Introduction

2021 was the breakout year for NFTs, and by now most people understand that NFTs are here to stay and there is a lot of opportunity to make money - or to lose it. But how to know which NFTs to mint, when and what to buy, and when to sell?

In the following guide, we try to provide some guidelines to navigate through the dangerous but exciting and highly lucrative waters of the NFT world.

The report is split into two main parts, “Primary sales / Minting” and “Secondary sales”, as these are currently the two main approaches to NFT investments (we might dive into other emerging approaches like farming in future reports). Below you find a quick breakdown of the main differences between the two, before we dive deeper:

| Presales / Minting | Secondary market |

|---|---|

| Minting refers to sales between the primary creator and collector, which typically occurs directly on the creator’s own website | Secondary Market refers to marketplaces where collectors can trade these NFTs amongst each other on places like OpenSea, LooksRare, etc. |

| Users will often have to rely on instincts and hype when deciding which collection to “mint”. Some of the only supporting data includes social metrics, general hype around the project, roadmap, whether the team is doxxed, etc. | Buying on secondary allows users to conduct a more stringent due diligence process. Users can rely on on-chain data to conduct stricter analysis. |

| There is an element of surprise when it comes to minting an NFT as opposed to buying it on the secondary markets. Minting an NFT would typically require users to wait a couple of days for it to be revealed. | When it comes to purchasing NFTs on the secondary market, users can handpick which NFTs they wish to purchase. |

Primary sales/ Minting

Mega-hyped projects

We’ve been seeing mega-hyped projects around the crypto space recently. A few key tips when evaluating mega-hyped projects with enormous followings, excessive whitelisting giveaways, and many influencers onboard.

The highest upside is typically to land whitelist spots for the project. There are several ways you can participate which includes:

- Being an active member on their Discord

- Most projects require you to land a specific level on Discord to qualify for their whitelist spots

- Finding projects at their early stages (<3000 discord + Twitter following)

- Participating in fan art activities, etc.

- Projects usually host whitelist giveaways on their Twitter page

- Might be helpful to turn on notifications for certain projects where the NFT communities have high conviction

Most of these strategies listed require a level of dedication and effort to qualify for their whitelist positions, especially for larger projects with a higher following.

@readyplayerh wrote a tweet on why automating whitelist is key, especially if you are planning to profit from flipping NFTs. He mentioned that automating allows you to get more done and constantly expand your impact. A few strategies to take note of:

- The whitelist grind can be tedious. There are a few sites where you can pay Discord members to sign up under your link (for invite requirements). Nothing works 100% of the time, but this has worked for some people and passed Discord bot verifications.

- Another strategy to make use of are Virtual Assistants. Try to find competent, savvy VAs to help with participating in certain tasks in the Discord channels.

Note that these are just based on past experiences from NFT whales and flippers.

Besides whitelists, here are some other strategies to use for mega-hyped projects before reveal.

Least risk, least profitable: Buy the NFT on the secondary marketplace before public mint and flip before reveal

High risk: Buy on secondary after public sale ends and flip before reveal

Long-term strategy: Buying reveal dip (typically 2-3 days post-mint)

Case Study #1: Invisible Friends

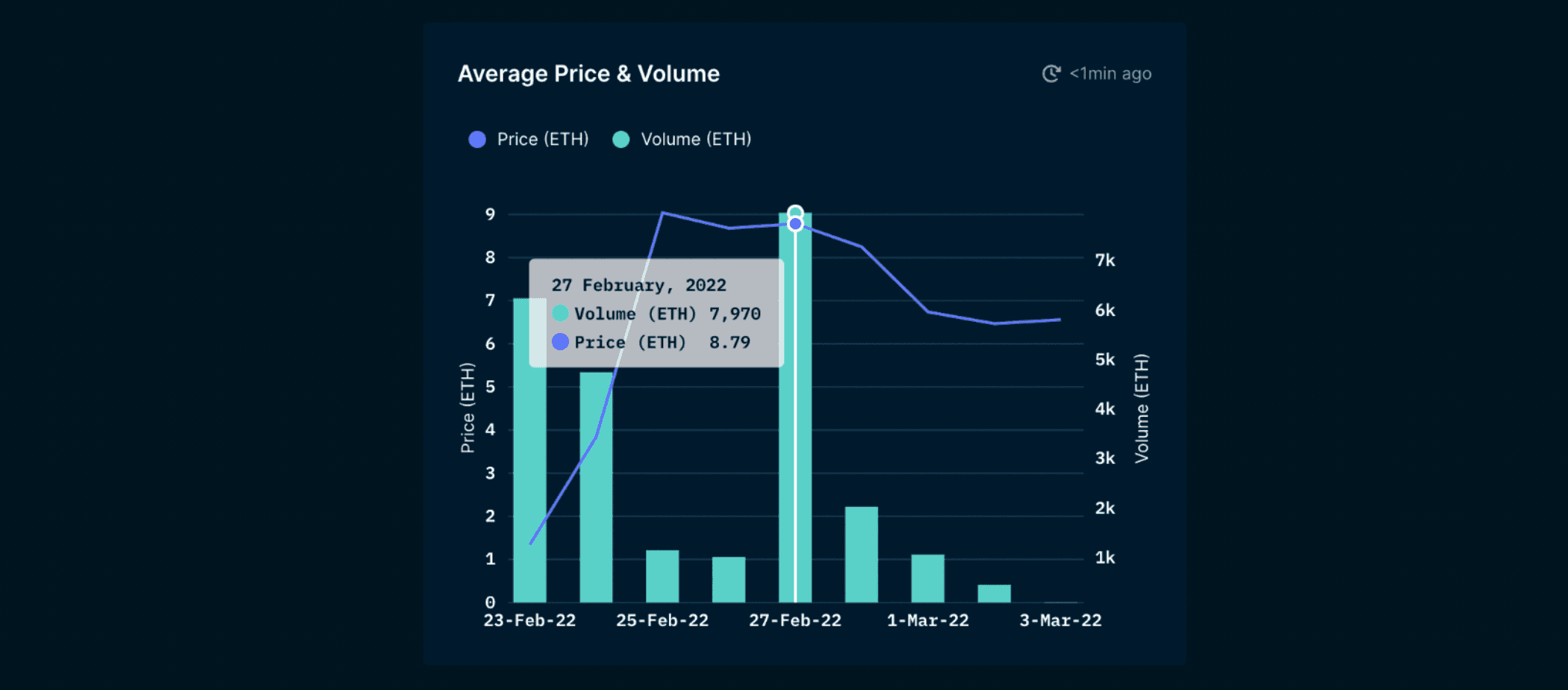

Invisible Friends had their early access mint on February 23, 2022. With nearly 500k followers on Twitter, the project was one of the most highly anticipated NFT collections to date.

- Invisible Friends’s 0.25 ETH mint shot up to 14 ETH instantly with ~6000 ETH ($14.4M) traded in just 4 hours. Right after reveal, the floor dipped to 6.9 ETH, with unique addresses down 289, and 36 Smart Money holders. Invisible Friends is interesting, in a sense that the artwork is not a typical PFP NFT, hence, it is strategically harder for this project to earn memetic value in the crypto space. Most of the existing projects work well because of the social movement they have created in PFP collections. Hint: Azuki, BAYC, Cool Cats, etc. (Disclaimer that the price floor was highly volatile post-reveal, which attracted many paperhands)

Stealth Drops

Stealth drops can be riskier in the sense that it may take a longer time for projects to gain mainstream adoption. In this case, if you are choosing to mint from these collections, there are different strategies to adopt:

- Observe floor sweeps from whales/notable buyers

- Nansen has a feature to track price movements on NFT Paradise, especially for collections that are currently minting.

- Users can track for projects with low-mid FOMO level and conduct due diligence before whales/Smart Money starts accumulating these initial low cap NFTs

- There are bots like Gem.xyz’s @0xGem bot for floor sweep action

- For this strategy, the highest upside would be to wait for projects to mint out 40-60% of total supply before buying in. Minters can double check the percentage of total supply that is left on Etherscan. This ensures that there is a high probability of projects minting out, and more generally to speculate the performance of the NFT collection in secondary marketplaces.

- Avoid sniping rares and 1/1s for stealth drops as these are extremely high risk and long-term negative EV (expected value) plays.

- Nansen has a feature to track price movements on NFT Paradise, especially for collections that are currently minting.

Unknown projects in bear/bull market

Bear market

- During the bear market/bearish periods, it is important to be more selective when minting projects.

- The total volume traded for NFTs tends to be lower, and there may be lower potential for good investment returns

Bull market

- You should try to mint more than 1 NFT. In fact, to get major upside, you should mint 3 or more. Sell 1-2 early to secure a good 2x and make back your initial investment.

- Always take profits and do not hold for too long if your goal is to +EV for a good flip

Secondary Sales

Estimated Market Cap + Volume Traded

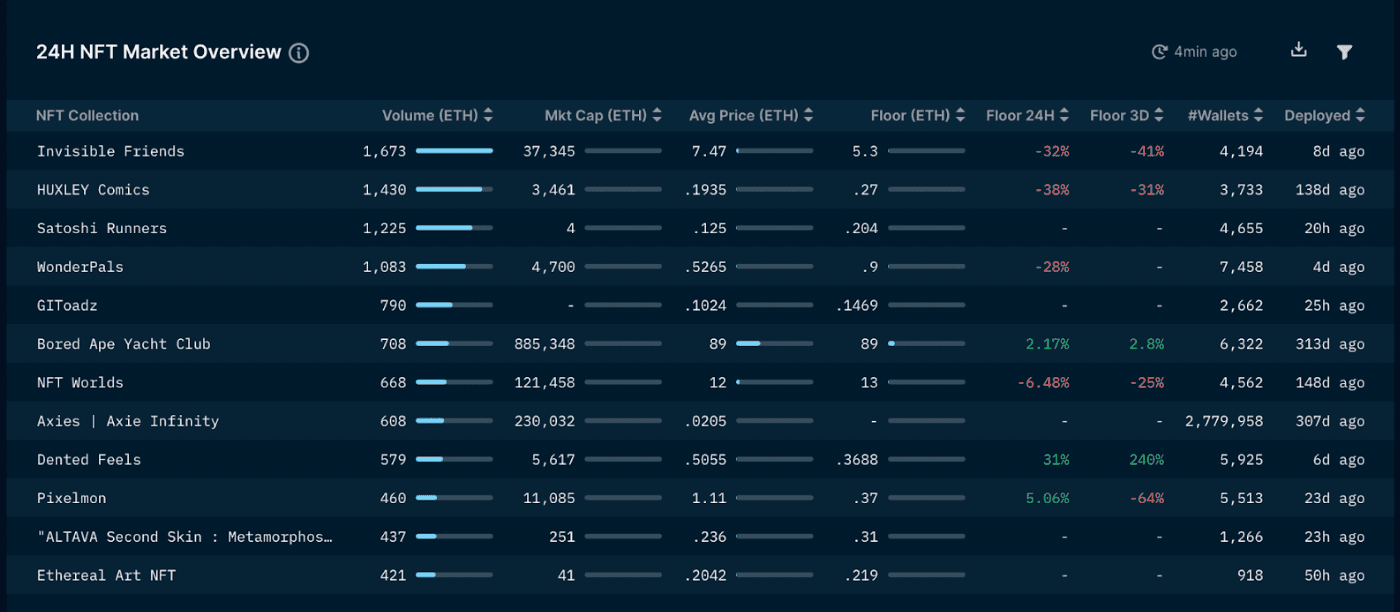

It is important to note the ratio between volume and market cap for individual NFT projects.

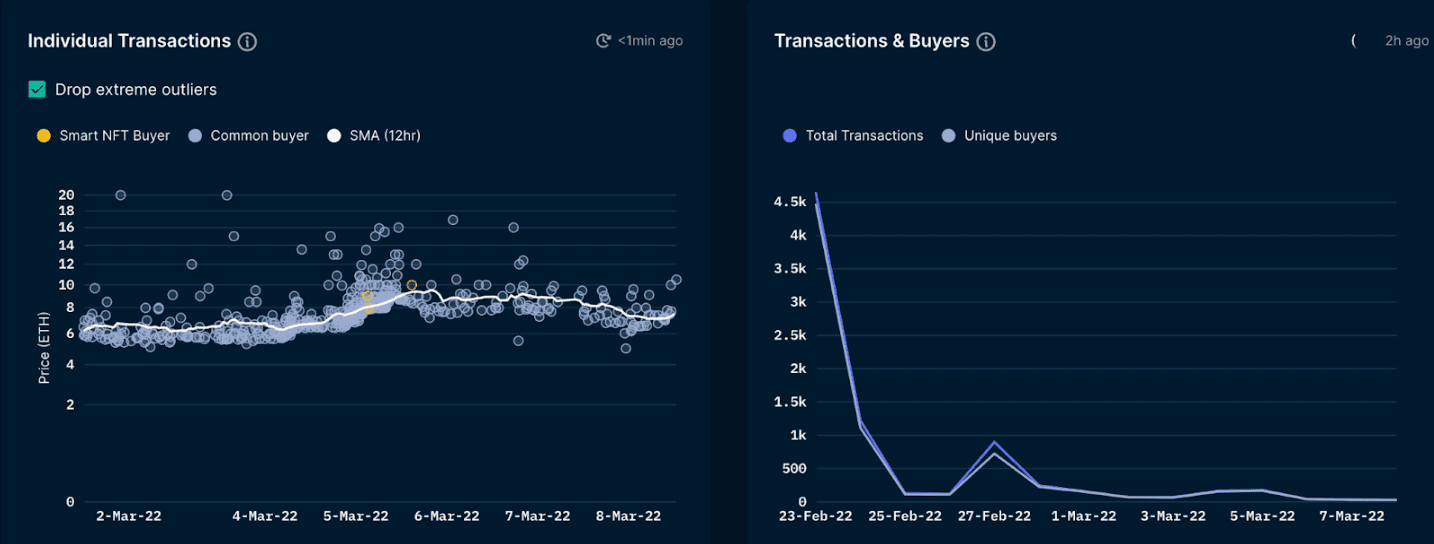

Projects that have low volume traded are typically more illiquid and sellers will face a harder time finding a buyer (vice-versa). With the Nansen NFT God Mode, we can track the number of transactions that occurred within a specific time period as well as identify if any Smart Money is investing in the particular NFT collection.

With higher transaction volumes, this implies that there is a higher chance of investors being able to sell off their NFTs with greater ease in the future.

Investors can also utilize the NFT section of the wallet profiler to assess liquidity metrics. For example, users can assess liquidity velocity and liquidity risk for their NFTs.

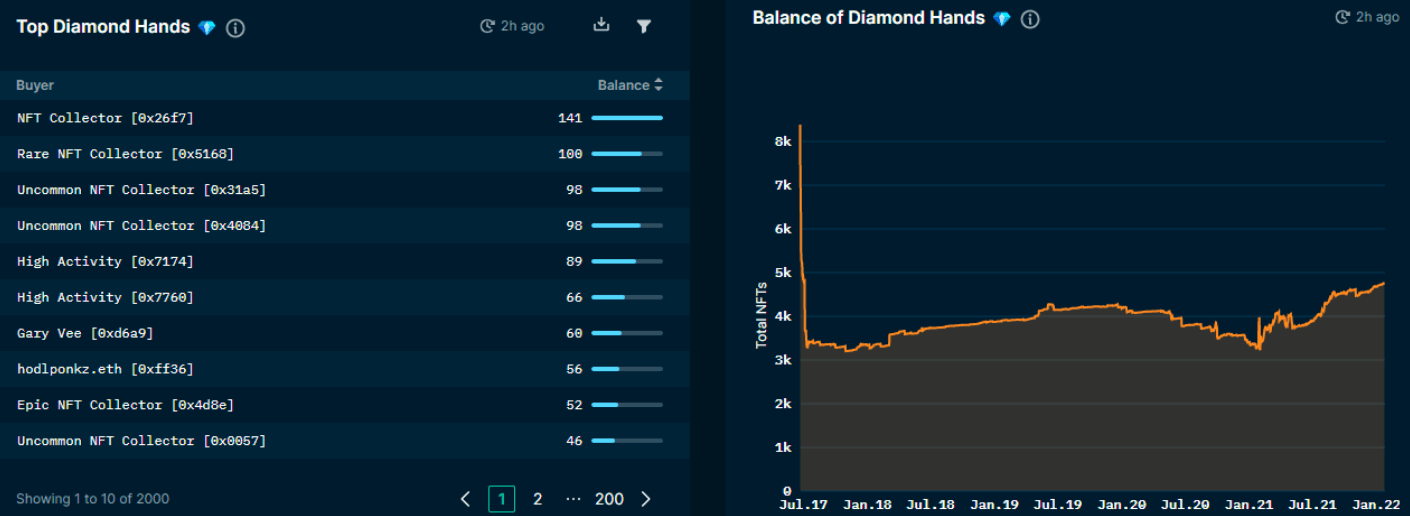

Diamond Hands Balance

Diamond Hands Balance: Total number of NFTs belonging to addresses who haven't sold any NFTs from a given collection. This is a useful indicator for identifying projects with true long-term believers.

Let’s look at the NFT God Mode Diamond Hands Balance for CryptoPunks:

Source: Nansen.ai, as of 25 Jan, 2022

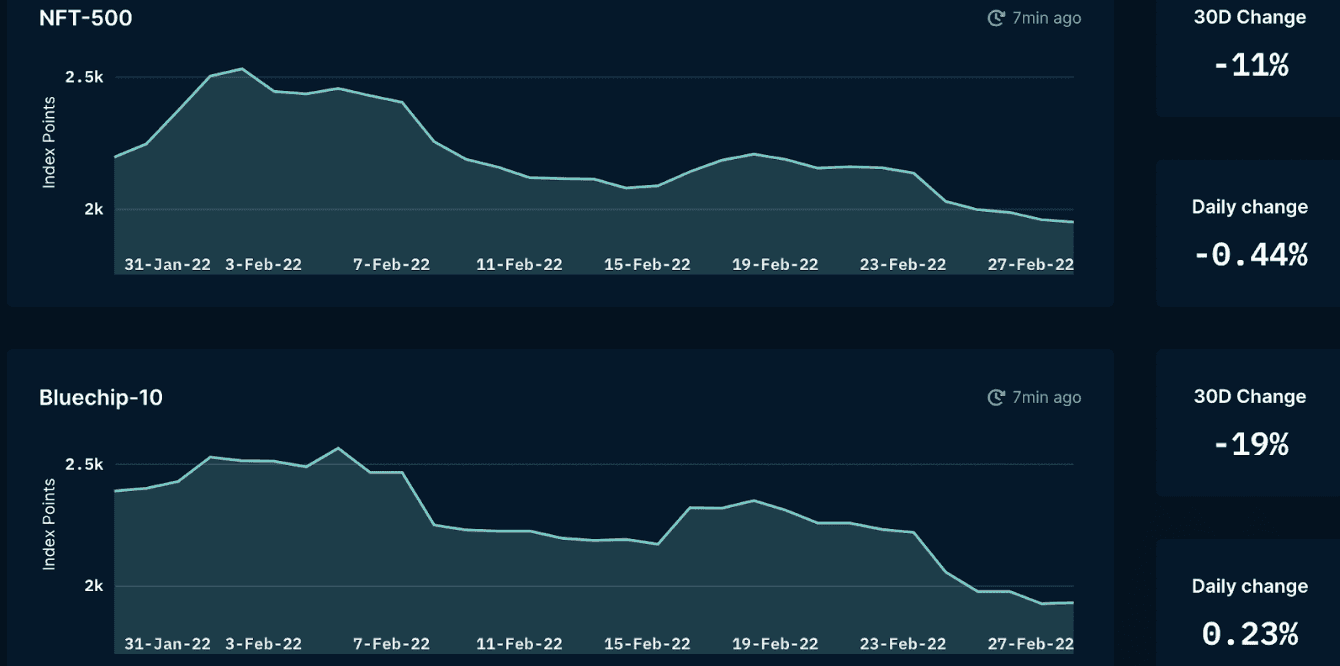

Observing general trends/NFT Index

When looking at the general landscape of NFTs, it is helpful to zoom out from individual collections/sectors of NFTs. They help investors to identify how a market segment is moving against other segments and the broader market.

Nansen has designed six indexes to capture the NFT marketplace activities on the Ethereum blockchain. The group of indexes consist of

- Nansen NFT-500

- Nansen Blue Chip-10

- Nansen Social-100 index

- Nansen Gaming-50 index

- Nansen Art-20 index

- Nansen Metaverse-20

The indexes are weighted according to the NFT collection’s market capitalization, which we have calculated using an adjusted 7-day mode price method.

- Head to NFT Index on Nansen

- Look at the performance of Nansen NFT indexes in the last 30 days

- Observe trends and look for early-stage/ established projects within that sector

Understanding NFT Hype Lifecycle

Oftentimes when we invest in NFT projects, we typically look for what collections to invest in. The question often lies in WHEN should you invest.

Based on the NFT Twitter hype life cycle diagram above, the stages of NFT projects usually start with early investors & traders accumulating the NFTs at cheap prices. When the project gains traction, volume traded and big sales start to increase, prices go up. When the hype starts to die down, we observe more paper hands. As hype starts to die down, we can witness two scenarios:

- Project adds a new layer of utility/ new announcement. As time passes, new interest enters and price of the collection increases

- Hype dies down completely and people dump to cash out

Realistically, we are seeing more and more projects following Scenario 2. In most cases, if users miss out on Phase 1, you should get in Phase 7 if the project has proven its longevity and utility.

Price Discovery/ Premium

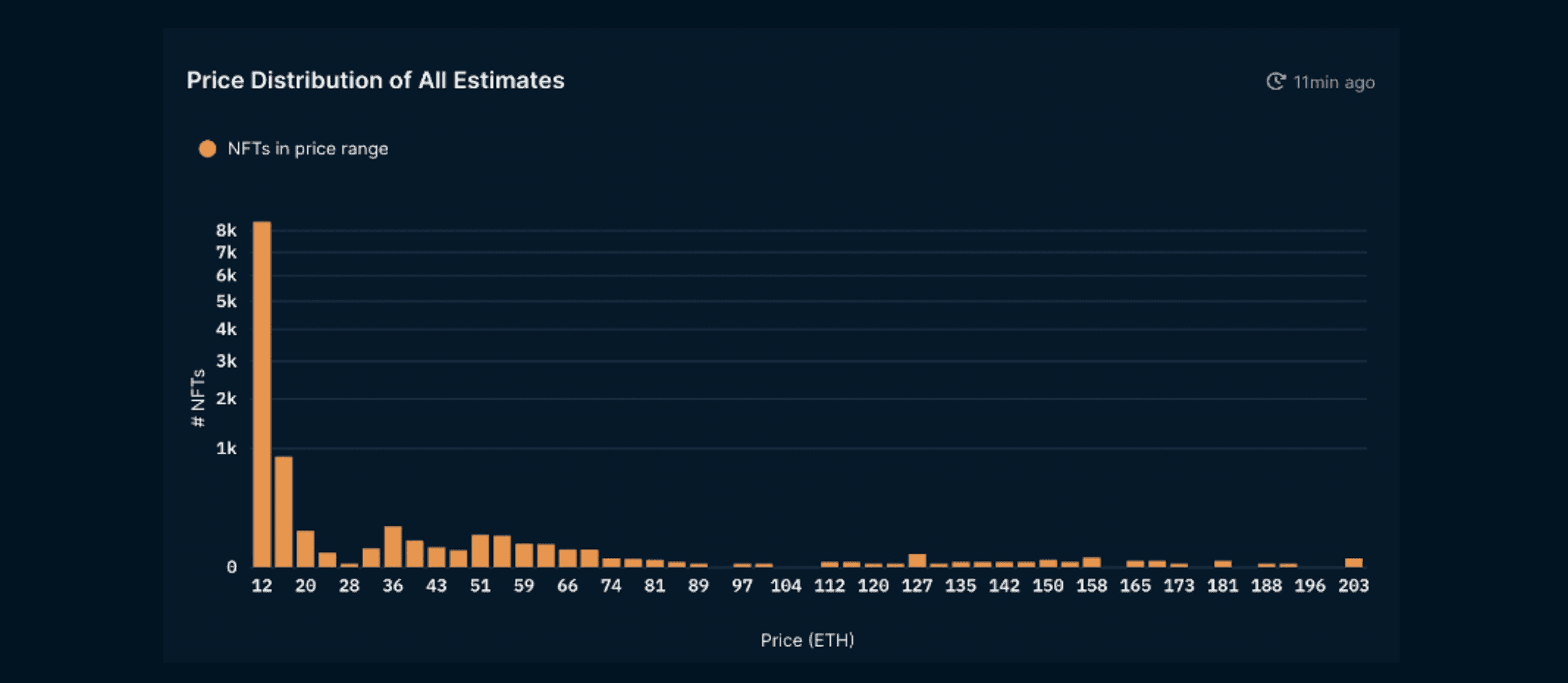

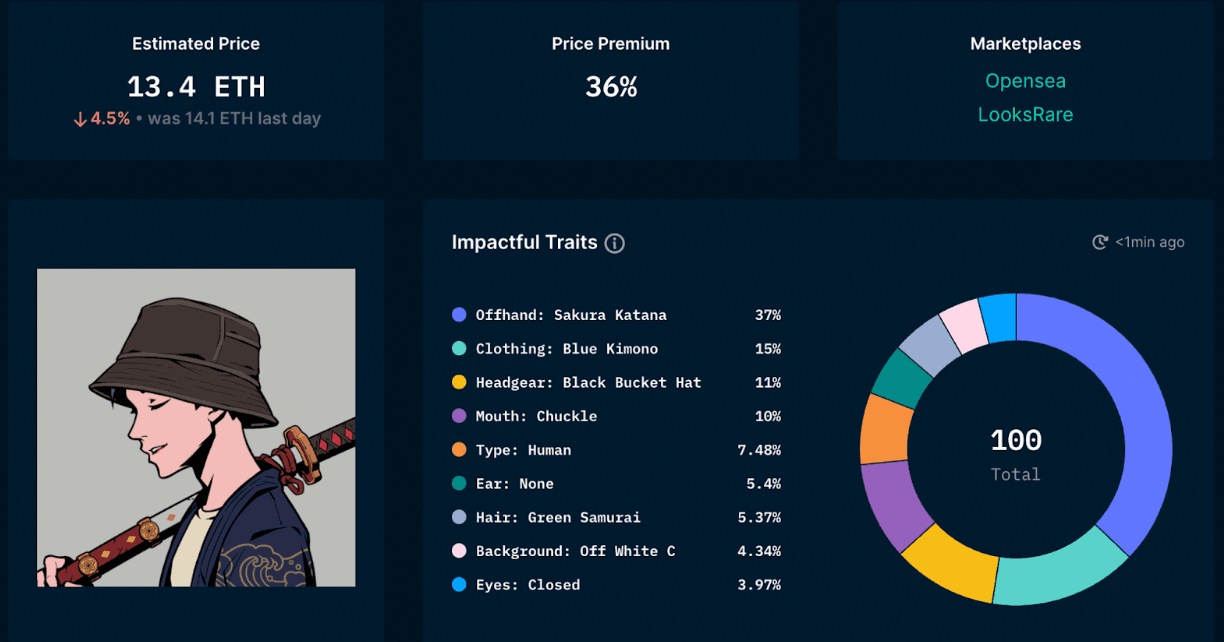

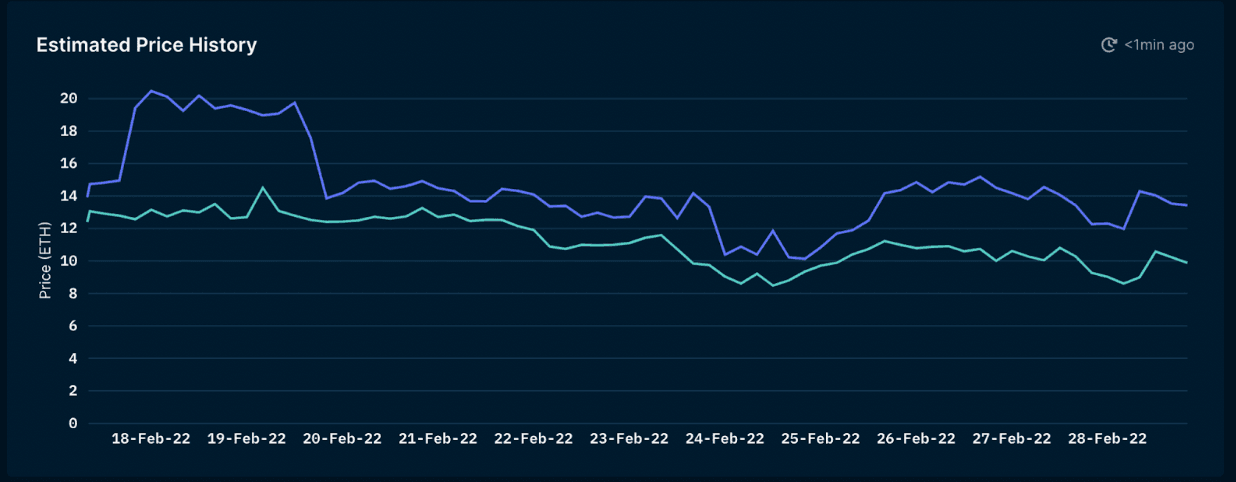

Nansen’s price estimate feature is a gem when finding underpriced NFTs. How the price estimate mode is set up is through using past sales data to calculate a price estimate for each NFT and compare it with listed price to detect which listings are undervalued.

You can also see the price distribution of estimates for all NFTs in the collection. Think of this as what a full and perfectly priced order book would currently look like.

- Head to Price Estimate tab on Nansen’s dashboard

- Toggle through the supported NFT collections (check here for supported NFT collections)

- Click on the collection + NFT ID

- Here you can view the estimated price & price premium (e.g Azuki’s collection)

- Check the estimated price history + current floor price trend

Risk-reward ratio

Each time you choose to mint or buy an NFT in the secondary markets, you are inevitably taking a risk. The risk is not only that the project might be a failure, but there are opportunity costs to consider.

NFTs are generally more illiquid than tokens. When someone invests in an NFT, they are taking a risk of that NFT itself, but also the risk of missing another golden opportunity of deploying their liquid capital elsewhere.

In that regard, projects that are the least risky are those in “blue-chip” territories who have proven their product and brand in the space.

Tools for further research

- NFT aggregators

- Gem

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Genie

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

- Gem

- Due diligence for minting

- Nansen’s guide here

- Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- NFTBank.ai

- NFT Marketplaces