Top News

- Yuga Lab launched their highly awaited land sale “Otherdeed for Otherside”

- CPG’s Genesis collection introduces POP on the 14th

- Link to public PREMINT raffle here

- 10K club spearheaded a new movement for ENS

- This new meta-narrative is stirred up by the fact that there will only be 10k 4-digit ENS domains ever, whereas NFT collections can easily spin up many 10k collections in similar regard.

- Notable blue-chip collection, Doodles hits ATH

- Phantom Network WL mint on May 5

- Ragnarok Meta launches NFT collection, reveal coming soon

- NFT Worlds Avatar mint on May 4 & 5

- Azuki’s BEANZ reveal happening on May 5 ~12 pm PST

- LooksRare will be standing by to push a full collection metadata refresh

- TreasureDAO announces Trove and TreasureDAO Marketplace Merger

- Something Token minted on May 2, offering exclusive access to discounts in the Americana Marketplace

- LooksRare Listing Rewards v2 is launching today

NFT Market Overview

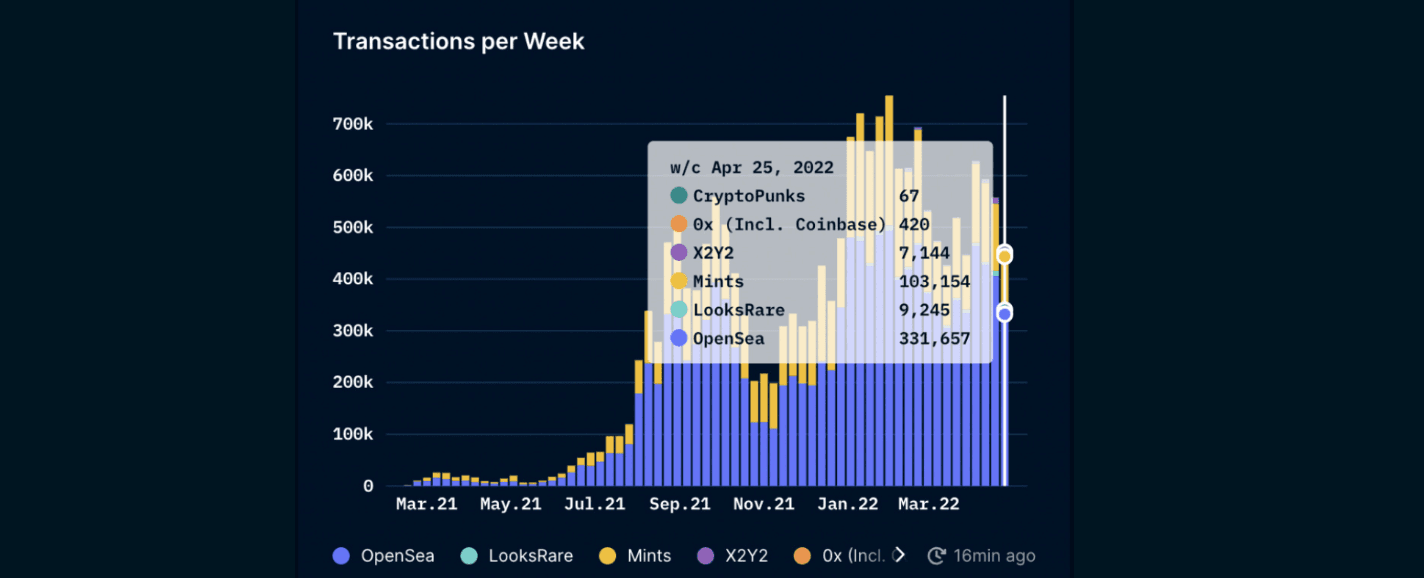

Volume per week

Here are some main observations for the week:

- We topped off the week with the highest volume since the NFT peak cycle in late January’22.

- This week marks the 4th highest volume EVER in the history of NFTs, not too far from the levels we’ve observed in late January to early Feburary’22 in peak season.

- Yuga Lab’s land sale dominated the market and raised ~$320M, with gas fees shooting up to about 2.6 ETH at an all-time high, this caused a spillover effect to other blue-chip NFT collections.

- Drawback in floor prices of BAYC and MAYC collections which happened post land reveal. BAYC’s floor price is currently standing at 108 ETH, a 23% decrease in 7 days. MAYC’s floor price is currently at 25 ETH, a 31% decrease in 7 days.

- Although we’ve seen the fourth highest volume per week in the history of NFTs, transactions per week have seen a consecutive decline for four weeks in a row. A few main possibilities:

- Users are buying into blue-chip collections where floor prices are much higher than mid-to-low cap collections - spiking up the volume.

- NFT degens are generally more cautious on their strategies when it comes to minting or buying collections on the secondary market, which is why the focus has shifted to accumulating more blue-chip collections, leading to lower transactions per week.

- As mentioned in our analyst Louisa’s Twitter thread, there’s been a drop in the ratio of wallets buying to wallets selling on August 21’. Since then, the ratio has been relatively stable, while NFT volume (ETH) has increased substantially. Wallets buying are generally twice as much as wallets selling per month.

OpenSea vs. LooksRare

- Looking back at past reports, we covered a similar chart in early March, where we observed the highly volatile trading volumes for LooksRare, as opposed to Opensea’s relatively stable volumes.

- The LooksRare marketplace is rife for their insider wash-trading activities, as users try to game the trading rewards model. As a result, we’ve seen volatile spikes in trading volumes (ETH), which is evident in the chart below. It does seem that as of recently, wash trading is not as rampant in LooksRare. Moreover, the trading volume (ETH) for OpenSea and LooksRare seems to be cutting close, as more organic volume takes over for LooksRare.

- LooksRare is launching their listing rewards v2 tomorrow. In V2, the closer your listing is to the floor price, the more points you’ll get. For example, listing ≤ 1.1x floor price will give you a massive 10x points boost. Full documentation here.

This Week's Highlights

Otherdeed for Otherside

Otherdeed for Otherside Mint Post-Mortem

- The Otherside NFT mint burned more than $157M in Ethereum, making it the sixth-largest source of burned ETH ever

- The gas fees went up to around 3 ETH at some point as secondary sales with over 71k ETH burned on May 1, 2022, a major spike compared to the overall Burned per day chart.

- Minters were disappointed by the lack of effort from the Yuga Labs team to ensure a smooth and optimized minting contract.

- Yuga Labs then proceeded with a Twitter statement stating that ApeCoin “will need to migrate to its own chain in order to properly scale”.

Since the integration of EIP-1559 on August 5, 2021, the BaseFee in May has already exceeded the BaseFee per month for the whole of August 2021. For those who are not familiar with the term BaseFee, it simply refers to the price you pay for the unit of gas for a transaction.

Yuga Labs hasn’t announced much information regarding the utility of the land, however, here are some of the things they’ve revealed so far:

- Immersive gameplay will be supported by AI and physics

- Multiplayer features will be made possible via Improbable M2 technology

- Otherside will include natural voice chat

Although some information has been released, Yuga Labs tends to keep things on a softer note, with the promise of under-promising and over-delivering. Nothing is set and stone and all the points reinstated above are rather general, not going through many details. What we now know is that the rarity is also dependent on whether one owns a Koda within their land. While these are mere speculations, it will be interesting to see how Yuga Labs will pull this off.

One thing to note is the Otherside Licensing Agreement. In the Koda licensing agreement, it is clear that the IP rights are largely attributed to the Yuga Labs team. Moreover, it was also stated that, of course, this is a debate that has been circulating in the wider crypto community in regard to IP rights.

Project PXN

Phantom Network is an anime avatar project from the Nanopass team. They’ve secured partnerships with notable NFT projects like Kaiju Kingz and Neo Tokyo.

Some of the project features:

Phantom: The NFT serves as a login token and avatar. Classifieds: A crypto-based marketplace where you can buy and sell your web2 items with web3 coin. R.A.T: [Redacted]

Project PXN is another hyped collection that was deployed around ~10 hours ago. The collection has already generated 17,848 ETH in the last few hours, placing it in the Top 4 in the 7D NFT Market overview. Currently, as the project is still in a public minting phase (dutch auction, started at 2 ETH), there are only about 4k in the collection. The WL sale will begin in less than ~24 hours, which will be capped at 0.35 ETH. Considering the current floor price of 2.8 ETH, whitelisted addresses are already up by 8x if the floor price continues to range at around 2.8 to 3 ETH.

Link to website: https://www.phantom.sh/

Upcoming Projects Highlights

Elite

Massive Potential

Others: https://twitter.com/asian_mint/status/1521002940118364162

(NFA, this list was retrieved from “Asian Mint” membership club)

Tools for further research

NFT aggregators

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- NFTBank.ai

NFT Marketplaces