Introduction

Following TGE, Hyperliquid continues to record impressive stats across user growth and solidify itself as the home for the onchain perp and spot markets. Since our pre-TGE report on Hyperliquid, a lot has happened, including new highs for volumes, open interest, and protocol revenues while maintaining 100% uptime. In this note, we go through our thesis on why the HYPE token is positioned well into 2025 despite the sideways/down price action of the last few weeks.

Our Thesis: HYPE's future value

Our Thesis: Future Value Drivers

Hyperliquid’s value proposition is built on multiple high-growth revenue streams, robust tokenomics, and its ability to continually deliver value to HYPE token holders. The following points outline why HYPE remains a compelling asset for long-term holders:

- Trading Revenues – Positive Trend:

- Hyperliquid’s trading volumes and open interest (OI) have grown consistently, even post-TGE, showcasing product stickiness and user loyalty.

- Rapid execution and responsiveness to market demand (e.g., TRUMP listing) reinforce its competitive edge, driving additional trading activity.

- The upcoming HyperEVM launch is expected to unlock new features that could further increase trading volumes.

- Auction Fees – Positive Trend:

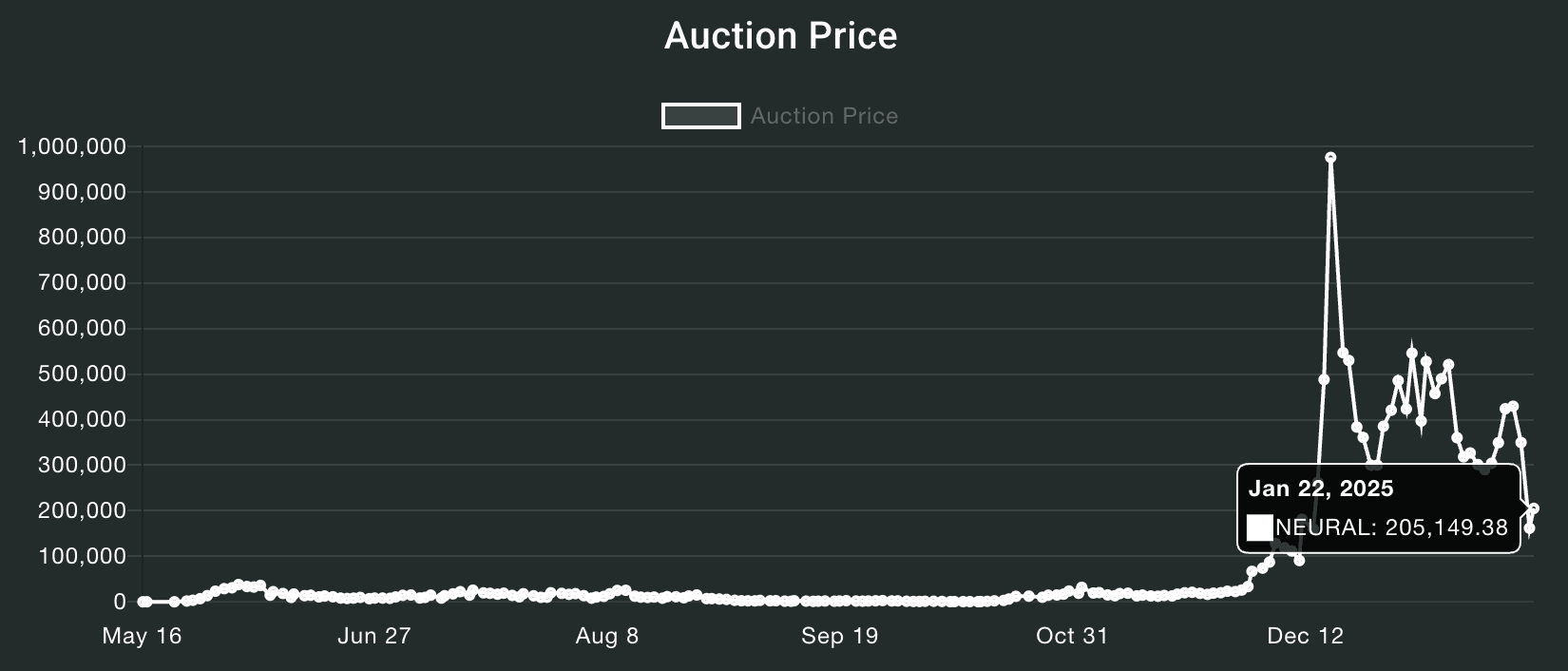

- Token listing fees generated through Dutch auctions have become a significant revenue stream. Demand for listings remains high, as evidenced by auctions like $GOD, which reached nearly $1M. New project launches in 2025 will likely bring additional auction-driven fees.

- Transaction Fees from HyperEVM - Upside Potential:

- The HyperEVM launch introduces transaction fees, adding another layer to Hyperliquid’s diverse revenue model. HYPE’s utility as the gas token strengthens its tokenomics and ecosystem.

- Staking Yield - A passive yield for long-term holders:

- Approximately 43% of the circulating supply is currently staked, offering holders a passive yield. This staking adoption reinforces the long-term value proposition for participants and aligns incentives across the ecosystem. Current yields are around 2.3% APY.

- Reward "Call Option" - Probable future airdrops:

- Hyperliquid’s treasury, supported by the assistance fund, ensures potential future rewards and airdrops for HYPE users/holders. Examples include buybacks of native tokens (e.g., PURR) and possible governance over future emissions. This setup further incentivizes staking and ecosystem participation.

With its strong revenue flywheels, competitive positioning, and focus on execution, Hyperliquid is well-prepared to capitalize on bullish momentum. Despite broader market reflexivity, the protocol’s consistent innovation and incentives for traders make it a standout performer in both onchain and centralized markets.

Our Thesis: Valuation

While Hyperliquid’s growth metrics and product innovation have been exceptional, evaluating whether HYPE remains undervalued relative to its peers is crucial. The protocol’s fundamentals are strong, but market participants should weigh current valuations against its future growth potential and broader market conditions. Below, we examine its relative valuation.

At current levels, HYPE’s Fully Diluted Valuation (FDV) trails top-tier centralized exchanges (CEXs) and competitive Layer 1 blockchain ecosystems. This positioning suggests potential upside, but a more conservative perspective places the ceiling lower than speculative extremes.

- Upside Potential: A 2x upside seems reasonable in a bullish scenario, especially as the protocol solidifies its dominance in an ever growing market. For example, reaching the previous all-time high (ATH) of ~$35 would represent a 48% move from current levels. Beyond that, achieving an FDV of $100B (a 4x from current prices of ~$23) or higher may be unlikely in the current market, given Hyperliquid’s current pricing relative to peers. We maintain a medium- to long-term view here, spanning a multimonth timeframe. However, in crypto, things move fast, and market dynamics could accelerate much quicker than anticipated.

- Picking "winners" in crypto market dispersion times: Mid to late-cycle phases typically reward consolidation into clear winners with strong fundamentals. In other words, “buying winners” can be a better strategy instead of chasing laggards in hopes of a catch up bid. This market has seen quite a lot of dispersion amongst alts, moreso than any other cycle, so buying winners is actually a way to protect oneself from foretelling who the market will eventually decide and being wrong. Hyperliquid, alongside other recently top-performing assets like SOL, offers a viable option for traders who can further rotate profits into more stable plays like BTC. While the growth may not be as exponential as earlier in the cycle, HYPE remains positioned to deliver steady returns as traders seek stability in top projects.

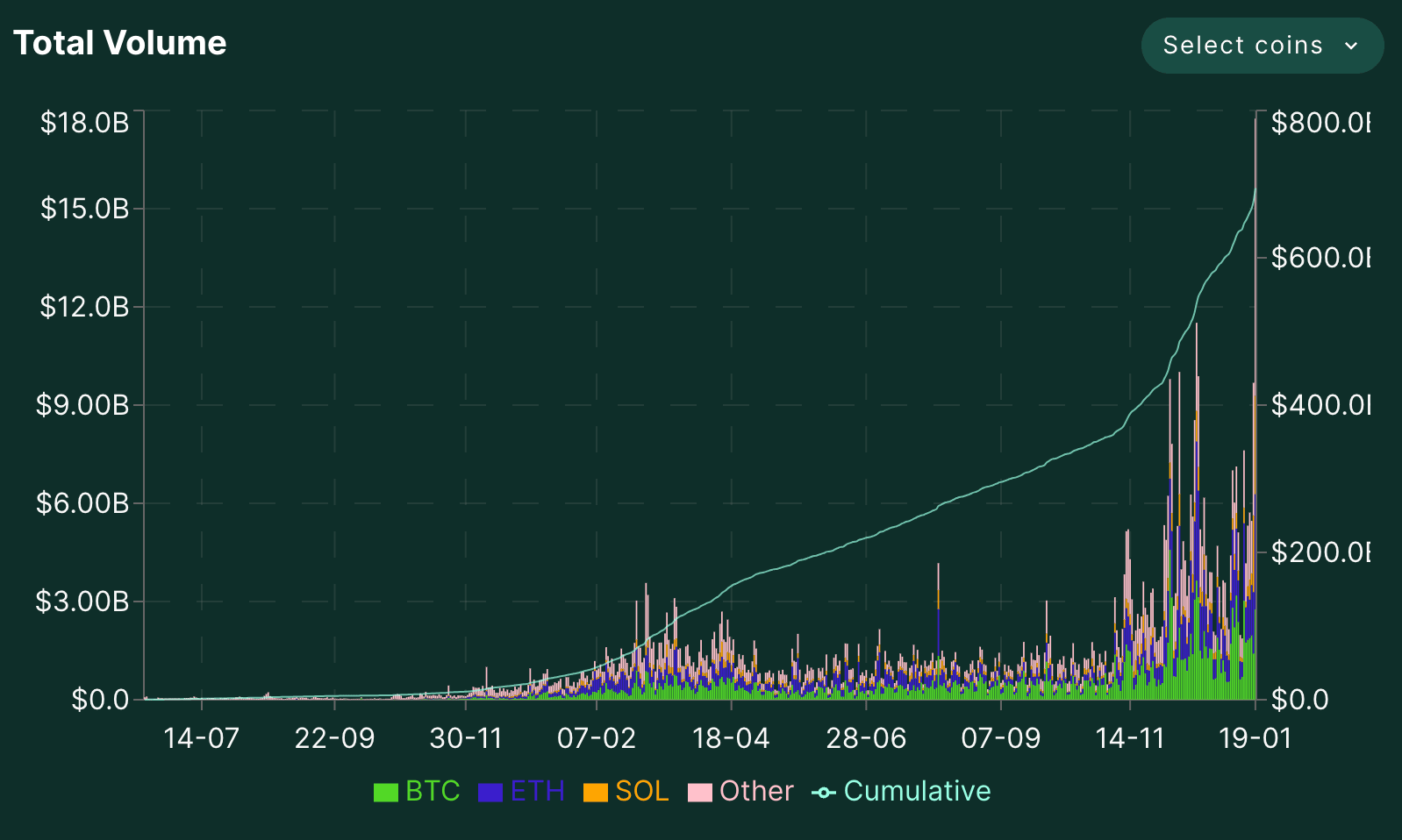

Trading Revenues: Positive Momentum post-TGE

Despite the points program ending with their airdrop, volumes, and OI continue to climb higher into the new year. The product is very sticky amongst traders, and its fundamentals continue to improve. Most recently, the protocol registered the following numbers (as of Jan 21):

- 24h volume: $21b+

- Open interest: $4.7b+

- 24h protocol revenue (fees + HLP): $9.5m+

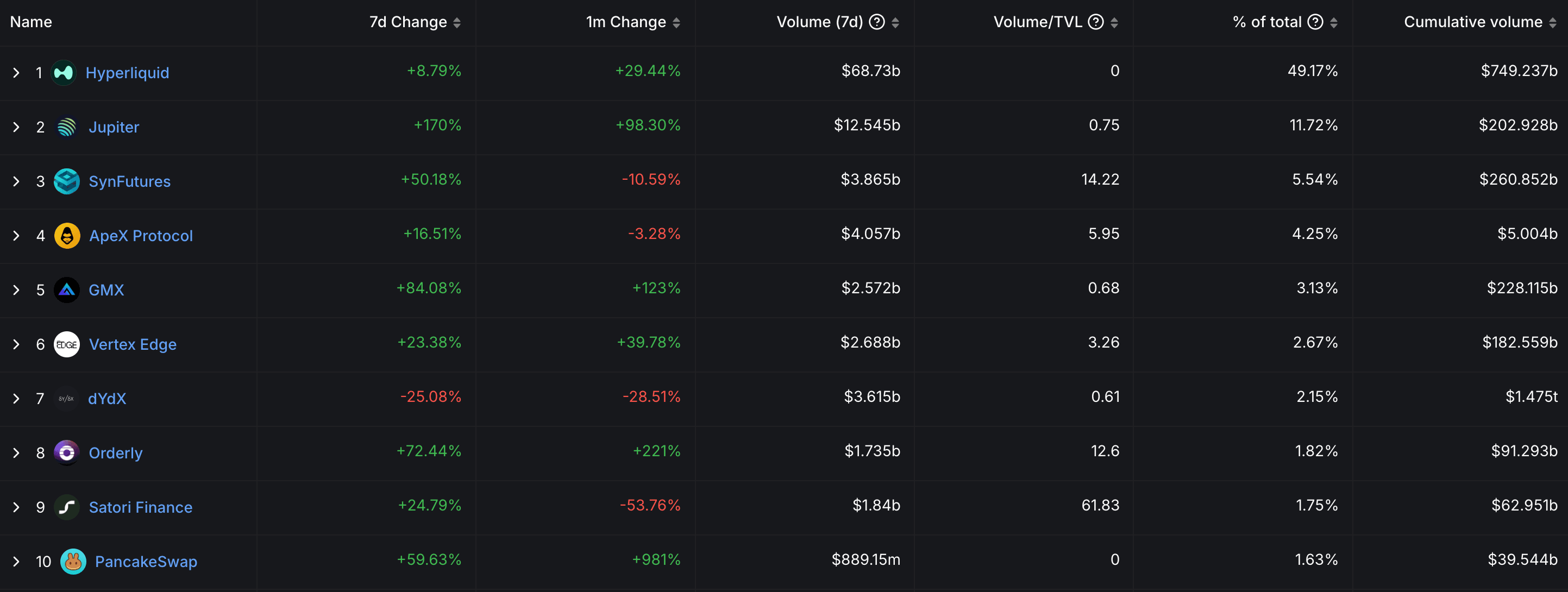

Zooming in on the onchain market, Hyperliquid already facilitates around ~50% of volumes of the entire perp sector.

In short, Hyperliquid maintains dominance in DEX market share while its trading volumes and open interest are increasingly approaching CEX market share levels.

Users

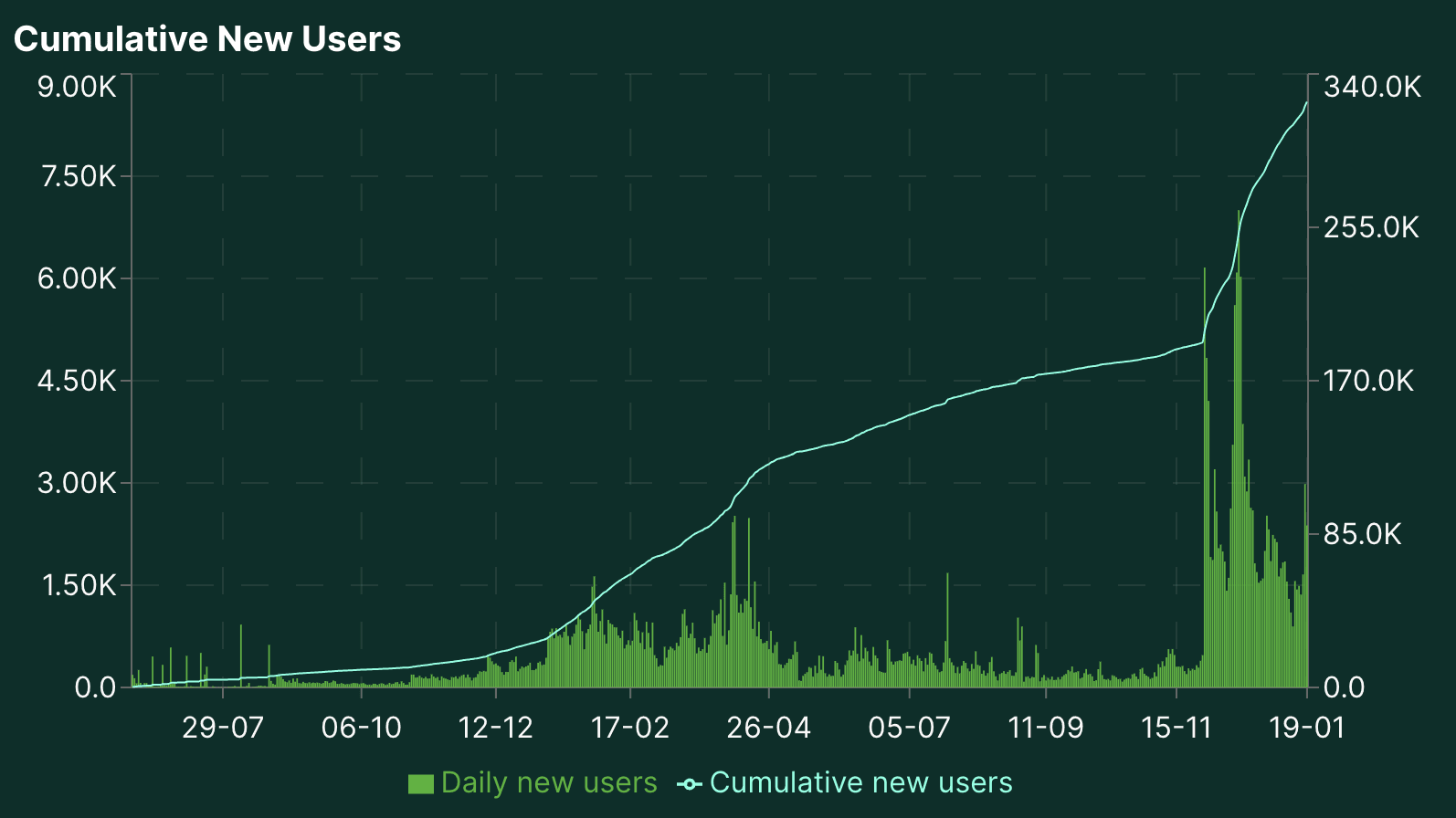

User growth on Hyperliquid shows a constant inflow of new users, adding around 1-3k new users daily as of recently. Cumulatively, Hyperliquid has over 324k new users.

HYPE Staking: Passive yield and other "goodies"

Bridging into Hyperliquid mainly happens through the official Arbitrum bridge. We saw brief net outflows from Hyperliquid on December 22nd onward until around January 13th. Thereafter, we reversed the trend and began to see net inflows into Hyperliquid. Some of this may have been caused by the North Korean-associated addresses using Hyperliquid, along with the fact that many community members were up many multiples on their original airdrop allocation and were selling. Regardless, there are more net inflows to Hyperliquid, with the trend accelerating into the new year.

Staking went live, and nearly 43% of the total circulating supply has already been staked. You can stake with Nansen, one of the largest and most trusted validators for Hyperliquid. On top of the native yield for HYPE stakes (current yields are around 2.3% APY), you can also earn Nansen points and receive special perks such as airdrops from future Hyperliquid projects like OmniX, Hyperlend, and others that are being added every day. With nearly $1b in HYPE secured with Nansen, you can join one of the fastest-growing communities while positioning yourself for potential multiple different airdrops and points programs.

Auction Fees: More to Come

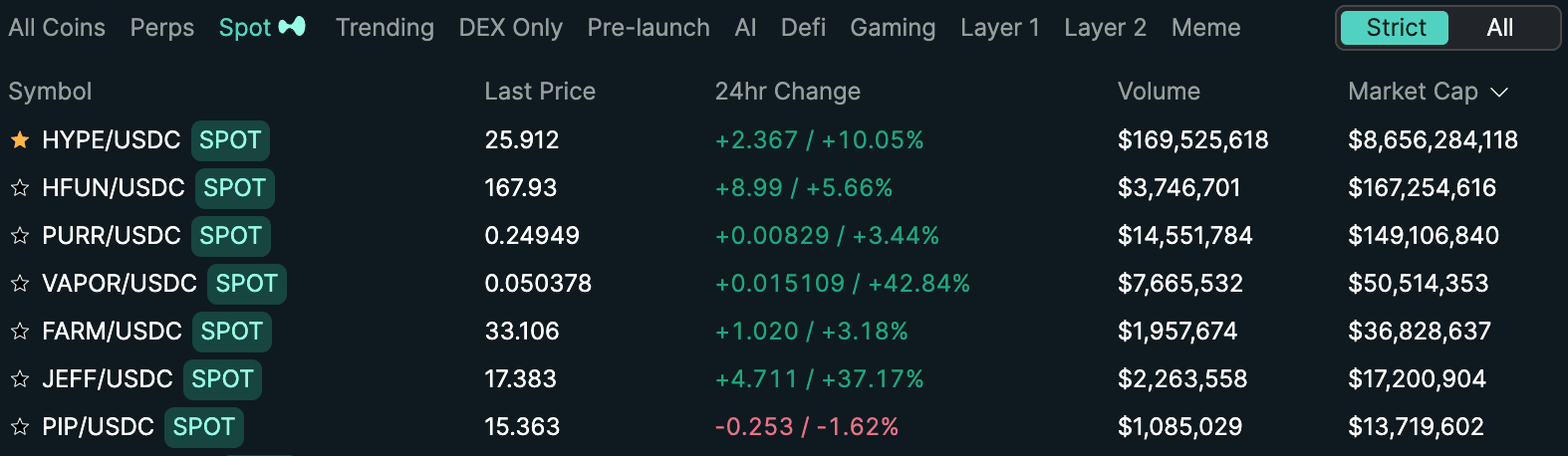

Spot markets continue to grow across native tokens, and new tokens are beginning to be listed. We have seen new entrants, such as SOLV, a LST issuer for BTC, list on Hyperliquid on the same day as CEX listings.

Most of the spot trading is dominated by HYPE itself, along with native memecoins. This leaves much room for growth when the HyperEVM launches, and many of these projects go live with tokens.

Additionally, when these tokens launch on Hyperliquid, they pay a fee to be listed via a Dutch auction model. As opposed to closed-door deals with CEXs, this is done openly and publicly so that anyone can bid in the auction to deploy a new spot asset. Auctions hit nearly $1m for listing fees with $GOD and have now normalized around a few hundred thousand dollars, which shows the very strong demand for Hype listings. Even projects that have existed for a while with decent liquidity elsewhere are also joining in on this demand, such as Sovrun listed as a spot market as well.

Fees from HyperEVM Launch

The highly anticipated HyperEVM has yet to launch. This will open up a new avenue for new onchain markets and interoperability for EVM apps to deploy. Without commenting specifically how the two VMs will work together (current order book and the new EVM environment), the two execution environments will live on top of the same chain, though the liquidity is not directly shared (unlike Berachain) users can still transfer most assets between the two. Complimentary trading toolings such as TG bots and others can be built on top of the RustVM (where the current order book lives today), but the HyperEVM opens the door for all developers to deploy and build apps there. The HyperEVM will use HYPE as the gas token and use the native order book oracles to power its DeFi apps and much more.

Buybacks and "Call Options" on Airdrops

The assistance fund continues to use revenue from exchange fees and listings to TWAP millions of daily buy pressure of HYPE tokens. On top of this, they have also begun to buy back native spot tokens in their ecosystem to diversify and support the broader chain. Starting with .5% of the PURR supply, they added PURR to the assistance fund. This will eventually be taken over by broader governance and can create interesting flywheels for HYPE stakes and projects launching on Hyperliquid - stakes can “direct” fee emissions to native tokens and receive potential airdrops in return for new projects. Again, this is multiple millions in revenues that can be used for the assistance fund to help bootstrap the ecosystem while aligning incentives across stakers and projects.

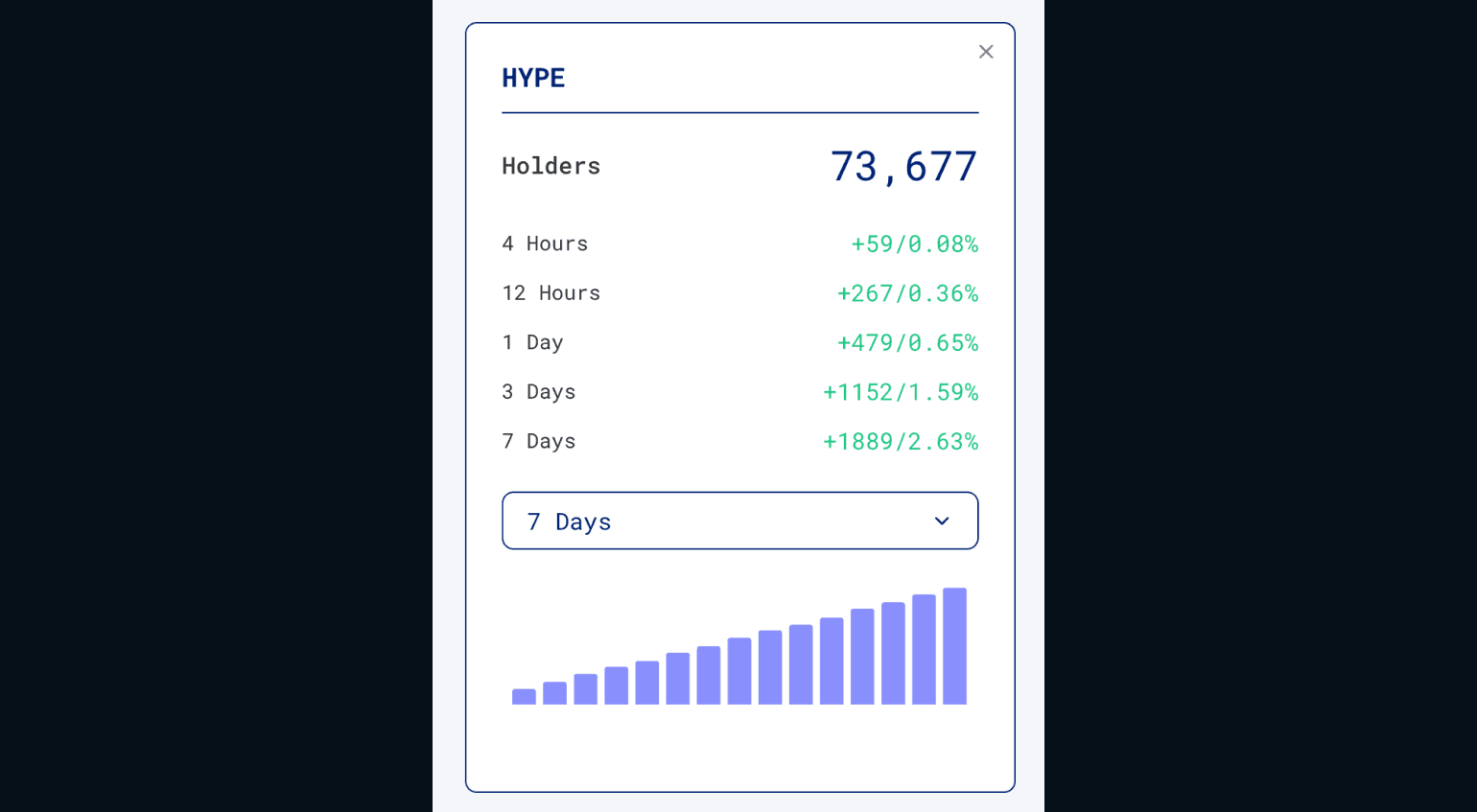

As for HYPE holders, we continue to see a growing holder base.

Since the BTC bottom on January 13th, HYPE has shown remarkable strength.

Most altcoins have continued to underperform relative to BTC, but HYPE defies this trend and continues to outpace BTC into the new year.

Outside of growing metrics and increased market share across DEXs and CEXs alike, Hyperliquid continues to execute key narratives. They were able to list TRUMP 12-24 hours before major CEXs began to list it, creating many millions in volume and fees generated for the protocol. Additionally, they have consistently been early by listening and shipping for their community, as is evident with other listings such as ANIME, MELANIA, and countless others, including a pre-launch category for users to trade assets prior to TGE. These are soft data points that illustrate the key advantages of being a DEX, where they can move faster with perp listings, and users can create permissionless spot markets. Additionally, they are now the premiere spot listing exchange, on par with CEXs, as noted with the SOLV listing that started with day 1 Hyperliquid and CEX listings.

Further, Hyperliquid is sitting on many billions of dollars. They reserved 38% of the entire supply for future incentives, which is an additional $8.74b in potential incentives at today’s prices. There has been no clearly defined use case of this funding but there is definitely room for rewarding power users and the ecosystem more broadly. In other words, there continues to be very large incentives for traders to continue using Hyperliquid over other exchanges.

In short, Hyperliquid continues to serve traders on par, if not better, than their CEX counterparts, delivering value through offering the markets they want with 100% uptime and the tooling they need. It has firmly established itself as a dominant force in onchain perp and spot markets. With ~50% of DEX perp volumes, $21B+ in daily trading volume, $4.7B+ in open interest, and $9.5M in 24-hour protocol revenue, its metrics are beginning to rival those of tier-1 CEXs. Key drivers include its ability to rapidly list assets like TRUMP ahead of major CEXs, consistent uptime, and diverse revenue streams—trading fees, auction fees, and soon, HyperEVM transaction fees, cementing it as a fully-fledged L1.

While Hyperliquid’s success has been reflexive with the bull market, this reflexivity works both ways. If market conditions cool off, volumes, open interest, and revenues may decline in tandem. However, this reflexivity holds across most altcoins, and Hyperliquid’s strong flywheels—bolstered by consistent innovation and incentives—make it well-positioned to capitalize on continued bullish momentum.

Staking adoption (43% of supply staked) and a growing HYPE holder base further reinforce its ecosystem and HYPE’s tokenomic advantages. The highly anticipated HyperEVM launch and ~$8.74B in reserved incentives position Hyperliquid to further expand its market share and reward users. By combining speed, innovation, and execution, Hyperliquid has built a sustainable and compelling flywheel that attracts both projects and traders, cementing its role as the leading venue for onchain trading in 2025 and beyond.