BTC, ETH, and DOGE

Some much-needed positivity in the markets from last week with asset prices ticking higher across the board

ETH was a notable outperformer, trading to a 1,664.3 high (+26% from the start of the week). BTC traded to 21,080 high (+10% from the start of the week).

The biggest surprise over the weekend was DOGE which rallied over 90% on the back of excitement over Elon Musk's takeover of Twitter. Musk's tweets have created price swings in the past, even suggesting using DOGE as payment for a twitter subscription.

Rate hikes

The narrative of a Fed pivot is starting to take shape with markets now pricing in a lower probability of a 75bps hike in December, from about 55%, down to 45%.

Other central banks globally have already begun to show dovishness with the BoC being the first to hike +50bps (vs +75bps expected) and the ECB easing their forward guidance, suggesting that they are nearing the end of their hiking cycle earlier than expected.

With markets shifting expectations towards a dovish outcome at the upcoming meeting, we are concerned about a negative market reaction to persistent hawkishness from the Fed.

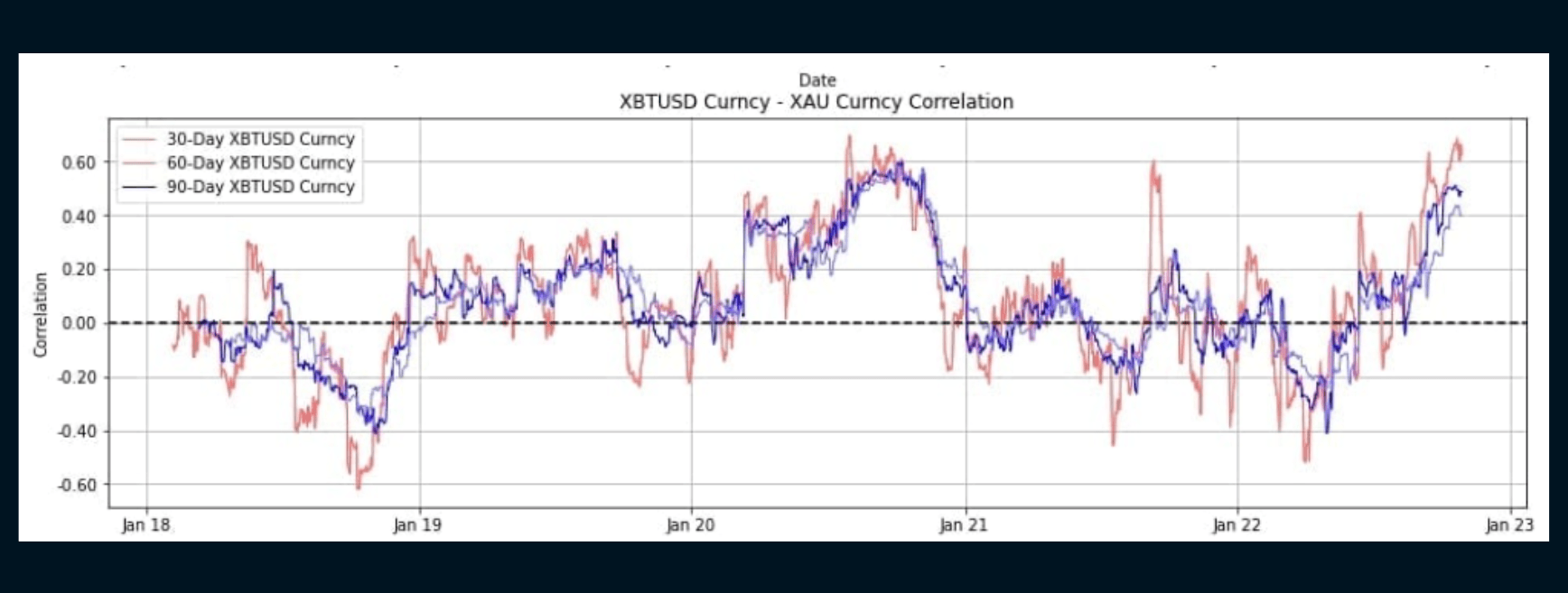

BTCUSD and XAU Correlation

Global macro forces and the dominant inflation narrative has driven BTC's correlation with Gold to a high, while the positive correlation with equities has begun to decrease (Chart 1).

Chart 1

The rush to buy BTC and ETH call options

In the options space, we saw vols spike as spot rallied. We believe the market has been significantly discounting topside for the last few weeks and the desk saw a rush to buy calls as spot ticked higher.

1m BTC ATM currently at 56 and 1m ETH ATM at 82. Along with the spot move higher, skews have continued to rally (become less negative) and now trade near the highs of the quarter with 1m BTC RR at +0.2%. This is significant as both BTC and ETH have had a persistent put skew since the downturn in prices this year.

We expect vols to be bid into FOMC (this Thursday, 3 Nov) and CPI (next Thursday, 10 Nov).

Disclaimer

QCP Capital is an exempt payment services provider pending licensing by the Monetary Authority of Singapore as an MPI for Digital Payment Token Services under the Payment Services Act (2019).

This information contained in this document is intended as a general introduction to QCP Capital and its activities as a Digital Payment Token (DPT) service provider and is for informational purposes only. QCP Capital is not acting and does not purport to act in any way as an advisor or in a fiduciary capacity vis-a-vis any counterparty. Therefore, it is strongly suggested that any prospective counterparty obtain independent advice in relation to any trading investment, financial, legal, tax, accounting or regulatory issues discussed herein. This document is only directed at informed and qualified investors. By reading this material attests that you are fully aware that trading of DPTs is not suitable for the general public and that you are an informed and qualified investor, and are also fully cognisant of all technological and financial risk(s) associated with trading Digital Payment Tokens.

Before you engage us or any of our services, you should be aware of the following:

Please note that this does not mean you will be able to recover all the money or DPTs you paid to your DPT service provider if your DPT Service Provider’s business fails.

You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. your DPT service provider if your DPT service provider’s business fails.

You should not transact in the DPT if you are not familiar with this DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider. You should be aware that your DPT service provider, as part of its licence to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoin”.