Disclaimer: Nansen has produced the following report in collaboration with Slice Analytics as part of its existing contract for services provided to Stellar (the "Customer") at the time of publication. While Stellar has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Stellar is an open-source, decentralized blockchain network designed to facilitate fast, low-cost cross-border payments and digital asset transfers. Created in 2014 by Jed McCaleb and the Stellar Development Foundation (SDF), it aims to bridge the gap between traditional financial systems and blockchain technology. Unlike traditional proof-of-work (PoW) or proof-of-stake (PoS) systems, Stellar uses the Stellar Consensus Protocol (SCP), a federated Byzantine agreement (FBA) model that ensures security and efficiency by allowing trusted nodes (validators) to reach consensus quickly without requiring energy-intensive mining. The network's native cryptocurrency, Lumen (XLM), is used for transaction fees and to prevent spam. Stellar also supports multi-currency transactions, allowing users to send payments in one currency while the recipient receives another through built-in automated forex conversion via decentralized exchange (DEX) functionality. Additionally, Stellar's Anchors act as on/off ramps, issuing tokenized fiat currencies or assets that can be seamlessly transferred across the network.

In H2 2024, the Stellar Development Foundation (SDF) introduced several key advancements to enhance the Stellar ecosystem. Galexie, the first component of the Composable Data Platform (CDP), enables efficient extraction and storage of Stellar ledger data, improving data retrieval speed and scalability while reducing reliance on Captive Core. Protocol 22, launched on December 5, 2024, introduced constructors for Soroban smart contracts and BLS12-381 cryptographic functions, enhancing contract efficiency and enabling privacy-focused applications. The Stellar Anchor Directory became browsable, facilitating seamless fiat-to-digital transactions across 180 countries, making blockchain more accessible. At the Point Zero Forum, SDF emphasized regulatory harmonization and highlighted blockchain-powered aid distribution by UNHCR in Ukraine. The Stellar Community Fund (SCF) 6.0 launched with Kickstart bootcamps, Build Awards, and accelerator partnerships to support ecosystem growth. A new Stellar Lab provided developers with an enhanced interface for testing and interacting with Stellar APIs. At Meridian 2024, LOBSTR, Blend, and Allbridge were honored with i³ Awards for their contributions to Impact, Innovation, and Interoperability, reflecting Stellar's growing role in DeFi, cross-chain connectivity, and financial inclusion.

Key Developments: H2 2024

- Stellar Development Foundation introduced Galexie, the first component of the Composable Data Platform (CDP). Galexie is a lightweight application designed to extract and store Stellar ledger data efficiently, decoupling data ingestion from transformation. It enables developers to export transaction metadata into a cloud-based data store, improving data retrieval speed and scalability while reducing reliance on resource-intensive tools like Captive Core. By compressing and organizing data optimally, Galexie facilitates faster and more cost-effective access to historical ledger data, benefiting applications like Hubble and Horizon. Running multiple instances can significantly speed up backfilling, with the entire 10-year Stellar Pubnet history being processed in under five days at an estimated cost of $600.

- Protocol 22 launched on Mainnet on December 5, 2024, after being tested on Testnet since November 12. This upgrade introduced constructors for Soroban smart contracts (CAP-0058) and support for BLS12-381 cryptographic functions (CAP-0059). Constructors streamlined contract initialization, improving efficiency, security, and developer onboarding by automating setup at deployment. BLS12-381 enabled advanced cryptographic operations like zk-SNARKs, facilitating privacy-focused applications such as anonymous logins (zkLogin, zkEmail).

- The Stellar Anchor Directory is now live to browse. The Anchor Directory bridges traditional finance with blockchain, enabling seamless fiat-to-digital asset transactions through banks, crypto exchanges, and money transfer operators. Anchors handle regulatory processes like KYC/AML, making blockchain more accessible, especially in underbanked regions. The newly released Anchor Network Map visualizes this extensive network, spanning 180 countries and facilitating fast, cost-effective cross-border payments.

- Stellar attended the Point Zero Forum, where SDF’s Chief Legal and Policy Officer, Candace Kelly, engaged in discussions on compliance and blockchain-driven aid. In a regulatory panel with industry leaders from Paxos, Binance, and others, she highlighted the challenges of integrating digital assets into traditional finance, emphasizing the need for global regulatory harmonization to reduce friction. The conversation also addressed the EU's new regulations, balancing innovation with consumer protection. In a separate panel on reimagining aid, Candace showcased how the UNHCR leverages the Stellar network to efficiently distribute aid in Ukraine, ensuring transparency, accessibility, and scalability. The discussion underscored key areas for improvement, including digital identity solutions, financial literacy, and connectivity.

- The Stellar Community Fund (SCF) entered its sixth iteration with a focus on strategic ecosystem growth, supporting projects from ideation to scaling. SCF 6.0 introduced Kickstart, a 5-day bootcamp that provided mentorship and up to $15K in funding for early-stage projects, and a revamped Build Award, which offered up to $150K in XLM for eligible projects. To foster post-launch success, SCF partnered with accelerators like DraperU, which granted $50K investments to startups. Additionally, Delegate Panels were implemented to enhance the funding process by leveraging expert input for project evaluation. The phased rollout began on September 4, 2024, with continuous enhancements, including accelerator collaborations and new pilot programs, extending into early 2025.

- Stellar released a new version of Stellar Lab. The new Stellar Lab is a modern, user-friendly tool for developers to experiment, test transactions, and explore APIs for interacting with the Stellar network. It offers features like easy account creation on Mainnet, Testnet, and Futurenet, access to Soroban RPC methods and Horizon endpoints, transaction simulation and submission, and the ability to save and share API requests. Stellar Lab also supports XDR ⇔ JSON conversion and is optimized for mobile use.

At Meridian 2024, the Stellar Development Foundation announced the winners of the inaugural i³ Awards, celebrating excellence in Impact, Innovation, and Interoperability within the Stellar ecosystem. LOBSTR won the Impact Award for its widely used non-custodial wallet, Blend received the Innovation Award for revolutionizing DeFi on Stellar with lending pools, and Allbridge earned the Interoperability Award for enabling cross-chain asset transfers across multiple blockchain networks.

Stellar announced a wave of large partnerships at Meridian, including MoneyGram announcing its new wallet built on Stellar, Stripe launching crypto payouts on Stellar, Mastercard announced the companies crypto credential solution used to verify interactions between consumers and businesses is coming to Stellar. Additionally Paxos announced they’ll be integrating with the Stellar by launching their USDL stablecoin, and Idris Elba debuted the Akuna Wallet targeting African creators in partnership with Chipper Cash and the Republic of Ghana

Ecosystem

DeFi

- Aquarius launched Soroban-based AMMs on Stellar Mainnet. Two types of pools — constant product and stable swap — are available for anyone to deploy.

BondHive, a financial automation platform, is now available on Stellar Mainnet. BondHive serves as a link between centralized trading and blockchain-based investments by securing funding fees from futures contracts to create yield-bearing tokens. Functioning similarly to zero-coupon bonds or fixed deposits, it allows investors to engage in predictable, stable yield opportunities ranging from 6% to 35% depending on market conditions.

CEX.io has integrated MoneyGram and the Stellar blockchain, enabling users to cash in and out of USDC at participating MoneyGram locations. This partnership expands fiat-to-crypto services in Europe, Africa, and Latin America, with plans for further expansion. Stellar's fast and low-cost blockchain technology facilitates seamless USDC-to-fiat conversions, enhancing payment accessibility. Additionally, a new euro-pegged stablecoin (EURT) will launch on Stellar, complying with the EU’s MiCA regulations.

In October 2024, Stellar partnered with Blockaid, a leading onchain security platform trusted by Coinbase and MetaMask, to enhance security across the Stellar ecosystem. The integration brings real-time threat detection to wallets like Lobstr and Freighter, including malicious dApp scanning, airdrop scam detection, and transaction risk assessments. With over 4.5 billion transactions scanned and $4B in losses prevented, Blockaid’s security infrastructure now operates automatically across Stellar's user interfaces, fortifying wallet safety as Stellar’s transaction volume continues to grow.

Enterprise & RWAs

- Paychant has integrated the Stellar Anchor Platform (SEP-24) to enhance fiat on/off-ramp solutions across Africa, enabling seamless USDC and XLM transactions for wallets and applications built on Stellar. This integration provides local payment options in Nigeria, Ghana, Kenya, and Uganda, allowing users to easily convert fiat to crypto through bank transfers, USSD, and mobile money.

- Validation Cloud launched Stellar Horizon Archive Nodes, enabling developers to access historical ledger data, transaction details, and account states from the Stellar network. Unlike standard nodes that only retain recent data, these Archive Nodes maintain a complete history, making them essential for applications requiring deep historical analysis of Stellar network operations. This allows developers, businesses, and researchers to efficiently query past transactions and account states, supporting use cases like auditing, compliance, and blockchain explorers.

Decaf Wallet now supports US accounts, allowing users to set up an account in just 2 minutes and receive USD as USDC. This feature enables users to receive payments or salaries from the US, get money from family and friends, or easily buy USDC, making cross-border transactions more seamless and accessible.

Etherfuse, a real-world asset (RWA) tokenization platform, raised a $3 million seed round at a $12.5 million valuation, co-led by White Star Capital and North Island Ventures, with participation from Stellar Development Foundation, FunFair Ventures, and others. This brings its total funding to $5 million, following a previous $2 million pre-seed round. Founded by David and AJ Taylor, Etherfuse focuses on tokenizing emerging market assets, particularly in Mexico, offering tokenized government bonds ("Stablebonds") from Mexico, Brazil, the EU, and the U.S. Currently live on Solana, Stellar, and Base, the platform has 10,000 Stablebond holders and $2 million in total value locked.

The Stellar Development Foundation was named a founding member of the newly launched RWA Foundation, a crypto-native initiative focused on establishing standards, utility, and adoption practices for real-world asset (RWA) tokenization. Incubated by Security Token Market, the foundation brings together leaders like Securitize, Ava Labs, Polygon Labs, and Maple to promote interoperability, multi-chain collaboration, and RWA market growth.

On-chain Data

Daily Transactions

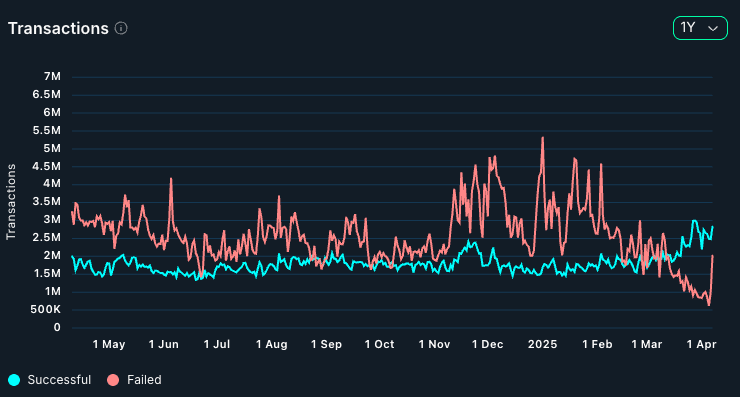

Note: Stellar transactions are not equivalent to industry standard transactions, on Stellar, operations are the fundamental actions that modify the ledger such as sending payments, updating account settings, or interacting with smart contracts—and are equivalent to what most blockchains refer to as transactions. A transaction on Stellar is a container that can bundle up to 100 operations. However, this report references transactions only, thus providing a reduced/conservative count of on-chain interactions.

H2 of 2024 was largely a period of consolidation for Stellar blockchain. From July until November, the daily transaction number was staying in the boundary between 1.5M and 2M - despite volatile market movements that caused many other chains to drop in statistics. Then, a breakout fueled by the announcement of the Protocol 22 update boosted the numbers above 2M daily range - peaking at over 2.4M on the 20th of November.

Daily Active Addresses

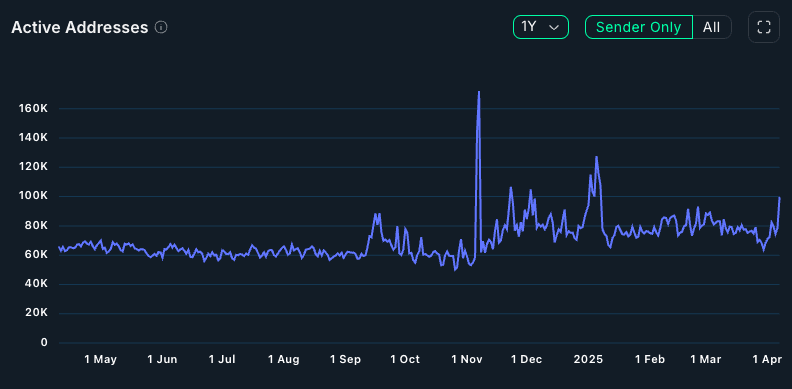

Active Addresses metric displays a significant breakout in user numbers starting in September. After a stable summer, where the average was hovering around 60K daily unique addresses, we saw a big breakout above 80k - which led to an even bigger breakout on 7th of November - potentially caused by anticipated positive shifts in the regulatory environment for crypto due to the US election. After the 172k peak, user numbers stayed in a significant uptrend eventually consolidating around an 80k mark until the end of the year. This increase of new users can likely be attributed to the recent surge that the Stellar Network has made in the real world financial realm, in thanks to both the election and corresponding regulatory victories.

Top Entities

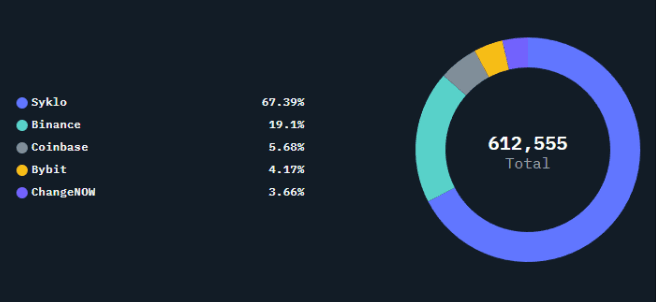

The Top Entities chart provides us with a comprehensive way to analyze projects based on the amount of users and transactions. In H2 2024, the most utilised on-chain entity was Syklo - a P2P solution allowing users to buy, sell and exchange currencies. Its smart contracts were responsible for over 67% of the entire Stellar unique user base, with almost 500K transactions over the period. The rest of the Top 5 is claimed by centralized exchanges - respectively Binance, Coinbase, Bybit and ChangeNOW. This shows a big impact of the CEX market on the chain inflows and outflows - and corresponding with user base numbers being on the rise, we can expect some of these numbers to shift towards on-chain decentralized alternatives in 2025.

Closing Thoughts

H2 2024 was a pivotal period for the Stellar ecosystem, marked by significant technological advancements, regulatory engagement, and growing adoption across DeFi and enterprise applications. The launch of Protocol 22, with its enhancements to Soroban smart contracts and privacy-focused cryptographic functions, has positioned Stellar as a more developer-friendly and versatile blockchain. Meanwhile, Galexie’s introduction revolutionized data handling, making ledger history access more efficient and scalable. Stellar’s real-world impact was further demonstrated through the expansion of the Anchor Network, providing seamless fiat-to-digital asset transactions in 180 countries, and initiatives like the UNHCR’s blockchain-powered aid distribution in Ukraine, showcasing the network’s ability to drive financial inclusion. Additionally, the Stellar Community Fund 6.0 and its partnerships with accelerator programs underscored the growing support for ecosystem innovation, fueling a new wave of blockchain startups. On-chain metrics reflected this momentum, with a steady rise in daily transactions and active addresses, especially after major announcements and global events like Devcon 2024. The increasing participation of centralized exchanges and DeFi protocols suggests a maturing ecosystem, with growing potential for decentralized alternatives to emerge in 2025. Looking ahead, Stellar is well-positioned for continued growth as it refines its infrastructure, expands cross-chain interoperability, and strengthens partnerships within both the blockchain and traditional financial sectors. With a strong focus on regulatory compliance, developer tools, and real-world utility, Stellar remains a key player in the evolving financial landscape, bridging the gap between blockchain technology and global finance.