Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Algorand Foundation (the "Customer") at the time of publication. While the Algorand Foundation has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s), who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report and our Terms of Service.

Overview

Algorand is a blockchain designed to overcome the common trade-offs between scalability, security, and decentralization. Its Pure Proof of Stake (PPoS) consensus mechanism ensures fast, secure, and efficient transactions with instant finality, making it highly reliable for decentralized applications. Unlike many blockchains, Algorand is fully decentralized and permissionless, enabling anyone to participate in consensus while maintaining low transaction fees and high throughput.

In Key Developments for H2 2024, Algorand introduced a unique real-time staking rewards protocol enhancement with no slashing or lockups, continued its work in decentralized identity by joining the Decentralized Identity Foundation and advancing did:algo, partnered with Coinbase to offer users educational on-chain tasks and rewards. During the year, the network surpassed 2B transactions and hosted successful regional hackathons in Vietnam, France, and Nigeria, empowering local developers to create blockchain-based solutions for payments, identity, infrastructure, and more.

Key Developments: H2 2024

- Algorand announced a unique staking rewards program coming in January 2025, offering real-time block rewards to validators without the risks of punitive slashing or token lockups seen on other blockchains like Ethereum and Solana. Validators will receive 10 ALGO per block, decreasing by 1% every million blocks, alongside 50% of transaction fees. Unlike inflationary reward models, Algorand’s setup does not affect the total token supply, and node runners retain full control of their funds at all times.

- The Algorand Foundation has joined the Decentralized Identity Foundation (DIF) to advance open standards for digital identity, building on its development of did:algo—a decentralized identifier (DID) on the Algorand blockchain. did:algo aligns with the W3C DID Spec and enables individuals and organizations to create secure, permissionless digital identities, with applications like Kare Wallet already using it to help disaster survivors access aid.

- Algorand and Coinbase have partnered to offer users a chance to explore the Algorand ecosystem and earn rewards. Through Coinbase Learning Rewards, users could complete five on-chain tasks involving DeFi swapping, farming, NFTs, and Web3 domain claiming using dApps like Pera Wallet, Tinyman, and Folks Finance. Participants were able to earn up to $20 in ALGO and USDC while gaining valuable Web3 experience and learning about the Algorand blockchain.

- Algorand’s Regional Hackathons in Vietnam, France, and Nigeria showcased local innovation, with developers addressing region-specific challenges across blockchain infrastructure, decentralized identity, payments, and supply chain solutions. Teams received technical and business training over two months, partnering with local organizations like VBI, 42Blockchain, and the Taraba Government of Nigeria. Winning projects included Algorand Blink and AlgoIDE in Vietnam, Certify, Safeout and Vibepass in France, and Data Bank, Jointly and Agroshop in Nigeria.

Ecosystem

DeFi

- European fintech ZTLment has transitioned from Ethereum to the Algorand blockchain to enhance the speed, efficiency, and scalability of its regulated payment operations while ensuring compliance with Europe’s PSD2 regulations. The switch allows ZTLment to develop blockchain components seven times faster, leveraging Algorand’s built-in features like Atomic Transactions and multisig approvals to reduce complexity, enhance security, and minimize transaction risk.

- The Algorand Governance Period 13 (GP13) voting session sought to ratify new xGov eligibility criteria and allocate over 22M $ALGO in rewards, split equally between general governance and DeFi rewards. The xGov proposal, which links voting power to blocks proposed during consensus, was overwhelmingly approved, alongside ten additional measures focused on allocating targeted DeFi rewards to platforms like Algomint, AlgoRai, Cometa, CompX Labs, Folks Finance, Meld Gold, Messina, Pact, Tinyman, and Wormhole, aiming to enhance liquidity, boost total value locked (TVL), attract new users, and strengthen cross-chain asset bridging within the Algorand ecosystem.

Startup Programs

- The Algorand Incubator’s first cohort concluded with 10 startups presenting their minimum viable products (MVPs). The eight-week program delivered 200 hours of specialized mentorship across developer relations, engineering, growth marketing, PR, social media, business development, and fundraising. The program also facilitated talent matching, resulting in two hackathon developers joining graduating startups. Three startups now operate on mainnet and four on testnet, while one cohort participant secured initial funding. The Foundation piloted "Bridge Services," connecting four teams with vetted external agencies for branding and community management support.

RWA

- TravelX, a project offering tokenization of airline travel tickets, has gone above and beyond some significant growth milestones, including over 1M NFT tickets minted in October 2024 alone.

- Algorand Foundation CMO Marc Vanlerberghe joined NASDAQ TradeTalks to highlight how enterprises and startups are leveraging Algorand’s blockchain for climate tech initiatives, including carbon credits, renewable energy projects, and sustainable finance. By tokenizing real-world assets, Algorand enhances transparency, efficiency, and accessibility in the sector, driving innovation in sustainable technologies. This discussion underscores Algorand’s growing role in climate-focused blockchain solutions.

- Algorand-based Lofty was featured in the Financial Times for its tokenized real estate platform, which modernizes property investment using blockchain technology. Lofty enables fractional ownership of real estate, making it more accessible and efficient. Founder Jerry Chu emphasized the goal of updating real estate for the 21st century, leveraging Algorand’s blockchain for secure and scalable tokenized asset management.

Enterprise

- Sweden’s Riksbank tested Algorand and Hedera as part of its e-Krona retail CBDC project to assess the potential climate impact and efficiency of different blockchain-based models. Algorand represented a decentralized design involving licensed financial institutions running larger systems, with 1,126 validators and a maximum throughput of 1,000 TPS. Both networks demonstrated energy efficiency per transaction, though Algorand’s was slightly higher. This research is part of a broader global trend, with 130 countries (98% of global GDP) exploring CBDCs, as blockchain platforms increasingly serve as the backbone for these digital currencies.

- AlgoBharat and SEWA partnered up to introduce a Digital Health Passport aimed at assisting women in India's informal economy. This initiative addresses the challenge these women face in proving their identity for enrollment in public health programs. By leveraging blockchain technology, the Digital Health Passport provides a secure and verifiable digital identity, enabling easier access to essential health services and resources.

- LabTrace leveraged Algorand’s blockchain to authenticate and protect scientific and medical data in response to growing concerns over AI-generated data manipulation. The platform timestamps research, tracks data ownership, and creates tamper-proof records, helping scientists, medical researchers, and device manufacturers ensure data integrity. LabTrace is used in the UNITY project, funded by the Bill & Melinda Gates Foundation, to verify MRI scans in low-resource settings, and has expanded into academia with its LabBook initiative for research documentation.

On-chain Data

Daily Transactions

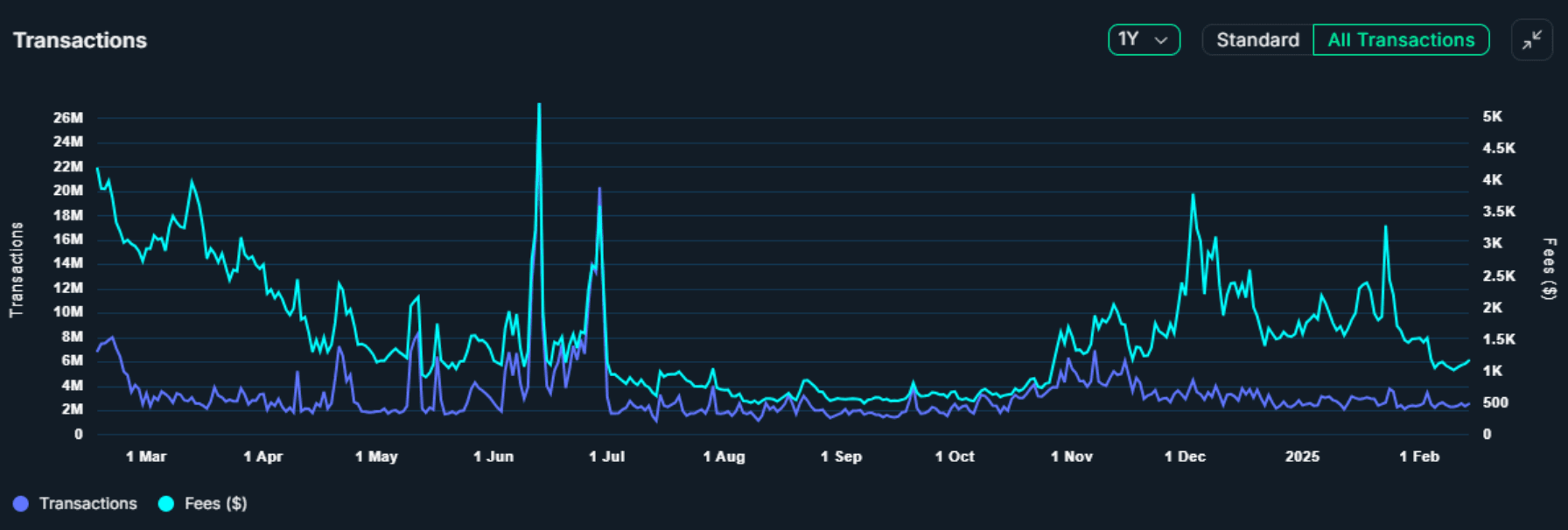

In H2 2024, the Algorand Network started off with a consolidation trend, cooling off from high peaks at the end of H1, keeping itself within the 2M-4M daily transactions range. Around October, the chart formed an upward trend, with its peak in late November. This trend is also reflected by the fees collected by the chain - which spiked over 350% at the peak compared to Summer 2024 average. This data shows increased usage of dApps deployed on Algorand in H2, as despite transaction numbers staying relatively even throughout the period, fees spiked up significantly in dollar terms due to fluctuations in the native token price.

Daily Active Addresses

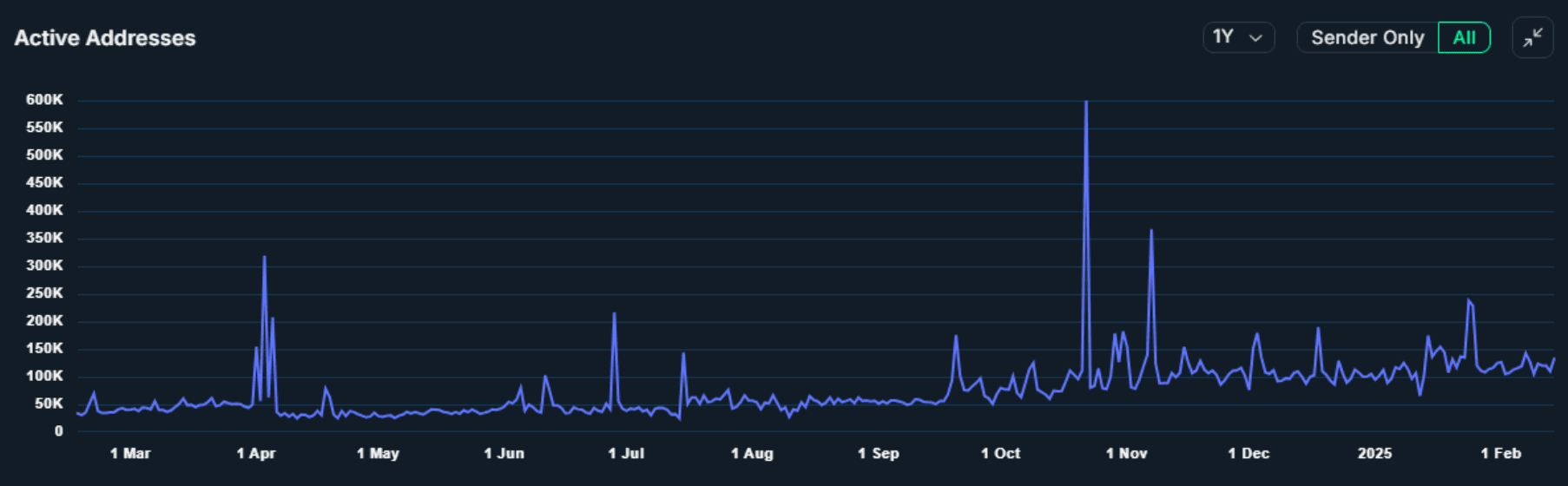

During H2 2024, Algorand saw an uptrend in user activity, with huge spikes reaching almost 600k users at its peak — that can be attributed to the Coinbase campaign ran between September and October. Despite Transaction numbers staying relatively stable from one month to another, Algorand’s Active Addresses metric continued to grow on a monthly basis - indicating that each month, new users were not only onboarded, but also stayed within the ecosystem for a longer period of time.

Top Entities by Users and Transactions

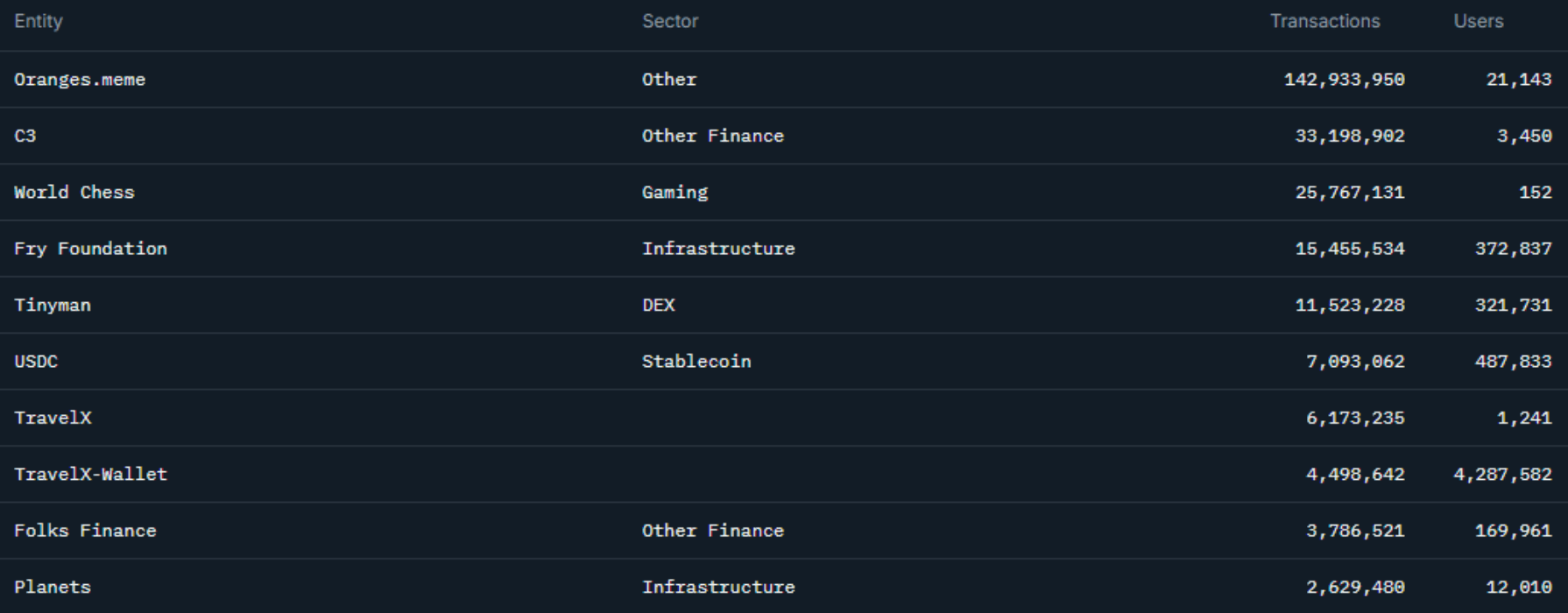

Algorand’s Entity ranking is showing great diversity in terms of sector representation. The top spot has been taken by Orange - a community meme project, boasting an incredible 142M on-chain transactions. Stablecoins are again strongly led by USDC with over 7M transactions, while DEX category saw Tinyman maintaining its lead over PACT and other decentralized exchanges. In the Infrastructure category, Fry Foundation overtook Planets with over 15M transactions and more than 370k users. In Finance categories, C3’s impact on the chain is still visible, despite closing down some time ago, while Folks Finance and TravelX maintained their strong presence in the market - both remaining in Top 10 compared to H1 2024. In Gaming sector, World Chess dominated the competition with its implementation of FIDE Online Arena state tracking for ELO system - registering over 25M transactions.

DeFi - Top Protocols

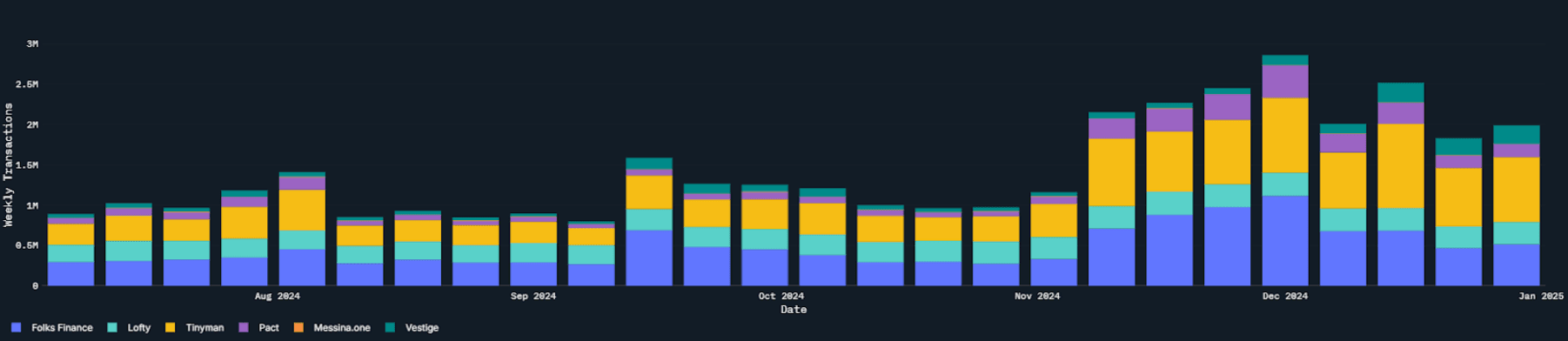

In terms of Algorand’s Top DeFi Protocols performance, the transactions metric above shows us a significant uptrend unraveling over the course of H2 2024. After a fairly stable summer, in September several protocols - especially Folks Finance and Tinyman - experienced a big uptick in the number of weekly transactions. After the growth period, we saw a brief period of consolidation, before a November explosion, which can be attributed to a significant rise of $ALGO token price. All protocols saw their numbers skyrocket, with PACT, Lofty gaining an astounding percentage of the DeFi Market Share in the November-December 2024 period. At peak, Folks and Tinyman were processing over 1M transactions on a weekly basis, with Lofty, PACT and Vestige trailing behind between 100-400k range.

Closing Thoughts

In conclusion, H2 2024 has been a transformative period for Algorand, underscoring its commitment to overcoming blockchain trade-offs through innovation and strategic collaboration. The launch of its unique staking rewards program, coupled with groundbreaking partnerships in decentralized identity, enterprise CBDCs, and digital health, has further solidified its position as a leader in the blockchain space. Significant milestones—such as surpassing 2B transactions, increasing daily active addresses, and a diverse array of high-performing entities—demonstrate not only the resilience but also the expanding adoption of the Algorand ecosystem. As the platform continues to attract new users and drive cross-sector innovations, it is well-positioned to sustain its momentum and pave the way for future growth in decentralized applications.