Introduction

The 'Pendle Wars' refers to Equilibria and Penpie seeking to accumulate PENDLE and liquidity on Pendle Finance. This PENDLE is then locked as vePENDLE, which grants holders a share of the revenue generated on Pendle Finance, increases yield to LP positions, and gives governance over the protocol’s emissions.

But what is Pendle Finance?

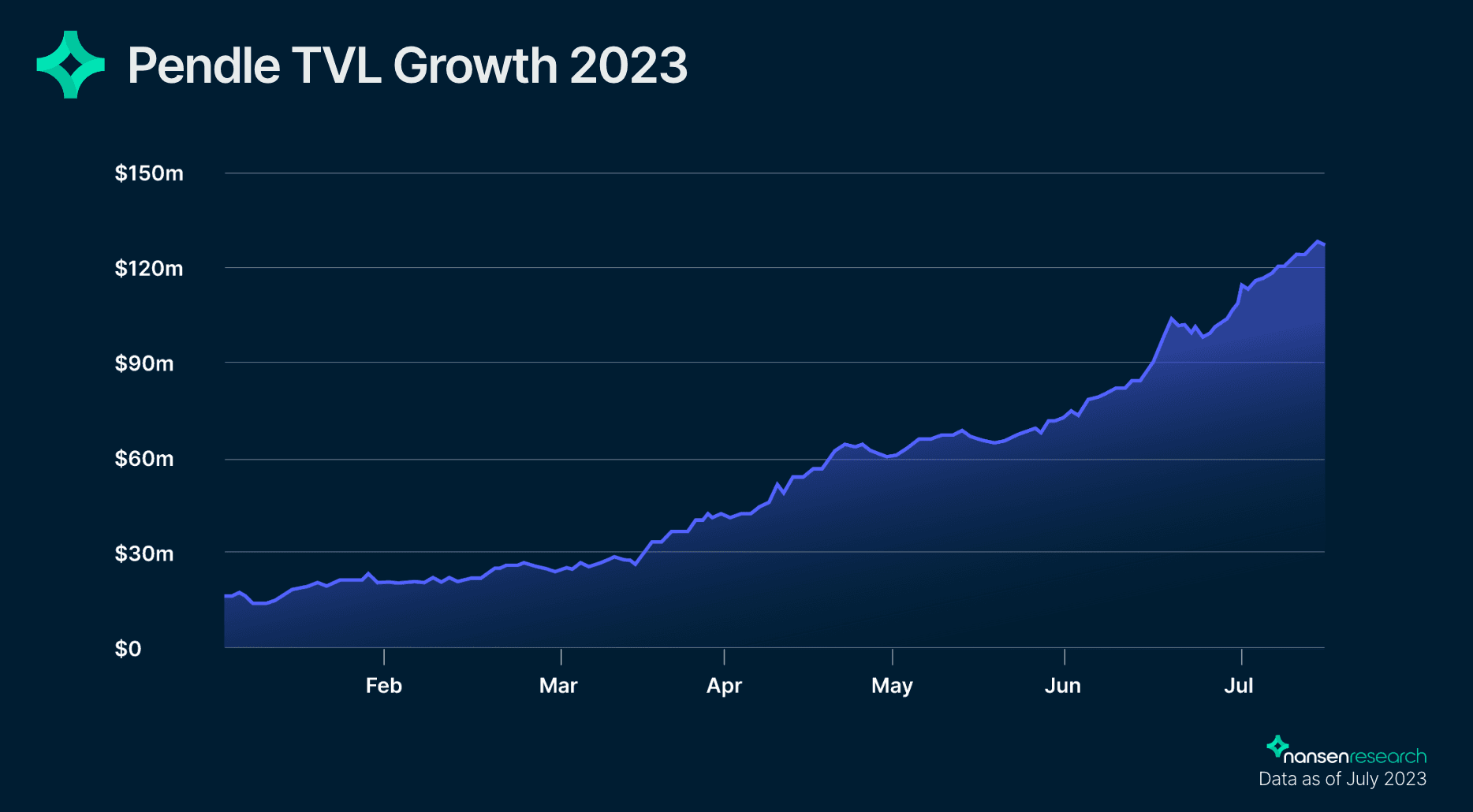

Pendle Finance enables the yield-trading of yield-bearing crypto assets based on the concepts of bonds. This has resulted in the rapid TVL on Ethereum and Arbitrum, which has increased almost 10x since the start of the year.

Pendle Finance splits the underlying yield-bearing asset into its principal and yield tokens, allowing investors to buy assets at a discount and earn a fixed yield to maturity, long the yield based on future expectations, or employ a mix of these strategies. In addition, Pendle has a custom AMM for trading these yield tokens. Learn more about Pendle with Nansen’s report here. Since the release of the report, Pendle has increased in price significantly.

‘Pendle Wars’ have ensued this year, given Pendle’s impressive TVL and popularity growth. The main protocols in the Pendle Wars at present are Penpie and Equilibria. These protocols are to Pendle what Convex is to Curve, and Aura is to Balancer. Essentially, they are protocols that accumulate PENDLE to gain disproportionate voting power over emissions as well as receive revenue.

Pendle Ecosystem Coins

For reference, here are the market caps for the Curve and Balancer ecosystems. Pendle is obviously far behind these, and it remains to be seen if it will reach such a scale.

Diving into a further comparison between these ecosystems and Pendle, here are the relative valuations of ecosystem yield protocols.

As you can see, Equilibria and Penpie have lower relative valuations than their blue-chip counterparts. While this may imply an attractive valuation, note that their combined FDV is around 20%, exceeding that of Convex but still far behind Aura. This suggests that there is room to grow by this metric. That said, it is difficult to be bullish on either project without being bullish on Pendle - their success depends on the growth and continued success of Pendle itself.

How vePENDLE Revenue Distribution Works

On Pendle Finance, vePENDLE holders receive yield from three sources:

- 80% of swap fees,

- 3% fees that the protocol collects from all yield accrued by Yield Tokens, and

- A portion of the yields after the maturity of unredeemed PT/YT tokens.

Revenue is distributed pro rata based on voting weight and vePENDLE balance and comes in USDC. As a result, it is highly desirable for anyone bullish on Pendle Finance to acquire these ve tokens. In addition, enhanced rewards are paid to LPs that have vePENDLE as well.

The Rationale for Using Yield Protocols

Ve tokenomics favor whales, which has resulted in ecosystem protocols such as Convex and Aura that enable easier access to the benefits. This is because rewards in the form of protocol revenue and yield boost are dependent on how much PENDLE you lock. Locking up capital like this is an unrealistic option for most participants. Enter the yield protocols; Equilibria and Penpie.

Users that deposit PENDLE in these protocols receive a liquid PENDLE derivative e.g. mPENDLE (Penpie) and ePENDLE (Equilibria). This can be staked to receive rewards. The protocols max lock the PENDLE as vePENDLE to maximize revenue.

Furthermore, users can earn greater yield by LPing through these platforms. This is because LPs on PENDLE can gain boosted yields depending on how much vePENDLE they have locked. Protocols like Equilibria and Penpie accumulate large shares of vePENDLE to provide LPs on their platforms with boosted yields. The more LPing and PENDLE that these protocols acquire, the greater the yields and revenue that they can distribute to their participants. This acts as a flywheel and is the reason for the monopolistic and oligopolistic market structure that arises from these protocols.

Bribes

Protocols may want to incentivize their liquidity on Pendle. To do so, they can pay ‘bribes’ to the protocol (i.e. vePENDLE holders), which serves as additional revenue to vlEQB and vlPNP holders.

For Protocols/Whales

vlPNP and vlEQB holders gain voting power over Penpie’s vePENDLE. This can enable more cost-effective participation in Pendle governance than outright buying and locking PENDLE. This is because PENDLE is locked for the maximum time (2 years) to maximize yield. This is difficult for normal users to justify doing.

Users interested in participating in Pendle Finance's governance can buy voting power more cost-effectively through PNP or EQB.

vePENDLE

At present, Equilibria and Penpie hold the greatest amount of vePENDLE. Equilibria have slightly more, and it will be interesting to see what protocol will gain dominance. In other markets, there has been a winner take all dynamic e.g Curve; however, the Balancer Wars have been more oligopolistic, with the whale ‘Humpy’ actually holding more veBAL than Aura itself (34% and 33%, respectively).

Penpie Smart Money

Check out the Smart Money addresses with the largest PNP holdings. These addresses are holding spot PNP and do not include those with vlPNP. Outflows of PNP may be attributable to vote locking.

Here are the largest vlPNP holders. These wallets are arguably more committed to the ecosystem than the PNP holders.

Equilibria Smart Money

Here are the largest Smart Money holders of Equilibria on Arbitrum. Note that Smart Money holdings are substantially lesser for EQB than PNP, which may suggest a preference of Nansen Smart Money towards PNP at present.

Here are the EQB vote lockers, with the top 3 notably large:

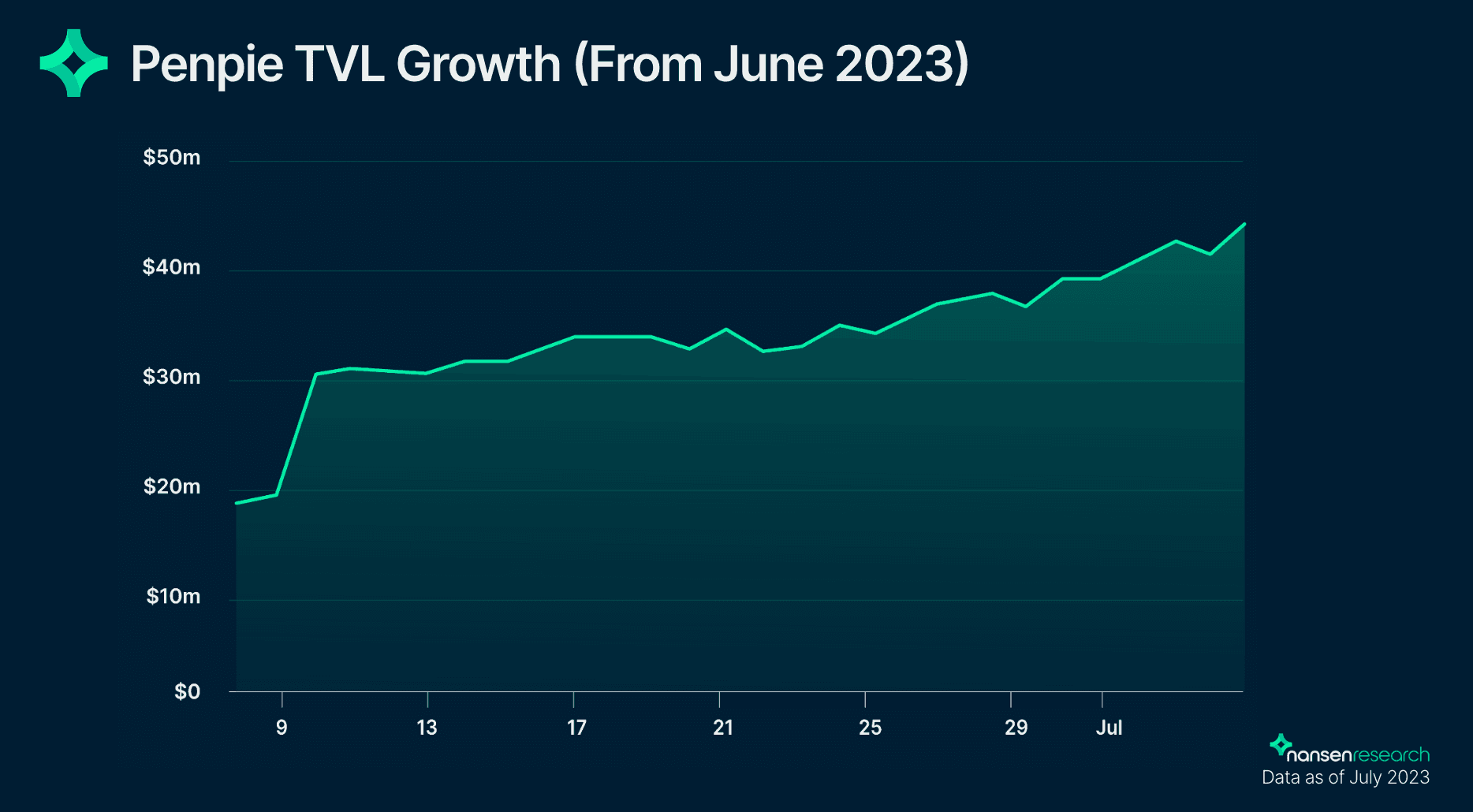

Penpie TVL

TVL has followed a general up-only trajectory since its launch a month ago. However, as noted above, Equilibria has slightly more vePENDLE. Penpie has achieved a greater TVL through liquidity providers depositing through their platform.

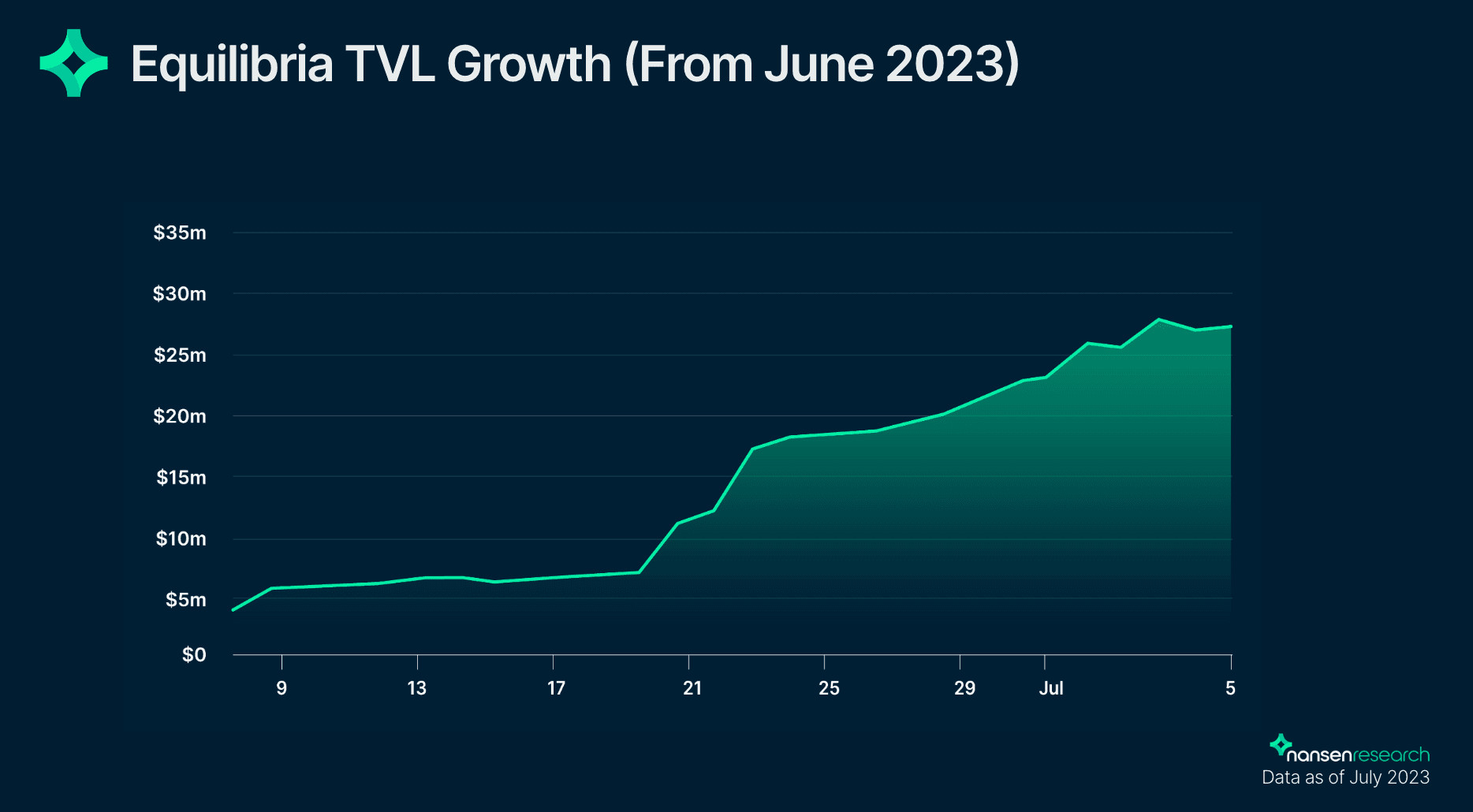

Equilibria TVL

The TVL has also followed a general up-only trend. However, it lags Penpie by around 25% at the time of writing. That said, it is still very early days for both protocols, and TVL remains relatively low for both. As mentioned above, it holds more vePENDLE than Penpie at the time of writing.

Penpie Revenue

Here is the current planned distribution of Penpie's revenue from Pendle Finance:

Boosted yield from farming on Pendle:

- 83% to the LPs

- 12% to mPENDLE

- 5% to vlPNP holders (as mPENDLE).

Boosted SY reward yield from liquidity farming on Pendle

- 83% to LPs

- 17% as autoBribe for the bribe market.

Equilibria Revenue

Equilibria currently has a 22.5% fee on its PENDLE revenue. This 22.5% is distributed as follows:

- ePENDLE stakers - 12.5%

- vlEQB - 7.5%

- Treasury - 2.5%

Risks

Participating in any DeFi protocol is risky, and yield protocols add another layer of smart contract and governance risk to users. Protocol audits seek to mitigate these risks, however, it does not guarantee the protocol is free from vulnerability.

Audits

Check out the audit report for Penpie here (WatchPug) and Equilibria here (WatchPug) and here (Peckshield).

Pendle has captured a lot of attention and has been one of the most successful DeFi protocols this year. For those bullish on Pendle, it may be worth looking into the ‘pick and shovel’ supporting protocols Equilibria and Penpie that seek to maximize yield for their users. The report compares the data between the two protocols, including Nansen’s proprietary Smart Money labels. At present, there is little separating the protocols, and time will tell if one emerges as a big winner or if they move in lockstep together. Nonetheless, their success is tied to that of Pendle, which makes them Pendle meta plays for now.