Where is Base Today?

Base is an optimistic rollup incubated by Coinbase. Since launching in the Summer of 2023, it has made large strides in adoption.

2024 Transaction Growth

Since the start of 2024, Base transaction activity has ranged between 270,00 - 632,000 daily transactions. It has outpaced Optimism on transactions and continues to grow. Looking at Base on its own, it paints a slightly different picture.

Transaction Activity Since Inception

Base activity peaked in September 2023, but has since found a consistent level of activity that has grown steadily with an average of over 483,893 daily transactions over its lifetime.

Daily Active Users

Next, we explored what Externally Owned Accounts (EOAs) look like across Base and the other top layer 2s. We filtered out all entities (outside of public figures), contracts, NFT washtraders, and MEV bots from these views, so this is tracking the daily counts of these active EOAs in 2024.

Base has had the most daily EOAs since the start of 2024, followed by Arbitrum and Optimism. But what about the average EOA user activity on these chains?

EOA Transaction Velocity

Next, we showed the daily outgoing transactions of EOAs across Base, Optimism, and Arbitrum since the start of 2024.

Arbitrum is leading in terms of EOA activity in 2024, followed by Base and then Optimism. Finally, we show TVL across Base, Arbitrum and Optimism to get a better sense of liquidity across them.

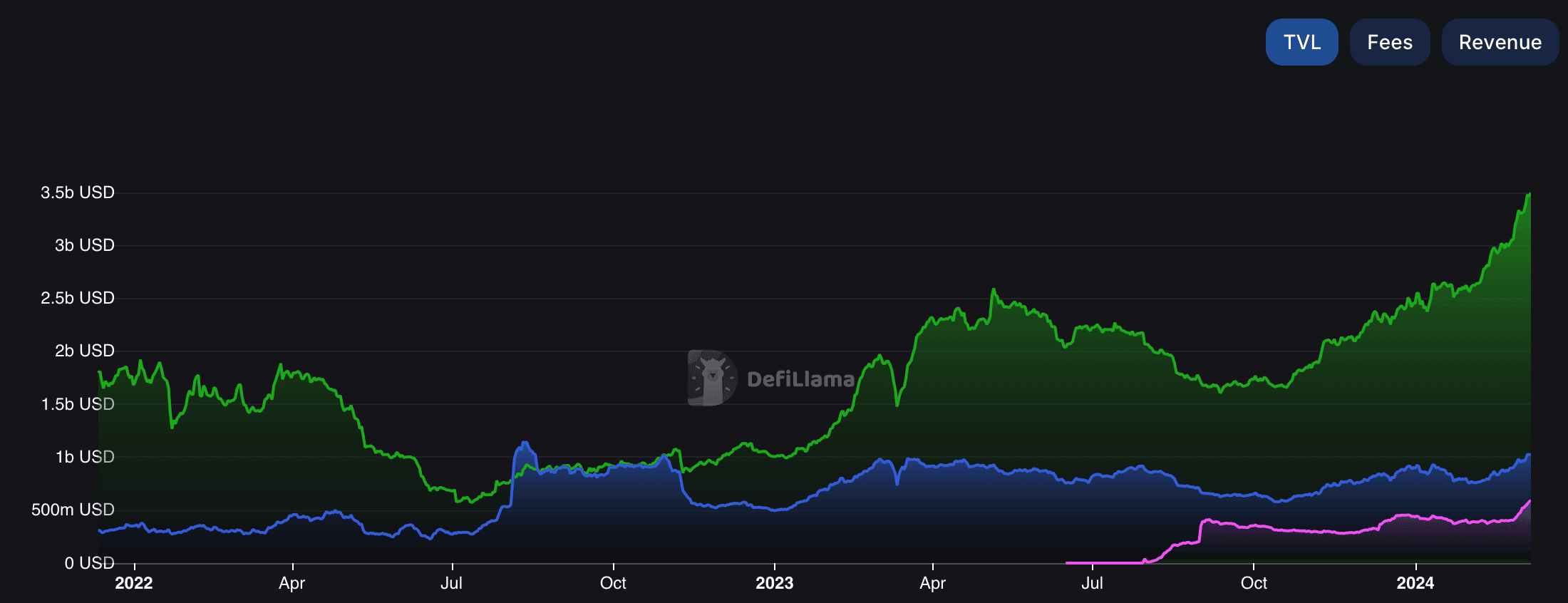

TVL Data (USD) Since 2022

Source: Defillama

Arbitrum is the clear leader when it comes to liquidity onchain, with over $3.5b in TVL as of March 6th. Optimism is in a distant 2nd with just over $1b, with Base quickly catching up nearing $600m in TVL. Although imperfect as a sole metric, the TVL data helps paint a better picture of the overall liquidity of the L2s.

We have shown the onchain growth of users, overall activity, activity across EOAs and TVL but what about future catalysts?

Future Drivers

The Base ecosystem has many catalysts going for it:

- Retail and accessibility

- Deep resources and a dedicated team driving the Base ecosystem

- Coinbase Ventures funding via Base Ecosystem Fund

- Investing in projects building on Base

- EIP upgrades allow for more scalability and cheaper fees

- EIP-4844

- The rising tide raises all boats (cheaper fees)

- ETH Beta ecosystem

- ETF Speculation

- General repricing higher of ETH

- Social Finance

- Ex: Farcaster, Friend Tech, Blackbird

- Potential airdrop

- Attracting airdrop farmers

- Open Source OP Stack

- All other OP Stack chains contribute to a shared SDK

- New features unlocked and interoperability

There are many catalysts for Base as an ecosystem but as for apps building on Base, some of the top builders are choosing Base. For example, the Rezy co-founder Ben Leventhal, has chosen Base to build his new restaurant app Blackbird on. Additionally, the top social apps in crypto today have also chosen Base which testifies to the builder ecosystem they have. For more information on Base’s 2024 plans, you can check out what they wrote extensively here.

Outside of new use cases of crypto and future catalysts, the performance of Base-native assets has done very well in terms of price performance.

Coin Ecosystem Tokens

Given the combination of good price performance and many catalysts, Base is positioned well for a continued bull market. To assist traders, we will highlight interesting wallets that were “early” to some of the most profitable meme tokens. From here, users can see what these ‘Base Degen Traders’ decide to buy/sell by tracking them through smart alerts or using a portfolio tracker.

Base Meme coins

Given the current meta of memes, we created a group of ‘Base Degen Traders’ who have traded 2 or more of the following tokens with $10k or more before a large price increase. We only look at token flows, not DEX trades, so these wallets may have sold tokens since or transferred out of their wallets.

We found the following meme tokens that have done well and identified the ranges of accumulation that were followed by a large price appreciation. Wallets who have satisfied our conditions based on the below tokens are considered our ‘Base Degen Traders’.

- TOSHI

- August 4 - February 28th

- MOCHI

- November 21 - January 23rd

- DEGEN

- January 6 - January 30th

- DOGINME

- February 7 - February 28

Base Degen Traders

After filtering out wallets based on our conditions, we were left with our ‘Base Memecoin Traders’.

A few of these wallets are dedicated to Base memes such as this wallet and many are still allocated to the memes they were early to. The links in the table take you directly to Nansen 2, as some wallets have transferred their holdings 1 or 2 hops from their original wallets. Interestingly, you can see alternative meme coins in a few of their wallets such as WASSIE, TYBG, BOGE, NORMIE, FROK, MEMBER, AYB, OMNI, and many others.

The table is sorted by tokens traded and USD value inflows, so you can toggle with the columns to get wallets who traded more size or those who had a higher hit rate amongst the chosen memes. We have shown their positions and other meme positions but what exactly are they doing on Base?

Top Counterparty Entities Over Last 14 Days

Using all of our ‘Base Memecoin Traders’, we look at their top counterparties over the last 14 days. Below is a list of the top entities sorted by interactions and number of wallets.

In light of these meme coin traders, it's no surprise that their top counterparties comprise mainly DEXs and memes. Lastly, we want to know if Base is something to keep paying attention to for memes. To do this, we look at daily transaction activity since Base launched for our ‘Base Memecoin Traders’.

Activity has increased dramatically since the end of 2023 and is only accelerating through March 2024. This suggests that Base remains opportunistic for these traders as they continue their meme coin trading.

In 2024, Base has shown remarkable growth and adoption, establishing itself as a significant player in the layer 2 space. With daily transactions fluctuating between 270,000 to 632,000, Base has not only surpassed Optimism in transaction volume but also demonstrated a steady increase in user engagement, maintaining an average of over 483,893 daily transactions since its inception in the summer of 2023. This growth is underscored by the high level of Externally Owned Account (EOA) activity, with Base users averaging 2,080 transactions per year, significantly outpacing counterparts on other Layer 2 platforms such as Arbitrum and Optimism.

The Base ecosystem is ripe with catalysts that promise to drive further growth and adoption. These include enhancements in retail accessibility, integration with smart wallets, utilizing Coinbase assets onchain, and strategic investments through the Base Ecosystem Fund. The ecosystem is further buoyed by a strong builder community, evidenced by the choice of Base by leading developers and social apps in the crypto space. Moreover, Base-native assets have shown impressive price performance, adding to the ecosystem's attractiveness.

Overall, the Base network's trajectory in 2024 reflects a robust and dynamic ecosystem characterized by strong user engagement, a thriving builder community, and active speculative trading. These factors, combined with strategic ecosystem investments and technological advancements, position Base as a pivotal platform in the layer 2 landscape.