Intro

dYdX Today

dYdX is a DEX for trading perpetuals , where traders can gain exposure to various assets on the platform with leverage of up to 20x. It is widely regarded as the gold standard derivatives DEX and has famously surpassed volume on Coinbase at times. However, in its current form, it is not properly decentralized in the sense that some features such as its order book are centralized and all fees accrue to the dYdX Foundation. Furthermore, the scaling solution StarkEx that it is built on is not fully decentralized and poses a few limitations according to dYdX.

This report will examine dYdX v4, and the data around the protocol and its token.

Why Cosmos?

dYdX is famously shifting from a StarkEx application (and the Ethereum ecosystem) to Cosmos where it is building its own app-specific chain. The team is taking the bet that an app-chain with its own validator set is best positioned to create a CEX-like experience with all the benefits of blockchain technology and decentralization. The V4 is expected sometime in September of 2023, but no dates have been confirmed.

dYdX has been notable for its excellent trading experience, so there are high expectations for v4. The team expects their new upgrade to unlock enormous performance improvements and is building out the entire technology stack from scratch to see it through. The transition to its own app-chain is a bold move, but it is in good company. Although the technology stacks are different, other teams like Ribbon Finance are opting for their own app-specific rollups. In the Cosmos ecosystem, there are other orderbook-based L1s as well such as Injective Protocol, Sei Network, Crescent Network, amongst others.

While it currently enables full self-custody of funds and open sources its smart contracts, its orderbook and matching engine are centrally operated and all revenues accrue to the dYdX Foundation. In other words, they could be seen as running an off-chain orderbook for potential securities from regulators - the need to decentralize all parts of the stack is not a nice to have, but a must-have feature. Additionally, DYDX stakers do not share in the fees generated by the platform - with all fees currently accruing to the Foundation, leaving the token holders out of shared upside (more on the revamped tokenomics later).

That said, dYdX has succeeded in creating strong liquidity for its core markets in part by optimizing its fee structure for institutional market makers. The protocol seeks to compete with CEXs for market share of the derivatives market.

Aims of v4

With Cosmos and v4, the dYdX team believe they can greatly increase its throughput, achieve decentralization of all aspects of the protocol, and greatly improve its tokenomics.

Throughput

dYdX v3 currently can process ~10 trades per second and 1,000 order placements/cancellations per second. While this is very high compared to what has been observed with other blockchains today, dYdX aims to compete with the largest addressable market - CEX market share. To do this, they will be implementing a decentralized but off-chain orderbook with v4. Given they have their own validator set, they can essentially “ask more from their validators” and have them run in-memory orderbooks. The orders are only committed to consensus when they have been filled (off-chain). dYdX’s design is betting that in order to compete with CEXs, they will need a 100x increase in throughput. With their design, they claim they can achieve this.

100x is a phrase with memetic value often used in crypto marketing so should not be taken at full face value. However, the team likely wouldn’t state a number this high unless they believed they could massively improve throughput. Although there is an off-chain component to the orderbooks, its decentralization is still maintained via the validator set, which is expected to be between 50 - 150. Of course, there will be liveness and safety concerns, so delegation should ideally be distributed across as many validators as possible.

In short, they can attempt such a dramatic performance increase due to their ability control all aspects of the protocol.

Indexer

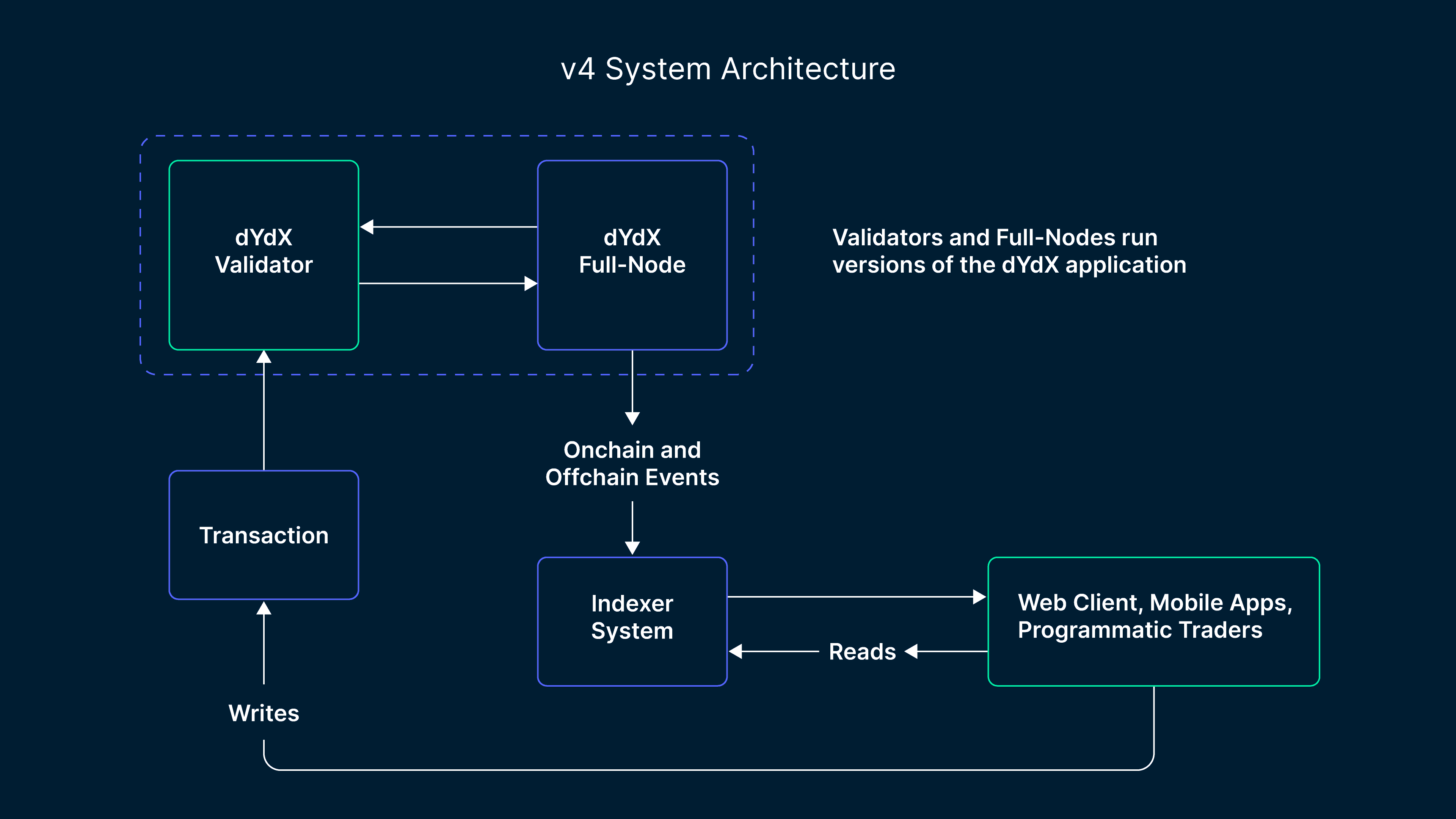

The indexer is responsible for processing and delivering data from dYdX full nodes, which can be read by web client, mobile apps etc. Here is a high level overview of the general architecture of v4. Note how the Indexer interacts with other components of the protocol:

The Indexer is designed to be both decentralized while enabling very high throughput. By separating the processing of on-chain and off-chain data, dYdX v4 can ensure that each service can be scaled according to the throughput requirements.

On-Chain Data This is data that can be reproduced by reading transaction commitments on the dYdX chain and that haw been validated by conensus. It includes (non-exhaustive)

- Account balances

- Account positions

- Order fills

- Fees

Off-Chain Data This includes:

- Short-term orders and cancellations

- Indexed order updates prior to being committed to the chain

- Orderbook of each pair

The Indexer will be open source, so anyone can use it. dYdX will release detailed documentation and tools for running the Indexer on popular cloud providers. Third-party operators who want to host the Indexer will need to set up infrastructure, deploy the Indexer code, and maintain it.

Oracle

dYdX currently uses Chainlink as its oracle which creates another dependency and reliance on an external protocol. In V4, validators will have their own mechanisms for accessing current prices and will come to consensus on prices for each block. This should make accessing price as decentralized as the protocol itself.

Revenue Sources

In its current form, dYdX is one of the highest fee-generating protocols in crypto. In its transition to v4, the company will no longer take trading fees or make revenue from the protocol. This means 100% of the revenues go directly to stakers/validators, which ensures revenue sharing with DYDX stakers.

Building as an app-chain also opens up new sources of value capture for the protocol. Arguably the largest source of potential revenues for app-chains is being able to internalize MEV which is discussed below.

Further Development on Top of the Protocol

Open-sourcing the protocol could result in various ancillary services being developed that could bring about more activity, accruing revenue to DYDX holders. Given dYdX is building out the core orderbook infrastructure, apps can simply build on top of it to offer an all-in-one suite of DeFi products. This could be borrowing / lending, spot markets and much more, which is similar to the UX offered on CEXs. At launch, dYdX will be interoperable with Osmosis and Noble chain to seed USDC liquidity. Afterwards, they may open up to other IBC-enabled chains such as the Cosmos Hub (ATOM).

Mesh Security

Although there have been no reports of dYdX implementing shared security, they will be a prime candidate to become a security provider. The main factor in that is their current market cap, which is around $290m at the time of writing, making it the 4th largest MC chain in Cosmos. There are 2 main ways dYdX can provide shared security:

- Interchain Security v1 -dYdX validators would secure new chains entirely. The Cosmos Hub is doing this now with Neutron.

- Mesh Security

- dYdX validators would partially secure other chains without sacrificing sovereignty.

Both of the above are open-sourced modules, meaning any chain, including dYdX, can freely use them. There are key differences in both, but the key takeaway is that DYDX stakers would be able to generate more revenues by providing security to other chains.

Mesh security is similar to Eigenlayer, it rehypothecates staked assets to secure other chains. In return, these stakers receive additional yield with additional slashing conditions. This could benefit dYdX if it becomes a very large market cap chain within the ecosystem, given many chains will want to provide security to one another bilaterally through mesh security.

This is simply speculative given dYdX has yet to launch, but it is worth mentioning given a common critique of its move to Cosmos is shared security. Rather, they will have plenty of ways of deriving security - their own validator set, mesh security, Babylon chain or even EigenLayer itself. A caveat is how the risk/reward plays out for mesh security in the market and dYdX successfully launching their v4. However, if the exchange executes its vision, its stake could be good to secure other chains and therefore offer an additional yield to stakers. Thus, its move to v4 directly addresses the meme of shared security and provides future avenues for DYDX holders to earn additional yield.

Token Utility

While it is slightly unclear on the exact token utility in v4, a big criticism of dYdX’s token (and most tokens for that matter) is that there is little utility. Outside of governance, there is no clear utility that allows DYDX to align incentives across all layers of the stack - traders, LPs and stakers. However, much more can be done with a token that is used to secure the chain. Upon launch, stakers will receive 100% of fees. After launch, it will ultimately be up to governance to decide how fees are shared. It is plausible that stakers of v4 may receive USDC rewards from trading activity, making it much easier to value and also receiving fees in a non-volatile asset (although revenue will largely be influenced by the general market conditions). It has not been confirmed if they will be rewarded with DYDX, USDC, or DYDX and USDC.

Decentralization

Proper decentralization is especially important given the hostile regulatory environment in the US towards crypto. If dYdX can operate with high performance in a decentralized fashion, it could be one of the first projects to do so and therefore create significant value for the space and demonstrate what is actually possible with blockchain technology.

Cosmos Summer?

The Cosmos ecosystem has been in general downtrend since early 2022. The below chart shows the general poor performance of Cosmos tokens since Terra's collapse. Note that this only includes tokens that existed at the time of Terra's collapse.

However, the ecosystem has a number of catalysts for a potential revival. Check out our report here.

Of the many catalysts, native USDC will be integral for dYdX and it will be integrated with Noble Chain, Circle’s native issuance chain from the start to seed USDC liquidity. dYdX will likely have a large impact on the Cosmos ecosystem itself, given it is one of the most used dApps in crypto today with real users. Compared to the likes of most Cosmos chains, it is a high-profile Ethereum dApp testing the waters of a Cosmos app-chain. The success of v4 can potentially foreshadow a general theme of Cosmos-technology adoption. However, the team has noted they will build wherever they think they can build the best product, whether that is an Ethereum L2 or a Cosmos app-chain - the user comes first.

Challenges

dYdX Foundation is a startup - and operates centrally in many ways at present. The Foundation has lacked transparency in:

- what it does with trading fees,

- the process of trade execution ordering,

- and some have raised concerns by suggesting the trading activity stats may be unreliable due to potential wash trading.

Although these are large problems, the team is very aware of them and is prioritizing them into the v4 design. Trade execution ordering (MEV) is being thought about carefully and the indexer will allow anyone to query trading activity. Time will tell to see how these challenges are addressed but it is important to note that the above are some of the core reasons why they are pivoting to their own chain.

Will Volume Fall When Incentives Dry Up?

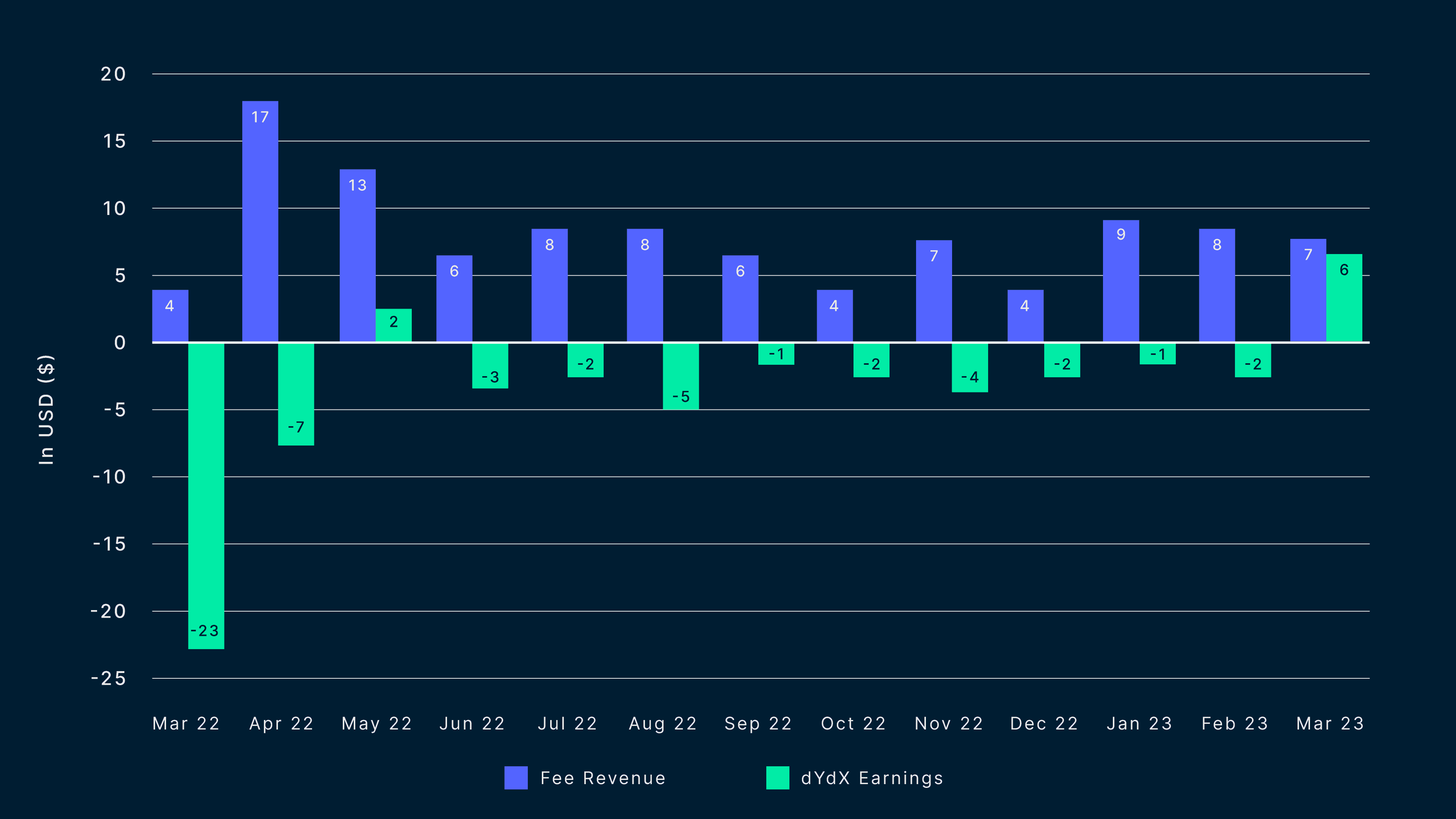

dYdX volume is currently heavily incentivized by the token. In order to overcome this, the exchange will need to offer market-leading experience and rates. It has often expended more in incentives than it generates in fees, in terms of the dollar value of incentives. That said, the protocol has become profitable since March 2023 (latest month on below image).

The movement to this 'profitability' is in large part due to the exchange reducing incentives by 45%. This is very promising, and indicates that dYdX is one of the few DeFi protocols that people actually use because the product is great, not because they are getting paid to do so. It will be worth closely observing how volumes, fees, and rewards develop going forward. The team's strong focus on core product will hopefully create an end state of minimal to no trading incentives, with volume and fees competing with the top CEXs

MEV

General purpose chains such as Ethereum are taking a PBS approach to MEV to redistribute profits across the PBS supply chain. However, MEV is still negative for most users and pushing it off-chain does not solve the core issue.

On the other hand, app-chains have a large design space around MEV which can allow dYdX to both combat ‘bad’ MEV (i.e frontrunning), while interalizing ‘good’ MEV (i.e arbitrage) to stakeholders. Although the exact details of dYdX’s approach are unknown, we can look to other solutions such as threshold decryption or Skip Protocol’s proto-rev module, among other solutions available. All in all, the design space of approaching MEV is much larger in their transition to v4.

Cosmos MEV approaches revolve around many mechanisms such as Protocol-Owned MEV, threshold encryption, PBS and on-chain/off-chain auctions and frequent batch auctioning. How blocks are built and how MEV manifests on-chain can be somewhat controlled - which could create more value for the system. On the other hand, Ethereum mainly has PBS and off-chain auctions with frequent batch auctioning at the application level.

Osmosis, for example, is working on combatting MEV with threshold encryption where transactions are encrypted in the mempool and once the transactions are committed to and ordered in the block they are decrypted.

dYdX’s Stance on MEV

The protocol has claimed it has developed a solution that prevents validators from extracting value from users. Additionally, any harmful MEV is expected to be punished by the community. While the entities behind validators could unify to control enough token supply to act maliciously, this would be a protocol failure and against their best interest. Validators rewards will be tied to the long-term revenue generation of the protocol, incentivizing them to act in its best interests. Again, there are both on-chain and off-chain ways of addressing MEV so it is ultimately up to the team on what they decide to do. Although much is not known about the specific mechanisms they will use, it is clear in what they are trying to achieve - minimize harmful MEV and maximize positive MEV. Check out their blog on MEV here.

High Smart Money Holdings

There are 20 Smart Money holdings exceeding $100k in value at the time of writing, many of which are funds. Funds such as Defiance, Polychain Capital, and Hashkey hold very significant holdings.

This is dYdX’s last round (June, 2021):

- Series C

- Funding: $65m

- Valuation: $215m (equity, unclear what token valuation).

Vesting Schedule

According to dYdX, the updated unlock schedule for investors (who accepted it) is:

- 30% (on December 1, 2023)

- 40% (over 5 months from January 1, 2024, to June 1, 2024)

- 20% (Over 11 months from July 1, 2024 to June 1, 2025)

- 10% (Over 11 months from July 1, 2025, to June 1, 2026.

27% of the token supply is allocated to investors. It is unclear what proportion of this follows the above vesting schedule as this was retroactively agreed and investors had to agree to the new terms. dYdX have not clarified what proportion of this follows the above vesting schedule, however, it is likely relatively high. Therefore, there could be some sell pressure in December, with a significant portion being unlocked at once. However, many of the investors on the cap table have reputations to uphold and selling straight away is not in their best interests given they want the token to do well. Additionally, the unlocks are scheduled to occur after the v4 upgrade but it is important to keep note of given how significant they are.

Competition

The exchange competes against both decentralized exchanges (DEXs) and centralized exchanges. Although DEXs are part of the competition, they only make up around 5% of trading activity whereas CEXs account for the lion's share. Given the addressable market of derivatives, particularly on CEXs, dYdX has the ultimate goal of being better than CEXs. In other words, not fight for a small sliver of the market (less than 5%) but actually make an exchange that competes with the likes of Binance and Coinbase.

Its activity greatly surpasses other DeFi derivative platforms such as GMX and Perpetual Protocol. While GMX has proven very popular, it is ultimately very expensive compared to dYdX and other centralized platforms and unlikely to attract long-term institutional capital.

As you can see, dYdX has a significantly larger market cap than its DEX competitors. The market has presumably priced this given that it generates far larger volume and has significantly lower fees.

Competition will likely drive fees downwards, and dYdX is already far more in competition with CEXs than DEXs. It will be a challenge for the team to create a blockchain-based system that actually is highly competitive against these platforms, but the rationale and theory behind v4 indicates that it could. However, only time will tell and v4 of course isn’t the end state for the platform.

dYdX Volume Compared to the CEXs

The below chart shows dYdX’s market share of the derivatives market next to 10 selected CEXs from December 1st 2022 to the present.

Our data shows that Binance dwarfs the other exchanges, however, dYdX exceeds the volume of exchanges such as Deribit, Bitfinex, and Kraken. Despite representing just 1.2% of the market (of selected CEXs) it is promising that dYdX is already competitive with smaller CEXs, given that v4 is expected to further improve the performance of the exchange. Attracting institutional liquidity from the likes of Binance will be the key to success.

Binance takes the lion’s share, however, Coinbase launched derivatives in May, and Gemini will be starting one as well, adding more competition to the market. dYdX has the benefits of being decentralized, which means it has captured market share with only 50 employees. Additionally, dYdX can also expand into other markets beyond perps, furthering its traction. CEXs such as Coinbase are regulated institutions and have a lot of trust with large institutional players, so building trust is key. While other CEXs have less trust, they have enormous liquidity, e.g. Binance and will be competitive so long as they have the liquidity and their dominant role in price discovery of crypto assets. dYdX will need to attract significant liquidity in order to become properly competitive against these giants.

Depositors

The top 100 depositor addresses at present have just over half of the deposits. This shows that it is not highly concentrated among a small number of addresses and indicates that there is a large number of traders on the platform. Granted, the same entity may have multiple wallet addresses but in general, it does show that there are a high number of traders using the platform.

Here is the breakdown of the top 10 wallets:

The top 100 wallets are relatively evenly distributed, with only 7 wallets accounting for 2%+ of total deposits:

Key Risks

Regulation

- Most of the team is in the US, which has taken a particularly hostile approach to crypto.

Competition

- Discussed above. High-performance CEXs with enormous liquidity such as Binance, and Coinbase entering the market will pose challenges. Will need to match performance / near match performance and attract significant liquidity for viable competition.

Execution Risk

- This is the primary issue with dYdX. Although the rationale for v4 makes sense on paper, they missed their target of launching by end-of-year 2022 but have since pushed it back to potentially September. A validator set will need to be bootstrapped, and the expected throughput will need to be realized.

- In addition, dYdX has always operated from a centralized team. As it becomes decentralized, it remains to be seen how effective the community will be in pushing through important product updates. Many DAOs are criticised by their inability to remain competitive due to slow decision making and too many uninformed stakeholders. Coordinating effectively will be a key challenge for the project to continue shipping as before.

Timing

- dYdX is early to the high-quality DeFi derivatives market. There is always a risk that they may be too early to attract sufficient interest/liquidity to really kick off. However, the team is well capitalized so should be able to keep building until they can prove they have a market-winning product / compelling enough value proposition to attract large liquidity.

dYdX is undergoing a significant transition with the upcoming v4 release. The shift to Cosmos aims to enhance decentralization, scalability, and token utility. The bullish features of dYdX v4, such as increased throughput, additional revenue opportunities, and tailored solutions for MEV present promising prospects for the protocol. The platform will leverage the benefits of blockchain technology but will need to compete with CEXs for liquidity in order to succeed. Its product arguably far surpasses what else is available in DeFi. However, risks related to regulation, execution, timing, and the need to attract significant liquidity must be carefully monitored. In addition, competition with CEXs will be stiff, with Binance having the most liquidity and Coinbase entering the derivatives market. Ultimately, its success will hinge on the team's ability to actually achieve its goals of v4, and ensuring the product can compete with CEXs in relation to UX and cost.