Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche is a three-chain smart contract platform designed to optimize scalability, network security, and decentralization simultaneously. Its primary network consists of the P, X, and C chains, with the C-chain implementing the Ethereum Virtual Machine (EVM) for compatibility with Ethereum applications. A key feature of Avalanche’s architecture is its Layer 1s, which are sovereign networks that define unique membership and token economics. This customizable framework allows Layer 1s to achieve consensus independently, supporting efficient scaling without affecting the main network.

In Q2 2025, Avalanche continues to strengthen its Web3 ecosystem with major initiatives across infrastructure, developer support, and real-world adoption. Codebase has opened applications for Season 4, offering hands-on mentorship and funding to early-stage builders focused on market traction. Meanwhile, Avalanche and the Filecoin Foundation have launched a cross-chain data bridge enabling smart contracts to offload verifiable archival data to Filecoin, improving scalability and compliance. The Avalanche Foundation also announced the first Retro9000 grantees - 19 projects awarded over $1M for deploying impactful Layer 1s and tooling on mainnet. At Avalanche Summit London 2025, industry leaders and builders gathered to spotlight key developments like FIFA’s dedicated Avalanche L1, VanEck’s real-world asset fund, and the Wyoming Stable Token initiative. In DeFi, the integration of Chaos Labs’ Proof of Reserves now ensures real-time, onchain verification of bridged assets like BTC.b and WETH.e, boosting trust and transparency across Avalanche’s liquidity infrastructure.

Key Developments: Q2 2025

- Codebase, Avalanche’s official incubator, has opened applications for Season 4, offering hands-on support to early-stage Web3 founders building natively on the Avalanche network. Since its inception, Codebase has supported 25 startups with over $2.5M in funding, helping them refine products and execute go-to-market strategies. Season 4 will place heightened emphasis on market traction, offering live practice sessions, expert feedback, and mentorship in areas like pricing and token launch prep. Ideal candidates should have a working demo and be ready to focus on product-market fit.

- Avalanche and the Filecoin Foundation have launched a native cross-chain data bridge, enabling Avalanche smart contracts to store data on Filecoin’s decentralized network with verifiable, tamper-proof integrity. Built using the Filecoin Virtual Machine (FEVM) and developed by FIL-B and FilOz, the bridge allows onchain apps to offload archival data - such as audit logs or KYC files - to Filecoin while maintaining onchain access and verification via cryptographic proofs. This integration enhances Avalanche’s scalability by separating storage and computation layers, offering institutions a compliant, low-cost solution for long-term data retention.

- The Avalanche Foundation has announced the first cohort of Retro9000 grantees - 19 projects awarded over $1M in retroactive funding for building impactful Avalanche Layer 1s and developer infrastructure already live on mainnet. Retro9000, backed by a $40M pool, is designed to reward builders who have delivered real results, with grantees selected based on technical contributions, community engagement, and ecosystem impact. This first round was tied to the Avalanche9000 Testnet campaign, and winners include projects like Tesseract, L1Beat, Suzaku, COQnet, and Snowpeer.

- Avalanche Summit London 2025 brought together thought leaders, developers, and community members for a three-day showcase of blockchain innovation at the historic Hatfield House. Key announcements included FIFA’s dedicated Avalanche Layer 1 for fan engagement, the Wyoming Stable Token initiative, and VanEck’s new “Purposebuilt” fund for real-world applications. Industry voices such as Anthony Scaramucci, Maryam Ayati, and Avalanche founder Emin Gün Sirer highlighted blockchain’s growing role in finance, commodities, and entertainment. The event also featured immersive experiences like the Adoption Tent, Gaming Zone, and a closing performance by Reggie Watts.

- Avalanche has integrated Chaos Labs’ Proof of Reserves (PoR) to bring real-time, onchain verification for bridged assets like BTC.b and WETH.e - key components of its DeFi infrastructure. This integration enhances transparency and trust by enabling continuous tracking and public validation of reserve data from canonical bridges and custodians. Users can now independently verify that bridged asset supplies are fully backed, while developers and institutions can integrate PoR data into dApps, risk engines, and governance systems.

Ecosystem

DeFi

- Nonco, a leading institutional digital asset trading firm, has launched its FX On-Chain protocol on Avalanche’s C-Chain to bridge institutional-grade foreign exchange (FX) liquidity with blockchain-based stablecoin markets. By enabling seamless, automated conversions between USD- and local currency-backed stablecoins (e.g., USDC, USDT, AUSD), the initiative aims to reduce costs and enhance efficiency in global payments and cross-border transactions. Key features include institutional liquidity provisioning, targeted FX pricing through RFQs, direct integrations with banks and stablecoin issuers, and atomic on-chain settlement.

- VanEck has launched its first tokenized fund, the VanEck Treasury Fund (VBILL), offering on-chain access to short-term U.S. Treasury debt across Avalanche, Ethereum, Solana, and BNB Chain. Developed in partnership with tokenization firm Securitize, VBILL targets qualified investors with a minimum investment of $100K (or $1M on Ethereum), with fund assets held by State Street and priced daily via RedStone oracles. The token supports 24/7 onramps through USDC and enables instant redemption via Agora’s AUSD stablecoin.

- XSY.fi has launched Unity (UTY), a delta-neutral synthetic dollar, on Avalanche to enhance capital efficiency, composable liquidity, and native yield within the DeFi ecosystem. UTY maintains price stability relative to the U.S. dollar by combining long AVAX spot positions with short perps, enabling users to retain AVAX exposure without selling or bridging assets. Designed to serve DAOs, treasuries, and individuals, UTY provides a stable, capital-efficient alternative to bridged stablecoins and supports integration into on-chain strategies.

- Euler Finance became the first DeFi protocol to integrate sBUIDL, a tokenized representation of BlackRock’s USD Institutional Digital Liquidity Fund, issued by Securitize. Built using Securitize’s sToken vault technology, sBUIDL enables holders of tokenized treasuries to interact directly with decentralized lending markets. This integration on Avalanche marks a significant milestone for institutional-grade assets entering DeFi, offering yield-bearing exposure to real-world U.S. Treasury-backed products within a composable on-chain environment. While sBUIDL is distinct from the BUIDL fund itself, this listing represents a major step toward bridging regulated traditional finance with permissionless protocols.

- Avant Protocol has introduced two Avalanche-native stablecoins designed for composability and sustainable yield generation across the DeFi ecosystem. avUSD serves as a base stablecoin for payments, lending, and liquidity, while savUSD is its yield-bearing counterpart, minted by staking avUSD. savUSD captures yield through on-chain strategies such as cash-and-carry trades, with potential expansion into real-world asset (RWA) exposure. Both tokens are fully native to Avalanche, aiming to provide capital-efficient, transparent stablecoin infrastructure integrated across lending markets, LP vaults, and automated strategies.

- Silo Labs launched Silo v2 on Avalanche, marking the network’s first risk-isolated lending protocol. The platform introduces 10 isolated markets supporting assets like savUSD from Avant and sBUIDL, a tokenized representation of BlackRock’s Treasury fund issued by Securitize. This architecture enables precise risk management, higher loan-to-value ratios, and tighter rate control, offering an institutional-grade alternative to traditional pooled lending markets.

NFTs & Gaming

- Pixelmon, the next-generation monster-collecting franchise, has partnered with Ava Labs to launch its flagship mobile game Warden’s Ascent on Avalanche, combining immersive gameplay, strategic RPG mechanics, and true digital ownership on a scalable, blockchain-powered infrastructure. Targeting the APAC region - home to over half the world’s gamers - Pixelmon leverages Avalanche’s low-latency C-Chain for seamless mobile play, with plans to evolve onto its own custom Avalanche Layer 1 for greater control and performance.

- MapleStory Universe, Nexon’s iconic MMORPG with over 100 million lifetime players, is expanding into Web3 with its own Layer 1. The new game, MapleStory N, brings player-made items, real ownership, and an on-chain economy, reimagining a classic gaming world with blockchain-native systems. Officially launched in Q2 2025, it marks one of the most prominent IPs to fully embrace Web3 infrastructure.

- EVEN, a leading direct-to-fan music platform used by artists like J. Cole and 6LACK, is launching its own custom Avalanche Layer 1 via AvaCloud to scale its high-throughput, creator-first ecosystem. By shifting from traditional streaming to fan-first music drops, EVEN enables artists to get paid instantly, retain ownership, and monetize directly from superfans - often earning more from 500 fans than 1M streams. The new Avalanche-powered chain will support real-time releases, token-gated access, and transparent revenue sharing, while simplifying infrastructure management.

- Fan3 has launched on Avalanche, introducing a fan engagement platform that reimagines the relationship between artists and their audiences through authenticated digital access, real-world rewards, and lasting community experiences. Designed to combat scalpers and bots, Fan3 uses wallet-based digital passes and NFC-enabled wristbands to verify genuine fans, enable seamless event access, and deliver exclusive perks. Its debut included the Bald E’s Pass with music icon Pitbull, offering fans early ticket access, exclusive content, and merchandise.

- FIFA has announced the launch of its own custom Layer 1 blockchain on Avalanche, marking a major milestone in the organization's Web3 strategy and digital fan engagement. Powered by Avalanche’s high-performance infrastructure and developed in partnership with Web3 technology firm Modex, the FIFA Blockchain will serve as the foundation for a range of interoperable digital products, beginning with the migration of FIFA Collect: its official digital collectibles platform. This move enables FIFA to streamline operations, enhance scalability, and offer seamless, low-cost experiences to its global fan base of over 5B people.

Enterprise

- Watr, a blockchain platform tailored for the $20T global commodities industry, has announced its migration to a dedicated Avalanche Layer 1 chain to power the future of onchain commodity markets. Built by veterans from Shell, BP, and J.P. Morgan, Watr aims to digitize real-world assets like metals, food, and fuel by leveraging Avalanche’s modular and high-performance infrastructure. The platform introduces a full-stack solution - including WatrMrks for asset traceability, WatrIDs for decentralized identity, NeoReserves for commodity financing liquidity, and VentureStream for fostering commodity-tech innovation.

- Sumitomo Mitsui Banking Corporation (SMBC), one of Japan’s largest banks, has partnered with Fireblocks, Ava Labs, and TIS to explore commercial applications of stablecoins using the Avalanche blockchain. Under a newly signed Memorandum of Understanding, the group will jointly assess the use of stablecoins for wholesale payments and settlements involving tokenized real-world and financial assets, such as bonds and real estate. This initiative follows Japan’s 2023 regulatory reforms that formally recognized stablecoins as electronic payment instruments.

- Blockticity has launched its own Avalanche-powered Layer 1 blockchain via AvaCloud to authenticate over $1.2B in global trade using tamper-evident, AI-ready Certificates of Authenticity (COAs). Migrating 45K COAs from Avalanche C-Chain and minting 700K more on its new mainnet, Blockticity aims to bring real-time compliance, auditability, and fraud prevention to industries like agriculture, fashion, and energy. Built to meet stringent U.S. and EU trade regulations, Blockticity’s metadata-rich COAs adhere to ASTM D8558 standards and are already in use across international supply chains.

On-chain Data

Daily Transactions Across Avalanche Chains

Avalanche has had an incredible quarter in terms of transaction volume. Beginning with a stable daily average of 4M transactions throughout April, development efforts by Ava Labs drove the numbers to skyrocket - reaching over 12M transactions per day by June. This growth continued steadily until another surge pushed the total to over 19M transactions in a single day, marking a more than 450% increase from April’s average and setting a new all-time high for the network. After peaking in early June, the chart stabilized in the 16–17M range - an encouraging sign for the future, indicating sustained interest in Avalanche’s offerings.

Daily Active Users Across Avalanche Chains

The Daily Active Addresses metric also saw significant improvement in Q2 2025. Initially hovering between 200K and 300K daily users in early April, the chart showed a clear upward trajectory - climbing to 400K before soaring to a peak of 2M active users in a single day, marking another all-time high for the chain. Following this peak, the metric stabilized within a new baseline range of 400K to 600K daily users - an impressive achievement that positions Avalanche among the top blockchain networks, rivaling the likes of Ethereum and Solana.

Top Entities by Users and Transactions

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Avalanche based on the number of users and transactions. By analyzing these interactions, we gain deeper insights into the behavior and trends of key entities on the Avalanche network.

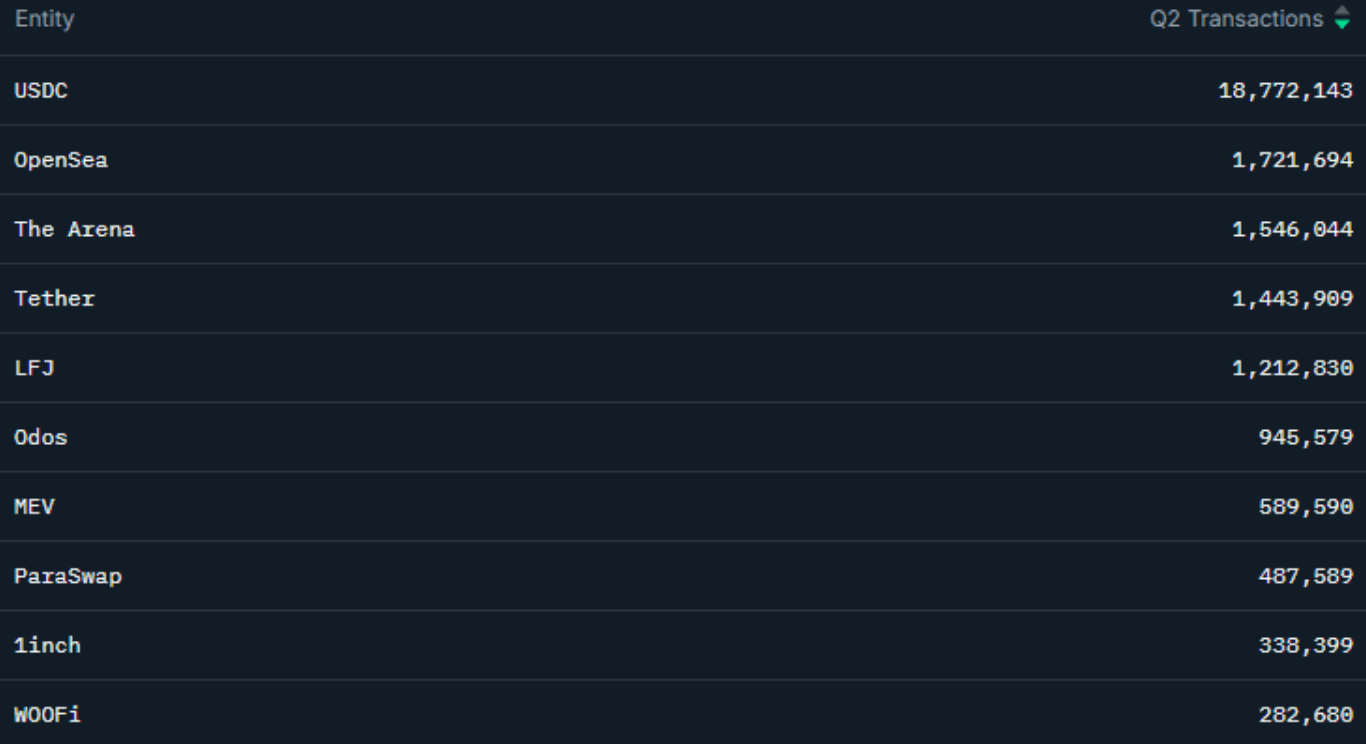

Avalanche Transactions by Entity

Avalanche’s Top 10 Entities by transaction volume in Q2 2025 highlight a vibrant and diverse ecosystem, featuring a mix of well-known cross-chain protocols and Avalanche-native applications. Leading by a significant margin was USDC - a stablecoin issued by Circle - which recorded over 18.5M transactions during the quarter. It was followed by industry heavyweights such as OpenSea, the NFT marketplace, with 1.7M transactions; The Arena, a SocialFi platform, with 1.5M; and Tether, another major stablecoin, with 1.4M. The middle of the list was dominated by DeFi protocols: LFJ (formerly known as Trader Joe) - a comprehensive DEX, aggregator, and token screener - secured over 1.2M transactions, followed by Odos, a smart swap routing platform with 945K, and MEV-related activity contributing over 500K transactions. Rounding out the Top 10 were ParaSwap, a cross-chain intent-based trading protocol; 1inch, a well-established swap aggregator and router; and WOOFi, a cross-chain swap protocol, which closed the list with 280K transactions. Together, these figures underscore the critical role that DeFi and cross-chain infrastructure play in Avalanche’s growing ecosystem.

Avalanche Users by Entity

In Q2 2025, Avalanche’s Top 10 Entities by user count showcased a dynamic and diverse ecosystem of projects - similarly to the transactions one. OpenSea led the rankings with over 1.7M unique wallet addresses interacting with the platform. It was followed by Tether and USDC, which attracted 540K and 320K users respectively. The Arena secured fourth place with 270K users, followed by LFJ with 230K, and Binance - one of the world’s largest cryptocurrency exchanges - with 185K users. The list was rounded out by ParaSwap with more than 100K unique wallets, MetaMask - one of the most widely adopted crypto wallets - with 88K users, and prominent exchanges Bitget and Coinbase, which saw 83K and 64K users respectively.

Closing Thoughts

As Q2 2025 comes to a close, Avalanche stands out as a leading force in Web3, demonstrating exceptional growth across core metrics, ecosystem expansion, and real-world adoption. From a record-breaking surge in daily transactions and active addresses to the launch of high-impact Layer 1s through initiatives like Retro9000, the network is proving its ability to scale without compromising performance. Developer programs such as Codebase Season 4 and integrations like the Filecoin bridge and Chaos Labs’ Proof of Reserves continue to reinforce Avalanche’s technical depth and commitment to transparency, composability, and developer empowerment. Beyond infrastructure, Avalanche is gaining traction across finance, gaming, entertainment, and global trade. The launch of FIFA’s dedicated L1, institutional FX on-chain via Nonco, and tokenized U.S. Treasuries from VanEck all signal growing institutional confidence. Meanwhile, cultural platforms like EVEN, Pixelmon, and Fan3 are redefining how creators and communities interact - backed by Avalanche’s speed, affordability, and scalability. With its vibrant ecosystem, growing adoption, and an expanding global footprint, Avalanche is not just enabling the next wave of decentralized innovation - it’s shaping the future of mainstream blockchain adoption.