Disclaimer

Nansen has produced the following report as part of its existing contract for services provided to Polygon Labs (the "Customer") at the time of publication. While Polygon Labs has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Polygon PoS, an EVM-enabled sidechain scaling solution initially developed by Polygon Labs, gained popularity due to its low fees and developer-friendly environment since its emergence in 2021.

Alongside Polygon PoS, Polygon Labs has developed various scaling architectures, such as Polygon zkEVM, and the Polygon Chain Development Kit (CDK). Announced this year, Polygon CDK is a collection of open-source software components that makes it easy for developers to design and launch ZK-powered L2s on Ethereum.

In the last quarter, Polygon has made significant strides in institutional collaborations. For example, they partnered with HSBC to develop a decentralized identity solution using Polygon ID, aimed at enhancing online verification processes. Additionally, Polygon's collaboration with Milano Hub on creating a secure DeFi environment for regulated entities exemplifies their commitment to merging traditional finance with blockchain innovations.

For developers, Polygon has been actively fostering growth and innovation. The relaunch of Polygon Village, offering substantial grants and mentorship, along with the integration of Celestia's high-throughput data availability solution and HyperOracle's zkOracle protocol into Polygon's Chain Development Kit (CDK), highlights their dedication to supporting and empowering the developer community. The collaboration with NEAR Foundation on a zkWasm prover further expands the capabilities and options available for ZK-powered L2s on Ethereum.

This quarterly report delves into the Polygon ecosystem's performance, spotlighting the recent advancements that have elevated its network efficiency and user experience.

Key Developments: Q4 2023

- The Aalborg Upgrade for Polygon's Proof-of-Stake network was introduced in PIP-11 (Polygon Improvement Proposal). The upgrade aims to significantly speed up block finality by about 5 to 6 times, using a concept called "milestones." This will make block finality deterministic after a certain number of blocks, reducing the likelihood of deep reorganizations and enhancing user experience, aligning with similar architecture in the Ethereum network.

- Polygon 2.0's update features POL contracts live on Goerli Testnet, transitioning from MATIC to POL for enhanced ecosystem support. This step, guided by community consensus, is pivotal for Polygon's aim to scale Ethereum, incorporating proposals for token-burning mechanism adjustments and prioritizing community-driven governance.

- The Inca Berry upgrade for Polygon's zkEVM Mainnet Beta has been completed as of 5th November 2023, featuring cryptographic optimizations and bug fixes. This upgrade includes improvements to the node and prover, enhancing functionality and compatibility across Linux distributions. Developers can test Inca Berry on the public testnet, with the final upgrade requiring updates to the latest node and prover versions.

- Polygon introduced a new-and-improved Polygon PoS v1 Testing Toolkit, designed to streamline devnet management and offers features like customizable deployment and efficient monitoring. This tool accelerates innovation by simplifying deployment, monitoring, and testing in the Polygon ecosystem.

Ecosystem

The following are notable developments that occurred within the Polygon ecosystem during Q4:

- Milano Hub collaborated with Polygon Labs on the "Institutional DeFi for Security Token Ecosystem Project." The initiative seeks a secure DeFi environment for regulated entities.

- Polygon introduced Polylang, a TypeScript-based language for Miden VM, designed for simplicity and ease of use. Polylang, familiar to JavaScript developers, simplifies coding for Miden VM, a novel ZK rollup for parallel execution and enhanced privacy. This new language reduces the complexity of creating programs for the Miden VM without extensive cryptography knowledge, making development more accessible.

- Book.io and TresCool partnered to launch a digital book on the Polygon PoS network that supports climate action. Each sale of "Climate Optimism" by Zahra Biabani contributes a percentage of royalties to purchasing carbon removal credits, combining blockchain technology with environmental sustainability. This initiative represents a novel way to integrate carbon offsetting into digital media consumption.

- Club Mahindra has launched its first NFT collection, "Discover India", on Polygon PoS, showcasing India's destinations through generative AI art inspired by iconic painters like Picasso, Van Gogh, and Da Vinci. This collection offers 25 digital artworks, each accompanied by a holiday voucher for Club Mahindra resorts, blending art with blockchain technology and tourism.

- HSBC is developing a decentralized identity solution with Polygon ID to streamline online identity verification, enhancing privacy and user control. Polygon ID's tools focus on privacy, decentralization, and self-sovereignty, using cryptographic proofs for secure credentials exchange. This initiative aims to improve online identity verification and KYC processes, marking a move towards decentralized finance in mainstream banking.

- Polygon Labs and NEAR Foundation are collaborating on a zkWasm prover to connect Wasm-based blockchains with the Ethereum ecosystem. NEAR joins Polygon Labs as a core contributor to Polygon CDK, enhancing developer customizability for ZK-powered L2s on Ethereum. The zkWasm prover will generate zero-knowledge proofs to improve scalability and decentralization, facilitating closer alignment between NEAR Protocol and Ethereum while offering developers more options for Polygon CDK chains.

- Polygon Village relaunched and offers over 110M MATIC grants to support founders in the Polygon ecosystem. The program includes strategic support, mentorship, co-working spaces, and connections to VCs. It's part of Polygon's efforts to facilitate growth for developers and builders, with Polygon 2.0 aiming to provide scalable Layer 2 solutions.

- OKX launched X1, an Ethereum-based Layer 2 network powered by Polygon CDK. X1 connects OKX's 50 million+ users to the Polygon and Ethereum communities, with OKB as the network's token. It's EVM compatible, enabling the deployment of decentralized apps (dApps) and interoperability with smart contracts, wallets, and tools.

- The city of Lugano's MyLugano payment app integrated Polygon PoS, allowing residents to explore the Web3 ecosystem. It offers a multi-chain digital wallet for experienced users and has enabled 30,000 users to access a loyalty circuit through LVGA stablecoin. MyLugano aims to become Europe's blockchain capital, accepting cryptocurrency payments for various services, facilitated by Polygon PoS.

- Amazon Managed Blockchain (AMB) Access added support for Polygon PoS, providing developers with scalable, cost-effective Web3 app development. It covers Polygon PoS mainnet and Mumbai testnet in public preview and offers instant, serverless access with predictable pricing and benefits like automatic scaling and cost-efficiency.

- Polygon zkEVM introduced support for the Bridged USDC Standard by Circle, to aid Layer 2 blockchains in transitioning to native USDC in the future. This standard helps networks manage the cold start problem and allows for the seamless upgrade of bridged USDC to native USDC on Polygon zkEVM.

- Wipro launched Falcon, an equipment data management platform on Polygon PoS, with support from Shell. It connects physical objects to Polygon PoS's immutable ledger, simplifying supply chain management and reducing counterfeit risks.

- Flipkart, a leading digital commerce company in India, is launching a bespoke blockchain with Polygon's Chain Development Kit (CDK) to enhance its FireDrops Web3 loyalty program. Since its September launch, FireDrops has attracted over 3.3 million wallets, with women owning nearly a third of them.

- Celestia is integrating its high-throughput data availability solution with Polygon's CDK, promising to drastically reduce Ethereum Layer 2 transaction fees and enhance scalability. This collaboration aims to simplify the creation of efficient Ethereum Layer 2 networks, marking a significant advancement in blockchain adoption.

- HyperOracle is integrating its zkOracle protocol with Polygon's Chain Development Kit (CDK) to enable advanced decentralized finance (DeFi) and on-chain artificial intelligence (AI). This integration facilitates the creation of innovative applications like decentralized stablecoins and AI-powered dApps, enhancing the capabilities of Web3 and driving growth in the sector.

- Gateway is integrating its new execution client, cdk-erigon, with the Polygon Chain Development Kit (CDK), making it the first multi-client zkEVM tech stack. This addition enhances Polygon's performance by reducing disk space usage and sync times, benefiting infrastructure providers and the wider Polygon ecosystem.

- Fox Corporation is using Polygon's PoS technology to power Verify, an open protocol for content and image verification. This protocol allows media companies to register content and grant usage rights to AI platforms and provides a way for consumers to confirm the origin of content from trusted sources. It represents a significant step in addressing the challenges of AI-generated media and establishing content authenticity.

Nansen On-Chain Data

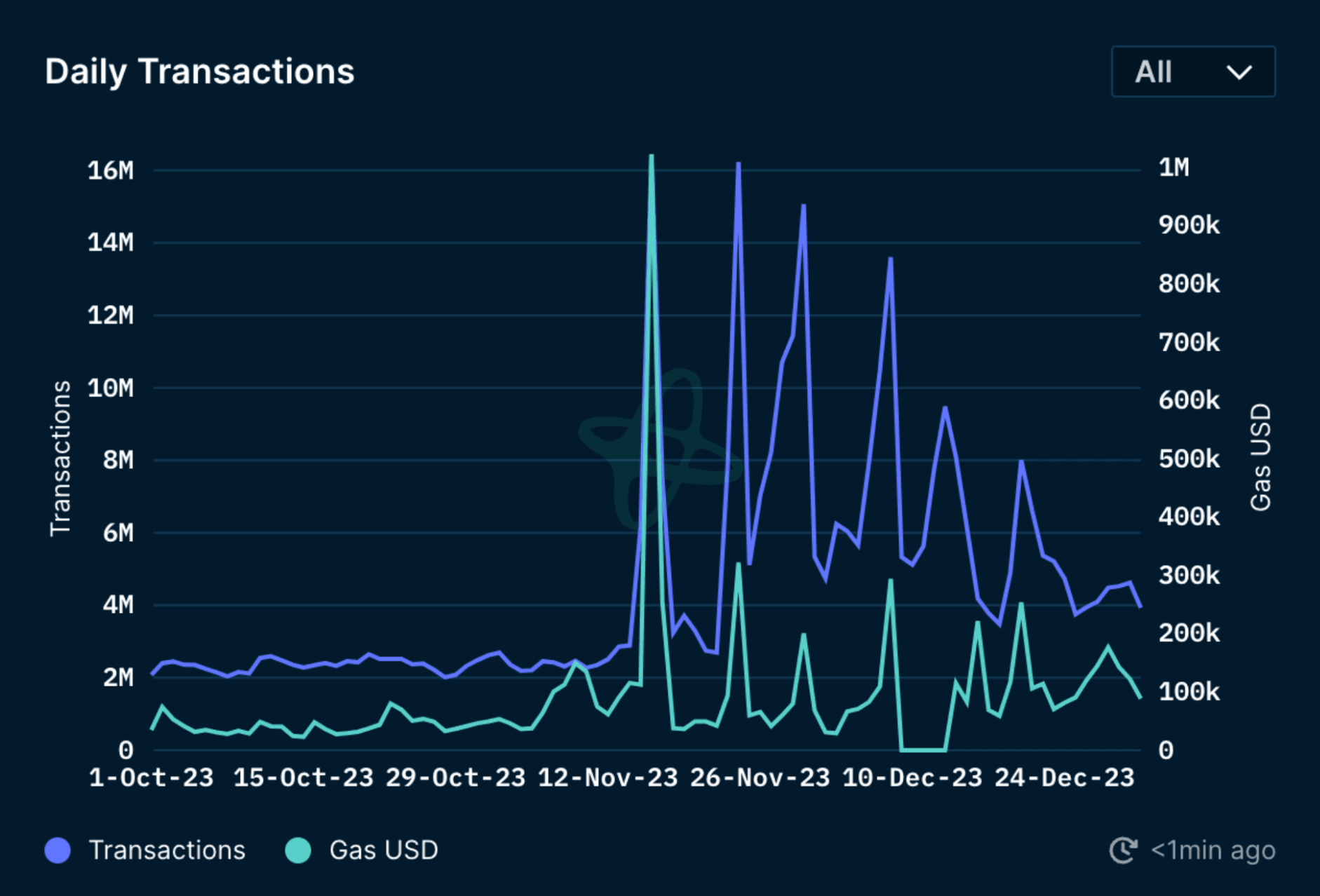

Daily Transactions

In Q4 2023, the daily gas fees on the Polygon PoS network exhibited significant volatility, with values oscillating between approximately $24k and $995k1.02m, outperforming Q3. In contrast, the previous quarter saw fees ranging from $279k to $153k.

Simultaneously, the daily transaction count for Q4 2023 peaked at roughly 16.5m transactions and dipped to a low of about 2m transactions throughout the quarter.

The intense spikes in transactions are likely due to the “inscription” craze that has been sparked by the success of BRC-20 tokens. This token standard, developed to support tokens on the Bitcoin network, uses transaction call-data to enable token functionality which had not yet been possible before. The massive excitement that ensued inspired similar token standards on other chains, although those chains may already support tokens. This led to massive surges in transactions across chains, with the most inscriptions of any EVM chain minted during that time being on Polygon PoS, leading to a peak of 16.5m daily transactions in November.

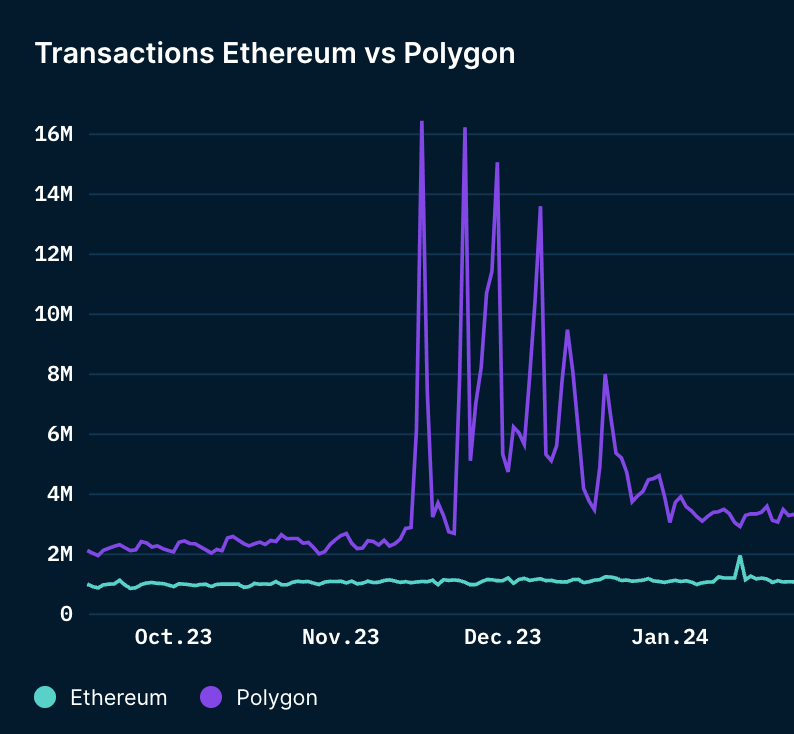

The chart coincides with the returning activity in the whole crypto industry including on many other chains. However, Polygon achieved significantly higher percentage-wise growth in transaction numbers compared to Ethereum.

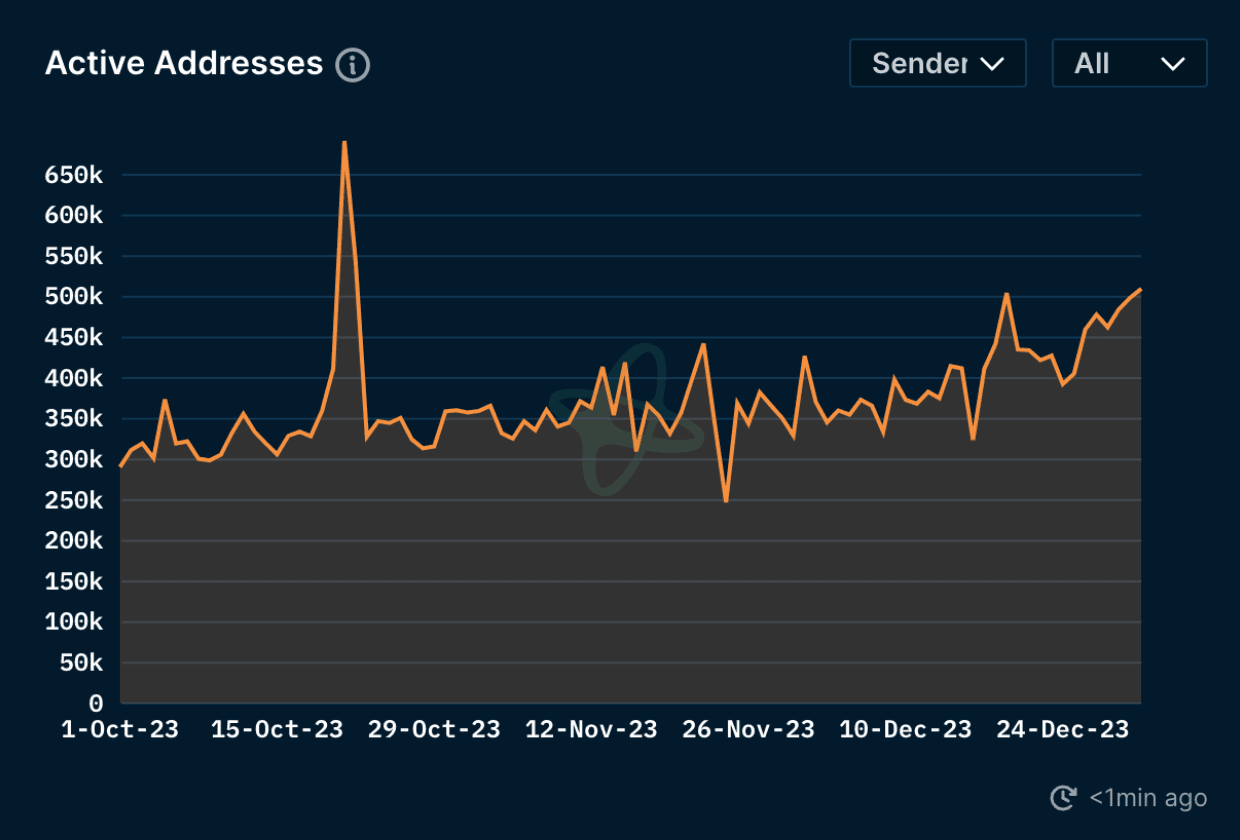

Daily Active Addresses

In Q4 2023, the count of daily active addresses on Polygon PoS showed large fluctuations, varying between 247k and 691k. Nevertheless, despite the fluctuations, a clear upward trend can be observed. This again coincides with the timing of the overall rise in interest and activity in the crypto market.

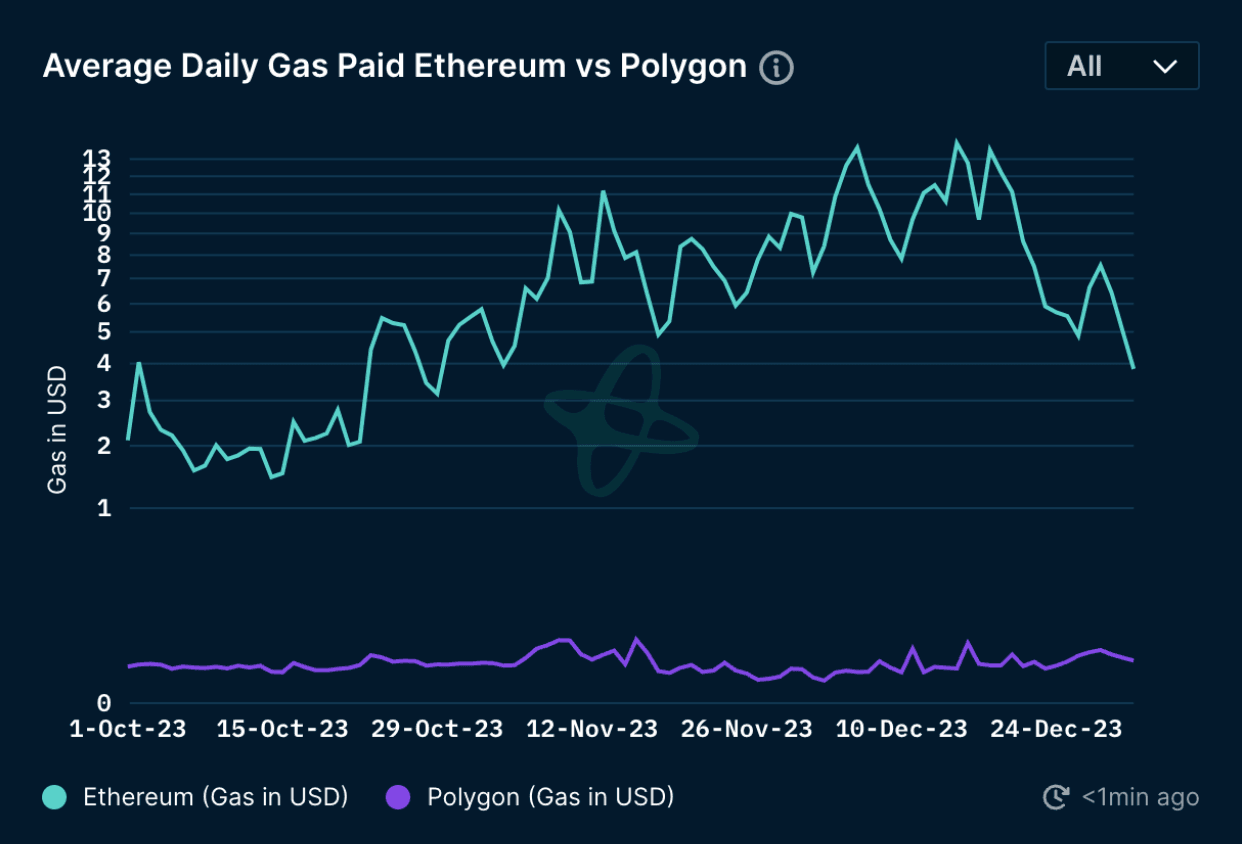

Average Daily Gas Paid (vs Ethereum)

In Q4 2023, Polygon PoS' average daily gas fees fluctuated between $0.01 and $0.06, significantly lower than Ethereum's gas fees, which ranged from $1.45 to a high of $14. Ethereum's gas fees exhibited a general increase over the quarter, whereas Polygon PoS’ fees maintained a more stable pattern, with only a notable rise in December where they nearly reached ten times their typical average. This is especially remarkable because, as mentioned before, Polygon PoS experienced massive spikes in daily transactions due to inscriptions (16.5m in the week of 16th November). However, while other chains struggled, Polygon PoS managed to remain fully operational and even keep average transaction prices below 10 cents, despite being the EVM chain with the most inscription activity at the time.

Top Entities by Users and Transactions

Nansen's list of labels provides a comprehensive way to analyze the top entity interactions on Polygon PoS based on the number of users and transactions. Chainlink is by far in the top position in the number of transactions at 44.61m, followed by MEV bots at 8.68m, with Up vs Down climbing to third at 5.67m. Regarding user engagement on Polygon PoS, the two largest stablecoins Tether and USDC stood out, boasting 1.54m and 848k users, respectively. The top entities suggest a primary use of Polygon PoS for financial dApps, but games also seem popular.

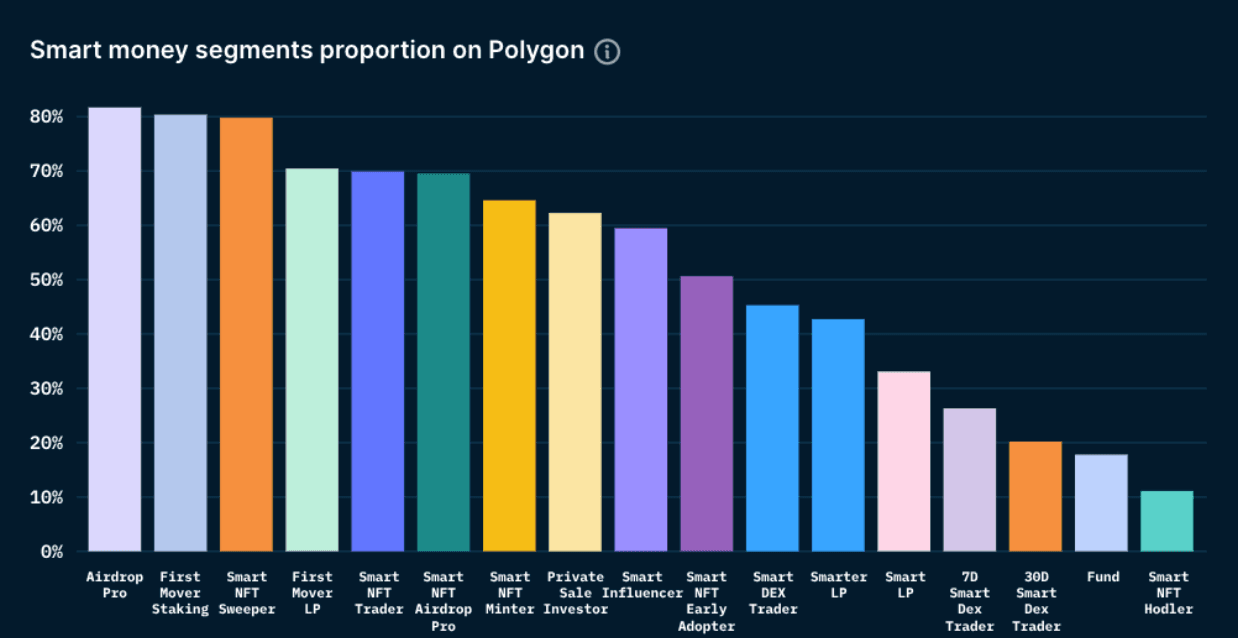

Smart Money Segments on Polygon PoS

The chart above provides a comprehensive breakdown of Smart Money Ethereum addresses active on Polygon PoS. Smart Money is one of the most beneficial features offered by Nansen, as it comprises a list of labels for wallets that exhibit high levels of activity and profitability on-chain. In Q4 2023, 80% of Smart Money addresses active on Polygon had the Airdrop Pro, First Mover Staking, and Smart NFT Sweeper labels. This could indicate that the clientele of savvy Polygon users comprises mostly early adopters (Airdrop Pros, First Mover Staking) as well as NFT enthusiasts (Smart NFT Sweeper), and fewer traders.

Check out this page for how the Smart Money categories are defined and how to use those labels on Nansen!

Closing Thoughts

In Q4 2023, the Polygon ecosystem continued to grow. Being among the most popular chains for institutions, offering a good mix of reliability, scalability, and cost-effectiveness, especially Polygon PoS keeps getting traction and collaborations from banks and other large (traditional) finance players. Looking at the highest activity smart contracts, stablecoins and DeFi-centric applications seem to dominate the chain, further solidifying Polygon's position as a top player in (institutional) DeFi. With continued support in the ecosystem, Polygon protocols could also see impressive growth on the retail front. Important on-chain metrics like fees earned, transaction count, and the number of active users have all been trending upwards. This might in part be due to crypto picking up steam across the board, but Polygon’s growth in transactions was significantly higher than Ethereum’s.

Additionally, the Polygon ecosystem supports not only the PoS chain but also several different projects like zkEVM, taking different approaches to scaling Ethereum. With growing cross-pollination between chains, Polygon seems broadly positioned and well-prepared for the future.

Disclosure

Nansen has produced the following report as part of its existing contract for services provided to the Customer at the time of publication. While the Customer has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.