Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Bitget (the "Customer") at the time of publication. While Bitget has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

A Look at The Recent CEX Landscape

FTX was the poster child of CeFi, endorsed by celebrities and even sponsoring stadiums. However, behind the scenes the exchange had been commingling client funds with its market maker Alameda, losing $4b in customer deposits and ultimately filing for bankruptcy. This caused shockwaves throughout the industry, with faith in centralized exchanges plummeting. This report seeks to examine the CEX landscape post-FTX and the general trends we see, backed by data.

Renewed Focus on Credibility

FTX and the market downturn has placed the emphasis firmly on CEX’s credibility, with users’ trust plummeting. Since then, users are demanding more transparency from exchanges, which has put a focus on Proof of Reserves and protection funds.

Proof of Reserve

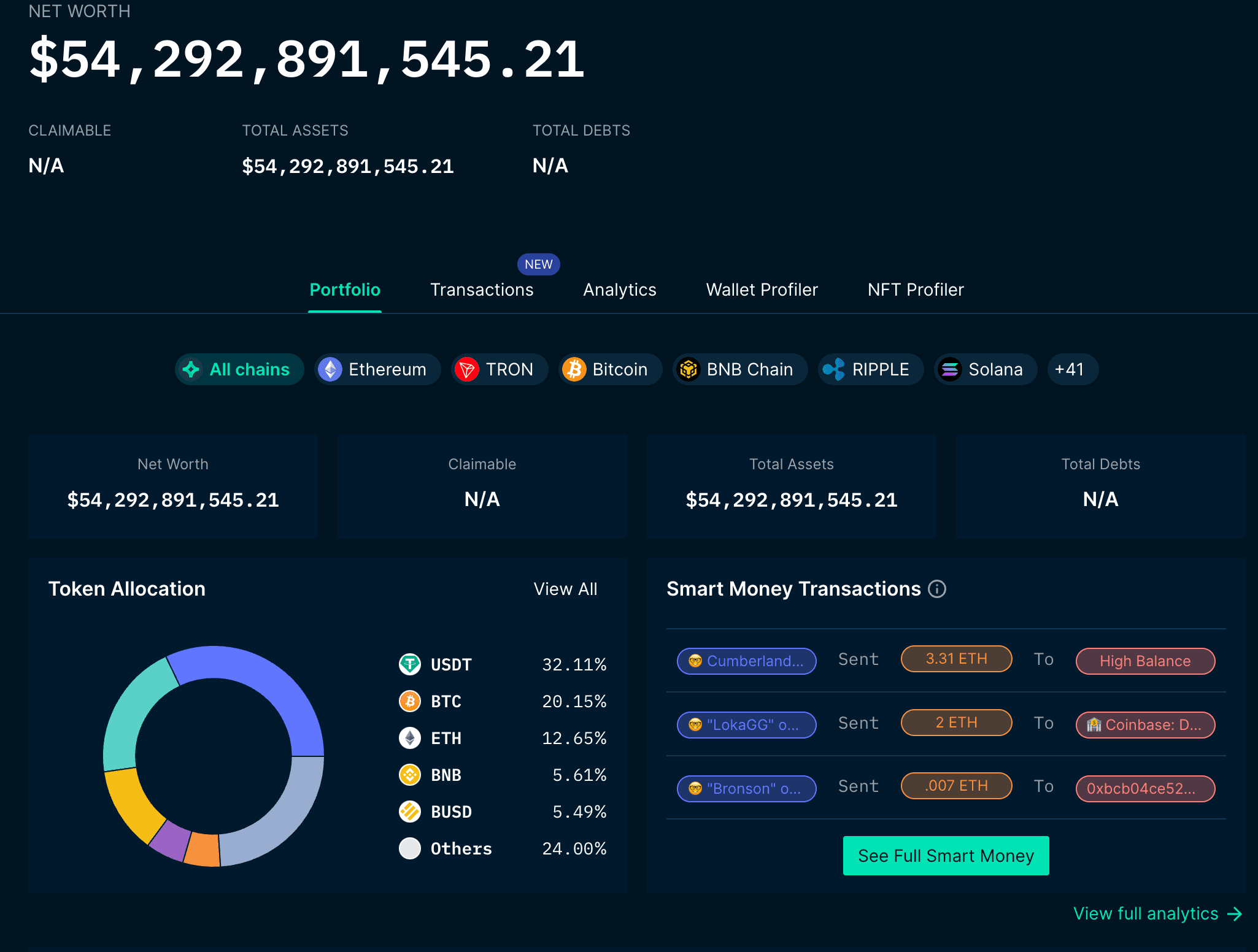

Many exchanges started offering Proof of Reserves in response to the FTX crash. In this context, Proof of Reserve refers to when a CEX makes a public declaration about their reserve assets. This is usually accomplished through an independent audit. Its purpose is to provide transparent and verifiable evidence that an exchange possesses sufficient assets to back customer deposits.

While it is a step in the right direction, PoR does not guarantee an exchange's solvency without an accompanying breakdown of liabilities. This makes it insufficient to fully rely on. A Proof of Liabilities would be an enhancement but is off-chain and requires an independent audit. Audits themselves have proven problematic, with FTX receiving two before its collapse.

Below is an example of Binance’s Proof of Reserves as seen on Nansen:

Check out Nansen’s data on exchange reserves here.

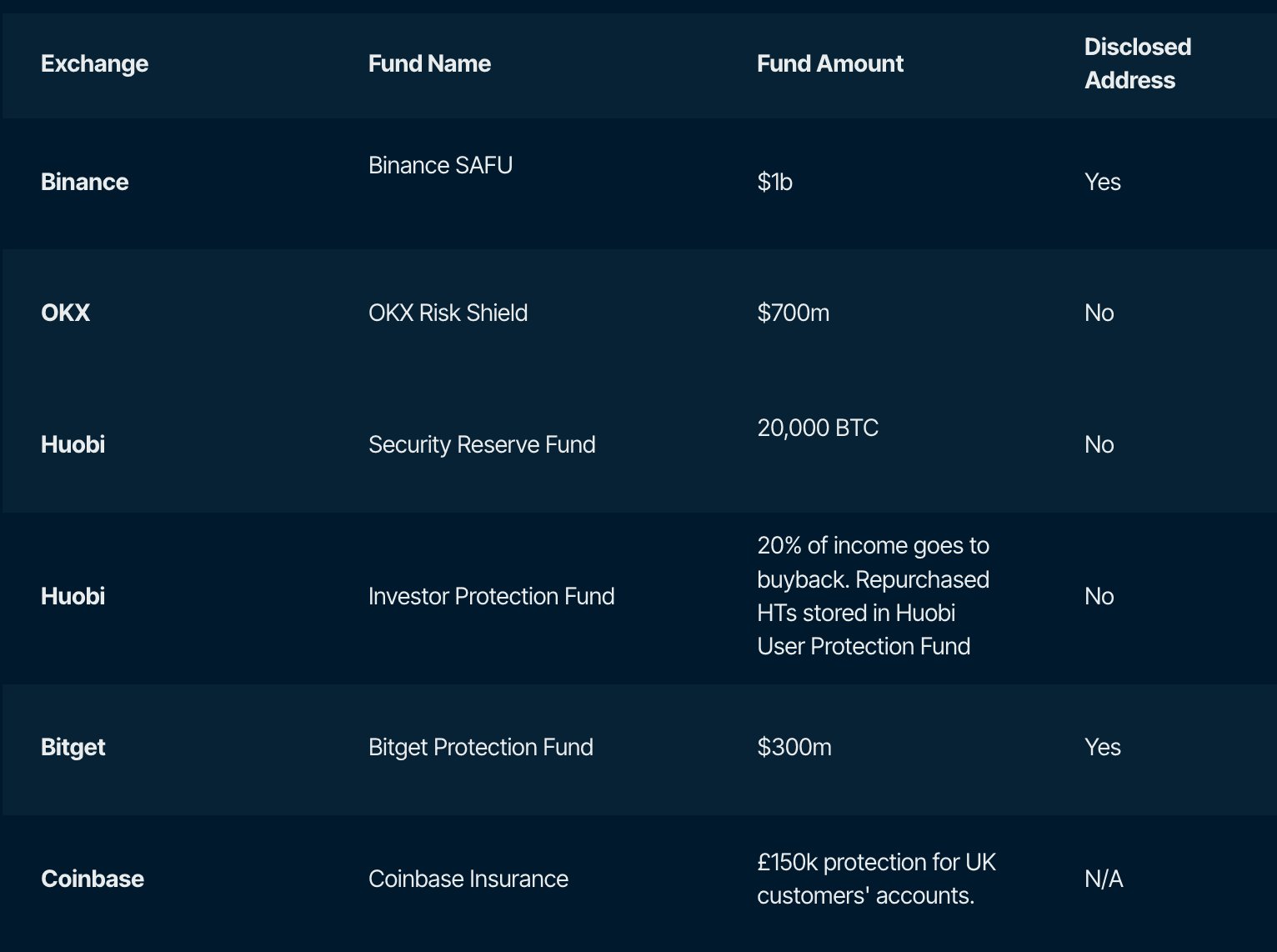

Protection Funds

The purpose of protection funds is to have a buffer in the event that an exchange loses its customer’s assets. By establishing a protection fund, exchanges aim to give their customers confidence that in the event of a hack, the exchange will have funds to cover deposits (so long as the fund size exceeds that of the hack). This practice can be viewed as an overcollateralization of customer deposits.

Even with a protection fund, implementing best practices in risk management, such as distributing funds across multiple locations, is of paramount importance to effectively mitigate the impact of various types of hacks. Following the FTX collapse, Binance topped up the dollar value of their fund from $735m to $1b. Similarly, Bitget raised its protection fund from $200m to $300m.

Below is a table of some of the largest protection funds in the industry. It is worth noting that of the exchanges studied in this report, Binance and Bitget were the only ones to disclose the wallet addresses for protection funds at the time of writing:

Proof of Reserves should become the minimum standard in the exchange industry, However, as stated above, these are both positive indicators for an exchange but do not guarantee its solvency.

A Look at Changes to the CEX Landscape

Total Trading Volume

Binance has maintained relatively stable volumes following the fall of FTX, with the 6 months prior having a monthly average of $470b and the 5 months after having an average of $428.4b. This means that volumes have remained relatively constant, albeit with a fall of approximately 10%. Note that trading volumes may be an indicator of an exchange's success but can also be manipulated through wash trading for example.

Below is the monthly exchange volume for 10 selected exchanges in the months following FTX. Note that this doesn't represent the entire industry but features prominent exchanges that have proven popular with users.

Spot Trading Volume

The data shows that there has been a slight decrease in spot trading in the 6 months following the FTX collapse. The large spike in late March can be attributed to the Arbitrum airdrop frenzy. Most exchanges took a hit on their spot trading volumes, with Bybit and Kraken notable exceptions, who managed to increase their volume.

Meanwhile, DEX trading volume has remained relatively stable over the same time period. The relative increase in DEX trading may be attributed to lesser trust in centralized exchanges following FTX’s collapse, in addition to further regulatory uncertainty.

| Exchange | Average Monthly Volume 6 months prior to FTX | Average Monthly Volume 6 months post-FTX | % change |

|---|---|---|---|

| Binance | $444,846,793,973 | $443,971,267,092 | -0.20% |

| Coinbase | $52,455,579,125 | $46,097,206,424 | -12.12% |

| OKX | $51,544,501,625 | $40,057,738,909 | -22.29% |

| Kucoin | $36,518,939,797 | $21,472,435,500 | -41.20% |

| Gate.io | $33,468,311,551 | $24,451,747,376 | -26.94% |

| Bitget | $18,495,048,328 | $17,146,262,185 | -7.29% |

| Bybit | $16,875,422,624 | $18,166,078,752 | 7.65% |

| Kraken | $16,539,668,655 | $18,913,409,621 | 14.35% |

| Bitfinex | $12,406,734,154 | $5,025,548,124 | -59.49% |

| Bitstamp | $5,135,799,390 | $4,678,174,714 | -8.91% |

(Data as of 31st May 2023).

Derivatives Trading Volume

Note that this doesn't represent the entire industry but features prominent exchanges that have proven popular with users.

Derivatives trading volume in the industry has experienced a small decline. A spike was observed following the FTX collapse in early November, followed by a general decline. However, since mid-January, volumes have recovered and remain at similar levels to that before the crash.

| Exchange | Average Monthly Volume 6 months prior to FTX | Average Monthly Volume 6 months post-FTX | % change |

|---|---|---|---|

| Binance | $1,494,296,902,115 | $1,301,352,479,460 | -12.91% |

| OKX | $432,703,834,261 | $358,540,678,655 | -17.14% |

| Bybit | $293,343,407,238 | $278,747,847,699 | -4.98% |

| Bitget | $194,683,684,498 | $204,121,830,772 | 4.85% |

| Kucoin | $106,623,098,789 | $62,921,839,503 | -40.99% |

| Gate.io | $72,893,116,178 | $48,310,422,646 | -33.72% |

| Deribit | $18,592,657,758 | 14,701,196,057 | -20.93% |

| Kraken | $4,506,845,817 | $3,621,258,096 | -19.65% |

| Bitfinex | $3,641,574,575 | $2,177,235,866 | -40.21% |

(Data as of 31st May 2023).

FTX was initially best known for its leading derivatives business. Derivatives trading is down among the top CEXs, with the exception of Bitget, who managed to grow their trading volume in the 6 months following FTX.

Exchanges that have performed relatively well over the period following the FTX collapse include:

- Bitget

- Bybit

- Binance

Overall, Bitget is notable in managing to capture additional volume. Bybit and Binance saw small declines but overall managed to maintain the majority of their volume (and grow their market share), whereas other exchanges saw more significant drops. This may also be attributable to the general downtrend in activity and the bear market.

Variety of Listed Coins

Different exchanges take different approaches to listings. For example, Binance only onboard projects that have demonstrated considerable interest and trading volumes elsewhere. In comparison, Gate.io takes a far more lenient approach and has listed a large number of tokens from projects that haven’t yet been listed for initial exchange offerings (IEOs).

Since the collapse of FTX, certain exchanges have been more reactionary to users’ needs and trends in the market. Let’s take the example of BRC-20s which grew to a $1b market cap within 3 months of launching.

The first four exchanges to launch BRC-20s were Gate, Bitmart, Digfinex, and Bitget.

- Gate.io

- Listed ORDI on May 8th.

- Bitmart

- Listed ORDI on May 8th.

- Digifinex

- Listed ORDI on May 9th.

- Bitget

- Listed ORDI on May 10th.

Listing new coins rapidly is key to serving users’ ever-changing needs, and many traders can benefit from access to new tokens. However, an exchange must balance listing coins while protecting users from scams. This is important to preserve the exchange's reputation and is why the largest exchanges such as Coinbase, Binance, and Kraken take a more conservative approach to listings. However, being slow can have drawbacks for exchanges, such as missing out on trading volumes for popular tokens and narratives like the recent memecoin season.

Legal Landscape

Looming regulations for DeFi and tokens, in general, may pose some significant challenges for exchanges. The SEC Chair Gary Gensler has posited that nearly all tokens are securities. This has prevented many exchanges from operating in the US. If the US takes this official position, it could cause significant issues throughout the world for CEXs. It will be worth carefully monitoring the position taken here.

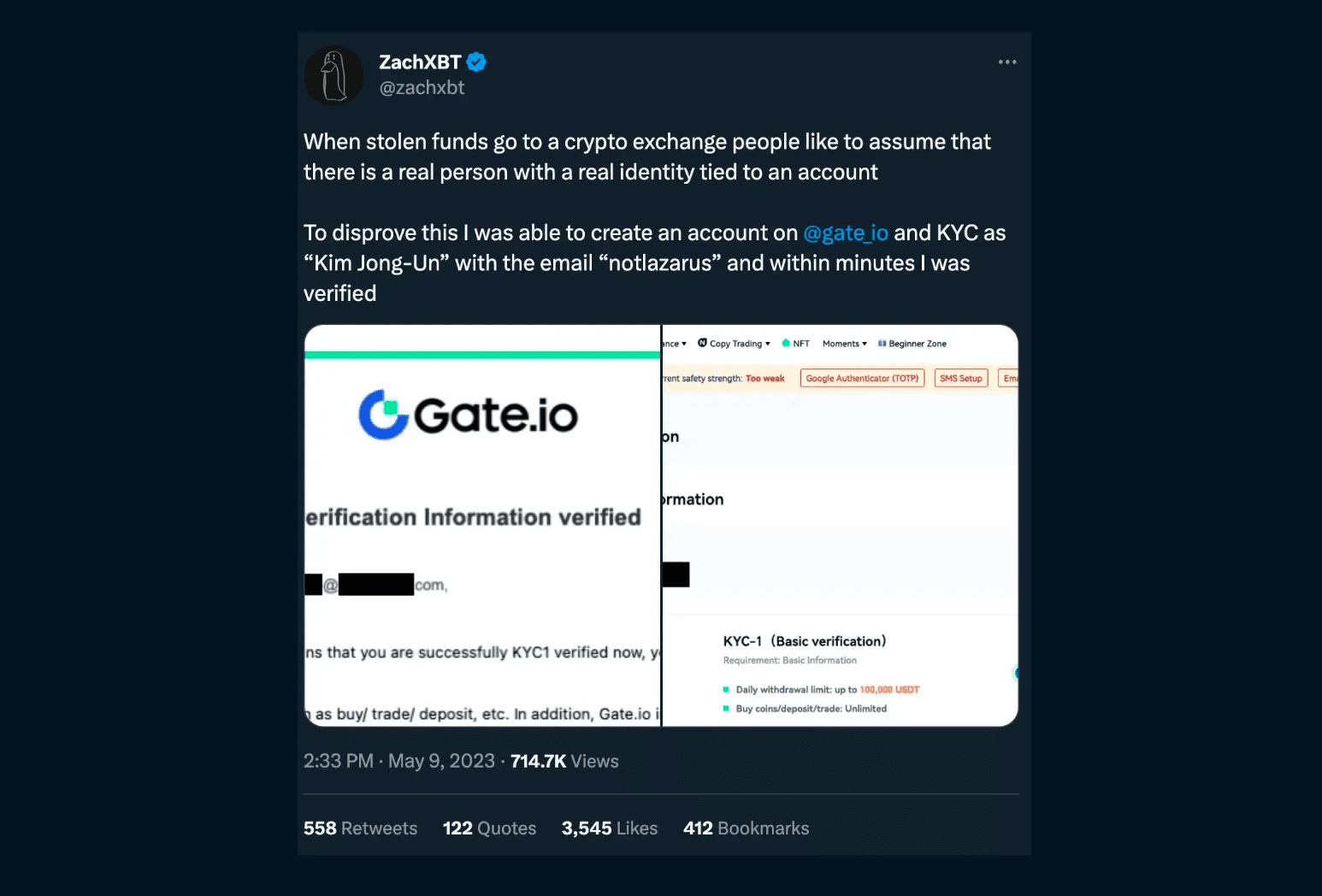

Exchanges also have varying requirements for KYC and Anti Money Laundering measures. These are very important for the exchange’s legitimacy and to ensure that it can continue operating in various jurisdictions. In addition, CEXs that are found to have enabled criminal activity due to inadequate safeguards suffer reputational blows. An example is zachXBT who alleged that he signed up to a Gate account with the name of ‘Kim Jong-Un’ and an email referring to Lazarus, the North Korean-affiliated hacking group.

Exchange Tokens

Several exchanges have listed tokens to incentivize users on their platforms. The following diagram shows the top 10 coins by market capitalization and their performance following FTX’s demise. Notable outperformers are MX, BGB, and OKB. These three coins have performed very strongly in the bear market and remain near their all-time highs.

MX

MX provides additional utility and benefits to users of the exchange. Furthermore, MEXC uses 40% of its profits to buy back and burn MX every quarter to keep the token’s circulating supply at 100 million.

BGB

BGB’s utilities relate to improving the user experience for Bitget customers with lower fees, access to exclusive products and more. Bitget is expected to do a buyback and burn program in the near future for BGB. Read more here.

OKB

OKB also is an access token to numerous products and perks on the platform. It conducts a buyback and burn each quarter, depending on “seasonal market and operating performance”. In the last report, they bought and burnt the equivalent of $177m over a 3-month period.

The effect of buyback and burning on token price is controversial, with some arguing it creates no value. However, with strong and consistent cash flows, the buying pressure from it can contribute to stronger token performance.

BNB

BNB is by far the largest CEX token by market cap. It is the gas token for BNB Chain, and also unlocks various features and benefits on Binance. It has an auto burn to keep the supply around 100m BNB, with burns depending on the price of BNB and the number of blocks generated on BNB Chain during the quarter.

| Coin | Market Cap Dec 11 | Market Cap May 31st | Market Cap Change % | Market Cap Rank Change |

|---|---|---|---|---|

| BNB | $46,979,017,087 | $49,203,273,431 | 4.73% | 0 |

| LEO | $3,488,512,992 | $3,273,182,388 | -6.17% | -1 |

| OKB | $1,260,000,000 | $2,824,590,503 | 124% | 11 |

| CRO | $1,627,558,635 | $1,517,251,739 | -6.78% | -8 |

| KCS | $644,158,344 | $724,462,669 | 12.47% | -8 |

| GT | $521,729,756 | $682,900,090 | 30.89% | 0 |

| BGB | $257,451,084 | $642,820,217 | 149.69% | 46 |

| HT | $844,600,347 | $517,479,104 | -38.73% | -33 |

| WOO | $149,541,470 | $385,850,967 | 158.02% | 74 |

| MX | $82,524,714 | $307,214,504 | 272.27% | 128 |

(Data as of 31st May 2023).

The above table shows the performance of CEX tokens since December until May 31st. MX, WOO and BGB are notable outperformers, with HT suffering the most notable decline.

Track Record

An exchange’s track record is important for its legitimacy. In fact, the majority of CEXs have experienced a hack in their lifetime with some never fully recovering their market share. Over $2.85b has been lost to hacks since 2012. Since FTX’s collapse, no top exchange has been hacked directly. However, hacks include:

- GDAC was hacked in April 2023 for $13m.

- Bittrue was hacked in April 2023 for $23m.

CEXs remain vulnerable to hacks, making strong risk management and protection funds more important than ever to ensure customers do not suffer losses in unforeseen circumstances.

Exploring the Latest CEX Trends

CEXs have also increasingly embraced the development of Web3 products. Coinbase, for instance, not only offers its own self-custody wallet but also plans to launch its L2 (Base) operating on the OP stack. Binance obviously launched BNB Chain and is extremely active in investing in the wider ecosystem. Similarly, Bitget has introduced MegaSwap, a DeFi aggregator enabling users to conveniently swap tokens, resembling typical DEXs. Additionally, in light of the remarkable success of NFT marketplaces during the previous bull market, major exchanges like Binance and Coinbase have launched their own NFT platforms, aiming to capture a portion of the NFT volume and associated fees.

Copy Trading

Another popular feature in CEXs is copy trading. Copy trading allows users to follow the strategies of top traders on the platform. This is done by users who wish to piggyback on others who are perceived to be high-quality traders.

An important difference with on-chain copy trading is that traders are required to explicitly grant permission to the exchange for others to replicate their trades. Conversely, on-chain copy trading is permissionless, enabling anyone to replicate trades from any address.

Some examples of exchanges that offer copy trading are:

- Bitget

- ByBit

- OKX

- Gate.io

The above exchanges provide copy trading services for both spot and futures trading.

Bitget's copy trade has over 100,000 lead traders and 490,000 copy traders according to their website. Lead traders can earn up to 10% in commissions by sharing their strategies, and there are specific requirements and an application process to become a trader.

Bybit has stated that 150,000 copy traders have utilized their copy trading feature, which provides access to over 7,000 lead traders to copy from. Lead traders can be sorted according to their 7-day win rate, 3-week win rate, and 7-day PnL and are entitled to receive 10% of the profits generated from their copy traders. Various parameters can be customized, including size, leverage, stop loss, and other relevant factors.

On OKX, 58 tokens are available for copy trading, and 1,489 lead traders to choose from. Fees are the same as regular trading fees, with a 10% profit share given to lead traders. Users can copy up to five different traders. Spread protection is provided, and maximum investment amounts can be set. Lead traders can have a maximum of 50 trades per day and can only close positions with market orders.

Gate.io currently counts 828 lead traders and offers them a 5% share in the profits generated by copy traders.

Things to consider when copy trading include track record, performance metrics, trading strategy, risk alignment, and community engagement (number of followers). It is also considered good practice to diversify the selection of traders to copy to reduce overall portfolio risk.

| Exchange | Lead traders | Followers | Commission | Trading Pairs | Max followings |

|---|---|---|---|---|---|

| Bitget | 100,000 | 490,000 | Up to 10% | 50 | Unlimited |

| ByBit | 7,000 | 150,000 | 10% | 78 | 10 |

| OKX | 1,489 | N/A | 10% | 58 | 5 |

| Gate.io | 828 | N/A | 5% | 34 | Unlimited |

Exchange’s Ecosystem Work

Many users are increasingly expecting CEXs to be involved and contribute to the wider crypto ecosystem.

Coinbase

In February 2023, Coinbase announced the testnet launch of BASE, an Optimistic Rollup on Ethereum built with the OP stack. This is in line with the Superchain vision, where there will be a number of interconnected rollups built with the OP stack. Coinbase has partnered with the Optimism core development team and has committed to decentralizing the sequencer in the future. This appears to show Coinbase’s movement on-chain and into the wider ecosystem, rather than maintaining all operations centralized.

Binance

Binance deployed a $1b ‘Recovery Fund’ following the FTX crash to provide capital to distressed but otherwise strong projects suffering as a result of the market turmoil. As of March, 18 organizations had joined the fund, bringing it to $1.1b. This shows a commitment to the wider industry from the exchange.

Bitget

In April, Bitget announced an Asia-focused $100m venture capital fund. It has started expanding more into the ecosystem, with an acquisition of Bitkeep in March 2023. The exchange also works with fetch.ai and CORE DAO to co-develop their ecosystems.

What Exchanges Will Succeed?

History has taught us that people will not want to have all their coins on one exchange. Different exchanges fulfil different purposes, and depending on global regulatory developments there is likely room for a number of large, geographically and legally distributed exchanges. Exchanges that actively contribute to the ecosystem should gain more favor and trust from users. Arguably most importantly, exchanges will need to demonstrate themselves to be secure, transparent and ‘trustworthy’ to thrive, in addition to a strong feature set and excellent user experience. Beyond this, exchanges will need to ensure that their business complies with impending regulations, as global regulators seek to impose their frameworks for digital assets. This will likely have significant impacts on the operating models of many exchanges.

FTX was a calamitous event for the industry as a whole and especially for CEXs. This has put a greater onus on transparency and depositor protection for CEXs. Since the collapse, proof of reserves has essentially become an industry standard. Further measures, like protection funds, are also being taken, with Binance and Bitget increasing their funds following the collapse.

Binance has maintained its position as the leading CEX, however, it did not monopolize the additional business left by FTX. We observed a relative decline in CEX spot trading compared to DEX spot trading. Most derivative trading platforms saw a decrease in trading volume, with Bitget being an exception having increased their trading volume slightly in the months after FTX.

While exchanges have made efforts to become more transparent, they must still be held to higher standards. Proof-of-reserves and protection funds are improvements but do not guarantee safety. Successful exchanges will need to offer the best features for their users all the while creating trust through increased transparency, protection funds, and ecosystem involvement.

Disclosure: Nansen has produced the following report as part of its existing contract for services provided to the Customer at the time of publication. While the Customer has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

The authors of this content and members of Nansen may be participating or invested in some of the protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Nansen does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Nansen at any time without notice. Nansen accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.