Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Celo (the "Customer") at the time of publication. While Celo has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Celo is a fully EVM-compatible layer-1 blockchain that was launched in 2020 as a global payment infrastructure for cryptocurrencies with a focus on mobile users. The Celo project aims to build a financial system that is inclusive for all, with its ability to facilitate payments between any phone number in the world. This is achieved via an ultra-light client that connects a device to a full node, enabling anyone to connect to the Celo Network with minimal data requirements.

Celo also revolves around the core idea of Regenerative Finance (ReFi), which is a proposed financial model to develop and build while maintaining a positive environmental impact and allowing communities to flourish. Leading the way with Climate Collective, a partnership of various web3 projects and organizations with a common goal to reverse climate change via accelerated ecological efforts, Celo aims to bolster ReFi efforts and provide the infrastructure to continue building towards a more sustainable future.

Check out Nansen’s previous quarterly report on Celo here.

Key Developments

stCELO

- StakedCelo is a liquid staking protocol developed by cLabs to encourage active participation and consensus from users.

- Similar to other liquid staking protocols, it involves users depositing CELO and receiving stCELO in return.

- stCELO is an ERC-20 token that is transferable and non-rebasing, which means that the value of stCELO would increase over time when measured in terms of CELO.

- Users may choose to withdraw their assets by exchanging their stCELO for a corresponding amount of CELO, along with any accrued rewards.

- Liquid staking offers users the flexibility of moving their liquidity around the Celo ecosystem, further compounding their liquidity despite having their CELO staked.

ReFi Initiatives

- Carbon Title aims to utilize blockchain technology to provide enhanced transparency into the carbon footprints of the real estate industry, providing better monitoring and tracking for businesses to offset their carbon impact.

- Another protocol, Thallo aims to create a decentralized marketplace for Voluntary Carbon Credits and builds upon Celo’s existing infrastructure of ReFi.

- Celo Foundation also partnered with IDEO, a global design and innovation firm, to launch a five-year program, IDEO Last Mile Program.

- This program aims to provide developers in the Celo ecosystem with in-depth insight into their dapps, leading to better quality products that facilitate user experience.

Integration on Brave browser

- On Sep 9, 2022, Celo announced that Brave, a privacy-focused web browser, integrated Celo as a preloaded network in Brave Wallet, an in-built wallet.

- This integration would provide users with ease of access to onboard their assets and interact with existing dApps built on Celo.

- Besides reinforcing Celo’s commitment to Regenerative Finance (ReFi), this partnership also points towards wider adoption of Web3 technology.

NFT-backed Rewards Pilot Program

- In May 2022, Atlas Cafe Coffeehouse in San Francisco partnered with the Celo Foundation to launch a pilot program where an NFT collection featuring the Atlas mascot was deployed on the Celo blockchain.

- The NFT allowed holders to redeem one free cup of coffee per day during the pilot period.

- Interestingly, the program increased traffic and revenue for Atlas Cafe, helped in marketing efforts via word of mouth and on-chain exploration, and provided Atlas with a deeper understanding of its customer demographic.

- Several learning points of this program included automating reward redemption, streamlining data collection, and developing more on-chain utility.

- With Starbucks embarking on a similar journey on the Polygon chain, it is exciting how the implementation of such technologies in our daily routines is starting to become more mainstream.

Web3 Africa Fund

- Celo Africa Web3 Fund was launched in Aug 2022, setting out to assist with African startup projects that were building on Celo.

- Not only does the Fund help in connecting startups to equity investors from venture capital (VC) firms, Celo’s team would provide technical guidance and mentorships through the Celo Developer Guild.

- At the recent Celo x Huobi Hackathon, Canza Finance, a protocol bringing financial accessibility closer to the community, also received the Most Innovative Product award.

Goldfinch Partnership

- On Aug 8, 2022, Goldfinch announced that they joined the Celo Alliance for Prosperity, a partnership between like-minded organizations to further build the Celo ecosystem and promote financial inclusion.

- Goldfinch is a decentralized credit protocol that implements a “trust through consensus” principle where borrowers are assessed based on their creditworthiness instead of the collateral they put down.

Nansen On-chain Data

Daily Transactions

The number of transactions on Celo ranged from around 150k to a peak of 650k transactions during the quarter. Gas on Celo also spiked multiple times, albeit not with a concurrent increase in transaction volume. Interestingly as transactions dropped from Jul 31 due to bearish market sentiment and volatility, Q3 ended with close to 250k transactions, 25% higher than the start of the quarter.

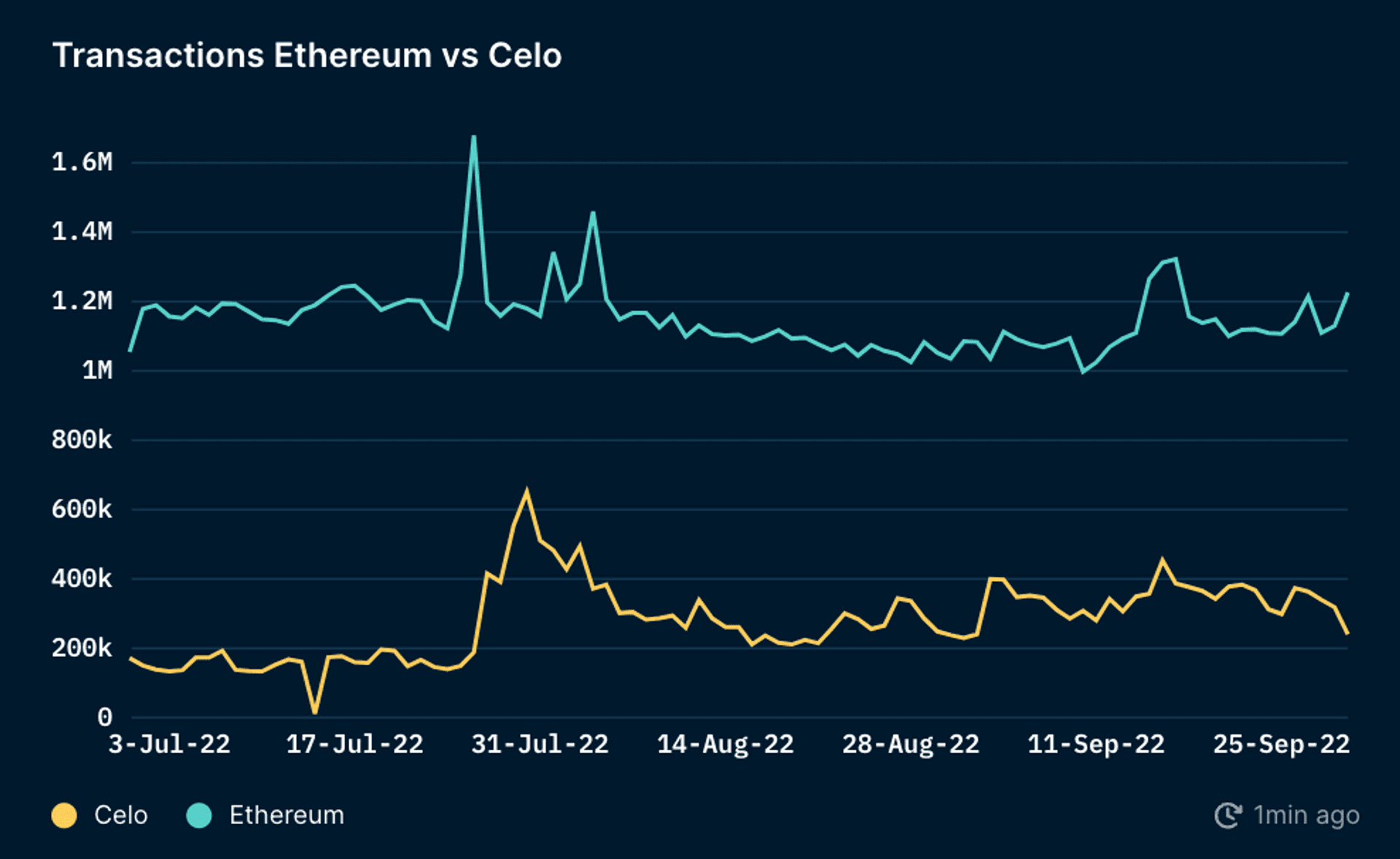

Daily Transactions vs Ethereum

Comparing the number of transactions on Ethereum and Celo, both chains followed a similar trend where transaction volume started to pick up in the early part of Q3 and dwindled towards the end of the quarter with Ethereum having almost 5 times as many transactions as Celo.

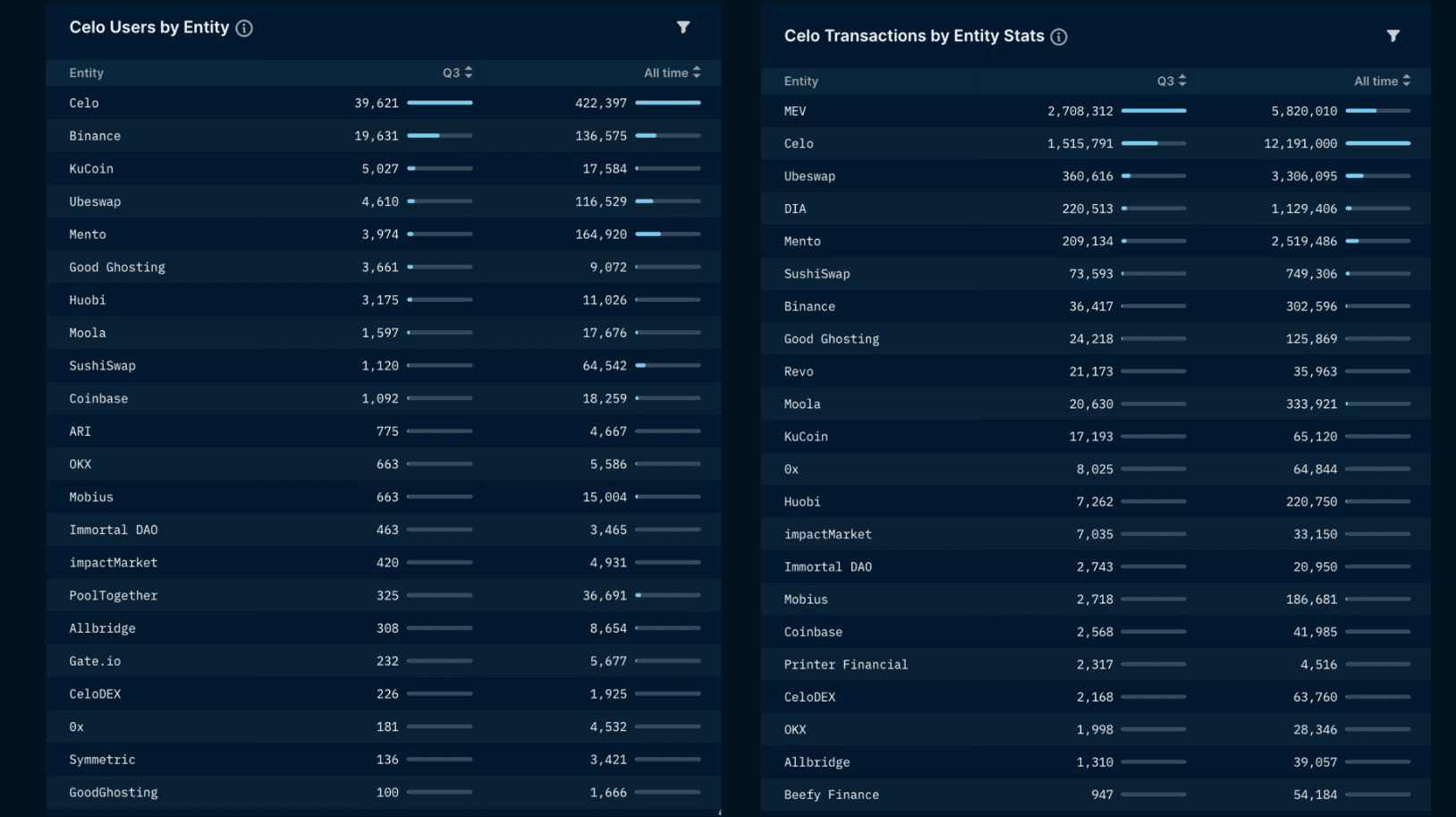

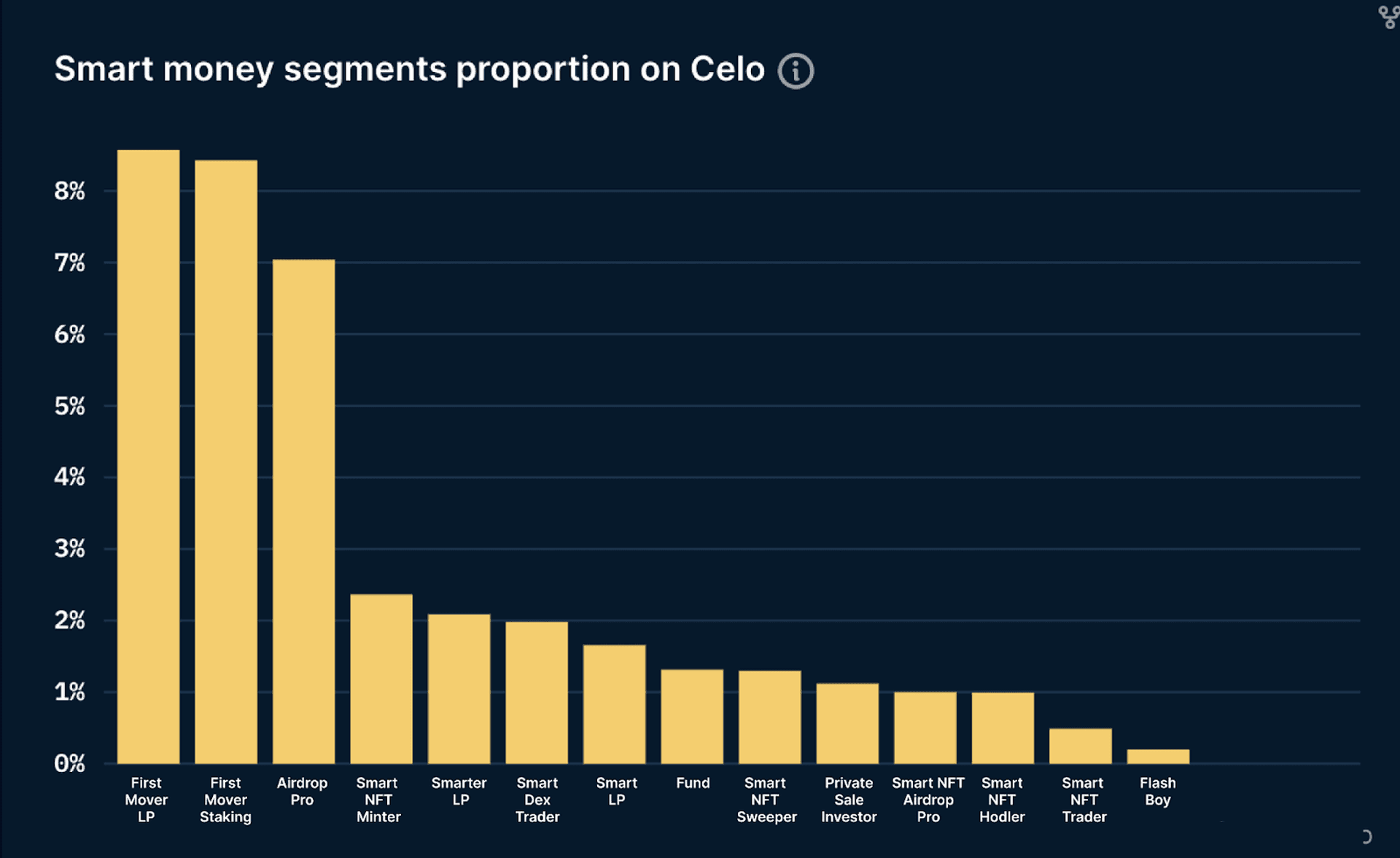

Smart Money Segments and Entities on Celo

Using the Smart Money label on Nansen, the largest percentage of overlapping addresses of Ethereum and Celo belonged to First Mover LP followed by First Mover Staking, potentially pointing towards DeFi opportunities within the Celo ecosystem. The data from the top entities also reinforced this trend. Besides exchanges, Defi platforms, such as Mento, Ubeswap, Moola, and Good Ghosting, had a high number of unique users and transaction volume in Q3.

Check out this page for how these categories are defined and how you can use these labels on Nansen!

Closing Thoughts

Despite uncertainty in the broader markets, Celo had remained steadfast in its commitment to ReFi by sourcing out strategic partnerships with innovative projects. Funding and mentorships were also provided by the Celo Foundation to continue developing dApps within the ecosystem and onboarding new talents. Celo’s value proposition of bridging the gap of financial accessibility and alleviating climate impact is notable, and the innovation on that front is an exciting one.