Introduction

Babylon Chain is a Bitcoin-secured Cosmos-based network that extends Bitcoin’s security to PoS blockchains and rollups alike. Put simply, it allows Bitcoin holders to stake BTC trustlessly (without wrapping or bridging funds) and earn rewards for securing other networks. In other words, Babylon allows BTC to be trustlessly restaked for additional use cases. This Bitcoin restaking approach is similar in practice to Eigenlayer where it unlocks new avenues such as yield opportunities via liquid staking tokens (LSTs) – so BTC holders can earn staking rewards and even use tokenized staked BTC in DeFi – all while maintaining self-custody of their bitcoin. For those looking into a deep dive into what Babylon is at a fundamental level, we would recommend reading our report here.

Babylon offers many different products to chains and users alike. It can integrate with existing PoS chains as a plug-in security and liquidity layer while users can now use BTC productively throughout DeFi. By leveraging Bitcoin’s security features (both its asset value and proof-of-work finality), Babylon aims to serve as a middle-layer that provides Bitcoin-grade finality and security to many blockchains, effectively turning BTC into a productive, slashable stake asset for the broader crypto ecosystem.

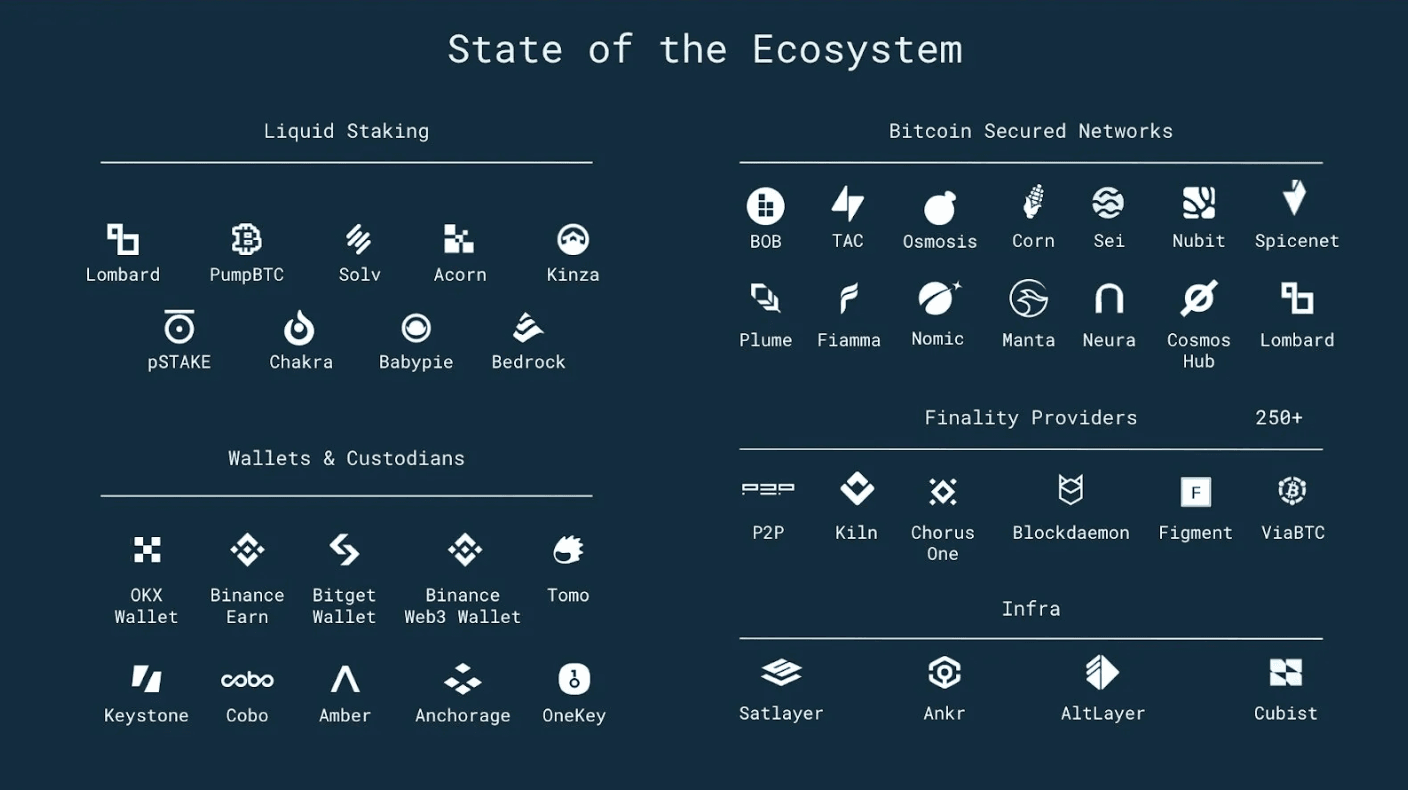

Since its Phase 1 launch back in August 2024, Babylon has seen over 57,000 BTC staked ($4.7b with BTC trading at ~$83k) on the staking protocol. From this, an emergence of LSTs, wallets, Bitcoin Secured Networks, Finality Providers, and over 135,000 unique UTXOs have emerged to create one of the most exciting ecosystems today.

The addressable market for Babylon is quite vast - it unlocks $1.5 trillion dollars of the most liquid crypto asset and it brings forward material security and UX unlocks for chains. Let’s dive into the most recent updates in Babylon’s three stages to mainnet.

Babylon Genesis – The Three Facets

Babylon’s mainnet launch is built on three stages that aim to deliver a fully fledged mainnet. Currently, they just launched the start of Phase-2, which unlocks some exciting features:

- A Bitcoin-secured layer 1 using restaked btc and 100+ traditional validators based on Tendermint, otherwise known as the genesis chain

- A coordination layer dubbed the ’control plane’ for security and liquidity across Bitcoin Secured Networks (BSNs)

Babylon Genesis is the first blockchain ever secured by Bitcoin staking, running a dual-consensus: ~100 Cosmos validators staking the native BABY token, and ~60 Finality Providers who stake BTC and sign off on blocks. Both sets of actors are penalized (slashed) for misbehavior, enforcing strong security. The result is that even a relatively small portion of Bitcoin’s market cap can impart massive security.

Babylon enhances security further by periodically timestamping its blockchain on Bitcoin’s ledger. Approximately every hour, Babylon’s validators commit the hash of the latest Babylon block to a Bitcoin transaction. These Bitcoin timestamps act as an immutable anchor, giving Babylon (and connected chains) the benefit of Bitcoin’s proof-of-work finality. This has two key benefits:

- It negates long-range attacks and conflicting fork histories – even if an attacker controls old validator keys, they cannot create a fake history that outpaces the Bitcoin-recorded timestamps. All honest nodes will see the canonical chain anchored in Bitcoin.

- It enables much faster unbonding (withdrawal) periods for stakers. Because the chain’s history is locked-in via Bitcoin, Babylon can safely let stakers unlock much sooner than typical PoS chains. In fact, Babylon’s unbonding times are just ~50 hours for BABY and ~7 days for BTC, dramatically shorter than the 2–3 weeks or more on other networks. This synergy between Bitcoin staking (short-range security) and Bitcoin timestamping (long-range security) ensures Babylon’s security is quite robust.

Looking beyond securing just the Babylon chain itself, Phase-2 sets the stage for Bitcoin re-staking – using staked BTC to secure other chains and applications simultaneously. In Babylon’s roadmap this corresponds to Phase-3. The idea is to create a shared security marketplace where a BTC holder can stake once, then **opt-in to secure multiple PoS chains or dApps with that same stake, earning multiple rewards. In Phase-2, Babylon Genesis already includes on-chain modules for restaking and will host BTCFi applications like a DEX, lending, and vaults to utilize BTC liquidity. This means BTC stakers (often via LSTs) can restake or deploy their assets in DeFi on Babylon while still securing networks. Together, Bitcoin staking + timestamping + restaking form a virtuous feedback loop: Bitcoin’s security is imported into Babylon and then then exported out to many app-chains.

Phase-2 Launch, What to Expect?

Babylon’s Phase-2 launch (Babylon Genesis mainnet) transitions the project from a successful BTC staking bootstrap into a live chain. So what does Phase-2 unlock?

- Permissionless BTC Staking: During Phase-1, Babylon onboarded BTC in capped tranches. With Phase-2, Babylon Genesis went live on April 10, 2025 as the first Bitcoin-Secured Network (BSN), and Bitcoin staking is opening up to everyone. There will be a brief two-week pilot where only the initial Phase-1 stakers are whitelisted to register onto the new chain. In practice, registering a BTC stake on Babylon is done via a Cosmos SDK transaction (paying a small BABY gas fee) containing proof of the Bitcoin UTXO to be staked. This design keeps the Bitcoin transactions minimal – you lock your BTC in a special script on Bitcoin once, then manage the stake on Babylon chain thereafter. Importantly, we will be tracking this closely to measure the “appetite” for restaked BTC and the overall demand of a BTC-led ecosystem.

- Restaking and BSNs: Phase-2 also rolls out the initial restaking toolkit for developers and partner chains. Babylon Genesis is not just an L1, but also a place for other chains to plug into Bitcoin security. Now that the Babylon chain is live, other blockchains (which will become BSNs in Phase-3) can start integrating via standard interfaces. BSNs can be any L1 or L2 that would like to be secured by BTC and tap into liquidity via Babylon. Phase-2 makes Bitcoin’s security as-a-service available: any appchain or rollup can begin to tap into Bitcoin finality and potentially reduce their dependence on inflationary native tokens for security. Additionally, PoS chains can protect themselves across long range attacks and decrease bonding times for unstaking from 28 days to just a few days. For modular blockchains and Cosmos appchains, this is a significant development – they can augment or even partially outsource security to Bitcoin (via Babylon) in a trust-minimized way. In return, Babylon’s model is that connected chains pay a portion of their staking rewards to Babylon as protocol revenue. Those fees are then distributed to Babylon stakers (BTC and BABY) per the tokenomics. This aligns incentives across ecosystems: chains get stronger security and access to BTC capital, Bitcoin stakers earn extra yield from many sources, and Babylon’s own network activity grows. Note, there still needs to be traction and serious demand for this to lead to attractive APRs for restakers, similar to restaked ETH via EigenLayer.

- Ecosystem Growth: Since its phase-1 launch, Babylon has seen a lot of growth across community of wallets, custodians, DeFi pillars, and liquid staking providers integrated into Babylon. For example, Lombard and Solv Protocol issued BTC staking derivatives and can be used to earn yield on Pendle, for example. This liquidity will be vital because those LSTs can now flow into Babylon’s upcoming DeFi modules (DEXs, lending, vaults) to kickstart BTC-focused DeFi (“BTCFi”). On the demand side, multiple PoS networks have lined up to become BSNs. At least three chains have announced plans to integrate: Osmosis (the largest DEX chain in Cosmos), XPLA (a gaming/content chain), and BOB (an up-and-coming network), among others. Osmosis for instance, passed a governance proposal with overwhelming support (>96% yes) to pursue a 3-phase Babylon integration. Osmosis will use Babylon for Bitcoin timestamping and finality, which lets them shorten their unbonding period and protect against long-range attacks on their DEX chain. This kind of alignment illustrates how Babylon is becoming a base-layer security provider for chains – a role analogous to how Ethereum’s EigenLayer offers restaking to many dApps, but powered by Bitcoin.

BABY Tokenomics

With Babylon’s mainnet comes its native token BABY. BABY, the native token for Babylon, has utility that spans the typical roles of a Cosmos chain token and unique roles tied to Bitcoin staking. Firstly, BABY is the gas and governance token of Babylon Genesis. All transactions, smart contracts, and cross-chain operations on Babylon require paying fees in BABY, giving the token fundamental utility. BABY holders also govern the network; they can stake BABY to validators (the CometBFT consensus) and vote on proposals that upgrade the protocol or adjust parameters. Beyond this, Babylon employs a dual-staking model: both BABY and BTC are staked for security. BABY-staked validators produce blocks and BTC-staked finality providers finalize them. To read the full details, you can visit their tokenomics page but the simplified breakdown is below:

Token Utility

- BABY serves as the gas and governance token, essential for transactions, staking, and voting.

- Economically binds BTC stakers (Finality Providers) and BABY validators, rewarding both with BABY emissions.

Emissions & Inflation

- Genesis supply: 10 billion BABY

- Annual inflation: 8% (split equally between BTC and BABY stakers)

- Initial distribution designed to prevent insider dominance—team/investor tokens locked initially. Specifically, investors and the team cannot stake their allocation until 1 year post TGE - thus, they cannot prematurely sell staking rewards such as the issue with TIA VCs at the moment.

Distribution Highlights

- Community Incentives: 15%

- Ecosystem Building: 18%

- R&D/Operations: 18%

- Early Investors: 30.5% (4-year vesting)

- Team: 15% (4-year vesting, 1-year cliff)

- Advisors: 3.5%

BABY is currently trading at a $168m MC and $737m FDV and is now trading on most major CEXs such as Binance, OKX and Bitget. At such a valuation, it feels this can be a massive opportunity given the lack of attention due to broader macroeconomic factors and the markets tanking. As of now, it has been hard to bet on the general growth of BTCfi without taking directional risk to a specific L2 or altcoin. Historically, these have not seen adoption or are way too early days and hence, price action has often been much worse than just holding BTC itself. BABY offers an alternative at a reasonable valuation, with solid adoption so far and a detailed roadmap for BSNs. The main question remains does the market have the appetite for a new restaking platform? We feel that because it is BTC-focused, this makes it 100x more interesting for most folks given the tailwinds of BTC and the ability to unlock it onchain for institutions and fundamental investors alike. Additionally, the restaked security makes immediate sense for most PoS chains today - potentially alleviating massive sell pressure from inflation and decreasing bonding times to just a few days. In short, we feel Babylon as a project and its potential revenues, span so many ecosystems - L1s, L2s and BTCfi in general.

Key Ecosystem Metrics

As of early April 2025, Babylon’s platform secures just under 50,000 BTC in its staking contracts. Despite some early stakers cashing out after the BABY airdrop, the vast majority of BTC remains locked, reflecting continued confidence and desire for yield. This ~49.6k BTC represents roughly 0.25% of Bitcoin’s circulating supply– a remarkable achievement for a protocol not yet a year old. It’s worth noting that at peak in December 2024, over 57k BTC was staked. During Phase-1, they saw growth to 57k BTC deposited over 135k unique BTC addresses/stakers in total.

Today, with ~50k BTC still staked (even after some natural unstaking post-airdrop), Babylon likely secures the single largest pool of Bitcoin outside of the Bitcoin network itself, valued at roughly $4b (based on today’s prices). Such scale puts Babylon in league with major DeFi protocols by TVL.

With Babylon Genesis launching, the count of Babylon-secured networks (BSNs) is set to grow in 2025. During Phase-2 itself, Babylon will primarily secure its own chain, but several partner chains are already in pipeline to become BSNs:

- Osmosis – is integrating Babylon in a 3-phase process. Phase-1 (Bitcoin finality via IBC) is approved and imminent, with deeper integration to follow pending governance. Osmosis will be the first external network to actively use Bitcoin staking for security. Additional profit sharing will happen via fees generated on LSTs traded on the DEX.

- XPLA – a Tendermint L1 focused on gaming and media – has joined as a BSN partner. XPLA is already testing Babylon’s Bitcoin staking integration on its testnet, aiming to inherit Bitcoin’s security and liquidity to benefit its gaming ecosystem.

- BOB – is joining the Babylon ecosystem as a BSN and aims to tap Bitcoin’s security and attract BTC liquidity via Babylon-enabled LSTs.

In addition to these, other projects are exploring integration. As of April 2025, at least three networks are publicly committed to adopting Babylon, and several more are in talks or trial phases. We can expect the “secured by Babylon” roster to expand significantly over the next quarters, especially once Phase-3 goes live.

Conclusion

In short, Babylon has seen impressive metrics and has executed on its 3-phase rollout, with phase 2 just going live on April 10th. With substantial BTC already staked, multiple integrations underway, the stage is set for Babylon to become an essential component for BTC and unlocking the most liquid asset in DeFi. However, although there are many perceived advantages of what Babylon can unlock, it still needs to gather adoption. We have seen the headwinds Eigenlayer has faced with too much idle TVL and relatively unattractive APRs given the minimal adoption in its early days. We feel the solutions Babylon offers actually stands a better chance in quicker adoption; mainly, BTC-based LSTs are a huge unlock for users to dive in immediately. As for security assurances, PoS chains and layer 2 gains better guarantees and offer users a better UX by integrating with Babylon and there is serious need for BSNs as it mitigates inflation concerns, unbonding times and other issues with app-chains. In short, we believe Babylon is uniquely positioned to become a critical hub for BTC.