Top News

- OpenSea lays off approximately 20% of its staff

- Minecraft bans NFTs

- Otherside completes tech demo of their metaverse with over 4,500 participants

- They have also released their litepaper which can be found here

- A hacker stole $375,000 from users of Premint NFT platform

- Kevin Rose’s PROOF Acquires Ethereum NFT Team Divergence

- MATIC Surges as Disney Chooses Polygon for Accelerator Program

- Snap eyes adding NFTs as AR filters in Snapchat

- Yawww launches a NFT marketplace where users get to decide the amount of royalties they want to pay

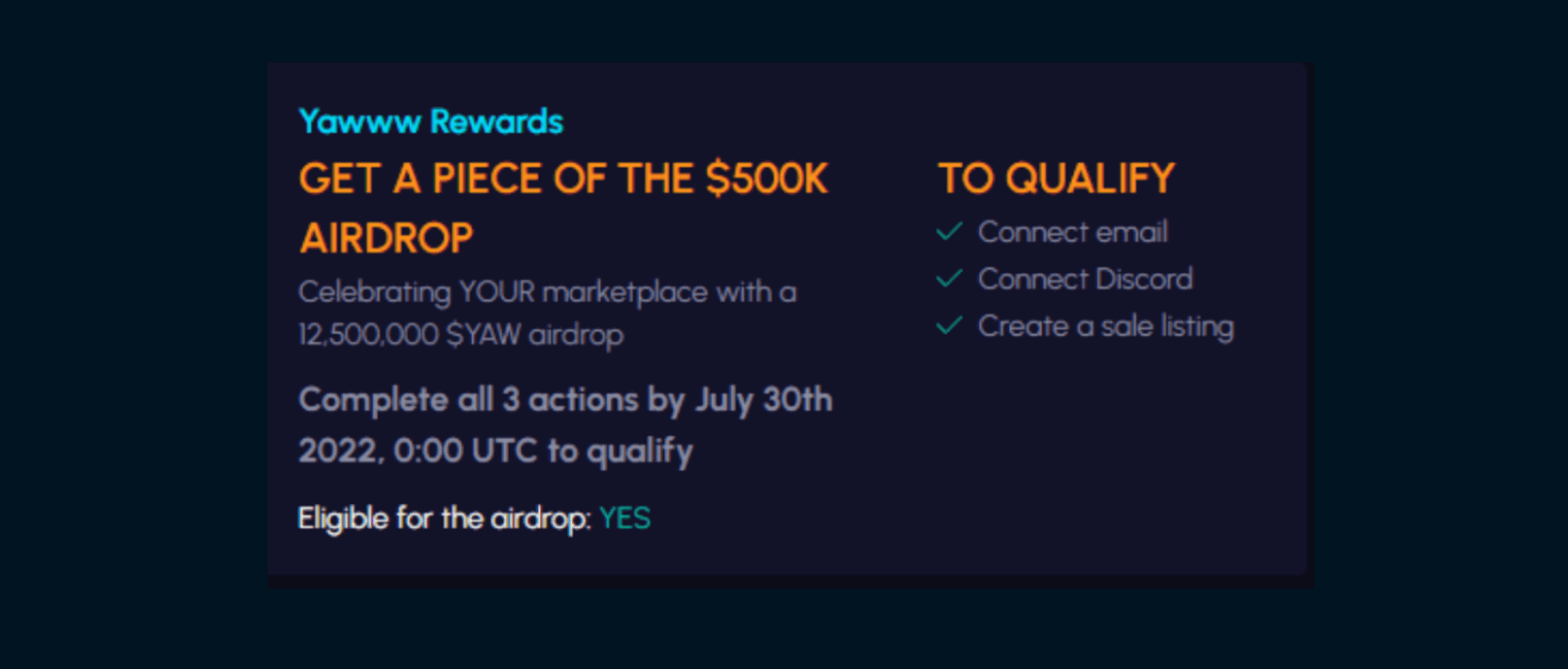

- They are carrying out an airdrop of their token YAW

- which users can claim if they complete certain actions by July 30

- They are carrying out an airdrop of their token YAW

- Rarible announces support for Solana NFTs

- Magic Eden launches gaming venture arm

- FUD surrounding Magic Eden for aggressively promoting Degen Town NFT which is now seen as a ‘soft rug’

- Zeneca’s tweet response to his recent Twitter account getting compromised

Raises

- Animoca Brands raises $75m at a $5.9b valuation

- Supermojo raises $6m - with participation from DRW Venture Capital, Intersection Growth Partners, Ripple, sfermion, arca, etc.

- DOSI raises an undisclosed amount with participation from Hashed, SoftBank, etc.

NFT Market Overview

Volume per week

Main observations

- Volume measured in ETH for NFT sales has seen a steady increase week over week throughout the month of July but still remains low compared to the weekly volume over the month of June. The overall trend in the recent two months still pales in comparison to earlier this year.

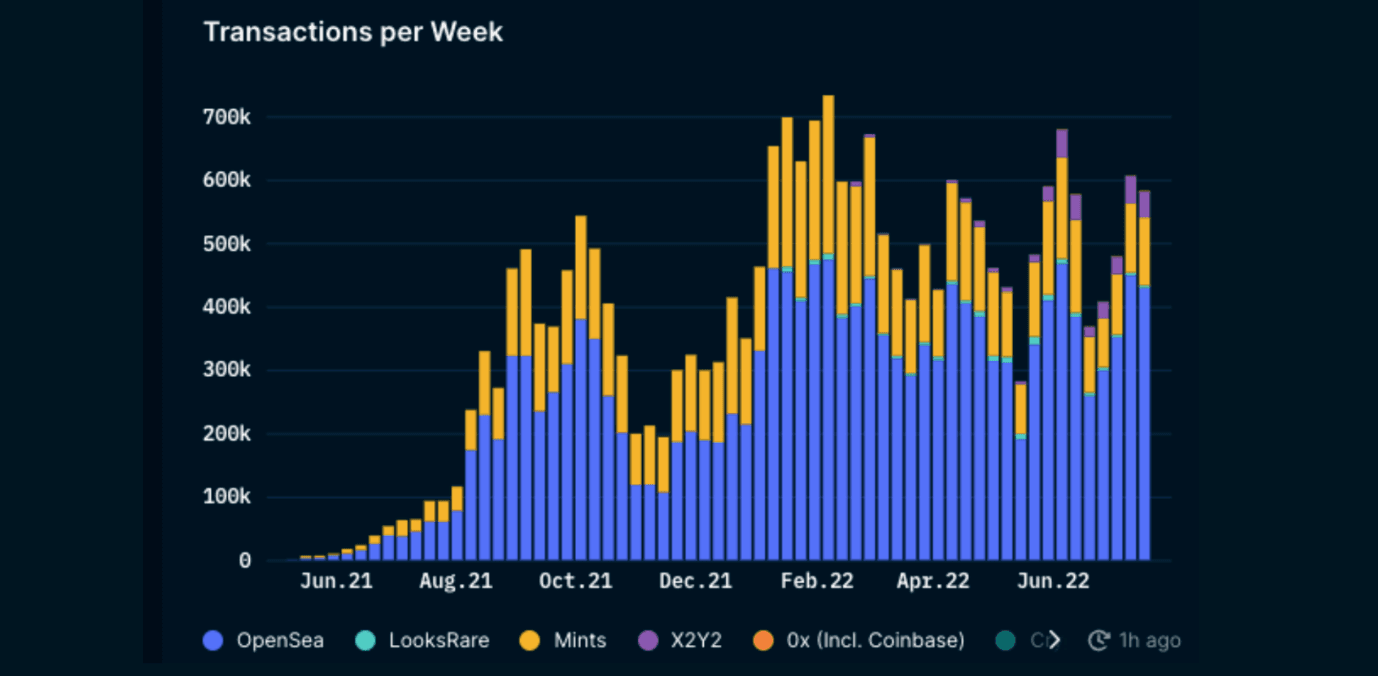

- Transactions per week had a huge spike entering the month of July with a small drop off in the most recent week but still remains among the top 10 highest transaction weeks YTD. The small dip is mainly due to the decline in transactions from OpenSea and X2Y2 marketplace.

- The Blue Chip-10 index has seen a recovery and is up 25% YTD measured in ETH terms though still very far from ATHs and down 47% YTD measured in USD terms.

- CryptoPunks was the clear leader with its floor price up 5.93% while the rest of the Blue Chip-10 index NFTs all plummeted with negative floor price gain. The top 3 biggest floor price drops came from Doodles, Azuki, and VeeFriends collections; 19%, 17%, and 15% respectively.

Marketplaces

X2Y2 vs. LooksRare

With the reduction of LooksRare’s listing and trading rewards, X2Y2 marketplace has been gaining a lot more traction. In fact, X2Y2 is beating out LooksRare in all metrics whether it be weekly volume, users per week, or even transactions per week. This could most likely be explained by X2Y2 offering a promotional period of 0.5% trading fees vs LooksRare’s 2.0%. With the promotion coming to an end in a few months, it’ll be interesting to monitor whether X2Y2 continues to outperform.

| Week 18 July | LooksRare | X2Y2 |

|---|---|---|

| Weekly Volume | 3942 ETH | 7972 ETH |

| Users per Week | 4050 | 20,059 |

| Transactions per Week | 4039 | 40,283 |

LooksRare Private Sale Post Unlock Activity

LooksRare is an NFT marketplace similar to OpenSea but more decentralized and actively rewards traders, token stakers, creators for contributing to the platform. LooksRare Private Sale unlock happened on July 15th. After a week of the private sale unlock, 63 out of the 71 investors (nearly 90%) have claimed their tokens. A pie chart was created to showcase all the potential post unlock activities including hold, compound staking, simple staking, transfer, sell, and disperse app.

According to the pie chart, the majority, or 47.8% of the investors have transferred their airdrop. A large number of investors have performed simple and compound staking. Only 4.4% hold their redeemed looks token until now and 2% have sold their airdrop. Only 1 has interacted with a disperse app in a transaction.

Staking overall takes up 46% of all the post-unlock activities. This indicates that the private sale investors are interested in the LooksRare token rewards opportunities. Given that the simple and compound staking APYs are 45.41% and 55.49% respectively, these high yield opportunities on LooksRare incentivize people to stake rather than the conventional action of selling immediately after the unlock.

Unlike most of the unlock where the price action of the unlocked token continuously goes down, the price for LooksRare token actually went up consistently after the unlock date. This suggests that LooksRare Private Sale Unlock is a more bullish unlock compared to other unlocks seen before.

NFT Index Performance

Main observations

- In the last 7 days, all indexes suffered a down week with Game-50 and Metaverse-20 dropping the most at -13% and -10% respectively

- The Art-20 index also witnessed a pull-back from its recent heated run-up

- The Blue-Chip-10 index continues to outperform and is up 25% YTD even during such market volatility

- Every index is up YTD except for Game-50 which suffered a -62% drawdown

An article on the composition of the indexes and its calculations can be found here.

This Week's Highlights

CryptoPunks

CryptoPunks had an incredible run-up this week. The collection generated 15k ETH in volume, overtaking the entire BAYC set including BAYC, MAYC, and Otherdeed for Otherside. CryptoPunks has built up a strong suite of historical value, especially considering the group of holders that owns the collection. This run-up did not come as a surprise for most holders, as the value accrual will always circulate back if the sentiment continues to be strong.

Otherdeed for Otherside

Otherside is a narrative gameplay experience (aka The Voyager’s Journey co-developed by Yuga Labs. Phase 1 will only be open to Otherdeed holders (aka Voyagers) and selected third-party developers will be able to participate in the first stages of the launch.

Otherdeed for Otherside had their “First Trip” demo this week, with an astounding 4300 voyagers. During the demo itself, a Bored Ape escorted the voyagers to a portal, where they were transported to a series of islands. According to the Otherdeed whitepaper which was released after the demo, there will be three big releases that will happen after each phase elapses.

Factura by Mathais Isaksen

Factura by Mathais Isaksen is a collection by gmDAO. gmDAO is a community of NFT collectors, artists, and investors created in September 2021. gmDAO has 3 main collections as of now: Koripo by Rich Poole, Mind the Gap, and Factura.

The DAO currently consists of 900 members and members were given priority access to mint these collections respectively. gmDAO might be a good opportunity to look into as the generative art trend has been making a comeback. They typically provide holders with a first-mover advantage to mint their curated collections at reasonable prices and there has been more attention and eyes on it due to the successes of the Factura collection.

Smart Money Movements

This week, Smart Money has been minting MEGAMI, ENS domains, and Mirakai Scrolls. MEGAMI registered 32 ETH in volume from 18 different Smart Minters, whereas 19 ETH of ENS names and 14 ETH of Mirakai Scrolls were minted by 16 and 14 Smart Minters, respectively.

MEGAMI is a collection of 10,000 anime characters by YouTuber Saito Naoki. The NFTs minted out at 0.1475 ETH per token on July 15th, but the current floor price is 0.1269 ETH. Mirakai Scrolls are a fully on-chain CC0 avatar project, where the scrolls contain various traits that make up the avatar. These traits can be re-rolled until the owner is satisfied, after which the scroll NFT can be exchanged for the hero avatar. Similarly, the scrolls minted for 0.05 ETH plus any tip the minter wants to give the team. The current floor price is 0.03 ETH. This has been a common theme in recent weeks, suggesting that the era of profitability from flipping immediately after mint could be ending. It has become increasingly challenging to remain profitable from flipping on secondary in the current market conditions.

The shift in the meta away from speculation and hype may contribute to the persisted interest in ENS domains since May, as ENS can be treated as a call option on Ethereum itself. If Ethereum succeeds in the long run, ENS domains will have a use-case as the leading name service for the Ethereum ecosystem. Thus, it has more "fundamental value" than most PFP NFTs.

This week's 7D Smart Buys chart consists of the hottest newly minted projects, including Mirakai Scrolls, Factura, Kingship, MEGAMI, and Nina's Super Cool World. However, Moonbirds Oddities topped this week's Smart Buys chart with over 15 unique buyers. ENS has also been seeing secondary market action in addition to the Smart Mints, with 7 different Smart Buyers picking up ENS domains on secondary.

Solana NFTs

NFT Market Overview

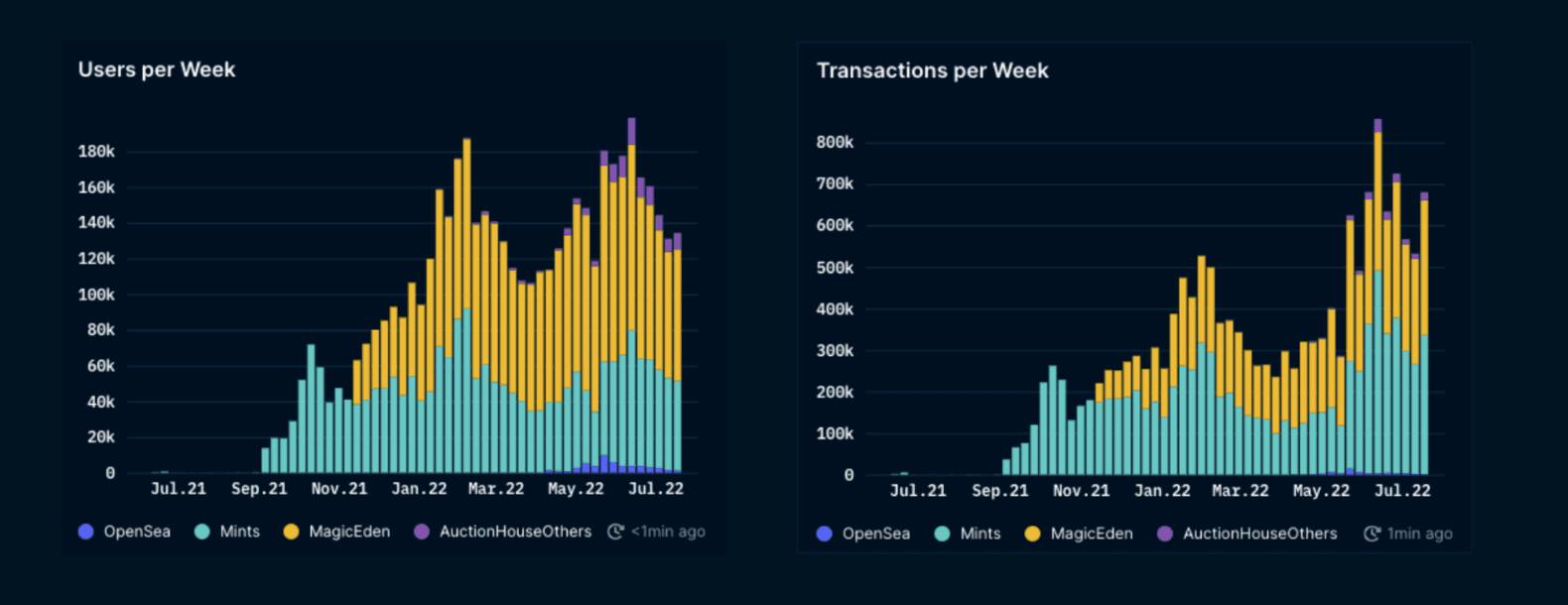

Solana’s NFT market cap currently stands at $844m, a slight increase from $835m just 2 weeks ago. 7D volume saw a slight increase from the previous week after decreasing for 4 weeks running. This could possibly be attributed to the uptick in prices across the board, which brought about some positive sentiments. The increase in volume from the previous week was largely brought about by Magic Eden, as volume from mints and OpenSea has continued decreasing while volume from other marketplaces increased slightly.

While Magic Eden continues to dominate NFT volume on Solana, a potential competitor might be on the horizon. Yawww is a platform for P2P loans and swaps for Solana NFTs. They recently launched their own NFT marketplace where users can decide the amount of royalties to pay to creators which includes the option of not paying at all. It is pretty significant as it could save a lot of fees for NFT traders, especially when a typical NFT project royalties range from 5-10% which comes up to be hefty for projects with high floor prices. The launch generated quite a stir on Twitter, with Magic Eden’s co-founder even coming out to ‘slam’ the platform for ‘destroying the NFT ecosystem’.

Since its launch 6 days ago, the platform has generated over 13.3k SOL in volume - coming in 2nd in terms of 7D volume across all Solana NFT marketplaces. This is a positive sign for early adoption but it would be interesting to see if volume can remain at this level or go even higher. Yawww is also carrying out an airdrop of their token - YAW, for users who connect their email, and discord and create a sale listing on their platform. Go to https://yawww.io/ to connect your wallet and click on my profile to be redirected to the page as shown below.

Users have to complete all actions by July 30 12am UTC to qualify for the airdrop.

Top Projects by 7D Volume

- Trends show that newer mints have slowed down and are not able to gain as much traction as before in terms of volume

- Okay Bears has seen a decrease in average and floor price even though it has seen an increase in volume from the previous weeks.

- The long-awaited hibernation turned out buggy on the day of the event, which created a lot of FUD and caused floor prices to drop

- This is one of the first utilities delivered to holders. Hence, the poor execution disappointed many and opinions of the success of the project is rather split on Twitter

- Degen Fat Cats is a project created by Degen Coin Flip (DCF). It has a similar model to DCF whereby it pays holders a portion of the revenue generated from the DCF platform. Most of its 20k supply were airdropped to DCF holders, with around ~4k supply left for the public mint.

- Despite a steep mint price of 9.99 SOL, the collection minted out and currently sits at a floor price of 15.6 SOL. Many are betting on the success of this project based on the success of DCF - which could explain the low listing numbers despite it being a large collection of 20k NFTs

- Gothic Degens has seen its floor price tripling from just 2 weeks ago - from ~5 SOL to 15 SOL.

- The project has increased its reach by collaborating with more prominent projects on Solana - including Primates

- Pokerfaces is the NFT collection of solcrash

- a betting game on Solana. It employs a revenue-sharing model where 90% of trading fees on the platform go to Pokerface holders

- With a low supply, the floor price of the project shot up from 12 SOL on July 16 to 150 SOL on July 21. Currently, the daily payout for holding one Pokerface ranges from 1.5 to 2 SOL.

- a betting game on Solana. It employs a revenue-sharing model where 90% of trading fees on the platform go to Pokerface holders

This Week's Highlights

Pokerfaces/Crashfaces

These two NFT collections were created by the team behind solcrash - a game on Solana where users bet on their SOL on the platform. Both collections have had a rapid increase in floor price in the past 7D - from 16 SOL to a peak of 191 SOL for Pokerfaces and 0.99 SOL to a peak of 43 SOL for Crashfaces.

Pokerfaces launched in January 2022 with a 0.33 SOL mint and a supply of 333. Crashfaces was an expansion to the project, launching in July 2022 with a 0.99 SOL mint and a supply of 1000. Despite being around for several months, the platform only gained significant volume from July 16 onwards, shortly before the run-up in NFT prices. There’s no clear reason as to why the platform suddenly gained so much traction, but the ease and addictive nature of the game probably helped.

The collections have a similar model to Degen Coin Flip. Holders receive 90% of the daily profit generated from the platform and the value of the payouts received for Pokerfaces is equivalent to 5 Crashfaces. Given that early investors had already covered their costs from long ago, it could incentivize them to hold for the long term since the daily payouts are ranging between 1.5 to 2 SOL for Pokerfaces and 0.3 to 0.4 SOL for Crashfaces. Under the ‘Hodlers’ tab in NFT God Mode, it shows that over 51% of wallets have held their Pokerfaces for longer than 90 days. This could have contributed to the sharp increase in prices as well since there is a supply crunch for the collection.

Overall, it is interesting to see how the platform and its relevant NFT collections have experienced a huge boost in traction in the past few days. While there are questions on sustainability, information in Discord shows that the team has been making profits daily - which could definitely contribute to the longevity of the project.

Upcoming Project Highlights

Duppies

(Twitter)

A second collection from the DeGods team. Duppies is a collection of 15,000 NFTs. All DeadGods holders will be guaranteed to mint 1 Duppie. The mint price will be 375 DUST.

- Mint date: Late July/early August

- Category: PFP

Rakkudos

(Twitter)

Rakkudos is the NFT collection of Shakudo - a data tools aggregator platform built for enterprise solutions. With Rakkudos, they aim to bring the benefits of cloud platforms to Web3 whereby the holders of Rakkudos can benefit from the success of Shakudo.

- Mint date: August 5th, 8pm UTC

- Category: PFP/utility

Taiyo Pilots

(Twitter)

Taiyo Pilots are a community-driven and lore-driven NFT project and are introduced as an extension to the Taiyo Robotics Universe. The Pilots utility will be a form of social staking that allows you to get graphite opportunities and access to the Taiyo incubator launches in the form of whitelist spots. There are a total 12,500 NFTs - Taiyo Infants and Taiyo Oil holders will be airdropped one Taiyo Pilot NFT.

- Mint date: TBA

- Category: PFP/utility

Pacer

(Twitter)

Pacer is a wellness-to-earn app that rewards users for sleeping week, practicing mindfulness or exercising consistently. The project is backed by notable investors such as FTX Ventures and QCP Capital. Giveaways and access to discord can be won through Pacy NFT’s Twitter.

- mint date: TBA

- category: gaming

Tools for further research

NFT aggregators

- Gem

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Genie

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

- Hyperspace (Solana)

- Hyperspace allows users to explore NFTs across all marketplaces on a single interface

- Gem

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- Solsniper.xyz (Solana)

- Solsniper allows you to track floor prices, volumes and an overview of your NFT portfolio

- NFTBank.ai

- NFT Marketplaces

- Opensea

- LooksRare

- Rarible

- Mintable

- Mintbase

- Zora

- SuperRare

- Magic Eden (Solana)

- Solanart (Solana)

- Coral Cube (Solana)