Top News

- Bored Ape creator Yuga Labs faces SEC probe

- Formula One files 8 NFT & metaverse trademarks for F1

- Manifold announces Gallery, zero fee marketplace for creators

- The CFO of OpenSea steps down

- DeGods announces zero royalties, including its secondary project - t00bs

- Magic Eden announces waiving of platform fees, following the rise of other zero fee marketplaces such as Solanart and Yawww

- Magic Eden acquires Coral Cube

- a NFT marketplace and aggregator platform on Solana

Zero-royalty discussion (The Chopping Block by Laura Shin)

On a recent discussion spearheaded by Laura Shin and Haseeb on The Chopping Block, the hosts invited Zhuoxun from Magic Eden and Li Jin from Variant on a head-to-head discussion on NFT royalties. The zero-royalty discussion has been a highly heated topic of debate over the past week.

Laura (pro-royalties):

- Laura feels that certain marketplaces are prioritizing only one-half of its constituents with the zero-royalty policy.

- Creators are on the other end of the spectrum - where a lot of creators rely heavily on royalties for their main source of income.

- This decision might delay the mainstream adoption for NFTs and shy creators away from NFTs.

- She feels that this is a bad business decision on marketplaces that have enforced the zero-royalty route.

Haseeb (anti-royalties):

- There’s no enforcement mechanism when it comes to royalties.

- There is a need to be innovating on this front because royalties are not an end-game solution for creators or buyers.

Zhuoxun (anti-royalties):

- Just to weigh in on some data points from Magic Eden, most creators receive up to 8% on royalties, and the other 92% is largely from primary mints.

- Making royalties optional is by no means an end-state - the debate on NFT royalties on Twitter is always on both ends of the spectrum. The reality is sometimes that being a creator and optional royalties can often co-exist.

- We saw a very gradual trend towards Haseeb’s analogy of people starting to extract not necessarily MEV but value through not paying royalties (i.e: OTC trades) - it’s been an ongoing trend whether we like it or not.

- “There's many, many layers of types of entities and creative types of business models that I think is actually at the heart of this question, right? It's not whether it's pro anti-royalty, it's like what is the sustainable business model that works in the market equilibrium structure?”

Li Jin (pro-royalties):

- Two main thoughts: the creator centric & collector centric argument.

- NFTs were very much this new monetization area for creators that allowed creators to tap into the digital economy.

- Over the last few years, a lot of Web2 companies have realized that they need to become more creator friendly because they’ve noticed that the entire value chain of their social networks of their content platforms, start with creators.

NFT Market Overview

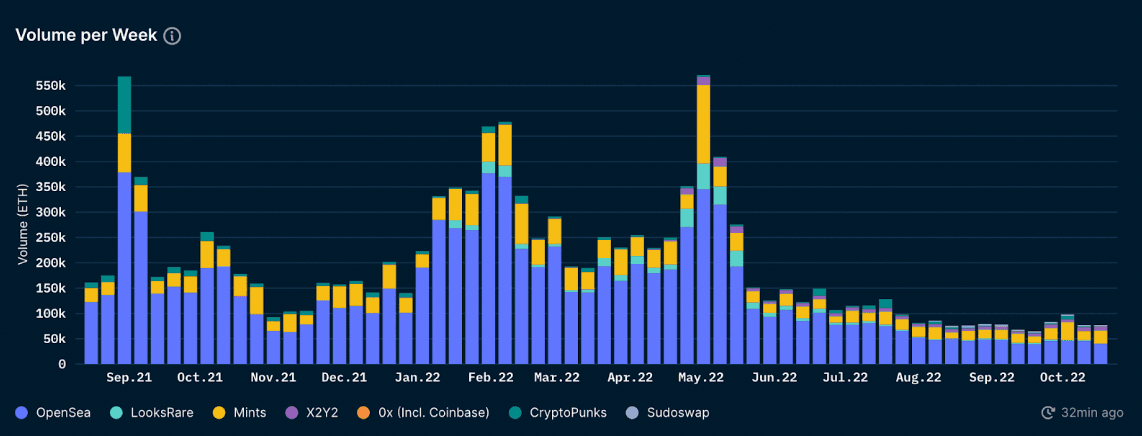

Volume per week

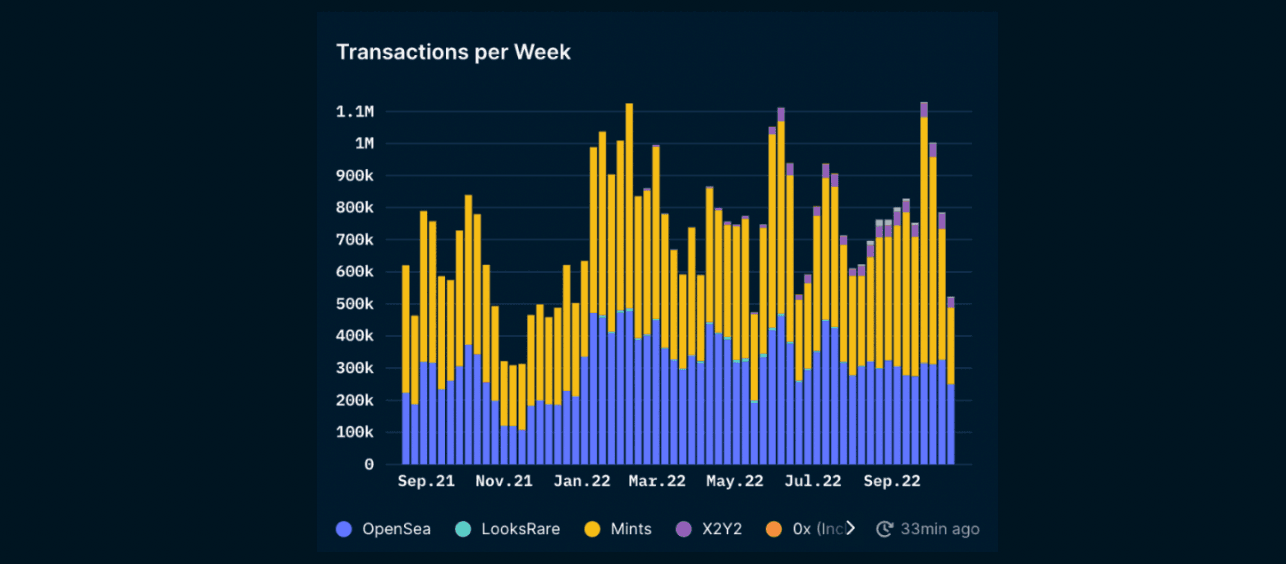

Transactions per week

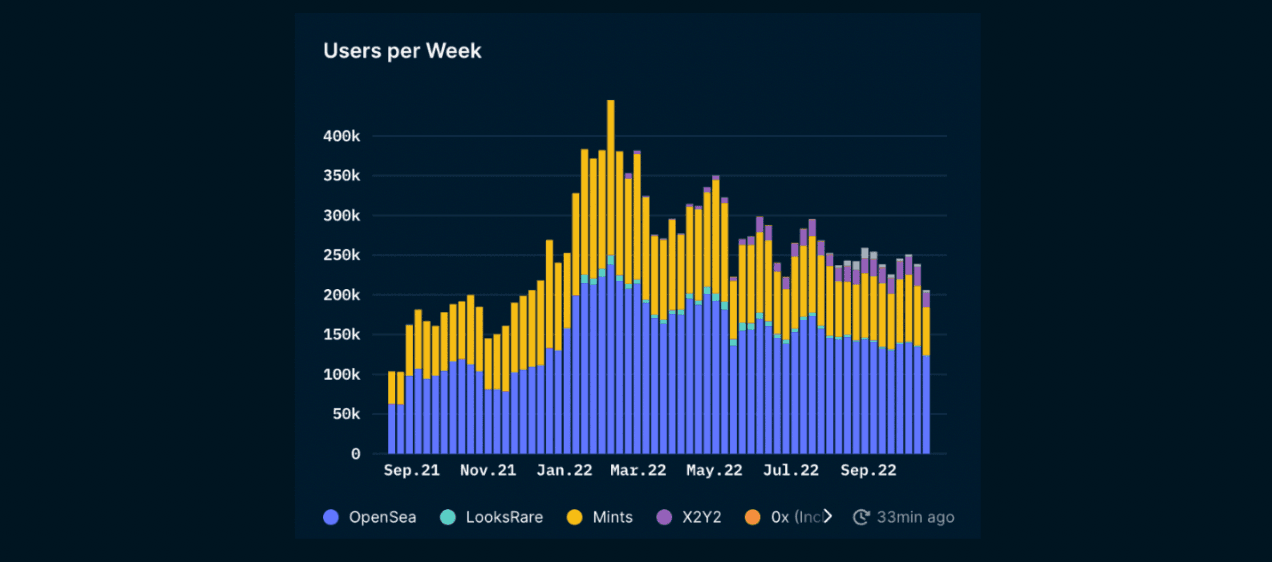

Users per week

Main observations:

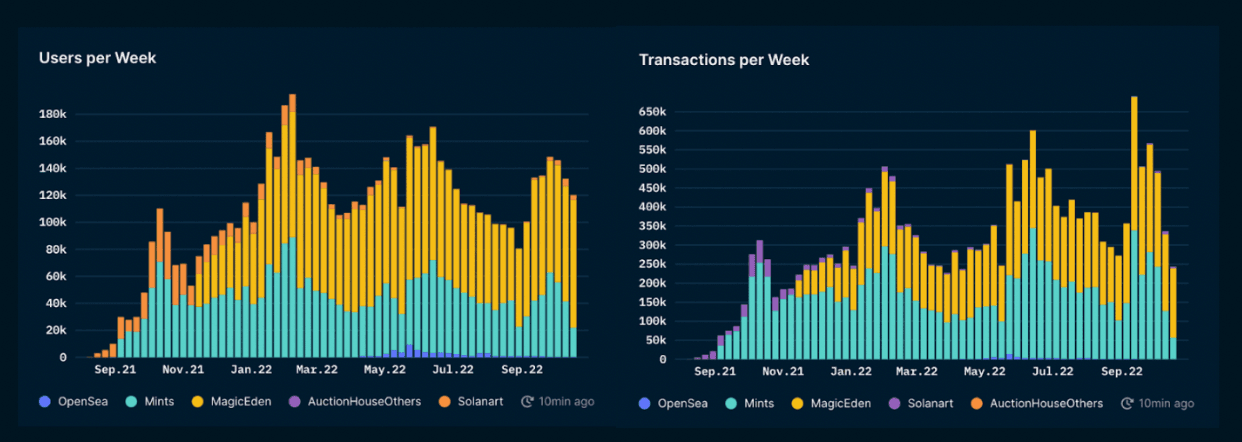

- Volume measured in ETH has continued to plateau and has ranged between 75-100k ETH for the past few weeks.

- Users per week is on a steady decline and has dropped to 210k across all marketplaces

- Transactions per week have fallen significantly by 50% from 1m to 500k compared to 2 weeks ago. This was largely attributed to the reduction in number of mints

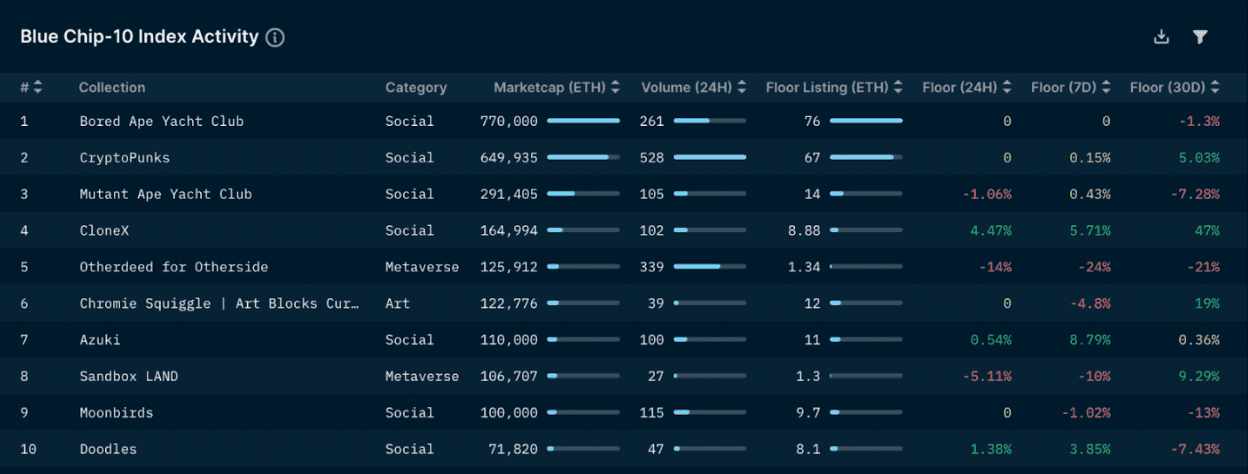

- The large spike witnessed from Oct 4-5 for the Blue Chip-10 index has completely round tripped and is now down -13% YTD

- In the last 30 days, CloneX has seen a 47% increase in its floor price

- Otherdeed and Moonbird’s floor prices have dropped by -21% and -13% in the last 30 days respectively

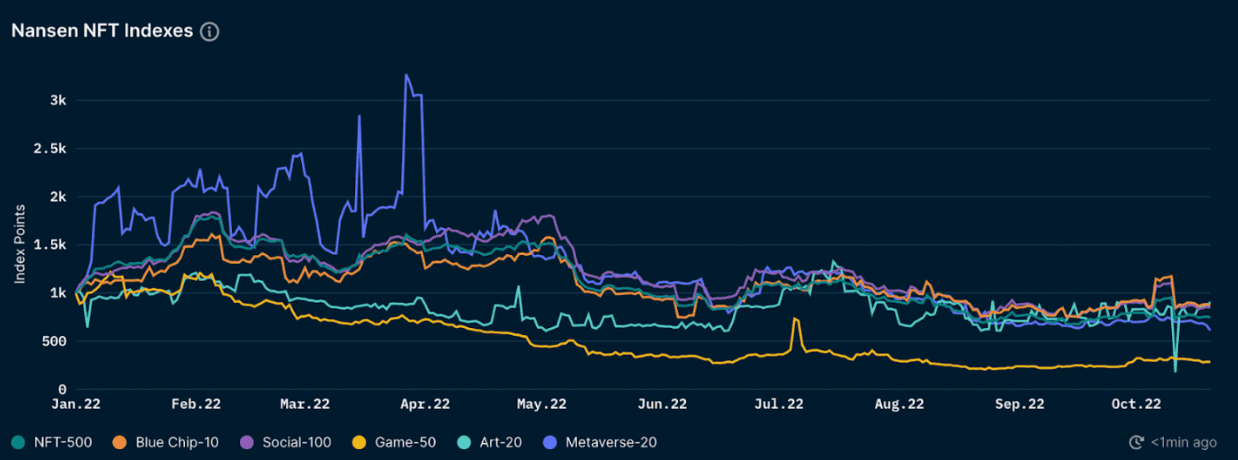

NFT Index Performance

Main observations

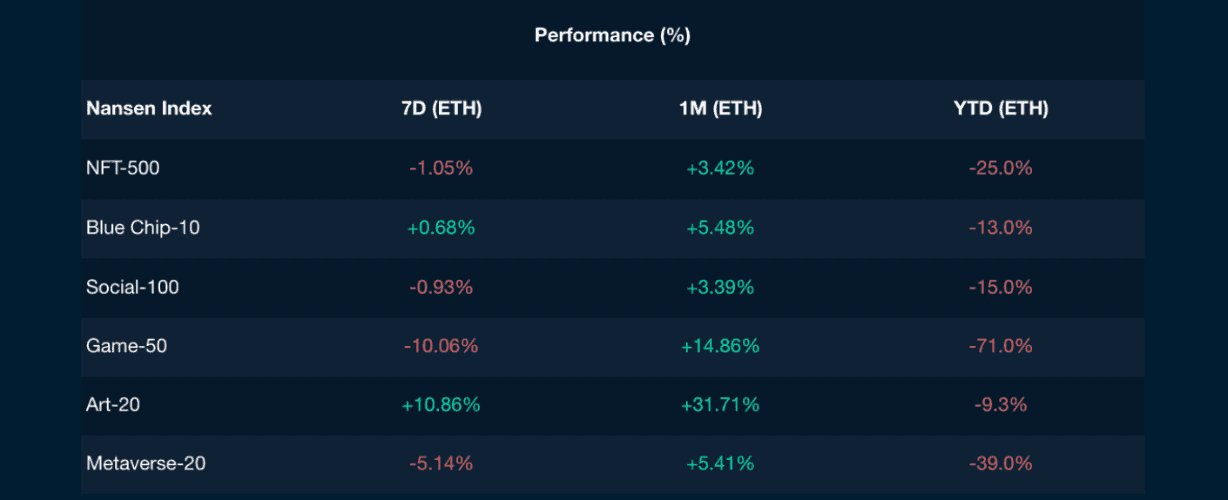

- In the last 30 days, all indexes experienced a positive ROI in ETH terms.

- Most surprisingly is the Art-20 index beating out the Blue-Chip-10 index in all timeframes.

- The Art-20 Index is up 31.71% over the 1M period and is only down -9.3% YTD while the Blue-Chip-10 index is down -13% YTD.

- Both the Game-50 and Metaverse-20 index continues to significantly underperform YTD and is down -71% and -39% respectively.

This Week’s Highlights

Blur.io

Blur is a new NFT marketplace and NFT marketplace aggregator launched this Wednesday, Oct 19 that can be considered as a combination of OpenSea + GEM. It claims itself to be a NFT marketplace for “pro traders” and is 10x faster than GEM with up to 17% less gas. It is embedded with analytics tools and aggregation features for free to help NFT traders to better manage their portfolio. Another highlight is that the platform charges zero marketplace fees.

In Blur’s own blog post, it reveals that the platform has been in a private beta status for nearly a year but its aggregator still reach the second highest volume in the space. In the blog, it also mentions that the team raised over $14m from investors and traders including Paradigm, 6529, Cozomo Medici, dhof, Bharat Krymo, Zeneca, OSF, MoonOverlord, icebergy, Deeze, Andy8052, Keyboard Monkey and more.

To participate in the airdrop, users need to list a NFT on Blur marketplace and other marketplaces that Blur supports. More detail will be discussed in the following paragrahs. One key emphasis is that Blur incentivizes traders to honor royalties via airdrops. Listers who include royalties will get a larger airdrop than listers who don’t.

Airdrop 1

Blur is airdropping undisclosed amounts of free $BLUR tokens in the form of Care Packages and $BLUR token is a governance token for the platform. Those who actively traded NFTs in the past six months during the bear market are eligible for this airdrop. The token and protocol governance will be launched in January 2023. As a result, airdrop recipients cannot open their Care Package gift in their wallets until January next year.

Qualified users can click into the airdrop page and view how many Care Packages can be claimed. The number of Care Packages that can be retrieved depends on each trader’s transaction volume during the past six months. Airdrop 1 will be free to claim for the next 14 days . To claim the airdrop, all users need to do is to list a single NFT on Blur in the next two weeks. There is going to be a separate airdrop if a user has participated in Blur’s private beta or have received Blur point for the waitlist when $BLUR token launches in January.

There are three types of airdrop package available to claim: uncommon, rare, and legendary. In Airdrop 1, there seems to be a hard limit that each wallet address can claim at most 299 Care Packages according to @pranksy from Twitter.

Airdrop 2

Airdrop 2 is for all traders who actively list on Blur and other marketplaces that Blur supports during November. According to Blur’s blog post, the number of Airdrop Packages in Airdrop 2 will be significantly higher than the Care Packages in Airdrop 1.

The tips that Blur give to help users maximize airdrop is as followed:

- The more you list, the more you earn

- Listing blue chips helps

- Listing more active collections helps

- Use all our listing tools — you can list by floor price, trait floor price, and ladder list

- Don't try to game the system (constantly relisting NFTs at unrealistic prices, sybil attacking, or listing dead collections) — we will conduct extensive analysis to weed out traders with unnatural listing activity

- With that said, if you just list naturally on Blur, you'll be fine.

- Don’t forget that you can also list on other marketplaces through Blur — you have nothing to lose and many Care Packages to gain by using Blur!

P.S. Try placing at least 3 sweeps on Blur before Airdrop 2 as well :)

The probability of obtaining a legendary package after opening a Care Packages on average is quite low. In airdrop 2, however, this percentage ties directly to “Loyalty”, which is a snapshot of how many NFTs are the users listed on Blur compared to other marketplaces. A high “Loyalty” will have a much higher chance of getting rare Care Packages containing a lot more $BLUR tokens.

- <50% loyalty - low luck

- 50-90% loyalty - medium luck

- 90-97% loyalty - high luck

- 97%+ loyalty - very high luck

The loyalty score won’t be affected when listing on other marketplaces if the price list on Blur is the same or lower than the price listed on others.

Here are some examples that Blur provides:

- List for 0.1 on Blur and 0.05 on other marketplaces, score goes down

- List for 0.05 on Blur and 0.1 on other marketplaces, score goes up

- List for 0.1 on Blur and 0.1 on other marketplaces, score goes up

Azuki

Earlier this week, Chiru Labs, the team behind Azuki's, announced the launch of their new token standard, Physical Backed Token (PBT). Their implementation of PBT is one of, if not the first, iterations of utilizing digital assets to verify ownership of digital goods. Specifically, Chiru Labs has partnered with Kong to create a Blockchain-Enabled Authentication Network (BEAN) chip. The BEAN chip is a physical cryptographic chip attached to the physical item that self-generates an asymmetric public-private key pair and can be scanned with a phone to transfer and prove ownership. They call this "scan-to-own". Along with the EIP proposal of PBT, Azuki has also released 9 gold-plated skateboards for auction as their first BEAN chip-integrated collectible. The auction is set to start at 6 pm PST today and will be live for 24 hours.

Prior to the introduction of PBT, there was no real or provable connection between digital token and their physical counterparts. For example, Damien Hirst's The Currency collection holders can burn their digital assets to redeem the actual painting, but there is no linkable connection. As stated by Chiru Labs, digital tokens are currently used to provide access to physical drops. However, PBT enables immersive digital experiences via the usage of physical goods.

Through this innovation, Azuki aims to merge the boundaries between the digital and the physical worlds. PBT leverages the transparency of blockchain data, allowing for the authentication and ownership lineage of physical items in a trustless and decentralized manner.

Use-cases

Firstly, PBT can be used for the decentralized authentication of physical items. Instead of trusting the counterparty and having to manually check the legitimacy of the good (which still does not completely guarantee its authenticity), users can now trustlessly verify it on the blockchain.

Authentication of items is the biggest bottleneck for niche/high-end markets like collectibles, sneakers, watches, etc. For example, StockX functions as the middleman for sneaker buyers and sellers and performs checks for sneakers before sending them to the buyer. While the company has grown significantly over the past few years from this selling point and have developed a reputation for authenticated sneakers, it has come under scrutiny recently due to passing over illegitimate sneakers to buyers on their platform.

PBT eliminates the trust of third parties for authentication since buyers can subsequently scan the chip with their phone to verify from the blockchain, which significantly reduces the friction of collectible/high-end goods exchange. PBTs extend the provability feature from NFTs and incorporate them into physical goods. Furthermore, it improves the liquidity of these markets and increases the value of the goods themselves.

Secondly, as PBTs are physical-first and link the physical items to the corresponding digital token, digital benefits and experiences can be derived and attached to possessing the physical item. The possibilities are endless here.

Check out this comprehensive thread by Seraph on the implications of PBT on web3 and opening up the value proposition of blockchain technology to existing markets and mainstream usage.

Solana NFTs

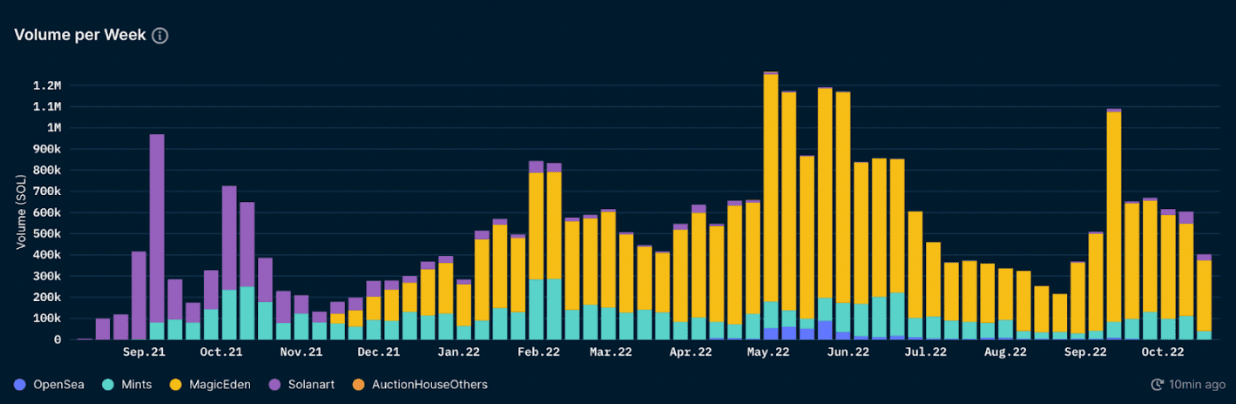

NFT Market Overview

Main observations:

- Volume, number of users and transactions have been trending downwards across the board probably due to the lack of any significant projects in the recent weeks as well as the larger macro outlook.

- Interestingly, Solanart’s volume increased by a significant percentage last week from previous weeks - probably due to the introduction of zero fees, whereby the debate of having zero fees has been a hot topic in the space.

- While the number of users and transactions have been decreasing, the decrease is mostly attributed to the decrease in mints as secondary marketplace users and transactions have remained rather consistent.

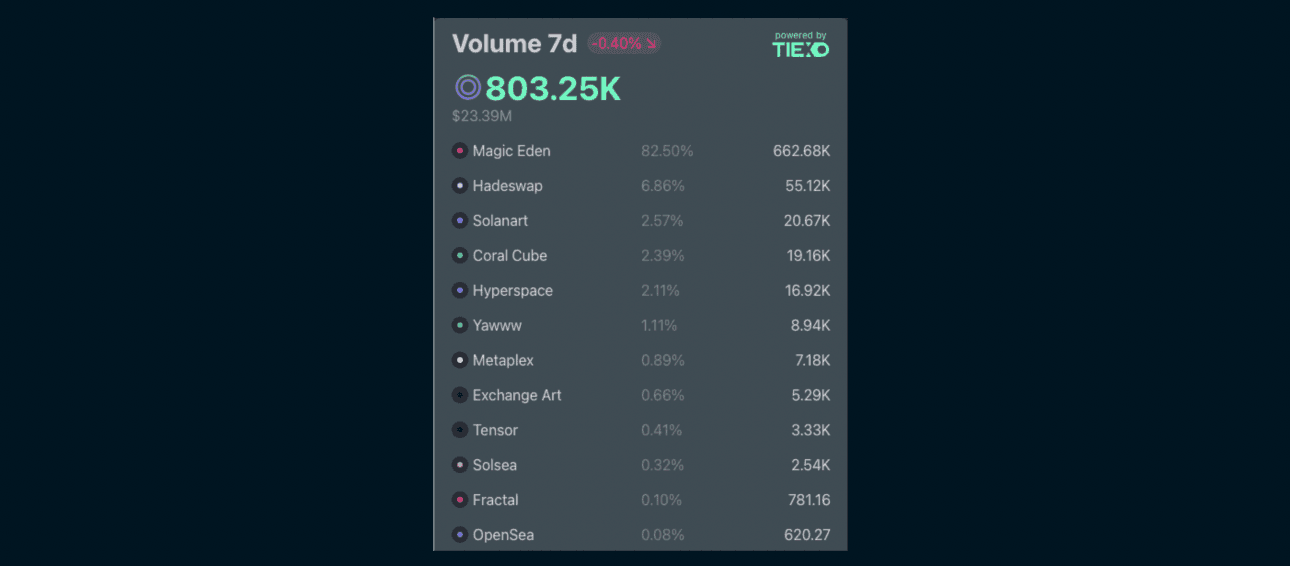

Marketplaces Breakdown

The marketplace competition has been heating up in Solana recently, after strong dominance from Magic Eden in the past months. The debate on zero royalties has been key to the competition between marketplaces, with the idea being first introduced by Yawww - a NFT marketplace that also facilitates lending, P2P trades. Since then, more marketplaces started introducing the idea of zero fees/royalties including Solanart and Hadeswap. Magic Eden also recently announced a move to waive platform fees and optional royalties.

Looking at the 7D volume across marketplaces, Magic Eden still dominates with 82.5% but at a lower percentage than before. Magic Eden has acquired Coral Cube as well, which pits it against aggregators such as Hyperspace as well. Response to the actions of Magic Eden has been rather negative since they backtracked on their words on letting creators decide on their own royalties. It would be interesting to see if that would have any impact on the volume in the next few weeks.

Top Projects by 7D Volume

- Liquidity is concentrated in the top 3 projects which has over 64% of 7D volume of the top 15 projects

- DeGods and t00bs takes top spots in terms of 7D volume once again. Both projects have faced significant drawdown since the perceived inaction of the team following the t00bs mint

- DeGods recently announced 0% royalties for both DeGods and t00bs which probably resulted in downward pressure on price since sellers need not set prices 10% higher to cover royalty fees

- DeGods’ tweet signals an upcoming announcement which could help to regain confidence in the project since most are still betting on Frank to deliver

- There were 12 Smart Money buys for t00bs in the last 7D, signaling confidence in the overall DeGods team still despite the recent inactivity

- Rifters is a project led by some members of the Communi3 team and is the first ever Massive Online Community Event Role Playing Game (MOCERPG). The project minted out at 10 SOL with 7,777 supply - which is impressive given current market conditions.

- The closed beta of the first season of the game - Rifters: Kalinvale went live on Tuesday for Exiles and Mad Scientist holders. The open beta is set to be launched next week which will give access to other eligible NFTs listed here.

- It would be interesting to see the response towards the game when it has opened up to the wider public and how the different DAOs unite to win the prize pool

Smart Money Movements

Based on the data, the 24H Smart Buys and Smart Sells consist of mainly the same projects with similar numbers of buys and sells which means that most wallets are buying and flipping quickly. Hence, it might not be wise to ape into these projects since the trading time frame is short which would lead to a bigger risk of bagholding.

The trend is similar for 7D Smart Buys and Smart Sells, with the exception of t00bs which has more buys than sells. Most of the projects that are being flipped are often projects that have rather low floor prices (<10 SOL), which allows for such quick trading due to affordability for most users. Projects like t00bs would have a smaller buyer pool given the risk is bigger to flip a higher priced NFT due to its liquidity. Hence, this could be a point to consider before entering such projects as well.

Tools for further research

NFT aggregators

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- NFTBank.ai

NFT Marketplaces