TLDR

Sudoswap can be considered as the Uniswap v3 for NFTs. It utilizes a bonding curve similar to Uniswap’s x*y=k and users can buy and sell from AMM pools instead of a single order book like OpenSea.

Either a constant, linear, or exponential bonding curve is required for each pool. These parameters will determine how much the price will rise or fall as more NFTs get bought or sold into the pool. Linear curves will increase or decrease by a specific amount of ETH while exponential curves will increase or decrease by a specific % after each buy or sell.

- Sudoswap allows for the creation of 3 different types of pools:

- Buy pools will buy NFTs. Users can deposit ETH and receive NFTs as traders swap with the pool.

- Sell pools will sell NFTs. Users can deposit NFTs and receive ETH as traders trade with the pool.

- Trade pools will both buy and sell (market make). Liquidity providers will deposit both ETH and NFTs and receive trading fees as traders swap with the pool.

Users can dollar cost average (DCA) in or out of a collection via pools and bonding curves.

Users can instantly sell their NFTs on the available liquidity from pools without having to wait for bids to come in like OpenSea.

It is significantly cheaper to sell on Sudoswap as it bypasses creator royalty fees and the protocol also only charges a 0.5% marketplace fee.

Sudoswap enables liquidity providers or large NFT owners to earn trading fees.

Introduction

With its highly anticipated launch in early July, Sudoswap has taken the crypto community by storm with its novel automated market maker (AMM) mechanism for NFTs. By applying a fully on-chain AMM model to NFTs, it allows users to trade and swap NFTs using liquidity pools. The protocol also enables instant liquidity and allows for royalty-free trading.

The primary problem Sudoswap aims to solve is liquidity for NFTs. Liquidity is important as it creates more efficient markets (trading volume) resulting in lower slippage and ultimately happier traders. It also allows for more primitives to be built on top of Sudoswap. The current state of NFTs makes it a challenging asset class for market participants who trade in size. This is exactly where Sudoswap comes in. It removes the need to pick individual NFT pieces and enables buying and selling in size. This unlocks a huge potential as it makes for a much more efficient and liquid NFT market. At the end of the day, some would argue that NFTs are primarily used for speculation and are just alt-coins with pictures.

Most NFT traders are primarily speculating on NFTs and are simply treating them as vehicles to make money. People often talk about sweeping floors and if we drill down to it, this translates to buying NFTs at the current price to sell higher at some future date. The NFT market is akin to buying altcoins but they just happen to be more illiquid (no instant liquidity unlike tokens) and incur higher slippage (royalty +marketplace fees). Sudoswap completely changes the landscape by providing instant liquidity for NFTs and removing royalty fees.

Protocol Design

By enabling the creation of liquidity pools via bonding curves, Sudoswap makes aggregation and execution at scale more efficient and simpler. Think of Sudoswap as the Uniswap v3 but for NFTs. It utilizes a bonding curve similar to Uniswap’s x*y=k and users can buy and sell from AMM pools instead of a single order book like OpenSea.

You can deposit tokens and/or NFTs depending on if you want to buy, sell or provide liquidity for a specific collection.

Sudoswap allows for the creation of 3 different types of pools:

- Buy

- Buy pools will buy NFTs. Users can deposit ETH and receive NFTs as traders swap with the pool. The pool is always ready to provide a quote to buy NFTs with its ETH.

- Sell

- Sell pools will sell NFTs. Users can deposit NFTs and receive ETH as traders trade with the pool. The pool is always ready to provide a quote to sell its NFTs for ETH

- Trade

- Trade pools will both buy and sell (market make). Liquidity providers will deposit both ETH and NFTs and receive trading fees as traders swap with the pool. The pool will provide quotes for both buying and selling of NFTs

Bonding Curve

When creating a pool, either a constant, linear, or exponential bonding curve needs to be selected. These specific parameters will determine how much the price will rise or fall as more NFTs get bought or sold into the pool. Linear curves will increase or decrease by a specific amount of ETH while exponential curves will increase or decrease by a specific % after each buy or sell. Note that a delta of 0 can be inputted if one does not wish to use a linear or exponential bonding curve.

Buy pool example with exponential curve:

Say a buy pool is created with 100 ETH with a starting price of 10 ETH for collection NFT X with an exponential curve of 10%. Any owner of the NFT X collection can sell their NFTs into the pool at 10 ETH for the first one, the second one for 9 ETH, the third for 8.1 ETH, and so on until the pool gets depleted of its ETH. As the supply of NFTs increases , the willingness to pay for an additional NFT goes down along with its price. This is what the bonding curve controls

Sell pool example with linear curve

Say a sell pool is created with 10 NFTs and a starting price of 10 ETH for collection NFT X with a linear curve of 1 ETH. Any buyer can come into the pool and purchase their first NFT at 10 ETH, second one for 11 ETH, third for 12 ETH, and so on until the pool gets depleted of all NFTs. The price should naturally increase as the supply goes down and there are fewer NFTs to sell. This is what the bonding curve controls.

Sudoswap UX/UI

On Sudoswap, every NFT collection consists of many individual pools of NFTs. Each pool is managed by one liquidity provider and is parameterized by a custom bonding curve. Traders can then pick a single pool to trade with or across multiple pools with the help of Sudoswap’s aggregator. Depositors create isolated pools that are indexed and selected for optimal trades by the front end. In terms of user experience, it works like any other NFT marketplace like Genie or Gem where users can quickly add NFTs to their shopping cart. All the various pools get routed and aggregated to the collection homepage.

Advantages of Sudoswap

- Fully decentralized on-chain marketplace with no censorship

- Users can create bonding curves that automatically adjusts the selling and buying price

- Users can specify things like “if my first NFT sells at 5 ETH, try to sell the next one for 5.5 ETH. On an orderbook-based exchange like OpenSea, this would not be possible, and listing prices will need to be adjusted manually

- Users can dollar cost average (DCA) in or out of a collection via pools and bonding curves

- If a user has 10 Azukis but does not want to sell them all at floor prices, they can create a bonding curve that gradually increases in price as more NFTs get sold. This allows users to efficiently scale out of an NFT position. Vice versa, if a user is trying to buy the dip they can scale in a position as the price goes down

- Users can instantly sell their NFTs on the available liquidity from pools without having to wait for bids to come in like OpenSea. Users who also own a lot of floor NFTs can easily bulk sell

- On OpenSea, users only have instant liquidity if they receive an offer on their specific NFT. Without an existing offer, the only way to sell is to undercut the current floor and price your NFT below in hopes of someone buying it. This can easily cause a cascade where sellers keep undercutting each other

- Users can make collection offers with customized bonding curves

- Say an NFT collection just launched and the price is overbought at a 10 ETH floor price. A user who wants to buy 2 NFTs at 8 ETH each with a constant curve can essentially create a limit order by depositing 16 ETH and when the floor price hits 8 ETH, Sudoswap will execute and automatically buy 2 NFTs

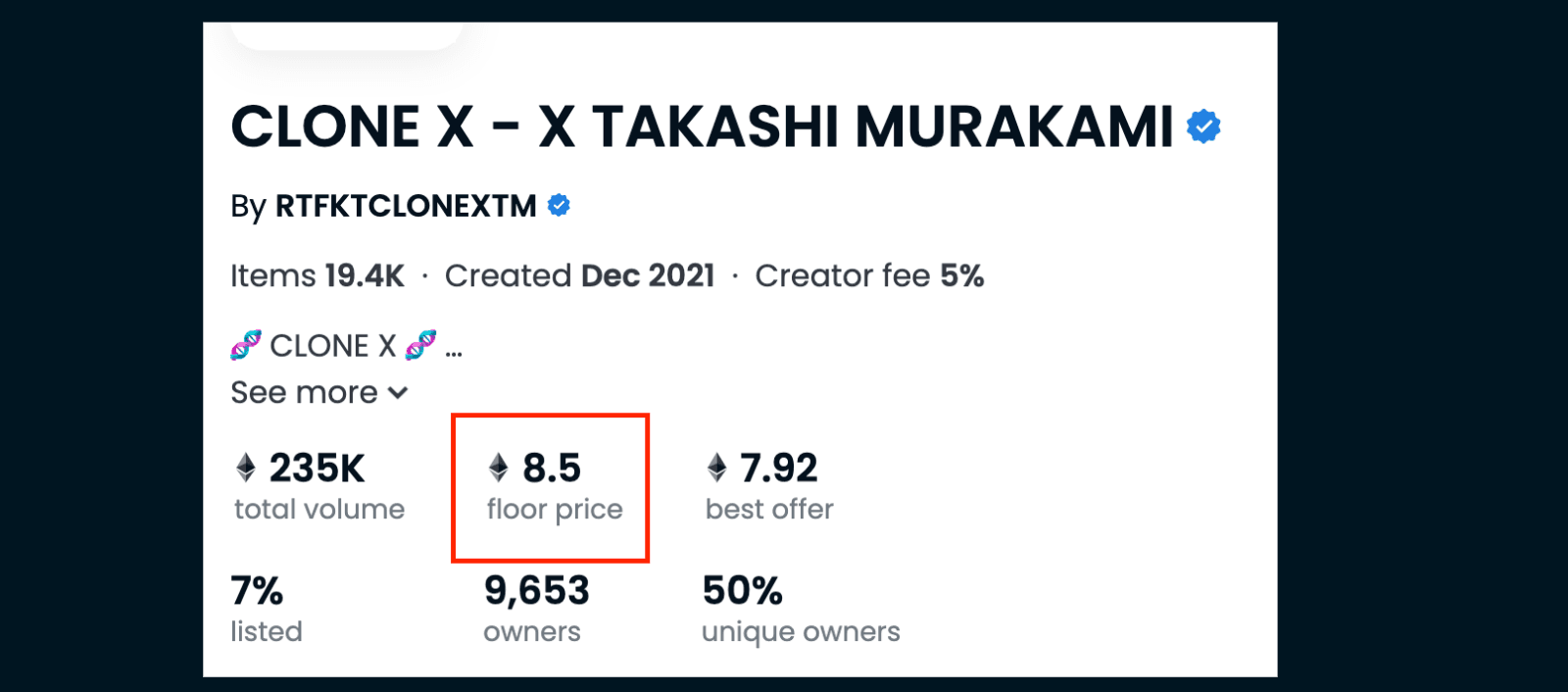

- It is significantly cheaper to sell on Sudoswap as it bypasses creator royalty fees and the protocol also only charges 0.5% marketplace fee

- The current floor price of a CloneX on OpenSea is currently at 8.5 ETH. If an owner was to sell on OpenSea, they would net 8.5 ETH 0.925 = 7.86 ETH after accounting for 5% royalties and 2.5% marketplace fees. On the other hand, they could list their CloneX at an even lower floor price on Sudoswap for 8.05 ETH and still manage to net more ETH. 8.05 ETH 0.995 = 8.01 ETH (0.5% marketplace fees). Due to the significant spread, there is a large financial incentive for traders to transact on a marketplace like Sudoswap which completely eliminates royalty fees. As a buyer, they can also save 0.45 ETH from transacting on Sudoswap vs OpenSea.

- Ability for liquidity providers or large NFT owners to earn trading fees

- At a glance, LPing in pools may appear as offering exit liquidity. But for the exact same reason ERC-20 token holders want to LP, LPs on Sudoswap can earn hefty trading fees

- Here is an example of a pool where a user deposited 10 Azukis along with 64.85 ETH into a Sudoswap pool 76 days ago. The pool was set with an exponential bonding curve with a delta of 2%. Without accounting for the increase in floor price, the pool has made 43.7 ETH simply from trading fees. Annualized, the liquidity provider is making 147% APR on their ETH. This shows how powerful LPing into Sudoswap pools are for hot collections that trade a lot of volume

- Aggregators like Gem or Genie can take advantage of Sudoswap’s pricing and give users who may not be familiar with Sudoswap better pricing when available

- Creators can easily launch NFT projects by creating an NFT only pool and setting their price bonding curve

Disadvantages of Sudoswap

- Sudoswap does not support filtering of NFT traits or rarities

- Sudoswap requires users to pay gas when creating pools or listing their NFTs

- Setting up pools is a complex task for retail NFT traders in comparison to just listing and buying off a centralized NFT marketplace like OpenSea

- The primary audience of Sudoswap generally caters more to traders, crypto natives, and DeFi users

Protocol Metrics

Since inception, Sudoswap has done $64.8m in volume and has amassed $321k in fees with 33.5k total users. A total of 34.8k pools have been created and 225k NFTs have been traded thus far

Although Sudoswap experienced exponential growth in August, metrics like volume (measured in ETH), the number of users, and the number of transactions have fallen dramatically in September and have plateaued in October thus far. Though the decline in metrics is not exclusive to Sudoswap, other NFT marketplaces have experienced similar declines.

Another possible explanation for the drastic drop could be the announcement of the SUDO token on 2 September. Given how a lot of users were likely using the protocol in hopes of receiving an airdrop, speculative users will have no incentive to continue using the protocol post-announcement.

Sudoswap vs LooksRare vs X2Y2

Compared to other notable marketplaces like LooksRare, Opensea, or X2Y2, marketplace fees on Sudoswap are significantly lower at 0.5% compared to 2-3% which already makes it a more attractive marketplace to trade on. Secondly, because Sudoswap does not honor creator royalties, sellers are able to save up to 10% in additional fees. OpenSea’s metrics were purposely left out to avoid skewing the data.

Main Observations

- Ever since the launch of Sudoswap, the protocol has overtaken LooksRare in all 3 metrics whether it be volume traded, users per week, or transactions per week. Meanwhile, X2Y2 continues to outperform Sudoswap in all 3 metrics, given their low marketplace fees and easy to navigate UI

- Since launch, Sudoswap experienced exponential growth up until the announcement of their SUDO token.

Tokenomics

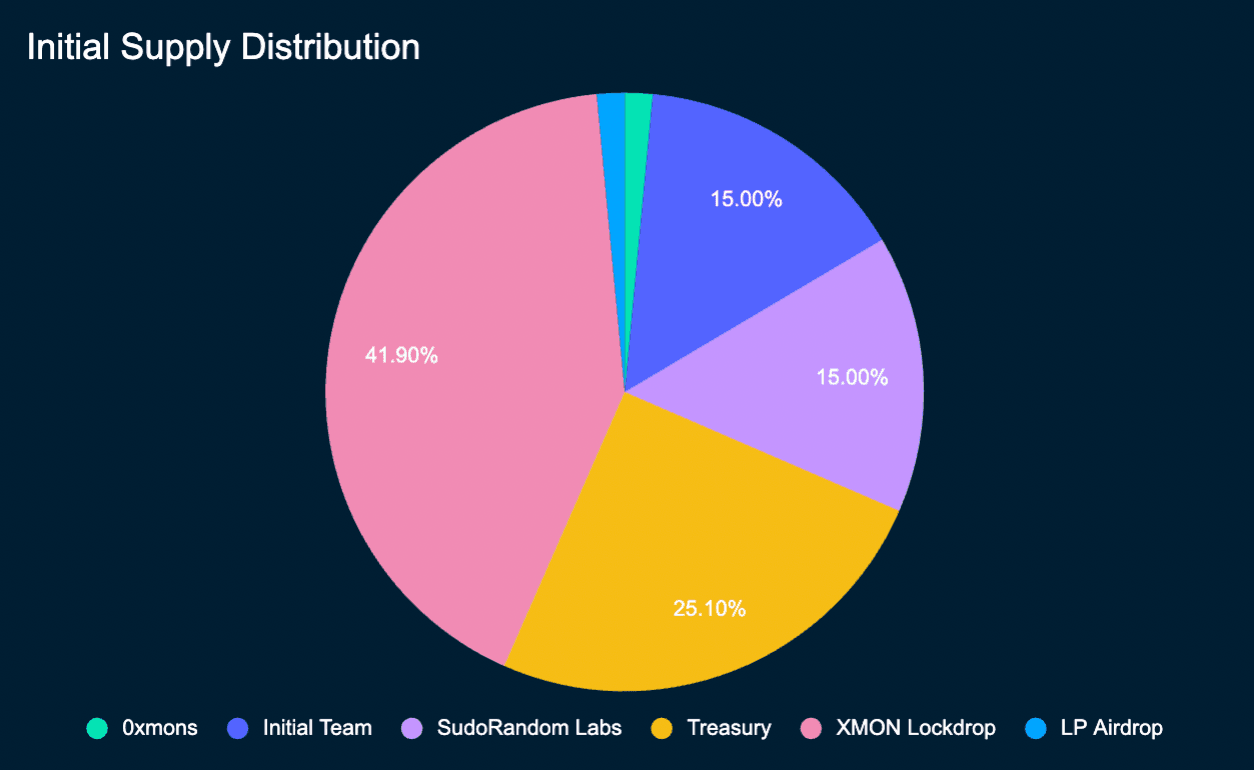

With the announcement of the SUDO token, 41.9% of the supply will go towards the XMON lockdrop. Holders are required to lock their XMON for 3 months in order to receive SUDO tokens. The SUDO that is not distributed during the lockdrop will go back to the treasury. There are currently no concrete plans on how the treasury will be used but some preliminary ideas include grants for future contributors/integrations/tooling, bug bounty programs, and liquidity. Surprisingly, there has been no mention of any incentives. Governance will also be able to mint more SUDO to the treasury if needed, up to a maximum inflation cap of 10% a year. The initial team will receive 15% of the supply with a 1-year cliff and a 3-year vest.

Valuation

At the time of writing, the XMON token at $25k equates to a market cap of $65m. $65m/0.419 = implied FDV of $155m for SUDO. X2Y2 has a FDV of $105m while LOOKS FDV is at $217m. In comparison, OpenSea’s last valuation round in Jan 2022 was $13.3b Based on these metrics, it may indicate that Sudoswap is trading at a discount against LOOKS, given that Sudoswap’s underlying fundamentals surpasses that of LooksRare.

While X2Y2 trades cheaper compared to Sudoswap with arguably better metrics, it is important to note that X2Y2 and LOOKS have questionable tokenomics that incentivize wash trading. Meanwhile, Sudoswap has done over $65.2m in volume and amassed 249 ETH in protocol fees without any token incentives.

Put simply, Sudoswap is able to attract volume and liquidity without having to introduce any inflationary tokenomics, unlike its counterparts.

On-chain Data

Interesting wallets

The wallet labeled as ‘heavy dex trader’ was a newly funded wallet from Amber OTC that started TWAPING into XMON since 11 Oct 2022. They have accumulated 27 XMON (~$675k) thus far. This is most likely Amber Group executing on behalf of their client(s) to buy XMON.

One of the top depositors in the xXMON pool , Sigil Fund has been accumulating XMON and staking it for almost 3 months at the time of writing. In fact, they increased their XMON position by 83% by buying 24 XMON on the same date of the SUDO tokenomics being released and subsequently staking it.

XMON Staking

19% of the circulating supply or 475 XMON is currently being staked.

Most of the top depositors first staked over a year ago into the xXMON pool. In addition, most wallets have never unstaked and those who did, unstaked months ago.

Plug & Play Smart Alert: >$50k XMON outflow either from xXMON pool unstaking or removing liquidity from XMON-WETH or XMON-USDC pool.

Smart Money

Smart Money balance and number of Smart Money wallets are on a steady uptrend.

Smart Money top holders of XMON have generally had no change in the last 30 days. A majority of them have held onto their tokens and even when selling, have sold a nominal amount relative to their position size

Plug & Play Smart Alert: Smart Money XMON holdings greater than $25k

Catalysts

- Sudoswap has no VCs so any funds who want exposure will be forced to buy on the open markets.

- XMON/SUDO could be a narrative that funds or investors get attracted to as they can bet on NFT infrastructure and get exposure vs making individual bets on specific NFT collections. Those who are bullish on NFTs as an asset class in the future can buy XMON/SUDO and not have to worry about picking the right NFT collection

- DeFi investors may invest in Sudoswap because they understand the importance of having liquidity for NFTs and the AMM protocol design

- Unit bias once SUDO token launches.

- 1 XMON locked will equate to 10k SUDO

- Assume the circulating supply of XMON (2511 tokens) gets locked, $155m FDV/60m tokens = $2.60 SUDO token

- Retail and degens will be much more likely to ape into a token that is trading at $2.60 than a token that is trading at $25k as it appears to have more “upside”

- Since every NFT always has floor liquidity, DApps can create products by executing instant liquidations on Sudoswap. This allows for new primitives to be built on top of Sudoswap

- Once NFT aggregators like Gem/Genie start integrating Sudoswap, more volume should flow into Sudoswap and away from Opensea

- In Scott’s (ead of Uniswap NFT and founder of Genie) thread, he is basically saying the Sudoswap design that focuses on solving liquidity makes sense and he expects more volume to flow through Sudoswap. Competitors like OpenSea will need to change their business model in order to remain competitive and avoid seeing their market share erode

- Future NFT projects may utilize Sudoswap to launch mints using LBP style auctions (liquidity bootstrapping pool) where the price of NFTs are designed to go down over time

- This prevents bot snipes and offers more organic price discovery on NFT mints

- Artists can show commitment/conviction for their project by owning their own liquidity (pairing their NFTs with ETH); essentially offering exit liquidity to the community

Risks

- There is a lack of product market fit and volume dies off

- Protocol only becomes popular among crypto natives/degens and is not able to reach escape velocity with retail NFT traders

- There is a learning curve for retail users to learn how to create pools vs buying/selling on traditional marketplaces like OpenSea

- There is a lack of demand for users to LP NFTs and ETH

- Pools get drained via smart contract risk

- Protocol gets vampire attacked and starts offering token incentives to attract liquidity away and capture market share; analogous to what LooksRare did to OpenSea (likely a temporary risk)

- The largest risk Sudoswap faces seems to be the NFT community becoming against 0% creator royalties

- People have often compared royalties to the tipping culture in the US, in hopes of NFT owners upholding the culture of paying royalties to artists in web 3. Tipping is not mandatory but it has become a social contract where the vast majority of people will tip. However, it's arguable that in an anonymous situation, there will always be a significant amount of NFT owners that will refuse to honor the social contract of royalties. Thus, there will always be demand for collections to transact on marketplaces that do not honor royalties. In addition, the current state of the NFT market is still primarily speculators trying to make money. Sudoswap will always have a competitive edge over other marketplaces that honor royalties as people will always go where the fees are lowest.