Top News

NFT Market Overview

Main observations:

- Volume measured in ETH had a very slight uptick from last week mainly attributed to an increase in mints. Volume has continued to plateau and is ranging from 75k-100k weekly ETH volume.

- Transactions per week continues to be suppressed and is at 580k for the last 7 days

- Users per week has increased slightly to 225k from the increase in mints.

- The Blue-Chip 10 index continues to trend lower but Chrome Squiggles and CloneX have witnessed an increase of 40% and 19% respectively.

NFT Index Performance

- In the last 7D and 1M timeframes, all indexes but Art-20 have experienced a negative ROI when measured in ETH terms.

- Chromie Squiggle and Art Blocks x Pace are the 2 main projects contributing to the outperformance of the Art-20 index

- Unsurprisingly, all indexes continue to be negative YTD in ETH terms.

- Both the Game-50 and Metaverse-20 index continues to significantly underperform YTD and is down -74% and -41% respectively.

This Week's Highlights

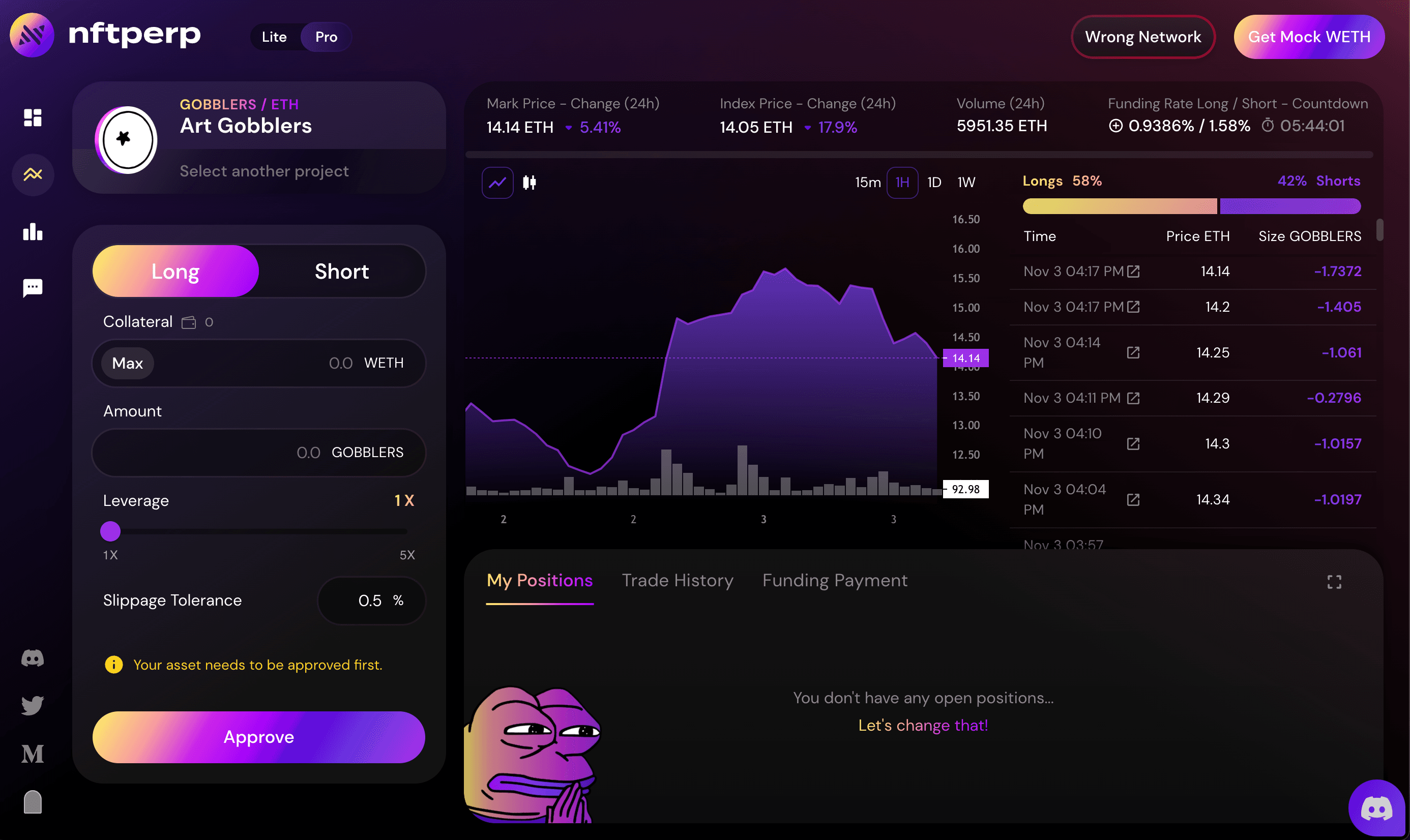

NFTPerp

NFTPerp is an Arbitrum-based perpetual futures DEX that allows NFT traders to long or short NFTs with up to 5x leverage. NFTPerp raised $1.7m at $17m valuation. This protocol uses vAMM (virtual AMM) to power its protocol. vAMM uses the same x*y=k constant product formula like most traditional AMM solutions. The only difference is that vAMM solutions do not require liquidity pools. Instead of the pools, traders’ collateral are kept in a smart contract vault and price is discovered through AMM bonding curve. All profits and losses are settled in the smart contract vaults itself. Each trade on the NFTPerp platform has a 0.3% fee, which is ultimately determined by the position size (0.15% goes to their insurance fund; 0.07% goes to their ClearingHouse smart contract; 0.075% goes to token stakers). Half of the trading fees will be redirected into their insurance fund to ensure solvency of the protocol.

Some pros of building a perpetual futures DEX for NFTs include:- Speculating on blue-chip collections

- certain blue-chip collections are highly costly and traders might not want to enter at a premium. NFT perps allow traders to speculate on the performance of blue-chip collections without needing to worry about liquidity (or lack thereof).

- Ability to hedge

- traders can hedge without needing to sell their NFTs. E.g: If a trader owns a BAYC with a floor price of 100 ETH and wants to lower downside risk without needing to sell their assets, the trader can open a 100 ETH short position on NFTperp. If the floor price of BAYC falls to 90 ETH, the trader would’ve hedged the 10 ETH that would’ve been lost without the short position. The only real downside to either opening a long or short position are the costs associated as well as funding rates depending on open interest.

- Ability to trade NFTs at leverage for advanced traders

- NFTPerp currently offers 5x leverage on longs and shorts. For more advanced traders with high conviction on a specific collection, leverage can provide greater capital efficiency.

- Ability to manipulate floor prices

- oracle-based solutions are still extremely risky in nature, especially during periods of high volatility. This is largely applicable for smaller collections with less liquidity, hence, NFTPerp is only focusing on established, blue-chip collections as of now.

NFTPerp recently launched their paper trading competition Season 2, with new NFTs collections to trade. Users can still sign up to participate with these simple steps:

- Sign up via Tide here

- Upon registration, a participation badge is minted on each users’ wallets

- Users can mint 5 mock WETH to start trading on the platform

- There are two teams, namely $PEANUT and $ALMOND, where users will be randomly assigned to.

- The leaderboard will show the top teams and addresses that are making a realized profit from the NFT mock trading competition

Art Gobblers

In this section, we'll be diving into Paradigm's Art Gobblers' on-chain data statistics following their highly anticipated mint. Read the background information and project overview on the Art Gobblers here.

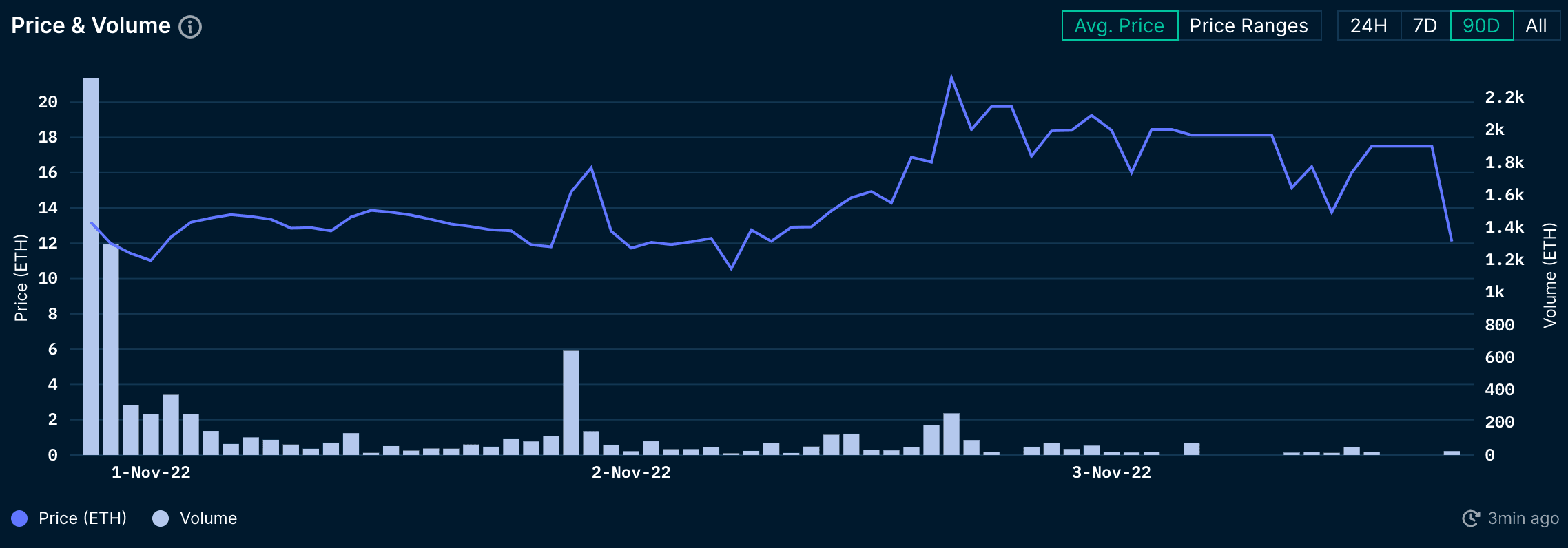

Art Gobblers have been all the rage on Crypto Twitter this week, aggregating over 6794.5 ETH in sales volume across all marketplaces in the first 24 hours with an average price of 12.82 ETH per NFT. The floor price briefly rose to 30 ETH but is now sitting at 13.4 ETH at the time of writing. Unsurprisingly, the volume spiked during the first day due to the hype but has subsided since then, with some hours recording no recorded sales.

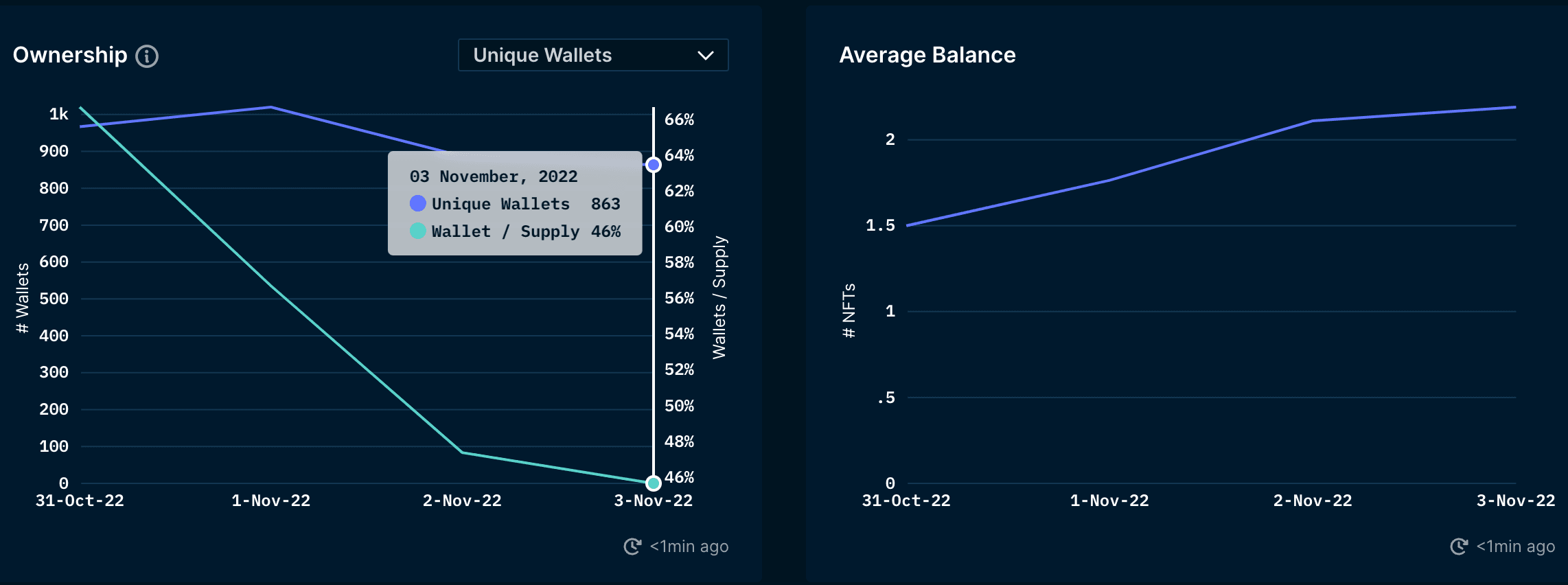

Excluding wash trading, the project has recorded over 8772.2 ETH in lifetime sales volume from over 657 different trades, whereas the circulating supply of Gobblers is at 1,892. In other words, approximately 34.73% of the collection has exchanged hands. The ownership distribution is 46%, meaning holders own 2 Gobblers on average. Additionally, 77% of holders own 1 NFT, and 13% own between 2 to 3 NFTs.

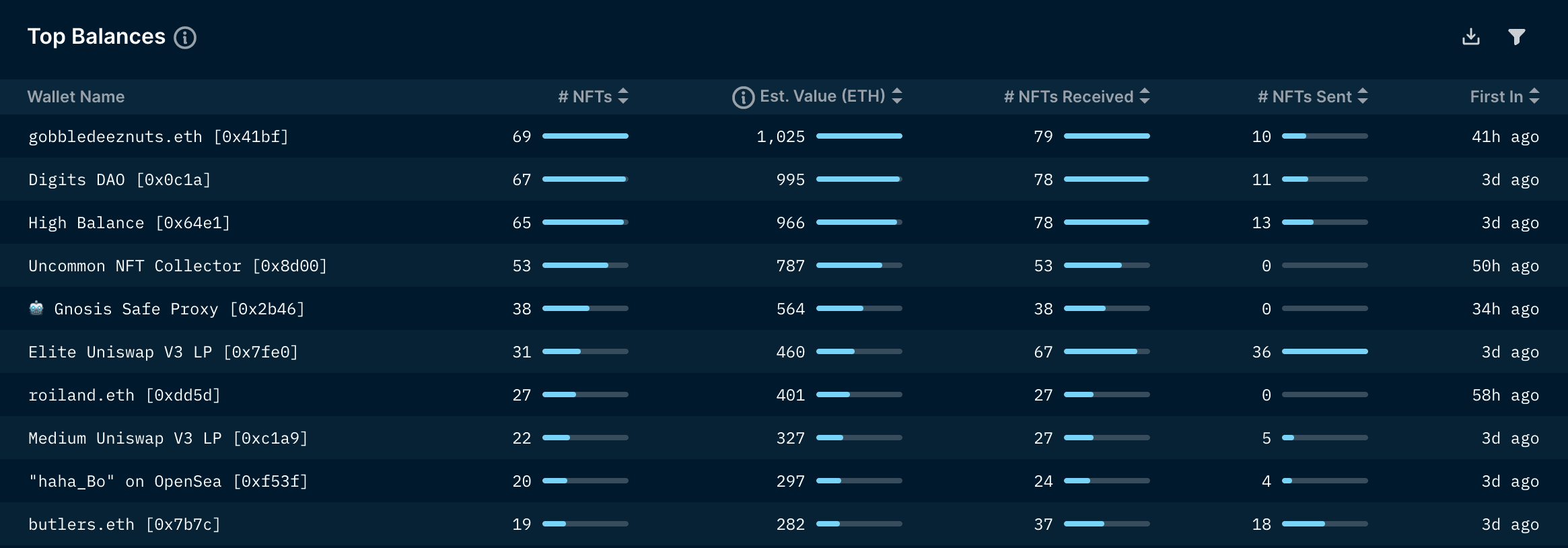

The top holders of Art Gobblers seem to be holding most of their assets for now. Based on transactions and NFT portfolios of these addresses, many seem to be DAOs and groups of individuals who have pooled their Gobblers together. This could be due to the flywheel effect of the game, which includes accumulating Gobblers to produce more GOO and mint new Gobblers, which could eventually be traded for a rare Gobbler and emit even more GOO. In the past day, High Balance [0x64e1] picked up 17 more Gobblers from Blur.io and is now the third-largest holder with 38 NFTs behind Digits DAO and gobbledeeznuts.eth.

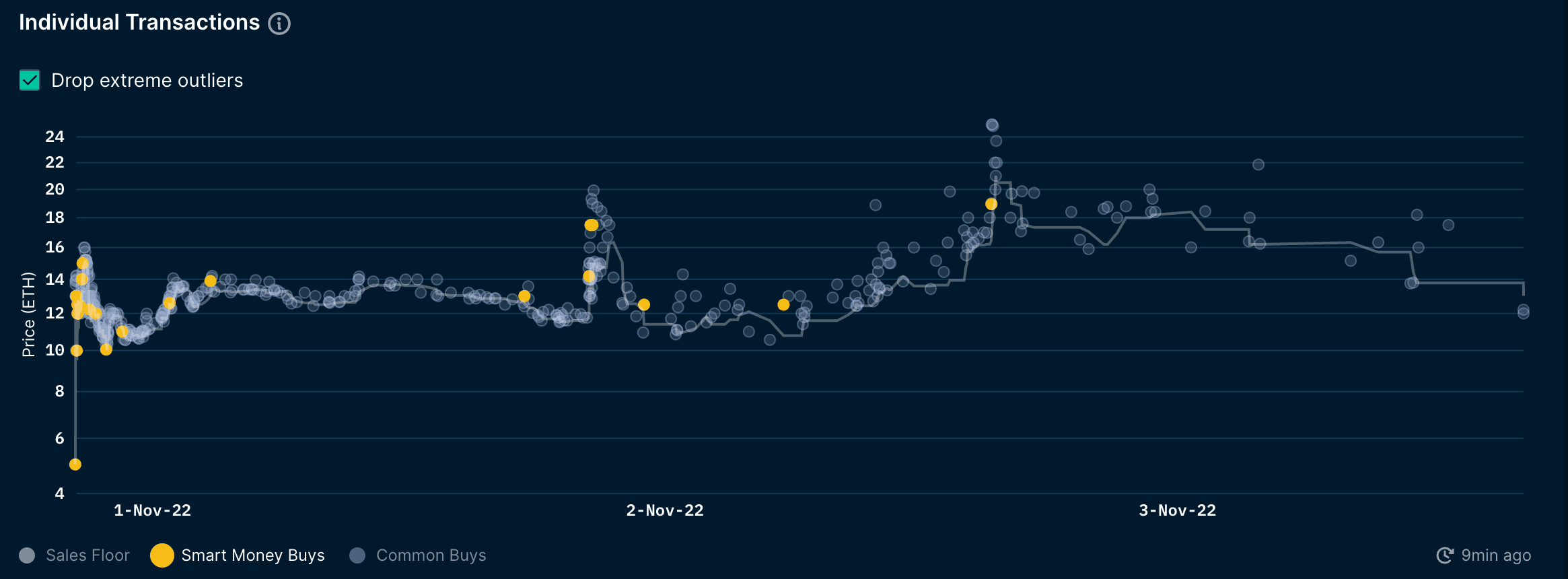

During the volume spike during the first few hours post-mint, smart money wallets were observed buying Gobblers between 10 and 16 ETH, which accounted for most of the smart activity for the collection so far.

In terms of listings, 124 NFTs are listed for sale, which accounts for around 6.5% of the supply. Although, the largest cluster of asks is between 28 and 56 ETH.

DigiDaigaku

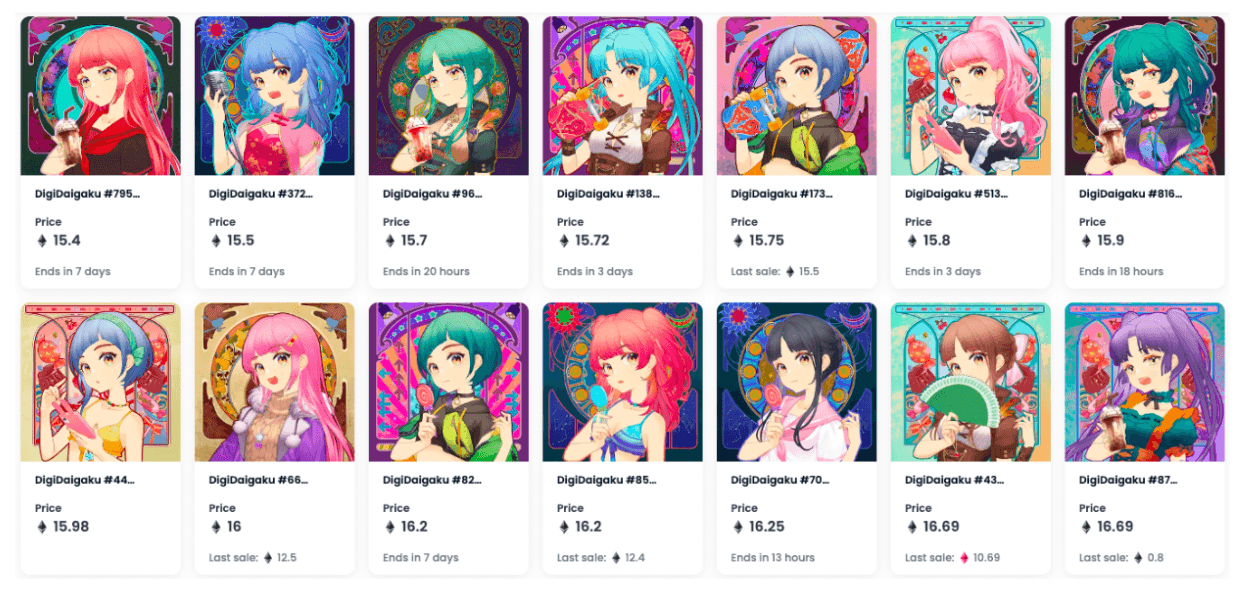

DigiDaigaku is an NFT collection of 2022 unique characters from a “free-to-own” game developed by Limit Break, a company founded by famous game designers Gabriel Leydon and Halbert Nakagawa. Gabriel is the former CEO of Machine Zone and Halbert is the former CTO of Machine Zone. Machine Zone is the team that built real video games including Final Fantasy XV: A New Empire, Game of War: Fire Age, Mobile Strike, and World War Rising. Given how prominent the team behind DigiDaigaku is, the project has been making headlines since its inception. The Genesis collection was a free mint that went up to around 15 ETH at the peak. Its subsequent collections - DigiDaigaku Spirits which was airdropped to all Genesis holders and DigiDaigaku Heroes which was redeemable when users burned their Spirits after completing a quest, also did well on the secondary markets. The founder of the project - Gabriel Leydon, is also the founder of Limit Break - a Web3 gaming company which raised $200m in a funding round recently led by Paradigm. The company has also planned out real life marketing campaigns for DigiDaigaku, whereby the project will have a commercial spot at the Superbowl LVII happening in February 2023.

With the strong success of the entire Digiverse ecosystem, the project aims to expand the community further with the upcoming fourth collection - Villain, which is set to be a collection of 10,000 - 5 times the supply of the current collections. All Genesis and Heroes holders will be given WL for the mint, while the remaining spots will be given out as the mint date nears. The collection will also be free to mint, in line with Leydon's motto of "Free-to-Own".

Phishing Attack

Leydon's Twitter got hacked on 2nd Nov - with a phishing tweet prompting users to a fake link for the Villain's mint. The contract interaction will prompt users to setApprovalForAll on their assets, masked as a seemingly normal transaction that most people are familiar with. The hack was significant as the attacker stole over tens of thousands worth of ETH as well as NFTs sucha as MAYC, worth around 12 ETH or about $19k. More details about the hack can be found here.

According to Leydon, this hack was mainly due to an unauthorized SIM swap from an AT&T employee that did an override on all Leydon’s security protections to his AT&T account and obtained his phone number. After the mobile phone number was obtained, a SIM swap attack was performed by using the mobile phone number and bypassing the two-factor authentication to gain access to the owner's social media accounts such as twitter and thus malicious activities were conducted via the twitter account.

Leydon was able to regain his access to twitter account after a couple hours and has made an announcement on his Twitter about the incident. The DigiDaigaku Twitter has also responded about the hack and clarified that Leydon is now back in control of his account. Limit Break is investigating the incidents and promised to help with users who got stolen. Rumor has it that the attack is associated with Monkey Drainer, an infamous scammer who was behind several hacks recently.

Despite the hack, the collections under Digiverse were not very hard hit, probably signalling that holders have faith in the project to still deliver overall. More information about Villains and collaborations with other projects can be expected in the next few days, which will be interesting to see how it unfolds.