Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Stellar (the "Customer") at the time of publication. While Stellar has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

H1 2025 marked a pivotal expansion phase for the Stellar network as it advanced its smart contract capabilities, deepened enterprise adoption, and demonstrated consistent on-chain performance. The release of Stellar RPC extended EVM-style developer tooling to the network, facilitating seamless wallet and dApp integration and lowering onboarding barriers for Web3-native teams. Complementing this, partnerships with OpenZeppelin and the launch of the Soroban Audit Bank reinforced Stellar’s commitment to secure, production-grade contract development.

Institutional adoption accelerated through integrations with leading financial entities. PayPal expanded the reach of PYUSD onto Stellar, enabling fast, low-cost global stablecoin transfers. Societe Generale-Forge deployed its MiCA-compliant EUR CoinVertible stablecoin on Stellar, highlighting the network’s regulatory alignment and enterprise-grade performance. Stellar’s positioning as a platform for real-world asset issuance was further strengthened by the announcement of USDY from Ondo Finance, Stablebond, and new fixed-income initiatives from FICC.ai. Developer and analytics tooling matured through integrations with Nansen, Bitbond, and broader API infrastructure.

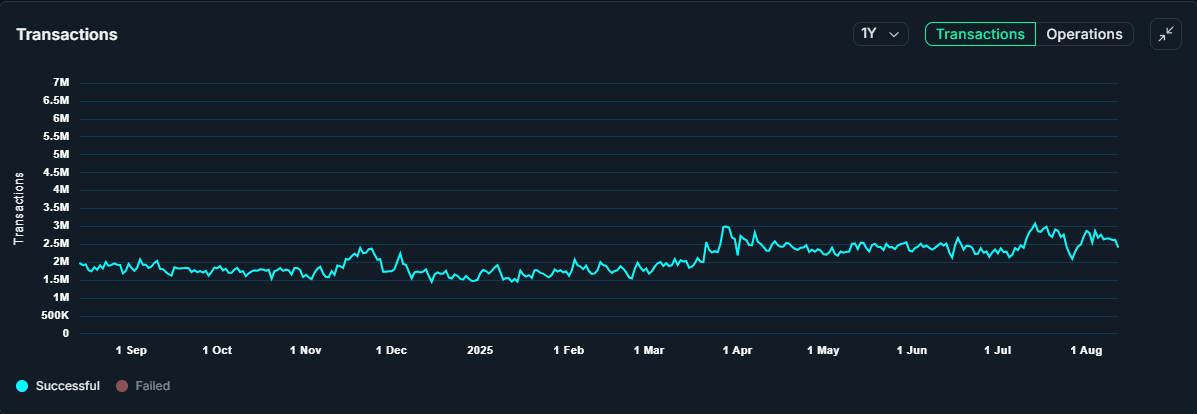

The network maintained stable daily transaction throughput between 1.5 and 2.5 million, with active address counts ranging from 60,000 to 90,000. Key spikes in March and July corresponded to major deployments and new partnerships.Together, these metrics reflect a maturing ecosystem capable of supporting complex DeFi, regulated financial products, and global payments use cases, positioning Stellar as a scalable and compliant platform bridging traditional finance and blockchain-native infrastructure.

Key Developments: H1 2025

The Stellar RPC launch represents a significant infrastructure upgrade for the Stellar network, introducing an Ethereum-style JSON-RPC endpoint that expands developer accessibility and tooling compatibility. Built atop the existing Stellar RPC stack, Stellar RPC enables Web3-native interfaces like eth_call, eth_getLogs, and eth_sendRawTransaction, streamlining interaction with Soroban smart contracts using familiar EVM conventions. This release bridges the gap for Ethereum developers, supports seamless wallet and dApp integration, and advances Stellar’s smart contract developer experience. By enhancing interoperability with existing Web3 infrastructure, Stellar RPC marks an important step in driving adoption and expanding the network’s programmable capabilities.

The Stellar Development Foundation (SDF) has partnered with OpenZeppelin to improve the security and usability of smart contract development on Soroban. This collaboration will bring OpenZeppelin’s battle-tested audit practices, secure development tooling, and standardized contract libraries to the Stellar ecosystem. As part of the partnership, OpenZeppelin is working to develop secure, reusable Soroban templates and contribute security-focused best practices for the developer community. The move strengthens the foundation for building secure, production-ready dApps on Stellar and signals growing institutional commitment to supporting a robust and composable smart contract environment.

PayPal announced the launch of its USD stablecoin, PYUSD, on the Stellar network, expanding the token’s multichain presence and advancing its utility in global payments and real-world asset settlement. The integration enables fast, low-cost transactions via Stellar’s efficient Layer 1 and positions PYUSD to serve as a bridge between traditional finance and blockchain-based payment solutions. This move also reflects growing institutional confidence in Stellar’s compliance-friendly infrastructure and performance characteristics. As one of the most recognized fintech brands globally, PayPal’s adoption of Stellar reinforces the network’s role as a foundation for regulated digital assets and enterprise-grade payment innovation.

Societe Generale-Forge selected the Stellar network to issue its MiCA-compliant stablecoin, EUR CoinVertible (EURCV), marking a significant milestone in Stellar’s enterprise adoption. EURCV will be deployed on Stellar to meet regulatory compliance and enable seamless settlement and interoperability across digital financial systems. This move reflects SG-Forge’s broader multichain strategy and highlights Stellar’s regulatory readiness, scalability, and alignment with institutional-grade financial infrastructure. The integration of a Euro-denominated stablecoin issued by a major European bank positions Stellar as a trusted platform for regulated assets and enhances its footprint within the real-world asset and compliant stablecoin sector.

Ecosystem

DeFi

FxDao introduced a decentralized DEX aggregator and governance layer designed for the network’s unique architecture. The platform enables efficient liquidity routing across Stellar-native AMMs, reducing slippage and improving capital efficiency for traders. FxDao also incorporates on-chain governance, allowing community members to influence protocol incentives and decision-making. By centralizing fragmented liquidity and promoting decentralized control, FxDao has continued to improve DeFi on Stellar. Blend, emerged in H1 2025 as a core protocol within Stellar’s evolving DeFi landscape. Blend enables developers and users to create and interact with isolated lending pools launched their V2 on Mainnet. On Blend, users can deposit to earn yield or borrow assets against overcollateralized positions. To protect lenders, each pool includes a backstop module—an 80/20 BLND-USDC fund that absorbs first losses in default scenarios. The protocol is governed by the BLND token, which incentivizes participation across pools and the backstop. Blend’s flexible design promotes safer, more inclusive lending tools and has already been integrated into applications that serve users traditionally excluded from financial systems. Blend has positioned itself as a foundational layer for DeFi on Stellar, driving increased user activity and composability across the ecosystem.

Enterprise & RWAs

Ondo Finance has announced the upcoming launch of its tokenized U.S. Treasury product, USDY, on the Stellar network. USDY is a yield-bearing stablecoin backed by short-term U.S. Treasuries and bank demand deposits, designed to provide institutional-grade exposure to real-world assets. By joining Stellar, USDY gains access to a scalable, low-cost blockchain optimized for global asset transfers and financial inclusion. The integration of USDY aligns with Stellar’s mission to bridge traditional finance and blockchain, enhancing its utility in cross-border payments, institutional DeFi, and regulated stablecoin use cases. Stablebond, a project from the team at Etherfuse and Secure Digital Markets group, has launched on Stellar, offering tokenized government bonds issued on-chain. These "stablebonds" represent sovereign debt from issuers like the U.S. and U.K., and are available to non-U.S. accredited and institutional investors. The bonds are backed by real-world Treasuries, offering predictable returns while leveraging Stellar's low-cost, fast-settlement infrastructure. This initiative expands Stellar’s real-world asset footprint by enabling direct access to high-quality sovereign debt instruments, democratizing access to global fixed income through blockchain rails.

The Stellar Development Foundation launched the Soroban Audit Bank, a security-focused initiative aimed at raising the standard for smart contract development on the Stellar network. The Audit Bank maintains a curated list of trusted auditors who are familiar with Soroban’s unique architecture, enabling teams to undergo pre-vetted code reviews and formal audits with funding support from SDF. This initiative is designed to accelerate secure adoption of smart contracts while minimizing vulnerability risks in mission-critical applications. The launch reinforces Stellar’s focus on secure, production-grade infrastructure, especially as Soroban adoption grows across financial use cases.

Bitbond has released a comprehensive guide on issuing tokens using Soroban smart contracts, aimed at streamlining tokenization for businesses and institutions. The guide walks through how to create, deploy, and manage a token on Stellar’s Soroban smart contract platform using pre-audited templates and modern dev tools. This initiative reflects Stellar’s increasing support for enterprise-grade tokenization, particularly in regulated sectors like RWAs and digital securities, by lowering technical barriers and accelerating time to deployment for asset issuers.

Protocol 23 a massive upgrade to Stellar network was announced for an H2 release. The upgrade introduces partial ledger archival, expanding the capacity for more complex contract logic and state management, while maintaining Stellar’s low-latency and low-fee model. It also optimizes resource metering and introduces a new fee model to ensure cost predictability for contract execution. As a result, developers can now deploy more robust applications directly on Stellar, signaling the network’s readiness for a new phase of on-chain programmability. The upgrade also unifies event streaming between Classic operations and Soroban contracts, enabling Classic operations to emit standardized events in the Soroban format. This improves consistency for asset movement tracking but introduces significant breaking changes to raw XDR data structures.

Huma Finance introduced the PayFi Ecosystem Map, highlighting a growing network of real-world asset projects, protocols, and issuers across multiple chains, including Stellar. The map positions Stellar as a key player in the on-chain payments and RWA ecosystem, especially in the context of asset-backed stablecoins and cross-border financial infrastructure. Stellar's inclusion underscores its expanding role in enabling programmable money and compliant financial primitives for enterprises and institutions seeking blockchain-native settlement. This recognition further aligns with Stellar's strategic positioning as a foundational network for RWA tokenization and payment interoperability.

Nansen and the Stellar Development Foundation have partnered to bring Nansen’s blockchain analytics suite to the Stellar network. This integration enables developers, institutions, and community members to gain insights into smart contract activity, token flows, and user behavior on Stellar and Soroban. Through Nansen Query and Nansen’s wallet labeling, the collaboration enhances transparency and data accessibility across the ecosystem. The partnership supports Stellar’s institutional and developer adoption goals by providing critical tooling for compliance, research, and ecosystem growth, reinforcing its role as a data-rich infrastructure layer for real-world blockchain applications.

FICC.ai secured a grant from the Stellar Development Foundation to build a platform for digital fixed-income securities issuance and tokenization. The company aims to develop a composable toolkit leveraging Stellar and Soroban to support regulated digital bond issuance with programmable compliance and atomic settlement. This aligns with Stellar’s broader push into real-world asset infrastructure, particularly in regulated fixed-income markets, and highlights Soroban's growing utility in enterprise-grade financial applications.

MoneyGram launched MoneyGram Ramps, a developer-first solution designed to simplify fiat-crypto interoperability. Built on the Stellar network, the API-based platform enables wallets, dApps, and exchanges to integrate seamless cash-to-crypto and crypto-to-cash flows via MoneyGram’s global retail footprint, covering 180+ countries and 30+ currencies. This expansion enhances access to Stellar’s on-chain ecosystem for underbanked users and furthers Stellar’s mission to support real-world financial inclusion. The launch also highlights the network’s growing enterprise-grade adoption and its strength as an infrastructure layer for regulated crypto-fiat interactions.

On-chain Data

Daily Transactions

Source: Nansen Query

Throughout H1 2025, the Stellar network demonstrated consistent transaction throughput, maintaining a stable and upward-trending baseline. Successful daily transaction counts remained within the 1.5 to 2.5 million range, with notable increases in mid-March and early July. These integrations contributed to increased usage and validated Stellar’s role as a scalable, production-grade blockchain for real-world asset issuance, payments, and stablecoin adoption. The sustained volume indicates growing confidence in the network’s infrastructure and highlights Stellar’s maturity as a high-throughput blockchain serving both retail and institutional use cases. Thoughts H1 2025 showcased Stellar’s emergence as a premier blockchain platform for regulated finance, real-world assets, and scalable smart contract applications. Institutional momentum accelerated with high-profile integrations from PayPal, Societe Generale, and Ondo Finance, reinforcing Stellar’s position as a trusted foundation for compliant stablecoins and tokenized financial products. Backed by consistently high transaction throughput, strong user retention, and dominant exchange activity, Stellar has firmly established itself as a leading Layer 1 purpose-built for global payments, asset issuance, and enterprise-grade DeFi. With a rapidly maturing ecosystem and a clear alignment with real-world financial needs, Stellar is poised to lead the next phase of blockchain adoption.