What is Vertex?

Vertex is an all-in-one DEX platform on Arbitrum that offers a spot DEX, perp trading, and access to money markets. Vertex uses a hybrid orderbook-AMM model where it can offer a vertically integrated experience for the user. Vertical integration offers a bundled experience similar to CEXs - traders can swap assets, borrow, and trade with leverage all from the same interface. With this experience, users can expect interesting product features such as cross-margining and sub-accounts and much more.

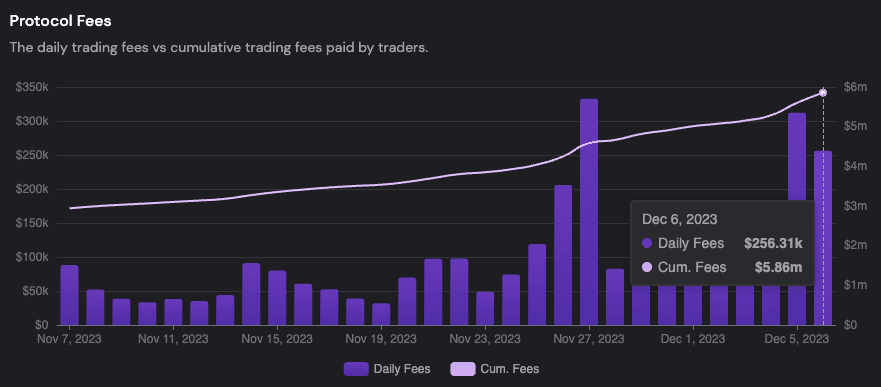

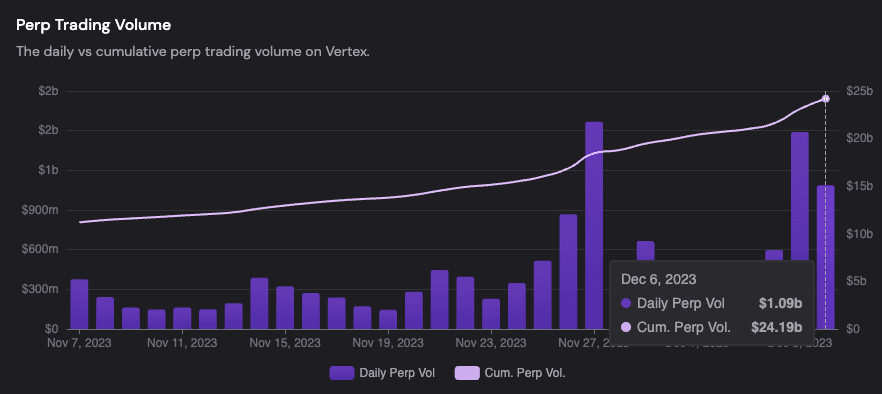

The protocol recently launched and has seen significant growth with over $26b in cumulative trading volume. It has consistently ranked in the top 2 to 3 of perp DEXs in terms of trading volume, sustaining well over $300m in daily volumes since November 24th. To tie incentives across traders, market makers, and other market participants, Vertex has the VRTX token. Currently, they are offering strong incentives for traders on the platform for the next few months.

Simply put, on-chain traders may be interested because:

- Vertex offers VRTX incentives to trade on the platform

- as well as cross-margining and a sub-account architecture

For further interest in how VRTX operates, we will dive into the key utility it unlocks for traders and the potential shared upside in the Vertex trading platform.

VRTX Flywheel

- VRTX is a utility token that gives holders:

- Rewards for traders and other active market participants

- Allows stakers direct access to cash flows generated on the Vertex platform

- VRTX stakers earn 50% of protocol revenues generated on the platform. At the time of writing, this amounts to around $300k USDC weekly

- At the time of writing, over 55m VRTX are staked, representing over 34% of the liquid supply

- Over recent weeks, stakers have been earning around 60% APR since staking went live a few weeks ago, this is paid out in USDC

Source: Vertex

- Daily volumes continue to climb higher

Source: Vertex

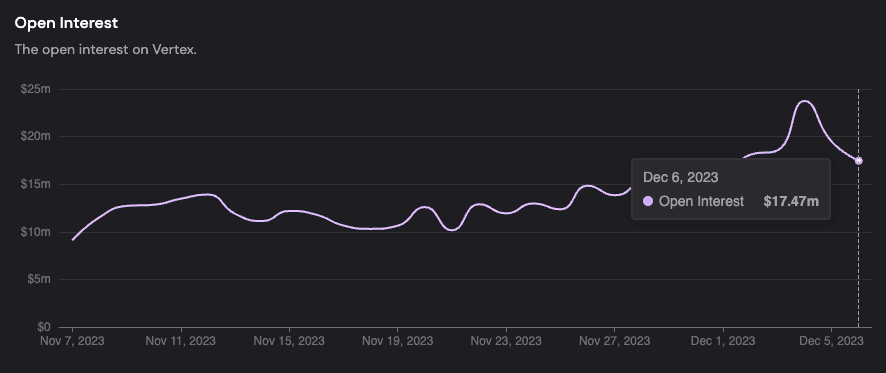

- Open interest also continues to increase consistently

Source: Vertex

In short, staking rewards are high and trading volumes and OI continue to trend higher. If this continues, the fees generated for stakers can increase, creating a flywheel for VRTX stakers to earn more rewards. When users staker VRTX, they generate a user score view called voVRTX, which has a multiplier effect on staking. The user score increases with the duration of a user's sub-account that has staked VRTX. The goal of this user score is to increase rewards for dedicated users over time.

New User Deposits

You can track daily active users on Vertex, but let's add some color to new depositors. Specifically, we want to categorize users based on how much they cumulatively deposited into the platform. This is not a net calculation so it does not account for withdrawals out of the platform. We filtered down for addresses that deposited funds after November 1st, 2023 using any of the depositCollateral or depositCollateralWithReferral functions. Finally, we defined users by their deposit amount (in USD) into the following group:

- Whale

- Deposited more than $20,000

- Professional

- Deposited between $10,000 and $20,000

- Retail

- Deposited less than $10,000

Users can track any of these traders and toggle with the search function to drill down on any particular segment or wallet address. Of these traders, we want to see what else these Whale traders are doing on-chain. Next, we look at the top entities the ‘Whales’ have interacted with, having filtered out some of the major coins and entities revolved around said coins. Below, is a list of the top entities sorted by interactions and number of wallets from these ‘Whales’.

Outside of Vertex, the top interacted entities can be grouped into the following categories:

- Derivatives

- Hyperliquid

- GMX

- DEXs/Aggregators

- Uniswap, 1inch, Paraswap, and Kyber Swap

- 0x, Camelot, Trader Joe, and Odos

- Firebird Finance and Open Ocean

- Lending

- Radiant Capital

- MakerDAO

- Silo Finance

- Aave

- Cross-chain/Interoperability

- Stargate

- Orbiter Finance

- Socket

- Synapse

- Squid

Competition

With the large growth in perpetual swaps as a product for traders, come various DEX participants. We have covered Vertex above, but there are many other perp platforms today building out their solutions on alternative rollups, app chains, generalized chains (i.e. Solana), and everything in between. Outside of where they are built, they also differ in their core design with the major one being LP-based AMMs like GMX vs CLOBs such as dYdX, or a hybrid version such as Vertex. Some examples of perp DEXs today include:

- dYdX

- Drift

- Hyperliquid

- GMX

- Synthetix

- ApeX Protocol

At the time of writing, many perp platforms are either directly incentivizing trading activity or are doing point systems for potential airdrop opportunities. It is important to realize that volumes might be elevated across platforms due to the incentives. Regardless of the sustainability, it is clear a lot of the perp DEXs will have incentives via trading rewards or airdrop farming well into 2024.

On the one hand, a user can perceive this as unsustainable in the long term, but on the other, it represents a lucrative opportunity to engage with one of the fastest-growing products in crypto where volumes and incentives are likely to increase alongside a bull market.

Risks and Considerations

Vertex uses a centralized off-chain orderbook, which is a large centralization vector for users. Additionally, VRTX holders must be aware of token inflation. The initial circulating supply was 150m, with 10m VRTX emissions monthly and the team/investor unlocks begin in April 2024. As with all newer projects, there is always smart contract risk, so users should exercise caution if they decide to use these products.

In summary, Vertex integrates spot DEX, perpetual trading, and access to money markets, offering a comprehensive and vertically integrated experience akin to traditional centralized exchanges. This approach, combined with features like cross-margining and sub-accounts, positions Vertex as a competitive player in the sector. The platform's rapid growth is evident, with over $26 billion in cumulative trading volume and a consistent ranking among the top perp DEXs by volume, maintaining over $300 million daily volumes since November 24th.

The introduction of the VRTX token provides incentives for traders and a direct stake in the platform's success through revenue-sharing mechanisms via USDC. The high APR for stakers and the voVRTX scoring system may further a potential flywheel effect for VRTX stakers.

However, the competitive landscape remains dynamic with various perp platforms offering diverse solutions across multiple chains and designs. Vertex's position, while strong, is part of a broader, rapidly evolving market where sustainability and long-term success are contingent on adapting to market demands and mitigating inherent risks such as centralization concerns and token inflation and ultimately serving traders.