Key Terms

| Term | Description |

|---|---|

| App-chain | A L1 blockchain focused on a specific vertical. For instance, Osmosis is a DeFi-focused app-chain. |

| Zone | A Zone is an app-chain on Cosmos that has enabled IBC. |

| Hub | Refers to a Zone that gets sufficiently popular where it becomes integral in cross-chain interoperability - any Zone can become a Hub. Examples include the Cosmos Hub (ATOM). |

| Cosmos Hub | Refers to the L1 blockchain that is home to ATOM, and does not reflect the broader ecosystem. This is confusing naming and should not be misconstrued with the entire ecosystem. |

| Inter Blockchain Communication (IBC) | A generalized messaging protocol that allows for any Cosmos Zone to be interoperable with each other. IBC comprises many parts, such as the base layer, transport layer, authentication layer and interface layer. |

| Shared Security | Where all apps on a chain inherit the base security of the L1. On Ethereum, apps such as Aave inherit the security assurances of Ethereum. On Polkadot, parachains such as Moonbeam inherit the base security of the relay chain. Cosmos chains do NOT have shared security and must secure their own chains with a native staking token. |

| Tendermint | A consensus engine and BFT consensus algorithm. Any state machine (app-chain) can be built on top of it in any language. It combines the networking and consensus layers of a blockchain into a generic engine. |

| Cosmos SDK | Is a modular framework that makes it as easy as possible for developers to build applications on top of Tendermint. Focuses on the application level by having an ecosystem of modules for developers to choose from, where you can build your own modules or use existing modules to easily support applications |

| Application Blockchain Interface(ABCI) | Is an interface that allows the Tendermint BFT engine to connect to the applications on a given chain. It uses a socket protocol, which allows for a consensus engine (Tendermint) to communicate with the application. |

ELI5 the Cosmos Ecosystem

Cosmos itself is not a blockchain, it can be thought of as the key infrastructure that builds blockchains. Similar to the core primitives/protocols that today's Web 2 companies are built on, Cosmos can be thought of as the underlying technology that powers all of these application-specific blockchains. Today, this vision has already played out. Many end users interact with some part of the Cosmos technology stack every day without ever realizing it - Binance Smart Chain, Polygon, Osmosis and many others.

What exactly is the Cosmos technology stack? The Cosmos stack refers to the many layers that make up any blockchain - the consensus layer, networking layer, and application layer. Cosmos modularizes these layers and offers customizability across them to help developers build for their users' needs. They created Tendermint which bundles the networking and consensus layers of a blockchain into a generic engine. Then they have the Cosmos SDK where developers can easily build applications. Tendermint was the first instance of PoS consensus and it has proven resilient with many of the top chains launching with some version of PoS or transitioning to it. Separating the 3 layers of a blockchain allows for much more customization from the chains building on it. The end goal is to provide the easiest way of spinning up a new chain for developers!

The vision is that end users will eventually not need to worry about IBC or the SDK, they will simply get to use the applications with superior UX - this is the end goal of the Cosmos stack, to make amazing apps that users love by being able to customize things from the protocol layer to the user-facing applications. All of these chains will be interconnected by Inter Blockchain Communication (IBC), a protocol that allows for the same composability of the EVM but for fully sovereign blockchains. A world where users can borrow against LP tokens on one chain to lend on another, amongst many other interoperable applications that will increase capital efficiency and ultimately create better products.

Cosmos provides the key tools that developers need to build out their own blockchains and provides a trustless way of composing together through IBC. A core theme of Cosmos is modularity - any blockchain built on the Cosmos framework can use or modify anything in the Cosmos stack as they see fit.

Core Thesis On Cosmos

Cosmos is a bet on a multichain future playing out. Cosmos has prepared for this world to play out and has been building out the architecture for a multichain world since 2017 when more than 99% of all DeFi activity occurred on Ethereum. Similar to Polkadot, Cosmos is a Layer-0 protocol that focuses on horizontal scalability for many blockchains to compose. Layer-0s are a chain agnostic bet that many chains will exist and Cosmos’s model offers a scalable and sovereign approach.

Cosmos itself is not a blockchain but rather a framework for building out independent and sovereign blockchains. The Cosmos architecture is a modular approach where they build out the essential tooling that chains will need, without enforcing any type of rent-seeking in the form of fees or shared security. Some of the key innovations they have built out include the following:

- Tendermint for chains to easily deploy PoS

- The Cosmos SDK to easily build out applications

- IBC for interoperability between Zones (chains)

- Interchain Security for an opt-in model of Shared Security

- CosmWasm for deploying smart contracts

The key difference between Cosmos and any other L1 or Layer-0, is that they give each chain the ability to use/modify the key tools they have built out or not use them at all. If a project wants to modify the Gravity Bridge for their specific zone, they can do so and this has been observed in practice already. There are multiple forks of the Gravity Bridge for chains such as Secret Network or Injective and can be customized any way the blockchain sees fit.

If a project does not want to enable IBC and exist as an isolated chain, it can also do that as demonstrated by BNB Chain. Cosmos treats interoperability and adoption as a spectrum, ultimately empowering the app-specific chains to be autonomous. In short, Cosmos arguably defeats the notion of the fat protocol thesis and enshrines itself to be the key infrastructure for sovereign and independent blockchains to coexist in a composable way.

Application-specific chains bring forward a new design space. Given changes can be made at the protocol level rapidly, the application layer can be rapidly iterated upon - pushing forward new features that could not be replicated on generalized smart contract chains such as Ethereum or Solana. Unlike Ethereum where protocol upgrades are generalized, Cosmos chains can make protocol changes to create new features that directly benefit the application layer. This phenomenon cannot be created on generalized smart contract chains given the increased number of shareholders between applications and token holders of these platforms. For instance, Ethereum protocol upgrades are not directly benefiting any specific application but rather a more general upgrade approach. Whereas Osmosis (a Cosmos Zone) can make protocol changes to create new features on its DEX such as Superfluid Staking, threshold encryption, multiple AMM pool types and much more.

What are the tradeoffs in its design/approach?

Cosmos differs from other Layer-0 protocols in its design approach. The main tradeoff is a lack of shared security across its chains. This means that any chain on Cosmos must be able to secure its own chain with a native token and bootstrap a diverse validator set. The main concern here is that each chain on Cosmos has varying security tradeoffs as well as centralization vectors - the validator count, centralization of stake across validators, token distribution, and relative market cap, amongst other things.

Given that security varies for each chain, what does this mean for cross-chain interoperability?

This means that any chain that decides to be connected via IBC is inherently trusting the security assumptions of each new chain it connects to. If a chain is corrupted, then the synthetic representations of the native assets are worth nothing on the destination chain. For example, if the Chihuahua chain is corrupted, then the Chihuahua tokens on Osmosis are worth nothing. This is obviously a large concern for building out composable financial applications, but developing a chain on Cosmos requires lots of work - diverse validator sets that can be sustained with protocol fees, inflationary rewards, and a sustainable token price that can secure the TVL on its own chain. An example of this trust assumption can be seen with Terra, whose token price crashed to the point that the network’s market cap was too low to make it secure and the chain was halted. Of course, this dragged down the price of OSMO and other assets that had a lot of liquidity shared in pools with UST or LUNA. However, the Terra fallout did not cause a contagion fallout of every other chain - it was limited to the chains that connected to it. Building out a chain’s staking token with a token that can experience a ‘death spiral’ is evidently not secure, and the other chains within the Cosmos ecosystem suffered great monetary losses due to their dependence on UST as the predominant stablecoin.

However, this type of design essentially minimizes the “blast radius” of the security assumptions to the two connected chains. Thus, the entire Cosmos ecosystem will not be affected by malicious behavior - the risk is isolated to the connected chains that decide on their own level of interoperability. If a chain is deemed risky, then it is up to each Zone to decide on whether they'd like to take on the risk by connecting with them.

Solutions to Shared Security

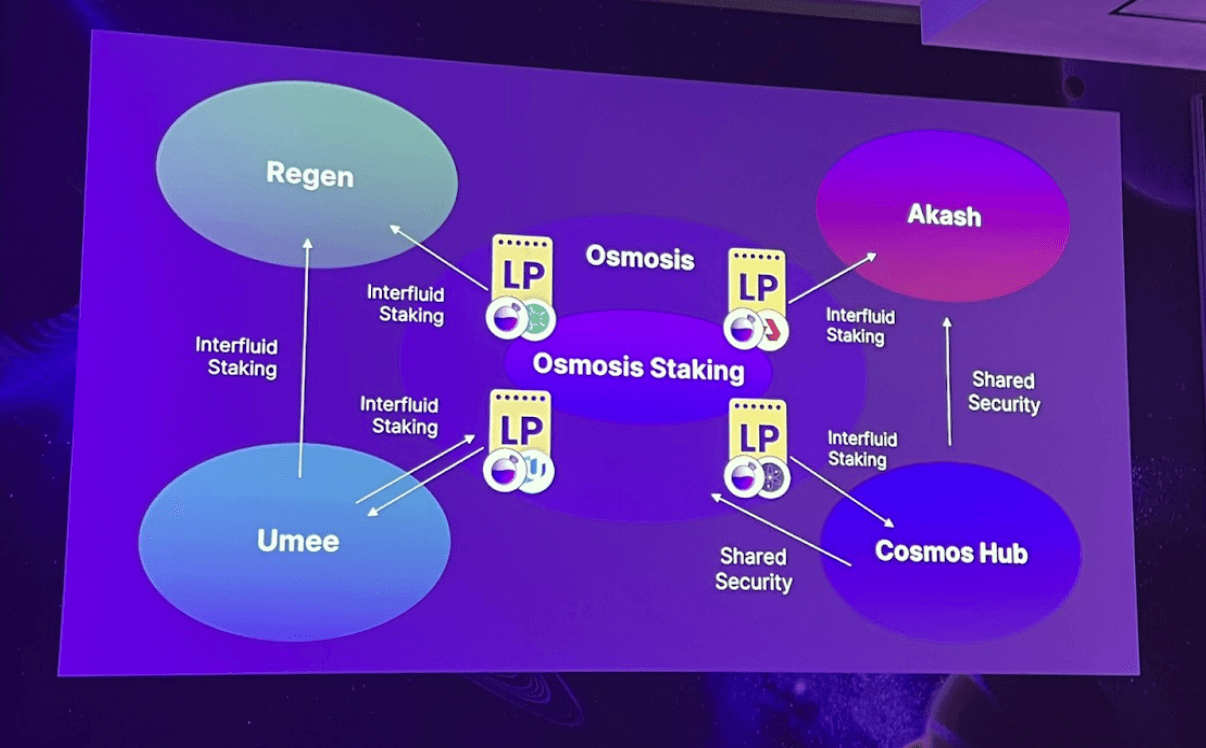

Given the design tradeoff discussed above, are there any leading solutions to mitigate this problem moving forward? The short answer is yes. Shared security will come in multiple forms and this report will lay out the varying security mechanisms being launched. The below image illustrates some of the mentioned shared security mechanisms - Interchain Security and Interfluid staking.

1. Interchain Security (ICS)

- Shared security for Cosmos SDK chains

- Shared security for new and existing chains via the Cosmos Hub (ATOM validators).

- Chains, called consumer chains, will “rent” out security from participating Cosmos Hub validators (“provider chain”) that will secure the consumer chain by validating the chain for them.

- For example, Crescent - a DEX chain, can borrow security from the Cosmos Hub, and participating ATOM validators will receive Crescent staking rewards for its services.

- Can make ATOM an index play - stake ATOM to get exposure to many Cosmos chains via Interchain Security. Receives staking rewards from each new chain it supports and ATOM staking rewards for the Cosmos Hub

- Launched in 2 phases:

- 1st Phase: Interchain Security is for the entire chain, meaning the “Consumer chain” receives all of its security from the Cosmos Hub validators. Launching Q3 of 2022. This 1st phase essentially makes the native staking token, a governance token. Not ideal for larger chains that want to borrow security from the Cosmos Hub while keeping their tokens as a means of security.

- 2nd Phase: Partial Interchain Security where consumer chains can borrow specific amounts of security from the Cosmos Hub - generates its security from its own validator set and the participating Cosmos Hub validator set. Thus, larger cap chains such as Osmosis will be likely to borrow security from the Cosmos Hub. Launching Q4 2022 or later.

- Ensures the native staking token can be used to secure the chain and ATOM validators. This is the more exciting design space of shared security given the spectrum of decentralization offered to Zones is increased to more established chains and it doesn't cannibalize the native staking tokenomics.

- There is execution risk given chains will actually need to use Interchain Security (not just theoretical) - if no chains use ICS, then ATOM does not have any value accrual.

- Interchain security will have to compete with other competing solutions mentioned below

- However, any chain can implement ICS given it is open source software so this can be an uphill battle for the Cosmos Hub given other chains like Evmos or Celestia can implement it themselves.

- Counterpoint: Cosmos Hub has the most diverse validator set which makes it an ideal Zone for ICS

2. Celestia Shared security for Rollups

- Shared security for Cosmos-based rollups and Ethereum-based rollups

- Celestia will be providing a DA solution for Ethereum rollups.

- For any Celestia native rollups such as Cevmos, they will inherit the shared security and consensus of the Celestia chain.

- Any Optimistic Rollup can compose on Celestia to benefit from their shared security.

- Ex: Cevmos uses a settlement layer on Evmos and uses Celestia as a DA layer

- Will be adding support for other execution environments after they support Optimistic Rollups.

- Ex: Substrate, Cosmos SDK chains, zk-rollups among others

3. Osmosis Interfluid Staking

- Shared security for Cosmos SDK chains via LPs bonded with OSMO

- Osmosis will allow for another form of shared security via Interfluid Staking

- Interfluid Staking refers to the ability of Osmosis to attest to a chain's assets in its liquidity pools. Will allow the Cosmos native asset in the pool to be staked on the native chain.

- Ex: AKT-OSMO LP pair, the AKT in the LP pair can be transmitted over IBC and staked on the Akash chain. Updates in the LP tokens will be rebalanced and updated over IBC.

- All of this is handled over IBC and allows chains to derive more security via the liquidity provisioning of Osmosis’s pools. Subject to changes in LP token balances for price changes, etc.

- Superfluid staking was launched in February but we are still waiting for Interfluid Staking which is expected to launch Q4 2022 or later

- More staked liquidity on Osmosis = more security for your chain

- Also means higher yields for the LPs

- Has an easier onboarding process for Cosmos SDK chains because most of their liquidity is already on Osmosis

- Will only add security to the respective native chains (such as Akash in the example above) and make liquidity on Osmosis more appealing:

- More security for the other Cosmos SDK chain

- Higher APRs for LPs who do not need to decide between farming incentives or securing the chain - do both at the same time without the need for liquid staking derivatives

- Will only add security to the respective native chains (such as Akash in the example above) and make liquidity on Osmosis more appealing:

4. Saga

- Saga is a Cosmos Zone aiming to provide shared security for thousands of chains with a focus on gaming and entertainment chains.

- Can read more about Saga in their whitepaper

Top market participants and protocols

Overall activity in Cosmos is relatively nascent when compared to more mature ecosystems such as Ethereum. Some of the top market participants in the space are outlined below. These are the largest chains by IBC volume (at the time of writing) which is a proxy metric for the popularity of a protocol. These are very likely to change but will provide a good baseline of the top blockchains today.

Osmosis

Osmosis is an app-chain focused on creating a DeFi hub of Cosmos. Its core product is a DEX, powered by an AMM design, and offers a diverse amount of pools for users to interact with. On top of its core product, they have permissioned smart contract functionality where other apps can be built on top of it. The easiest way to understand what Osmosis is building is to compare it to Binance, but a decentralized version of it. Similar to how Binance has its core functionality as an exchange, it also has complimentary products that compliment the core product. Osmosis is currently emulating that vision and will be offering lending, leverage, synthetic assets, dollar cost averaging, and much more. Given Osmosis is decentralized, it allows any market participants to use their products without enforcing KYC. Being an IBC-enabled chain, all of Osmosis’s assets and liquidity can be accessed by any other IBC-enabled Cosmos chain via the token transfer module or via more composable methods such as Interchain Accounts - both of which are modules built on top of IBC.

Cosmos Hub

The Cosmos Hub was the first instance of a PoS chain and it hosts the ATOM token and provides public funding to other Cosmos chains. Much of the core tooling and infrastructure of the Cosmos ecosystem today was spearheaded by the Cosmos Hub and it leads in the R&D for protocol development on Cosmos. Today, many chains airdrop tokens to ATOM stakers on the Cosmos Hub to tap into its diverse community and to get access to the diverse validator set. The Cosmos hub is based on credible neutrality and Hub minimalism, ensuring that other chains can be fully sovereign with complete autonomy over their chains, while also being interoperable over IBC.

The Cosmos Hub is working on many new initiatives to bring access to the Interchain, including Interchain Security and IBC routing as a service. These are key initiatives that will help push forward more development in the Cosmos ecosystem. The Cosmos Hub refers to a specific chain, not the entire Cosmos ecosystem. The naming is confusing but that is a clear distinction that should be made for understanding the broader ecosystem.

Juno

Juno Network is a ‘sister chain’ to the Cosmos Hub. It is a fully sovereign chain that is bringing fully permissionless smart contract development to the Cosmos ecosystem. Most other chains have permissioned smart contracts but Juno allows anyone to deploy apps there. They have a vibrant developer community and bootstrapped a diverse validator set with decentralization as a core primitive. They have launched many notable apps - JunoSwap, the DAO DAO, and many other initiatives. They intend on being the home of CosmWasm, the fastest growing VM in the Cosmos ecosystem. Tools such as the DAO DAO are built as CosmWasm contracts, so any other Cosmos chain can integrate them such as Osmosis and the Cosmos Hub.

Blue Chips

This section covers some of the top applications built on top of the chains mentioned above, along with some of the chains’ core functionalities. Note that there will be a lot of overlap given that the chains are application specific.

Osmosis

Although Osmosis was laid out as one of the top participants, its AMM has proved crucial for all Cosmos assets to find liquidity for the first time. If a user wants to get exposure to any Cosmos native asset or any CW-20 token, then they will likely have to make the swap via Osmosis’s DEX given that is where a majority of the liquidity is. Users can choose to farm certain pools and earn OSMO, as well as external incentives. To get a holistic view of these yields, visit Dexmos.

Osmosis has two frontends as it currently stands:

- The main frontend

- These are official pools approved by governance and are often incentivized via OSMO incentives.

- All of the bridged ERC-20 assets are Axelar canonical versions as it is the main bridge provider for Osmosis

- The frontier

- This frontend has all of the pools in the main frontend AND permissionless pools that are NOT approved by governance.

- Although there is an overlap of the pools, the pools only listed on Frontier do NOT have OSMO incentives (can have external incentives which can be viewed on Dexmos).

- Contains any bridged asset and any CW-20 tokens. Multiple bridged assets mean different canonical representations of the same asset. Ex: g-USDC and axl-USDC.

The reason they have 2 frontends is to ensure the UX of the trading experience is best for the user. Given each new bridged version of a token is not fungible with one another, which leads to fragmented liquidity and poor UX when there are 5 different versions of the same token. They will bring on an official bridge provider for the main frontend (Axelar), but the Frontier frontend will always remain permissionless for other bridged assets to find liquidity.

Other notable applications launching on top of Osmosis include:

- Mars: A lending protocol that allows for contract-to-contract lending. This will replace what was called Isotonic, the two have merged into Mars. It was formerly deployed on Terra but will be launching its own chain with many ‘outposts’ with the first being on Osmosis.

- Void Protocol: A privacy application launching on Osmosis that allows for private transactions and swaps. It is similar to what Tornado Cash is on Ethereum.

- Ion DAO: Ion is a token that launched with the genesis of Osmosis. The team was originally working on synthetic protocol but has pivoted since. The team is spearheaded by Alphaworks and they are experimenting with a few separate ideas such as an overcollateralized stablecoin model similar to MakerDAO. The roadmap is still a bit unclear but the Osmosis team and Ion DAO are committed to bringing utility to the ION token.

- Kado: Fiat on-ramps for stablecoins, currently working on bringing over USDC via the Axelar bridge but will be expanding to other tokens in the future.

- Phase: Dollar cost averaging (DCA) and automated trading strategies

- Defund: multichain ETFs

- Saage: sports betting protocol

- 4k: bringing physical assets on-chain

- Apollo Safe: multi-sig manager and other key tooling

- Membrane: tokenized debt protocol that allows for margin, borrowing, and credit

- Streamswap: upgrade of the existing LBP

- Autonomy: automation protocol to allow for limit orders, stop losses - anything with conditional logic on-chain

The rest of the dApps and tooling can be found here.

Best Aggregators/DEXs

- Best place for liquidity and incentives for Cosmos SDK tokens and CW-20 tokens.

- Best place for the long tail of CW-20 tokens that can include niche DAO tokens and other things unique to Juno Network and beyond.

SiennaSwap/Secret Swap

Sienna Swap:website Secret Swap: website

Best place for swapping sTokens, which are wrapped tokens on the Secret Network that ensure privacy. They have secret versions of stables, Cosmos tokens and other ERC-20 tokens.

Multiple bridges from Ethereum mainnet, Monero, Binance Smart Chain and of course IBC transfers from Tendermint chains.

Decentralized Derivative DEXs

Injective Protocol

- Injectice is its own chain with a fully on-chain orberbook that has many markets for spot and perpetuals

- Can use their bridge to bring funds over from Ethereum

- Can use IBC to bring Cosmos native coins to trade

- They recently launched a BAYC perp as well but there are very little volumes across most of their market in comparison to other derivatives exchanges

dYdX

dYdX is one of the biggest derivatives exchanges on StarkEx (Starkware app-specific rollup) whose volumes have exceeded competing CEXs such as Coinbase.

They announced they will be launching their own Cosmos chain for its v4 to offer a better product and further decentralize certain components of the stack

NFT Collections and Metaverses

NFTs are rather early in the Cosmos ecosystem, but there are a few chains, marketplaces and NFTs that have launched.

Stargaze

Stargaze is a Zone on Cosmos that is focused on bringing an NFT marketplace to the Cosmos ecosystem. They just had some genesis mints but will be opening up the marketplace soon. It is IBC enabled so the marketplace can have interoperability with other marketplaces and NFT collections on other chains - meaning NFTs can flow across chains which opens up a huge design space for NFT utilities on multiple chains. It is currently in the top 5 chains by IBC volume and the marketplace hasn't even launched yet. Being its own L1 it can offer unique mechanisms such as the ability to stake your NFTs to receive 45% of block rewards.

Passage <> Strangeclan

Passage is a platform supporting a suite of features for metaverse integrations - a built-in NFT marketplace, play-to-earn games, in-platform 3D land powered by Unreal Engine and profit sharing with its token holders. Passage launched their NFT marketplace on Juno at the end of February. To start, the marketplace will only be for Strange Clan’s NFTs using the CW-721 standard but will soon expand to support other NFTs. Passage is able to be streamed on any device, from a smartphone to a desktop and they partnered with Akash Network to help stream high-resolution graphics for its cloud compute.

Passage is creating an ecosystem built for the metaverse, with Strange Clan being the first 3D play-to-earn game to launch there. They have built out their platform to support many customizable 3D worlds and facilitate the development and modification of the games on it. Strangeclan is an adventure game with varying quests, battles and in-game items to be traded on the marketplace. Passage will provide the key marketplace for characters and in-game items to be sold. Although Passage is mainly building out their marketplace for Strangeclan, it will eventually be open to any IBC-enabled NFT on any chain for a 3% transaction fee (which covers the cloud compute costs). Given it is built on Juno, Passage will be able to compose with every NFT on other Cosmos chains via IBC which uses the same token standards. It is demonstrating this cross-chain NFT composability with its recent partnership with Stargaze, an L1 focused on NFTs.

PASG is the token that powers the Passage platform, offering incentives to stake your tokens to receive discounted fees, profit-sharing rewards, discounts on marketplace transactions and much more.

Omniflix

Omniflix is its own Zone focused on creators and communities to gain access to NFTs and social tokens. They aim on creating sovereign networks that are created by record labels, studios and other agencies. Users can mint, manage and monetize NFTs with a specific focus on creators. Their main focus is on media and content creators alike.

DAO Developments

One of the most interesting projects on Juno is the DAO DAO, which is a DAO that builds tools for building DAOs. The DAO DAO exists as a set of CosmWasm contracts that can be used by any Cosmos chain using CosmWasm. The main developer activity is happening on Juno and they have provided a UI for all DAO activities: voting, creating, deploying or joining DAOs in just a few clicks and without any coding necessary. These DAOs are built to be inherently cross-chain, using IBC, these DAO tokens can be sent to any IBC-enabled chain. Their technical stack involves building out smart contracts in Rust and they remain in Beta, but their v1 DAO contracts have just completed their first audit.

Over 2,550 DAOs have already been created using the DAO DAO stack at the time of writing. Although there is an extreme variance in DAO quality, this speaks volumes for the ease of use of the DAO DAO framework and its scale at just a few months old. Many are excited to see the development of DAOs on Juno and believe the DAO DAO is positioned to play a key role in the future design of DAOs across the interchain. There is even discussion for using the DAO DAO CosmWasm implementation to support an IBC DAO natively on the Cosmos Hub - the DAO DAO is becoming a core building block for any interchain DAO.

There is other complimentary DAO tooling being developed on Juno. Another notable mention is DAO Up, which is a crowdfunding platform for DAOs that is fully integrated with the DAO DAO. DAO Up provides a transparent system for creators and backers - if a funding goal is not met, backers are guaranteed refunds. Users that decide to back a DAO through DAO Up, can become part of the project and its community which is guaranteed by having successful campaigns having their treasury sent to a DAO controlled by the backers. DAO Up is another building block in the DAO stack for Juno, allowing users to set funding goals, tokens to fundraise and to compose with existing DAOs from the DAO DAO.

To contextualize the 3 apps mentioned above, let's give an example that connects them together. One can create a DAO using the DAO DAO tooling, fundraise it via DAO Up, and can immediately find liquidity for these tokens via JunoSwap - the pieces are coming together.

Fiat Onramps

The easiest fiat onramp is to buy ATOM on a CEX and send them to your Cosmos wallet on Keplr. These are the most liquid assets on CEXs and you can send them directly to your address on Keplr. Wallets for each chain are denoted by the chain prefix in the wallet. For the Cosmos Hub it is ‘cosmos-’.

However, Kado is working on fiat onramp solutions to bring stablecoins and Cosmos SDK assets accessible on Osmosis. They are currently working on these solutions as well as Circle, who is working on bringing native USDC to the Cosmos ecosystem.

Easiest way to bridge from Ethereum

There are many bridges to Ethereum and no clear winner in terms of liquidity as of yet. Given the majority of activity and overall liquidity of Cosmos is on Osmosis, the canonical bridge provider (Axelar) will likely end up being the dominant bridge for most of the Cosmos ecosystem (until IBC connects all chains).

As of now, there are multiple options. One can use Axelar (Satellite), Wormhole (Portal), The Gravity Bridge, or the specific bridges into an ecosystem - Injective Protocol Bridge, Secret Network Bridge, Umee Bridge as well as any others not mentioned. Users can bridge assets over any of these bridges but these assets are not fungible with one another so it is important to view the dominant canonical asset of the application you intend on using.

After Axelar has been voted in as the main bridge provider for Osmosis, much of the liquidity for ERC-20 tokens is bridged over Axelar. They have a $20.50 fee for bridging and funds arrive in a few minutes.

Trust/Security assumptions

Each chain has varying security assumptions based on multiple factors. Thus, all chain security is not created equal in Cosmos, and users must recognize this risk when interacting with different chains. When users are sending funds to other chains, they are assuming the risk of that chain. For instance, if a user sends ATOM to Kava, then the ATOM on Kava is subject to the risk of the Kava security where 3 validators (⅔ are CEX validators) control over 45% of the stake. This is to highlight the security differences between separate Cosmos chains.

Shared Security Solutions

There are multiple solutions to working on better shared security in Cosmos. They are all listed more in-depth above, to reiterate, the 4 solutions are listed below.

- Interchain Security from the Cosmos Hub or other chains that implement ICS

- Rollup shared security from Celestia

- Interfluid Staking from Osmosis

- Saga shared security

Scaling Roadmap

Cosmos scales by having many independent Zones, so the scaling roadmap will vary by each chain depending on the level of activity and traction they receive. For instance, generalized smart contract chains will face different scaling obstacles in comparison to app-chains with a limited set of permissioned apps co-located on the same chain. There are multiple scaling roadmaps at the chain level, with Celestia leading the rollup space. Each chain itself is built on Tendermint which currently has a soft capacity of 150 validators per chain, but theoretically, developers have “infinite” horizontal scalability given you can always spin up a new chain that can be interconnected via IBC if one chain becomes too congested. Of course, this brings other security assumptions among other things, but most Cosmos chains are app chains so they have so far been able to limit the bloat on their chains - only host apps that compliment the core product. The scaling roadmap will vary for each chain that might decide to pursue layer-2 solutions or to spin up more chains - this is entirely up to the specific app-chains who decide on their scalability roadmap.

However, MEV guarantees that any chain with a sufficient amount of financial activity will always be expensive. This means that every L1 chain that launches within Cosmos that gains any traction will have to face MEV in some form or another.

Tendermint consensus itself is being tested to have faster block times and larger validator sets as seen with Quicksilver which has over 500 validators that are equally weighted with 6-second block times in their current testnet. Other chains are experimenting with 2 second block times as well which will increase scalability. Thus, changes are being made at the consensus level to create more scalability in addition to the current scaling road that app-chains have currently available.

What Would Cause Cosmos to Fail?

The Cosmos ecosystem is a Layer-0 protocol, so the failure is subject to each individual chain. Thus, the IBC and protocol features will always exist for the entire ecosystem, although specific chains on Cosmos can fail on an individual basis. For instance, if the Chihuahua chain ultimately fails and the chain is corrupted, all of the other chains on Cosmos will continue to function as always. Recently, the Juno Network was halted (Cosmos chains prefer safety over liveness) but Osmosis continued to process trades. Although the individual channels between Juno and Osmosis were backed up during the halt, Osmosis and other chains functioned normally. This is a key design feature for the Cosmos ecosystem, that limits the failures of each chain to not affect the entire ecosystem. A final example demonstrating this limited blast radius is best seen with the recent fall of Terra. Any chain that decided to be interoperable with Terra, was directly affected by the sudden price drop. Osmosis suffered the most given $OSMO pairs were very heavily in $LUNA and $UST pools which brought a lot of downward price action on the $OSMO token as people exited their UST and LUNA positions. However, the Osmosis blockchain continued to work and produce blocks as it normally would.

As for the Cosmos ecosystem to fail in general, it would mean that a more monolithic world plays out with 1 chain winning a majority of the market share. This can be Ethereum and the layer 2 roadmap being a winner takes most model and all of the activity moves back there. This seems unlikely for many reasons and app-chains on Cosmos offer a differentiated design space in comparison to layer 2s on Ethereum. This is a key differentiator and opportunity for a world of layer 2s and app-chains to compliment each other. With that being said, most applications might decide to launch as an Ethereum layer-2 which can reduce the number of app-chains on Cosmos. However, as seen with dYdX’s recent move to its own app-chain from an Ethereum layer-2, the market is waking up to the modularity and progressive decentralization the Cosmos stack offers.

The 3rd possibility of the Cosmos ecosystem failing would be losing out against other multichain competitors such as Polkadot, Avalanche or NEAR. However, based on today's development, it seems like the Cosmos SDK is years ahead of many others and these other layer-0s are mostly launching EVM chains on a different consensus engine or lack a trustless cross-chain interoperability standard like IBC. Instead, many of the other multi-chain solutions are looking to connect to the Cosmos Ecosystem via IBC such as examples that can be seen here and here. Even if the traction of these other chains surpasses Cosmos, the underlying architecture and token standards used in IBC are being shared among all of them - an interoperability protocol that is chain-agnostic for anyone to use. Even all of the predominant trusted cross-chain communication protocols such as Axelar, LayerZero, Wormhole and Composable Finance are integrating IBC in some capacity - examples include adopting the data standards or using IBC as the transport layer. The Cosmos stack is agnostic to all other chains.

What Would Cause Cosmos to Succeed?

A multichain world plays out with the Cosmos stack set to provide the key tooling, infrastructure and connectivity for any chain to compose with. If things such as Interchain Security and Interchain Accounts (just implemented by the Cosmos Hub) gain adoption, then Cosmos will have the composability of the EVM and a spectrum of shared security for its chains to take advantage of. To read our full thesis on Cosmos, check out our report here.

Wallet setup/recommendation and how to react if transactions are failing/not going through?

- Fun video tutorial setting up your Keplr wallet, funding it and using IBC on Keplr.

- Once you send a token transfer, it will be in the queue. If for some reason the transaction was not sent to the destination chain, do NOT resend the same transaction.

- Unlike Ethereum where users can speed up transactions by paying more gas for fees, IBC transactions are sent over channels that are relayed by off-chain relayers. Sending more transactions further backs up the queue and is redundant, it is best to just wait for the relayer to come back online and process the queue of transactions.

- Check out the status of the channels here and it works for all supported IBC chains

- Toggle with the chains at the top and navigate to the relayer tab to get a real-time update