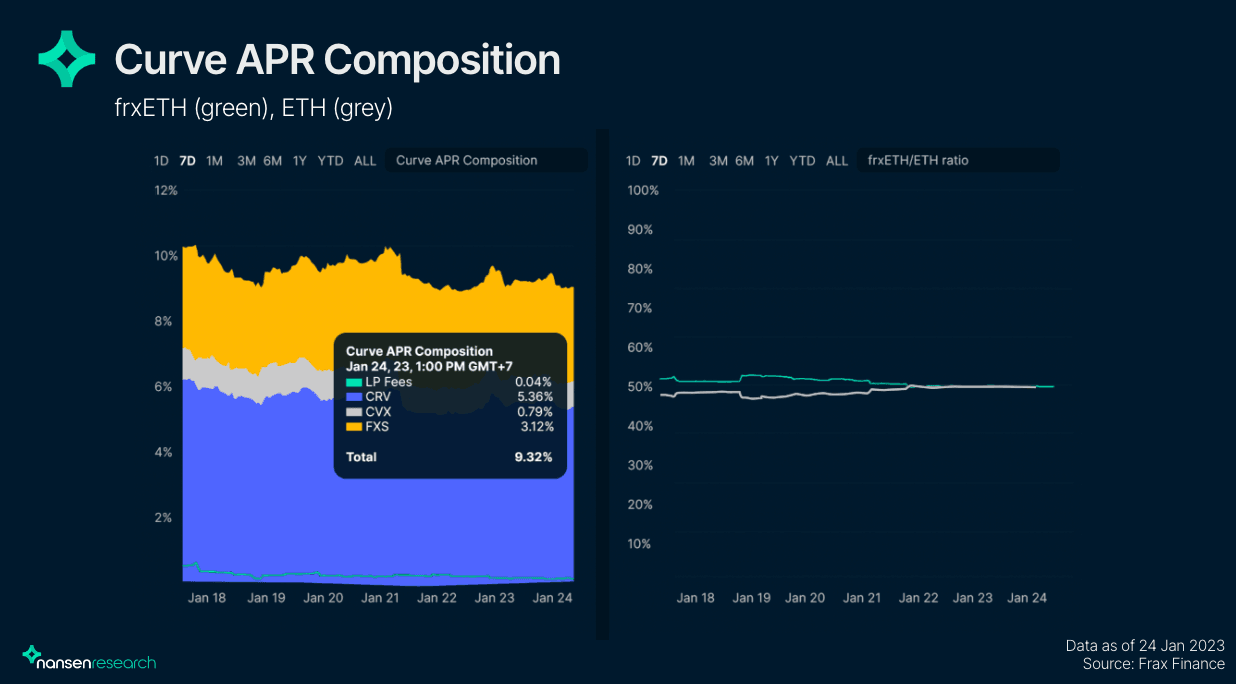

But why would frxETH holders want to become an LP instead of staking their ETH? As the protocol is already the largest DAO holder of CVX, it is able to direct CRV emissions to the frxETH-ETH pool, along with other Frax pools on Curve, in addition to bribes. Hence, frxETH-ETH LPs earn CRV, CVX, and FXS. Specifically, the yield consists of 5.36%, 0.79%, 3.12%, and 0.04% in CRV, CVX, FXS, and LP fees, respectively, giving a cumulative APR of 9.32%.

However, since the protocol is running its own validator nodes, sfrxETH holders are subject to trusting the team, particularly in their commitment to maintaining uptime, maximizing MEV opportunities, and discipline to avoid slashing or other risks. This trust assumption increases the underlying risk for the protocol. Therefore, some may consider liquidity provision as the less risky of the two strategies.

Liquidity Growth

Presently, providing liquidity to the frxETH-ETH pool returns a marginally higher yield than staking, incentivizing deeper liquidity for the pair. On the other hand, this also draws away frxETH holders who would otherwise deposit their position into the sfrxETH vault, giving the remaining sfrxETH holders more interest. In short, a win-win situation for LPs, stakers, and the Frax protocol itself.

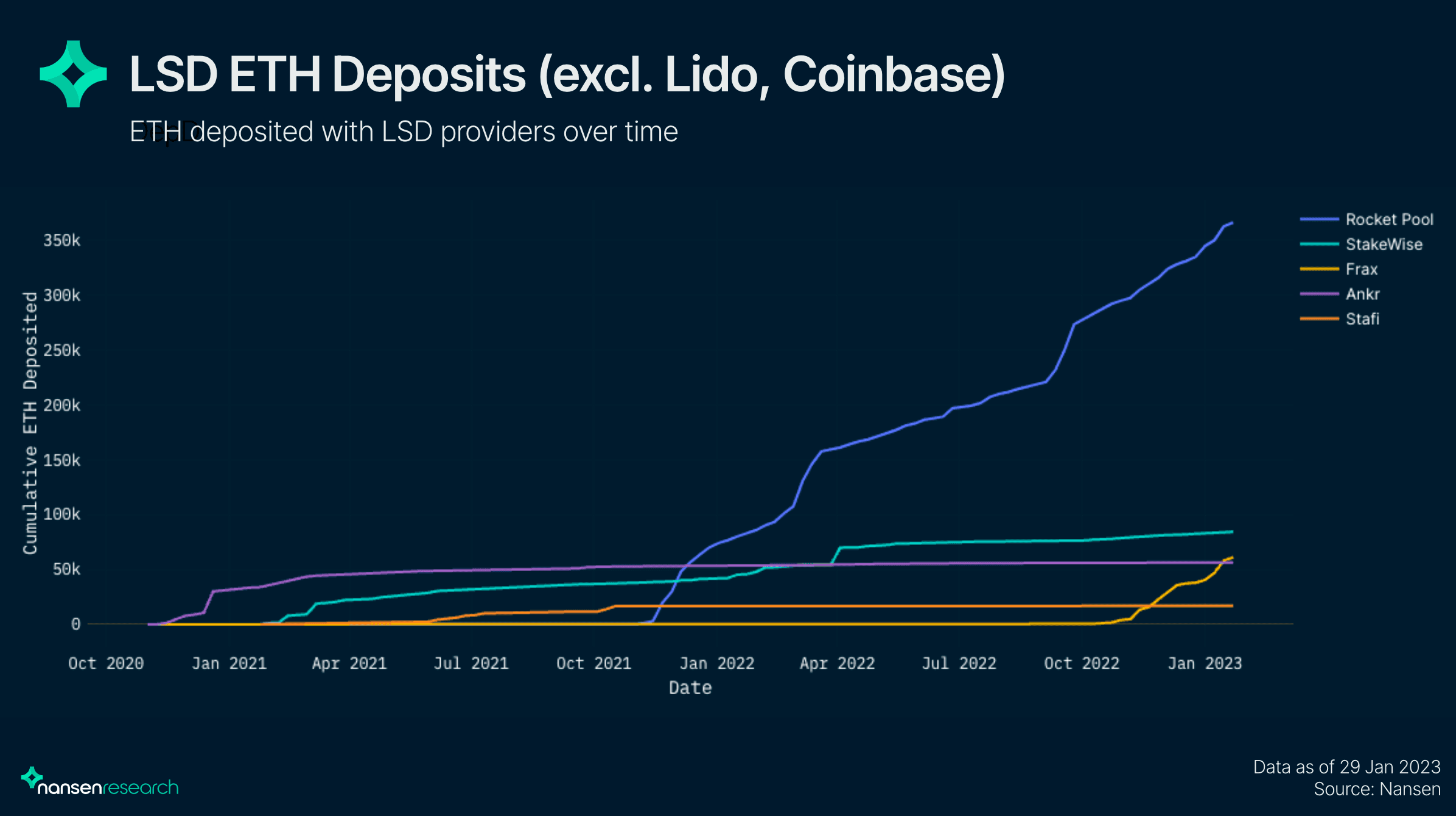

Because of its design, Frax Finance can offer substantially higher yields than its competitors sustainably, which has led to the acceleration in frxETH's liquidity growth and, subsequently, its adoption. Since its inception, frxETH has amassed a TVL totaling over $121m at current ETH prices within 3 months and has been gaining market share within the liquid staking derivatives sector.

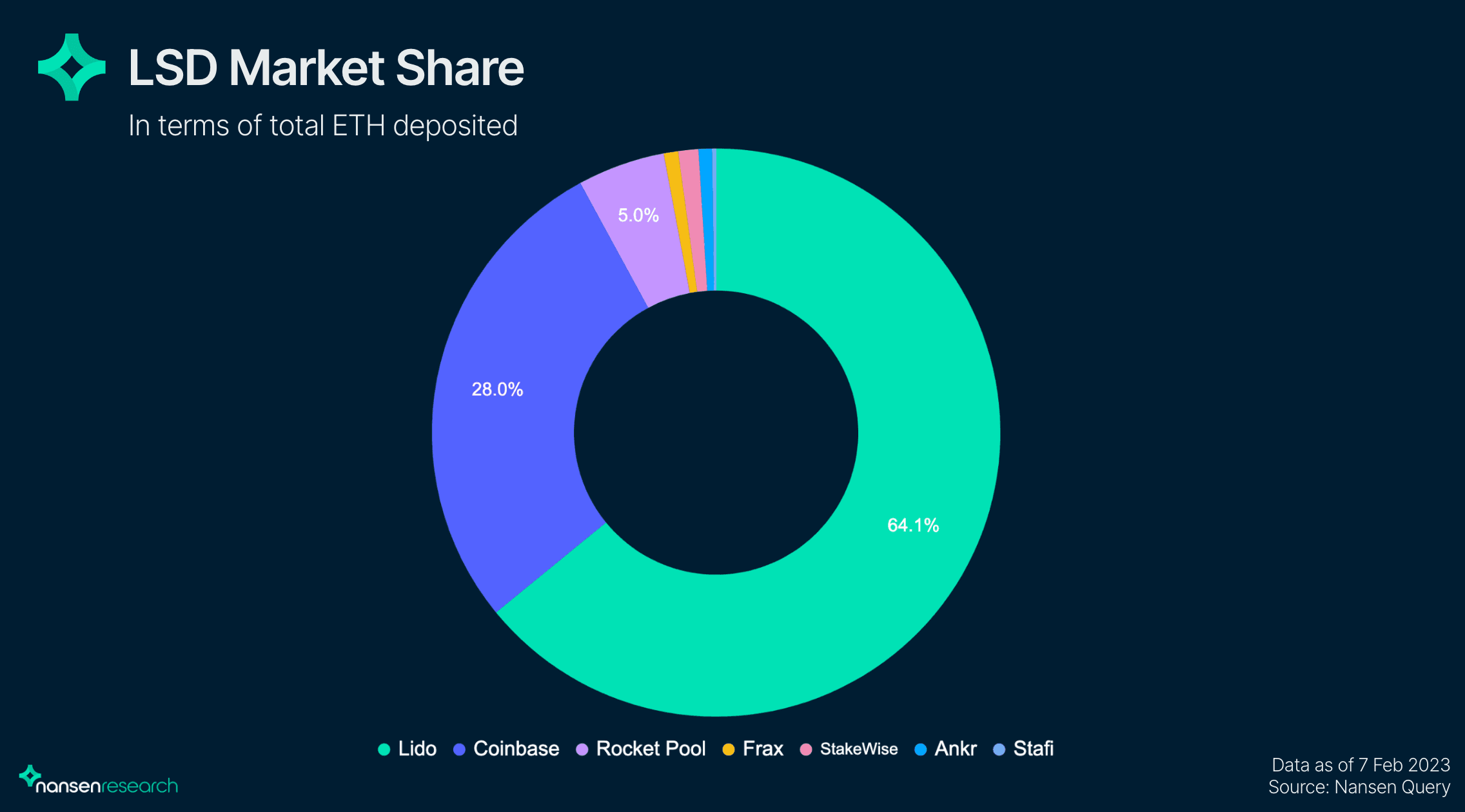

Despite Frax's recent growth, the amount of ETH deposited to each LSD over time shows that Lido still controls the vast majority of the market share at 64% and still trending upwards, followed by Coinbase's cbETH and Rocket Pool’s rETH at 28% and 5%, respectively.

Zooming in on the recent market share growth for Frax against its closest competitors and taking out Lido and Coinbase, there has been a steep spike in the frxETH supply, indicating demand and interest for frxETH as a product while most of its competitors have plateaued out in recent months. Specifically, Frax has overtaken Ankr, propelling it to become the fifth-largest LSD provider.

Effects On The Greater Frax Economy

Introducing an ETH-pegged stablecoin into the Frax ecosystem has multiple benefits and value-adds to its economy:

- As mentioned, frxETH can be easily integrated into existing DeFi products offered by Frax Finance, which adds more utility to frxETH as an asset.

- The inclusion of a native form of wrapped ETH keeps users within Frax's ecosystem and drives traffic to other Frax products, generating additional revenue for the protocol and benefiting veFXS holders.

- 8% of all revenue from earning ETH goes back to the Frax Treasury in the form of frxETH, which is then distributed to veFXS holders.

All in all, frxETH fits well into the flywheel of the Frax economy and its vision to become a DeFi one-stop shop with a robust system and deep liquidity.

Key Considerations

There are three primary key considerations to Frax Finance’s liquid staking solution:

- Centralization

- the community has raised concerns over the centralization of validator nodes. Specifically, nodes are run in-house by the team, meaning there is a lack of transparency when depositing, and users have to rely on various trust assumptions. However, both Jack Corddry (Frax Developer) and Sam Kazemian (Frax Founder) have stated that the team intends to control the nodes, for now, to reduce any friction points while bootstrapping the product. Once the product is more mature, a more decentralized structure will be implemented.

- Smart contract risk

- For frxETH in particular, the admin controls the frxETH Minter contract, allowing them to mint an unlimited amount of frxETH, set any arbitrary address as a validator, and withdraw ETH from the contract. Additionally, the ETH treasury is a 3/5 multisig wallet.

- De-peg risk

- lastly, there is also a slight de-peg risk involved. Even though frxETH is 100% collateralized, unlike its stablecoin, which has a minor algorithmic component, there is still a non-zero de-peg risk if liquidity from the Curve pool or base pool gets drained nonetheless. A similar event already occurred with the stETH deviation a couple of months ago.

Conclusion

Frax Finance has seen early-stage success with its liquid staking derivative solution, with cumulative ETH deposits surging past $121m within 3 months. This was driven by Frax’s dual-token design, which enables the protocol to offer yields on both frxETH (through Curve pool LPing) and sfrxETH (through staking rewards), resulting in overall higher yields. This gives frxETH a flywheel effect on the greater Frax economy.

However, it is yet to be determined whether frxETH will continue attracting liquidity in the long run, as centralization and smart contract risks are causes of concern. Apart from staking yield, Frax must also implement further integrations on top of frxETH, such as lending loop strategies via other protocols, to stay competitive against Lido’s stETH in the long term.