Safe Core Protocol

Safe has developed a core standard for smart accounts - blockchain accounts that can have arbitrary logic implemented within. The benefits of smart accounts are discussed in various pieces about account abstraction - you can read Nansen’s brief on account abstraction here. In short, smart accounts can have arbitrary functionality implemented into them. This opens up a world of possibilities, including:

- Social recovery

- Wallet security measures e.g. daily tx limits

- Batched transactions

- Plug-ins

- Session keys

- Intents

Despite the recent hype about account abstraction, smart accounts on Ethereum have thus far failed to gain mainstream adoption. They are often incompatible with dApps and are more expensive than EOAs, so they actually make the experience worse for most users.

Safe Core seeks to address this by creating a standardized development environment for smart accounts - providing essential infrastructure for them to develop and thrive.

Primary Challenges Safe Core seeks to address

Fragmentation

- At present, there is fragmentation of infrastructure for smart wallet developers which is holding back the ecosystem. There is no shared standard yet to build and iterate upon.

- Safe Core is ‘account agnostic’ meaning that any smart account can use it - not just Safes. Open and widely adopted infrastructure is required to take smart accounts from 0 - 1.

Vendor Lock-In

- Functionality in smart contract accounts is currently siloed among different wallet providers. For example, EOAs can move between wallet providers e.g. Metamask to Rabby.io. Smart accounts today cannot do this - which is another reason they have not been adopted.

- Safe Core aims to be usable to all, meaning that accounts will be interoperable and portable. All modules and services from Safe will be openly accessible so users can use their accounts in different environments e.g. swapping account providers.

Security

- Smart accounts introduce smart contracts, which adds smart contract risk to the system.

- Safe seeks to optimize security by providing a flexible framework that the community can develop modules on according to best security practices. This ties in with its centralized registry which seeks to uphold standards for modules. While this approach makes sense, it does introduce some trust assumptions at least initially. It remains to be seen whether or not there will be some bumps in the road with the first few iterations as the community comes to consensus on what works well / doesn’t work.

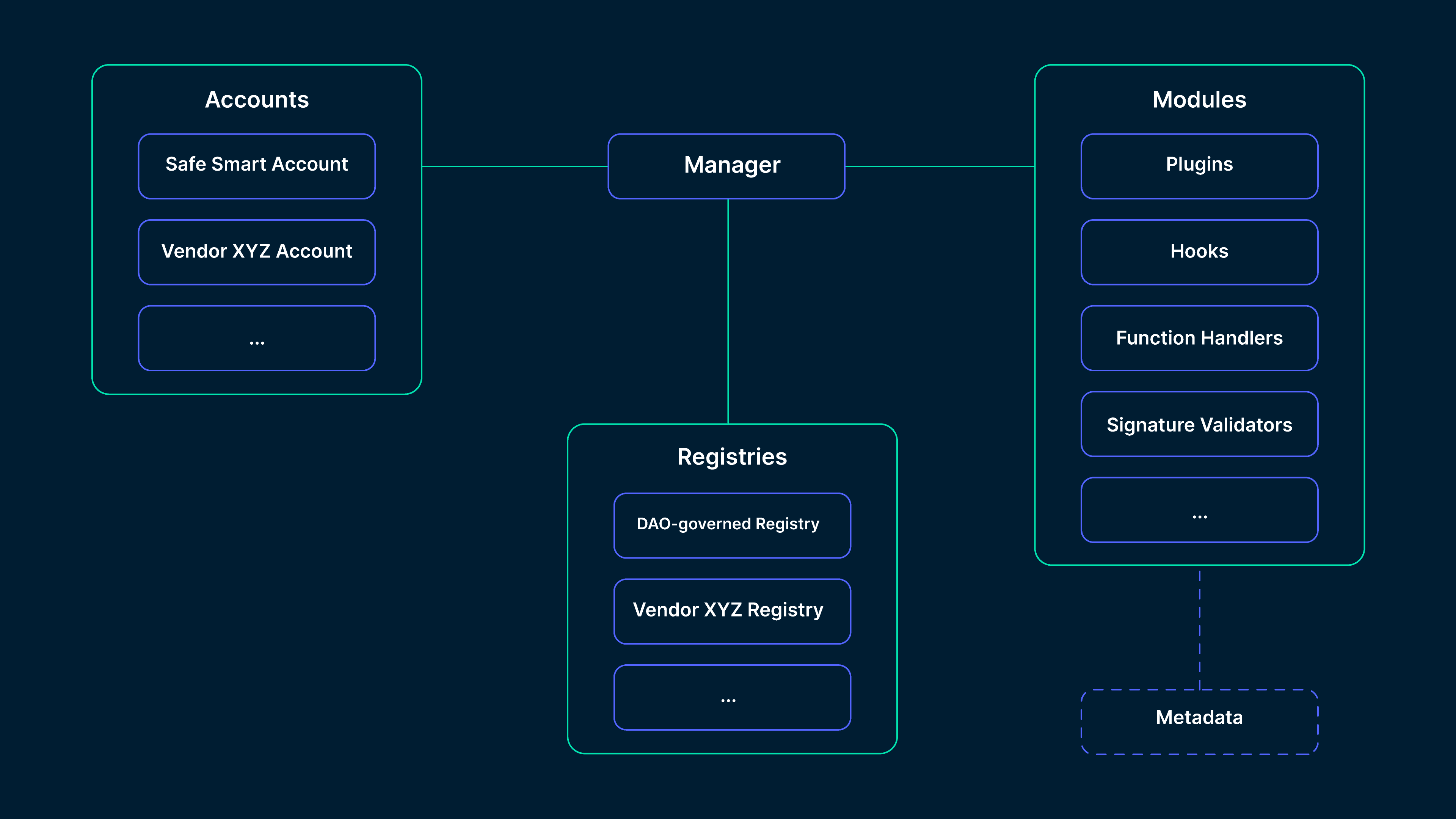

Safe Core Components

Safe Core Protocol aims to create a standard that enables components to be re-usable for all wallet providers; essentially a shared infrastructure. This by effect can increase security, composability, and interoperability among smart wallets - and greatly accelerate overall progress.

But what are these components?

Registries

In Safe Core design, the registry is a marketplace for modules. It is the gatekeeper of quality so that modules adhere to minimum standards of security and compliance checks. This will be centralized initially with the Safe team. It will be interesting to see how this is decentralized over time.

There can be multiple Registries. One example would be a smart wallet that creates smart accounts for their users but wants the user to only enable Plugins that the Wallet vendor created themselves and that are exposed via the wallet using specific features. This could allow stronger security properties as the wallet can guarantee that users do not enable third-party Modules. The user is always free to choose a different Registry, but then this specific wallet might not work anymore.

Modules

These give accounts the additional functionality that makes us all so excited for smart accounts. This includes the likes of paymasters, social recovery, auto-recurring payments, intents, and various other arbitrary functionalities. Types of modules include:

Plugins

Allow arbitrary logic to be incorporated into an account such as social recovery mechanisms and various other automations. On Safe, these plugins are external smart contracts that are activated by the manager. These can be for both additional general wallet functionality as well enabling builders to develop app-specific plugins.

Hooks

Hooks refer to logic that can run at specific points in a transaction’s lifecycle. These can enable various protections such as MEV protection, allow/deny lists etc.

Signature Validators

These leverage ERC-1271, enabling domain-based customizable logic for signature validation. This currently powers CoW Swap’s TWAP product (moooooo!).

Read more about the different module types here. At the highest level, modules can give accounts customizable functionality that can take crypto mainstream. Note that some caution should be exercised when incorporating modules as they introduce more smart contract risk versus an EOA.

Accounts

User-owned accounts that opt into the protocol by enabling the manager or when implementing the first module.

Manager

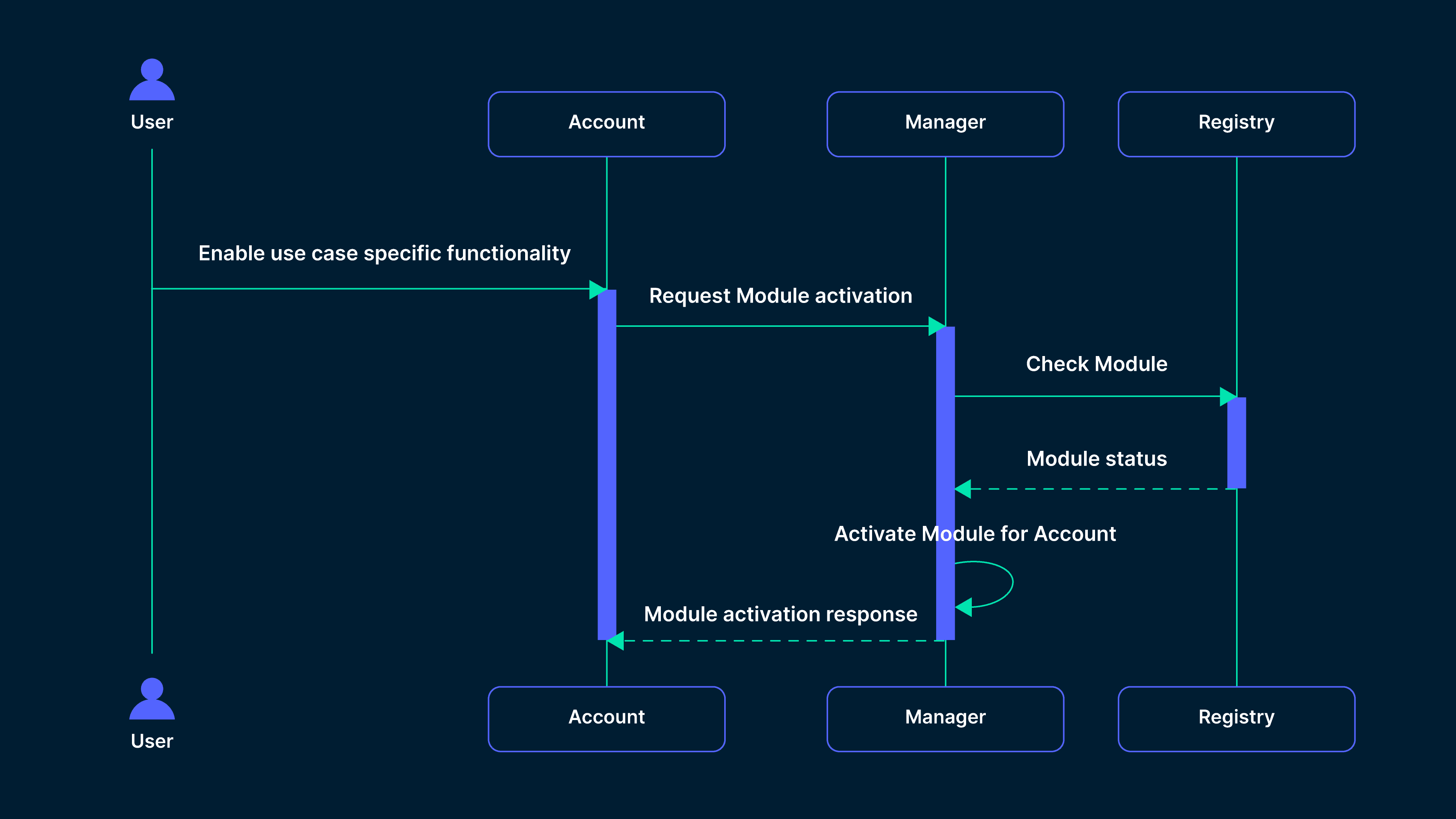

The Manager coordinates between accounts, registries and modules. It provides varying levels of permissions to different modules on accounts. The first implementation will have a Manager that is just a static smart contract, meaning its non-upgradable. However, it could be DAO-controlled Managers in the future which would introduce additional trust assumpations. The below diagram shows how the manager coordinates between the various components of the system for the user.

How Will It Work?

Safe intends to create an economy around modules. Module developers and participants in the smart account operation will need to be compensated for their contributions in order for it to be sustainable. For modules, this could be in the form of subscription fees, or pay-as-you-go.

Safe is also looking into introducing more module types beyond its current suite. This is in a bid to ever improve the functionality and usability of accounts.

Ultimate Goal

Safe is aiming to produce a smart account standard that finally brings a usable version of smart accounts to the EVM. The current landscape is very undesirable - given that it is set up for EOAs and smart accounts are clunky, don’t work for most applications, and are more expensive. Blockchains will not succeed if they do not have widely adopted smart accounts. The crypto user experience with EOAs is too bad for it to go beyond the small niche and subset of users it has today. Whether or not this infrastructure brings about the widespread adoption of smart accounts, it is clear that it is needed and it is a step in the right direction.

Other Updates in Safe (Previously Gnosis Safe) and Gnosis Ecosystems

- Safe(Previously Gnosis Safe) raised $100m last year from investors including 1kx and Coinbase.

- Safe Core also underpins the 2 Million Smart Accounts created by WorldCoin which has made it the immediate leader of accounts at the intersection of AI and crypto.

- They also provide the backbone of Gnosis Pay which integrates your self-custodial crypto wallet with traditional financial rails.

- Included in this is Gnosis Card - a Visa card that draws from users’ self-custodial Safe Smart Accounts.

- This is EU-compliant thanks to banking and payment partners.

- Payments are enabled using Gnosis Pay L2 which runs on top of Gnosis Chain. Gnosis Chain has thus far not had any significant traction but is noted for being one of the most decentralized EVM chains with 125k validators.

- Check it out on their website here.

It will likely launch the SAFE token. There is currently a forum discussion exploring possibilities for this.