Top News

- Ronin Bridge exploit

On March 23 2022, the Ronin Bridge was exploited, with the loss of 173,600 ETH (worth around $590M at current prices and 25.5M worth of USDC). It was said that around 5 out of 9 validators were attacked and controlled during the incident. The main purpose of validators is to create transaction blocks and update data oracles.

Link here for statement by the Sky Mavis team.

- Axie Infinity Origin launches on April 7th

- Universe.xyz Beta marketplace launches

- Genie 2.0 is live

- LookRare x Manifold.xyz (New function to mint NFTs)

- Azuki #9605 sold for 420 ETH

- World of Women launches a second collection

The World of Women Galaxy NFTs used a Dutch auction, which can give artists and developers more potential revenue. A dutch auction also allows wealthier collectors to sweep floors while others are still priced out; Gas reportedly hit over 900 gwei due to the drop.

- NFT Worlds is releasing their own NFT avatars

- Madonna purchases BAYC

NFT Market Overview

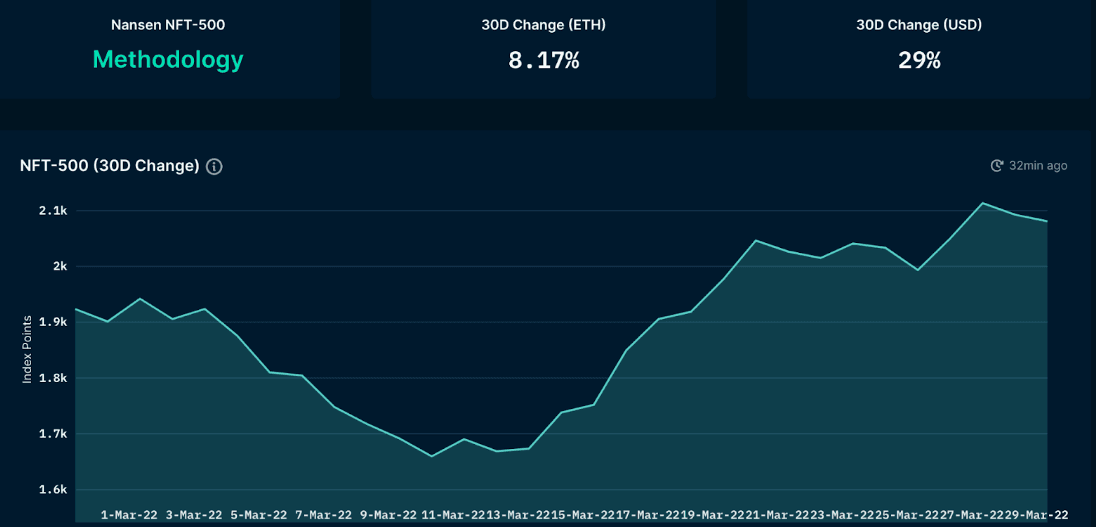

- Overall, the NFT-500 index point is looking healthy. The market has seemingly recovered from the local “bear” run in early March and has been consistently outperforming week after week since.

- In the last 30D, the NFT-500 index point has increased by 8.17% in ETH and 29% in USD.

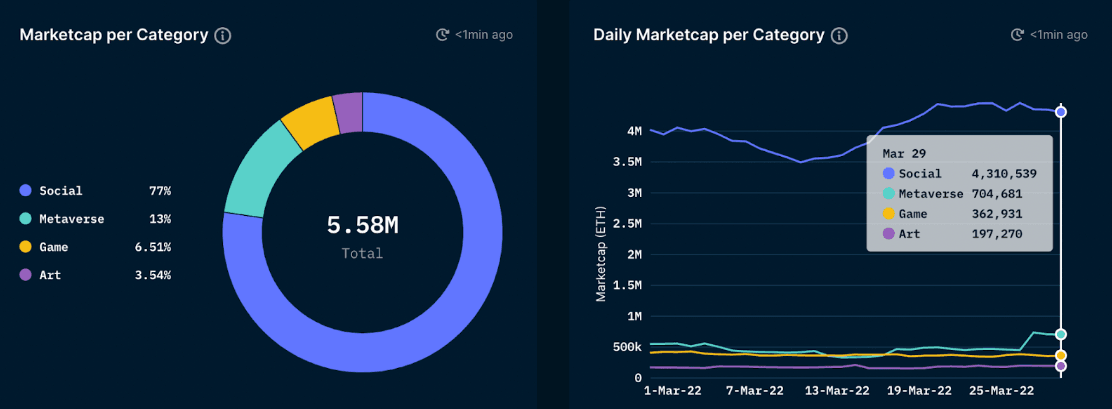

- Social NFTs take the lead, with consolidation in the metaverse NFTs sector.

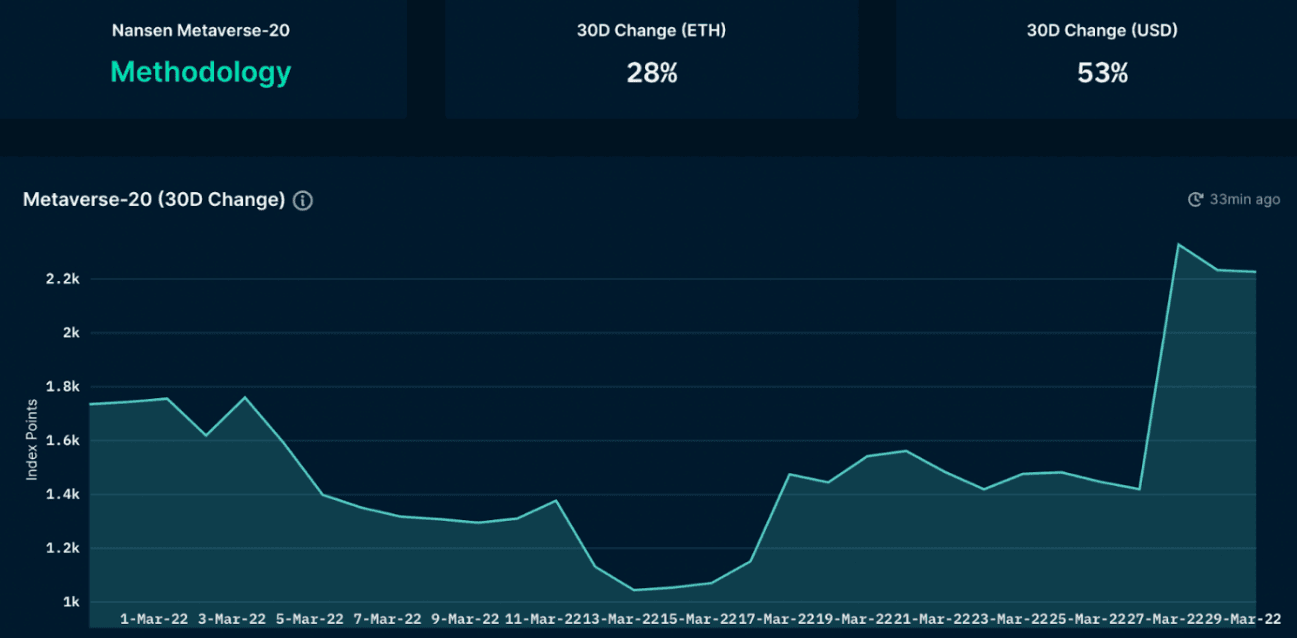

- Looking further into the metaverse NFT sector, there seems to be a catalyst in terms of general interest within this asset.

- In the past 3D, the NFT-500 index point has increased by 28% in ETH and 53% in USD.

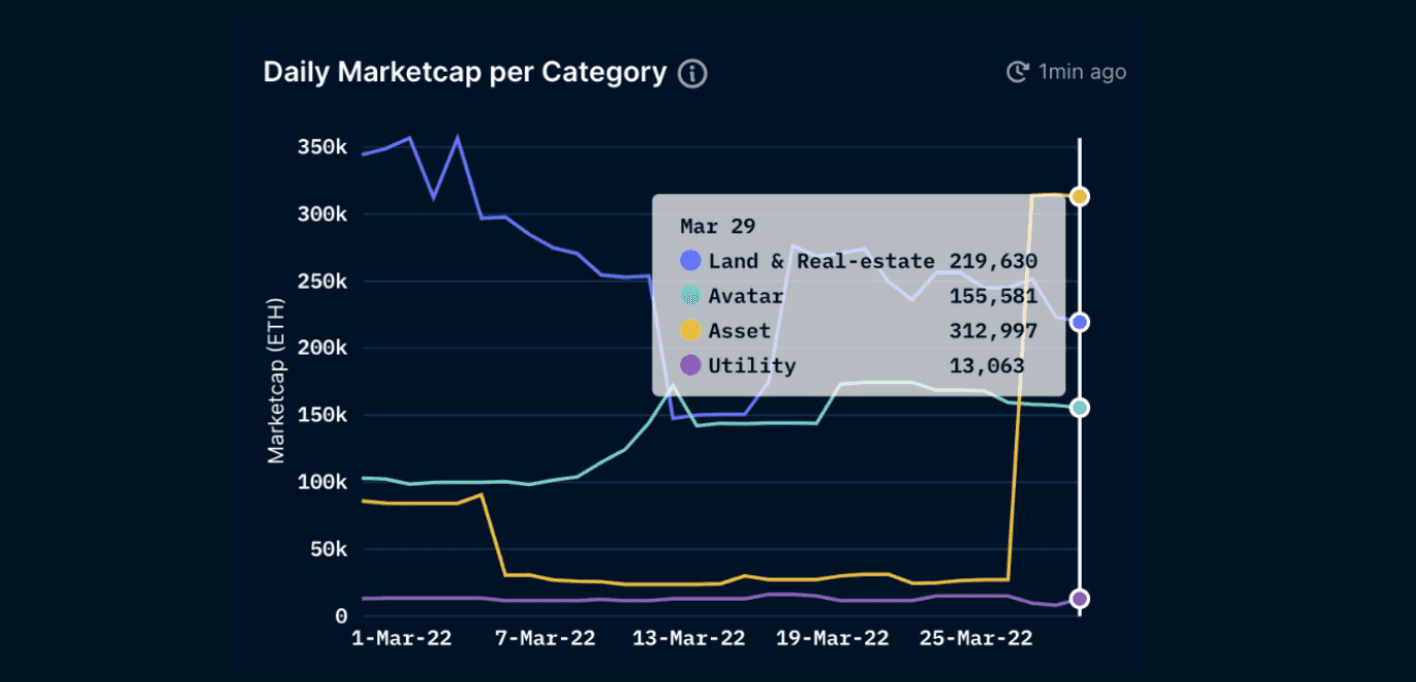

- Assets, in particular, have experienced a huge wave of interest recently, outperforming land & real-estate, avatar, and utility(E.g: Sandbox’s ASSETs, BYOPills, Jadu Hoverboard, etc.). In many of these metaverse-like projects, users are able to exchange these digital assets for physical goods.

This Week’s Highlights

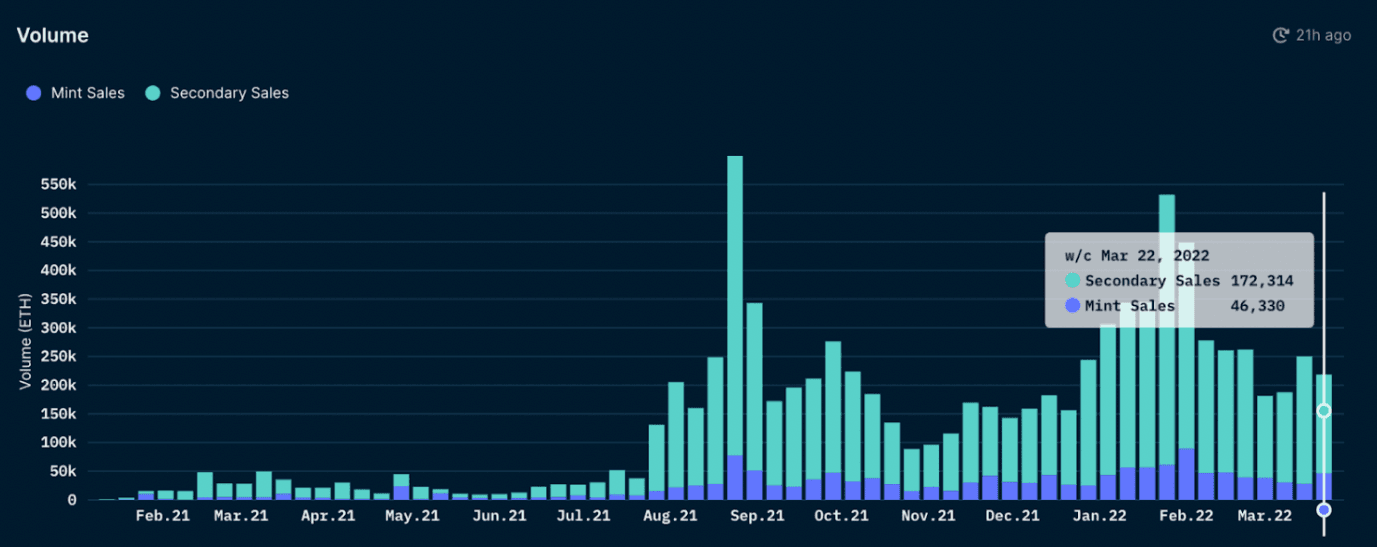

- Total volume (ETH) including secondary and mint sales continues to grow. The volume traded is averaging between 150-200k+, which is still significantly lower than the NFT bull run in late January, however, still positive growth this month.

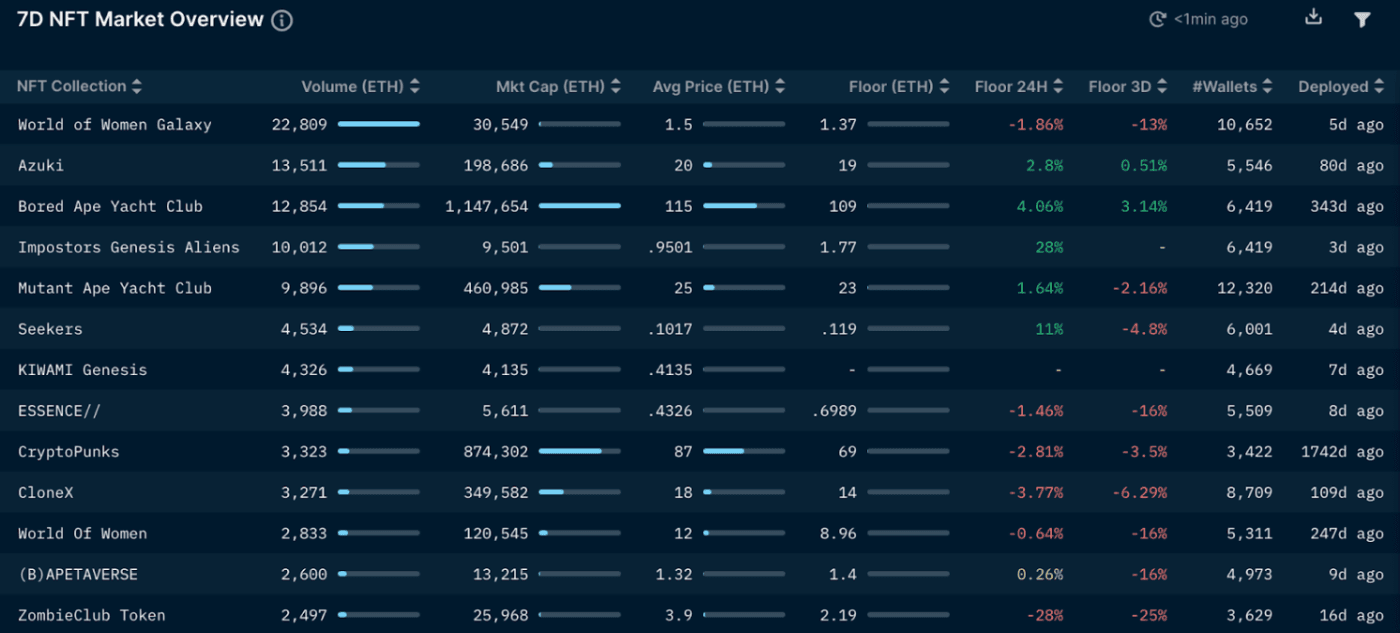

- World of Women Galaxy tops the charts this week. WoW Galaxy is a 2nd collection by the World of Women collection. The WoW Galaxy team used a dutch auction method. Dutch auction techniques can bring more money to artists and project developers, but are they good for NFT collectors? Many projects use the dutch auction techniques for more popular collections to avoid gas wars. All WoW holders were able to mint the WoW Galaxy NFTs for free, and another 10k was put on public sale in a dutch auction method, which sold out for 1ETH.

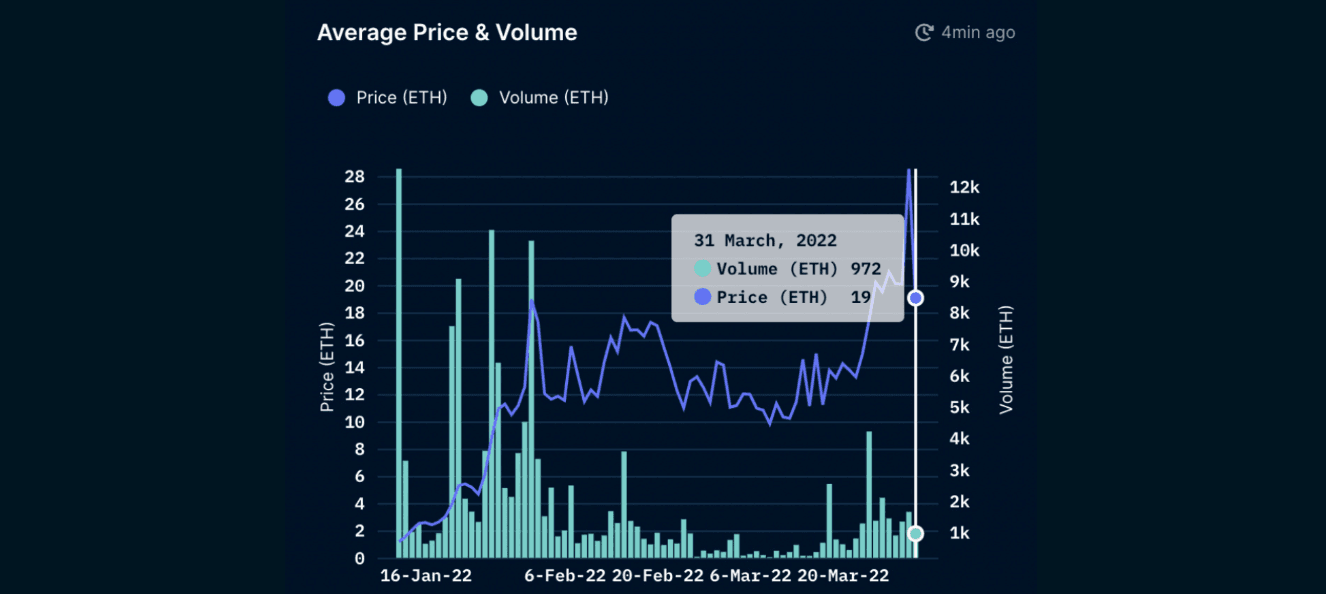

- Azuki tops the chart (again), with its current floor price of 19 ETH. With the pace that the project is moving forth, it is clear that Azuki is a strong contender to claim a blue-chip status. Moreover, there are speculations in the space in regards to Azuki launching a token, similar to how BAYC performed. If Azuki continues with this price movement, it is evident that the project can achieve new heights.

OpenSea & Looks Rare

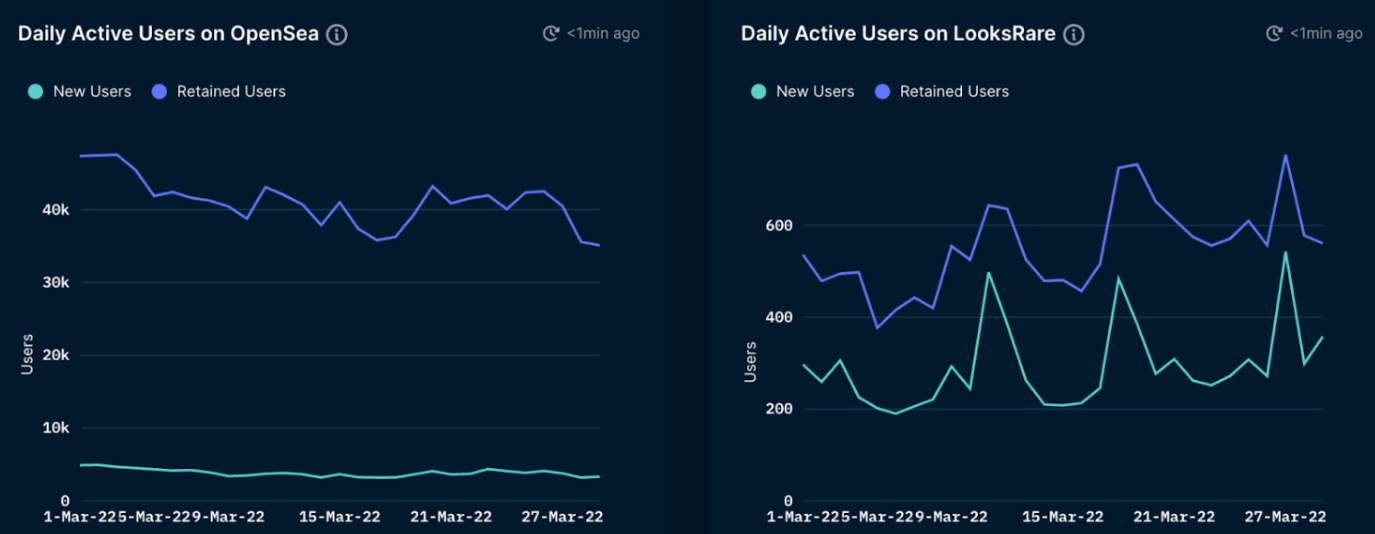

OpenSea’s daily active users are holding up, averaging at 35-40k per day. On the other hand, LooksRare is picking up pace in terms of daily active users and transaction volumes.

- LooksRare surpasses OpenSea’s daily trading volume for the 4th consecutive week in a row. We will be observing OpenSea’s volumes when Solana NFTs are live on their platform.

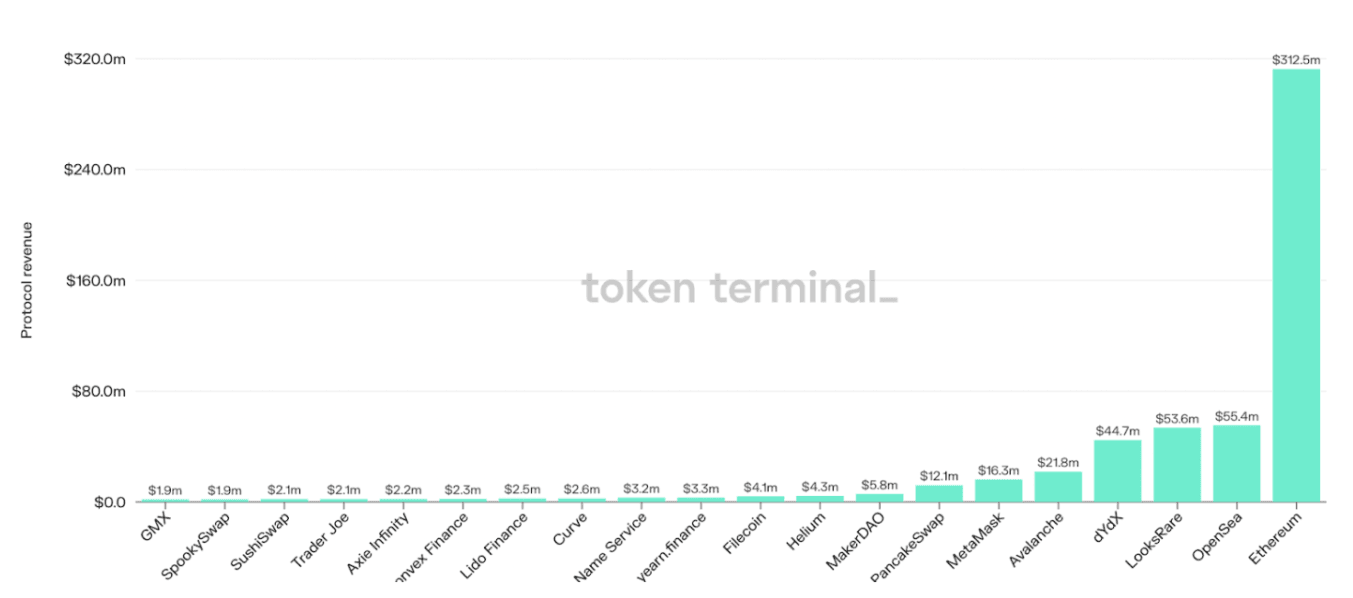

- In terms of protocol revenue, LooksRare has caught up to OpenSea, with $53.6m in the last 30D. LooksRare released Looks Compounder, to automatically compound WETH rewards into LOOKS tokens. Learn more in their official report here.

Contract Activity

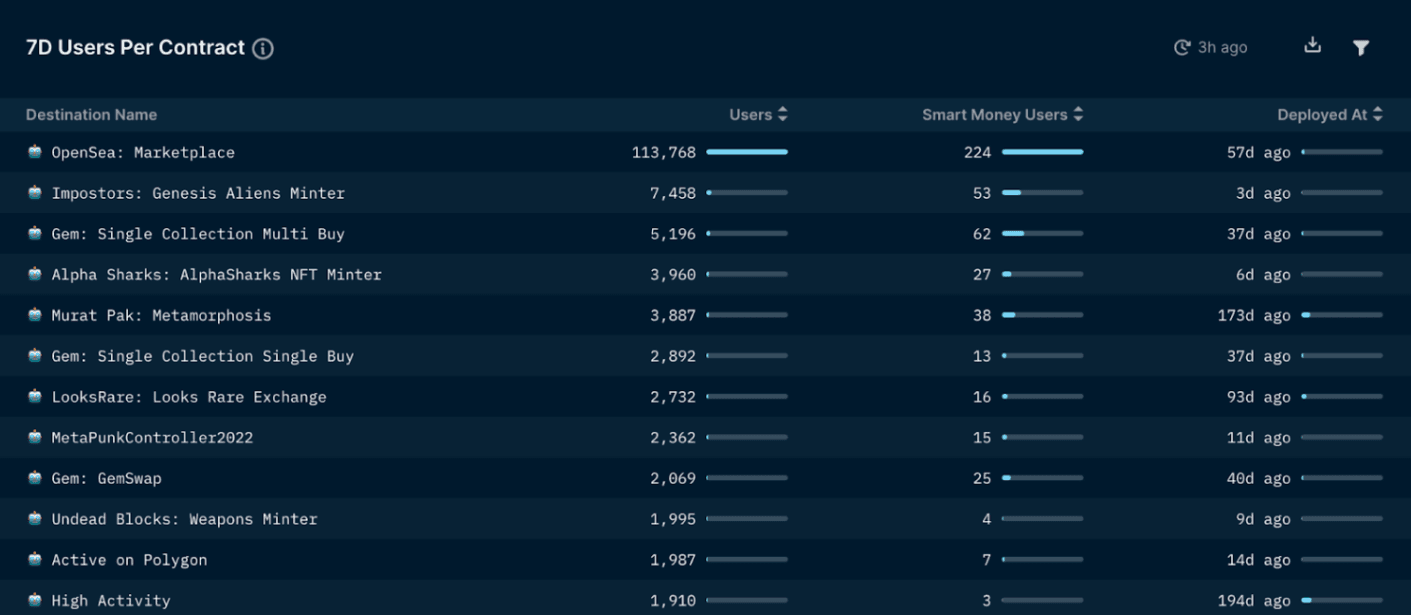

The 7D users per contract dashboard is a good indicator for identifying user activity between marketplaces and also discovering the latest innovative contracts in the NFT space.

This week we have:

- OpenSea: Marketplace

- Imposters: Genesis Alien Minter

- Gem: Single Collection Multi Buy

- Alpha Sharks: AlphaSharks NFT Minter

- Murat Pak: Metamorphosis

- Gem: Gemswap

- Undead Blocks: Weapons Minter

- Active on Polygon

- High Activity

Interesting Plays to Watch

- The rise of cc0, IP and NFTs

cc0 stands for “Creative Commons Zero”, meaning that there are no intellectual property rights reserved by the creator of a piece of art / content.

Additional reads here.

- Gem vs. Genie narrative

- NFT perps

- LOOKS vs. OpenSea narrative

- Solana NFTs

Solana NFT will be live on OpenSea.

- The case for Music NFTs bull run

Music NFTs is still generally an unexplored sector with huge potential.

Tools for further research

NFT aggregators

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- NFTBank.ai

NFT Marketplaces