Overview

TRON is a high-performance blockchain platform designed for decentralized applications and smart contracts, with a focus on high throughput, low transaction costs, and scalability. Built on a Delegated Proof of Stake (DPoS) consensus mechanism, TRON has established itself as one of the largest blockchain networks by transaction volume and user activity, supporting a diverse ecosystem of DeFi protocols, stablecoin transfers, gaming applications, and cross-chain infrastructure.

Recognized for its low transaction costs and fast settlement speeds, TRON has established itself as the world's leading liquidity rail for stablecoins and a burgeoning hub for Real-World Assets (RWA) and decentralized finance (DeFi). Settling trillions in stablecoin value annually, Tron has evolved from a retail-focused network to a critical layer of the global digital economy.

Q4 2025 was a quarter of significant infrastructure maturation and ecosystem deepening for TRON. During this period, the network completed testing and validation of the GreatVoyage-v4.8.1 (Democritus) upgrade on the Nile testnet, enhancing system compatibility with ARM architectures and optimizing P2P network performance to support institutional-grade workloads. Despite a challenging market environment, the network's fundamental metrics hit all-time highs: total accounts grew by 26% year-over-year, and the network solidified its dominance by settling over $7.9 trillion in USDT transfer volume throughout 2025. The quarter was characterized by a strategic pivot toward institutional-grade DeFi and RWAs, highlighted by the explosive growth of the SunX decentralized perpetual exchange.

Key Developments: Q4 2025

- In November 2025, the TRON mainnet successfully completed deployment of the GreatVoyage-v4.8.1 (Democritus) upgrade, following prior validation on test networks. This critical update introduced native support for ARM architecture, significantly lowering operational costs for node operators and expanding hardware compatibility. The upgrade also included a major overhaul of the P2P network to prevent malicious connection occupation and enhance node synchronization stability, alongside EVM compatibility improvements via the SELFDESTRUCT instruction update.

- Tron reinforced its position in the derivatives market with the rapid ascent of SunX (formerly SunPerp). Through a "Trade to Earn" campaign concluded in early December, the platform recorded over $410 million in trading volume, with total volume surpassing $9.5 billion. This move aims to capture the on-chain derivatives market by merging centralized exchange efficiency with DeFi security.

Ecosystem

DeFi

- SunSwap demonstrated remarkable growth with 1.9 million transactions or a 116.02% increase from Q3 2025, led by increased transaction frequency per user and growing DEX activity.

- JustLend DAO continued to serve as the liquidity backbone, supporting the ecosystem's multi-billion dollar Total Value Locked (TVL). The integration of "Trade to Earn" mechanisms across these platforms drove higher user retention and capital efficiency during the quarter.

- Bridgers, a cross-chain aggregation protocol, showed stable cross-chain activity with 859,101 transactions and 313,557 users over Q4 2025.

Stablecoins & Payments

- TRON maintained its position as the premier stablecoin network, ending 2025 with $82.2 billion in circulating USDT supply, accounting for 42% of the global market. The network processed an average daily USDT transfer volume of $23.86 billion in the final months of the year.

- A significant regulatory milestone was achieved in December when USDT on TRON was recognized as an accepted fiat-referenced token in the Abu Dhabi Global Market (ADGM), further legitimizing the network for institutional payment flows.

- New Issuance: The quarter saw the first minting of USD1, a stablecoin from World Liberty Financial, further diversifying the stablecoin assets available on the network.

Onchain Data

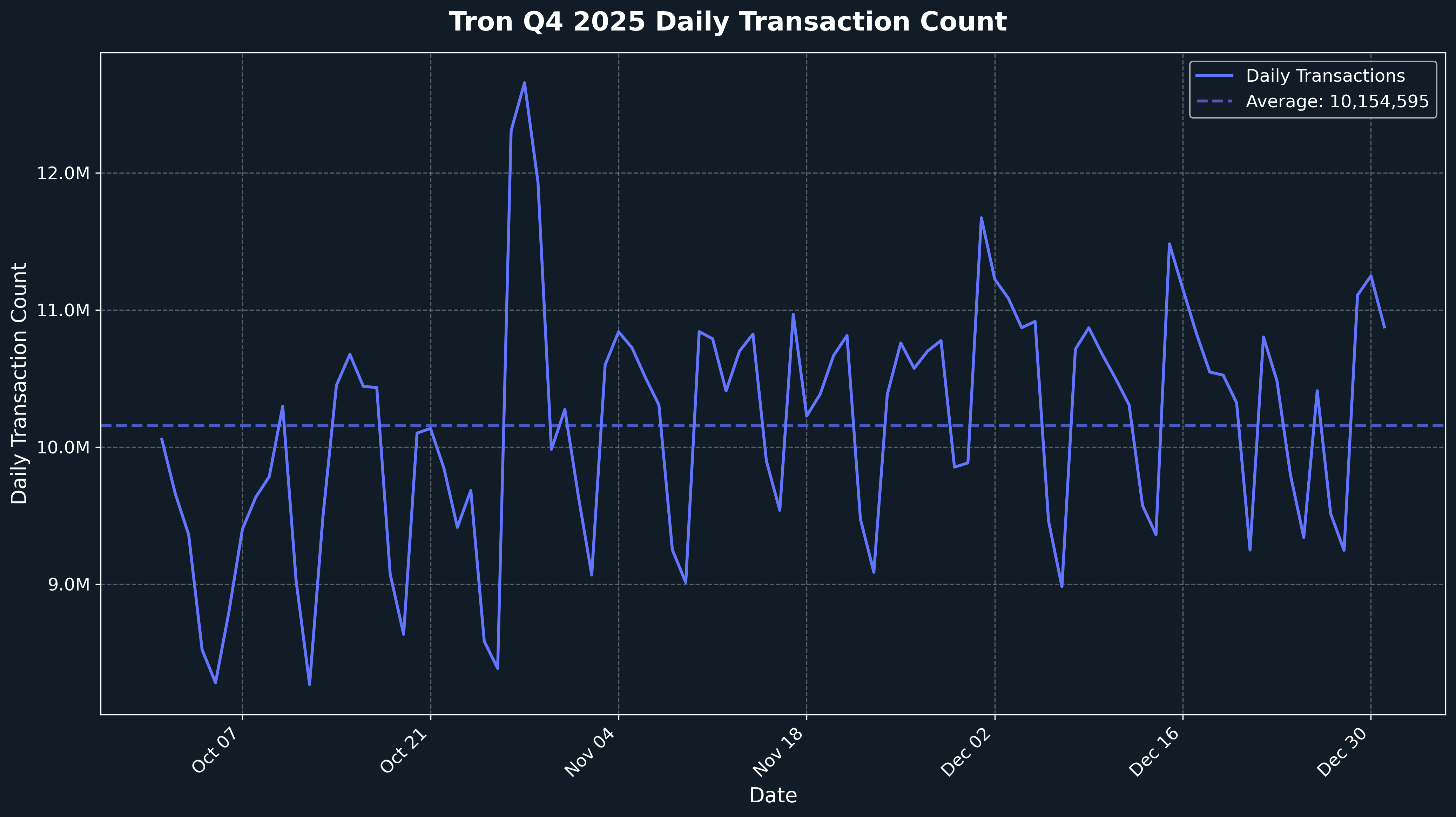

Daily Transactions

TRON demonstrated robust transactional activity throughout Q4 2025, with an average of 10.1 million daily transactions and a peak of 12.7 million. The quarter showed consistent throughput, reflecting strong protocol usage and ecosystem engagement.

Notable activity spikes occurred in late October 2025, with daily transactions exceeding 12.6 million on October 28th, and again in early December 2025, with daily transactions reaching 11.7 million on December 1st.

The network maintained high transaction throughput, averaging around 9.5-10.5 million transactions daily, demonstrating TRON’s capacity to handle large-scale transaction volumes efficiently.

The consistent transaction volume throughout Q4 2025 reflects TRON’s capacity to handle substantial workloads while supporting diverse use cases including stablecoin transfers, CEX operations, DeFi protocols, and gaming applications.

This sustained activity aligns with the network's expanding role as a high-throughput blockchain platform, where major exchanges, stablecoin issuers, and DeFi protocols utilize Tron for high-frequency applications requiring low costs and scalability.

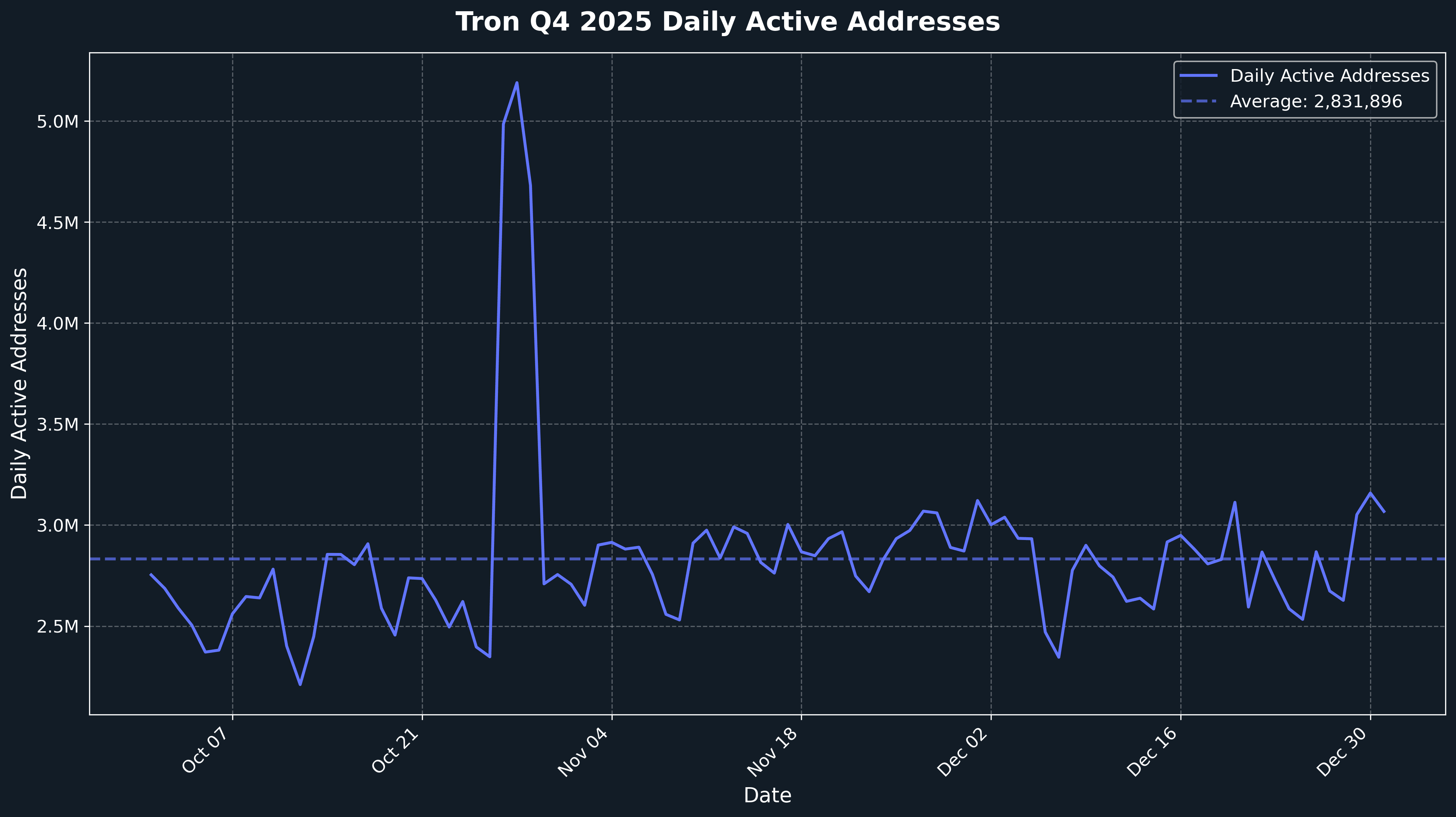

Daily Active Addresses

Tron maintained a healthy base of active addresses throughout Q4 2025, averaging 2.9 million daily active addresses with peaks reaching 5.7 million.

The quarter showed periodic surges in user activity, particularly in late October 2025, when daily active addresses exceeded 5.1 million on October 27th and 5.2 million on October 28th, representing significant spikes in user engagement.

The network maintained relatively stable daily active address counts throughout November and December 2025, with values typically ranging between 2.5 million and 3.1 million addresses per day, demonstrating consistent user retention and engagement.

Activity spikes demonstrate growing user engagement across diverse use cases—from stablecoin transfers and CEX operations to DeFi protocols and gaming applications.

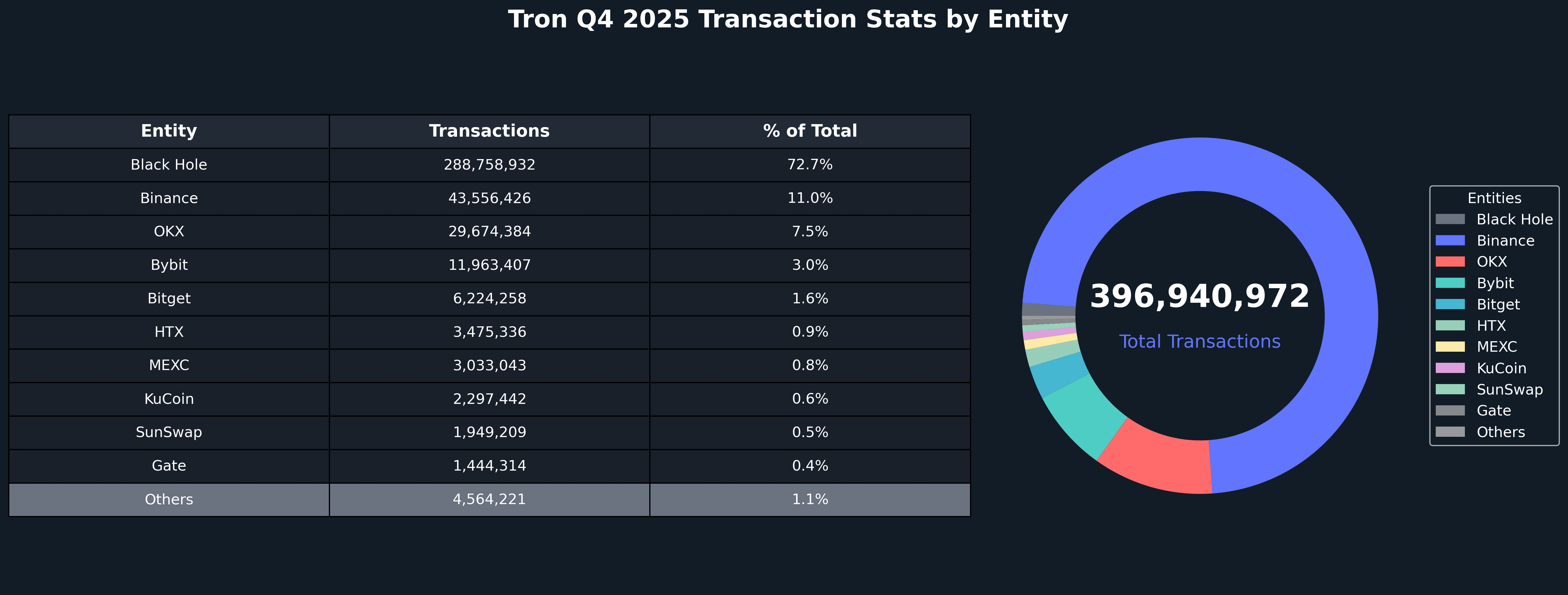

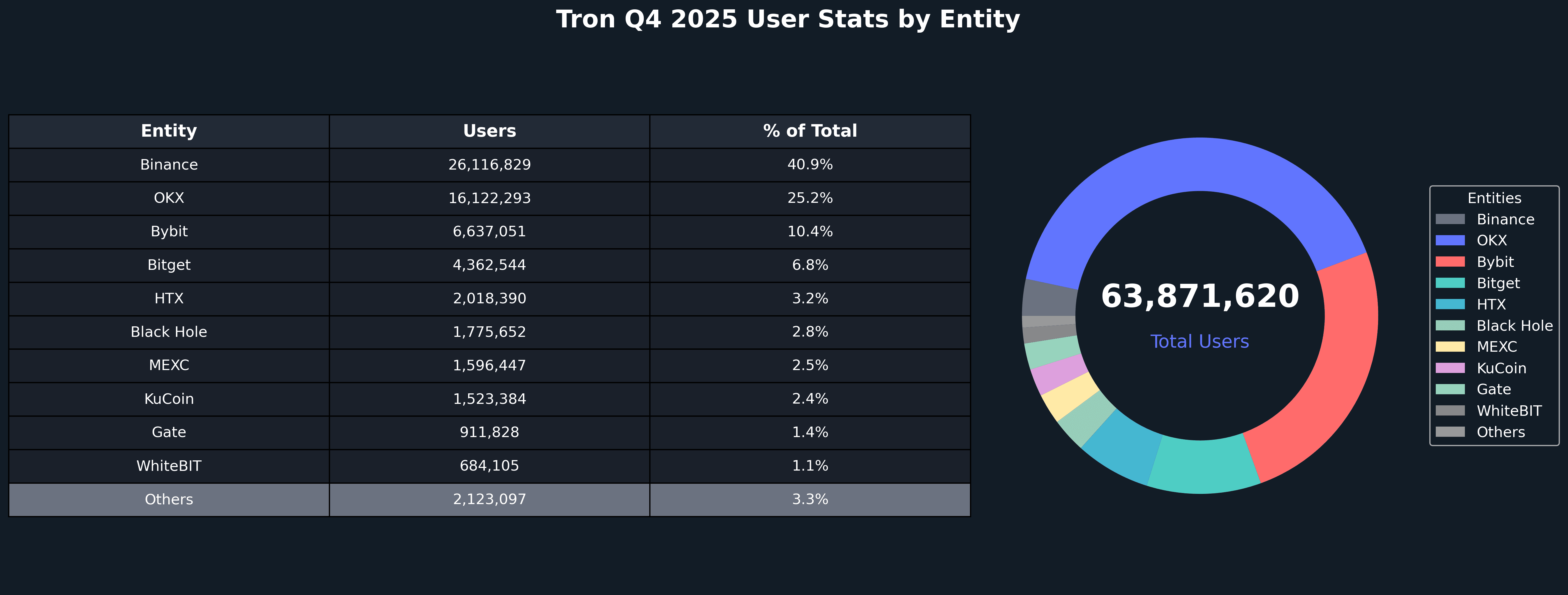

Top Entities by Users and Transactions

Tron's top entities by users and transactions highlight a mature ecosystem anchored by centralized exchanges, stablecoin infrastructure, and DeFi protocols.

Binance leads with strong exchange activity and user adoption, processing 43.6 million transactions (40% of total) with a 37% increase from Q3 2025, with 26.1 million users (50% user growth).

OKX maintained a significant presence as a major exchange with 29.7 million transactions (27% of total) and 16.1 million users.

Bitget showed exceptional growth, processing 6.2 million transactions with an 86% increase from Q3 2025, with 4.4 million users (135.55% user growth), indicating rapid expansion.

SunSwap demonstrated remarkable growth too with 1.9 million transactions showing a 116.02% increase from Q3 2025, indicating growing DEX as well as CEX activity.

Tether showed growing stablecoin adoption with 645,737 transactions (+19% QoQ) and 594,411 users (+18% QoQ), while USDC exhibited very strong growth from a smaller base, with 2,531 transactions (+94% QoQ) and 2,078 users (+78% QoQ), indicating expanding USDC presence on Tron.

The ecosystem's distribution reinforces Tron's dual role as both a high-throughput settlement layer for major exchanges and a platform for DeFi protocols and stablecoin infrastructure, with centralized exchanges and stablecoins serving as the foundational layer for high-frequency applications requiring low costs and scalability.

Closing Thoughts

Q4 2025 has demonstrated Tron's continued position as one of the most active blockchain networks globally, with the network processing millions of transactions daily and maintaining substantial user engagement across diverse sectors. The quarter's onchain metrics showcase a mature ecosystem with strong centralized exchange activity, growing stablecoin adoption, expanding DEX usage, and diverse protocol participation. Tron's ability to consistently handle 8-12 million daily transactions with millions of active addresses, combined with low transaction costs and high throughput, positions the network as a preferred platform for high-frequency applications including stablecoin transfers, exchange operations, and DeFi protocols.

The exceptional growth of key protocols like Binance, SunSwap, and USDC highlights accelerating adoption across exchange, DeFi, and stablecoin sectors, while the network's ability to maintain stable overall activity despite entity-level variations demonstrates ecosystem resilience. Tron enters 2026 positioned to continue serving as a high-throughput blockchain platform supporting diverse applications from stablecoin transfers and exchange operations to DeFi protocols and gaming applications, maintaining its role as one of the most active and utilized blockchain networks in the industry. Entering 2026, Tron is positioned well to further its position as a primary settlement layer for the digital economy.