Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a three-chain smart contract platform designed to optimize scalability, network security, and decentralization simultaneously. Its primary network consists of the P, X, and C chains, with the C-chain implementing the Ethereum Virtual Machine (EVM) for compatibility with Ethereum applications. A key feature of Avalanche’s architecture is its Layer 1s, which are sovereign networks that define unique membership and token economics. This customizable framework allows Layer 1s to achieve consensus independently, supporting efficient scaling without affecting the main network.

In Q3 2024, Avalanche expanded across DeFi, NFTs, gaming, and enterprise solutions, with the launch of Avalanche9000, the network’s largest upgrade since its mainnet launch, marks a transformative moment for the Avalanche blockchain. Designed to tackle challenges like congestion, technical constraints, and scalability limitations, Avalanche9000 advances Avalanche’s vision of a unified, multi-chain ecosystem.

This upgrade reduces the economic barriers to launching new L1s and provides integrated tools on the C-Chain, Avalanche9000 simplifies deployment, supports scalability, and promotes decentralization. It also fosters innovation through initiatives such as Retro9000 which streamlines the grant distribution process by enabling user submissions.

Meanwhile, Avalanche’s Boost campaign drove DeFi adoption significantly, increasing Avalanche’s total value locked (TVL) by around $249M (~34%) since early Q3, highlighting the campaign's impact on liquidity. Additional key initiatives like Agora’s AUSD stablecoin and BENQI’s liquid staking further boosted liquidity and stability, with stablecoin usage surpassing $2 billion by the quarter’s end. In NFTs and gaming, partnerships like 3thix and Tixbase demonstrated Avalanche’s commitment to sustainable Web3 economies and secure event ticketing through blockchain solutions.

Enterprise initiatives also made headlines as the California DMV digitized 42 million car titles on Avalanche, illustrating blockchain’s utility in government services. Collaborations with Franklin Templeton showcased Avalanche’s ability to attract traditional finance, making it a compelling platform for tokenized assets.

This report delves into these initiatives, highlighting Avalanche’s role as a leading blockchain platform fostering innovation and real-world applications across its diverse ecosystem in Q3 2024.

Key Developments: Q3 2024

- Avalanche launched Avalanche9000, representing the largest upgrade to the Avalanche network since its mainnet launch, delivering a transformative framework for builders to create and scale their own Layer 1 (L1) chains. With a focus on economic feasibility, ease of customization, and faster deployment, this upgrade equips developers with enhanced tools, community-driven proposals, and a live testnet environment to accelerate innovation. Avalanche9000 aims to eliminate traditional constraints by enabling tailored staking economics, seamless integration with the C-Chain's pre-built resources, and the ability to scale across any virtual machine, empowering businesses to bring their visions to life without compromise.

- Following Avalanche9000, the Foundation introduced Retro9000—a $40M retroactive grant program to support developers within the Avalanche9000 ecosystem. The program specifically targets developers building Layer 1 chains and essential tooling on the Avalanche9000 testnet, aiming to bootstrap a robust L1 ecosystem and provide early developers with incentives to innovate and launch products.

- Avalanche launched the Boost Program strengthened liquidity and engagement across key DeFi protocols, including Trader Joe, GMX, BENQI, and DeltaPrime. Since early July, total value locked (TVL) has increased by about 34%, rising from $756.99M to $1.005B by the end of Q3. Protocol-specific impacts were notable: Aave, BENQI, and DeltaPrime distributed Boost rewards in select lend/borrow markets, resulting in TVL increases of ~34%, ~54%, and ~179%, respectively, underscoring the effectiveness of incentives in attracting liquidity.

- The Avalanche Foundation launched a community airdrop to reward active users with AVAX and COQ tokens, targeting participants of the Memecoin Rush program and “diamond hands” holders with high Chill Factor scores from Frosty Metrics. Tokens were distributed through the Core Airdrop Tool, showcasing the Foundation’s commitment to utilizing Avalanche-built tools for community rewards.

- Avalanche’s Codebase program began accepting applications for its second season, offering early-stage Web3 startups access to funding, mentorship, and resources. Running from August 6 to December 18, 2024, the 10-week program will award five selected teams a $50K stipend each, with a $1M prize pool up for grabs on Demo Day. This initiative builds on the success of the first cohort, aiming to accelerate innovations across DeFi, NFTs, and blockchain infrastructure.

- The Avalanche Foundation introduced the InfraBuidl Program, providing grants and resources to projects focused on network scaling, interoperability, and enhancing user experience. This program supports the long-term growth and resilience of Avalanche’s ecosystem infrastructure.

Ecosystem

- Agora launched its stablecoin, AUSD, on Avalanche, introducing a stable, secure digital dollar for seamless payments and transfers within the Avalanche ecosystem. With an initial minting of $20M AUSD and support for trading on Trader Joe, Agora’s AUSD offers a reliable asset for decentralized finance applications, enhancing overall liquidity and usability in Avalanche’s DeFi landscape.

- GoGoPool enhanced its infrastructure-as-a-service offering, aimed at bolstering Avalanche’s security, liquidity, and community engagement by simplifying AVAX staking and creating a decentralized staking pool. The platform has successfully launched 281 validators, accounting for 18% of Avalanche’s total validator base, and promoting increased network decentralization and improved validator incentives.

- Solv Protocol introduced SolvBTC, a decentralized Bitcoin reserve on Avalanche. SolvBTC allows users to maintain Bitcoin exposure within the DeFi ecosystem while earning returns, as it is minted using BTC.b as collateral. This integration marks an innovative step in incorporating Bitcoin into the broader Avalanche DeFi landscape, providing a new avenue for BTC holders seeking yield opportunities.

- Folks Finance launched its decentralized platform for borrowing and lending digital assets. By using a hub-and-spoke model, the protocol allows users to deposit and borrow seamlessly across Avalanche and connected networks from a single account, expanding DeFi flexibility and accessibility.

- BENQI’s liquid staking solution recorded remarkable adoption, with over 8 million AVAX staked, underscoring its vital role in providing liquidity across Avalanche’s DeFi ecosystem. This aligns with the recent “Avalanche 9000 Summer,” a season of growth and innovation within the network.

- Avalanche’s stablecoin market cap exceeded $2 billion, anchored by leading assets such as USDT, which comprises 69%, and USDC, comprising 21%. The launch of AUSD has added further stability, quickly reaching a $22 million market cap and reinforcing the use of stablecoins in enabling users to exit volatile positions, facilitate payments, and boost liquidity for other DeFi assets.

DeFi

- Agora launched its stablecoin, AUSD, on Avalanche, introducing a stable, secure digital dollar for seamless payments and transfers within the Avalanche ecosystem. With an initial minting of $20M AUSD and support for trading on Trader Joe, Agora’s AUSD offers a reliable asset for decentralized finance applications, enhancing overall liquidity and usability in Avalanche’s DeFi landscape

- GoGoPool enhanced its infrastructure-as-a-service offering, aimed at bolstering Avalanche’s security, liquidity, and community engagement by simplifying AVAX staking and creating a decentralized staking pool. The platform has successfully launched 281 validators, accounting for 18% of Avalanche’s total validator base, and promoting increased network decentralization and improved validator incentives.

- Solv Protocol introduced SolvBTC, a decentralized Bitcoin reserve on Avalanche. SolvBTC allows users to maintain Bitcoin exposure within the DeFi ecosystem while earning returns, as it is minted using BTC.b as collateral. This integration marks an innovative step in incorporating Bitcoin into the broader Avalanche DeFi landscape, providing a new avenue for BTC holders seeking yield opportunities

- Folks Finance launched its decentralized platform for borrowing and lending digital assets. By using a hub-and-spoke model, the protocol allows users to deposit and borrow seamlessly across Avalanche and connected networks from a single account, expanding DeFi flexibility and accessibility

- BENQI’s liquid staking solution recorded remarkable adoption, with over 8 million AVAX staked, underscoring its vital role in providing liquidity across Avalanche’s DeFi ecosystem. This aligns with the recent “Avalanche 9000 Summer,” a season of growth and innovation within the network.

- Avalanche’s stablecoin market cap exceeded $2 billion, anchored by leading assets such as USDT, which comprises 69%, and USDC, comprising 21%. The launch of AUSD has added further stability, quickly reaching a $22 million market cap and reinforcing the use of stablecoins in enabling users to exit volatile positions, facilitate payments, and boost liquidity for other DeFi assets.

NFTs & Gaming

- Avalanche partnered with 3thix to advance democratized Web3 gaming economies by introducing innovative revenue-sharing models that reward active players. Through this collaboration, a decentralized Identifier for Advertisers (IDFA) will be developed on Avalanche, allowing companies to leverage targeted consumer behavioral data while upholding user privacy. This initiative underscores Avalanche's commitment to fostering sustainable and user-centered economies in the Web3 gaming ecosystem.

- In a significant move for blockchain-based ticketing, Tixbase partnered with Passo in a five-year agreement to integrate Avalanche’s blockchain for secure and transparent ticketing solutions. This collaboration aims to tackle fraud and enhance the efficiency of event ticketing, showcasing a powerful real-world application of NFTs in the events industry.

Enterprise

- California’s Department of Motor Vehicles (DMV) made a landmark move by digitizing 42 million car titles on Avalanche’s blockchain, streamlining title transfers and enhancing the efficiency of record-keeping. Vehicle owners will be able to claim digital titles through the DMV’s secure wallet app using verifiable credentials. This initiative highlights blockchain’s transformative potential for modernizing traditional administrative processes.

- Franklin Templeton launched the Benji fund on Avalanche, a tokenized money market solution that makes traditional investment products accessible on the blockchain. BENJI token holders can invest in the firm’s $420M Fund, with plans for secondary market trading and collateralization options. This milestone bridges institutional finance and DeFi, inviting traditional investors to explore blockchain-powered assets.

- Legendary filmmaker Pressman Film partnered with the Republic investment platform to raise capital for film projects using Avalanche’s blockchain. Private investors can fund new movies and intellectual properties with the opportunity to share in potential financial returns. This blockchain-based approach enables fractional ownership and transparent funding, redefining film investment access.

- ParaFi Capital joined forces with Securitize to launch a tokenized fund on Avalanche, providing secure, compliant, and transparent access to alternative investments. The tokenized fund expands investor access to ParaFi’s strategies, with future plans for Securitize Credit’s borrowing and lending features, further enhancing DeFi's appeal for institutional participants.

- Colombian neobank Littio partnered with OpenTrade to offer interest-bearing USD accounts on Avalanche, utilizing real-world asset (RWA) yield vaults. Littio provides customers with yield-bearing savings options backed by U.S. Treasury Bills, supporting financial inclusion in Latin America amid double-digit interest rates, high inflation, and currency devaluation that drive investors toward dollar-based savings.

- Grayscale introduced the Grayscale Avalanche Trust, offering accredited investors access to AVAX tokens in the form of a security, with a management fee of up to 2.5%. This trust reflects Avalanche’s increasing relevance in RWA tokenization.

Nansen On-chain Data

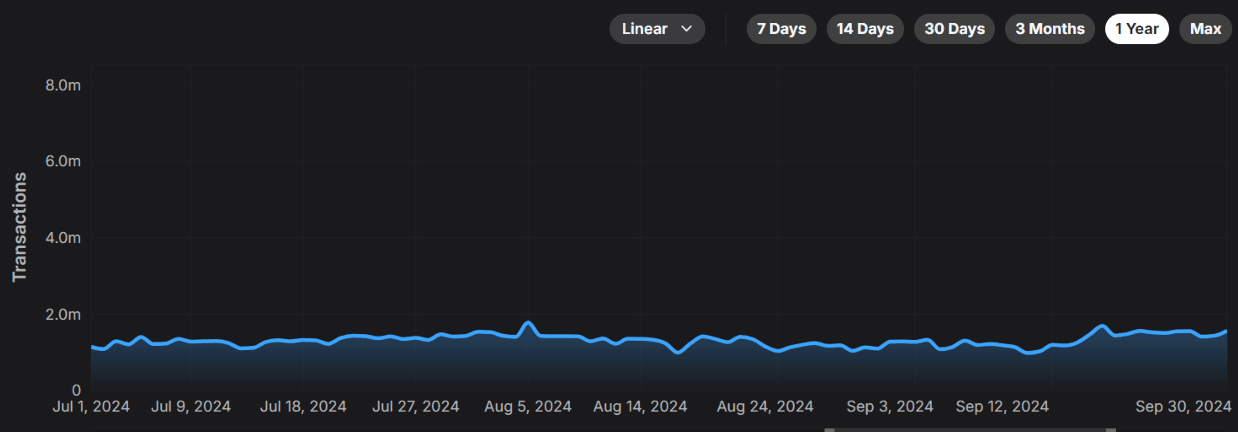

Daily Transactions Across Avalanche Chains

By the end of Q3, daily transactions on the Avalanche reached 1.56M, marking a 37.2% increase from 1.14M transactions recorded at the start of July. Transaction volumes across Avalanche Layer 1 networks saw sustained growth, particularly driven by stablecoin activity within DeFi platforms. In Q3, Tether’s USDT was responsible for 49.7% of all transaction activity, with over 215K users actively trading on leading Avalanche DeFi protocols like Trader Joe.

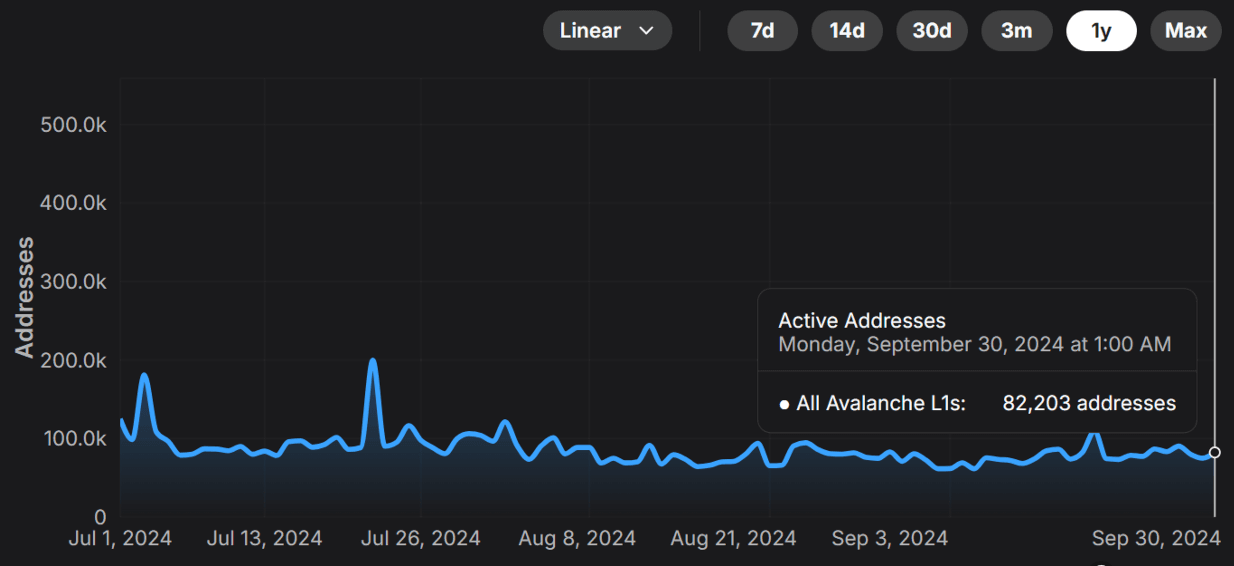

Daily Active Addresses Across Avalanche Chains

Despite a decline in the broader crypto market in Q3, influenced by macroeconomic policies and geopolitical uncertainties impacting investor sentiment and user engagement. Daily active addresses on Avalanche remained steady, oscillating from 82.2K to a peak of 199.8K on July 22.

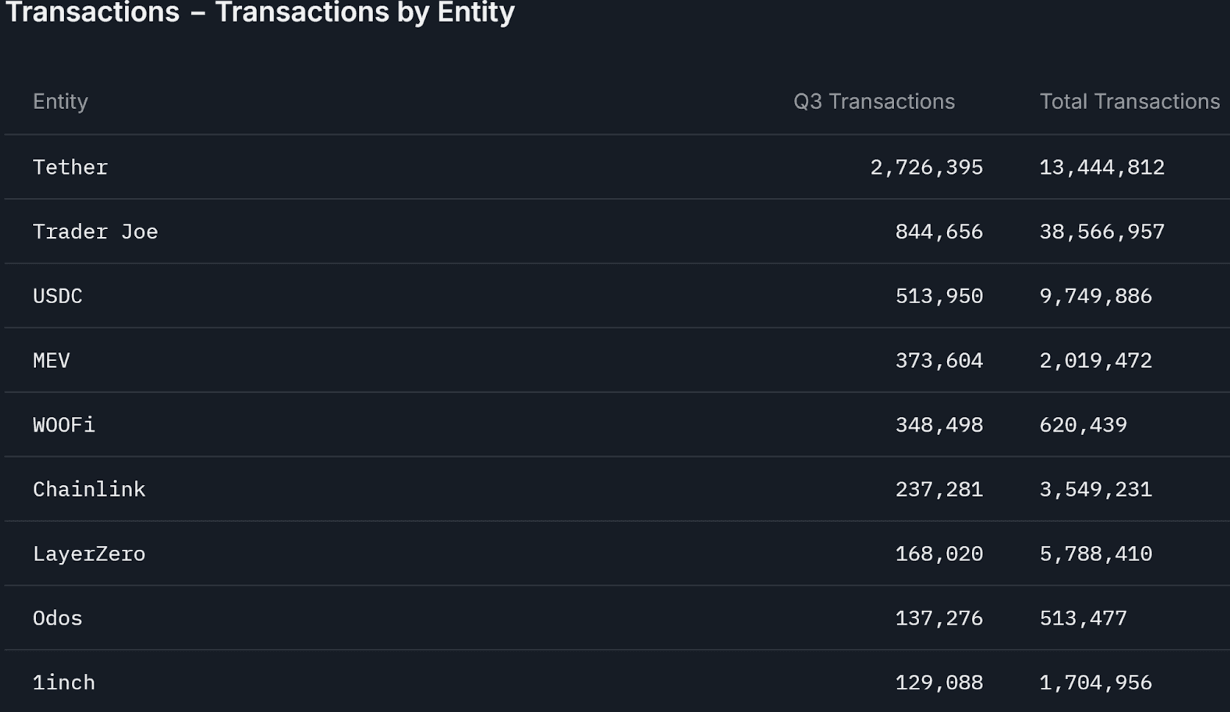

Top Entities by Users and Transactions on C-Chain

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Avalanche based on the number of users and transactions. By analyzing these interactions, we gain deeper insights into the behavior and trends of key entities on the Avalanche network.

In Q3 2024, Tether remained the top entity on Avalanche, with transactions rising slightly to 2.72M, underscoring steady demand for stablecoins amid market uncertainty. Trader Joe saw a notable increase, with transactions growing to 844.6K, indicating sustained DeFi activity. USDC also experienced a slight rise in usage, reaching 513.9K transactions, which suggests a shift toward stable assets. MEV and WOOFi remained key players, with 373.6K and 348.5K transactions, respectively, highlighting growing demand for transaction routing and swapping within Avalanche’s DeFi ecosystem.

In Q3 2024, Tether’s USDT and USDC led Avalanche’s user activity with 891.1K and 242.1K users respectively, solidifying preference for stablecoins in the wake of market slowdowns. Trader Joe followed, with 215.2K, highlighting strong DeFi engagement. In addition, LayerZero attracted 13.3K users due to cross-chain demand, while Odos saw 26.8K users leveraging its transaction routing capabilities. MEV, Chainlink, and WOOFi maintained steady, niche user bases, reflecting consistent utility in specialized services across the ecosystem.

In Q3 2024, Avalanche reinforced its position as a high-performance blockchain network through strategic expansions and community-focused initiatives. Daily transactions surged by 37.2%, from 1.14M in early July to 1.56M by the end of September, driven largely by stablecoin activity within DeFi platforms. Tether’s USDT contributed 49.7% of this transaction volume, with over 215K users actively trading on leading Avalanche DeFi protocols like Trader Joe. The network’s recent initiatives, including the launch of Avalanche9000 and the $40M Retro9000 grant program, position it to attract developers focused on Layer 1 chains, interoperability, and liquidity growth within the ecosystem. The Avalanche Boost Program further strengthened DeFi liquidity, resulting in a 34% increase in total value locked (TVL) and benefiting key protocols like Trader Joe and GMX. Moreover, Avalanche's EVM compatibility, sub-second transaction finality, and low transaction fees continue to make it an appealing platform for decentralized finance (DeFi) and tokenization of real-world assets (RWAs). Avalanche’s ongoing collaborations with established institutions like Franklin Templeton, ParaFi Capital, and Securitize are further enhancing the network's appeal. These collaborations provide robust infrastructure and resources for asset tokenization. As more institutions seek to leverage blockchain technology, Avalanche is well-positioned to become a leading ecosystem for RWAs, attracting diverse projects and users in the evolving blockchain industry.