Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon Labs has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon Labs is a software development company building and developing a network of aggregated blockchains via the AggLayer, secured by Ethereum. As public infrastructure, the AggLayer will bring together user bases and liquidity for any connected chain, and leverage Ethereum as a settlement layer. Polygon Labs has also contributed to the core development of several widely-adopted scaling protocols and tools for launching blockchains, including Polygon PoS, Polygon zkEVM, and Polygon Miden, which is in development, as well as Polygon CDK.

In Q2 2024, Polygon continued to advance its ecosystem through several significant developments. The introduction of the AggLayer redefined blockchain economics, enabling seamless cross-chain interactions and lowering barriers to entry. Governance saw the launch of the governance framework, enhancing community-led decision-making. In the DeFi space, the role of smart contracts in an aggregated network was explored, while Union, the interoperability layer associated with the Cosmos ecosystem, announced its integration with the AggLayer. Polygon Labs also made strides in enterprise solutions with the ISO 27001 certification and the acquisition of Toposware to strengthen ZK research.

Additionally, Ronin Network announced plans to build a zkEVM L2 using Polygon Chain Development Kit (CDK), supporting Layer 2 chains and enhancing scalability for gaming. Movement Labs integrated MoveVM-based Layer 2 chains into the AggLayer, bridging Move and EVM ecosystems. Polymarket, a decentralized prediction market built on Polygon PoS, gained mainstream traction, surpassing $1 billion in trading volume, driven by the U.S. election season. In the NFT and gaming sector, the Moonveil project marked a new phase in Web3 gaming on Polygon protocols, and exclusive NFT minting opportunities, such as those featured in the Polygon PoS Validator Spotlight series, engaged the community. Polygon Labs’ focus on innovation, security, and community-driven development continues to solidify its position as a leader in the blockchain space.

Key Developments: Q2 2024

The AggLayer introduces a new paradigm for blockchain economics by aggregating Ethereum and other chains, reducing transaction costs, and improving user experience. The AggLayer enables seamless cross-chain interactions, creating a more accessible and efficient ecosystem for developers and users.

Ronin Network announced plans to integrate zero-knowledge Ethereum Virtual Machines (zkEVM), allowing developers to launch Layer 2 chains on Ronin using Polygon Chain Development Kit (CDK). This upgrade aimed to enhance scalability, support more games, and improve transaction efficiency on the Ronin blockchain. The first zkEVM chains are projected to launch by Q1 2025, with a focus on expanding Ronin’s ecosystem and providing a seamless gaming experience.

Movement Labs announced that MoveVM-based Layer 2 chains will integrate with the AggLayer, marking the first Move-based network to utilize this framework. The integration, coinciding with Movement Labs' public testnet launch and $160 million in committed TVL, paves the way for seamless interoperability between Move and EVM ecosystems. This development expanded the possibilities for unified liquidity and shared users across all aggregated chains.

Polymarket, a decentralized prediction market built on Polygon PoS, has gained mainstream traction, surpassing $1 billion in trading volume, fueled by increased interest during the U.S. election season. The platform stands out for its transparency, self-custody via Safe, and decentralized dispute resolution with UMA. With Farcaster Frames now enabling Polygon transactions, users can make predictions directly from their feed, enhancing accessibility. Polymarket's decentralized nature offers fast, low-cost transactions, providing a robust alternative to centralized prediction markets.

Polygon Labs introduced a new governance framework for its Community Treasury, which includes Polygon Funding Proposals (PFPs) and the establishment of a Community Treasury Board (CTB). The CTB will oversee funding allocations and strategy for the 1 billion $POL already promised to builders. The framework offers two funding tracks: direct and Grant Allocator-based, with a strong focus on impact reporting and community engagement in the governance process.

Polygon Labs introduced the pessimistic proof, designed to ensure cryptographic security for cross-chain interoperability within the AggLayer. This zero-knowledge proof mechanism assumes that all chains connected to a unified bridge are unreliable, preventing any compromised chain from draining funds from others. By maintaining strict scrutiny of chain balances through local and global exit trees, the AggLayer guarantees safe cross-chain transactions, even in the presence of potential security issues on individual chains.

Polygon Labs integrated Succinct Labs' SP1, a general-purpose zkVM built with Plonky3, into the AggLayer to generate pessimistic proofs. These proofs enhance the security of cross-chain interoperability by ensuring that no single chain can compromise others on the unified bridge. SP1’s use of Rust and open-source architecture accelerates development and makes it easier for chains, including non-ZK ones, to connect to the AggLayer, unifying liquidity and state across chains.

Polygon Miden Alpha Testnet v2 introduced significant updates, including Public Accounts and Notes for on-chain data storage, a streamlined command line interface (CLI), and the introduction of SWAP notes for asset exchanges. The testnet also expanded data storage capabilities and introduced note refactorings, allowing developers to create notes without assets. These enhancements aimed to improve the user experience and support higher throughput applications, marking another step toward the future integration with AggLayer.

OKX launched the X Layer mainnet, a ZK-powered Layer 2 built with Polygon Chain Development Kit (CDK) and integrated with the AggLayer, enabling over 50 million users to access unified liquidity. X Layer, using OKB as its native token, connects to Polygon zkEVM, with core infrastructure providers and dApps like Galxe, The Graph, and QuickSwap already integrated. This launch marks a significant step towards a unified, scalable multichain environment, enhancing liquidity and user experience within the AggLayer network.

Ecosystem

DeFi

Polygon Labs explored the role of smart contracts in an aggregated blockchain network. In this expanded paradigm, smart contracts power DeFi by executing code based on specific conditions across multiple chains. The introduction of the bridgeAndCall() Solidity library allows seamless cross-chain asset transfers and contract executions in a single transaction, significantly enhancing user experience and unlocking new possibilities in DeFi.

The interoperability layer Union announced its integration with AggLayer. This integration will enable seamless message passing and asset transfers between Inter-Blockchain Communication (IBC)-enabled chains and those connected to the AggLayer, including OKX's X Layer and Polygon zkEVM. This collaboration enhances liquidity sharing, interoperability, and cross-chain communication across both ecosystems.

NFTs & Gaming

The Moonveil project, built on Polygon’s CDK, signified the next phase of Polygon's involvement in Web3 gaming. It aims to create a dedicated ecosystem for game developers, supporting cross-chain interoperability and offering a lower-cost solution for scaling Web3 gaming experiences.

The Polygon PoS Validator Spotlight series featured an exclusive NFT mint opportunity on Galxe, where users could unlock and mint the Citrine Gemstone NFT by finding the secret passphrase within the article. This event was part of Season Two of Spotlight Quest, offering collectors and enthusiasts a chance to engage with the Polygon community through unique digital collectibles.

The Polygon Governance Hub launched with interactive community engagement through Layer3's NFT mints. These mints encouraged users to participate in governance-related tasks and quests, offering NFTs as rewards for completing activities that demonstrate commitment to decentralized governance on Polygon.

Enterprise

Polygon Labs achieved ISO/IEC 27001:2022 certification, marking a significant milestone in their commitment to information security. This globally recognized certification reflects the robustness of Polygon Labs' information security management system (ISMS), which was audited by Schellman Compliance, LLC. The certification scope includes all aspects of Polygon Labs' operations related to developing blockchain scaling solutions..

Polygon Labs acquired Toposware, a leading ZK engineering startup, to strengthen its ZK research and development capabilities. Toposware's team, instrumental in creating the Type 1 ZKEVM prover, will integrate with Polygon Labs to advance the AggLayer, Polygon Chain Development Kit (CDK), and Polygon zkEVM, and to potentially upgrade Polygon PoS to a ZK-secured chain. This acquisition enhances Polygon's ability to pioneer the next wave of ZK technology and support the broader Ethereum ecosystem.

Streamr Network integrated with Polygon PoS to power DePIN by providing real-time data broadcasting. Key projects like DIMO, RedStone, and Arkreen utilized Streamr to enable secure and efficient data flows, enhancing transparency and scalability within their operations. Streamr's collaboration with these DePIN projects showcased the potential for decentralized infrastructure to surpass centralized alternatives, leveraging Polygon PoS's low-cost, high-speed environment for real-time data streaming and efficient resource management.

Fox Corporation announced that it is upgrading the beta version of its Verify protocol to a dedicated zero-knowledge (ZK) blockchain using Polygon Chain Development Kit (CDK). This marks Fox as the first enterprise to launch a ZK-powered Ethereum L2. TIME has been announced as the first external media partner to utilize Verify for content licensing and verification. The upgrade enhances Verify's capacity for content attestation and provenance, offering publishers like TIME a cryptographic bridge to AI platforms and enabling consumers to verify the authenticity of registered content.

Nansen On-chain Data

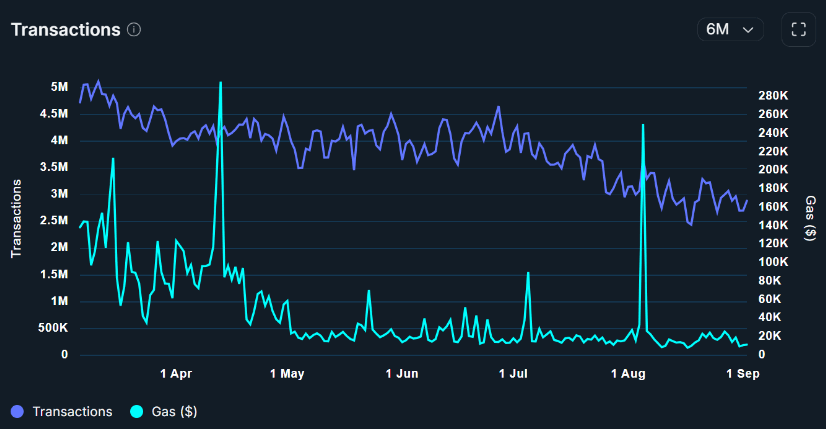

Daily Transactions

In Q2 2024, the Polygon PoS network consistently recorded high daily transaction counts, ranging from 3.5 million to 4.6 million, outperforming Q1’s low of 2.1 million. Daily gas usage fluctuated, peaking at approximately $296,000 USD, compared to Q1’s peak of $280,000.

Despite the broader crypto downtrend in Q2 2024, Polygon PoS's daily transactions held within a range just below all-time highs. This resilience highlights the network’s ability to maintain strong user activity with its robust infrastructure.

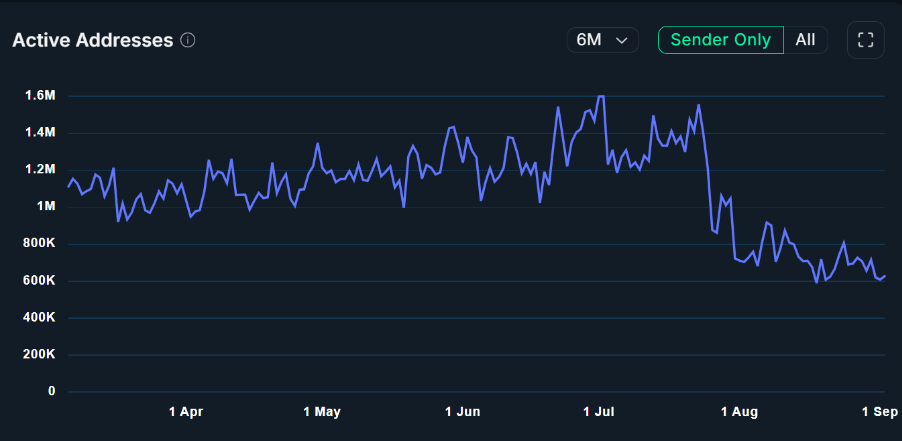

Daily Active Addresses

During Q2 2024, Polygon's PoS network saw a significant rise in user activity, with daily active addresses reaching 1.55 million—a 29% increase from Q1 2024. Despite the market downtrend that affected daily active addresses on popular chains like BNB Chain, Ethereum, and Optimism, Polygon PoS continued to defy the trend.

Average Daily Gas Paid (vs Ethereum)

In Q2 2024, the average daily gas fee on Polygon PoS fell below $0.01 for multiple days, making it one of the most cost-efficient networks for transactions. In stark contrast, Ethereum's gas fees remained significantly higher, ranging from $1.27 to a peak of $13.60. This substantial difference highlights Polygon PoS's advantage in providing affordable transaction processing. Polygon PoS's ability to maintain such low fees, even as it supported increasing user activity and transaction volume, underscores its effectiveness.

Top Entities by Users and Transactions

Nansen's list of labels offers a comprehensive analysis of top entity interactions on Polygon PoS, focusing on the number of users and transactions. Matr1x FIRE claimed the top position for the second consecutive quarter, with 74.84 million transactions. Chainlink held second place with 17.82 million transactions, followed by Tether at 11.80 million. Matr1x FIRE also led in user numbers, with 34.27 million users. Polygon PoS continues to be a dominating network for gaming protocols followed closely by financial dApps.