Top News

- Why OpenSea Is Sticking With NFT Creator Royalties

- Magic Eden now supports Polygon NFTs

- Yuga acquired Beeples wenewlabs/10KTFshop

- Nike launches .Swoosh Web3 Platform, With Polygon NFTs Due in 2023

- Cristiano Ronaldo launched an NFT collection with Binance

NFT Market Overview

Main Observations:

- Volume in ETH has continued to plateau around the 75k-100k ETH mark. The slight uptick in volume compared to previous weeks was largely attributed to an increase in mints.

- Users and transactions per week have been in a clear down-trend for months now. In the week close on 21st November 2022, there were 210k weekly users and 410k weekly transactions.

- In the last 7 days, Moonbird and Doodles both witnessed 12% increases in their floor prices. Sandbox Land continues to suffer and is down -15% 7D and -22% 30D.

NFT Index Performance

- In the last 7 days, all indexes except for Art-20 have seen minor gains when measured in ETH terms.

- Notably, the Game-50 Index has significantly outperformed in both the 1M and 7D time frames as a result of the Beyond Earth Land collection. Despite this, Game-50 is still down -73% YTD and suffers drastically compared to its peers.

- The Blue-Chip-10 Index continues to fall and is down -25% YTD and interestingly, has underperformed indexes like Art-20 despite its “blue-chip” status of NFT collections.

This Week’s Highlights

Valhalla

Valhalla is a collection of 9,000 PFP NFTs developed by Stacked, a game streaming platform startup built especially for Web 3.0, which raised $15m in a series A funding round. Valhalla's mission is to create a tight-knit community supporting Stacked and blockchain gaming while developing its independent brand and IP at the same time.

The project has caught the attention for the wrong reasons. Prior to the mint day, some allegations against the founder, Alex Lin, for his past of failed startups, lies and coverups, alleged connection to Zagabond (Azuki Founder), admitting to rug pulling Valhalla, banning longtime community members, and many more incidents.

Some of the allegations made by the NFT Twitter community can be found here:

- Links to the initial Azuki team rug pull

- Banning longtime community member

- Bribing notable individuals in the space to combat the negative portrayal

Following the much-anticipated Valhalla drop, the collection has seen some interest on the secondary market, generating 299 ETH in volume over the past 24 hours, ranking third behind Bored Ape Yacht Club and Bored Ape Kennel Club at 1441 and 680 ETH, respectively. However, looking at the volume over time, it is evident that the speculation has died down significantly after the first few hours post-mint. This chart pattern has been a common occurrence for many for newly launched projects in recent times, reflecting on the current market conditions and suggesting that investors are reluctant to chase collections on secondary markets. This first true prolonged bearish period for NFTs could also mean that market participants are more cautious and selective with their investments due to a lack of liquidity.

The mint price for the public sale was 0.5 ETH, while early participants could mint for 0.35 ETH. The floor price dipped as low as 0.52 ETH but is currently back up to 0.62 ETH. Approximately 860 NFTs out of the 9,000 listed on the market, corresponding to ~9.56% of the supply. 74 of those are listed at floor. The largest cluster of listings resides between the 0.89-1.02 ETH and 1.2-2.4 ETH range.

In contrast to other high-profile mints like Art Gobblers, which saw a run-up in floor price during its first few days, the secondary market sales for Valhalla have stalled and slightly trending downwards. Some Smart Money Buyers were observed picking up between the 0.55 and 0.65 ETH range on November 24th.

Over the past day, 4 Smart Money addresses have picked up a total of 18 NFTs, compared to 5 that have sold an aggregate of 11 NFTs. Most notably, sucemabite.eth increased their holdings by 5, taking their position size to 60 NFTs, and is now the joint-second largest holder of the collection. One of Pantera Capital’s wallets (Pantera Capital: 0x8d37) also minted 5 Valhalla NFTs.

The data shows that the fundamentals and value proposition from holding the NFTs currently outweigh the speculation and quick-flip narrative. Even with the hype generating initial volume, short-term NFT traders are not able to realize as many profits as before. In addition, many who were on the mint list are looking to liquidate their asset right away. There are still too many looking for a quick return, leading to an oversupply of sellers relative to the demand and little to no follow-up on the volume.

Moonbirds

Moonbirds is a collection of 10,000 Ethereum NFTs, with each describing a pixelated owl PFP with random traits. Moonbirds was launched by tech VC investors Kevin Rose, famously known as a high value NFT collector and a founder of NFT-based private member community club called Collective Proof. As of 24th November, this collection’s floor price has reached 8.25 ETH, equivalent to $9,939.

“Off-Chain” vs “In-Chain” Approach

On 22nd November, Moonbirds has announced their innovative “in-chain” approach to fully store Moonbirds NFTs art on-chain. Understanding the concept of “in-chain” requires an understanding of where the metadata of the NFTs are stored. Metadata refers to the digital content of NFTs that makes up the appearance including shape, colour, size, etc. and some other NFT-related information such as name and maximum supply. Currently, most metadata for the NFTs are stored “off-chain”, relying on third-party storage services. Those “off-chain” NFTs simply point to the images that stored in the servers of the hosting service companies. The problem with this is that if the off-chain storage solutions provider encounters any malicious attacks or service breakdown then the NFTs cannot be successfully generated or even get lost completely.

In contrast, storing “in-chain” refers to all the metadata are stored on blockchain so that all these information remain decentralized. In addition to the metadata, the entire creation of the NFT art is also stored on-chain. That means the code that created the digital artwork will also be stored on blockchain such that the NFTs can be generated completely based on the smart contract code “in-chain” without the need for any “off-chain” storage provider. This “in-chain” approach guarantees that each Moonbirds NFT will be available as long as Ethereum lives. It is also much easier for other developers to build additional derivative features on top of the NFT projects.

Post-announcement Activity

After this recent announcement, this fully decentralized approach received a lot of attention. As seen in Nansen Trends & Indexes dashboard, Moonbirds NFT has experienced a 12% increase in floor price in the past 7 days, the second highest among all the NFT Blue Chip-10 index.

In a follow up Q&A live-stream in response to the announcement, the Moonbirds team also shared that they are going to launch their third NFT PFP collection called Mythics by early 2023. More detail can be found here.

Exclusive Coverage: Solana NFTs

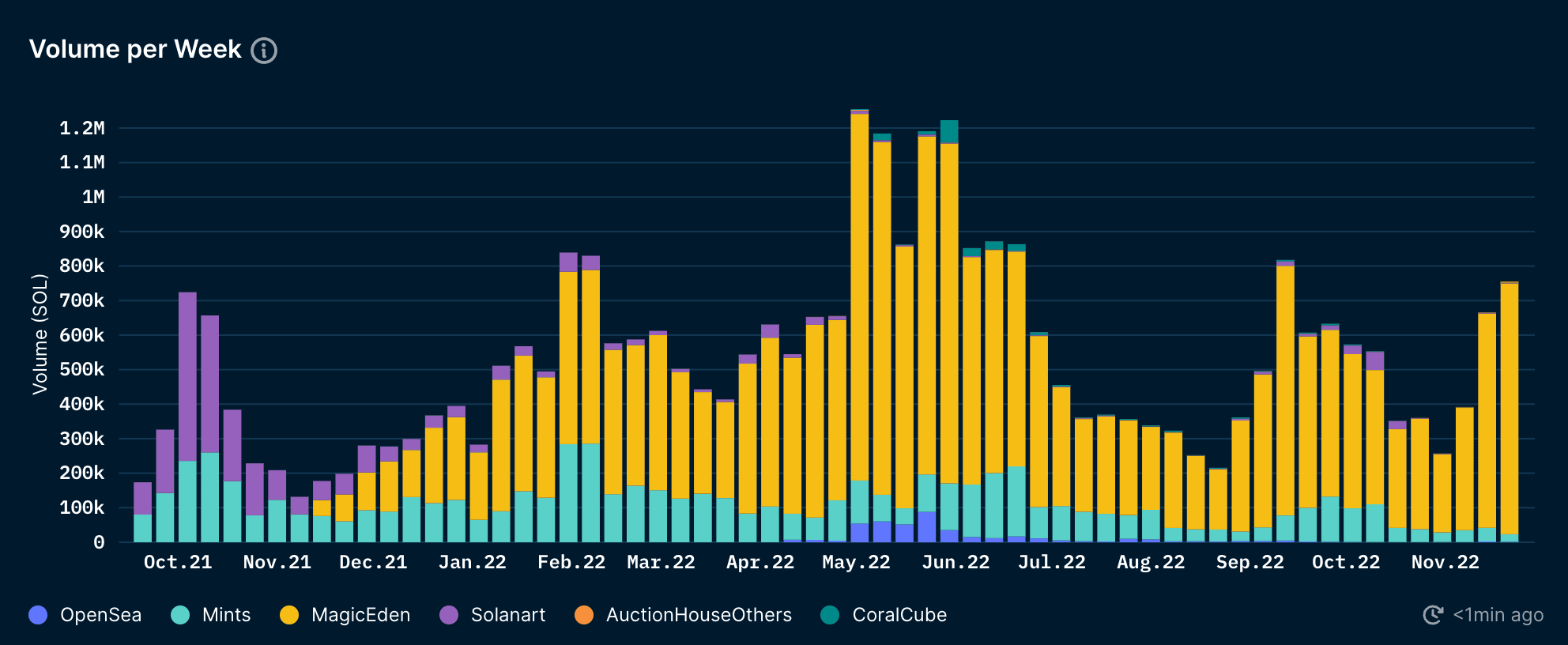

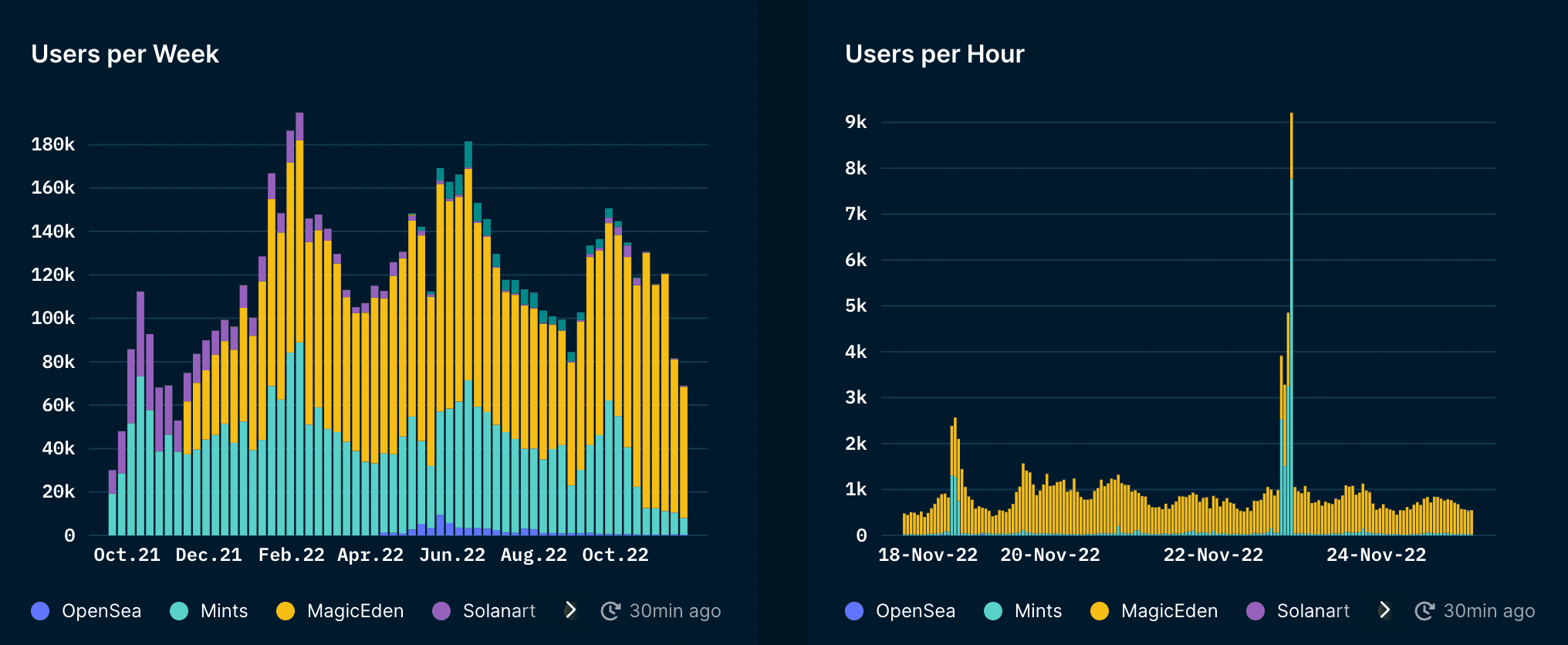

The Solana NFT volume per week seems to have bottomed on the week closing 31st October, and has increased significantly since.

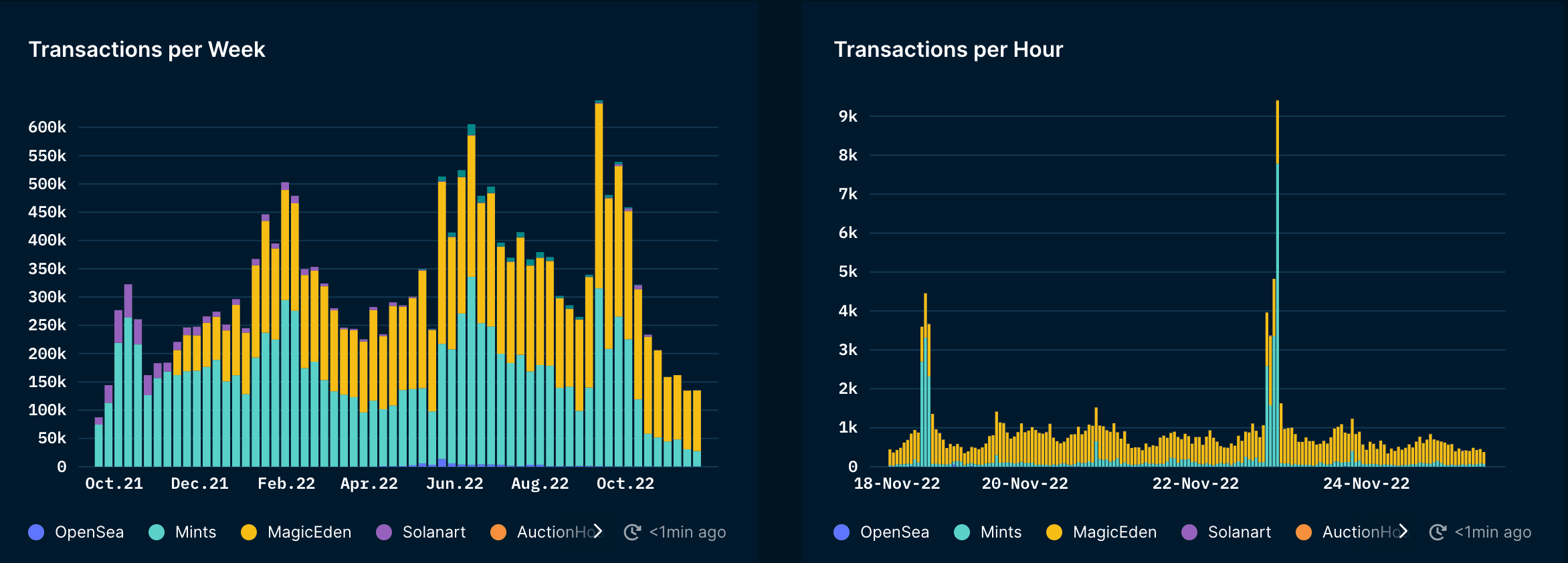

Magic Eden has taken a large share of the percentage increase in volume recently. Despite the massive increase in volumes from the various Solana marketplaces, users per week has been experiencing a steady decline across the boards. Magic Eden for instance has been averaging at 80k-100k weekly users from October to November, and is currently at 60k users this week.

Similarly, transactions per week has experienced a larger decline, steading at 100k+ per week, but has now fallen to values below 100k on average.

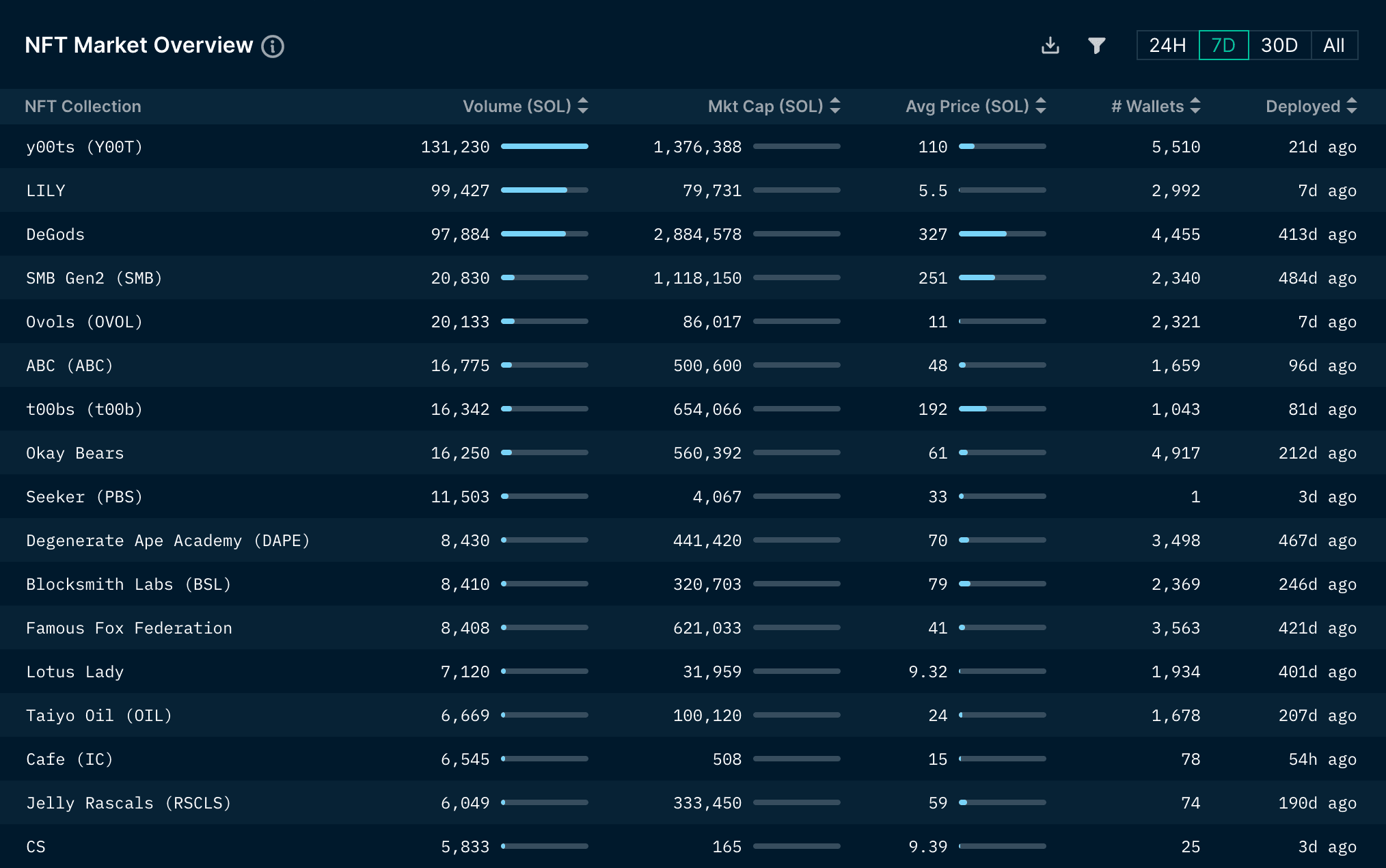

Looking at individual collections, y00ts still takes the lead as the most traded NFT collection in the last 7D. The collection has generated 131k SOL in volume, with an average price of 110 SOL per NFT.

Interestingly, we’ve also seen new collections dominate the charts this week. Collections like LILY and Ovols generated substantial volumes this week, despite current market conditions.