Top News

- Magic Eden launches the Open Creator Protocol, which aims to protect creators by giving them the power to remove their collections from marketplaces that do not respect royalties

The launch also includes other functionalities, such as:

- Dynamic royalties for larger sales,

- Customizable parameters on NFT transferability + bulk transfers,

- And the ability to freeze trading before a project mints out

solving several pain points that the ecosystem has been facing

- Founder of DeGods and Yoots NFT, FrankTheGod, doxxed himself in public, causing a massive surge in floor prices for both collections

- Clone X faces backlash on the monolith forging, taking a toll on the Clone X holders

- NFTs go live on Uniswap Marketplace

- APE Staking is live and the pre-commitment period started on 5 Dec; Reward Accrual is set to be live on 12 Dec

- Tim Ferriss launches a new NFT project “The Legend of Cockpunch”

- Shibuya, a Web3 film distribution platform, raises $6.9m in their seed round, backed by A16z and Variant Fund

- Ledger launches Ledger Stax, a new touch-screen digital asset storage device that can be used with the Ledger Live mobile app

- Blur

- The platform’s second airdrop, ten times that of the first airdrop, is live. Users have 14 days to claim by placing a bid

- Blur.io’s bidding feature bug resulted in some investors buying NFTs for much more than what they initially bid

- Game maker The Mirror raises $2.3 million in Founders Fund-led round

- NounsDAO will donate 100 ETH to ZachXBT as funding for investigative journalism

- Coca-Cola partners with Crypto.com and artist GMunk to release 10,000 FIFA World Cup NFTs

NFT Market Overview

Lower Volumes, Cautious Buyers, and No Clear Signs of Divergence in the NFT Markets

Is the gloom from the NFT market over? We’ve seen a few notable blue-chip collections emerging this week. With Pudgy Penguins taking the NFT world by storm - dubbed one of the “smartest bear market hedges”, Azukis topping the charts, and other bullish catalysts, are NFT traders back in full force? Let’s take a look:

Main Observations:

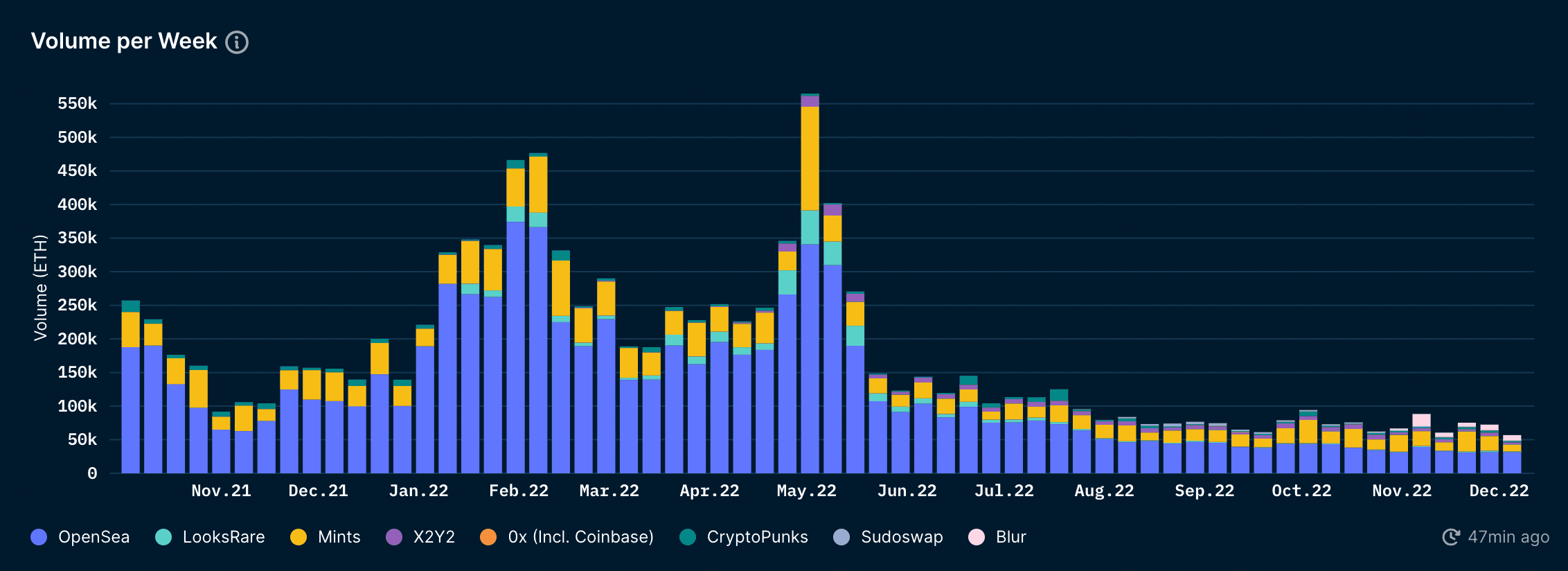

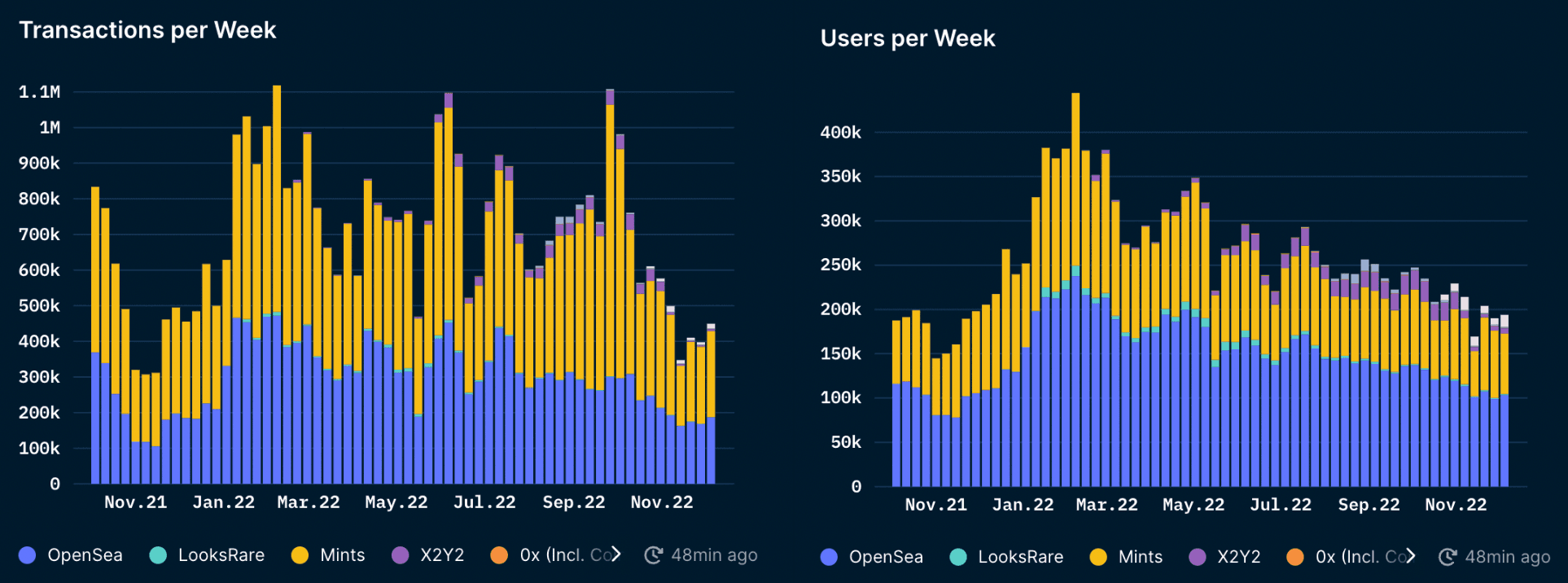

- The general outlook for the NFT markets still remains grim. Despite a few collections performing significantly better than others, the volume per week is stagnating at lower volumes. At the peak of the NFT markets this year in May with an average of 300-500k ETH in volume per week, we are now hovering at 50-60k ETH values.

- On a brighter note, transactions per week have hit local all-time highs for the fourth consecutive week. This might allude to traders starting to make more trades again, whether it is buying or selling - or both.

- Users per week have also been on a downward trajectory since March this year, implying that traders might still be on the sidelines, or have left the NFT markets completely.

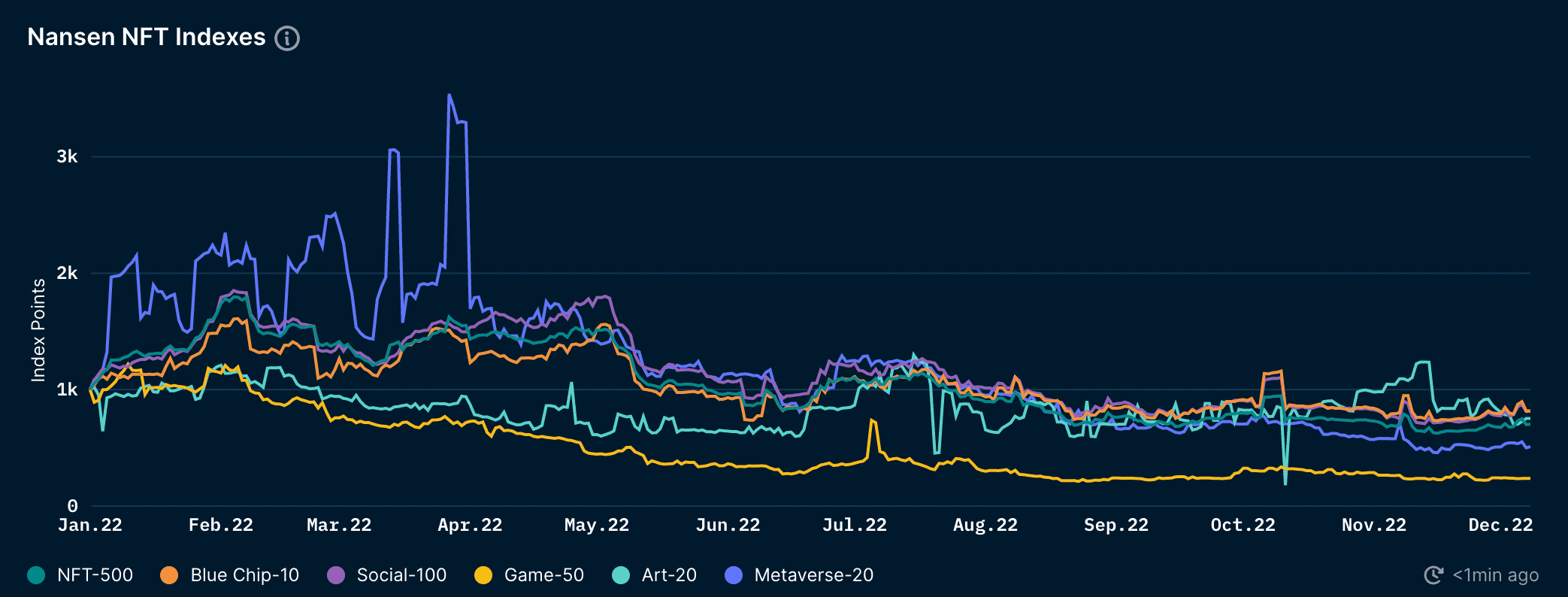

- There is no clear divergence in the NFT indexes trend. All of the categories above have remained quite consistent over the past few months.

- Nansen’s Blue Chip-10 Index experienced a slight uptick in December.

- In particular, Azukis have experienced a 17-18% increase in floor price over the last 30D.

- Clone X, however, saw a 24% drawdown in the last 30D. Clone X had a physical drop this week from the Monolith boxes, but it was announced that the physical shoes are unable to be shipped to any holders outside of the US.

- This news came as a shock to the community considering the vast majority of holders are most likely based outside of the US.

Solana NFT Market Overview

Main observations:

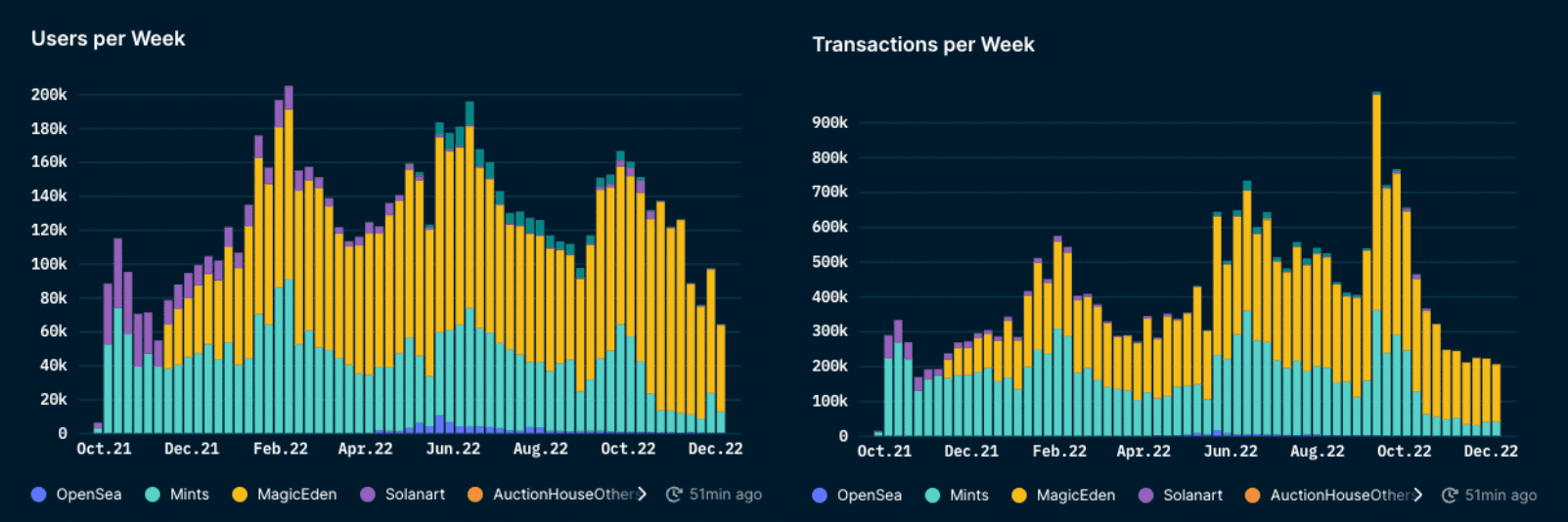

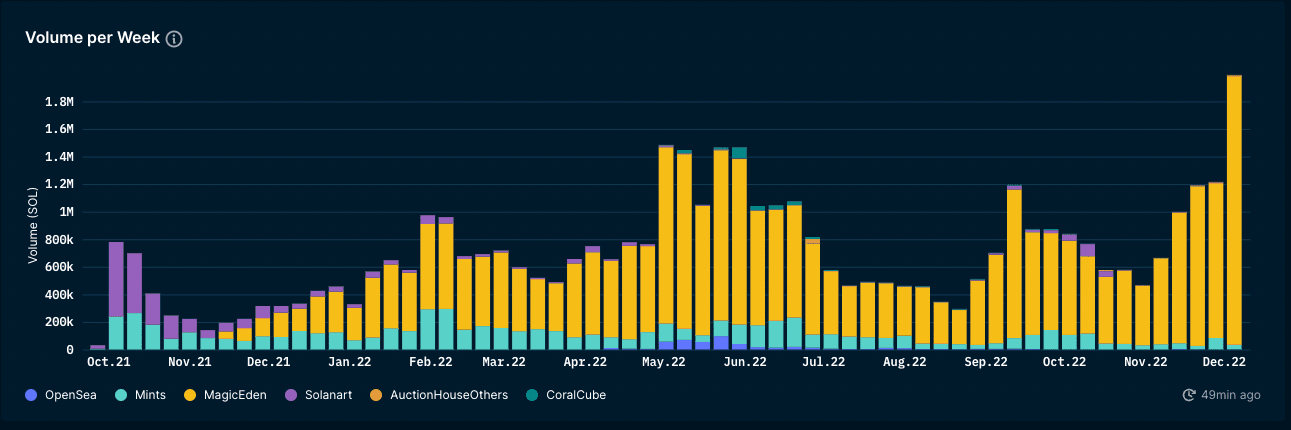

- Volume on Magic Eden has hit an all-time high of 1.9m SOL in the past week, largely brought about the activity on projects like y00ts and DeGods.

- The activity could also be attributed to the launch of the Open Creator Protocol by Magic Eden, as mentioned above.

- Despite an ATH in volume, the number of users and transactions has fallen to an all-time low in the past year, meaning that the average transaction value has gone up significantly in SOL terms.

- This could be attributed to the >50% reduction in SOL’s price, resulting in the rise of many NFT projects’ floor prices in SOL terms.

This Week’s Highlights

Pudgy Penguins

Pudgy Penguins have been one of the best performers in the NFT market this past week, registering a 295.3% influx in volume week-over-week from 256.53 ETH to 1,014 ETH and a subsequent 33.4% rise in floor price since December 1. The floor price has risen 86.8% from the lows in mid-November without any pullback.

The surge in interest is likely tied to a few factors; Pudgy Penguins Merch and Toys, Sotheby's auction along with the first-ever Penguin soul-bound token (SBT), holder R&D session and an event at Art Basel last week, and continued presence in the space, among other initiatives. Luca Netz, the CEO, has been instrumental in pushing the brand forward and setting the standard for great leadership and communication by appearing on multiple podcasts, conferences, and interviews, such as ngmi and Benzinga, detailing the project's roadmap and vision.

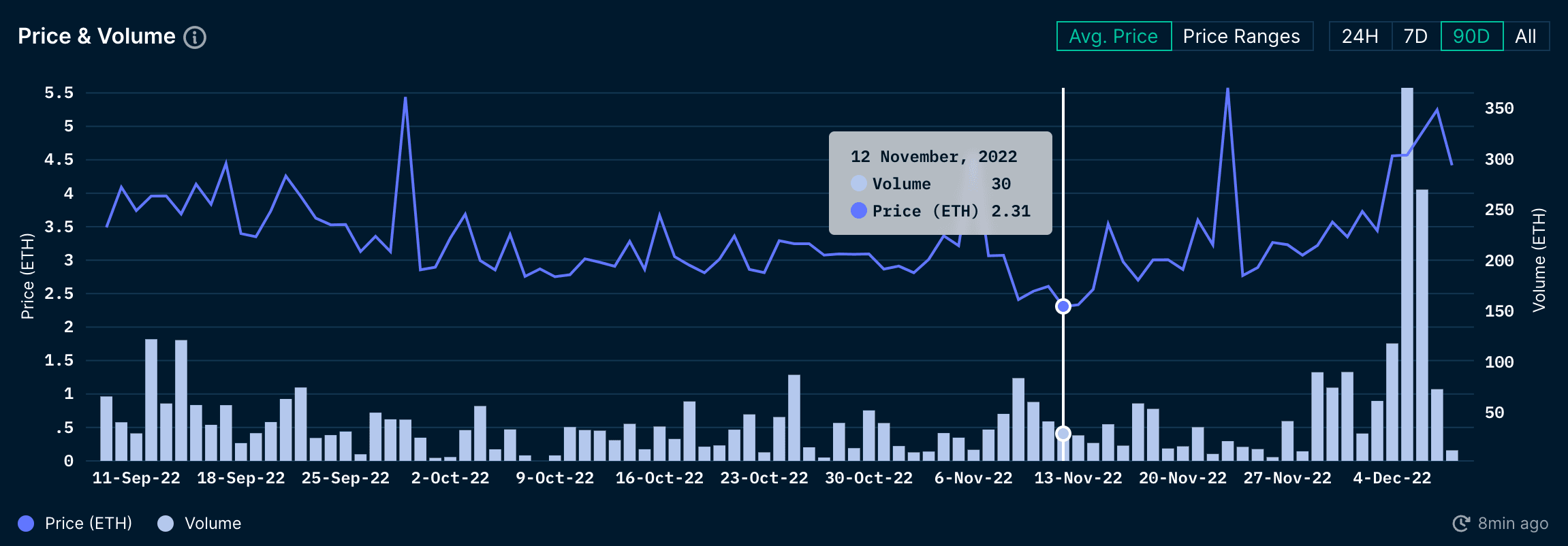

The collection has been holding up relatively well in the past 90D and bottomed out at an average of 2.31 ETH per Pudgy sold on 12 Nov. Since then, it has been on a steady uptrend, with significant volume spikes in the past few days and peaked on December 5. Pudgies registered 370 ETH and 270 ETH in trading volumes on 5 and 6 Dec, respectively. However, with such a large uptick in volume, buyers may be exhausted in the short term.

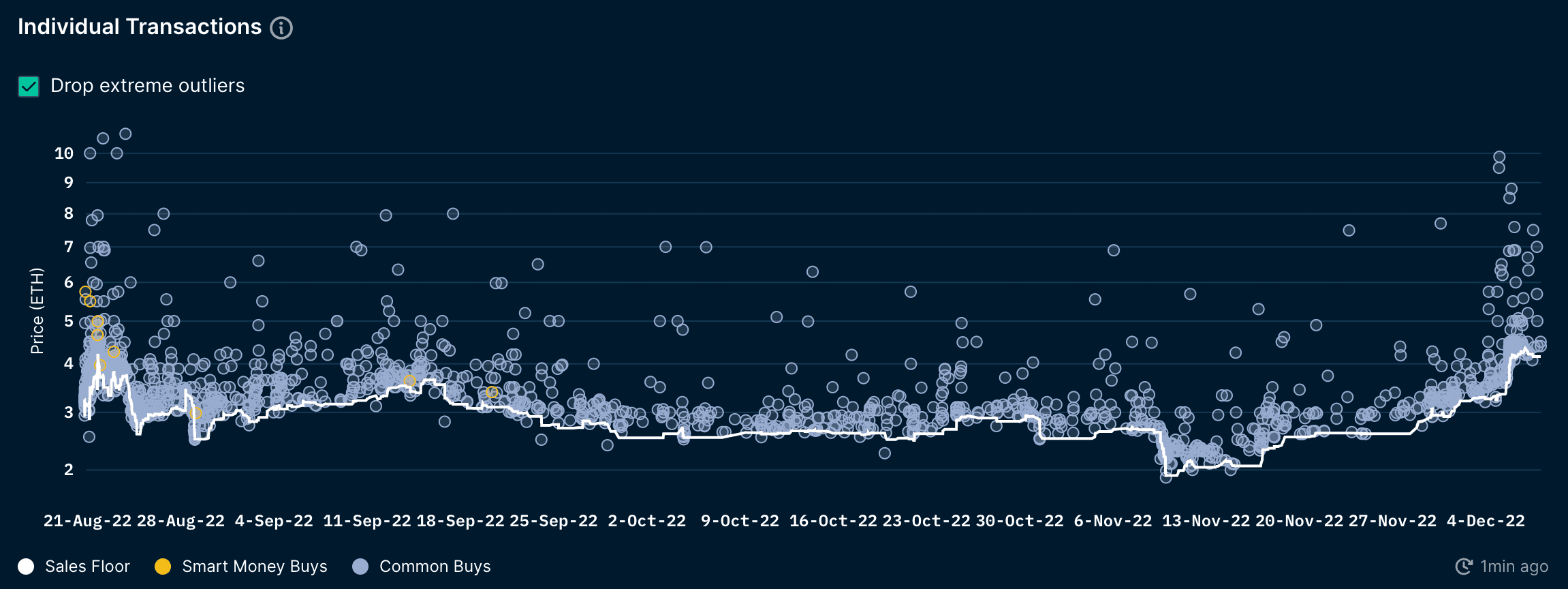

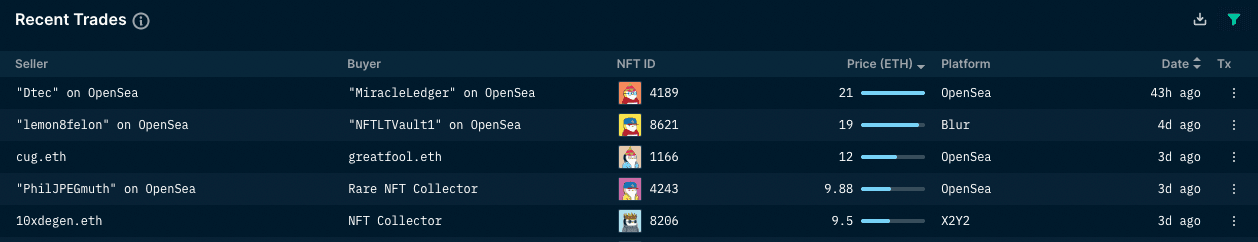

In correlation with the trading volume and increase in floor price, there have been more higher-value sales this week compared to the past 90D, with multiple sales around the 5-7 ETH area. The most notable sales over the past include two golden skin Pudgies at 21 ETH and 19 ETH, respectively. Although, all of the sales have been from common buyers. There were no Smart Money wallets observed buying Pudgies recently.

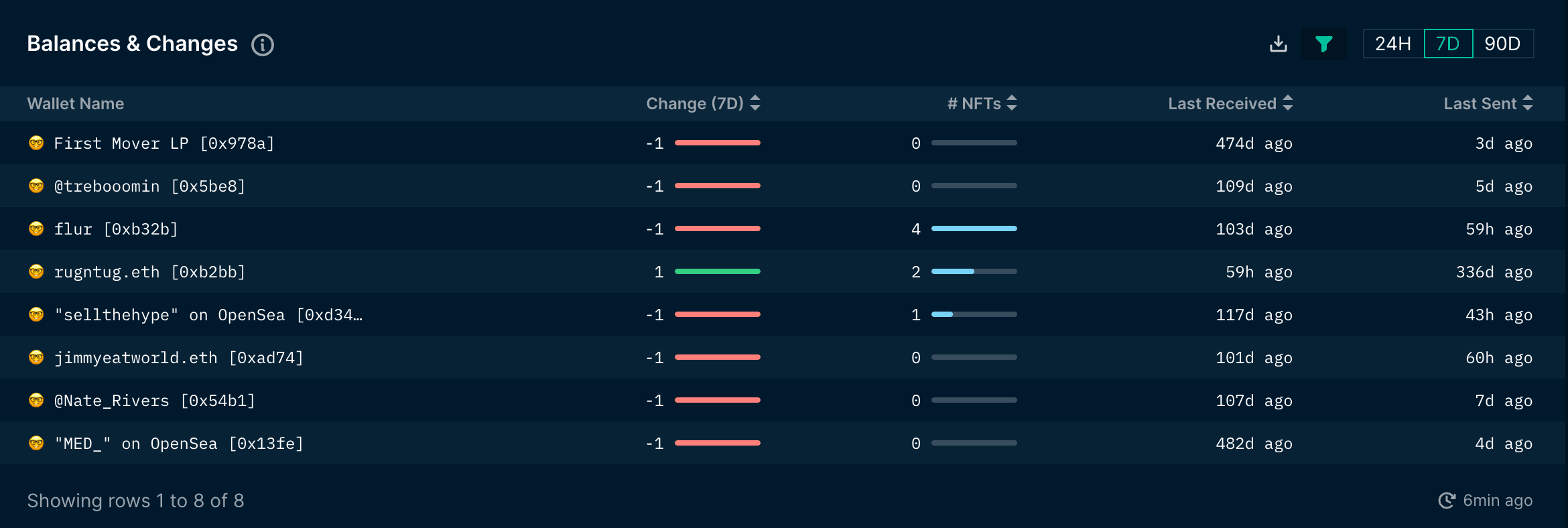

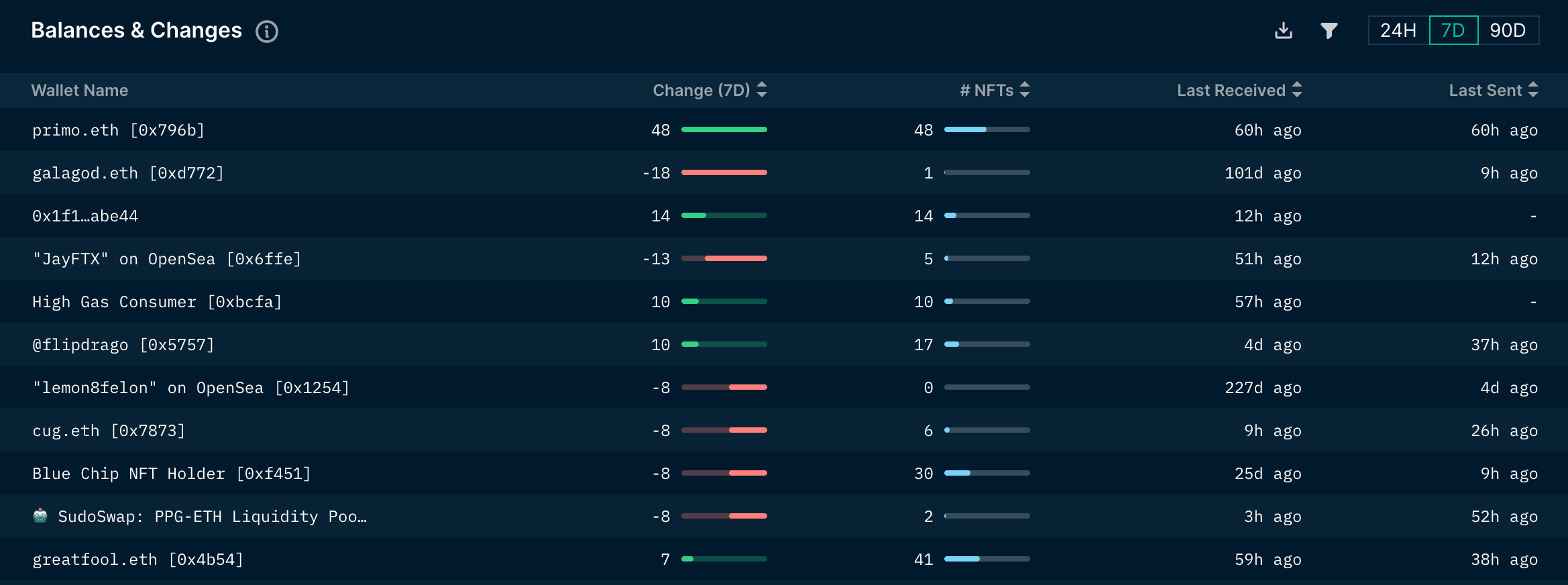

While Smart Money activity for the collection primarily consisted of taking profits, there were non-Smart Money buyers of size in the past week. Particularly, primo.eth bought 48 Pudgy Penguins, while greatfool.eth picked up 7 more in the past 3 days. They are now the 6th and 10th largest holders, respectively. On the contrary, Blue Chip NFT Holder reduced their position by 8 and currently owns 30 NFTs.

There are 42 Smart Money addresses currently in possession of an aggregate of 180 Pudgy Penguins, translating to ~2% of the supply. SonnyF90, fifilechien.eth, coinpop.eth, and devmons.eth are some of the largest Smart Money owners of the collection, with 27, 14, 12, and 11 Penguins, respectively.

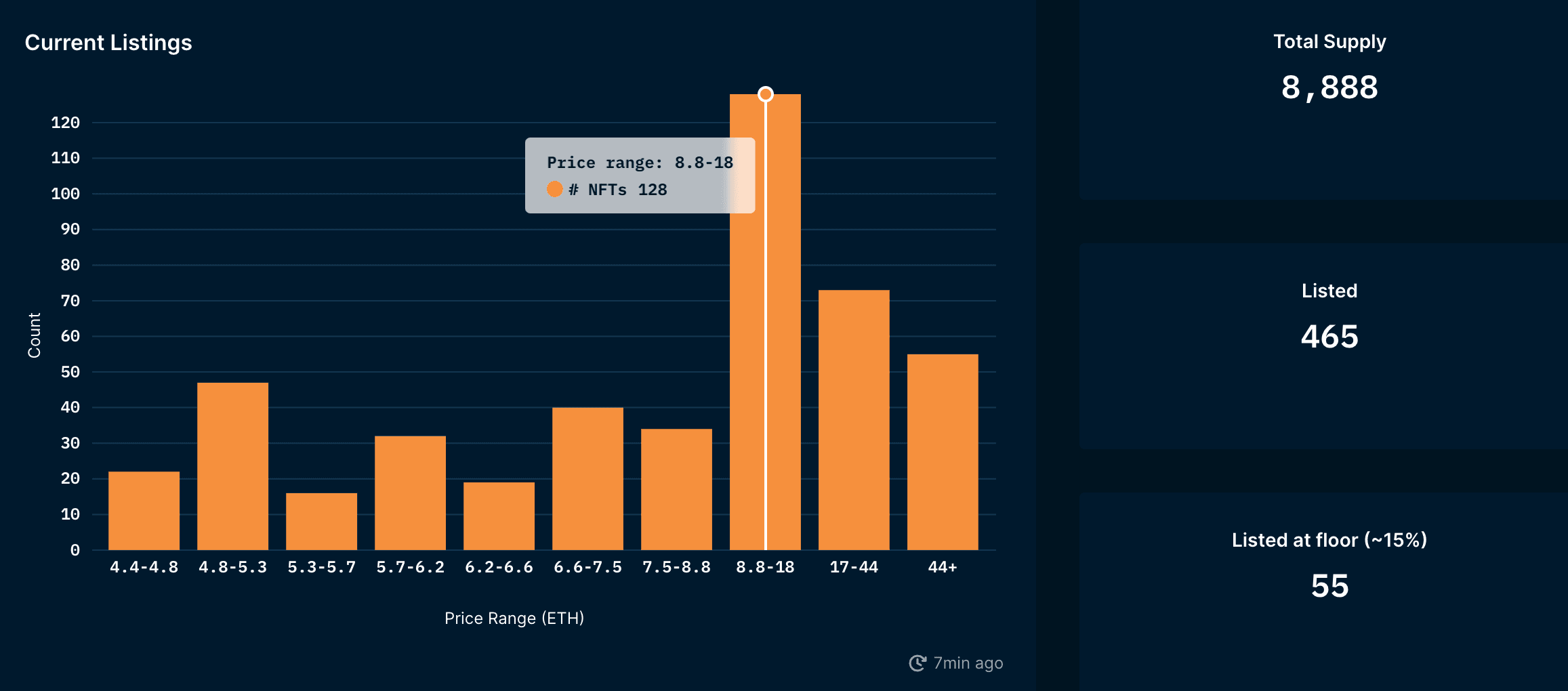

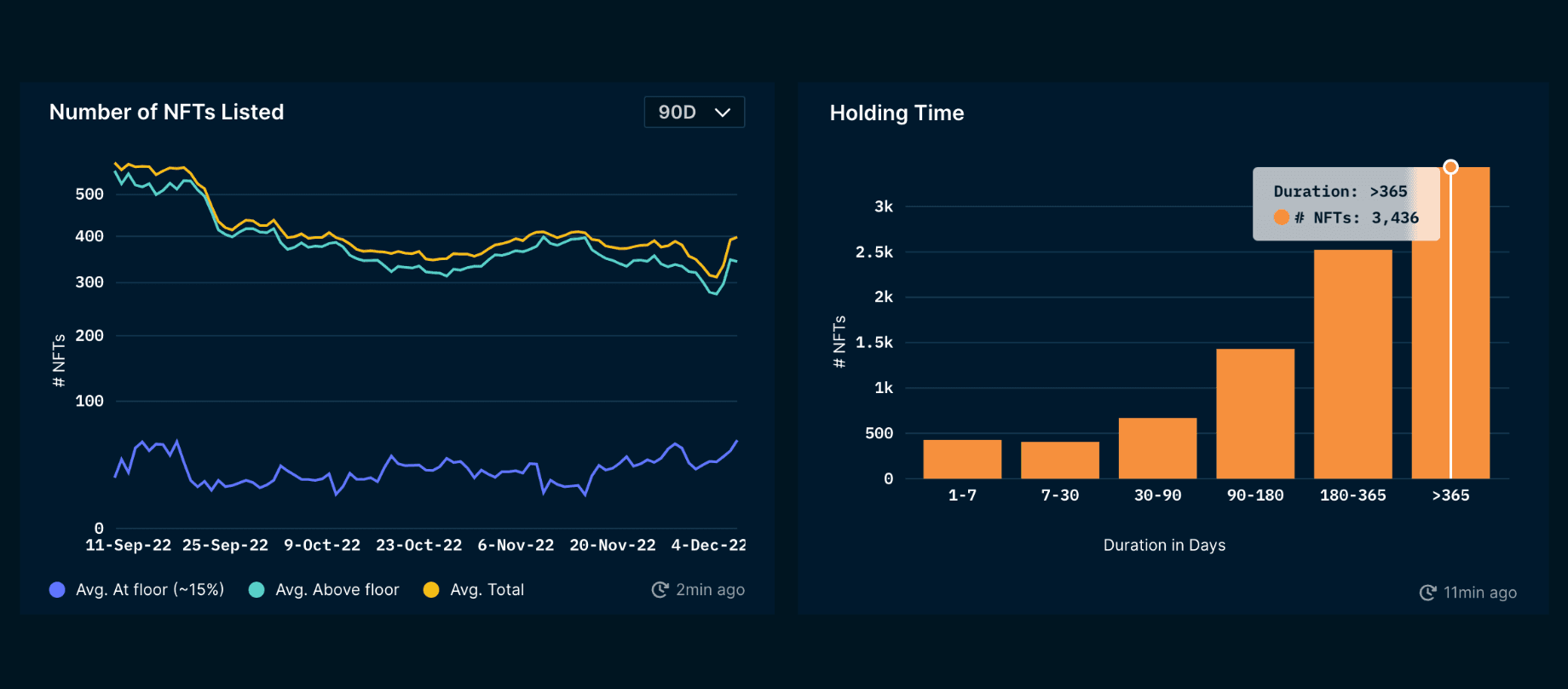

Naturally, as interest and volume increase, some market participants will look to take profits from their holdings. The number of listings has been trending downwards since September and bottomed out at 311 NFTs but has gone back up to 465, representing ~5.2% of the collection's supply, which is low relative to most projects. While 54 of those are currently listed at floor, the largest cluster of sellers has an asking price of between 8.8 ETH and 18 ETH.

Additionally, 3,436 Penguins, or approximately 38.7% of the collection size, have been held in the same wallet for over a year. The number of diamond-handed NFTs has been stable at ~4660 NFTs (~52.4% of supply) since the beginning of the year. These metrics indicate that many Pudgy Penguin holders are long-term believers in the project.

Art Blocks

The froth in the NFT markets is nowhere near clear, but Art Block buyers seem to be bullish. The Generative Art NFT scene is still a largely untapped market and it is presumably still early days. Only time will tell if Art Blocks will continue pushing boundaries for Generative Art or if other contenders will start taking a chunk of their market share.

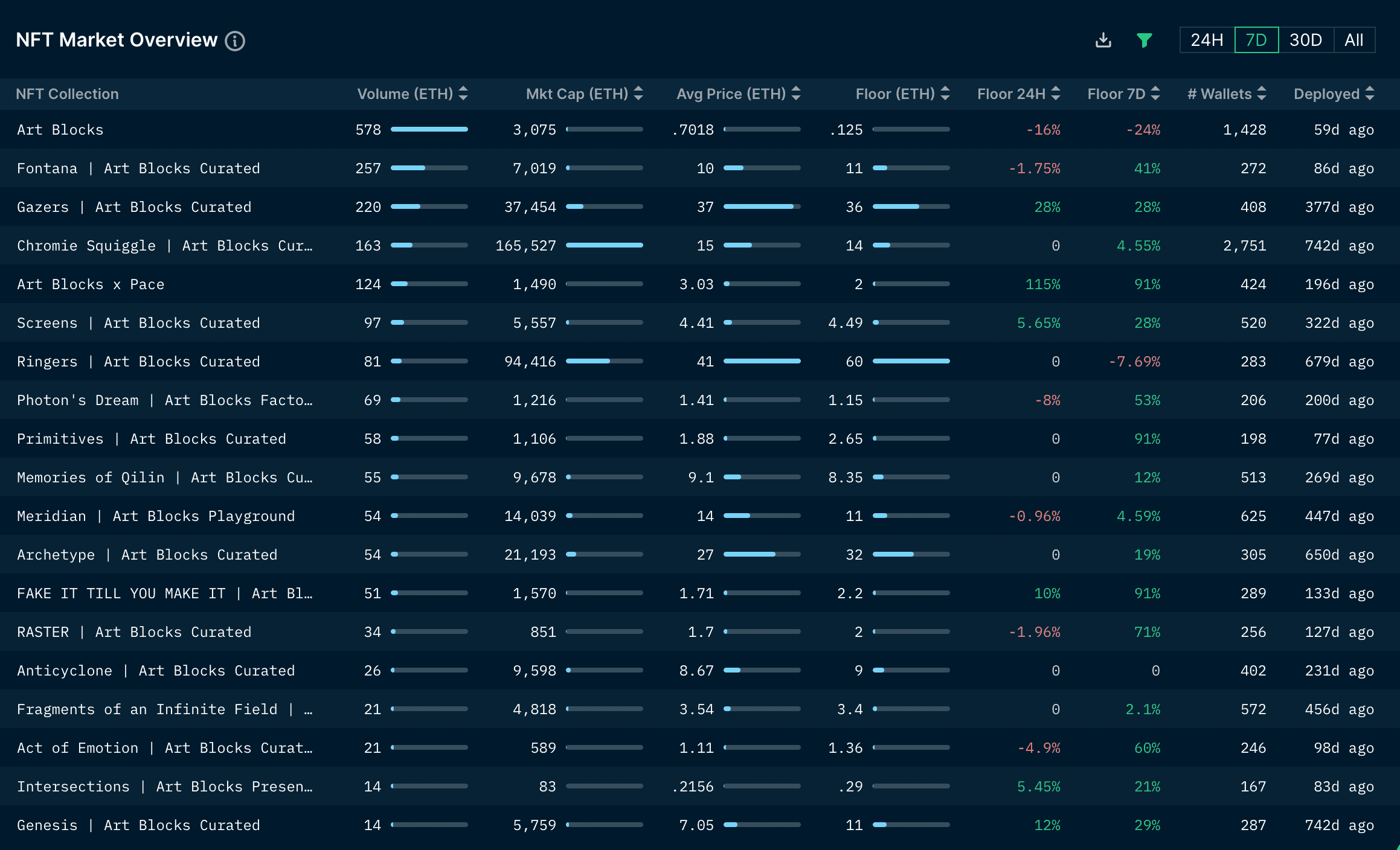

Over the last 7D, we’ve seen a rise in floor prices and volumes for a vast majority of sub-collections for Art Blocks Curated.

Some of the collections to keep an eye on:

- Fontana

- Gazers

- Art Blocks x Pace

- Screens

- etc.

Uniswap NFT Marketplace

NFTs have finally launched on Uniswap on 30 Nov, since Uniswap acquired Genie back in June. The launch was long awaited as $5m USDC was airdropped to historical Genie users, coupled with gas rebates (up to 0.01 ETH) for the first 22k users. Besides being an aggregator, the platform is also touted to bring about greater gas savings for users (up to 15%) by utilizing on the Universal Router contract developed by Uniswap. The contract allows users to batch-swap NFTs/tokens in a single transaction without the need for token approvals with the Permit 2 functionality. It allows users to batch approve or revoke allowances, set expiring approvals, and bypass allowances with a one-time signature. Overall, Uniswap NFT aims to provide a seamless experience for users by reducing the amount of transactions needed and optimizing for lower costs.

| Marketplace | 7D Volume (ETH) |

|---|---|

| OpenSea | 31,378 |

| X2Y2 | 3,139 |

| LooksRare | 1,355 |

| Blur | 8,330 |

| Sudoswap | 809 |

| Uniswap | ~800 |

Source: Nansen NFT Trends / Dune (as of 5 Dec 2022) Note: Uniswap’s 7D volume was adjusted based on the average of the 6 days since launch.

Despite being an aggregator and having lower gas fees, the Uniswap NFT marketplace has not been very successful in taking market share from its competitors. While OpenSea continues to dominate, Blur has been steadily gaining traction. The reason for this is probably due to its airdrop mechanism which requires users to use the platform as much as possible and remain ‘loyal’ to it, which has been a huge driver of its growth. Therefore, without sufficient incentives - it will be hard for users to switch over from other platforms to Uniswap.

Its current offerings also pale in comparison to other aggregators such as Blur, which offers more functionalities such as bids, sweep functions, and better data on sales/activity. Such functionalities would be more important for most users to have all they need on a single platform, rather than a more seamless experience whereby the difference would be less evident for most users. Given that Uniswap’s main product is still its DEX, it would be interesting to see if there are any product updates in the near future to increase its competitiveness among other marketplaces.

COCKPUNCH

On 7 Dec, famous American author and podcast host Tim Ferriss launched his own NFT project named “The Legend of Cockpunch” or simply “Cockpunch”. “Cockpunch” consists of 5,555 images describing anthropomorphized rooster characters. As Ferriss describes, “it is the first-ever Emergent Long Fiction (ELF) project of its kind”. Different from the usual PFP project, the ELF project is an approach to building a fictional world. The full storyline and “C”s (characters, conditions, constraints, etc.) are not predetermined and are ongoing and evolving. Tim has roughly written a few chapters to set the stage and will continue to develop new adventures and reveal them through his new “Cockpunch” podcast.

The primary sale was conducted via PREMINT and has yielded over $2 million. The funds will be donated to the Saisei Foundation, a private nonprofit foundation that funds research initiatives related to psychedelic medicine, mental health therapeutics, and more. At the time of the mint, the NFT was priced at 0.3 ETH (about $370). The collection reached a volume of 664 ETH on Opensea in the past 24H and is currently ranked second among all Ethereum NFTs. The floor price now sits at 0.93 ETH. The project also receives a lot of attention from Smart Money wallets. In the past 24H, there were 3 Smart Money buyers in the project, contributing 11 ETH in volume, the highest among all the Ethereum NFT projects. Since launch, the top 2 most accumulated Smart Money labels are “Smart NFT Sweeper” and “Smart NFT Hodler”.

Tim Ferriss is the main driver behind “Cockpunch”’s massive popularity and support. Tim is an author and investor that became famous through his “4-Hour” self-help book series and Blog Podcast. Many people believe in the success of his first NFT project because of his success in the entrepreneurial space and the memetic potential, as suggested by the entertaining project name itself. In addition, his relationship with Kevin Rose, the founder of Moonbirds, further adds credibility to Tim’s potential in the NFT space to create and manage a promising project. According to Tim Ferriss’ Bankless interview, his primary objective in this NFT project is to create an NFT that is amusing rather than offering some form of utility. He has neither intended to create a high-end community nor a form of investment vehicle. In the podcast, he explicitly downplays the project’s chances of financial success but instead emphasizes no existing utility roadmaps for the collection as the project mainly serves as a funding source for the Saisei Foundation.