Quick Breakdown of the 3 Derivative Platforms

Introduction

In our previous report on Automated Market Makers (AMMs) for spot markets, we discussed the latest developments in AMM designs. In this report, we will look into decentralized perpetual exchanges.

Composability, deep liquidity, and top-notch UI/UI are key when it comes to protocol design for the end users. The ultimate goal of decentralized exchanges - whether spot or perpetual futures - is to resemble the experience of trading on CEXes as closely as possible.

In this context, we will explore some of the popular decentralized perpetual models.

Perpetual Protocol (vAMM)

Perpetual Protocol’s Virtual Automated Market Maker (vAMM): Similar to the traditional AMM model on Uniswap, the vAMM does not have any real asset pools stored inside. Instead, the deposited asset is stored in a smart contract vault that manages all of the collateral backing the vAMM. For example, if you deposit USDC into a vAMM, you receive a synthetic token vUSDC in return, which can be traded on the platform. Unlike depositing $10m of USDC and USDT as liquidity into a Uniswap pool, your vAMM contains a virtual pool as if it had that $10m of USDC and USDT.

Following the protocol’s v1 issues which included the inability to incentivize a balance between long and short positions, Perpetual Protocol introduced a new model in its v2 version that leverages Uniswap v3 as its backend AMM / execution layer.

The protocol's prices are established by the vAMM itself. Instead of relying solely on a price feed from an oracle, the vAMM employs a TWAP of both the Uniswap price and the average price from other major exchanges (using Chainlink). The oracle index price is used for funding rate calculations and liquidations (important mechanism to incentivize a balance between longs and shorts)

This approach is technically more advanced than GMX as it enables price discovery. Furthermore, the utilization of Uniswap's concentrated liquidity mechanism also helps in reducing slippage, enabling better prices. This design, however, has its own drawbacks since prices are impacted by the amount of liquidity available on the Uniswap virtual pools.

The protocol charges a flat 0.1% fee on all trades, of which 80% are allocated to LPs and 20% allocated towards PERP's insurance fund (for bad debt when liquidators are unable to liquidate in time).

The vAMM design also offers the advantage of a permissionless setup, which theoretically enables anyone to establish perpetual markets as long as a price feed is accessible on Chainlink or Uniswap. However, at present, the protocol only allows users to trade assets that are listed on the platform. The concept of a permissionless market is a long-term objective for the project, which may be more feasible during the next cycle when there is more liquidity available in the overall markets and when the protocol can support multiple actively traded markets.

The market-making/LP process is also more complex than the typical Uniswap LP process. In Perpetual Protocol, makers deposit "single-sided liquidity" into the protocol, which is subsequently utilized to establish range orders comprised of two virtual tokens in Uniswap v3.

To illustrate, suppose you deposit USDC into the protocol; this USDC will be utilized to generate equivalent amounts of vUSDC and vETH, which will constitute the liquidity in the Uniswap vUSDC-vETH pool.

Nonetheless, this design has its drawbacks. As you have only provided USDC as collateral, your ETH liquidity is essentially "borrowed" from the platform. Suppose ETH appreciates, resulting in the exchange of your vETH liquidity for vUSDC, when you withdraw your liquidity from the protocol, you will be required to purchase the missing ETH at the current market value, rather than the price at which you borrowed the ETH. This could present a significant risk for unhedged LPs.

The same issue arises when ETH prices depreciates. Your vUSDC is swapped to vETH, meaning you have to fork out additional capital eventually to repurchase the vUSDC that was swapped to vETH when vETH was at a higher price.

If you're interested in LPing on the protocol, PerpSim is a useful tool that allows you to simulate and backtest your strategy.

dYdX (Order-book)

dYdX is the market leader in terms of trading volume for perps. It uses the battle-tested order -book design, similar to how centralized exchanges operate.

However, while the settlement layer is done on-chain, the order-book matching mechanism is done off-chain on Amazon Web Services (AWS) in Tokyo. This creates a potential source of failure, e.g. AWS faced an outage back in December 2021 and forced dYdX to halt its operations.

The utilization of an order-book design means that traditional LP yield earning activities are not available to everyone - one of the core features of DeFi. Instead, sophisticated market makers are the only ones providing liquidity and deepening the protocol’s market depth. However, considering that the majority of LPs, especially passive LPs are unprofitable on AMMs such as Uniswap, this might not necessarily be a bad thing after all.

Perpetual markets are typically the driving force behind price discovery, but effective price discovery can be limited by liquidity on AMM models. That's why newer protocols like GMX and its forks are moving towards an oracle price feed system to eliminate the impact of illiquidity on price movements. However, market participants such as Serum believe that true price discovery can only be achieved with deep liquidity, which is typically only available through s in the long run. This theory has been supported by the fact that CEXs and dYdX still dominate the space with the deepest liquidity, providing an environment for the most efficient price discovery among their peers.

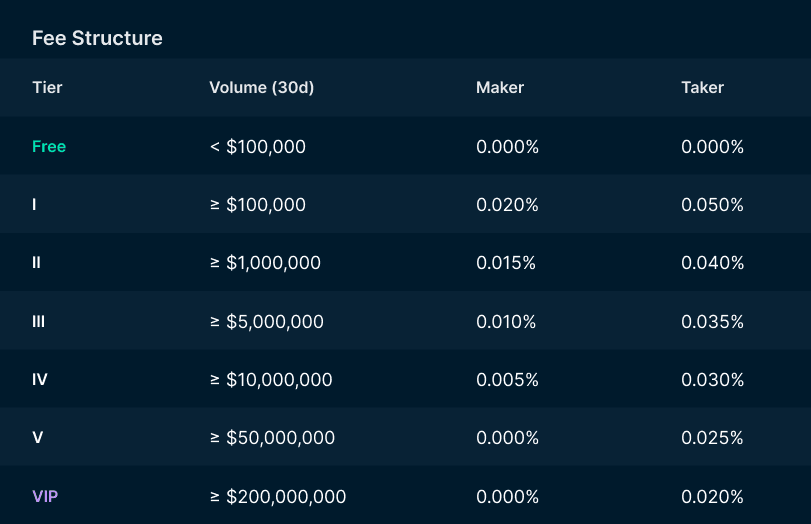

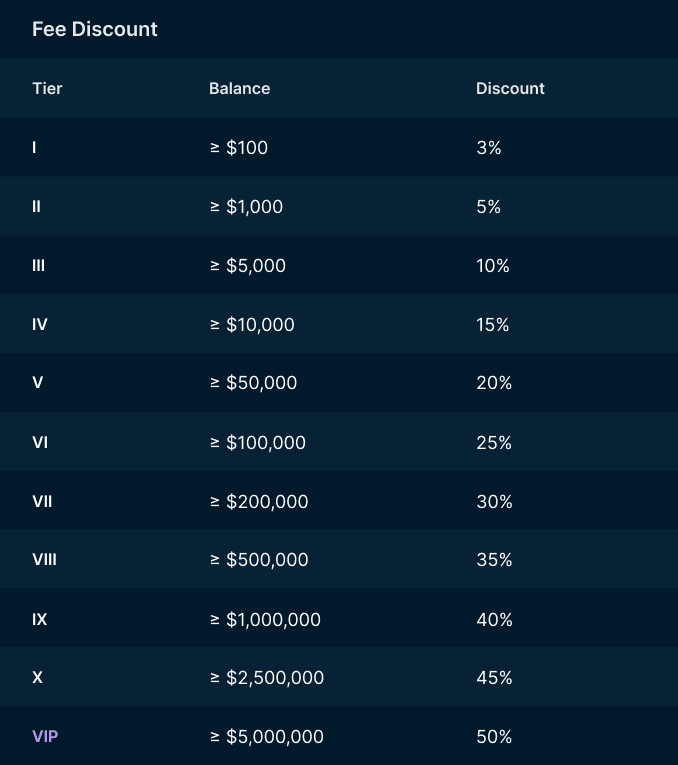

dYdX uses a fee structure that is highly similar to CEXs like Binance. The protocol offers fees that are much lower than its competitors, not including the fee discounts from holding dYdX tokens. However, unlike many of its incumbents, dYdX keeps all of the fees for itself.

Like many other decentralized exchanges, dYdX has an insurance fund to cover any losses resulting from bad debt. However, dYdX's insurance fund is not decentralized. Instead, the dYdX team is responsible for managing and overseeing deposits/ withdrawals from the fund. This approach may raise some concerns among users who value decentralization, as it requires a level of trust in the dYdX team to manage the fund appropriately.

dYdX offers most major trading pairs. The protocol also offers “legacy” pairs such as Yearn, Monero, Zcash and Ethereum Classic.

As the most popular decentralized perpetual exchange in the market, dYdX has naturally attracted the most significant market depth. For instance, dYdX’s BTC/USD market has $3.1m depth within 10 bps from BTC’s spot price, which allows large trades to be executed within a tighter range and with less slippage as compared to other perpetual protocols

Although dYdX is technically permissionless, the platform is restricted by geographic location for certain areas like the US.

In 2022, dYdX made headlines when it attempted to require users to undergo KYC verification using webcam face recognition technology. Users who deposited a minimum of $500 on their first transaction were eligible for a $25 bonus if they completed the webcam KYC process. The purpose of the webcam KYC was to prevent users from taking advantage of the promotion through "sybil-attacking”.

Furthermore, dYdX blocked accounts that were included in the US Treasury Department's Tornado Cash Ban in 2022, which led to a further deterioration of its reputation among DeFi enthusiasts. Judging by its trading volumes, it appears that the majority of traders remain unfazed by the centralization aspect of the protocol.

dYdX v4

The protocol is moving towards a fully decentralized system in its upcoming v4 version. Meaning that most (if not all) of the above mentioned issues - AWS servers / KYC / Insurance fund / etc. would hopefully be eliminated.

v4 was originally slated to be released at the end of 2022 but was further delayed to Q4 2023.

dYdX's main focus in its v4 plans is to decentralize its order-book and matching engine. Each validator will run an off-chain in-memory order-book that will be consistent with the order-books of other validators throughout the entire network. Orders placed will then be propagated through the network and then matched together. The resulting trades will then be committed on-chain.

This could present significant challenges as dYdX's competitive advantage has been largely attributed to its centralization aspect - sub-second latency and large scalability potential and the new v4 iteration is largely untested.

As part of v4, dYdX has announced that they will be moving to its own Cosmos-based appchain (dYdX Chain) away from Starkware. The decision is likely to leverage Tendermint's cross-chain capabilities, interchain security and customizable scaling capabilities to scale the mammoth order-book.

GMX (Shared Liquidity Pool)

Originally launched as Gambit Financial on BSC. GMX remains the largest protocol of the Arbitrum ecosystem with over $86b in processed total volume and 233k total users to date.

Similar to dYdX, GMX takes an unconventional approach by using neither an order-book system nor the typical AMM model. Instead, GMX obtains asset prices directly from Chainlink oracles, and traders trade against the GLP pool (formed by GMX's liquidity providers) using this oracle price. This enables GMX to offer true market prices without requiring deep liquidity or relying on market makers, which can be a significant advantage during tight liquidity conditions. Since prices are not determined by a constant product curve, there is no price impact or slippage involved. However, this advantage comes at a significant cost - the lack of price discovery for its markets.

The fact that GMX does not use your traditional LP / AMM model means that liquidity providers do not experience impermanent loss - since LPs deposit single-sided liquidity into a multi-asset pool GLP. The introduction of GLP shared liquidity mechanism was also unique in the space. The multi-asset GLP pool achieves its multi-asset target weight based on a function of net open interests on the platform, e.g. increasing ETH Long Perps on GMX results in GLP’s ETH target weight to increase. GLP will then source for more ETH from liquidity providers by lowering the swap fee for ETH/GLP to incentivize LPs to sell ETH. This oracle-price design is a stark contrast to other AMMs whereby traders do not benefit at the expense of the protocol’s liquidity providers.

Trading fees are set at 0.1% per trade with the usual funding / borrow fee that is deducted every hour. The funding fee however, is calculated differently as compared to dYdX. GMX uses the formula: (Assets borrowed / Total Pool Assets) * 1bps to calculate its borrow fee. These fees are then distributed to GMX (30%) and GLP (70%) holders. By basing its funding rates on the total depth of the asset pool, this creates a glass ceiling on the amount of leverage GMX traders can utilize, since past a certain threshold, it would not make sense to pay a higher funding rate to trade on GMX as compared to a CEX or other decentralized perps, assuming all other factors remain the same. Also, GMX charges 0-80 bps as fees for the minting and burning of GLP.

Since GMX’s LPs are essentially the “house”, if a cluster of highly successful and sizable traders begin to leverage GMX, it could deplete the GLP pool and potentially shift the responsibility of the protocol's sustainability onto GLP holders. However, this is unlikely to be an issue since the house always wins in the long term. Furthermore, with this design, GMX can only list high volume majors to prevent price manipulation which it implemented after the AVAX price manipulation event.

Looking at GMX Trader’s PnL since the start of 2023, it seems that these traders are net profitable meaning GMX LPs are at the losing end.

Another potential issue with GMX is its borrow fee system. Unlike the conventional mechanism where longs pay short funding fees when funding rates are positive, GMX traders pay borrowing fees regardless of the direction of their trades. This may discourage traders from solely using GMX to execute strategies like delta-neutral, pair trades, or shorts when funding rates become too positive in the market.

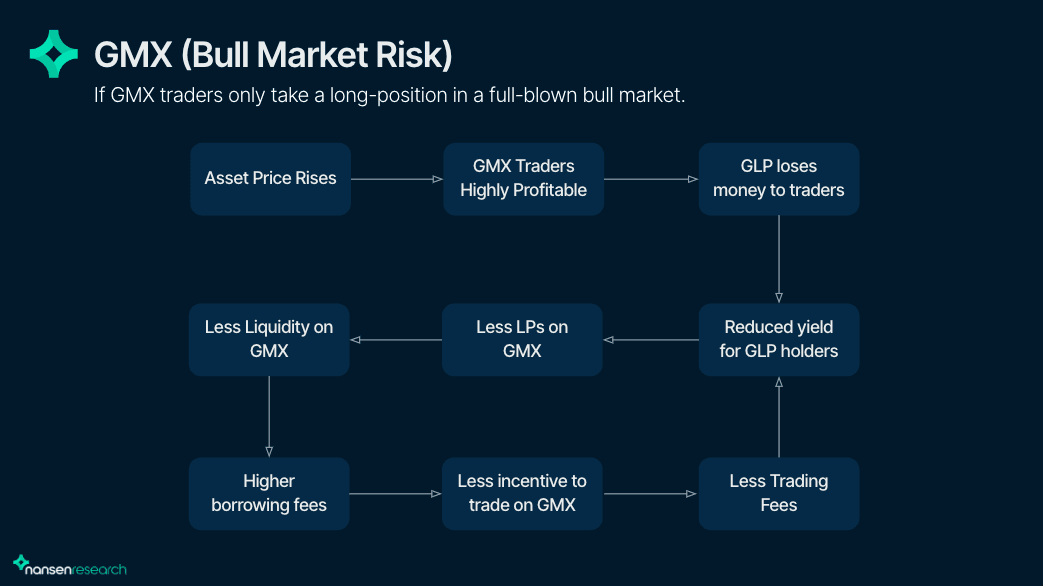

GMX gained most of its popularity during the current bear market. However, its design has not been tested in a full-fledged bull market, which could cause issues as depicted in the image above. LPs will only use GMX if trading fees more than compensate for their GLP losses. Whether GMX can withstand a potential bull market issue remains to be seen.

Imitation is the sincerest form of flattery. Many newer protocols like GNS, Vela, and MUX are essentially forks of GMX with minor tweaks. This attests to the popularity of GMX's model. For instance, MUX solves GMX's liquidity fragmentation issue by aggregating liquidity across the multiple chains that the protocol is on while still leveraging GMX's unique shared liquidity concept.

GMX only offers major cryptocurrencies for trading pairs like ETH, BTC, WBTC, LINK, UNI and AVAX. Unlike Perpetual Protocol, GMX has no plans to create a fully permissionless system for new markets. This is because the GLP pool may become too complicated to manage with more assets. The practical approach for GMX to add non-major tokens would be to create new asset pools. However, price manipulation is a significant risk that the protocol wants to avoid.

Since fees are tied to liquidity and GMX has lower liquidity than dYdX and other CEXs, large traders may be less likely to use GMX.

Rage Trade

Rage Trade is a dual product platform that offers an ETH perpetual market and a USDC yield farming product.

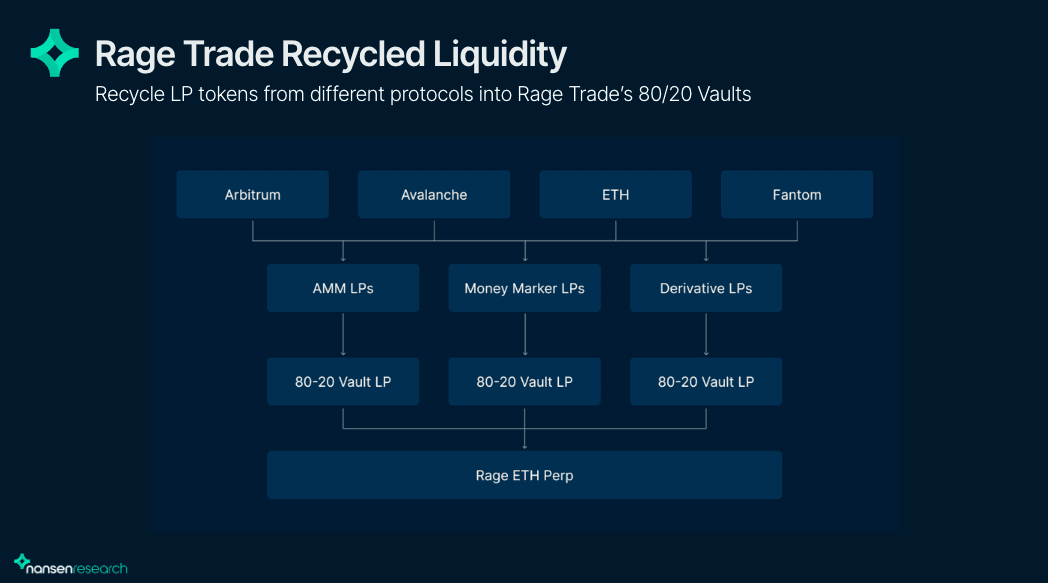

While the ETH perpetual trading product is relatively conventional, the USDC farm on Rage Trade protocol is generating interest. The platform's "recycled liquidity" feature lets users reuse their ETH-USDC LP tokens from other chains and protocols, and add liquidity to Rage Trade's 80-20 LP vaults for added yield. The ability to combine liquidity from multiple chains and protocols is a significant advantage in terms of composability

As of today, the protocol only supports Curve’s Tri-crypto LP tokens for the recycled liquidity portion. However, looking at the list of LP tokens that will be soon to be integrated, most top-tier protocols will be involved. (e.g. Aave / Compound / Uniswap / Sushi / Trader Joe / Pancake Swap / Quickswap / etc).

Rage Trade’s 80-20 Vault uses a very simple concept:

- 80% of deposits generate yield externally (Curve, GMX, Sushi, etc).

- 20% of deposits provides concentrated liquidity on Rage Trade’s ETH perp market.

With this, recycled LPs get to earn external yield, trading fees and Rage tokens as token rewards. This product is quite useful since the additional yield could be used to compensate for any impermanent losses on the underlying AMM itself.

Moving on to the Delta Neutral Vaults, there are two vaults that vary on risk profile.

The Risk-Off vault is a simple strategy that involves lending the deposited USDC to Aave and the Risk-On vault. As a result, the vault earns yield directly from Aave, as well as a percentage of the ETH rewards earned by the Risk-On vaults through LP-ing on GMX's GLP.

The Risk-On vault is designed to allow depositors to provide liquidity on GMX's GLP pool. It uses a flash loan from Balancer to help hedge long exposure from the GLP pool by shorting on Uniswap and Aave. As a result, the vault's yield comes from GLP's esGMX and ETH rewards.

It's important to note that the Risk-Off vault is not entirely isolated from the Risk-On vault, so it may not be as low-risk as it appears. This is because the Risk-On vault's delta-neutral mechanism has multiple possible points of failure, which could impact the Risk-Off vault as well. Additionally, the risk premium associated with lending USDC to the Risk-On vault, which comes from the ETH rewards earned from GLP, must be significantly higher than earning yield from staking USDC on Aave to make it an attractive option given the risks associated with a protocol that only has $16m in TVL. As of now, this premium is about 4.7%, but whether it's sustainable depends largely on the success of GMX's GLP. The strategy will only work if GMX traders lose overall, which may not be the case in a bull market, as mentioned earlier. This same issue also affects the Risk-On vault, as its yield is also obtained directly from GLP.

As the crypto derivatives market has grown, existing decentralized market solutions like GMX and dYdX have had to sacrifice some critical features to scale efficiently. dYdX plans to achieve full decentralization, but it remains to be seen if it can handle the higher computational workload while keeping costs affordable. GMX may face challenges when the markets recover due to its design without significant risk management measures for GLP holders. On-chain perps have already been implemented on Solana's Serum and could potentially function on newer scaling solutions such as on different L2 rollups and Cosmos App-chains. dYdX's v4 implementation remains a key experiment which would provide more colour on where and how new perp protocols will be developed. It is also important to recognize the value of other perpetual models since there is a compelling case for a market that allows regular users to earn yields without the involvement of professional market makers.

With that being said, we could potentially see increased institutional participation when the infrastructure eventually becomes more robust and capital efficient.