Key Terms

| Term | Description |

|---|---|

| Layer-2 Rollups | Layer-2 (L2) refers to blockchain scaling solutions that handle transactions off Ethereum layer-1 (L1), with settlement and data availability on L1. |

| Optimistic Rollup | Transactions are executed off-chain on L2. These transactions are submitted to L1 where they can be challenged. If they are challenged, a fraud proof is run and if the transaction(s) are faulty, they will be reverted. |

| Fraud Proof | If an incorrect transaction is identified, a ‘fraud proof’ contract is run on-chain to prove the fraud and roll back the transactions. |

| Verifiers | Verifiers play a crucial role in verifying the integrity of transactions before they are confirmed on L1 and submitting fraud proofs if there are any fraudulent transactions |

| Sequencers | Sequencers are responsible for ordering transactions from L2 bundles that are then committed at L1. At present, this is centralized. For example, Arbitrum has 1 sequencer - operated by Offchain Labs (Arbitrum team). |

ELI5 Optimistic Rollups

- Ethereum has limited capacity and high demand, making transaction fees very expensive, with basic token swaps frequently costing more than $100 during periods of high activity.

- Optimistic Rollups essentially take this activity away from the congested mainnet, execute the transactions off-chain and then confirm a batch of these transactions on Ethereum.

- All transactions are assumed to be correct (hence the term ‘optimistic’), and there is a ~7-day window whereby any fraudulent/incorrect transactions can be identified and proven to be false - using a fraud proof.

- Optimistic Rollups only require one honest watcher to flag any incorrect/fraudulent transactions. If a transaction is proven to be incorrect, it will be reverted, the dishonest validator will have their stake slashed, and the watcher rewarded. This incentivises honest behavior.

- Optimistic Rollups are highly compatible with Ethereum, and most rollups are building towards EVM equivalence, making it extremely easy for Ethereum-based dApps to deploy. This is a significant advantage for the adoption and development of Optimistic Rollups.

- Optimistic Rollups enable enhanced scalability because they don't do any computation by default and remove much of the computational burden from L1. Instead, after a transaction, they propose the new state to L1 or "notarise" the transaction.

- For example, during the Optimism airdrop, transactions peaked at 22 TPS, the highest average transactions was 12 TPS per second (the equivalent of Ethereum mainnet) while using just 5% of gas on mainnet. This is in its early stages and efficiency and scalability will improve. It was a good indicator of the ongoing process of Optimistic Rollups as they start to scale Ethereum.

At a high level, Optimistic Rollups (and rollups in general) can be broken down into three characteristics:

- Transaction execution occurs outside L1

- Transactions occur in an off-chain environment on L2.

- Transactions are then sent to and recorded on L1.

- There is a rollup smart contract on L1 that can enforce the correct transaction execution on L2 by assessing the transaction data posted on L1.

- This crucially means that L2 transactions inherit the underlying security and decentralization of L1.

- Transactions occur in an off-chain environment on L2.

Rollups essentially move computation data storage off-chain, while retaining L1 security by posting the transaction data and a condensed proof of its off-chain computation on L1 where it can be validated. Maintaining some of the data on-chain enables anyone to verify the validity of the transactions being recorded.

Optimistic Rollups offer a low-cost, high-speed environment for dApps while still leveraging the security and decentralization of the Ethereum mainchain.

What is the core thesis on Optimistic Rollups?

Alternative L1s effectively addressed the pain points of using Ethereum - specifically transaction costs and speed. Despite this, they have failed to achieve the level of decentralization and security offered by Ethereum, and have significantly smaller developer communities. They arguably rose to prominence during the bull market of 2021 as Ethereum scaling solutions were not available to meet the increased demand for on-chain activity. However, Ethereum scaling has now arrived and is developing rapidly. Ultimately, users and dApps will select a chain that best suits their needs, and those that prioritize decentralization and security will likely opt for Ethereum and its rollups which are designed to inherit its security.

Optimistic Rollups specifically enable high EVM compatibility and equivalence. This makes deploying applications very easy, explaining their popularity with the Ethereum developer community. The Ethereum ecosystem remains by far the most active and innovative in crypto, with much of the activity now occurring on major Optimistic Rollups like Arbitrum and Optimism.

Last year, Vitalik Buterin stated that Ethereum fees will grow worse and that Ethereum is already in the process of shifting from an L1-centric ecosystem to an L2-centric ecosystem. This came as a surprise to many, after the multi-year expectation of a scalable Ethereum 2.0. Vitalik envisions Ethereum primarily being a settlement layer for L2s, rather than users. This places the focus firmly on the nascent L2 ecosystem that has exploded over the last year.

Key benefits of Optimistic Rollups:

- Optimistic Rollups enable EVM compatibility and equivalence enabling direct access to the Ethereum developer community.

- This is Optimistic Rollup’s key value proposition. Zero-Knowledge (ZK) and Validity Rollups are struggling with EVM compatibility due to the nature of the validity proofs. Developers in the Ethereum ecosystem remain far more numerous than other ecosystems and Optimistic Rollups represent a more scalable and builder-friendly environment than alternatives. In addition, further scaling solutions such as AnyTrust with Arbitrum can open up Optimistic Rollups to very high volume applications that require minimal costs, such as gaming.

- Optimistic systems provide transparency

- Transaction data is submitted to L1, meaning that there is full transparency regarding all activity of the rollup.

- Trustless progress is far easier to provide in Optimistic Rollups compared to validity rollups.

Read this interesting article arguing in favor of Optimistic Rollups over ZK-Rollups. Note that it may be biased given that it was written by Offchain Labs (developers of Arbitrum).

The three most prevalent Optimistic Rollups today are:

- Arbitrum

- Optimism

- Metis

Metis is a fork of Optimism, and all three share the same underlying principles, with some subtle mechanism differences.

What are the tradeoffs in its design/approach?

Ethereum Virtual Machine

Interestingly, Optimistic Rollups' key value proposition also represents a tradeoff. The EVM is a generalized VM and is not optimized for specific use cases. Some see this as a flaw, and various ecosystems are taking an app-specific approach to their design. Polkadot and Cosmos for example are built on the premise that each chain should be optimized for its specific use case and not constrained by generalized design decisions like with the EVM.

Centralization?

- If none of the whitelisted verifiers review transactions, incorrect and fraudulent transactions will be posted on-chain and funds can be lost.

- It is widely considered highly unlikely that this will happen.

- Only one honest verifier is required.

- If the centralized validator fails, new block production will be halted and funds will be frozen.

- Note that this will not result in funds lost but would be a very serious issue for the Rollup. Decentralization of validators and backup validators will be required.

- The centralized operators could front-run transactions and therefore extract MEV.

- Regulators could order the team to shut down the L2 network.

- Polyna argues that this can be avoided by a multisig form of community distributed across the world.

Team Control

The rationale for the team retaining control over the network is so that the network is carefully managed in its infancy before it is ready to decentralize. For example, the Arbitrum team holds the private key to a proxy contract that can change many of the system’s key contracts.

These include:

- Rollup contracts on Ethereum

- The Ethereum token bridge

- The sequencer contracts.

In addition, Arbitrum’s transaction capacity has been deliberately limited - with a ‘speed limit’ put in place. The purpose of this is to ensure validators have the time and resources to check transactions. This has resulted in gas fees that are higher than alt L1s and will rise in the future with increased demand. However, the speed limit will be raised as the network stabilizes and capacity will increase over time.

What are the possibilities of abuse?

Ultimately, a single entity has control over the network including the ability to shut it down. This makes Optimistic Rollups centralized, but in reality, this level of control is desirable for fast upgradeability and stability early on. Once stability has clearly been established, the teams have stated that controls will be phased out and Optimistic Rollups will become more decentralized. At present, block sequencing is controlled by teams, but in the future, there will be a transition to decentralized block sequencing. It will be interesting to see how or if this transpires.

Paradoxically, Optimistic Rollup teams are taking the approach that in order to be satisfactorily and securely decentralized in the future, it needs to be centralized now.

This centralization is necessary for the healthy development of the ecosystem. Already there are billions of dollars locked on Arbitrum, and the complex and novel nature of Optimistic Rollups needs to be carefully managed by an expert team for it to stand maximal chances of success. However, the censorship risk is a key issue, and the faster they can reasonably decentralize, the better.

Scalability

Optimistic Rollups are inherently less scalable than zk-Rollups. However, further scaling solutions such as AnyTrust Chains for higher-volume lower security applications are being developed. In addition, some Ethereum members speculate that in the future Optimistic Rollups will integrate validity rollups (commonly referred to as zk-Rollups) depending on how that technology matures.

Time Delay For On-Chain Confirmation

As a result of all transactions optimistically assumed to be valid, there is a period of time (approximately a week) whereby the transactions are not confirmed on L1. This is to give a reasonable length of time for a validator to submit a fraud proof if there are any invalid transactions. This can be circumvented by using bridges, however, these bridges have additional risk assumptions and the time delay on Optimistic Rollups can generally be seen as a negative.

Fees

Currently, transaction fees are still much higher than alternative blockchain networks such as Solana. This will realistically price out many users. However, under the ‘blockchains are cities’ mental model - Ethereum is New York and Optimistic Rollups are its suburbs - remaining relatively expensive due to its ties with Ethereum L1. This arguably justifies the slightly higher transaction fees. That said, various scaling solutions such as EIP-4488, proto-danksharding, and sharding will greatly increase the capacity of rollups and significantly reduce fees.

Interoperability

Trustless interoperability is not enabled between Optimistic Rollups. While capable of trustless bridging to L1, Optimistic Rollups can not securely interoperate with one another. Although various bridging protocols can be used, there are additional trust assumptions that need to be taken into account and they are inherently less secure than the native bridge.

Technical Risks

Optimistic Rollups are a new and complicated technology and errors in their implementation can result in a loss of funds. Users must have faith in the team’s ability to ship watertight code. The key risk here is that there are very few people and entities capable of competently assessing the risks here to make a properly informed decision. Ethereum’s increasing complexity as it scales and transitions to a more rollup-friendly environment also increases risk.

Leading Optimistic Rollups

Ethereum maintains the strongest developer community in crypto. It has established a significant moat, and although L1 alternatives offer a compelling value proposition, Ethereum maintains the most high-quality and experienced builders with a preference for Solidity.

Optimism

- Optimism is the second-largest OR by TVL at the time of writing. It has a number of top-quality Ethereum apps building on it which is a testament to builder confidence in what the Optimism team is building.

- Optimism is notable in that it uses single-round fraud proofs which makes them instant. Effectively, L1 executes the entire L2 transaction on-chain to verify the state root.

- Optimism has incorporated EVM equivalence into its design - which goes beyond EVM compatibility that some of the competing L1s and Rollups have incorporated. Optimism is focused on aligning itself as much as possible with Ethereum L1.

- Optimism notably launched the OP token on 31st May. OP enables holders to vote on protocol upgrades, project incentives, and more. This is part of the Optimism Collective - which will be described below.

The top 5 protocols on Optimism are:

- Synthetix

- A derivatives liquidity protocol.

- Lyra

- An options trading protocol.

- Perpetual Protocol

- An on-chain perpetual futures DEX.

- Uniswap

- An AMM protocol.

- Curve

- A DEX designed for swapping between stablecoins while maintaining low fees and slippage.

Synthetix makes up approximately ⅓ of TVL on Optimism and is an example of a project that has migrated to Optimism to escape reliance on Ethereum’s excessive gas fees that had been hampering its progress.

Arbitrum

- Arbitrum is by far the largest Optimistic Rollup, typically boasting ~80%+ TVL of all Optimistic Rollups. For a more in-depth overview of Arbitrum, check out Nansen’s report from January.

- While extremely similar to Optimism in most aspects, the difference arises in how Arbitrum processes a disputed transaction off-chain. Arbitrum only sends the disputed part of the transaction back through the EVM - rather than the entire transaction.

- Arbitrum also has a number of blue-chip Ethereum protocols building atop it which is a testament to developer confidence in its infrastructure.

- Interestingly, Offchain Labs (the company developing Arbitrum) has previously stated that they will pivot towards Validity Proofs in the future if it becomes apparent that they can overcome EVM compatibility and equivalence challenges. However, the team has taken the view that this is unlikely and remains convinced that Optimistic Rollups are the best scaling solution.

- Check out Nansen Alpha’s report on the current landscape of the Arbitrum Ecosystem here.

The top 5 protocols on Arbitrum by TVL are:

- SushiSwap

- A community-built platform for DeFi apps including trading, lending and leverage.

- GMX

- A decentralized perpetual exchange platform that offers BTC, ETH, AVAx, and more with up to 30x leverage and reduced liquidation risks.

- Curve

- A DEX designed for swapping between stablecoins while maintaining low fees and slippage.

- dForce

- A complete set of decentralized finance protocols covering assets, lending, and trading.

- Stargate

- A fully composable native asset bridge built on top of Layer Zero.

Interestingly, the top projects on Arbitrum and Optimism are different (with the exception of Curve), with different teams opting to focus on a single rollup (at first).

Metis

Metis is the third-largest Optimistic Rollup by TVL.

The top 5 protocols on Metis by TVL are:

- Netswap

- A Metis-native AMM based on Uniswap, with the NETT governance token.

- Synapse

- A multi-chain bridge

- Hummus: A Metis-native single-side AMM for stable cryptocurrencies (similar to Curve)

- Hermes Protocol: Hermes is Metis-native DEX designed for low cost and low slippage trades on both correlated and uncorrelated assets.

- Tethys Finance: Tethys is a Metis-native DEX.

Check out DefiLlama to explore the largest dApps by TVL on all chains.

NFT Collections and Metaverses

TreasureDAO

TreasureDAO began as a derivative of the Loot project. They launched their first 10k collection in August 2021. As the project gained traction and the interests of the community grew, they launched the MAGIC token in September. When we look at the current state of NFTs or gaming initiatives, buyers typically have to purchase the NFTs before gaining access to their utility. TreasureDAO takes the opposite approach by allowing users to play for free. Users then acquire valuable items by working instead of paying for them. TreasureDAO works in three main steps, which can be broken down into MAGIC, Treasures, and Legions.

| Project | Description |

|---|---|

| MAGIC | MAGIC is the “natural” resource of the Treasure metaverse. It acts as the in-game currency - players can earn MAGIC through playing, mining, and participating in Bridgeworld. MAGIC is also designed to be increasingly scarce (emissions declining as the complexity of the economy increases). |

| Treasures | Treasures (NFTs) are economic resources shared across the metaverse. Players will be able to use Treasures to craft consumables or burn them for special effects. |

| Legions | Legions (NFTs) are physical entities of Bridgeworld. Think of Treasures as resources and Legions as players. Players take control of Legions and Mine, Farm, Craft, Quest, Battle, and more to propagate and build the Bridgeworld through collective efforts. |

TofuNFT

TofuNFT is one of the main NFT marketplaces for Arbitrum NFTs.

Governance

Optimism Collective

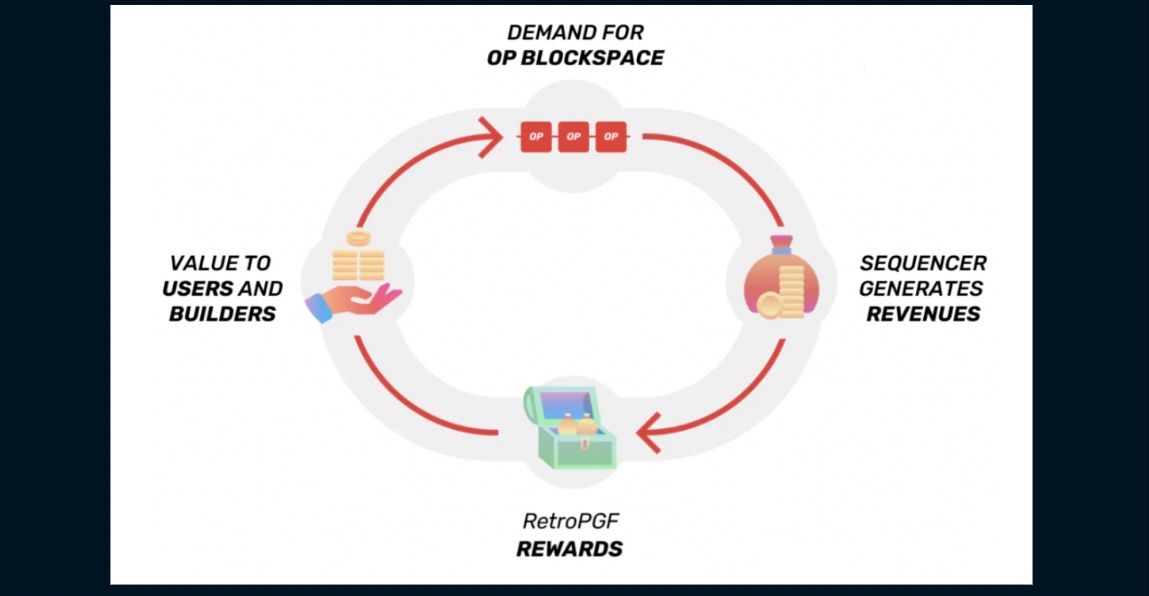

Optimism has launched the Optimism collective - an innovative approach to decentralized governance. Optimism describes the collective as “a band of communities, companies, and citizens united by a mutually beneficial pact to adhere to the axiom of impact=profit.”

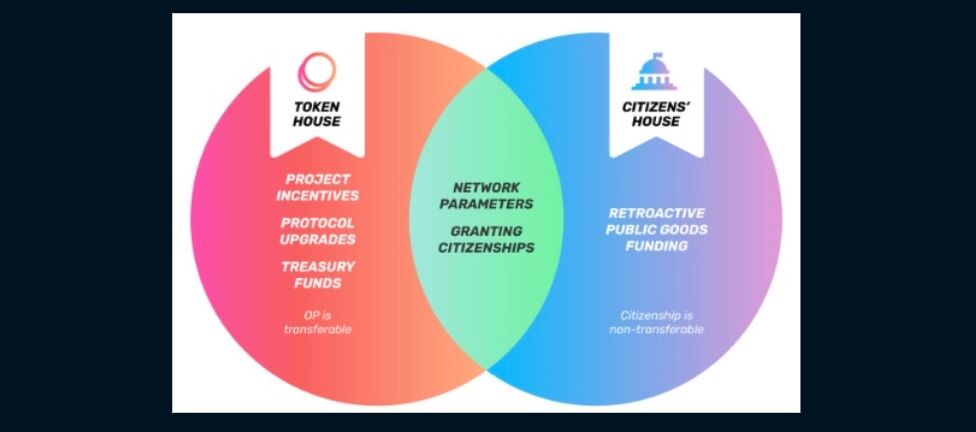

The Optimism collective will be co-governed by (1) token house and (2) citizen’s house.

Token House

This will comprise the OP token holders who can vote on project incentives, protocol upgrades, and the allocation of treasury funds.

Citizens House

This will facilitate retroactive public goods funding using the revenue generated by the network. Citizenship is attained through non-transferable soulbound NFTs.

The Citizen’s House is yet to launch but is expected later this year (2022). The below diagram provides a rough high-level overview of Optimism’s proposed governance. It will likely evolve over time.

Check out the Optimism governance docs here.

Although Optimism has already conducted an airdrop, this will only be the first of several. This approach makes sense, as it incentivises longer-term engagement with the protocol with the view to attracting and keeping users and developers - something most incentive programmes have failed to achieve.

It will be interesting to see how the token accrues value over time - right now, its value derives from participation in the Token House.

Arbitrum Governance

The team at Offchain Labs (developing Arbitrum) has long stated their ambition to decentralize Arbitrum. It is difficult to see how they would do this without a token - and therefore it is widely expected that they will launch a token in the future.

Interacting with the dApps on Arbitrum might be a good way to qualify for Arbitrum’s widely speculated token. More specifically, participating in the Arbitrum Odyssey could qualify for a potential future airdrop. Check out Nansen Alpha’s farming report that covered Arbitrum Odyssey here.

Metis Governance

Metis has not yet launched a community governance model - however, the team has always stated its commitment to decentralization.

Metis Community Ecosystem Governance Program

Part of Metis community governance is Community Verified Projects (CVP). In CVP, the community can vote on Community Builder Proposals - whereby community builders seek funding from Metis.

- Builders submit a proposal on Candidac (Metis governance portal).

- The project is assessed for minimum requirements. If these are passed, it is sent to a vote. If it does not pass the requirements, it is moved to the ‘Update Requested’ category

- A Snapshot is created, and a majority pass of 80%+ is required for community verification.

- Members can vote with just 1 METIS

- Delegated METIS is returned after the vote

Metis Community Ecosystem Governance is notably subject to change and in its early stages.

Fiat Onramps

- Integrations with Arbitrum: Crypto.com, FTX, Binance, KuCoin, Huobi

- Arbitrum has especially impressive integrations with centralized exchanges which in part explain its continued dominance.

- Check out the list of centralized exchanges that support Arbitrum here.

- Integrations with Optimism: Check out the full list here.

Bridging from Ethereum

Ethereum to Arbitrum

Arbitrum was designed to allow ETH, ERC-20 tokens, ERC-721 assets to trustlessly move from Ethereum to Arbitrum chain and back. In principle, any asset can be bridged from L1 to L2 and back. The Arbitrum protocol does not have a native notion of any token standard by design - which is also referred to as the “Canonical Bridge”. It is effectively a dApp with contracts on both Ethereum and Arbitrum that leverages Arbitrum’s cross-chain message passing system to achieve basic token-bridging functionality. All Ethereum to Arbitrum token transfers are initiated via the L1GatewayRouter which is responsible for mapping L1 token addresses to L1 Gateway, acting as an L1/L2 address oracle and ensuring that each token corresponds to one gateway.

By default, the official Ethereum to Arbitrum bridge is most commonly used to bridge assets. As mentioned, Arbitrum’s execution happens optimistically, hence the Ethereum blockchain cannot natively confirm the correct state of the transfer and must wait for the challenge window to halt (or when all challenges have been resolved). Thankfully, users can also use third-party protocols like Hop Protocol to bypass the 7-day withdrawal period that early Optimistic Rollups face. Similarly, users can also use Connext and Across Protocol to bypass Optimistic Rollup’s withdrawal period.

Check out the extensive list of bridges here.

Ethereum to Optimism

The standard bridge from Ethereum to Optimism is the Optimism Bridge. The standard bridge allows a one-to-many mapping between L1 and L2 tokens, meaning that there can be many Optimism implementations of an L1 token. However, there will always be a one-to-one mapping between an L1 and l2 token in the Optimism token list. The token list is used as a source of truth for the Optimism Gateway, which is the main portal for moving assets between L1 and L2 on Optimism. Other third-party bridges that users can use are Synapse protocol and Orbiter Network.

Ethereum to Metis

The official Metis Bridge allows users to bridge assets to and from Ethereum.

List of L2 Bridges

- Hop Protocol

- Connext Network

- Celer network

- Synapse Protocol

- Anyswap Exchange

- Orbiter Finance

- Across

- Li.Fi

What’s the difference between the official bridges and bridges like Hop Protocol?

The main difference between the official L2 bridges and Hop Protocol is that it allows users to send tokens from one rollup to another almost immediately, bypassing the rollup’s challenge period. Moving tokens from L1 to L2 and back is an expensive and slow process. For users to fully realize the benefits of a rollup ecosystem, they must be able to seamlessly transfer assets from L1 to L2 and back without the L1 network becoming a bottleneck - whether it is time or cost.

Each rollup has a Native Token Bridge that bridges assets between the L1 base chain and the rollup. In some cases, applications may also provide custom bridges for their tokens called Application-Specific Bridges. These are helpful for applications that have a more flexible trust model than the rollup itself, applications that have both L1 and L2 components, or applications that use bespoke sidechains. Lastly, there are General Token Bridges, like the Hop Bridge. Generally, Token Bridges are provided by third parties and bridge ERC-20 tokens in a generic way.

One key term to understand General Token Bridges is a component called Canonical Tokens. A bridge may create a new L2 token representation of the L1 token being bridged, or the bridge may allow users to convert to an existing L2 representation. Even if multiple L2 token representations of an L1 token exist, applications will likely gravitate towards a single representation of the L1 token. This is because it’s in each application’s best interest to be composable with the other applications on the rollup. Therefore, each application will choose to use the version of each token that is most compatible with the other applications. The version most widely adopted is the canonical version for that rollup (e.g., ”Canonical ETH”, ”Canonical DAI”).

Check out the fiat on-ramps here.

Trust/Security assumptions

The argument for zkRollups is often the offering of their cryptographic verification of off-chain execution and thus, security advantage over Optimistic Rollups. ZK Rollups currently rely directly on a designated party to execute transactions, build blocks, and include proof of validity. This reliance on a single party creates a potential vulnerability. For example, if the relayer goes offline for any reason, there won’t be a readily available alternative for other parties to take over processing responsibilities.

With Optimistic Rollups, a single party called the sequencer is responsible as the block producer and transaction processor. Additional validators are involved in the process of calling out for fraudulent transactions. These additional validations can also take on block processing roles if required. Optimistic Rollups have an assumption that “one of n participants” is honest - which means that as long as there is one honest network user that can submit a fraud proof, the rollup protocol will process the transactions accordingly. In the case that all participants are forced offline, a fraudulent batch can be submitted to the main chain without triggering a dispute resolution, which would then be irrevocably accepted by the base chain. Although this attack scenario is feasible in theory, Optimistic Rollups have a dispute period of one or two weeks. In addition to the validators, any participants who are actively monitoring the network can submit a fraud proof during the dispute period. This goes to say that the assumption of ZK-Rollups characterized as generally more secure than Optimistic Rollups is less straightforward than just the offering of cryptographic verification.

OR vs ZKR Cheat Sheet

The following cheat sheet is provided to contextualize ZK-Rollups in the L2 space. Check out our report on Arbitrum here.

| Optimistic Rollups | ZK Rollups | |

|---|---|---|

| Security | Optimistic Rollups introduce a single party (“sequencer”) which is designated as the block producer and transaction processor. The other validators on the network serve as a “referee” on the sequencer which can call out for fraud proofs when necessary to detect fraud transactions. These additional validators can even take over block producing roles without additional processing power/ knowledge. | ZK Rollups have a designated party that executes transactions, builds blocks, and includes proof of validity (“relayer”/ “prover”). Each batch of transactions has its own “validity proof” which is then submitted to L1. |

| Exit time | Optimistic Rollups require a ~7-day exit time. If fraudulent transactions are detected, the rollup executes fraud proofs and runs the correct transaction computation using the data available on L1. To ensure that they are incentivized to process only legitimate transaction data, sequencers are required to stake ETH. If they perform their duties diligently, they receive staking rewards. If a sequencer identifies a fraudulent transaction to the Ethereum main chain, their stake is slashed. | ZK Rollups do not require a challenge period as the validity proof has already verified the legitimacy of the transaction data. As soon as the proof is verified on L1 (can be up to a few hours). Instant withdrawals are also possible with bridging protocols such as Hop or Synapse. |

| Proofs | Fraud proofs are initiated by validators who identify incorrect transactions. Less complex. | Validity proofs relying on cryptography. Complex and computationally intensive. |

| EVM Compatability | Easy, live today and first to market. | Complex, only limited applications live today but a Solidity transpiler is being developed. |

| Computation | On-chain: Higher (needs more data on-chain for fraud disputes). However, fraud proofs only occur in the event of a challenge. Off-chain: none (all assumed to be valid). Sequencers are responsible for ordering transactions from L2 bundles that are then committed at L1. Currently centralized. | On-chain: Lower Off-chain: High (Validity proving is very computationally intensive). Currently centralized. |

| Operating | Sequencers are responsible for ordering transactions from L2 bundles that are then committed at L1. Currently centralized. | Requires powerful machines, currently done by one operator (StarkWare) for StarkEx and StarkNet. |

| Community Sentiment | Short term: Dominant for general-purpose EVM computations due to “first-mover advantage” and ease of EVM compatibility Long term: Far less competitive if ZK-Rollups fulfill their potential and decentralize satisfactorily. | Short term: Dominant for “simpler” tasks (payments, exchanges, application-specific tasks etc.) Medium-Long term: Dominant overall as the technology matures. |

| General Approach | ‘Innocent until proven guilty’ approach to verification. | ‘Guilty until proven innocent’ approach to verification. |

What would cause Optimistic Rollups to fail?

A key reason for Optimistic Rollups failing would be superior alternatives. The best products and infrastructure will ultimately prevail, and if alternatives prove objectively superior to Optimistic Rollups, they will likely fail.

ZK-Rollups, for example, are widely believed to be a better long-term alternative to Ethereum scaling compared to Optimistic Rollups. This is because of the additional scale that ZK-rollups enable, as well as the far faster transaction confirmation times at L1. Some see Optimistic Rollups more as a temporary solution, and their rise to relative prominence is due to their easy EVM compatibility and lesser technological complexity compared to the ZK-Rollups. However, some hold the view that Optimistic Rollups today like Optimism and Arbitrum will transition towards a hybrid ZK-rollup in the future.

Layer-0 Protocols: Polkadot and Cosmos

Polkadot is seeking to build a layer-0 platform that will enable arbitrarily different parachains (blockchains) to interoperate in a trustless way through shared security. This means that parachains do not need to bootstrap their own validator set (like in Cosmos). Cosmos is another layer-0 ecosystem that facilitates app-specific blockchains and prioritizes blockchain sovereignty. Interestingly, dYdX recently announced that they will be moving from StarkEx (a validity proof scaling solution on Ethereum) to set up a Tendermint chain on Cosmos. The rationale for doing so is that L2s are currently centralized, and a standalone and customizable Cosmos blockchain was best suited to optimising their product and scaling it beyond what is currently possible on StarkEx. This could set a strong precedent for blockchain-based products opting to build out a customisable blockchain on Cosmos rather than an Optimistic Rollup. However, this is on a case-by-case basis, and there remains a significant challenge in bootstrapping a secure validator set.

Polkadot’s technology and vision are impressive, however, its execution has not been. The vast majority of innovation remains on Ethereum, and Polkadot’s technical infrastructure is lagging. However, if Polkadot does succeed, it will provide strong competition to Optimistic Rollups as it optimises for specific use cases, whereas Optimistic Rollups optimize for EVM equivalence - and therefore inherit the generalized design decisions of the EVM.

Avalanche Subnets

Some members of the Avalanche community argue that subnets are inherently a better model than rollups. They argue that:

- Subnets have better value accrual to the AVAX token.

- They are simpler in design. Rollups are overly complex and the additional complexity equates to increased risk.

- Subnets are highly customizable, enabling developers to optimize the subnet for their specific application(s).

However, it is not apparent that subnets can have trustless bridges with the mainchain, like rollups do with Ethereum.

Should significant unforeseen issues arise in the future regarding the security of major rollups, subnets may have their chance to shine.

Inherent Issues

If major Optimistic Rollups start experiencing issues, the market could lose confidence in them. These include:

Centralization Issues - Optimistic Rollups are currently centralized and if governments take drastic actions against teams who could technically halt the network, this would have a very detrimental effect. Ultimately, this shows why they are in a race to decentralize so issues like this cannot arise.

Smart Contract and Design Issues - If the OR contracts transpire to be faulty, then this would likely cause them to fail. Furthermore, if the game-theoretic assumptions of 1 honest watcher do not hold true in reality, then the legitimacy of Optimistic Rollups will be lost.

What would cause Optimistic Rollups to succeed?

- Similar to how they would fail, Optimistic Rollups will ultimately succeed if they prove to be more secure, reliable and performant than most other scaling solutions.

- Optimistic Rollups should inherit the security of Ethereum L1, which will be a serious competitive advantage compared to alternative L1 chains with fewer security guarantees.

- Additionally, EIP-4488 will result in a large reduction in gas costs for rollups, which should make Optimistic Rollups more competitive against alternative L1 blockchains and the enhanced security of Ethereum justifying any additional transaction costs.

- Furthermore, a sharded Ethereum will further bring costs down

- Key to achieving this will be the decentralization of the major rollups like Optimism and Arbitrum.

Scaling Optimistic Rollups

EIP-4488

EIP-4488 (if implemented) is expected to reduce gas costs by approximately 5x. This is designed to improve the capacity of L1 for rollup transactions. However, EIP-4488 is not without controversy and it is unclear as of now if it will be implemented. This is because the blockchain growth would accelerate, making it more expensive to run a node. EIP-4444 removes this history after a year and should help, but the long time frame (1 year) will reduce the impact of this compared to EIP-4844 whereby this period will be approximately 1 month. Note the potentially confusing similar names of the EIPs.

EIP-4844 - Proto-danksharding

Vitalik submitted a proposal to reduce transaction costs for rollups - EIP-4488. This is expected to reduce costs for rollups by up to 10-100x from the current state. EIP-4488 introduces ‘blobs’ which are a transaction type whereby transactions are no longer posted as call data, but as ‘data blobs’ which are removed after approximately 1 month. This gives more than enough time to satisfy data availability security assumptions while reducing storage requirements.

Given that most of the transaction cost in Optimistic Rollups is from posting the call data to L1, EIP-4844 will deliver far greater cost savings to Optimistic Rollups vs ZK-Rollups.

Arbitrum

Like all blockchains, Optimistic Rollups have an upper limit on capacity. However, additional scaling solutions are being worked on for applications that may not need institutional-grade security but want to leverage the benefits of blockchain technology. This suits applications like the gaming sector.

Arbitrum is launching AnyTrust Chains - which will enable lower cost and faster withdrawals than Arbitrum One - with the caveat of additional centralization. However, as it is still built atop Ethereum, it can indirectly leverage the security of L1 (as opposed to sidechains).

AnyTrust will work as follows:

- AnyTrust chains will be operated by a committee of nodes, with a minimal assumption regarding how many nodes are honest e.g. 2/20.

- This is significantly better than sidechains which may require a ⅔ honest majority. The reason for only needing a low proportion of nodes is that if the nodes fail or refuse to cooperate, the transactions will revert to rollup mode and be confirmed on the L1.

- With the assumption that 2/20 are honest, there is no need to record transaction data on the L1 as nodes can rely on the committee for data instead. Only the transaction hash is recorded on L1.

- Another benefit of AnyTrust Chains is that withdrawals can be executed immediately (if vouched for by the committee).

How safe is this?

- Turning again to the example of a 2/20 honest committee member assumption, this would mean that anything signed by 19 members is correct. If this threshold is not reached, the transaction will revert to rollup mode and be confirmed on L1.

- If all validators are offline it can be impossible to withdraw funds. However, assuming at least one will provide data there will be the ability to reconstruct state and process a withdrawal via rollup mode.

- If the additional assumption of honesty (e.g. 2/20 honest) fails then funds can be frozen and stolen.

- AnyTrust Chains obviously have lower security than a traditional rollup and therefore are not suited to applications that require very high levels of security e.g. DeFi. However, for applications that do not require such high security e.g. gaming, they offer a good alternative.

How scalable are AnyTrust Chains?

Offchain Labs has released little information on AnyTrust so far. However, it can be expected that they are far more scalable than the rollup chain. Updates will be provided as more information becomes available.

Polyna on Optimistic Rollup Scaling

Polyna argues that Optimistic Rollups will scale faster than ZKRs, and that transactions could be under 1 cent by the end of 2022. On top of this, he believes that they will continue to improve with state expiry and statelessness being implemented in 2023. However, he takes the view that they will eventually move towards validity proofs. This is a common view in the community. This is not necessarily bearish for Optimistic Rollups, which could prosper significantly in the short-term while transitioning to the inherently more scalable validity proof rollup mode in the future.