Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Scroll (the "Customer") at the time of publication. While Scroll has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Scroll is a native zkEVM Layer 2 solution for Ethereum, designed to provide seamless scalability while maintaining full Ethereum compatibility. Built with zero-knowledge proof technology, Scroll enables developers to deploy existing Ethereum applications with minimal modifications while benefiting from significantly lower transaction costs and faster finality. The network's mission centers on scaling Ethereum for mass adoption by providing a secure, efficient, and developer-friendly infrastructure that preserves the security guarantees of the Ethereum mainnet.

In Q3 2025, Scroll continued to advance its ecosystem through key technological developments and strategic partnerships. The network introduced Cloak, a practical privacy solution for onchain finance, addressing the growing need for privacy in financial transactions as traditional financial institutions adopt blockchain technology. This development comes at a critical time as stablecoin settlement on Ethereum surpassed $900 billion, with banks, fintechs, and payment processors exploring onchain rails for global money movement.

The network's infrastructure continued to evolve with enhanced security features for crypto-native financial services. ether.fi Cash Card leveraged Scroll's infrastructure to provide a secure, efficient crypto-native banking experience that meets enterprise-grade security requirements. This solution bridges traditional and crypto economies through security-first blockchain infrastructure, predictable low-latency execution, and fully autonomous chain architecture, enabling crypto-native credit cards to compete with traditional financial services.

Key Developments

- The Feynman Upgrade was a major evolution of the Scroll protocol focused on performance, compatibility, and simplicity. It introduced an EIP-1559–style congestion pricing model, where fees rise with demand and fall during low activity, while rollup fees now account for transaction compression, efficient transactions stay cheap, large unoptimized ones pay more. The upgrade also brings full Ethereum compatibility, with real blockhash returns, complete ecPairing support, and EIP-2935 integration allowing contracts to access the last 8,191 block hashes. Finally, it streamlines smart contracts by removing legacy codec versions and transaction skipping, completing the cleanup from the Euclid migration to OpenVM. Feynman enhances Scroll’s scalability, reliability, and alignment with Ethereum, delivering a cleaner, faster, and more predictable network experience.

- Scroll introduced Cloak, a practical privacy solution for onchain finance, addressing the growing need for privacy in financial transactions as traditional financial institutions adopt blockchain technology. With stablecoin settlement on Ethereum surpassing $900 billion in the past year, banks, fintechs, and payment processors are exploring onchain rails for global money movement, making privacy solutions like Cloak essential for enterprise adoption.

- Scroll Community Grants Program, launched by the Scroll DAO Community Council, empowers local and virtual communities worldwide with up to $10,000 per activation to host meetups, workshops, and educational events that expand the Scroll ecosystem. Applications are open until Dec 19, 2025, with activities to be completed by Mar 31, 2026. The program supports grassroots organizers, covering venues, materials, and logistics, while promoting collaboration, transparency, and compliance (KYC/KYB for grants above $2K). By funding community-led initiatives, Scroll transforms its infrastructure into a real-world movement, bridging on-chain innovation with global engagement and fostering long-term network growth through education and participation.

- Scroll is evolving its DAO to a structure that aims for faster, more strategic execution. The DAO, which never managed user funds (all assets remain safe), will now operate under Foundation oversight with defined veto powers, annual/biannual treasury cycles, and an Execution Council handling day-to-day decisions. This hybrid model balances autonomy with accountability, improving agility and coordination across governance, community, and technical teams. Existing initiatives like the Delegate Accelerator, Community Council, and Security Subsidy continue under the new framework, and the transition, guided by delegate input and one-on-ones, targets full rollout by January 1, 2026, marking a shift toward a more disciplined, growth-oriented DAO architecture.

Ecosystem Highlights

Scroll has formed an Ecosystem Growth Council (EGC), a 5-seat body with internal and external experts and a delegated 2 million SCR budget over a 6-month trial, to drive execution of high-impact growth programs via weekly governance, transparent reporting, veto mechanisms, and a renewal charter. The EGC is guided by a strategic direction focused on Builder Support and Onboarding, Liquidity and Economic Infrastructure, User Acquisition and Retention, and Community and Local Ecosystems (though direct funding for the latter remains with the Community Council). Funding allocation is dynamic, shifting according to proposal quality, ecosystem outcomes, and emerging opportunities rather than preset quotas.

- ether.fi Cash Card leverages Scroll's infrastructure to provide a secure, efficient crypto-native banking experience that meets enterprise-grade security requirements. The solution bridges two parallel economies through security-first blockchain infrastructure, predictable low-latency low-cost execution, and fully autonomous chain architecture, enabling crypto-native credit cards to compete with traditional financial services. By the end of Q3, it facilitated over $58 million of spending volume and continues to bring crypto mainstream.

- Moss Genomics Inc (CSE: MOSS | OTC: MSSGF), a publicly listed company with a formal Ethereum treasury strategy, has started using ether.fi Cash, powered by Scroll, to manage its corporate treasury and operational expenses. This represents a significant milestone as a publicly traded company adopts Scroll's infrastructure for treasury management, demonstrating real-world enterprise adoption of blockchain technology for corporate finance operations.

- USX

- the first neodollar on Scroll was announced - which allows you to spend in real life - gasless, private, and earns yield when you stake. Together with other integrations, USX is able to provide IRL payments via Ether.Fi, Cloak to provide privacy, and yields via onchain and offchain strategies through Blend Money.

Onchain Data

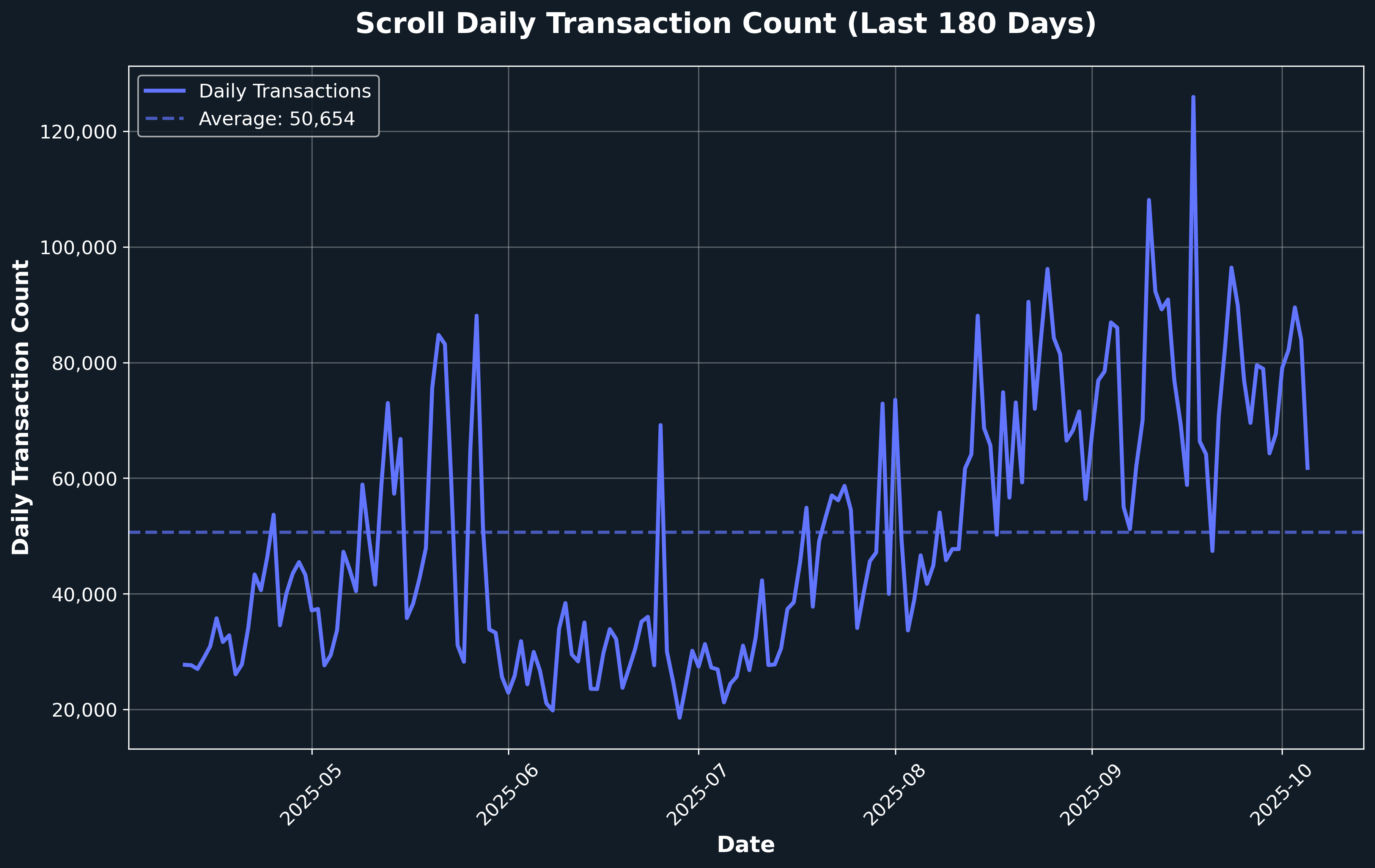

Daily Transactions

Scroll demonstrated steady transactional throughput across Q3 2025, with an average of 50,654 daily transactions. The network maintained consistent activity levels with peak performance reaching 125,949 transactions in a single day, reflecting robust protocol usage and sustained dApp engagement. Despite some volatility in daily volumes, Scroll's infrastructure proved reliable for high-throughput applications, with transaction patterns showing resilience throughout the quarter.

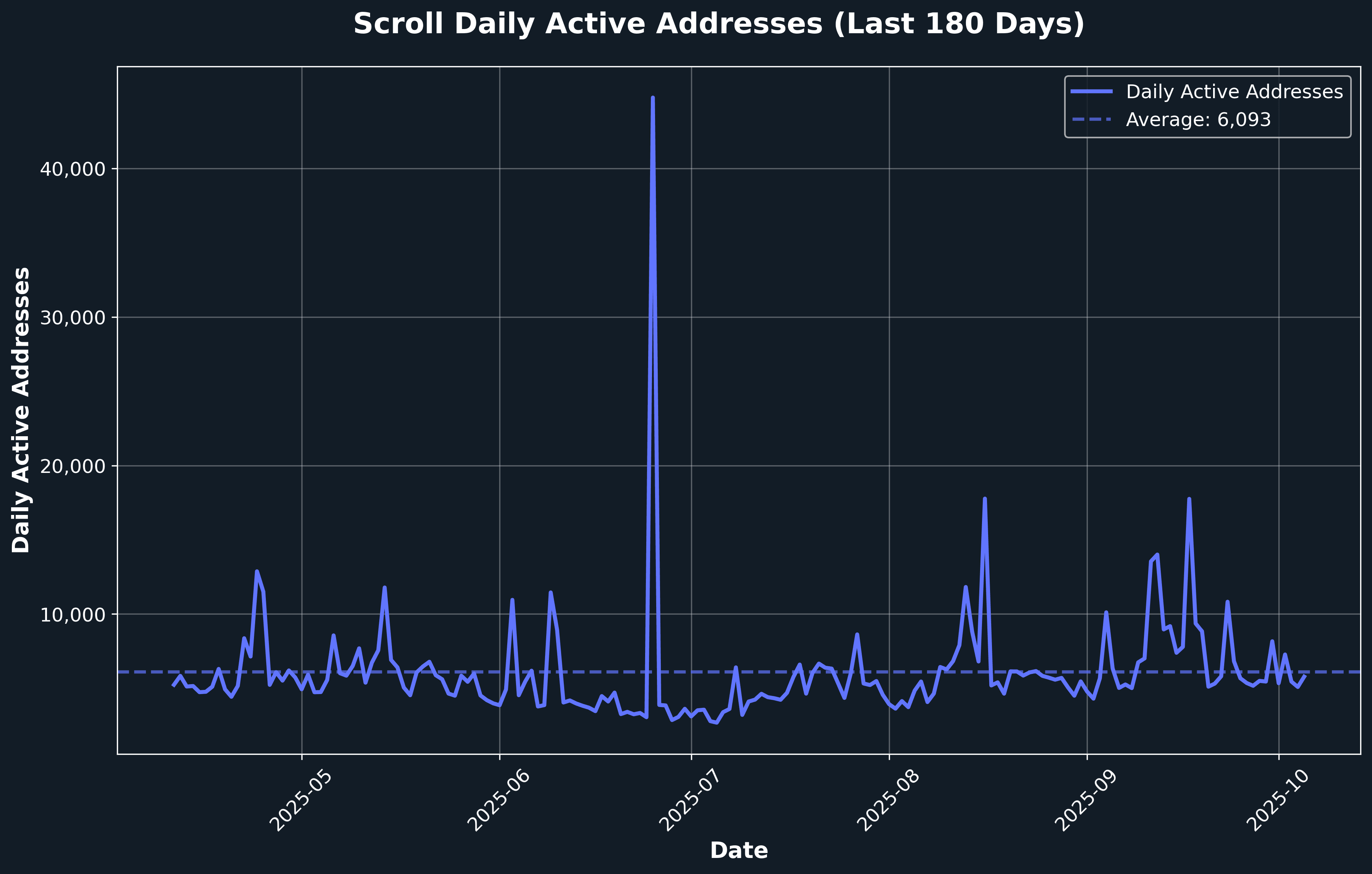

Daily Active Addresses

Scroll maintained a healthy base of 312,257 unique users across Q3 2025, with an average of 6,093 daily active addresses. The network experienced significant user engagement spikes, reaching peaks of 44,775 active addresses on high-activity days, while maintaining a solid floor of 2,683 users during quieter periods. This user distribution reflects Scroll's growing adoption across diverse use cases, from DeFi protocols to cross-chain bridging operations, demonstrating the network's appeal to both retail and institutional users.

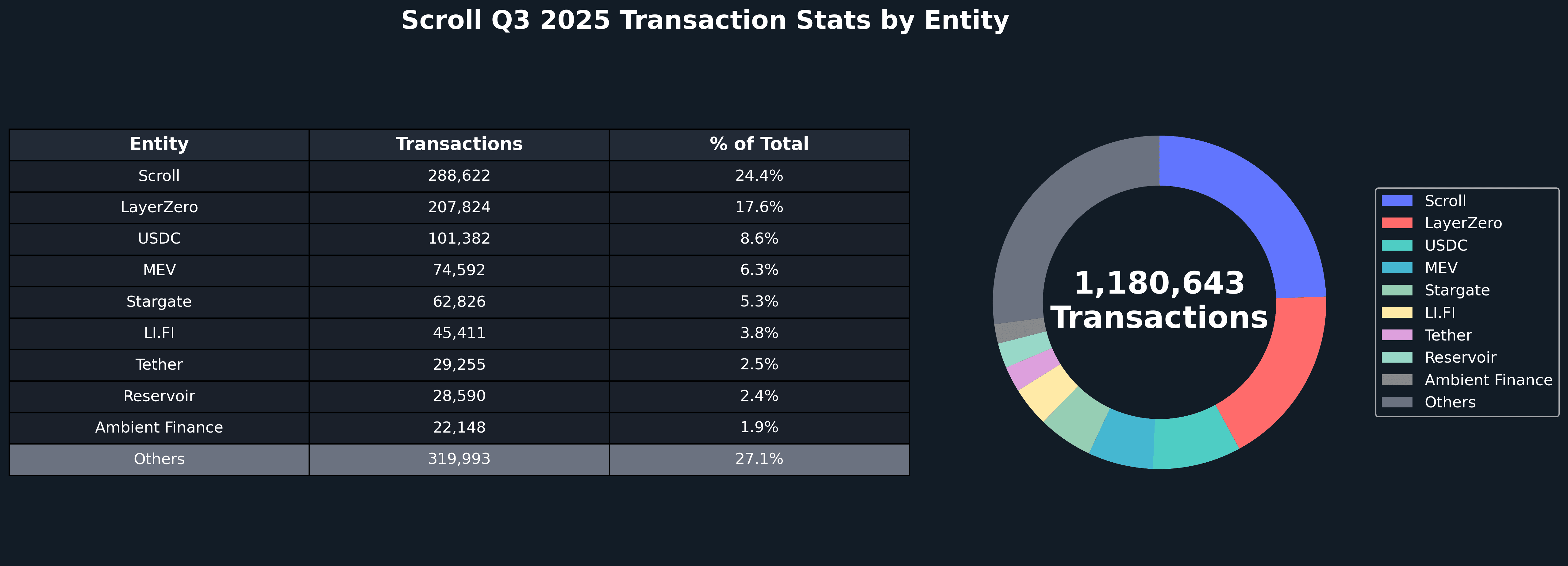

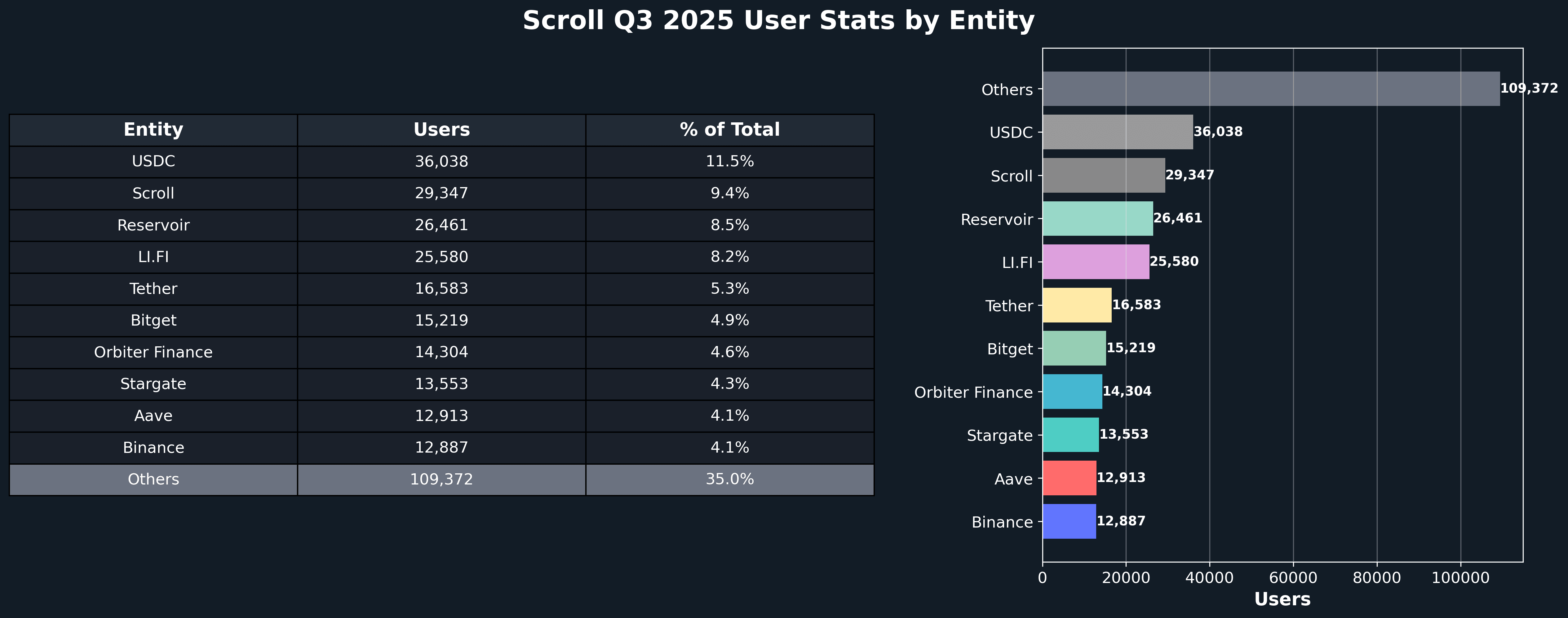

Top Entities by Users and Transactions

Scroll's ecosystem in Q3 2025 was anchored by core infrastructure and cross-chain protocols, with Scroll Infrastructure leading transaction volume at 288,622 transactions (24.5% of total). LayerZero followed with 207,824 transactions (17.6%), highlighting strong cross-chain demand. Notably, USDC showed significant growth (+35% transactions, +3.7% users), becoming the top user entity with 36,038 users, reflecting increased stablecoin adoption. However, most major entities experienced QoQ declines, with MEV activity dropping 46.4% and Stargate falling 58.1% in transactions, suggesting a period of market consolidation. The ecosystem's 160 active entities demonstrate Scroll's diverse utility across DeFi, bridging, and infrastructure applications.

Closing Thoughts

Scroll’s Q3 2025 performance underscores its maturation into a scalable, enterprise-ready zkEVM Layer 2. The Feynman Upgrade marked a technical leap, introducing EIP-1559 style fee markets, full Ethereum compatibility, and simplified smart contract logic, resulting in a cleaner, faster, and more predictable user experience. The rollout of Cloak, Scroll’s privacy framework for onchain finance, addresses a pivotal enterprise requirement as global stablecoin settlement surpassed $900 billion, enabling secure institutional use of Ethereum infrastructure. Enterprise integration deepened through Moss Genomics Inc., the first public company adopting ether.fi Cash on Scroll for treasury operations, signaling real-world corporate use cases. Meanwhile, the ether.fi Cash Card facilitated over $58 million spending volume, proving that Scroll’s infrastructure can power crypto-native financial products meeting enterprise-grade security and latency standards.

Governance and ecosystem expansion advanced in parallel. Scroll’s DAO evolved into a hybrid model with Foundation oversight, Execution Council, and defined treasury cycles, preserving decentralization while enhancing agility. The launch of the Ecosystem Growth Council (EGC), with a 2M SCR six-month budget, and the Community Grants Program reinforced Scroll’s long-term vision of aligning builders, enterprises, and communities under a cohesive growth framework. As the network enters Q4, Scroll is strategically positioned at the intersection of performance, growing adoption and institutional trust, ready to capture the next wave of enterprise and onchain financial adoption through a blend of open governance, robust infrastructure, and scalability.