Top News

- LG to allow users to buy, sell, and display NFTs on their TVs

- NBA has partnered with Sorare to launch a fantasy basketball game

- GameStop announces partnership with FTX

- Chicago Bulls are collaborating with 23 artists to recreate the Bulls logo as an NFT

- FIFA launches NFT platform on Algorand

- Fortnite developer Epic Games’ marketplace lists first NFT game

- New York’s Museum of Modern Art considers buying NFTs with proceeds of $70m auction

- Starry Night Capital's NFT Collection will be liquidated

Raises

- Doodles raised $54m at $704m valuation

- Token management platform Magna raises $15m Seed round at $70m valuation

- Goldsky raises $20m to bring real-time, on-chain data to crypto companies

- Crypto options trading startup Synquote raises $2.8m from Initialized, Polygon

- Blockchain game developer Horizon raises $40m in Series A funding round

- NFT utility tracking startup Lasso Labs raises $4.2m

- Web3 data protocol Golden raises $40m in a round led by A16z

NFT Market Overview

Volume per Week

Transactions per Week

Users per Week

Main observations

- Volume measured in ETH for NFT sales have increased over the last two weeks and has reached around 100k, highest in the past two months. The rise in volume is mainly due to the increase in volume from CryptoPunks and Mints.

- Despite transactions per week having declined from previous week ATH YTD, it still passes 1m, one of the highest transactions weeks in the past 6 months.

- Users per week increase a bit from previous week although not by a significant amount, now reaching above 250k.

- The Blue Chip-10 index has a huge spike from Oct 4th to Oct 5th, with a 16% YTD increase measured in ETH and a -57% YTD decrease measured in USD.

- Doodles and Azuki have had the largest floor price increases in the last 7 days and are up 6.67% and 4.71% respectively.

- Bored Ape Yacht Club, Mutant Ape Yacht Club, Otherdeed for Otherside and Moonbirds all have underperformed in the last 7 days with negative floor prices.

Marketplaces

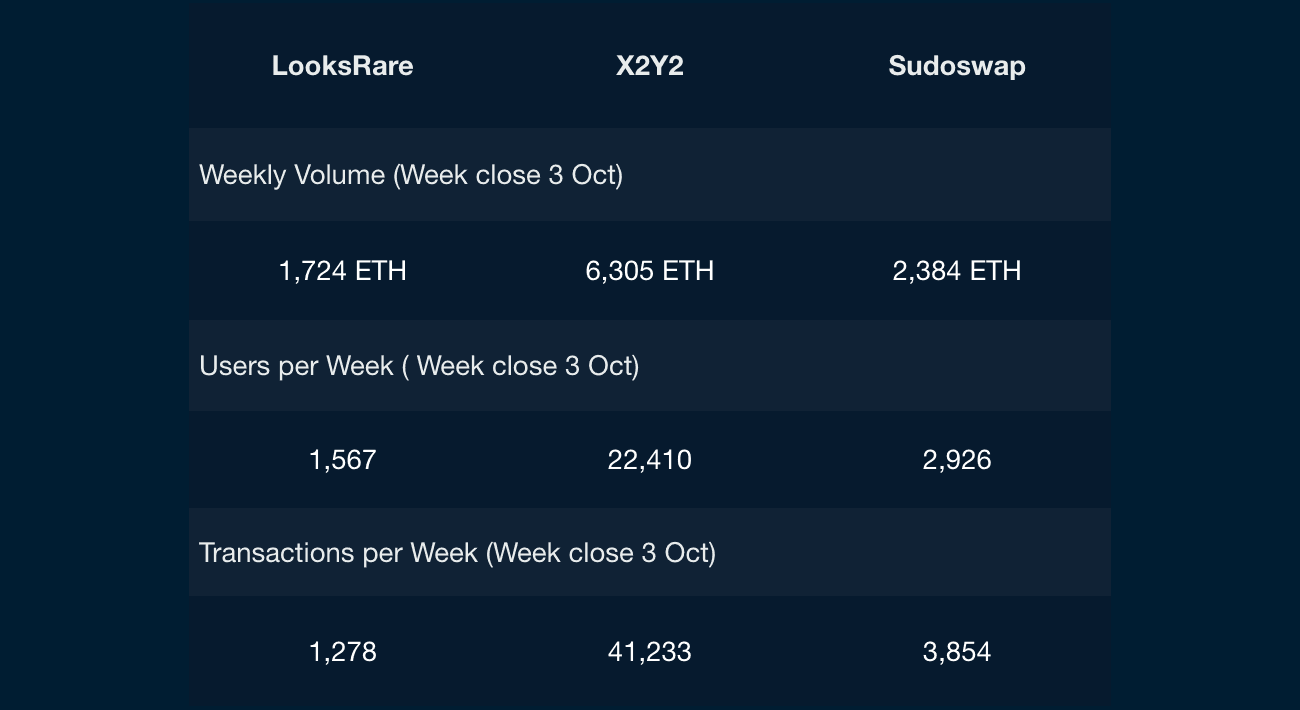

LooksRare vs X2Y2 vs SudoSwap

- Although overall volume in the NFT has slightly increased in the past week relative to previous weeks, LooksRare, X2Y2, and Sudoswap all recorded lower volumes for their respective platforms. The increase in this week's volume mostly came from the minting of new collections, which saw an uptick of 12,701 ETH. On the other hand, the weekly trading volume on OpenSea stayed stagnant.

- As for users and transactions per week, LooksRare and Sudoswap both saw lower activity in comparison to last week, while X2Y2 statistics remained relatively constant.

NFT Index Performance

Main observations

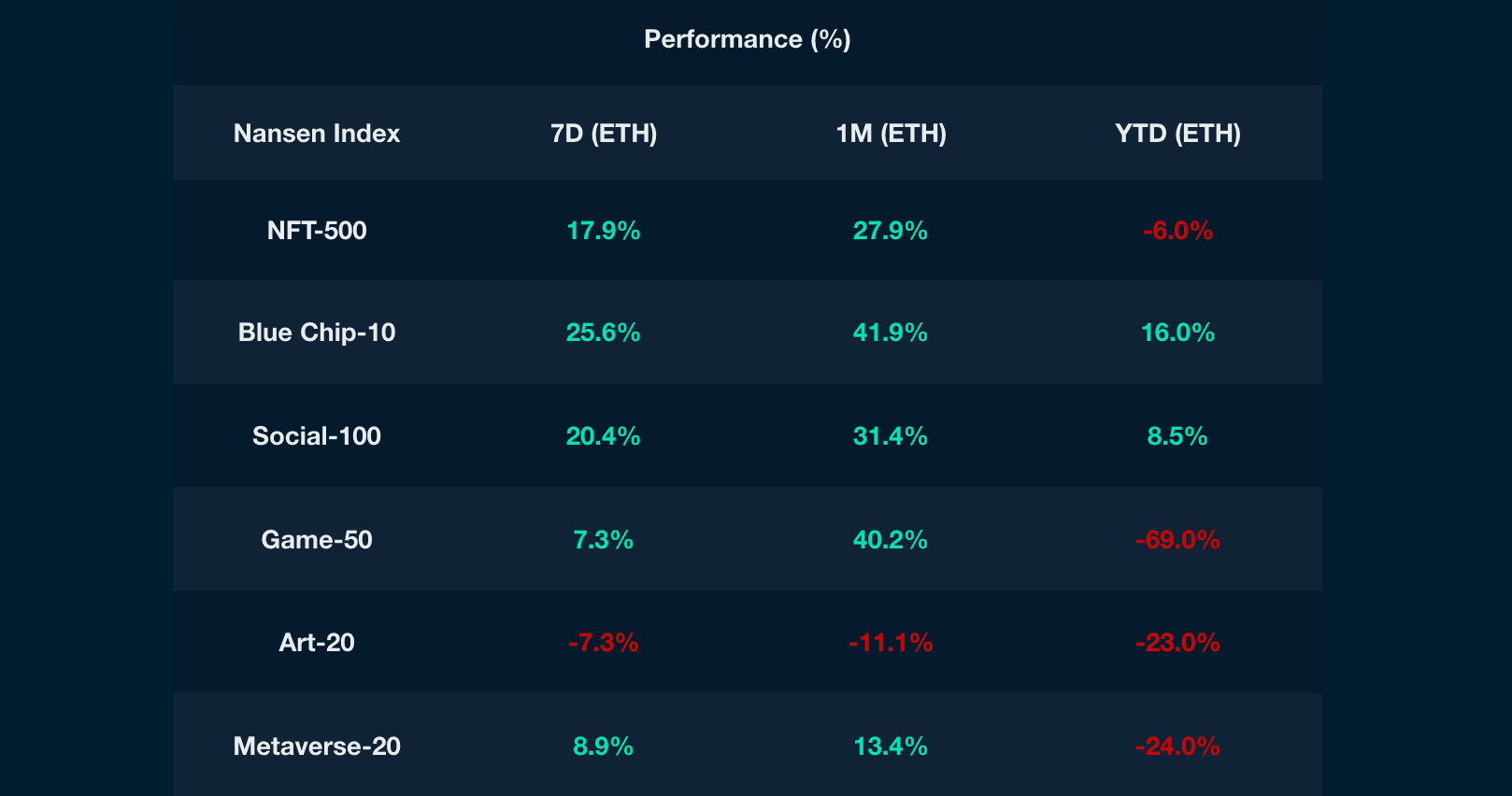

- With NFT trading volume picking up slightly this week, many of the indexes saw a spike upwards and now have a positive ROI (in ETH terms) over the past 7D and 1M periods.

- In particular, the Blue Chip collections were the best-performing index over the past week and month, up 25.6% and 41.9%, respectively. Meanwhile, Art-20 is the only index with negative returns during the same time horizons.

- From a YTD perspective, Blue Chip-10 and Social-100 are the only indexes in the green. In contrast, Game-50 has had the worst returns, sitting at a -69% ROI.

This Week’s Highlights

RENGA / Black Box

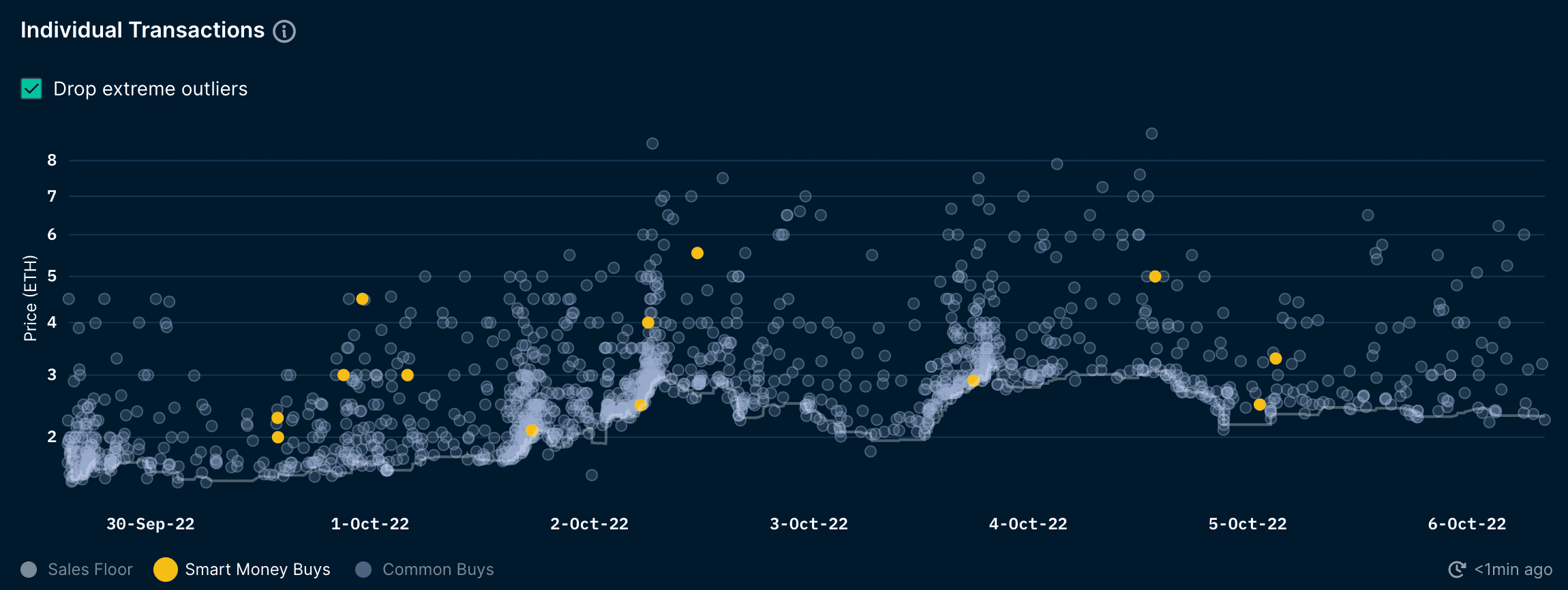

RENGA - created by Dirty Robot, an independent artist and illustrator - had an incredible run-up in floor price and volume, with a whopping 6109 ETH in total volume in the last 7D. Over the last 7D, the floor price has increased by over 85%, with the current floor price of 2.4 ETH. This collection was deployed 35D ago and has garnered consistent traction and interest from the community since.

RENGA has a unique and strategic method of storytelling. We’ve seen the development of their first collection The Art of Seasons (TAOS), with a strategic airdrop for RENGA’s Black Box (worth ~4.3 ETH) and the remaining NFTs went for public sale.

When observing the smart money activity, it appears that Smart NFT Traders, Holders, Early Adopters, and Sweepers have all increased their position for RENGA NFTs since inception. The smart money holders appear to have high conviction in the successes of RENGA as a collection.

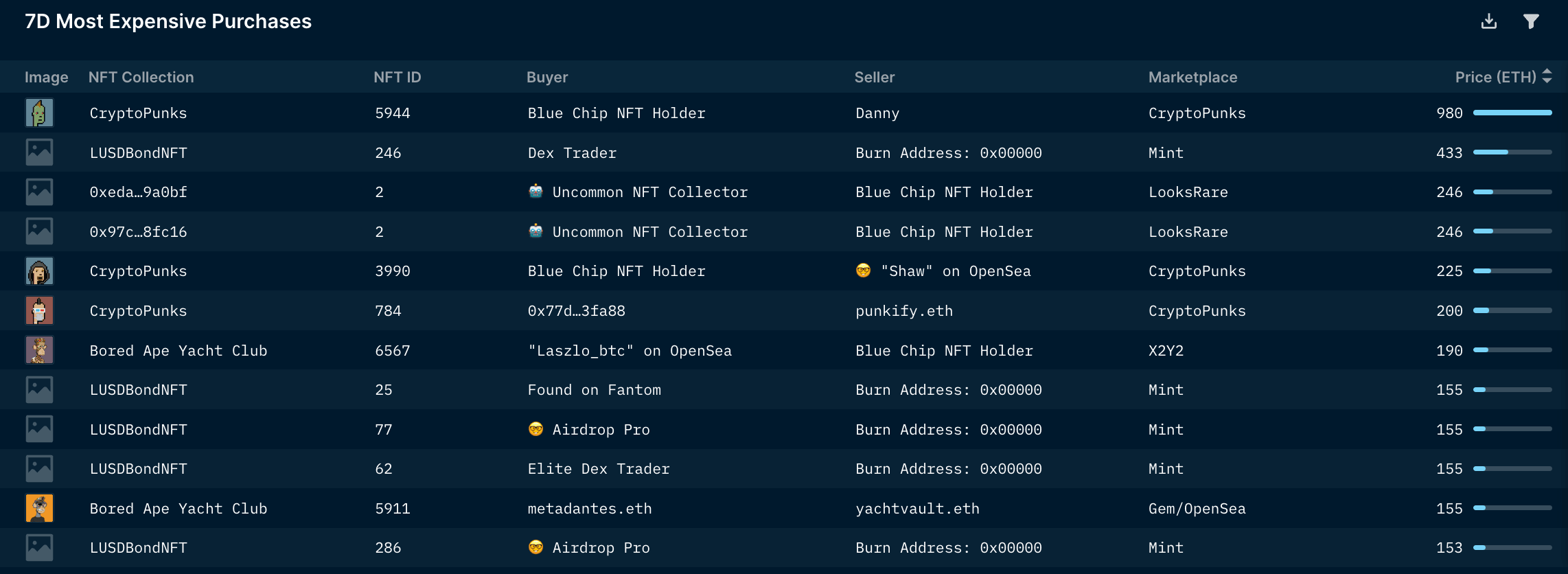

QQL Mint Pass

QQL Mint Pass is a new NFT project from Fidenza’s creator which generated a whopping $17m upon launch. Interestingly, a code in the QQL Mint Pass’s smart contract blacklists platforms like X2Y2, a royalty-free NFT platform. This move is a response to crypto Twitter’s debate on whether it is necessary for artists to receive royalties - in which protocols like SudoAMM and X2Y2 opted not to. For a more technical and detailed thread on how QQL’s smart contract “blocks” secondary sales from taking place on X2Y2’s marketplace, read this.

For context, QQL is an interactive project that allows users who minted the pass to mint their own QQL using the code. QQL NFT will receive a 2% royalty on the secondary market sales of that NFT, assuming that the sale takes place in a marketplace that supports standard royalty mechanism. However, it is not guaranteed that the users will actually receive the 2% royalty, as the final mover is up to the marketplaces.

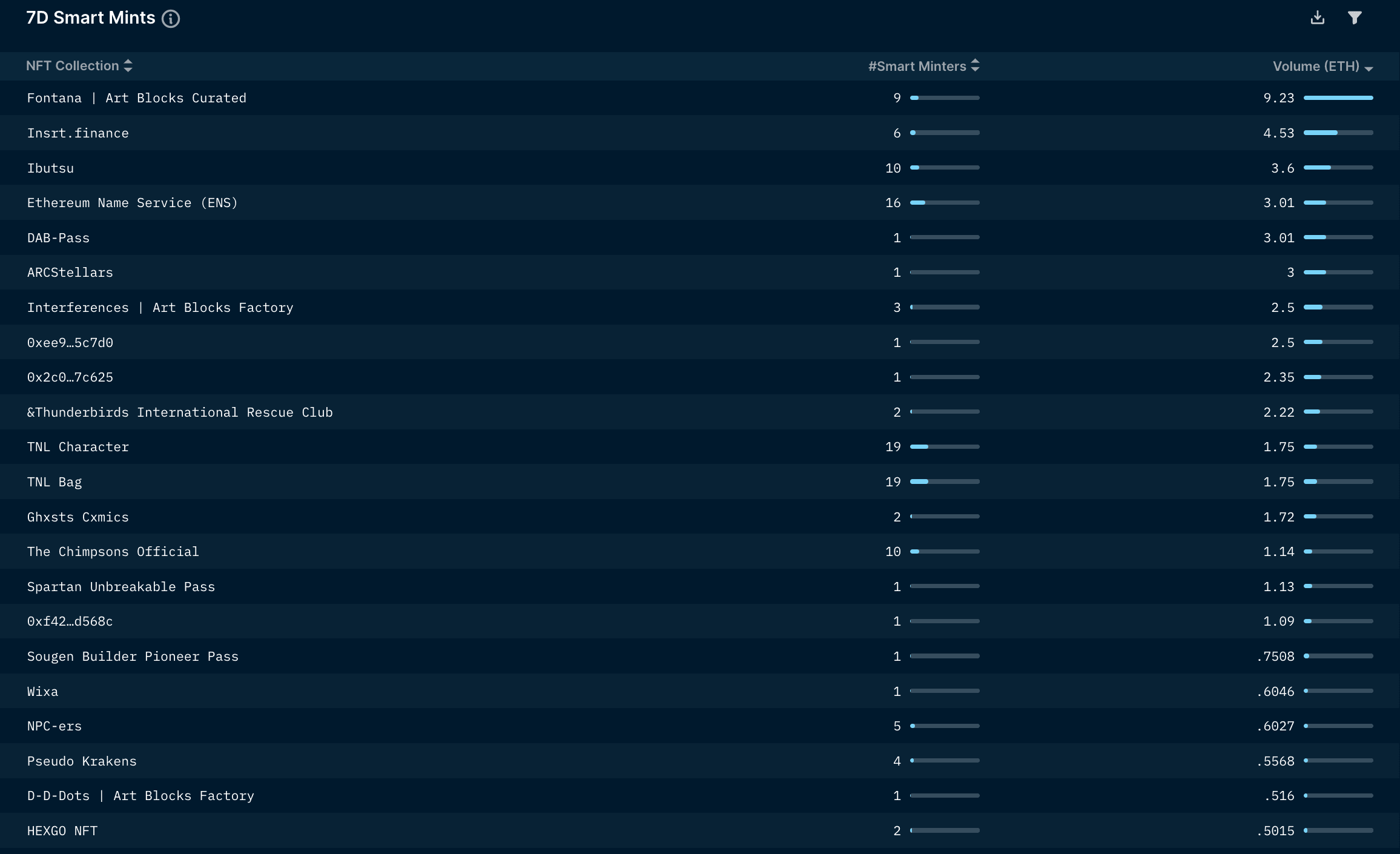

Smart Money Movements

This week's Smart Minters were observed minting NFTs from multiple Art Blocks collections, some of which include Fontana from Art Blocks Curated and Interferences and D-D-Dots from Art Blocks Factory, respectively. The activity and slight resurgence around Art Blocks could be due to Tyler Hobbs' QQL and its novel minting mechanism.

Ibutsus, ENS, and TNL are other notable collections minted by Smart Minters in the past week. 10 unique Smart Money wallets also picked up 3.6 ETH worth of Ibutsus, a PVP-style NFT game consisting of 3,333 avatars powered by APE and the Otherside metaverse ecosystem. We notified our Alpha members of Smart Money minting and buying Ibutsus in our Alpha Radar article on Tuesday, October 4th. Unsurprisingly, ENS domains continue to gain traction, with 16 different Smart Minters minting a total of 3.01 ETH in volume this week.

Additionally, 19 Smart Money addresses minted 1.75 ETH from TNL (The Next Legends) Characters and Bags. TNL is a metaverse AI boxing game featuring Muhammad Ali developed by Altered State Machine in partnership with Non-Fungible Labs and ABG. The floor price currently sits at 0.109 ETH.

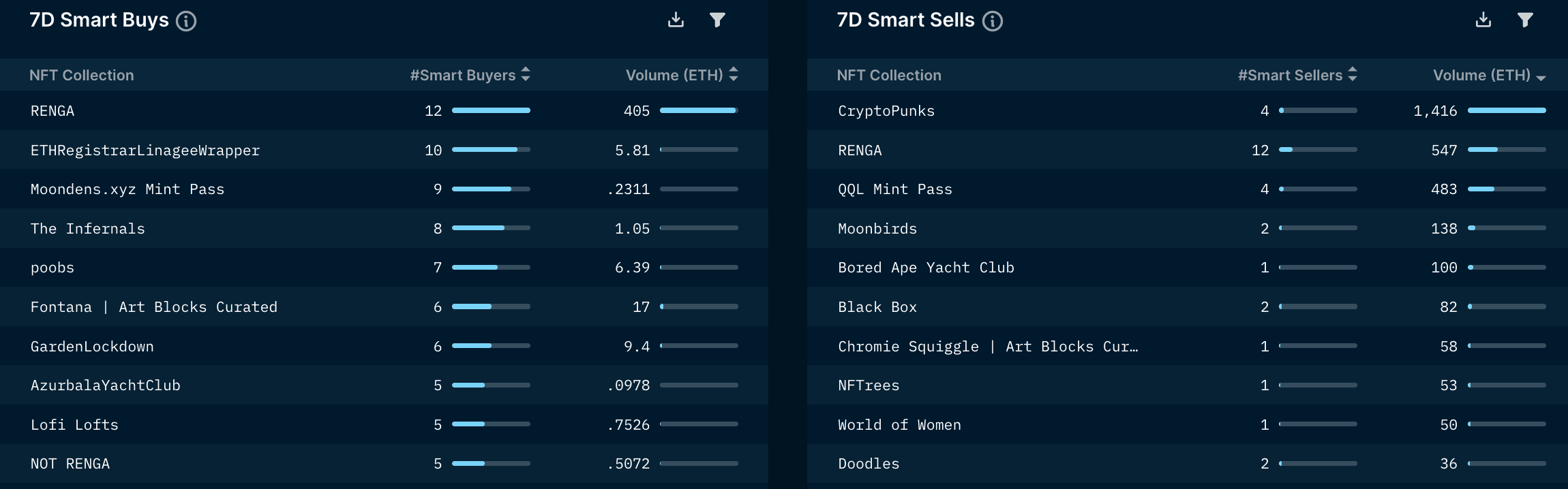

On secondary markets, RENGA, ETHRegistrarLinageeWrapper, and Moondens.xyz mint pass were the top collections bought by Smart Money this week. 12, 10, and 9 Smart Buyers purchased an aggregate of 405 ETH, 5.81 ETH, and 0.2311 ETH from each of the respective collections.

At the time of writing, RENGA has a floor price of 2.54 ETH, with trading volume peaking at 2,977 ETH on Sunday, October 2nd. While activity around the project has declined since then, the floor price has increased approximately 57.7% relative to last week.

As mentioned in the Weekly Highlights section, there have been some Smart Money purchases in the past week, but as seen from the chart above, some Smart NFT Sweepers have sold their assets off. On the other hand, other Smart Money segments, most notably Smart NFT Hodler and Smart NFT Early Adopter, have had an uptick in wallet count holding RENGA.

In terms of individual Smart Money wallets, OGDFarmer is the top Smart Money holder of the project, with 80 NFTs in total, followed by 0x1ba with 44 and 7-7-7.eth with 39. OGDFarmer has increased their holdings by 5 NFTs in the past 7D. In contrast, both 0x1ba and 7-7-7.eth both reduced their positions by 5 and 4 NFTs, respectively. It is also important to note that OGDFarmer has 14 of the 80 assets listed (1 listed at floor), as well as 0x1ba, who has 14 of the 44 assets listed.

Solana NFTs

NFT Market Overview

Main observations

- Volume for Solana NFT sales have decreased by nearly half from a high just a few weeks ago (which was brought about by the t00bs mint), signaling that market sentiments are still rather bearish.

- Number of users has increased slightly from previous weeks, largely brought about by users from mints.

- Transactions per week have decreased but remain at rather high levels. Number of transactions from mints have decreased from the week of t00bs mint while the number of transactions on Magic Eden have remained relatively constant at an average of ~280k.

Top Projects by 7D Volume

- Overall, newer projects have been garnering the most volume in the past week, which could be a signal that most users are trying to protect capital by concentrating on short-term flips for newer projects.

- Rifters is a project led by some members of the Communi3 team and is the first-ever Massive Online Community Event Role Playing Game (MOCERPG). The project minted out at 10 SOL with 7,777 supply - which is impressive given current market conditions.

- The first season of the game - Rifters: Kalinvale is set to be launched on October 17, with a prize pool of $1m to be won by the winning player/DAO. Users will need an NFT to participate in the game, including Rifters: Exiles as well as other eligible NFTs listed here.

- Critters Cult is a project created by the creator of solsunsets. The project is focused on art and aims to become a platform for art creation and development in the future.

- t00bs has managed to maintain its floor price well despite the delay in the reveal of the NFT. Meanwhile, DeGods has seen a significant decrease in floor price from its ATH (nearing to the t00bs mint), which showed that the price action was driven by the t00bs hype.

This Week’s Highlights

NFT AMMs/Lending Protocols on Solana

Hadeswap - an AMM NFT marketplace that allows users to trade/swap NFTs using liquidity pools has launched its beta version one week ago. More details on how Hadeswap works can be found here. The protocol is led by HGESOL and has generated a pretty significant volume since its launch. Holders of ABC can soon stake their NFTs to generate $HADES - the governing token of Hadeswap. More utilities have yet to be announced on the value accrual of the token and for ABC holders.

SharkyFi is an NFT lending protocol that recently launched its own NFT collection - sharx. The protocol helps to facilitate loans between lenders and borrowers, offering instant loans by allowing lenders to make offers at any time. While the platform has been around for some time, there is renewed interest in it due to the launch of the NFT collection which will allow holders to stake their NFT for $FISHY. The token will have utilities such as access to trading tools, raffles for defaulted NFTs, and upgrading the sharx NFTs. The protocol also teased utility for revenue share, of which the details has yet to be revealed.

Tools for further research

NFT aggregators

- Gem

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Genie

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

- Hyperspace (Solana)

- Hyperspace allow users to explore and collect NFTs across all the marketplaces on a single interface

- Hyperspace allows users to track floor prices and volumes of NFT projects

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- Solsniper.xyz (Solana)

- This platform allows you to track floor prices, volumes and an overview of your NFT portfolio

NFT Marketplaces