Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a smart contract platform designed for scalability, with a multichain framework consisting of Subnets that scale the network. The primary network includes P, X, and C chains. The P-chain manages validator and Subnet-level functions, the X-chain manages Avalanche Native Tokens (which are a digital representation of real-world assets), and the popular C-chain is an implementation of the Ethereum Virtual Machine (EVM).

Subnets on Avalanche refer to a subset of nodes or validators that work together to achieve consensus on transactions related to one or multiple blockchains. A Subnet can be a network operating within another network or a network built on top of a larger network. Avalanche's Subnet architecture offers fast finality, custom Virtual Machine support, and a wide range of configuration parameters to builders.

In Q1 2024, Avalanche continued its growth trajectory through various key initiatives and partnerships across DeFi, NFTs, gaming, enterprise solutions, and even memecoins, reflecting its diverse and robust ecosystem.

Key Developments: Q1 2024

- Avalanche's startup incubator, Codebase, has announced its first cohort of grant recipients, chosen from nearly 250 applications worldwide. In partnership with Colony Lab, the program offers substantial funding of $500k to $1m per project and a $400k investment prize pool. The 10-week accelerator provides mentorship from Web2 and Web3 experts and culminates in a pitch day at Consensus. Projects span diverse fields, including decentralized finance, social platforms, and blockchain services, demonstrating Avalanche's commitment to nurturing innovative Web3 startups.

- Homium, a digital home equity investment platform, launched tokenized home equity loans on Avalanche, offering a novel way for homeowners to access their equity without increasing debt. This blockchain-native approach provides transparent terms and sub-second transaction finality. Homium's collaboration with Securitize allows institutional investors to gain exposure to home price appreciation through tokenized assets.

- The Avalanche Foundation has introduced the Icebreaker Program, designed to bolster the Avalanche ecosystem through new projects, market stability, diversification in the ecosystem, and active engagement. The initial phase focuses on liquid staking tokens (LSTs), with up to 500,000 AVAX allocated to select LSTfi projects. Continuous assessment and community feedback will shape future phases, ensuring ongoing support and innovation within the Avalanche ecosystem.

- Citi utilized Avalanche's Evergreen Subnet, Spruce, to investigate the advantages of blockchain in private markets. The focus was on token transfers, secondary trading, and collateralized lending. Results highlighted improved efficiency, compliance, and data security. Citi's trials indicate significant potential for transforming private market transactions through blockchain technology, emphasizing automation and transparency.

Ecosystem

DeFi

- The Avalanche Foundation has launched Memecoin Rush, a liquidity mining incentive program to support the communities built around memecoins on Avalanche. The first phase involves partnerships with SteakHut and Trader Joe, offering incentives for various community tokens. This initiative builds on the success of Avalanche Rush, aiming to enhance liquidity, drive momentum, and foster broader ecosystem support for Avalanche-native tokens.

- Struct Finance has joined the Avalanche Rush program, securing up to $1m in AVAX incentives. Known for its structured finance products, Struct offers interest rate vaults and tranching mechanisms, enabling both fixed and variable yield products. This initiative enhances liquidity and accessibility for a broader range of participants, aiming to foster a more inclusive DeFi ecosystem on Avalanche.

- Sub-Saharan Africa is emerging as a hub for DeFi due to high inflation, a large unbanked population, and fragmented currencies. Key drivers include retail payments, peer-to-peer exchanges, and remittances. With Bitcoin and stablecoin adoption rising, platforms like Canza Finance’s Baki are leveraging Avalanche for slippage-free swaps of African fiat currencies. Additionally, improved fiat-to-crypto services, such as Fonbnk, and stablecoins are helping reduce transaction costs for businesses, promoting broader financial inclusion and stability in the region.

NFTs & Gaming

- MMORPG MapleStory is extending its universe to Avalanche with MapleStory N. This new iteration offers user-generated content and blockchain rewards, aimed at enhancing gameplay. Powered by a dedicated Avalanche Subnet, MapleStory N ensures proper scalability for traditional gamers to explore blockchain benefits, without compromising on gameplay. The launch is slated for late 2024, marking a significant milestone for both Avalanche and the MapleStory franchise.

- Funtico, a new incentivized gaming platform, has partnered with Avalanche to revolutionize Web3 gaming. The platform will feature up to 10 games, including Formula Funtico and Heroes of the Citadel, all supported by the $TICO reward token. Leveraging Avalanche's customizable subnets, Funtico aims to provide seamless, engaging gameplay experiences.

- Owned launched BattleTech on Avalanche, blending SocialFi with gaming. Players create a Player Pass that backers can trade, investing in their future success. Battle Tech integrates with Steam and FaceIt, leveraging gamers' histories. Funded by Unix Gaming, the platform aims to decentralize esports, providing new monetization avenues. BattleTech's tournaments link prize pools to player pass liquidity, ensuring fans benefit from player success.

- Best Dish Ever, a community-owned food show, has introduced NFT memberships on Avalanche aimed at transforming culinary exploration. Founded by Trustless Media, the platform offers exclusive content, restaurant discounts, and access to unique events. Leveraging Avalanche’s speed and low fees, it democratizes food culture engagement, allowing members to participate in community voting and earn rewards. This initiative blends blockchain technology with a passion for cuisine, enhancing the connection between food enthusiasts and culinary experiences.

- Sports Illustrated's SI Tickets has partnered with Ava Labs to launch Box Office, a primary NFT ticketing platform on the Avalanche blockchain. Box Office provides complete event management and ticketing solutions for various events globally. Utilizing Avalanche’s low transaction fees and rapid finality, the platform enhances ticketing experiences through NFT functionalities, offering collectibles, exclusive offers, and loyalty benefits. This partnership aims to transform event ticketing, promoting dynamic engagement between hosts and attendees.

- The NFT artist development program Avaissance is back for a second season. In the first season, artists were paired with mentors and given stipends to create their NFT collections. The program continues to support and nurture emerging NFT artists. Check out the announcement for more details.

Enterprise

- Coachella has introduced Coachella Quests, a loyalty game powered by Avalanche, blending physical and digital experiences. Festival-goers complete various Quests to earn NFTs and XP, unlocking exclusive rewards such as VIP access, merchandise, and unreleased music. Integration with OpenSea Wallet facilitates reward collection. This initiative aims to enhance fan engagement and loyalty by utilizing Avalanche’s blockchain technology for secure, efficient transactions.

- Really, an AR platform for movie experiences has deployed an Avalanche Subnet to support its growing user base and ensure scalability. The platform has distributed over 250,000 Proof-of-Attendance (POA) ’Fandime’ NFTs, verifying movie attendance and unlocking exclusive digital rewards. The new Subnet aims to enhance performance during high-demand periods and expand capabilities for users and partners. Initially available in the USA, the service plans to expand globally, offering a pioneering approach to Web3 entertainment engagement.

Nansen On-chain Data

Daily Transactions on C-Chain

In Q1 2024, the Avalanche C-Chain experienced notable fluctuations in daily transaction counts, ranging from 500k to 5.5m transactions. Correspondingly, gas usage also varied considerably, peaking at approximately $6.5m USD.

The primary driver behind these fluctuations can be attributed to ASC-20 inscriptions. As we saw in Q4 2023, these inscriptions allowed users to attach data to AVAX tokens using extra data space in each transaction, known as Call Data. This innovation led to multiple spikes in activity, with the most significant occurring in late December 2023 and early January 2024, and another prominent spike on February 24th, 2024.

The activity related to inscriptions was intense but short-lived, with transaction volumes and gas usage normalizing shortly after each spike. This pattern highlights the Avalanche C-Chain's capacity to handle sudden increases in network usage efficiently while maintaining stability in the long term.

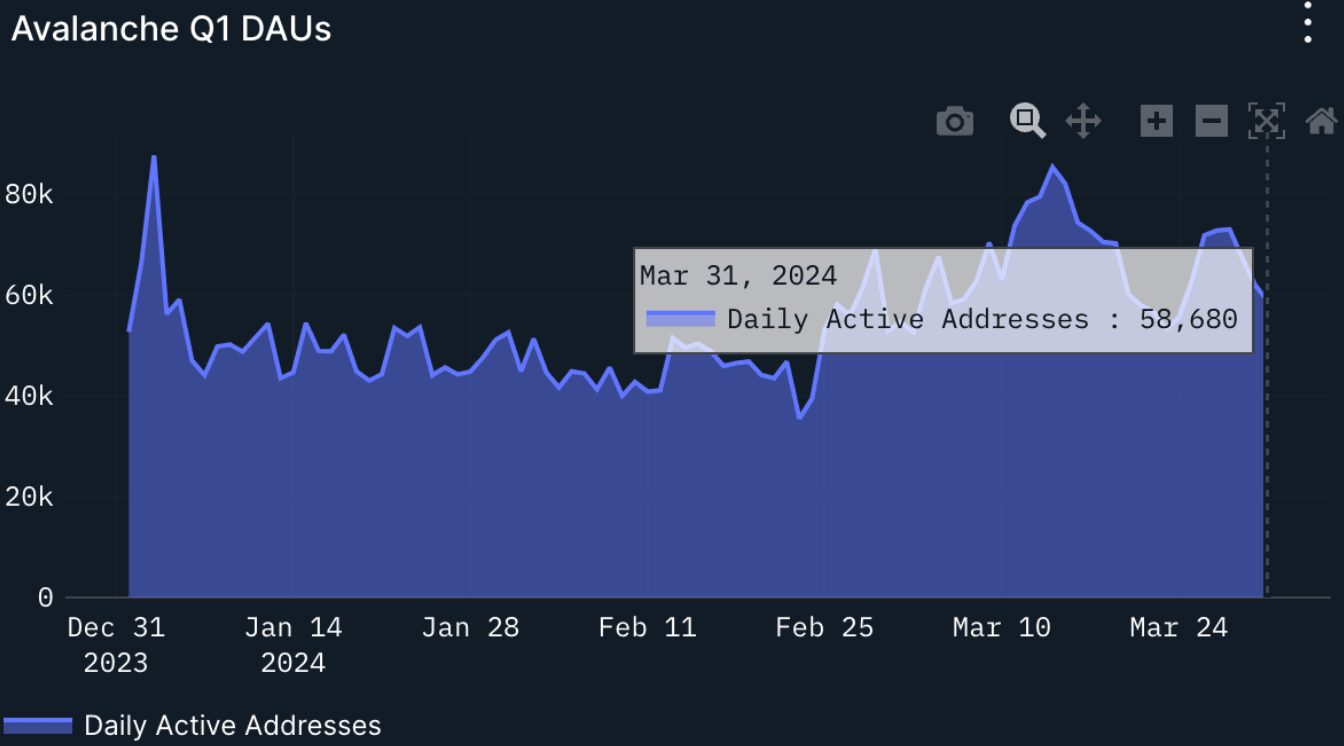

Daily Active Addresses on C-Chain

During Q1 2024, Avalanche's C-Chain experienced fluctuations in user activity, with daily active addresses peaking at 90k (compared to a peak of 95k in Q4 2023) and fluctuating between 30k and 90k. The number of active addresses then stabilized between 40k and 50k through March and April, reflecting ongoing adoption and sticky activity.

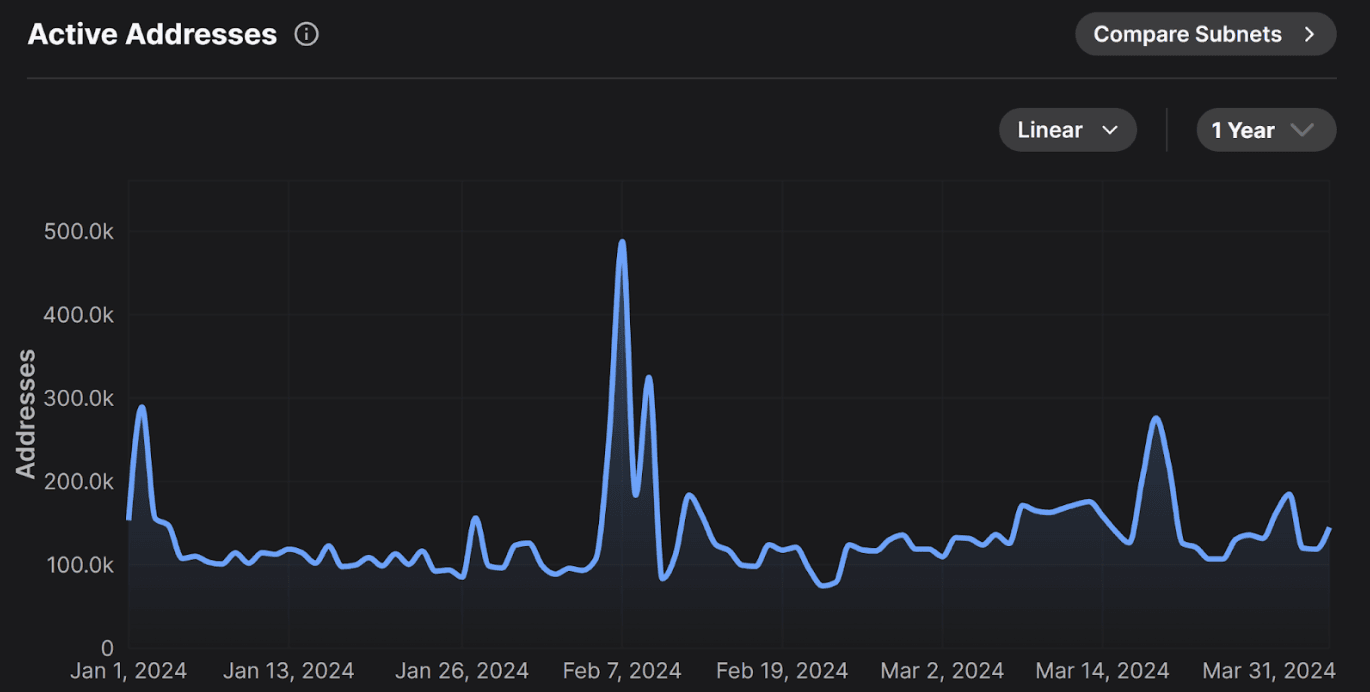

Active Addresses Across Subnets

Total active addresses ranged from 75k - 488k across the subnets. The Avalanche C-Chain remains the dominant subnet. Other notable subnets include DeFi Kingdoms, PLAYA3ULL_GAMES, UPTN (a Web3.0 Platform where real-world business and lifestyle services can integrate into) and Beam (Merit Circle) subnet.

Average Daily Gas Paid (vs Ethereum)

In Q1 2024, the average daily gas fee on Avalanche varied between $0.01 and $1.60. In comparison, Ethereum's gas fees were significantly higher, ranging from $6 to a peak of $26. Unlike Ethereum, which experienced notable spikes and an overall upward trend in gas fees throughout the quarter, Avalanche's gas fees showed more moderate fluctuations. The peak periods for Ethereum were early in the quarter and again in March, while Avalanche maintained a relatively consistent trend, with minor surges in specific periods. This contrast highlights the cost-efficiency and stability of Avalanche's network in managing transaction fees compared to Ethereum.

Top Entities by Users and Transactions on C-Chain

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Avalanche based on the number of users and transactions. Trader Joe maintained the top position in the number of transactions at 2.89m, followed by Tether at 1.95m, and USDC reclaiming the third position at 1.03m. By analyzing these entity interactions, we can better understand the behavior and trends of different entities on the Avalanche network.