Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to TRON DAO (the "Customer") at the time of publication. While TRON DAO has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

The TRON network is a high-performance, Layer-1 blockchain platform designed to support decentralized applications, digital assets, and smart contracts with a focus on scalability, low transaction fees, and high throughput. Founded by Justin Sun, TRON uses a Delegated Proof-of-Stake (DPoS) consensus mechanism, allowing fast and energy-efficient transaction processing. With over 337 million user accounts and billions of transactions, TRON has become a prominent ecosystem for stablecoins, particularly USDT and DeFi applications. Its mission centers on decentralizing the internet by enabling seamless, borderless value exchange and fostering widespread adoption of blockchain technology.

In Q3 2025, TRON DAO achieved unprecedented milestones that solidified its position as a critical infrastructure for global financial systems. The network was selected by the U.S. Department of Commerce to publish official GDP data, marking the first time a federal agency has published economic data to public blockchains. This historic recognition came alongside a 60% fee reduction that immediately drove adoption, helping TRON surpass 2.5 million daily active users and overtake both BNB Chain and Solana in activity metrics. The quarter also saw significant ecosystem expansion through strategic partnerships with MetaMask, PayPal USD integration via LayerZero, and the deployment of the $TRUMP token, positioning TRON at the forefront of the evolving digital asset landscape.

TRON's growing institutional adoption was further evidenced by Kraken's election as a Super Representative, bringing institutional-grade protocol staking infrastructure to TRON's governance. The network's dominance in stablecoin settlements reached new heights, with over $600 billion in monthly stablecoin transfers and 50% of all USDT currently circulating on TRON. These achievements, combined with the expansion of T3+ crypto crime unit and multiple cross-chain integrations, demonstrate TRON's evolution from a high-performance blockchain to a foundational infrastructure for global financial inclusion and institutional-grade transaction processing.

Key Developments: Q3 2025

- TRON selected by U.S. Commerce Department for GDP data publication

- The U.S. Department of Commerce selected TRON as one of the primary networks for posting official economic data, beginning with the Q2 2025 GDP release. This marks the first time a federal agency has published official GDP data to public blockchains, with the Bureau of Economic Analysis recording the SHA256 hash of the Q2 2025 GDP data (3.3% growth) immutably on TRON. The selection acknowledges TRON's proven ability to deliver scale, speed, efficiency, and global accessibility, processing over $22 billion in daily settlement and more than 8.8 million daily transactions.

- 60% fee reduction drives massive adoption surge

- TRON's community governance approved a 60% reduction in energy fees in August 2025, sharply lowering transaction costs and immediately driving adoption. Within days, TRON surpassed 2.5 million daily active users, overtaking both BNB Chain and Solana in activity. This move was designed to preserve accessibility, particularly for stablecoin transfers, where TRON leads globally with more than $79 billion in USDT circulating on the network.

- Kraken elected as Super Representative

- Kraken, one of the industry's longest-standing and most secure crypto platforms, was elected as a Super Representative (SR) on the TRON blockchain network. This brings institutional-grade protocol staking infrastructure to TRON's decentralized governance, enhancing network security and efficiency while enabling broader institutional participation in TRON's incentive model. Kraken's multi-tier signing and listening node architecture delivers stakeholders the ideal combination of security, scalability and decentralization.

- Tron Inc. expands TRX treasury to $220+ million

- Tron Inc. (Nasdaq: TRON) announced the expansion of its TRON (TRX) token treasury holdings to over $220 million through Bravemorning Limited's exercise of all warrants for $110,000,000. This transaction adds 312,500,100 TRX tokens to the Company's treasury portfolio and expands Bravemorning's total equity investment to $210 million, making it the controlling shareholder with 86.6% ownership. The company positions itself as the largest public holder of TRX tokens.

- TRON surpasses $600B in monthly stablecoin transfers

- CoinDesk Data published a comprehensive protocol report highlighting TRON's continued leadership in stablecoin settlements, rapid user growth, and increasing influence on global financial inclusion. Key insights include: USDT represents 61% of the global stablecoin market capitalization with 50% of all USDT currently on TRON; around 60% of all USDT transactions on TRON are under $1,000, indicating strong adoption among everyday users; and data from 31 stablecoin payment companies found that TRON was the most-used blockchain for stablecoin transfers in 35 of the 50 countries included in the analysis.

- Binance joins T3+ crypto crime unit

- Binance joined as the first member of T3+, an expanded effort from the T3 Financial Crime Unit founded by TRON, Tether, and blockchain analytics firm TRM Labs. The group has reportedly helped freeze over $250 million in illicit assets less than a year after launch, with T3+ functioning as a public-private collaboration between industry actors and law enforcement agencies around the world.

Ecosystem

DeFi

- MetaMask native integration

- TRON DAO announced strategic agreements with MetaMask for native integration of TRON into the world's leading self-custodial crypto wallet. This integration enables MetaMask users to interact directly with the TRON ecosystem, which has a strong footprint across high-growth regions in Asia, South America, Africa, and Europe. The collaboration reflects aligned goals in expanding access to Web3 and advancing user-centric innovation.

- PayPal USD expands to TRON via LayerZero

- TRON DAO announced that PayPal USD will be available on the TRON network through Stargate Hydra as a permissionless token, PYUSD0, leveraging LayerZero's Omnichain Fungible Token (OFT) Standard. This integration builds on LayerZero's acquisition of Stargate, applying the Hydra model to extend PYUSD to TRON and other blockchains, enabling both users and institutions greater accessibility to stablecoin payments.

- $TRUMP token deployment

- TRON DAO announced the official deployment of $TRUMP on the TRON blockchain, enabled by LayerZero's Omnichain Fungible Token (OFT) standard and Stargate Finance's user interface and liquidity transport protocol. This deployment positions TRON at the forefront of the evolving digital asset landscape, leveraging TRON's infrastructure optimized for high-speed and low-cost transactions. The integration allows $TRUMP to move across supported blockchains without traditional bridges, reducing fragmentation and increasing accessibility.

- Cross-chain clearing and settlement integrations

- Multiple major cross-chain protocols integrated with TRON: deBridge completed full integration, making TRON instantly composable with 25 other blockchains through three pillars of cross-chain interoperability; Everclear launched TRON network support for capital-efficient rebalancing, allowing the largest circulating supply of USDT ($82+ billion) to move seamlessly between TRON and over 20 other blockchains; THORSwap announced integration bringing support for native $TRX and USDT (TRC20) cross-chain swaps with Bitcoin, Ethereum, XRP, Solana, BNB, Base, ARB, DOGE and more.

- Real-world asset yield integration

- Plume announced a strategic integration with TRON to launch SkyLink across the TRON Network, enabling TRON's vast global user base to access asset-backed yields from tokenized U.S. Treasuries, private credit, and other real-world financial products. SkyLink is Plume's omnichain RWA yield distribution protocol that enables secure, permissionless access to institutional-grade financial products across chains.

Infrastructure

- The Graph real-time data streaming

- The Graph announced a strategic integration with the TRON blockchain network, leveraging Substreams to offer developers instant streaming access to TRON network data. This integration enables TRON developers to access live chain metrics such as wallet activity, token swaps, and Total Value Locked (TVL) without custom backend infrastructure. The Graph provides multilingual documentation, targeted webinars, and strategic hackathon bounties to support developers globally.

- NEAR Intents integration

- TRON DAO announced a strategic collaboration with NEAR to integrate NEAR Intents on the TRON blockchain, enabling seamless swaps through a frictionless, intent-based experience. NEAR Intents is a multichain transaction protocol that allows users to make requests and let third parties compete to provide the best solution, abstracting away blockchain complexity. The integration unlocks cross-chain transfers requiring no wallet setup, no bridging, and no awareness of chain mechanics for users on one of the world's most active blockchains.

- Developer infrastructure expansion

- AIDA became fully live on TRON mainnet with all features including trading across DEXs, token launching, and AI-powered analytics; Polymer Labs went live on TRON network, providing app builders a one-click gateway to integrate with TRON through EVM<>TronVM compatibility and single API access to all chains.

Enterprise and RWAs

- Tokenized equities integration

- TRON DAO announced a strategic collaboration with Kraken and Backed to integrate xStocks with the TRON blockchain, opening up new opportunities for tokenized equities exposure. In the coming weeks, Kraken clients in eligible jurisdictions will be able to deposit and withdraw xStocks directly through the TRON blockchain, enhancing accessibility for users worldwide. Backed will deploy xStocks on TRON as TRC-20 tokens, maintaining full 1:1 backing for each tokenized asset.

Onchain Data

Daily Transactions

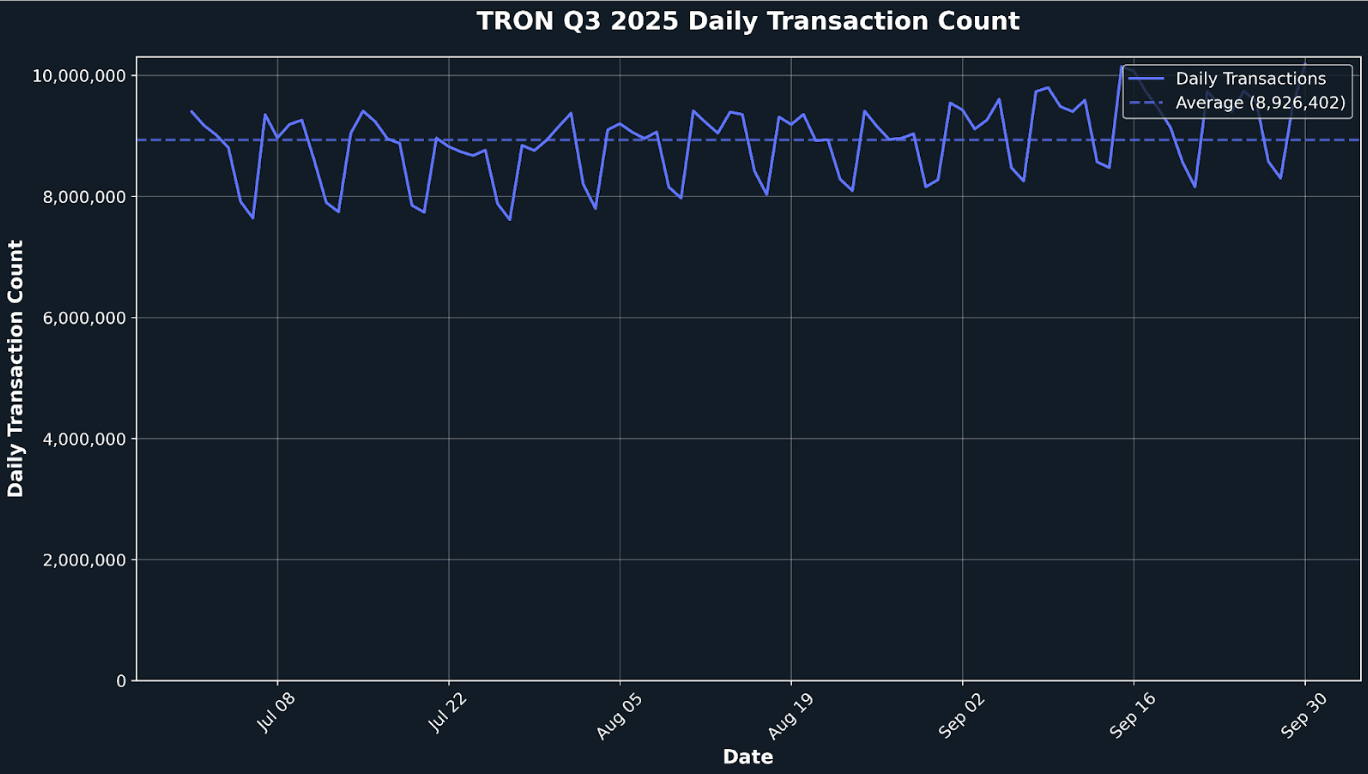

TRON demonstrated exceptional transactional throughput throughout Q3 2025, processing over 821 million transactions with remarkable consistency. Daily transaction volumes averaged 8.9 million per day, ranging from 7.6 million to 10.2 million, reflecting the network's robust infrastructure and sustained user engagement. The quarter showed steady month-over-month growth, with July averaging 8.7 million daily transactions, August at 8.8 million, and September reaching 9.3 million daily transactions. This upward trajectory aligns with the 60% fee reduction implemented in August, which immediately drove adoption and helped TRON surpass 2.5 million daily active users, overtaking both BNB Chain and Solana in activity metrics.

Daily Active Addresses

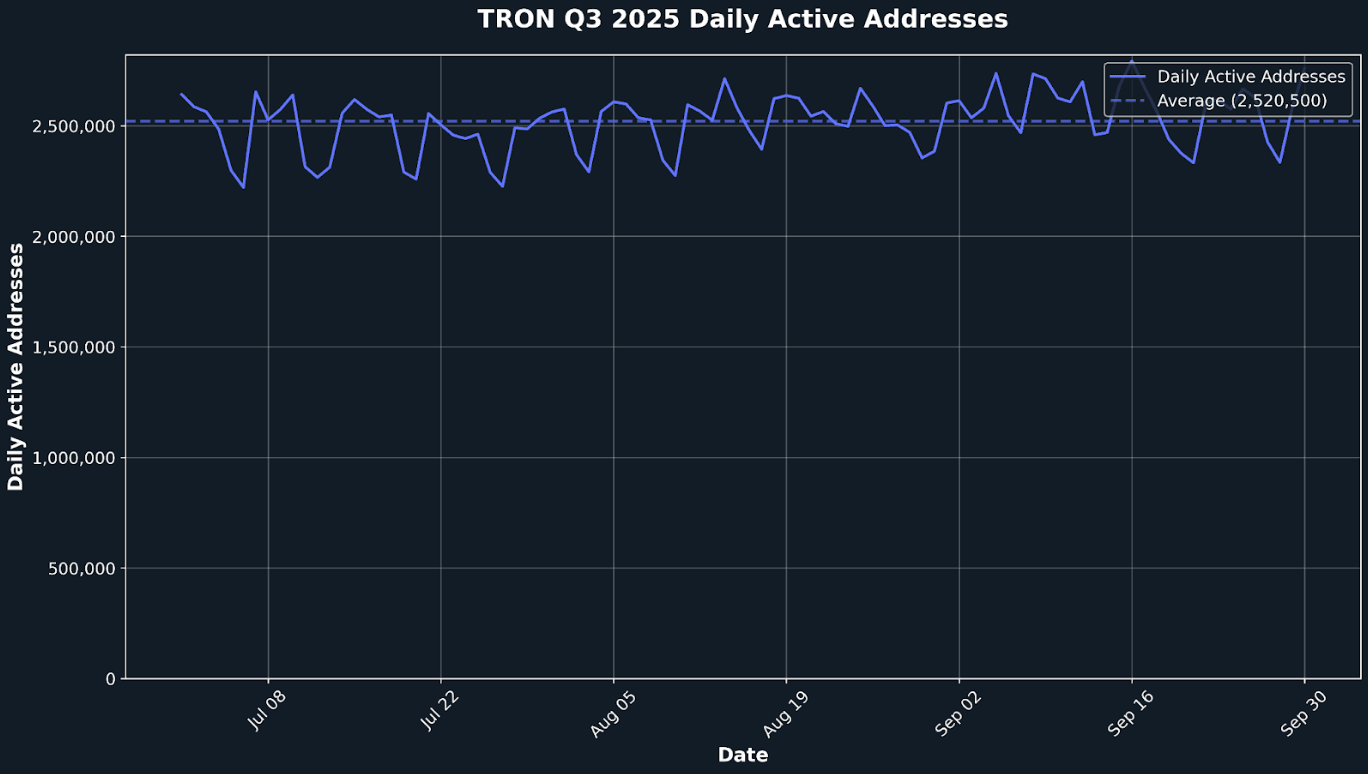

TRON maintained a strong and consistent base of active addresses throughout Q3 2025, with daily active addresses averaging 2.52 million across the quarter. The network demonstrated strong stability, with daily active addresses ranging from 2.22 million to 2.79 million, showing minimal volatility despite the significant fee reduction mid-quarter. Monthly trends showed consistent growth, with July averaging 2.47 million daily active addresses, August at 2.52 million, and September reaching 2.58 million. This sustained activity reflects TRON's position as a leading platform for stablecoin transfers, particularly USDT, where the network processes over $79 billion in circulating supply and handles 60% of all USDT transactions under $1,000, indicating strong adoption among everyday users.

Top Entities by Users and Transactions

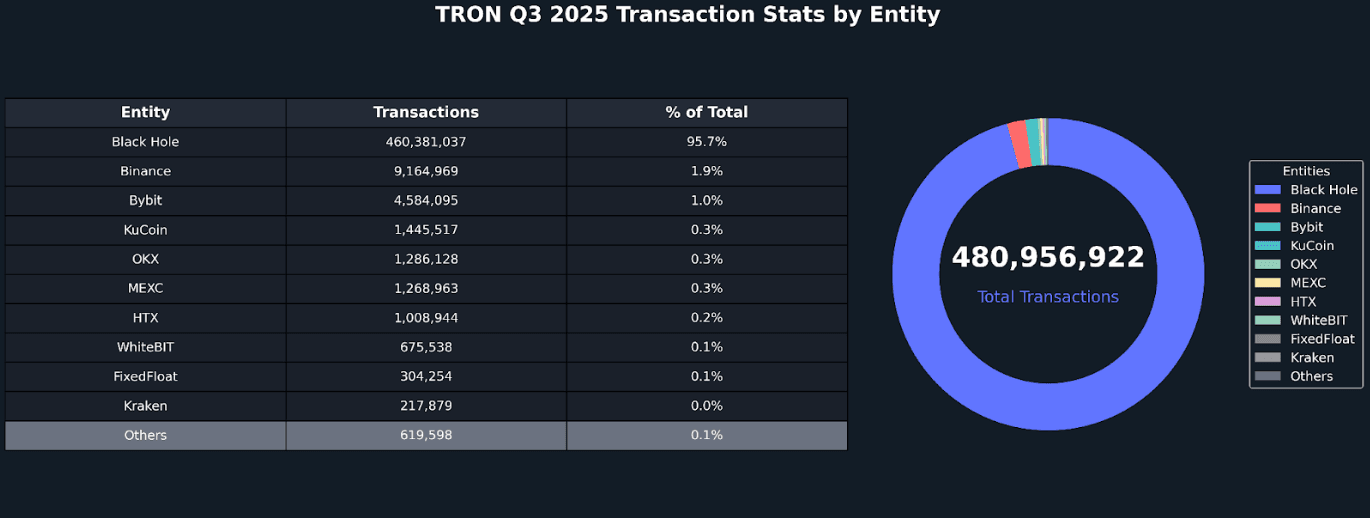

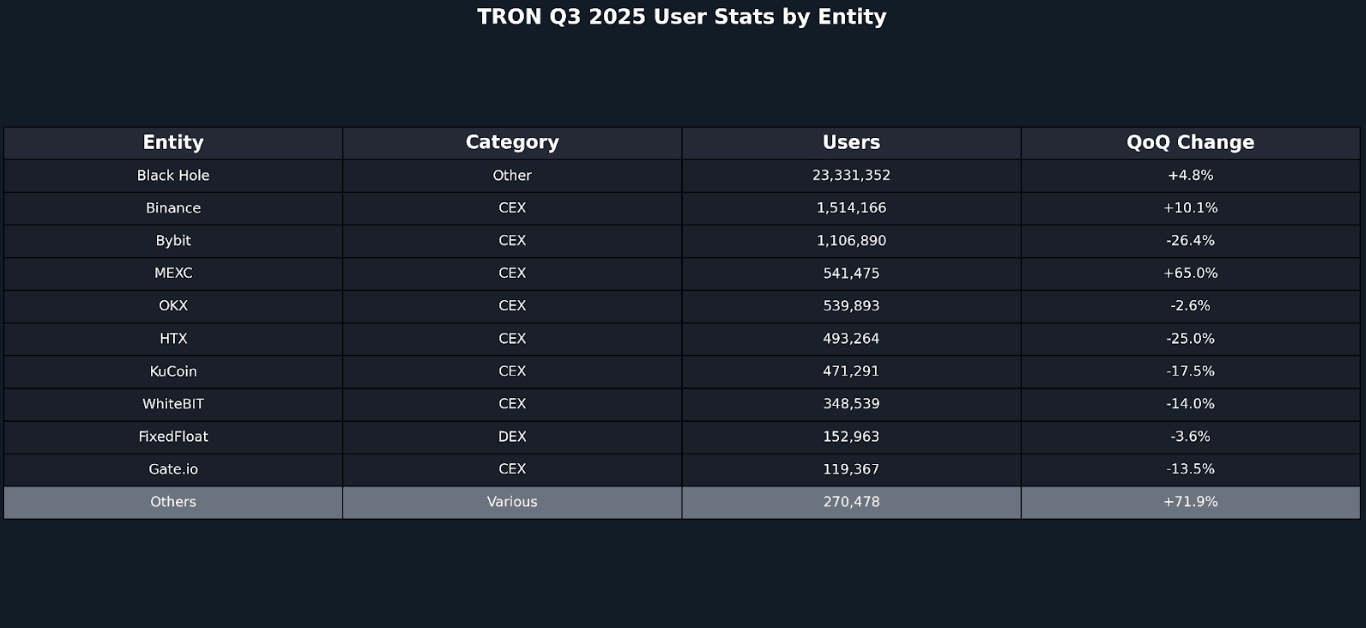

TRON's Q3 2025 onchain activity reveals a highly concentrated ecosystem dominated by Black Hole, which accounted for 95.7% of all transactions (460.4 million) and 80.8% of unique users (23.3 million), representing a 7.1% and 4.8% quarter-over-quarter growth respectively. This dominance reflects Black Hole's role as a critical infrastructure component for TRON's transaction processing, especially when minting or burning tokens. This reflects TRON’s growing role in facilitating crosschain activity.

The centralized exchange (CEX) sector represented the second-largest category, processing 4.2% of transactions and serving 18.7% of users, with Binance leading at 1.9% of transactions and 5.2% of users, showing strong 13.4% and 10.1% QoQ growth. Notable growth stories include MEXC's impressive 69.5% transaction growth and 65.0% user growth, while several exchanges experienced declines, including Bybit (-24.7% transactions, -26.4% users) and HTX (-29.3% transactions, -25.0% users). The DEX sector remained relatively small at 0.1% of transactions and 0.5% of users, with FixedFloat being the primary DEX entity. This distribution underscores TRON's role as a high-throughput settlement layer optimized for stablecoin transfers and institutional-grade transaction processing, with infrastructure and core protocol operations driving the vast majority of network activity.

Closing Thoughts

Q3 2025 has been a transformative quarter for TRON, marking its evolution from a high-performance blockchain to a critical infrastructure for global financial systems. The U.S. Department of Commerce's selection of TRON for official GDP data publication represents a significant milestone, signaling institutional recognition of blockchain technology's role in transparent, immutable record-keeping. This historic achievement, combined with the 60% fee reduction that immediately drove adoption past 2.5 million daily active users, demonstrates TRON's ability to balance accessibility with institutional-grade performance.

The network's onchain metrics tell a compelling story of sustained growth and stability. Processing an average of 8.9 million daily transactions, TRON maintained remarkable consistency throughout the quarter, with steady month-over-month growth from July to September. The 2.52 million average daily active addresses, with minimal volatility despite the significant fee reduction, reflects the network's robust infrastructure and growing user base.

TRON's ecosystem expansion through strategic partnerships with MetaMask, PayPal USD integration via LayerZero, and the deployment of $TRUMP token positions the network at the forefront of cross-chain innovation. The addition of Kraken as a Super Representative brings institutional-grade governance infrastructure, while the expansion of T3+ crypto crime unit demonstrates TRON's commitment to security and compliance. With over $600 billion in monthly stablecoin transfers and 50% of all USDT circulating on the network, TRON has established itself as the premier platform for global financial inclusion and real-world blockchain integration. As TRON enters Q4 2025, the network is well-positioned to capitalize on its growing institutional adoption, robust onchain performance, and expanding ecosystem partnerships.