Top News

- Magic Eden announces integration with Ethereum

- Solana Hack likely attributed to backend issues with Slope Wallet

- Starbucks to unveil its web3-based rewards program next month

- Tiffany & Co launched an NFT collection of 250 digital passes called NFTiff. The NFTs can be minted by CryptoPunk holders and forged into a physical pendant

- Gucci announced that it will be accepting ApeCoin payments at its U.S. boutiques

- Meta confirms NFT rollout across 100 countries

- Moonbirds just make all their NFTs public domain

- OpenLab and TokenTraxx announce first Audio-Visual NFT collection

- Global esports firm MegaFans launches its first NFT collection

Raises

- OneOf NFT Platform has raised $8.4m in a strategic funding round that included Amex Ventures, the venture capital arm of American Express

- Lattice Capital raises $60m for its second crypto fund

- Hardware wallet maker Ledger in talks to raise additional $100m

NFT Market Overview

Volume per week

Main observations

- Volume measured in ETH for NFT sales has reached an ATL YTD. The overall trend starting in the month of June pales compared to earlier this year.

- Transactions per week continues to decline from last week and has seen a steep drop off compared to two weeks ago.

- The decrease in transactions can be largely attributed to a decrease in OpenSea and X2Y2 transactions. Transactions on OpenSea decreased from 339k to 295k and transactions on X2Y2 decreased from 28k to 21k.

- The Blue Chip-10 index continues to drop and is only up 3% YTD measured in ETH terms but down 56% YTD measured in USD terms.

- Meebits and CryptoPunks were the clear leaders with its floor price up 15% and 6.22% respectively while all the other NFT collections were down in floor price. The biggest drop in floor price comes from Sandbox LAND, CloneX, and Bored Ape Yacht Club; -9.34%, -5.16%, and -4.93% respectively.

Marketplaces

LooksRare vs X2Y2 vs Sudoswap

| Week close Aug 1 | LooksRare | X2Y2 | Sudoswap |

|---|---|---|---|

| Weekly Volume | 1665 ETH | 6036 ETH | 359 ETH |

| Users per Week | 3011 | 14,487 | 1125 ETH |

| Transactions per Week | 2932 | 21,967 | 1596 |

NFT Index Performance

Main observations

- Recent market conditions have taken a blow on the NFT market and all 6 indexes are down in ETH terms in both the 7d and 1m time frame.

- In fact, only the Blue Chip-10 index is up a measly 3% YTD while everything else is red across the board.

- The Game-50 index continues to underperform its peers and is now down -69% YTD

An article on the composition of the indexes and its calculations can be found here

This Week's Highlights

The NFT market this week is still relatively quiet with lower volumes overall.

NFTiff

NFTiff is a collection of 250 custom NFTs designed to become a digital and physical pendant of CryptoPunk holders. This NFT is selling for 30 ETH each. There were some chatter around crypto Twitter surrounding the intention behind Tiffany & Co’s entry into NFTs, and whether the 30 ETH is too expensive to justify the digital and physical pendant. Our two cents lies in the fact that this is one of the very first synergies between luxury brands and NFTs. This brings us to the point of another use-case for NFT utility that we have yet to see. This is a good example of bringing NFTs to the mainstream by creating in-real life assets and luxury goods that fit in nicely with one another.

The Potatoz

“THE POTATOZ” is a collection of 9,999 utility-enabled PFPs. Each Potatoz is your entry ticket into the Memeland ecosystem by 9GAG.

With a consistent uptrend in floor prices since launch date, the collection is also seeing a continuous wave of smart money buys at various floor prices.

While there are lots of speculations surrounding the project. We know that the rarity of the Potatoz NFT will ultimately change over time. As mentioned on MEMELAND’s twitter, the current rarity is not final and more traits will be revealed when the Potatoz grow. NFT traders are often driven by hype and speculation and the Potatoz does well in luring more stakers to continue staking to receive more benefits in the long-run.

Other interesting catalysts to look forward to is their stake-to-win feature, meme coin launch, and the staker: listing distribution in the next few weeks.

Smart Money Movements

Due to the persisted muted NFT and general crypto market outlook, it is not surprising that many teams and projects are choosing to hold off on their mint dates until the market conditions pick back, signaled by increasing volume. Thus, Smart Minters also seem to be waiting for more excitement and activity in the market to deploy capital. In general, there have also not been many high-quality projects released during this time. This week, NFTiff, Tiffany & Co.'s set of 250 custom NFTs which accompanied the CryptoPunk physical pendants saw the most minting volume of 360 ETH from 8 different Smart Minters. However, the high volume is due to the high cost of 30 ETH for the entire set.

While registering similar weekly volumes, there has been much less trading activity from the number of unique Smart wallets compared to recent weeks. On the buyers' side, Nina's Super Cool World topped this week's chart with three different wallets buying a cumulative volume of 115 ETH. On the sellers' side, two Smart money wallets sold an aggregate of 928 ETH worth of CryptoPunks. Overall, Smart money seems to be focused on trading higher-tier and blue-chip projects such as Bored Ape Yacht Club, CloneX, Meebits, and more. This behavior is likely due to a more risk-off sentiment from macro uncertainty.

Upcoming Projects Highlights

Webaverse

Here are some updates from the Webaverse team on the upcoming launch date. Nansen Alpha members were also given the opportunity to be whitelisted.

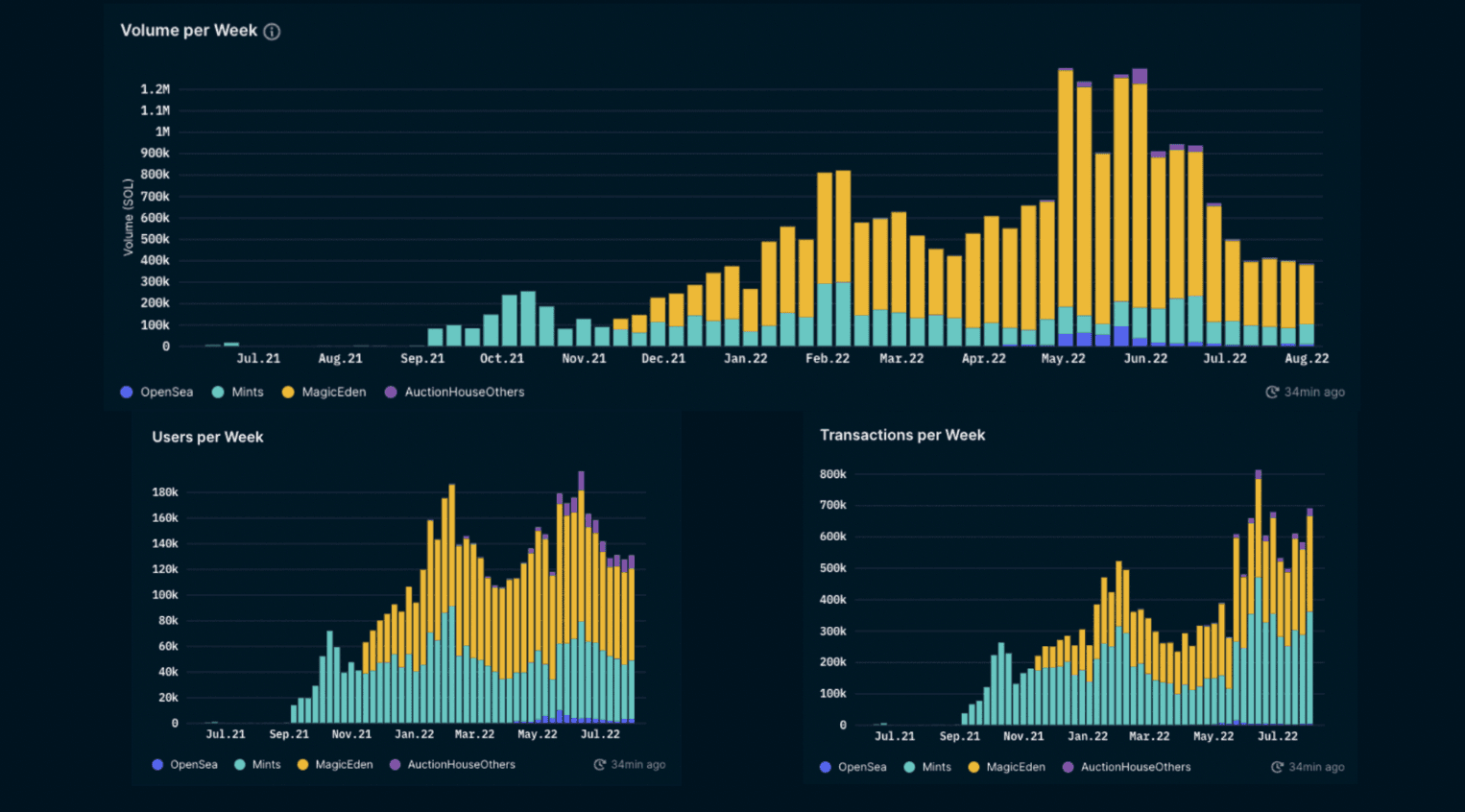

Solana NFTs

NFT Market Overview

Solana’s NFT market cap currently stands at $800m, a decrease from $844m just 2 weeks ago. 7D volume continues to decrease as market sentiments and macro conditions remain bearish. The recent hack affecting Solana wallets has definitely dampened the outlook of the ecosystem, as users are currently risk-off and would avoid doing transactions as much as possible. As a result, volumes across most marketplaces have fallen, while mint volume has increased by over 20k SOL. This could be attributed to a high profile mint which happened two days ago - Rakkudos, which generated over 31.5k SOL volume alone.

While volume on Magic Eden has decreased, Yawww has seen an increase in 7D volume - averaging 20k SOL in the past 2 weeks. The team made changes to its tier system for users to save on marketplace fees, lowering the base fee to match Magic Eden’s marketplace fees and reducing the number of NFTs needed to enjoy discounts on the fees to just one. This increases competitiveness for marketplaces in the space and could push for greater initiatives in the ecosystem.

Despite a decrease in overall volume, there has been an increase in the number of users and transactions from the past weeks. The increase in number of users from the past week was largely attributed to mints, while the increase in number of transactions came from mints and Magic Eden.

Top Projects by 7D Volume

- New mints are not gaining traction as much as before, with the exception of Rakkudos. Instead, more established projects such as DeGods, Okay Bears and Cets on Creck have seen an increase in their weekly volumes.

- Rakkudos is the NFT collection of Shakudo - a data tools aggregator platform built for enterprise solutions.

- The NFTs has utility in terms of discounted pricing of Shakudo, referral programs as well as staking for the protocol token - KUDOS

- People are looking to the KUDOS token as a potential form of revenue sharing from the Shakudo platform in the future, as details on its full utility is still unknown

- DeGods’s volume has more than doubled from two weeks ago, possibly due to the incorporation of John Le into their secondary project - y00ts (rebranded from Duppies)

- Okay Bears had the Bear Drop for holders, which probably helped the project to gain some traction in the past week

- Utility for the NFT is not clear yet, but the team has mentioned that it could be a potential PFP with experimental utility

Upcoming Project Highlights

y00ts

(Twitter)

A second collection from the DeGods team. The collection is a rebrand from Duppies, after a prominent designer in the space - John Le joined the team

- mint date: Late July/early August

Taiyo Pilots

(Twitter)

Taiyo Pilots are a community-driven and lore-driven NFT project and are introduced as an extension to the Taiyo Robotics Universe. The Pilots utility will be a form of social staking that allows you to get graphite opportunities and access to the Taiyo incubator launches in the form of whitelist spots. There are a total 12,500 NFTs - Taiyo Infants and Taiyo Oil holders will be airdropped one Taiyo Pilot NFT.

- mint date: TBA

Pacer

(Twitter)

Pacer is a wellness-to-earn app that rewards users for sleeping week, practicing mindfulness or exercising consistently. The project is backed by notable investors such as FTX Ventures and QCP Capital. Giveaways and access to discord can be won through Pacy NFT’s Twitter.

- mint date: TBA

Tools for further research

NFT aggregators

- Gem recently launched on January 20.

- Gem allows users to explore and collect NFTs across all the marketplaces on a single interface, giving you a birds-eye view of the market - ensuring you never miss out on a good deal.

- Batch buy & list NFTs across all major marketplaces in a single transaction. Save time & gas.

- Genie was technically the first NFT aggregator in the NFT space.

Due diligence for minting

- Nansen’s guide here

Wallet management + tracking

- NFTBank.ai

- This platform is a leading platform for tracking your NFT inventory

- Zapper

- Zapper is a good tool for tracking an overview of your NFT portfolio

- NFTBank.ai

NFT Marketplaces