Overview

Gravity is a high-performance Layer-1 blockchain platform designed to deliver high throughput, minimal latency, and developer-friendly infrastructure for decentralized applications. Built on a foundation of cutting-edge technology, Gravity leverages the Reth Ethereum client implementation to power its network, enabling EVM compatibility while pushing the boundaries of blockchain performance. The network's mission centers on providing a scalable, efficient infrastructure layer that supports the next generation of onchain applications, from DeFi protocols to gaming platforms and enterprise solutions.

In H2 2025, Gravity Alpha Mainnet continued to demonstrate exceptional performance metrics, establishing itself as one of the best-performing chains since launch. The network achieved remarkable rankings in block time speed and transaction throughput, with real-time performance metrics showcasing its technical capabilities. Gravity's infrastructure powers live applications with significant user traction, most notably Galxe, which operates natively on the network. The development team made substantial contributions to the open-source Reth codebase, with meaningful improvements being merged upstream, demonstrating Gravity's commitment to advancing Ethereum infrastructure. These technical contributions received recognition from industry leaders, including an endorsement from Georges, CTO of Paradigm, highlighting the quality and impact of Gravity's development work. The network's continued focus on infrastructure development, including the Gravity SDK and other developer tools, positions Gravity as a significant contributor to the broader Ethereum ecosystem while delivering a high-performance platform for onchain applications.

Key Developments: H2 2025

Gravity Alpha Mainnet has been actively powering production applications throughout H2 2025, with Galxe operating as a live application with real user traction on the network. Since its launch, Gravity has established itself as one of the best-performing chains in the ecosystem, achieving top rankings in critical performance metrics. The network ranks among the fastest by block time, as demonstrated by Chainspect's analysis, and has processed among the most transactions since launch, reflecting both its technical capabilities and growing ecosystem adoption.

Gravity's development team has been shipping meaningful improvements to the Reth codebase, with contributions being merged into the open-source repository. These enhancements power Gravity's L1 infrastructure alongside other features like the Gravity SDK, demonstrating the network's dual role as both a high-performance blockchain and a contributor to Ethereum's core infrastructure. The quality of this technical work received external validation when Georges, CTO of Paradigm, endorsed Gravity's development efforts, highlighting the significance of the team's contributions to the Reth ecosystem. Additional details on Gravity's Reth contributions were shared publicly, showcasing the network's commitment to open-source development and infrastructure advancement. Real-time performance metrics were also highlighted in a technical analysis, further demonstrating Gravity's position as a high-performance blockchain platform.

Onchain Data

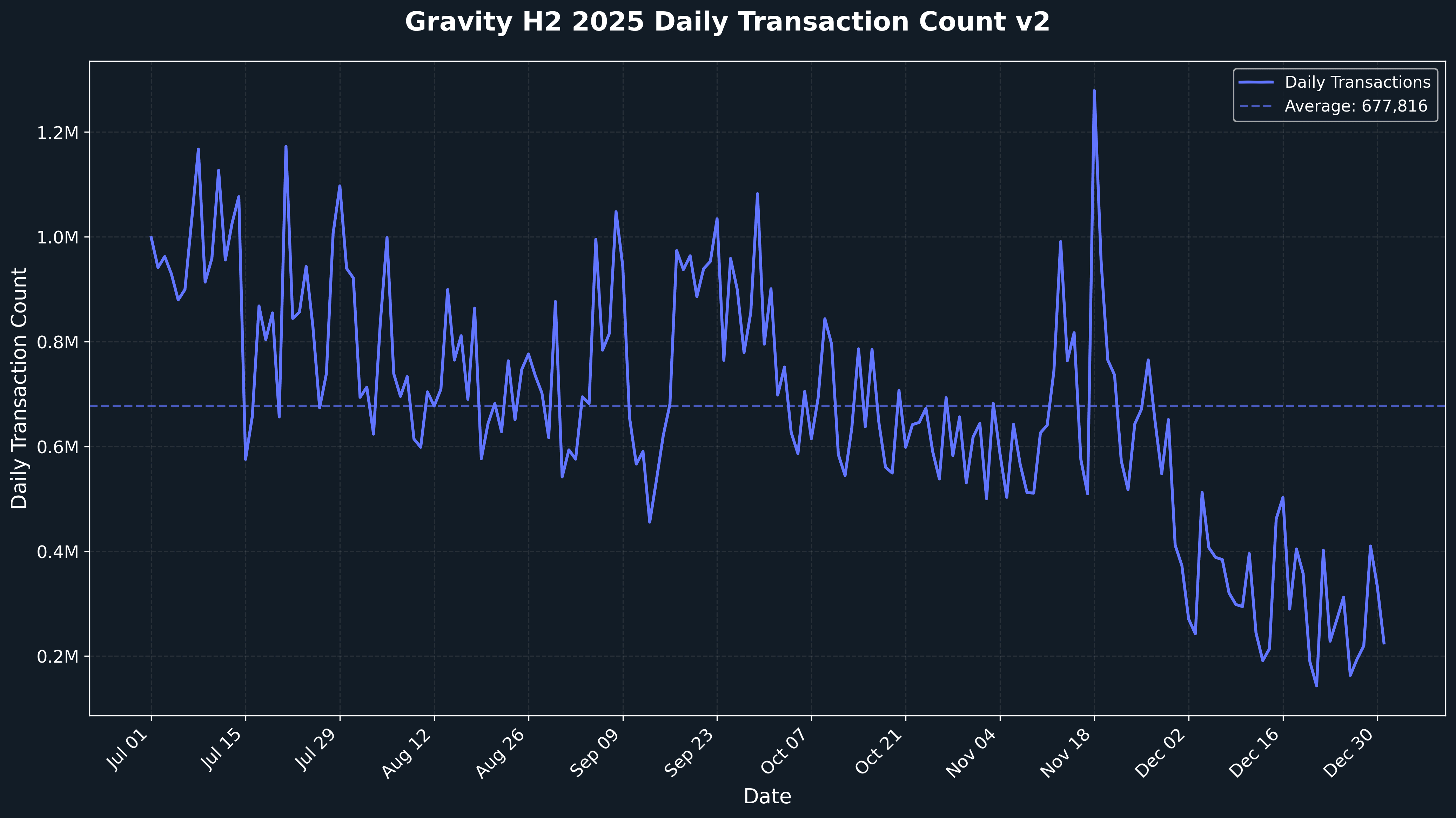

Daily Transactions

Gravity demonstrated strong transactional activity throughout H2 2025, with an average of 677,816 daily transactions. The network showed consistent throughput with peaks reaching 1,279,065 transactions, reflecting robust protocol usage and ecosystem engagement. Transaction volumes remained relatively stable across the half, with the lowest daily count at 143,300 transactions. The consistent transaction pattern reflects growing protocol usage and sustained engagement across Gravity's infrastructure, particularly driven by the $G token ecosystem and the Galxe platform. This sustained activity aligns with Gravity's role as a core infrastructure layer for omnichain applications and cross-chain settlement.

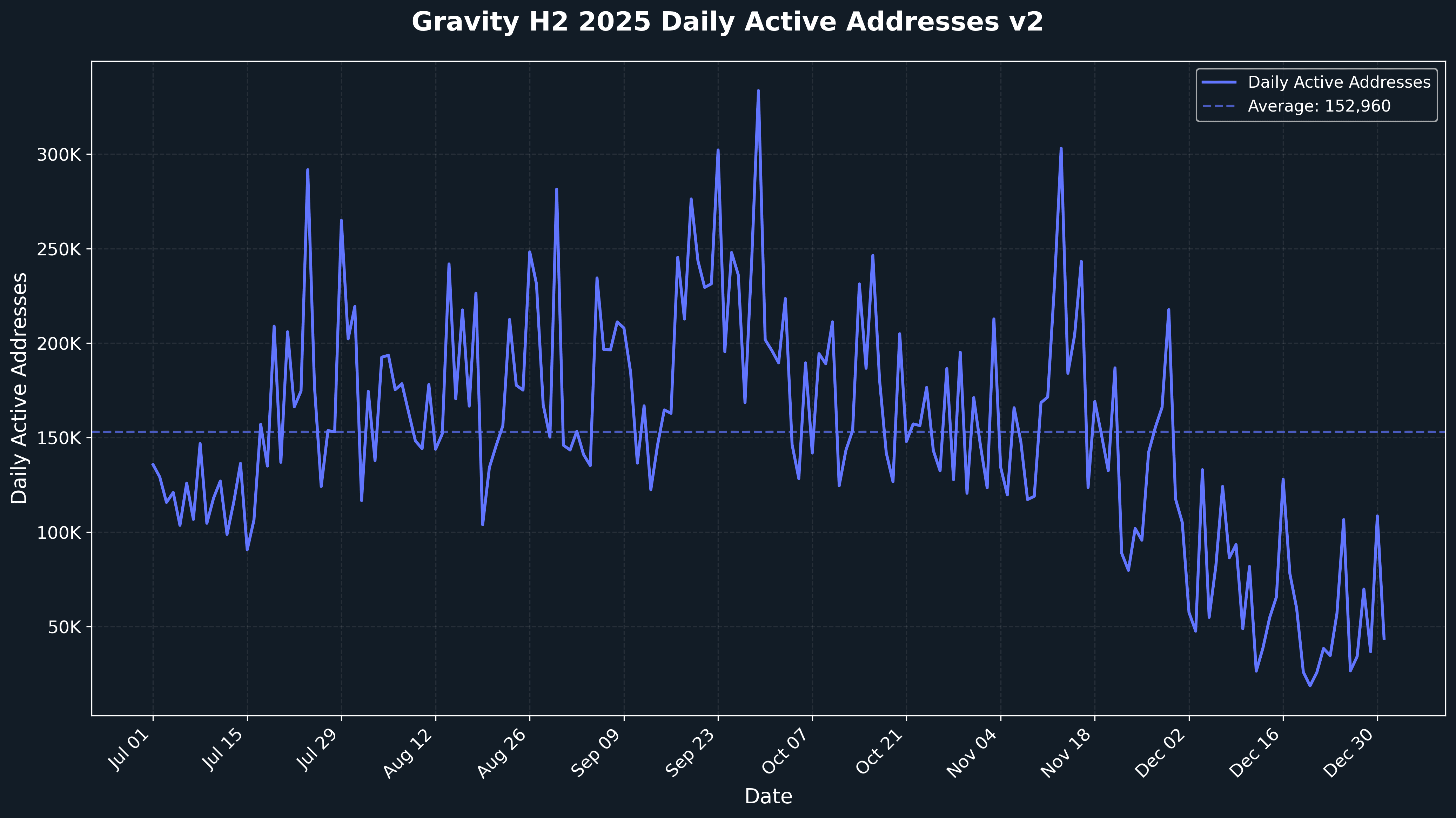

Daily Active Addresses

Gravity maintained a healthy base of active addresses throughout H2 2025, averaging 152,960 daily active addresses with peaks reaching 333,589. The quarter showed periodic surges in user activity, particularly in late September when daily active addresses peaked at 333,589 on September 29. Activity remained relatively strong through November, with notable peaks in mid-November reaching 303,075 addresses on November 13. The consistent user base reflects ongoing engagement with Gravity's infrastructure, particularly around key developments such as the mainnet launch preparations and ecosystem expansions. These activity patterns demonstrate growing user engagement across diverse use cases, from DeFi protocols and cross-chain infrastructure to campaign platforms and NFT applications.

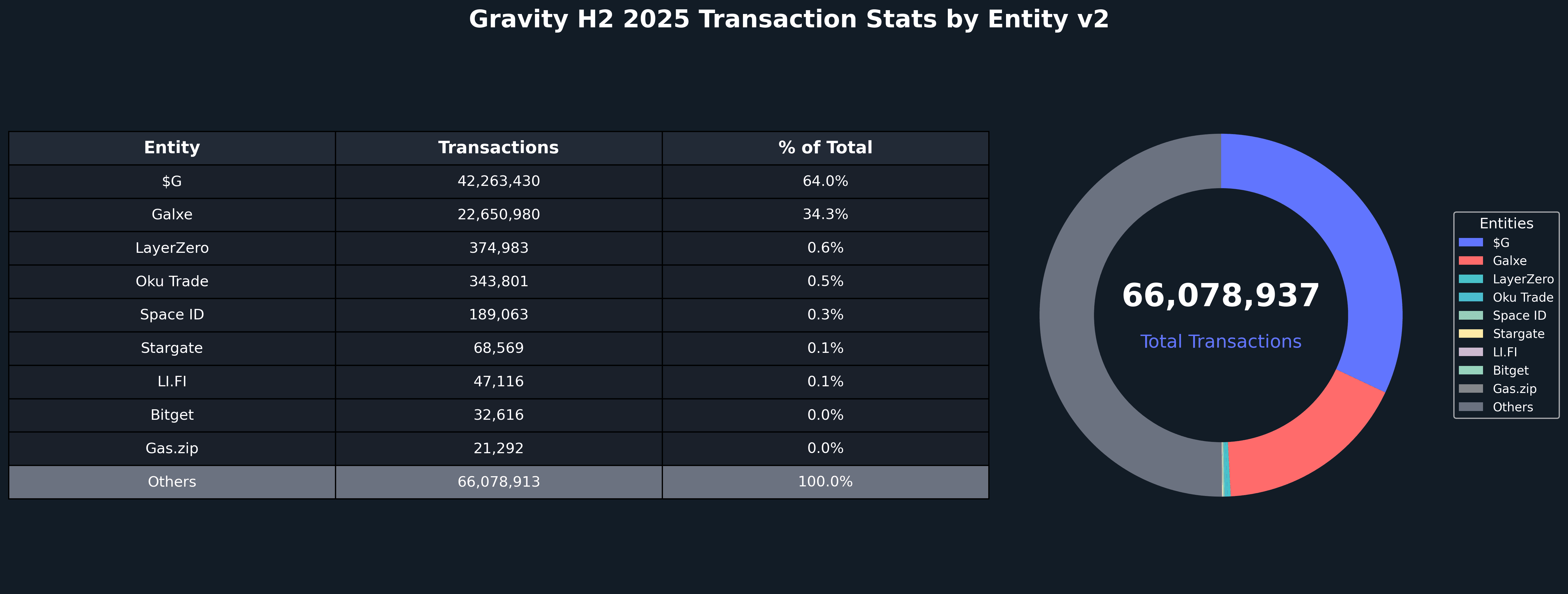

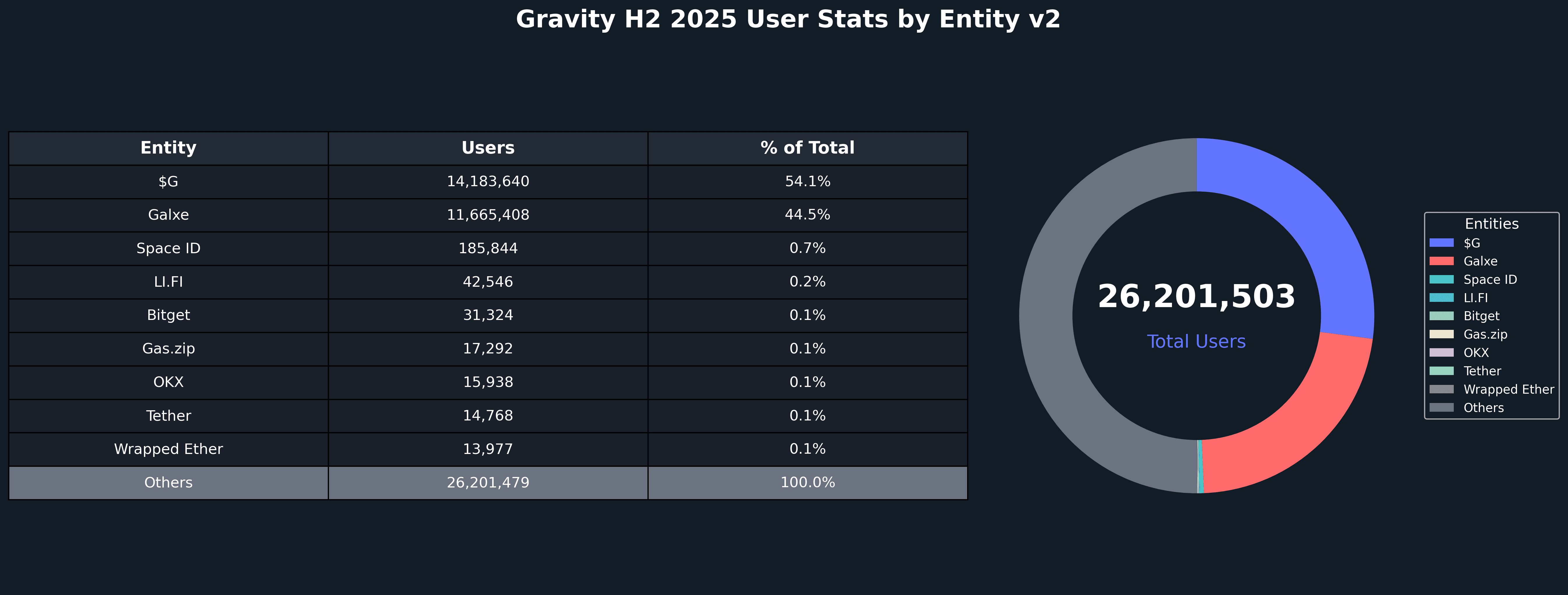

Top Entities by Users and Transactions

Gravity's top entities by users and transactions highlight an ecosystem dominated by infrastructure providers, with $G and Galxe accounting for the vast majority of network activity. $G dominated transaction volume with 42,263,430 transactions (64.0% of total), though this represented a 36.4% decline from H1 2025, reflecting normalization after the token generation event and early adoption phase. Galxe emerged as the second-largest entity with 22,650,980 transactions (34.3% of total), showing 4.3% growth half-over-half, highlighting the continued strength of campaign-based user engagement and reward distribution mechanisms.

On the user side, $G led with 14,183,640 unique users (54.1% of total), showing impressive 39.6% growth from H1 despite the transaction decline, indicating broader user distribution and more diverse usage patterns. Galxe followed with 11,665,408 users (44.5% of total), with 38.5% half-over-half growth, demonstrating strong user acquisition through campaign mechanics. Notable growth stories include Space ID (NFT) with 256.9% transaction growth and 327.4% user growth, LayerZero (Infrastructure) with 17.1% transaction growth supporting cross-chain messaging, and Bitget (CEX) with 237.1% user growth reflecting increased centralized exchange integration.

The ecosystem's heavy concentration in $G and Galxe reflects Gravity's positioning as a specialized infrastructure layer for token ecosystems and campaign platforms. The network showed emerging diversity with cross-chain protocols (LayerZero), decentralized exchanges (Oku Trade), and NFT projects (Space ID) gaining traction, indicating gradual ecosystem maturation beyond the dominant infrastructure players.

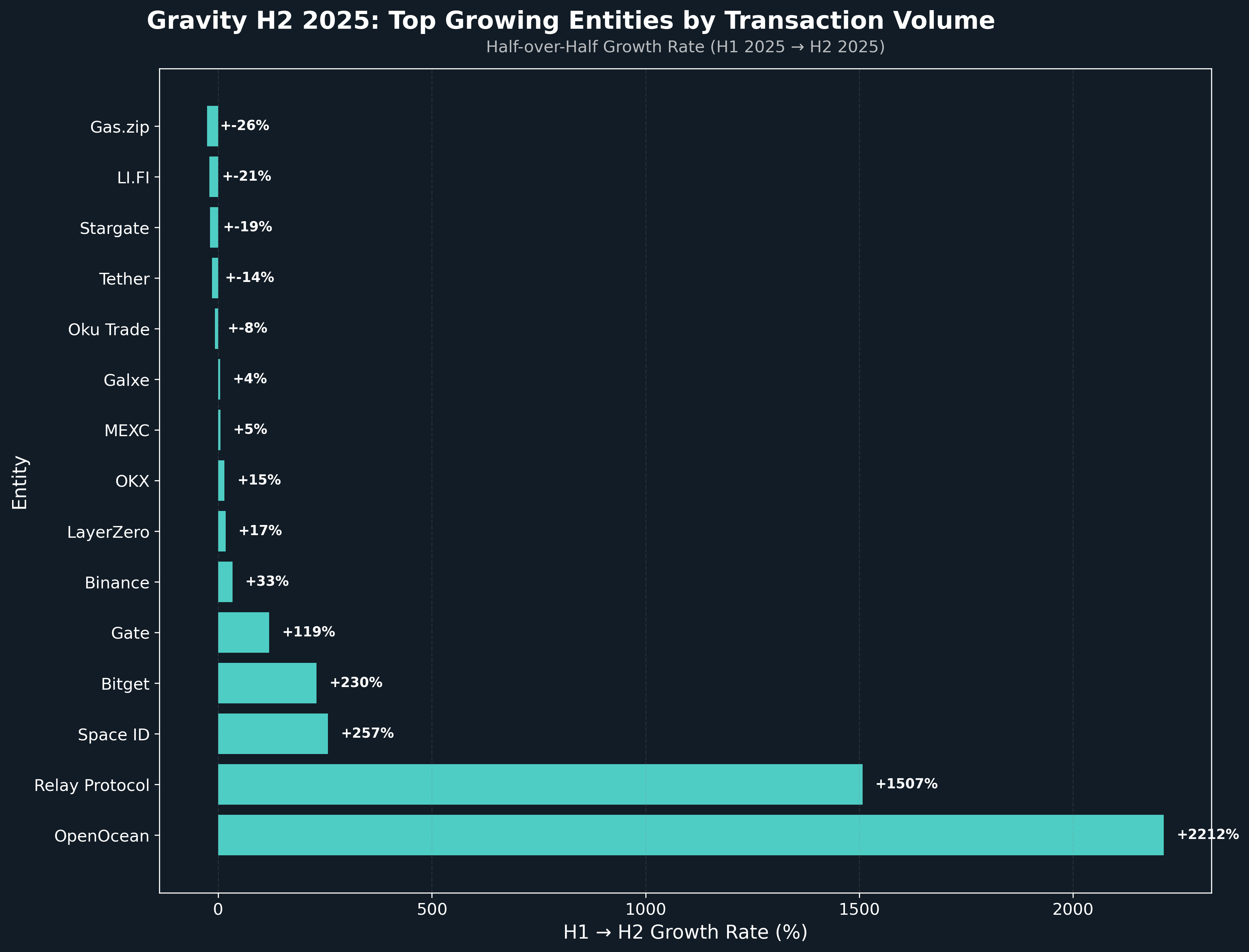

Gravity's ecosystem showed exceptional growth momentum across multiple sectors in H2 2025, with several entities experiencing explosive expansion. OpenOcean (DEX) led transaction growth with a remarkable +2,212% increase from H1, followed by Relay Protocol (Infrastructure) at +1,507% and Space ID (NFT) at +257%, demonstrating strong momentum from decentralized exchanges, cross-chain infrastructure, and NFT platforms. The growth was particularly concentrated across centralized exchanges, with Bitget growing +230% and Gate at +119%, while established infrastructure players like Binance (+33%), LayerZero (+17%), and OKX (+15%) showed steady expansion, reflecting Gravity's expanding role as a settlement layer for diverse application types.

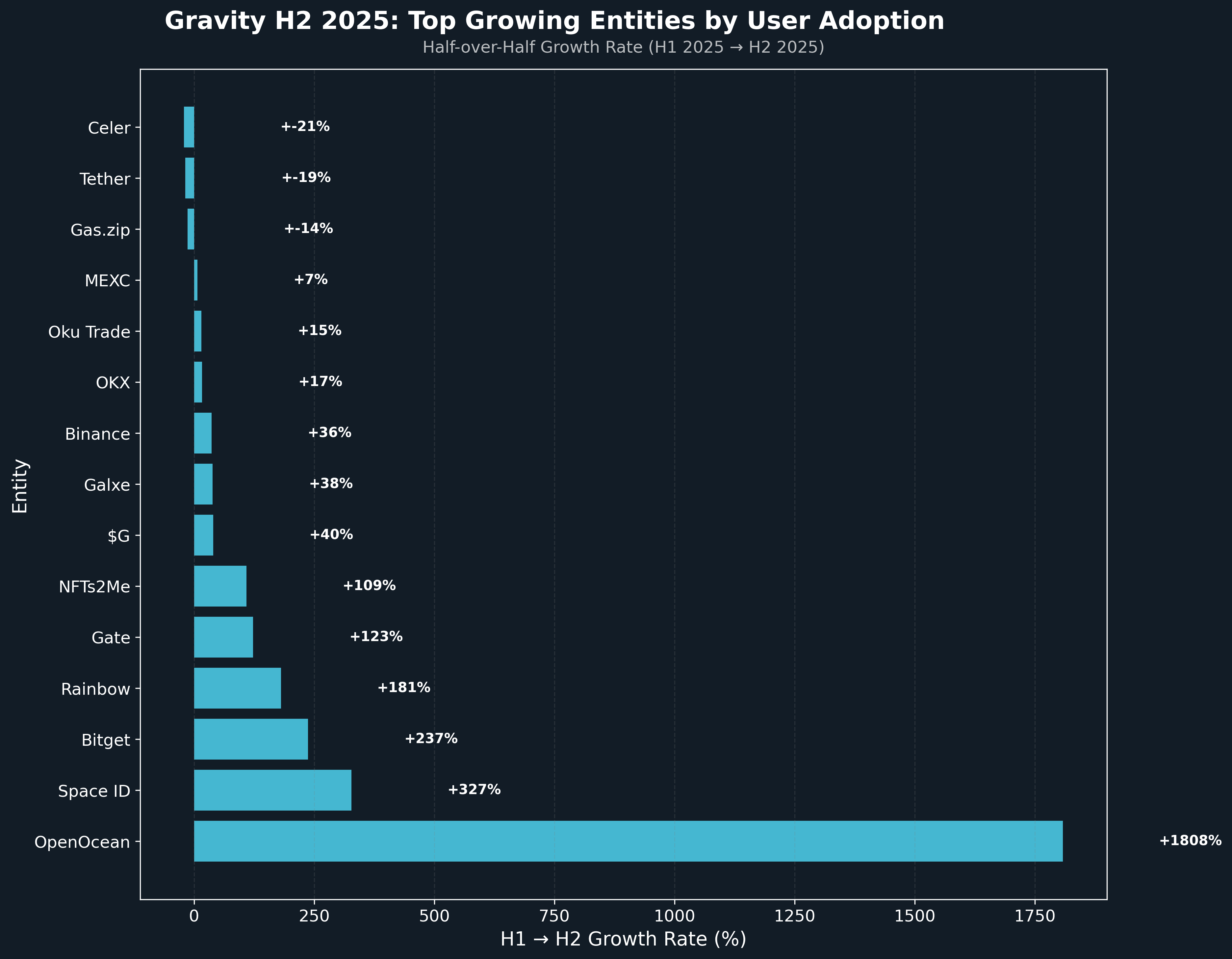

User adoption showed similarly impressive growth trajectories, with OpenOcean leading at +1,808% user growth, followed by Space ID (NFT) at +327% and Bitget (CEX) at +237%. The strong performance across CEXs (Bitget +237%, Gate +123%, Binance +36%, OKX +17%) indicates increasing institutional adoption and integration, while NFT platforms (Space ID +327%, Rainbow +181%, NFTs2Me +109%) demonstrate growing consumer-facing applications. Even the dominant infrastructure players showed healthy user growth, with $G at +40% and Galxe at +38%, highlighting Gravity's momentum as a maturing Layer 1 ecosystem with diversifying use cases beyond its initial infrastructure focus.

Closing Thoughts

H2 2025 has reinforced Gravity's position as a high-performance Layer-1 blockchain with exceptional technical capabilities and growing ecosystem adoption. The network's robust onchain metrics, averaging 644,300 daily transactions and 145,566 daily active addresses, demonstrate sustained engagement and the network's ability to support production applications. Gravity's achievement of ranking among the fastest chains by block time and processing among the most transactions since launch validates the network's technical foundation and performance-oriented design.

As Gravity continues to develop its infrastructure, including the Gravity SDK and other developer tools, the network enters 2026 well-positioned to support the next wave of onchain applications. The combination of performance metrics, real-world application adoption, and meaningful open-source contributions establishes Gravity as a significant player in the Layer-1 ecosystem, bridging high-performance blockchain infrastructure with practical, user-facing applications.