Top News

- OpenSea News

- OpenSea Invests $100k to Bring New NFT Art to Life With FWB DAO

- OpenSea Changes Stolen NFT Policy Following User Outcry

- Tencent stops sales on its NFT platform Huanhe

- New EU Law will regulate NFT collections like Crypto

- Samsung signs MoU deal to give new NFT project offline utility

- Magic Eden submits proposal to build ApeCoinDAO an NFT marketplace

- NFT analytics firm Zash partners with Binance, marking push for data-backed projects

- NFTfi Partners With Safe To Create First NFT Rights Management Wallet

Raises

- Crypto Investing Giant Paradigm leads $20M round for Fractional NFT Protocol, which has currently been rebranded to Tessera

- Blockchain platform Fair.xyz raises $4.5m for NFT minting tech

- Greylock, Pantera Led $18M Round for NFT Infrastructure Provider Pinata

NFT Market Overview

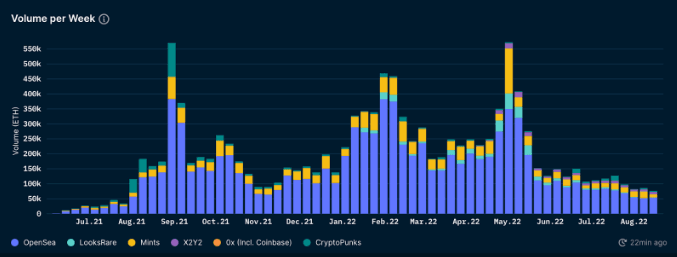

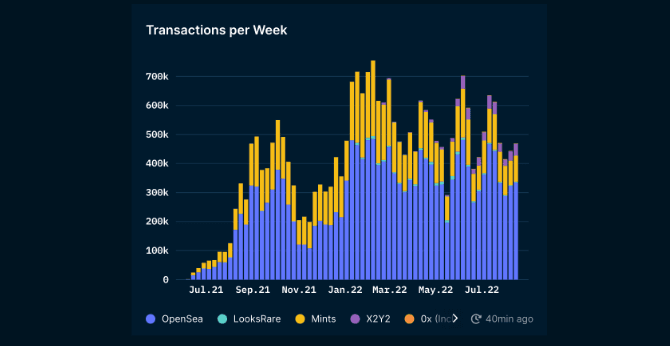

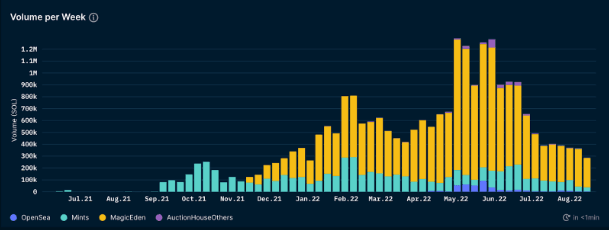

Volume per week

Main observations for the week:

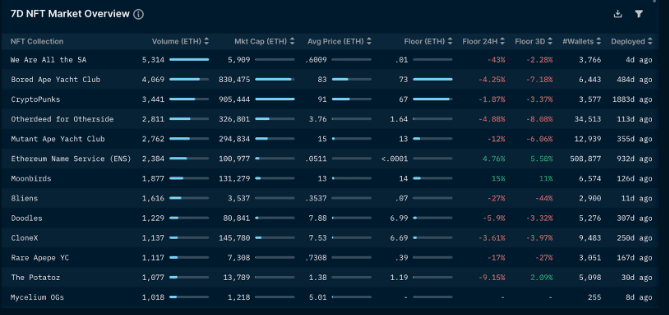

- Volume expressed in ETH for NFT has hit ATL YTD and is still declining. The volume in August as a whole is considerably lower than it was in August of last year.

- Transactions per week have increased steadily over the last two weeks, albeit it hasn’t yet surpassed 500k.

- The increase in transactions can be largely attributed to an increase in OpenSea and X2Y2 transactions. Transactions on OpenSea increased from 322k to 334k and transactions on X2Y2 increased from 33k to 40k over last week.

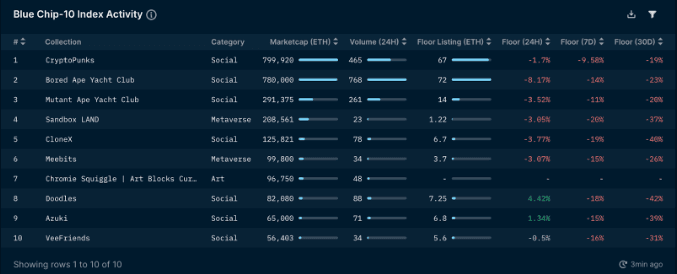

- The Blue Chip-10 index continues to drop and is only up 4.5% YTD measured in ETH terms but down 47% YTD measured in USD terms.

- All of the Blue Chip-10 collections saw a decrease in floor price: Sandbox LAND, CloneX, and Doodles declined the most with its floor price dropping 20%, 19%, and 18% respectively.

- The only collection whose floor price decreased less than 10% overall was CryptoPunks, with a decline of 9.58%.

Marketplaces

LooksRare vs X2Y2 vs Sudoswap

| Week close Aug 15 | LooksRare | X2Y2 | Sudoswap |

|---|---|---|---|

| Weekly Volume | 1355 ETH | 8109 ETH | 4028 ETH |

| Users per Week | 2793 | 20,343 | 6447 |

| Transactions per Week | 2711 | 40,552 | 11,554 |

Source: Nansen NFT Trends & Indexes, Dune Analytics (as of August 18, 2022)

- SudoSwap has been picking up steam in terms of overall weekly volume, users per week, and transactions per week.

- The general consensus between Alpha members is concerning the emerging narratives and trends of the market. In the case of the NFT market, are we moving into “sub-narratives” like SudoSwap, which is categorized as the first AMM for NFTs, or is it still too early to tell?

Here’s a quick guide on buying and selling NFTs on SudoSwap:

Before users consider buying and selling NFTs on SudoSwap, there are generally a few key terms to understand. Bonding curves allow for dynamic customizability to determine the price of NFTs as you buy/ sell. This can be iterated based on a few parameters that can be adjusted by the buyers/ sellers. A second keypoint is to understand what “pools” are. In the context of Sudo, pools refer to groups of NFTs that a single wallet owns. Instead of a single orderbook like OpenSea, users buy and sell from pools.

- Buying NFTs on Sudo

Firstly, we’ll touch on buying NFTs on SudoSwap. There are two ways a user can go about this.

If users are buying multiple NFTs from the same pool, users may notice that the prices of the NFTs will dynamically increase on each NFT. This is where the bonding curve takes effect.

Another option is to make a collection offer. Using the same bonding curve effect, users can take advantage of this feature to make collection offers that decrease in price with each purchase.

- Selling NFTs on Sudo

When selling NFTs on SudoSwap, users can create a pool here.

There are three options when selecting a pool type: buy NFTs with tokens, sell NFTs for tokens, or do both and earn trading fees. In the case of selling, users can pick the “Sell NFTs for token” option.

Next, users can select assets that they wish to deposit and which tokens they want to receive. The next step is to determine pricing. The start price refers to the price users will like to sell 1 NFT at. Users can also choose how many NFTs they’d like to put up for sale. In terms of pool pricing, users can set the initial price and how their pool prices change over time - either using a linear curve or an exponential curve.

NFT Index Performance

- All 6 NFT indexes continue to trend down in ETH terms on both the 7d and 1m timeframe except for Metaverse-20 which is up 4.4% in the week

- Only the Blue Chip-10 index is marginally up 4.5% YTD while everything else is red across the board

- Game-50 continues to take a significant beating and is now down 77% YTD

An article on the composition of the indexes and its calculations can be found here.

This Week's Highlights

BendDAO’s potential potential liquidation cascade

For a more in-depth coverage of peer-to-pool NFT lending models like BendDAO, please check out our NFT lending landscape report here.

To recap, BendDAO is a prime example of a liquidity pool NFT lending model. Depositors provide ETH liquidity to earn interest and NFT holders are able to instantly borrow ETH through the lending pool using NFTs as collateral. Instead of P2P models where pricing mechanisms are determined by lenders, BendDAO’s pricing mechanism is purely based on the floor prices of the NFT collections.

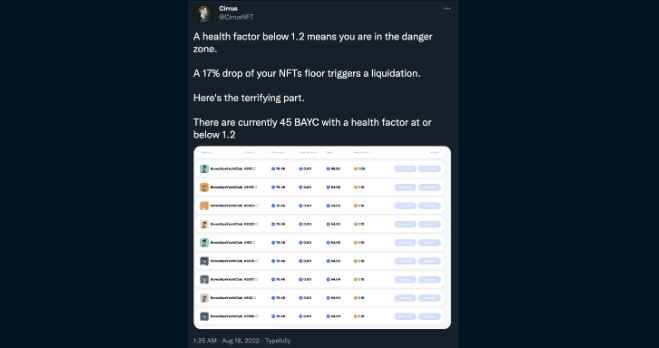

If a user allows the health factor of their loan to fall below 1, their NFT is put up for a 48 hour auction and sold to the highest bidder if the user does not pay the loan in time. As mentioned by CirrusNFT, there are currently 45 BAYC with a health factor at or below 1.2.

With the NFT market experiencing a downtime in terms of overall volume and demand, this liquidation scare is something to pay attention to in the short to medium term. If a potential liquidation cascade for BAYC occurs, there will be significant consequences for the broader NFT market. At the current time of writing, there simply isn’t enough liquidity in the NFT market to absorb these liquidations without a significant impact on floor prices. Considering that BAYC is one of the pioneering collections in the NFT market, the impact of this potential liquidation can have serious implications for the wider market and consequently, all the other NFT collections.

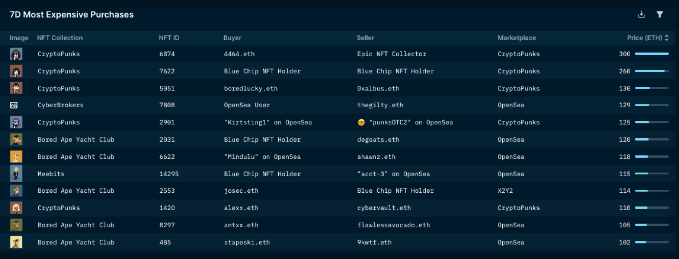

7D NFT Market Overview

This past week has been particularly quiet for the overall NFT market. Volume expressed in ETH, as seen in the NFT index, has hit ATL YTD and is still declining.

Smart Money Movements

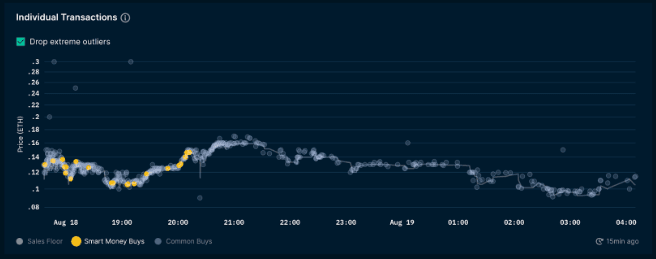

While many expected the NFT trading volume and activity to pick back up as a result of Ethereum and the broader crypto market somewhat finding its feet, there has been no sign of a relief rally in the NFT sector. As stated in the Market Overview section, volume continues to dwindle despite ETH rallying approximately 100% from the lows suggesting the prolonged risk-off sentiment and high-risk spectrum that NFTs fall within the cryptocurrency industry. Investors may still be fearful that the fungible market rally is in a bear market rally rather than a full recovery and hence are still on the sidelines waiting for more confirmation.

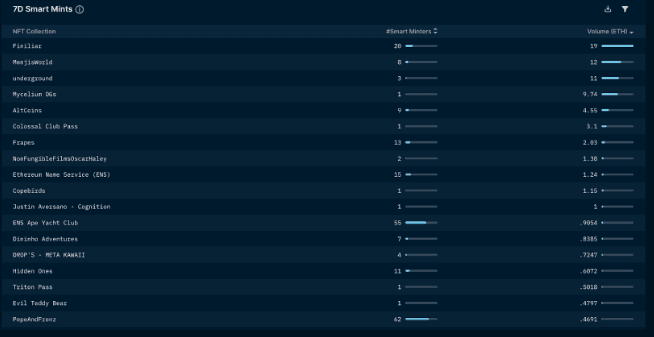

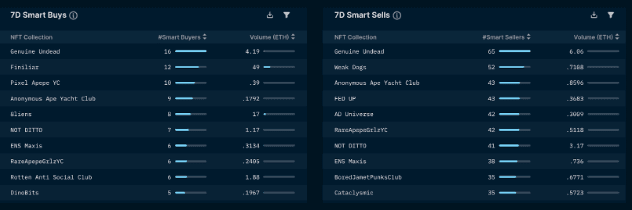

The reluctance to deploy capital into non-fungible assets is evidenced by the lack of high-quality projects launching this past month. From the 7D Smart Money mints chart above, 19 Finiliars were minted by 20 different Smart Minters. Finiliars also topped today's hot NFTs dashboard by volume, totaling over 1000 ETH. Finiliars are a series of 10,000 "living" NFTs that respond to the prices of cryptocurrencies via oracle. They express emotions based on the current price of major cryptocurrencies.

Smart Money was observed buying the collection right after the public sale at around the 0.1-0.15 ETH range. In addition, xhumera, one of the most notable Smart Money OpenSea accounts, who was an early supporter of the project (as seen by the first in of 142 days ago - during the time of the public presale), also picked up 89 Finiliars. Aave founder Stani Kulechov was also seen picking up 38 Finiliars today.

Other notable collections minted by Smart Money over the past week include MenjisWorld, which is also at the top of the hot contracts segment today, with 8 Smart Money depositors and $199k of inflows within the past day.

Continuing with the trend in recent months, there have generally been more Smart Sellers than Smart Buyers. Genuine Undead received the most activity from both sides of the market, with 16 Smart Buyers picking up 4.19 ETH in volume, whereas 64 different Smart Sellers offloading a total of 6.04 ETH. Similar to Finiliar, Genuine Undead is also one of the top collections by trading volume this week, placing third at 449 ETH, behind Bored Ape Yacht Club at 717 ETH. Unsurprisingly, 12 Smart Buyers bought up 49 ETH of Finiliar. Another recognizable collection picked up by Smart Money this week is 8liens, one of the most hyped collections recently.

Solana NFTs

NFT Market Overview

Main observations for the week:

- Volume for Solana NFT sales has reached the second lowest week YTD, standing near 300k SOL. The overall trend starting in the month of July pales compared to May and June.

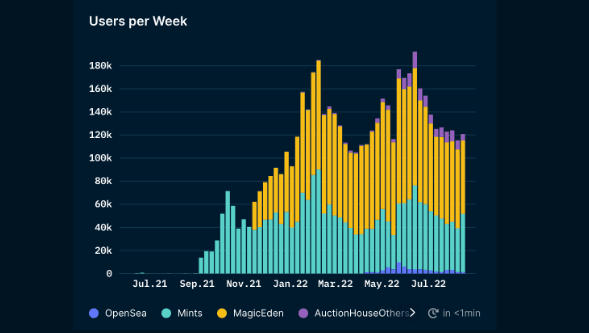

- Users per week has remained stagnant at around 120k with a non-obvious increase from the prior week due to a huge jump on mints from 38k to 50k.

- Transactions per week drop from the previous week and are now at around 454k. The decline is mainly driven by mints and MagicEden.

Top Projects by 7D Volume

- Most of the volume comes from established projects led by Genesis Genopets Habitats, Okay Bears, and Degods, which generate 15.3k, 13.8k, and 7.7k SOL volume respectively. The only new mint that receives traction is Rugged Revenants Gen 1 (RRDC) and has a SOL volume of 8.3k.

- Rugged Revenants Gen 1 (RRDC) is the NFT collection of a free-to-play, win-to-earn game named Rugged Revenants. Rugged Revenants are NFTs that holders will use as playable characters within the game. They provide in-game benefits such as fighting and extra lives based on their attributes.

- This NFT game provides players the opportunity to take revenge on projects that rugged them. All of the enemies in Rugged Revenants are actual NFTs from rugged projects.

- The core aspect of this NFT is its partnership with many projects across Solana to create those in-game characters. For example, its partnership with The Dope Cats and Sovana offer unique power-up characters, onboarding more NFT holders in the Solana ecosystem into the game.

- Major benefit of completing the final level of the game is the reward of Loot Coffins, a valuable NFT collection in the Solana ecosystem.

Tools for further research

NFT aggregators

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

Hyperspace (Solana)

- Hyperspace allow users to explore and collect NFTs across all the marketplaces on a single interface

- Hyperspace allows users to track floor prices and volumes of NFT projects

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- Solsniper.xyz (Solana)

- This platform allows you to track floor prices, volumes and an overview of your NFT portfolio

- NFTBank.ai

NFT Marketplaces