Overview

Solana is an open source project implementing a new, high performance, permissionless blockchain. As of today, Solana is one of the fastest blockchains in the world with thousands of projects spanning DeFi, NFTs, Web 3 and more.

Solana Price Action

During the 2021 L1 summer, Solana saw tremendous price growth considering that it started 2021 at US$2 and reached an all time high price of US$259 in November 2021.

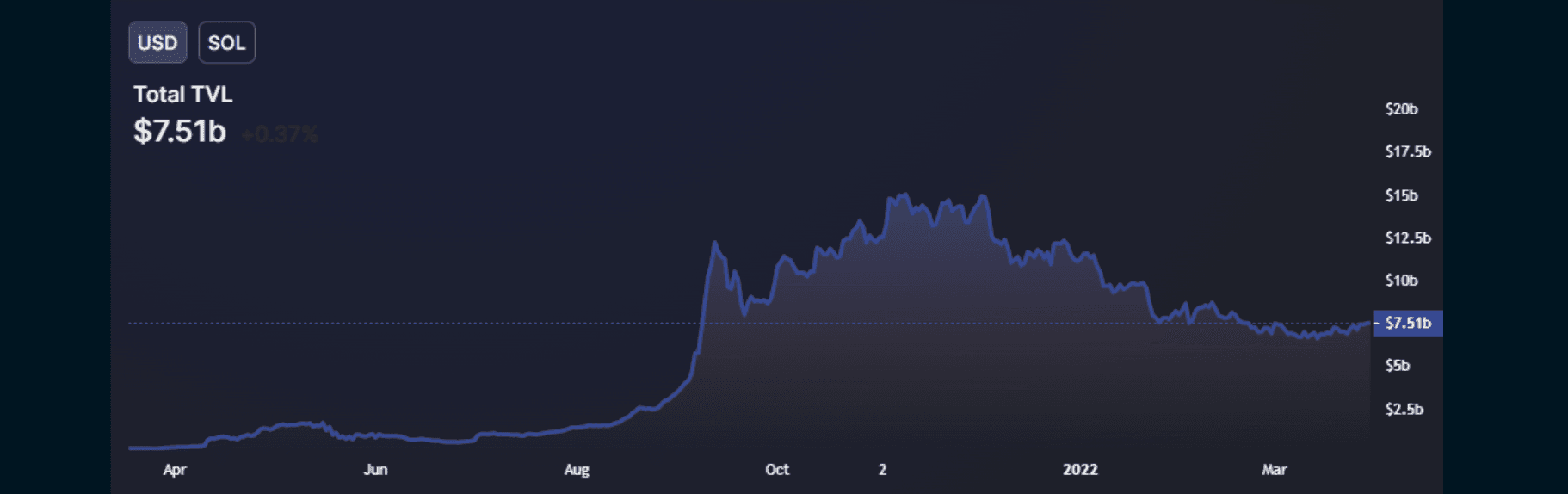

Solana TVL

Number of Unique Projects on Solana

Similarly, the number of unique projects on Solana increased at an exponential rate, with the TVL reaching a high of US$15 billion in November 2021. The narrative of Solana as the "Ethereum Killer," with considerably lower transaction fees and faster transaction speeds than Ethereum's ever-increasing gas fees, was primarily responsible for the increase in price and TVL.

Solana Data | Metric | Feature | |:---:|:---:| |Price|$136| |Market Cap (USD)|$44,315,068,937| |Circulating Supply (SOL)|325,813,654| |Total Supply (SOL)|508,180,963| |Current Inflation Rate|7.5%| |Maximum Supply|Uncapped| |Market Segment|Web 3 Cloud Economy|

Source: Coingecko, Data as of April 4, 2022

Notable Features

Proof of History Mechanism

In November 2017, Anatoly Yakovenko, the co-founder of Solana published a whitepaper describing Proof of History (PoH), a technique for keeping time between computers that do not trust one another. This new idea eventually became Solana’s unique timing mechanism.

Proof of History establishes a historical record that proves the existence of a certain event at a specific point in time. Unlike other blockchains, which require validators to communicate with one another in order to agree that time has passed, each Solana validator keeps track of time by encoding it in a simple SHA-256, sequential-hashing verifiable delay function (VDF).

This is in contrast to the existing standard of blockchain infrastructure, which relies on a sequential creation of blocks that is hampered by the need to wait for network confirmation before progressing. In terms of speed and capacity, Proof of History represents a significant advancement in the structure of blockchain networks.

To make it simple to understand, let's use an analogy to explain the essence of Proof of History. Imagine a car manufacturing line that churns out the different spare parts of a vehicle. To assemble the vehicle, the spare parts must be assembled in a certain order (e.g. Part 1, Part 2, Part 3 and so on…). Previously, many car manufacturers produced the spare parts in this order, which became the bottleneck for the number of vehicles they could produce. Instead, Solana’s proof of history allows the car manufacturer to produce the different spare parts simultaneously, and arranges these spare parts in a way that allows them to be assembled in the required order with ease.

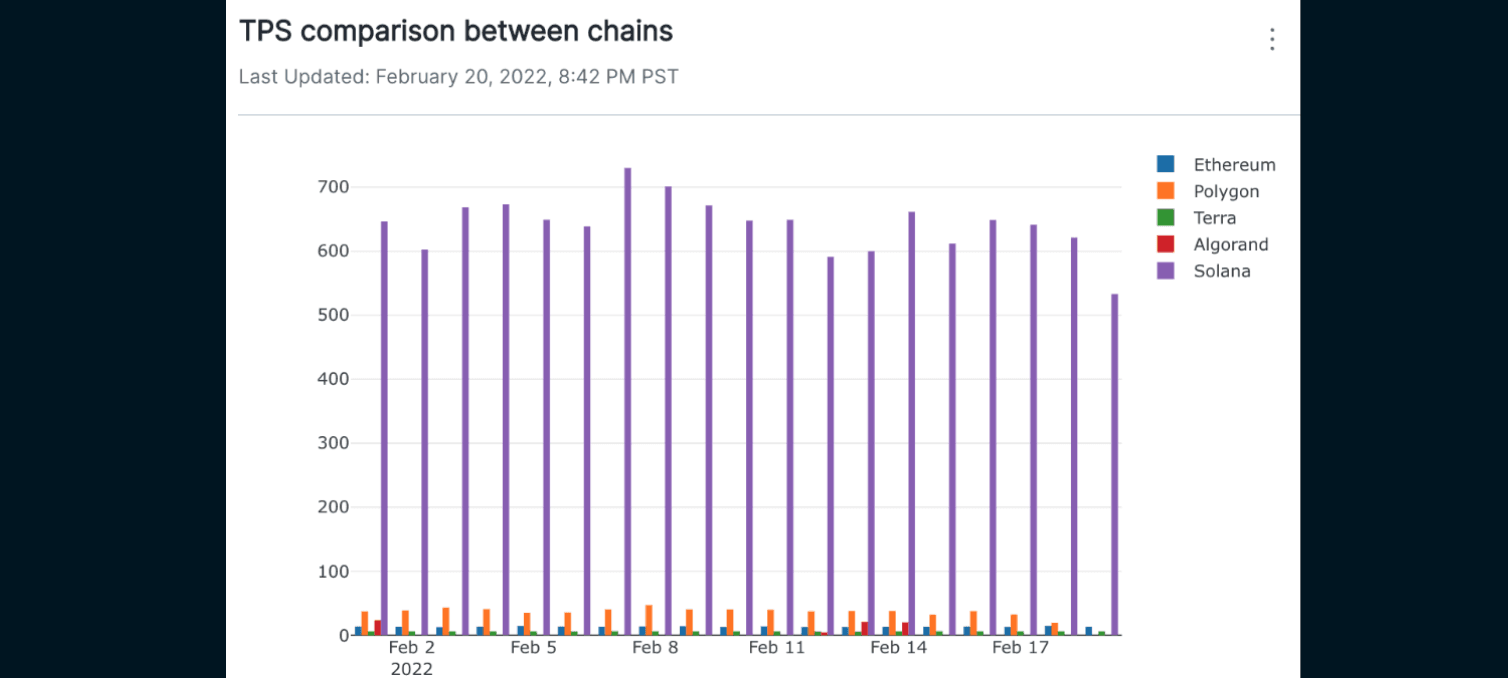

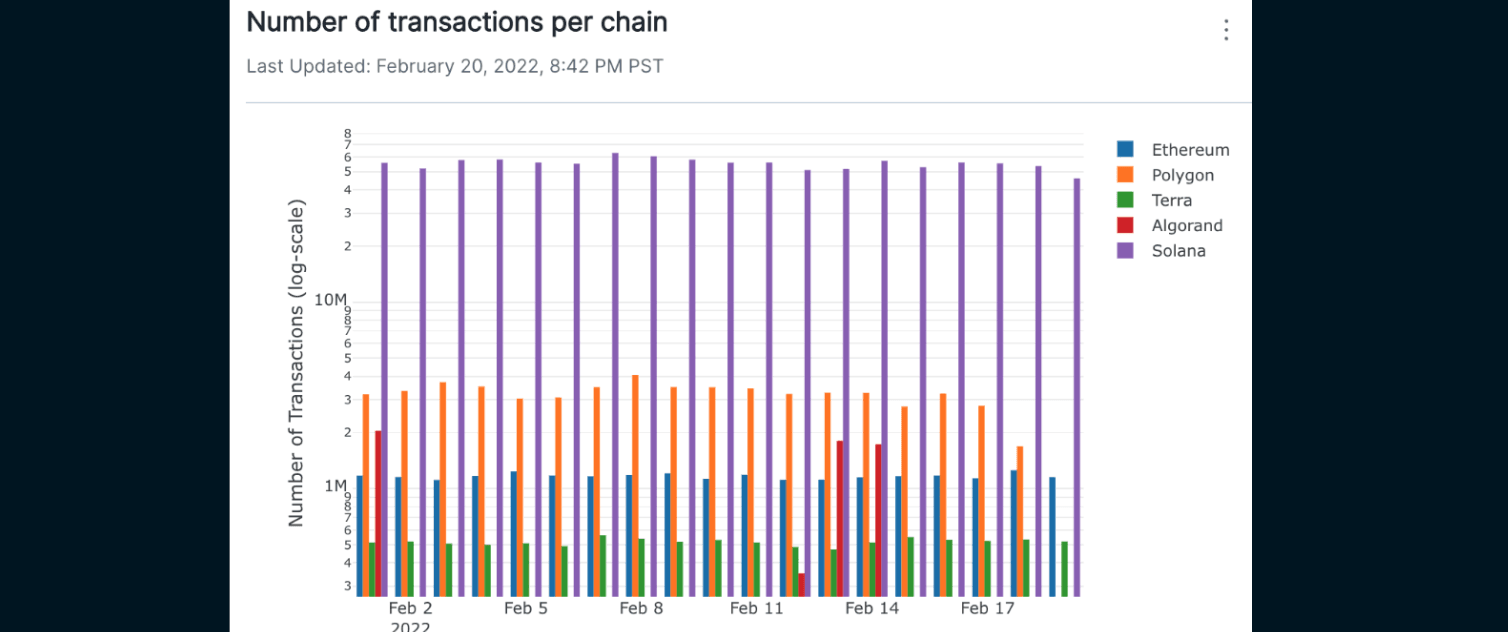

Cheaper. Faster. Transactions

Solana has some of the lowest fees compared to any other blockchain available. Solana’s lower block time and higher block size allows it to process transactions at a cheaper rate than its incumbents.

Using transactions per second (TPS) alone can be deceiving because transactions that haven't reached finality aren't legitimate and can be void/null, denied, or returned. TPS overlooks the time it takes for transactions to be processed and subsequently finalized in the network. As a result, Time to Finality (TTF) is a preferable choice. Although TPS is a measure of network speed, it is unrelated to finality; a blockchain could have a high TPS but its TTF could take a long time to establish. Some chains can achieve considerably greater TPS than Solana, but it will take a long time for them to reach finality.

| L1 Blockchain | Projected TPS | Avg TPS | TTF | Avg Fees |

|---|---|---|---|---|

| Solana | 65,000 | 3,000 | 13s | $0.00025 |

| Fantom | 300,000 | 10 | 2s | $0.05 |

| Terra | 10,000 | 40 | 5-6s | 0.6% |

| Avalanche | 4,500 | 10 | 2s | $0.3 |

| Binance Smart Chain | 220 | 53.8 | 35s | $0.35 |

| Cosmos Hub | 4,000 | - | 7s | $0.01 |

| Polkadot | 1,000 | 166 | 12-60s | - |

| Ethereum | 30 | 15.9 | 78s | $37 |

| Ethereum 2.0 | 100,000 | - | 768s | TBC |

Source: TheBlockResearch, Platform Websites, Testnet Results, SolanaFM, FTMScan, AvaScan, LoopFinance

As seen above, while Solana doesn't have the greatest combination of TPS and TTF, it is definitely one of the stronger chains among its incumbents.

Standing out from the incumbents

Chain Comparison

| Features | Ethereum 2.0 | Near | Solana | Polkadot | Avalanche | ||

|---|---|---|---|---|---|---|---|

| Architecture | Multichain (shards) | Multichain | (shards) | Single-chain (synchronous) | Multichain | (Parachain) | Multichain (Subnets) |

| Security | Shared | Shared | Shared | Shared (Only if parachain is connected) | Shared (validators choose the subnets) | ||

| Consensus | Casper POS | Nightshade POS | PoS | NPoS | PoS | ||

| EVM/ Development | EVM (Solidity, Vyper) | WASM, Aurora (EVM) | Sealevel (Rust), Neon Labs (EVM) | WebAssembly / Substrate, EVM | AVM (Go), Ethereum (EVM) | ||

| Validators (today) | ~200,000 | 73 | 1,695 | 297 | 1,222 | ||

| TPS | ~100,000 in year 2023 | ~100k once nodes are fully live | 65,000 | 1,000 | 4,500+ | ||

| Time to finality | 768s | 2 sec | 13 sec | (variable) | 12-60 sec | 2 sec |

It is also a good point to note that Ethereum limits the maximum stake to 32 ETH to encourage decentralization of power as it prevents any single validator from having an excessively large vote on the state of the chain. However, this also indicates that 1 single entity can run multiple validators if they have a big bag of ETH, which may result in Ethereum looking to be more decentralized than it actually is.

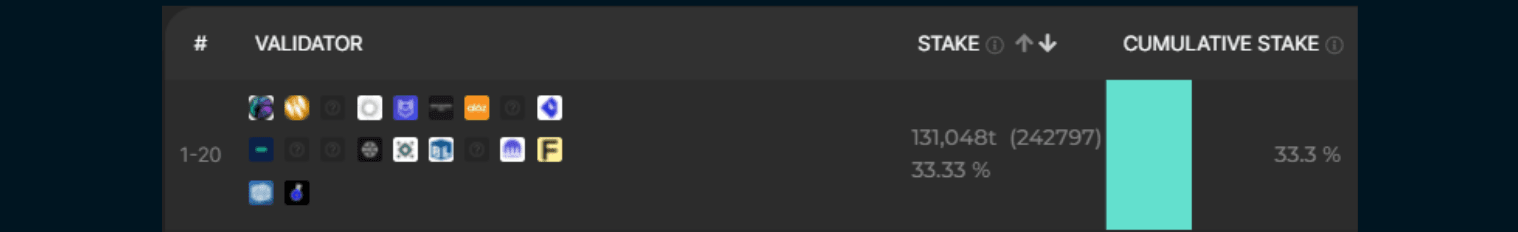

Conversely, Solana does not have such a requirement, and the top 20 Solana validators have a cumulative stake of 33.33% of the network which will be discussed below.

Decentralization

The Blockchain Trilemma Blockchains are often forced to make trade-offs that prevent them from achieving all 3 aspects:

- Decentralization: Large number of distributed independent nodes vs small number of centralized nodes.

- Scalability: How many transactions can the blockchain support?

- Security: Defense against attacks, bugs. Sybil attack anyone?

Based on the above mentioned trilemma, it is clear that blockchains are often forced to choose a certain combination that allows them to achieve their goals. Solana seems to have given up decentralization in favor of scalability and security. In fact, compared to other major L1 chains, Solana is often regarded as the most centralized due to its reliance on the Solana Foundation in developing core nodes on the blockchain.

There is no strict minimum amount of SOL required to run a validator on Solana. However, the hardware requirements of running a Solana node is steeper than its incumbents in order to boost Solana's scalability (higher TPS). According to Solana Compass, aside from hosting costs which can run to the tens of thousands of dollars annually, Solana validators must also roughly pay around 3 SOL every epoch (2-3 days) to be eligible to vote. With all the math done, this means that a validator will need to own 5000 SOL ($530,000 today) staked to its own network to break even.

Since running Solana nodes is more expensive, fewer people are willing to shell out the money to run a node, hence reducing the number of independent validators and reducing the network’s decentralization.

According to Solana Beach, the top 20 validators also have a cumulative stake of 33.33% of the network. This means that the top 20 validators control sufficient staked Solana to halt the network if they had the intention to. Anyone that holds 33% of the total staked value on the network can censor the network and prevent it from finalizing transactions.

Among these top 20 validators, we also see big names like Kraken, Jump Crypto, a16z and Block Daemon. Furthermore, 45% of Solana’s validators are also hosted on 2 data centers, and one can only imagine what would happen if these 2 data centers get compromised.

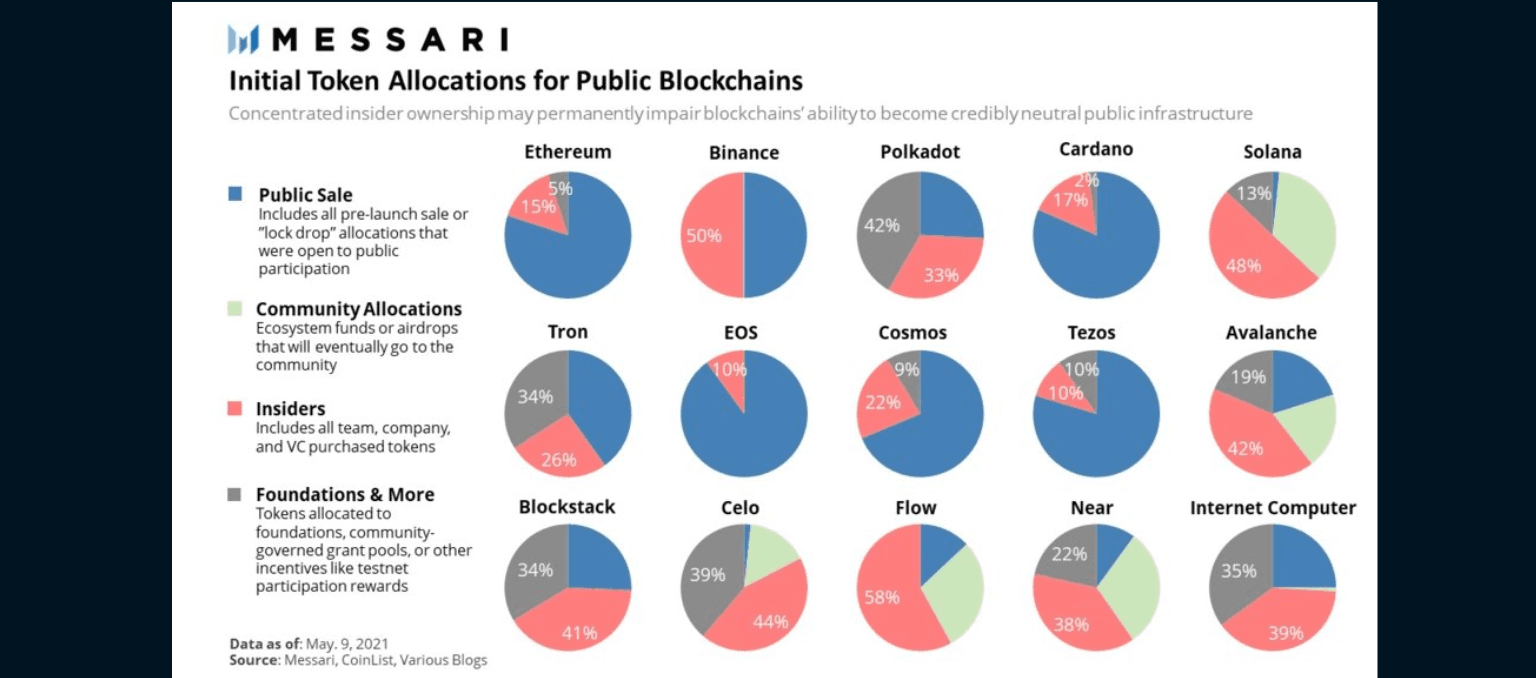

Looking at the token distribution of SOL tokens, Solana looks to be more centralized than it seems. In 2021, Messari posted a chart of the insider’s token allocation among the top 15 projects. Solana had 48% insider investors and 13% allocated to the Solana Foundation as compared to Ethereum which only allocated 20% of its tokens to early investors and the Ethereum foundation. Understanding these token allocations are important, as a more diversified distribution allows power to be distributed more evenly. With a significant portion of Solana being allocated to insiders, it is likely that the majority of the staked Solana tokens that are used for network validation are also held by these insiders.

However, most networks are centralized when they first emerge, and increasing SOL token distribution would likely alleviate this problem.

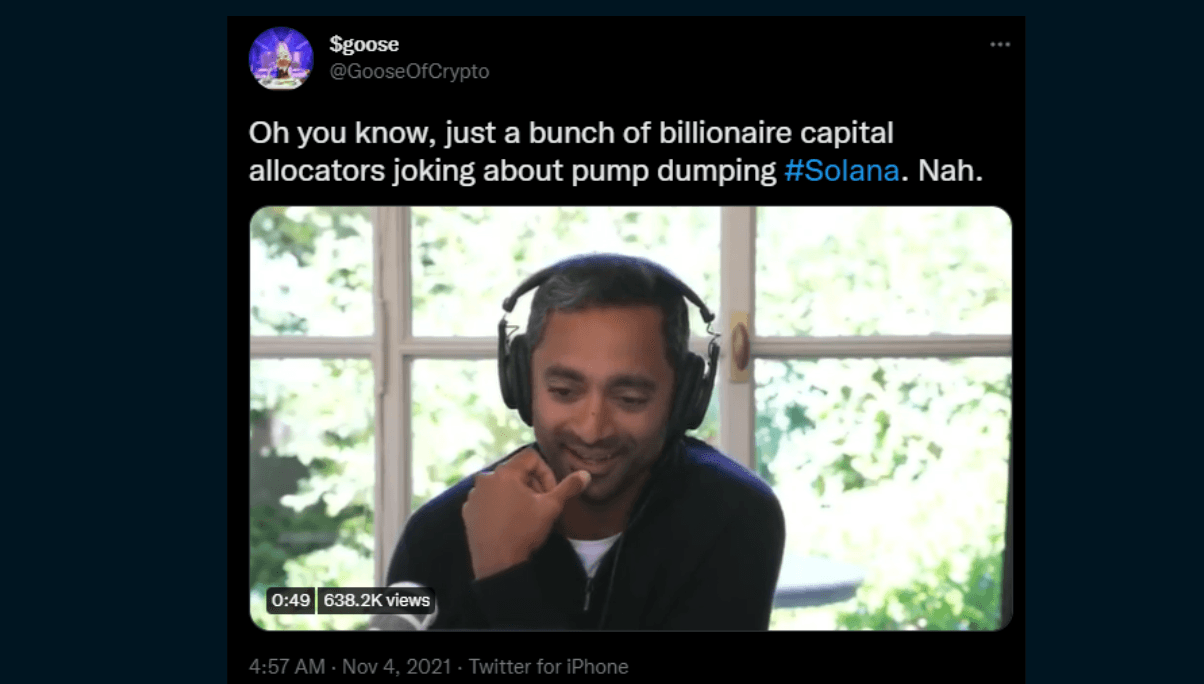

A handful of the Solana whales, including Chamath Palihapitiya of Social Capital, joked about pump-dumping Solana in November 2021. This emphasizes the fact that retail investors are not competing on an equal footing with VCs and insiders.

Looking at present developments, one can't help but wonder if people are truly committed towards decentralization. In fact, what does the word decentralization even mean? We have multiple vectors to give us a rough idea, to name a few- staking/hash power distribution, number of clients, number of validators in the consensus group, and the number of validators or miners who can impact liveness- for PoS that’s 33% and 51% in PoW. However, Solana is proving that a spectrum of decentralization will likely exist and users can make the needed trade-offs based on their needs. People appear to value speed and low fees above everything else, which could be a decisive factor in Solana's decision to prioritize scalability above decentralization.

Project Marketing

Solana’s aggressive marketing efforts definitely rank as one of the top few among any cryptocurrencies out there. In fact, they are among the most active compared to any other L1 chains as well.

Its tremendous rise in 2021 can be due in part to its large number of endorsements, which include BofA, JP Morgan, pop star Jason Derulo, and famous professional boxer Mike Tyson. Having SBF as a vocal supporter of Solana didn't hurt either.

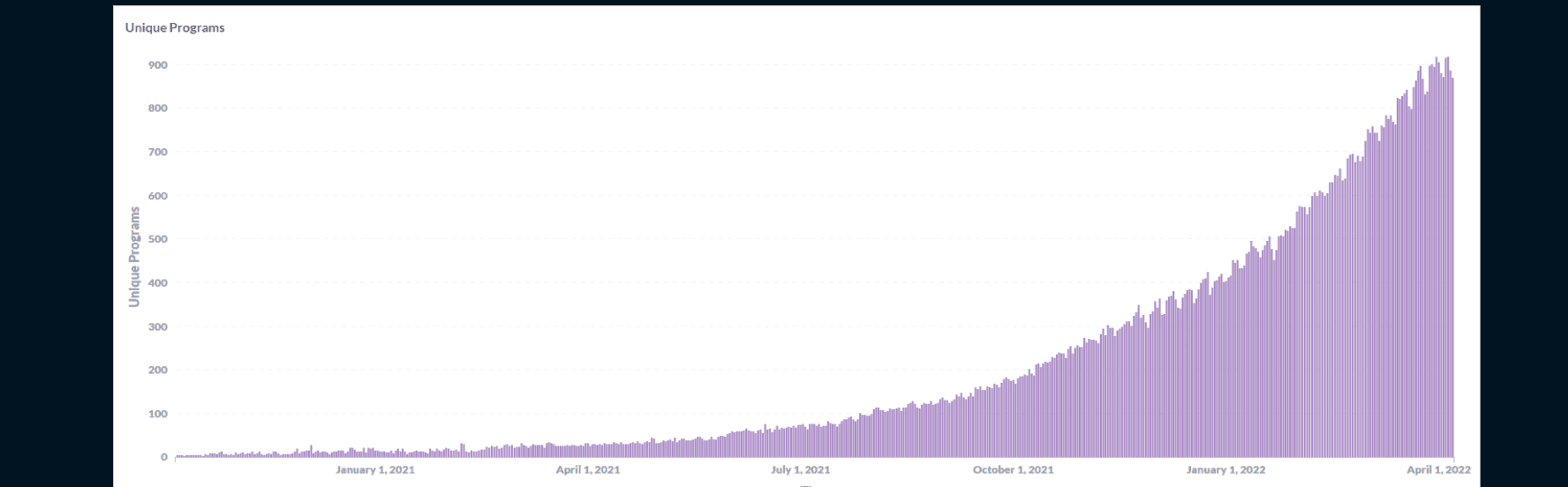

Developer Community

Developers are in high demand right now, and they're hard to come by. Finding the right developers that aren't just in it for the money is even more difficult. As a result, chains with greater developer activity are a strong indicator of a thriving ecosystem and possibly a better investment prospect.

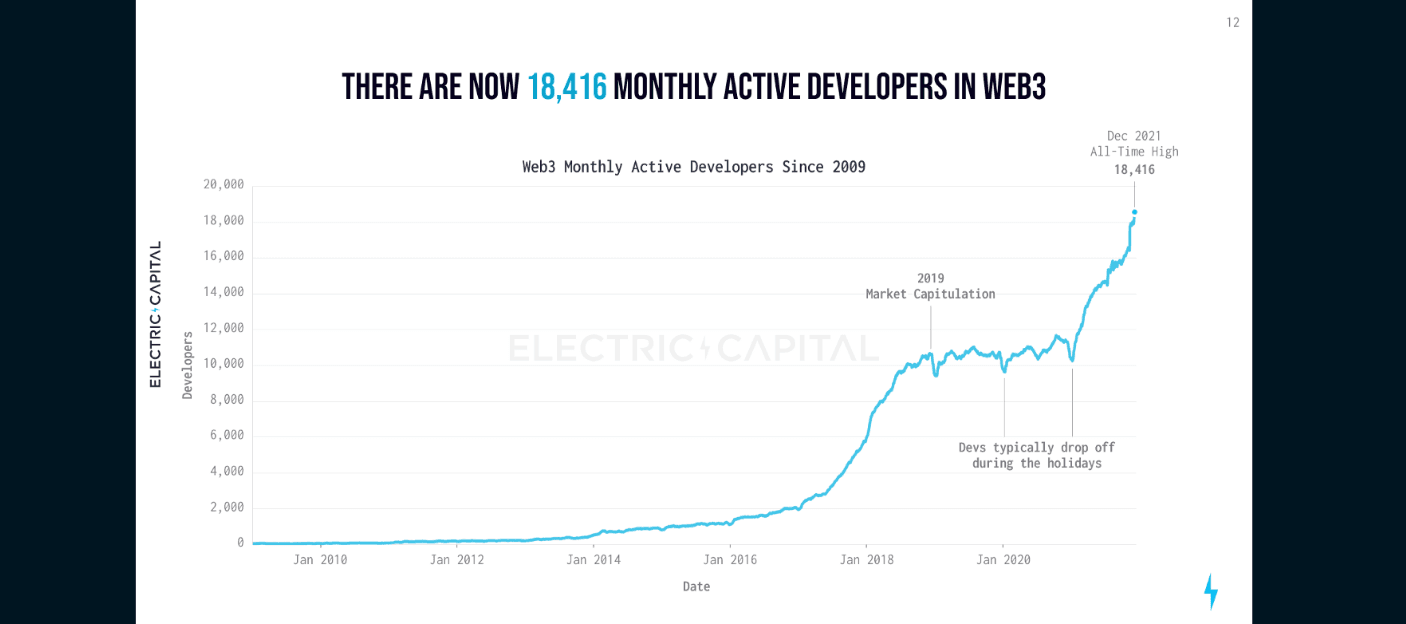

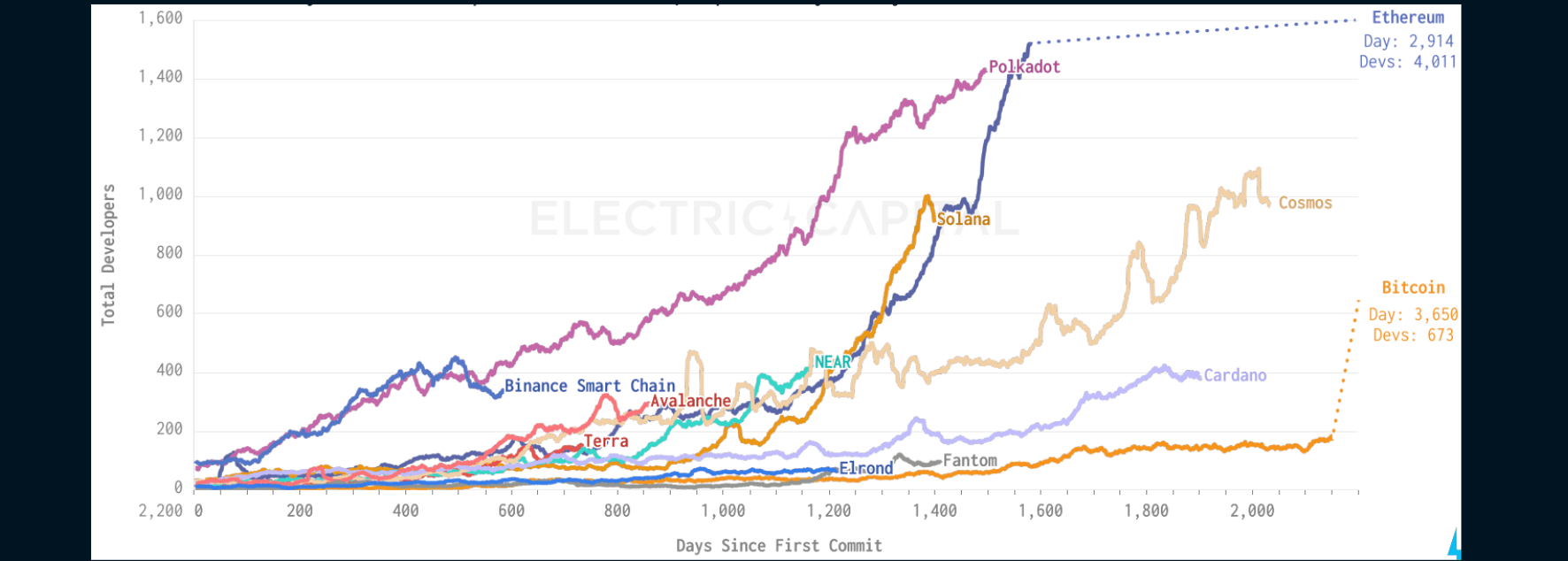

According to the 2021 developer report by Electric Capital, the number of Web3 developers is increasing exponentially with no signs of slowing down.

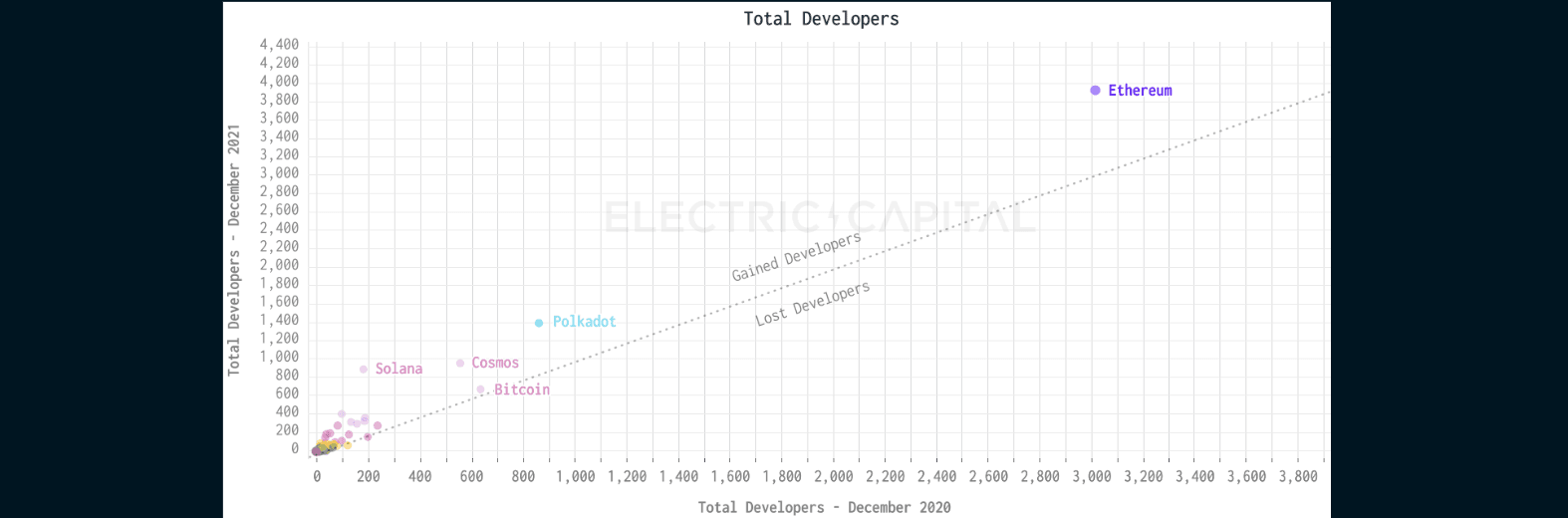

Looking at the overall number of developers in the respective blockchains, it is clear that Solana was able to increase the number of developers in its ecosystem during 2021, although it still has far fewer developers than Ethereum and Polkadot.

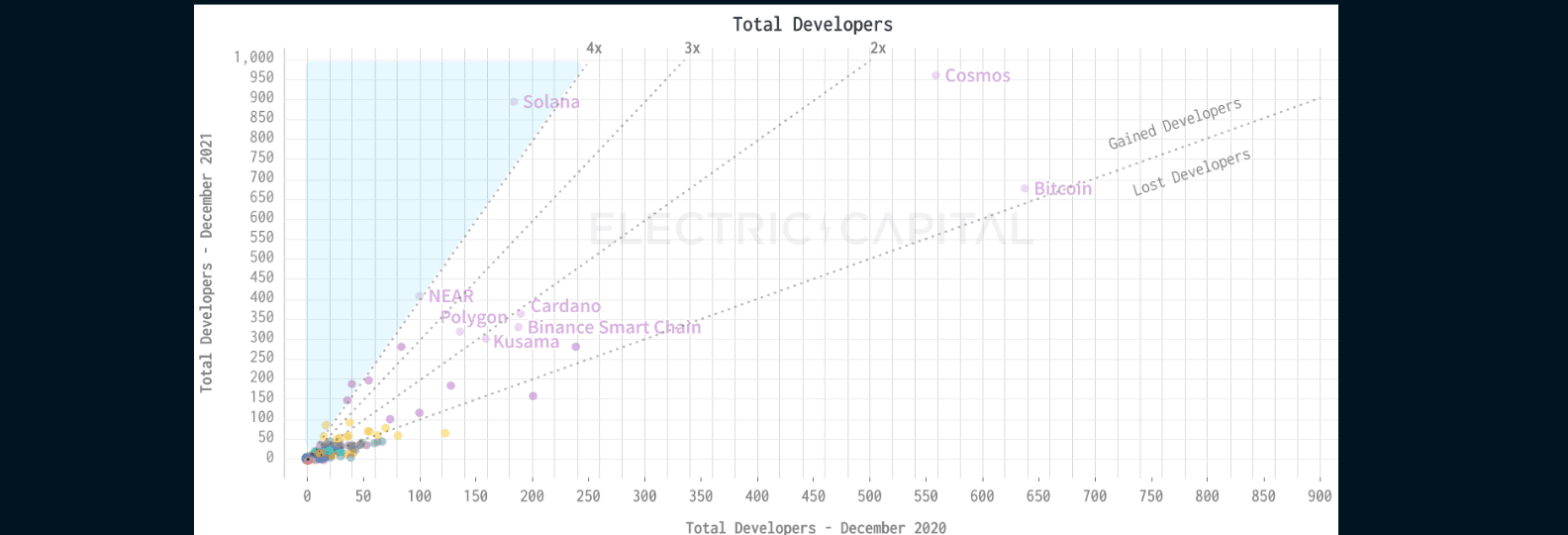

However if we compare Solana with other ecosystems that have at least 300 developers, we see that Solana had the highest growth in the number of developers than other major chains. In 2021, Solana almost increased its developer count by 500%.

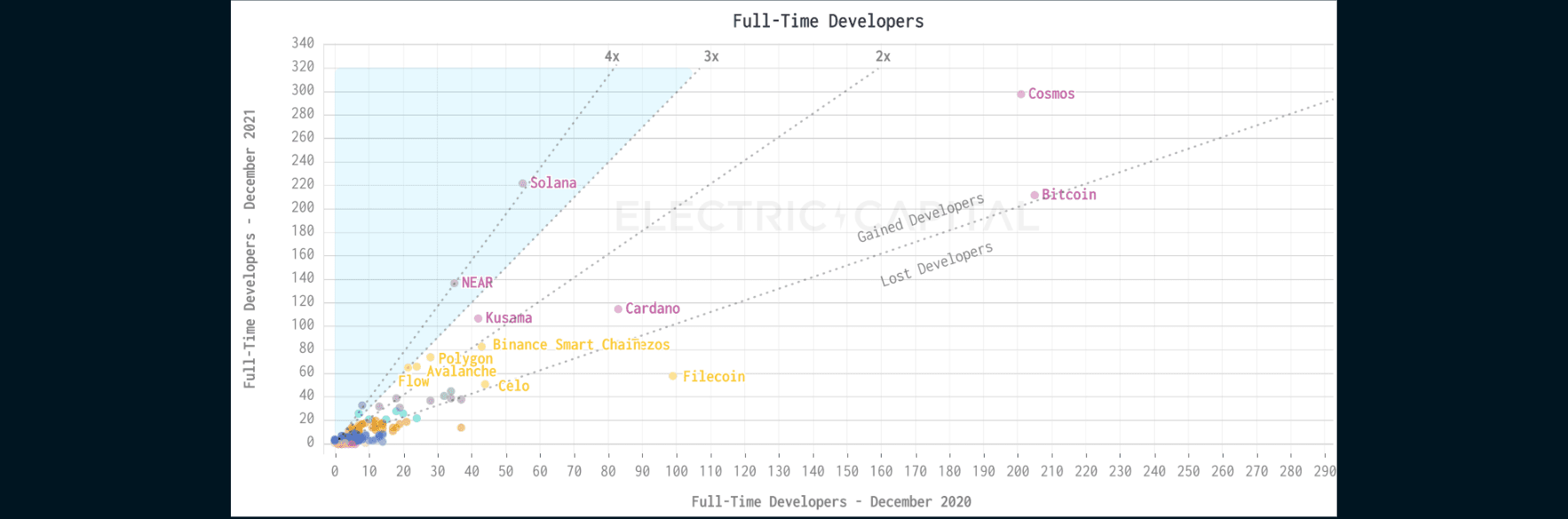

Let's clean up the data by omitting one-time developers and focusing just on full-time developers…

Solana was still able to impressively increase the number of full-time developers in the ecosystem by about 400%.

Comparing Solana with its incumbents, Solana does indeed have one of the highest developer counts than any other chain despite its lower “days since the first commit”.

The surge in developer activity on Solana might also be attributed to Solana’s programming language which uses Rust instead of Solidity. Even Twitter’s Jack Dorsey is a big fan. To add, Solana uses its own VM so the developer community was bootstrapped from nothing. Whereas EVM chains have allegiance to the EVM and wherever the liquidity will end up, not the specific layer 1 the devs are currently building on. This is a key distinction between Solana devs who program in Rust and alternative EVM chains that use the current infrastructure of the EVM.

Solana's Valuation

As you may be aware, determining the value of tokens is a tricky task. These tokens aren't the same as traditional equities, which can be priced using a set of fundamental frameworks. These native tokens can theoretically be used for whatever purpose users desire (security, gas, productive financial asset, etc.). As a result, some may argue that the blockchain's potential is boundless and their native tokens can similarly capture varying amounts of value.

Note: Since value accrual methods for respective tokens can be different, there isn’t really any clear way to do relative valuations.

| L1 Blockchain | Price | Price to Sales | Price to TVL |

|---|---|---|---|

| Solana | $137 | 1,690.3x | 5.37x |

| Fantom | $1.58 | 117.7x | 0.6x |

| Avalanche | $97.6 | 255.9x | 2.47x |

| Binance Smart Chain | $448 | 126.5x | 5.61x |

| Cosmos | $32.5 | 4,065x | 0.55x |

| Polkadot | $23.1 | 25,588x | 12.07x |

| Ethereum | $3,505 | 84.8x | 3.27x |

| NEAR | $16.3 | 3,700.6x | 9.64x |

Source: TokenTerminal, DefiLlama, Data as of April 4, 2022

Price to sales: Calculated by dividing the network’s fully-diluted market cap by its annualized revenues. A lower ratio indicates that the network is generating relatively higher revenue than the network’s value thus being possibly undervalued.

Price to TVL: Ratio of the market cap and how much of the market cap is locked up in smart contracts. A lower ratio might indicate that the network is undervalued.

Looking at Solana’s Price to Sales ratio, it appears that the market is more optimistic in Solana’s growth potential than the other L1s like Fantom and Avalanche which are trading at a much lower multiple. The same goes for its Price to TVL ratio.

All-time High & Lows | Metric | Data | |:---:|:---:| |ATH (USD)|$258.93| |ATH Date|7 Nov 2021| |Time since ATH|5 months ago| |% change from ATH|-47.45%| |Cycle Low (USD)|$76.63| |Cycle Low Date|24 Feb 2022| |Time since cycle low|1 month ago| |% change from cycle low|+77.56%|

Source: Messari.io, Data as of April 4, 2022

Recent Key Developments & Events

Change in TVL

| Top 10 Projects by TVL | 1 Jan 2022 TVL | Current TVL | TVL Change % | MCAP/TVL | FDV/MC |

|---|---|---|---|---|---|

| Serum | $1.29b | $1.07b | -17.05% | 0.39796 | 37.74 |

| Marinade Finance | $1.38b | $986.19m | -28.54% | 0.00953 | 12.12 |

| Solend | $600.63m | $836.12m | 39.21% | 0.02747 | 8.92 |

| Raydium | $1.55b | $761.79m | -50.85% | 0.44339 | 5.67 |

| Quarry | $842.07m | $551.28m | -34.53% | - | - |

| Tulip Protocol | $808.84m | $468.8m | -42.04% | 0.04418 | 6.97 |

| Lido | $214.9m | $452.01m | 109.87% | 3.16283 | 3.44 |

| Saber | $620m | $399.96m | -35.49% | 0.07803 | 11.19 |

| Atrix | $612.39m | $399.5m | -34.76% | - | - |

| Orca | $707.22m | $391.32m | -44.67% | 0.10518 | 5.54 |

Source: DefiLlama, Data as of April 4, 2022

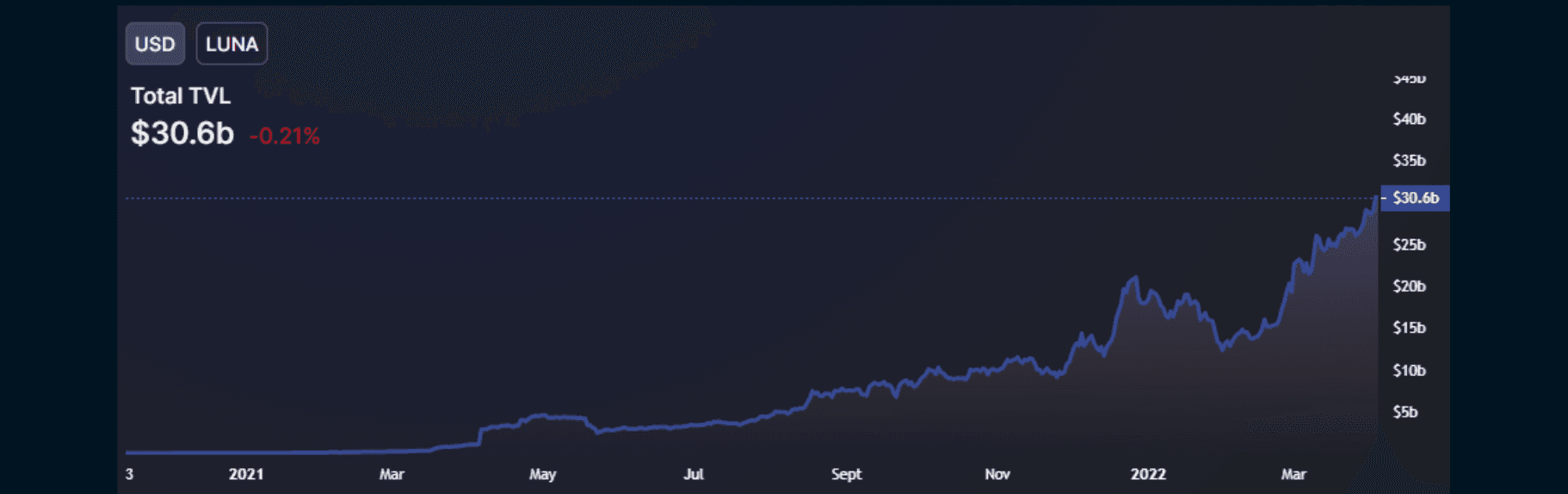

Since the start of 2022, Solana DApps have seen a significant decrease in TVL, and this drastic decrease is likely attributed to the flow of capital from Solana to “newer” ecosystems such as Terra and Avalanche, which have seen strong growth in TVL.

Terra TVL

Solana NFT Explosion

On the flip side, the NFT scene on Solana has exploded since the start of the year. NFT sales on Solana crossed the US$1b mark In Jan 2022, with Solana NFT monthly sales volume rising to $267m in Oct 2021 while unique buyers increased by more than 400% over the last few months.

| Month | Sales (USD) | Unique Buyers | Unique Sellers | Total Transactions | Avg Sale (USD) |

|---|---|---|---|---|---|

| August, 2021 | $160,524,576.81 | 14,579 | 14,850 | 63,873 | $2,513.18 |

| September, 2021 | $254,658,778.51 | 40,892 | 44,482 | 184,268 | $1,382.00 |

| October, 2021 | $267,131,696.50 | 67,520 | 75,750 | 265,502 | $1,006.14 |

| November, 2021 | $148,887,422.79 | 44,989 | 35,442 | 173,775 | $856.78 |

| December, 2021 | $148,103,012.85 | 59,445 | 22,797 | 230,056 | $643.77 |

| January, 2022 | $225,725,897.43 | 100,707 | 28,971 | 431,446 | $523.18 |

| February, 2022 | $169,942,681.10 | 99,188 | 68,085 | 430,906 | $394.38 |

| March, 2022 | $171,578,443.62 | 90,733 | 101,673 | 456,592 | $375.78 |

Source: CryptoSlam

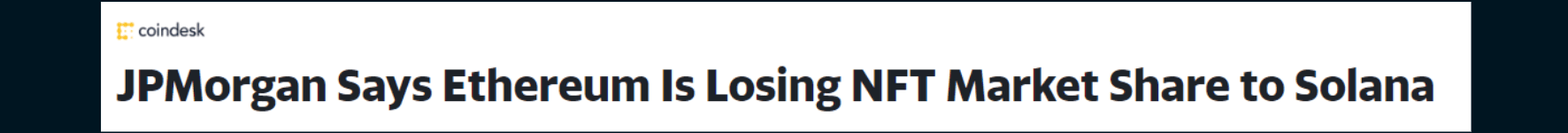

In January 2022, JPM also hinted that it is simply a matter of time before Solana overtakes Ethereum in the NFT space. A key reason for the surge in popularity of NFTs on Solana is most likely the high gas fees on Ethereum, especially during periods where popular NFT projects are being minted on an FCFS basis.

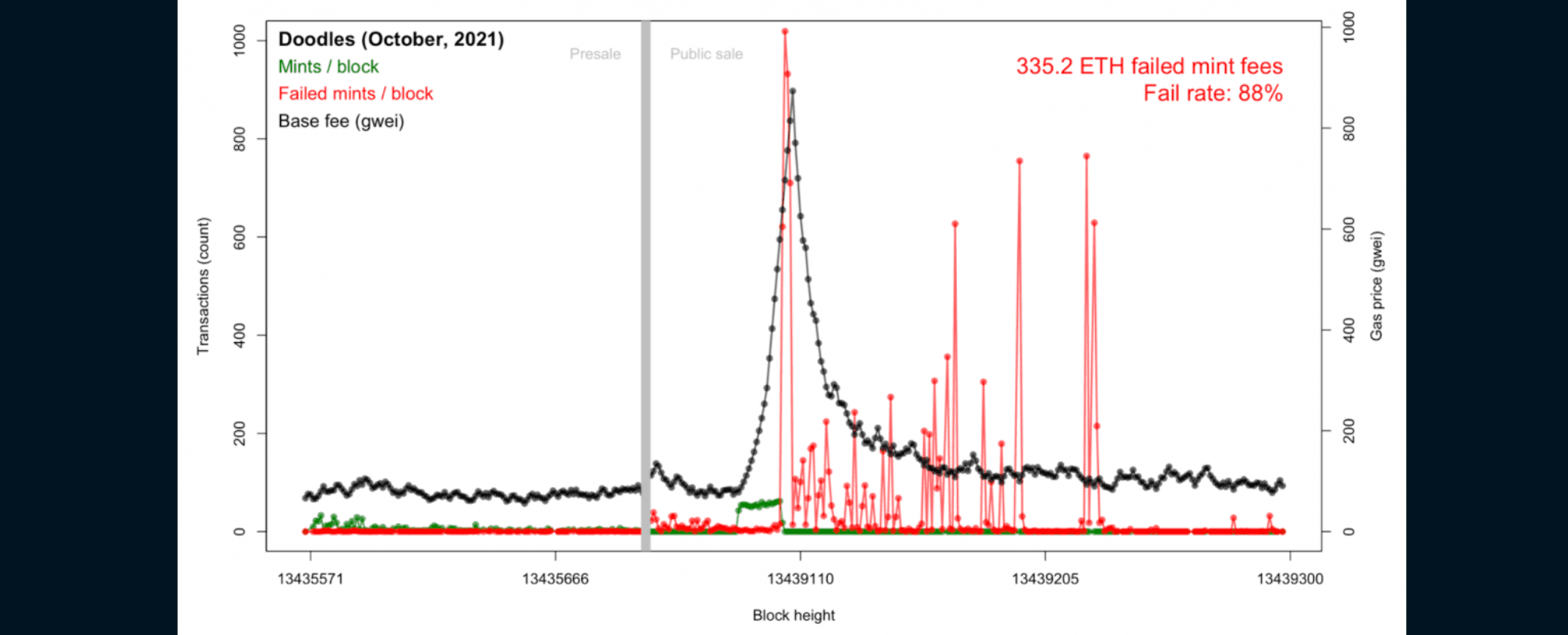

Take the Doodles NFT minting for example. The project had two minting phases, a whitelist-only mint followed by a public mint thereafter.

During the whitelist mint, users were able to mint at their own pace, hence gas remained relatively stable as seen in the left half of the chart. However, when the FCFS public mint started, the gas fees soon exploded. To make matters worse, during the public mint, 90% of the mint attempts also failed which resulted in about 335 ETH wasted on gas. This type of minting experience is alleviated by Solana which allows users to incur much much lower transaction costs and faster processing times.

On a side note, OpenSea has also recently announced their integration of Solana onto their platform, which attests to the strong demand for Solana NFTs. Opensea’s Solana Beta just recently launched on April 7th.

However, despite the strong NFT performance seen on Solana, Ethereum still remains king when it comes to sales volume. What Solana lacks is high-profile NFT projects like CryptoPunks.

Wormhole Exploit

Wormhole is the largest bridge to Solana and accounts for most of the wrapped assets bridged over. On Feb 2nd, over 120,000 wETH (worth over $325 million) was stolen from the Wormhole bridge, which connects the Ethereum and Solana blockchains. This was the second-largest exploitation to date, trailing only the most recent Ronin chain exploit, in which hackers made off with US$600 million in ETH.

This exploit was only made possible due to Wormhole’s security loophole which allowed the hackers to mint $325m worth of wETH without providing the equivalent ETH collateral required. With the minted wETH, the hackers could then swap it for ETH back on the Ethereum blockchain to cash out.

Thankfully, Jump Crypto quickly provided the missing $320m to bailout the Wormhole bridge which prevented a potential massive liquidation scenario due to the collapse in wETH prices caused by its under collateralization.

Following the exploit, SOL price plummeted 10% overnight but soon recovered from the bloodbath when Jump Crypto announced that they would restore the exploited funds.

Incident Timeline: 18:26 UTC - Contract was exploited for 120k ETH 00:33 UTC - Vulnerability was patched 13:08 UTC - Jump Crypto steps in. ETH contract has been filled and all wETH are backed 1:1 13:29 UTC - Wormhole bridge restored

Solana Network Woes

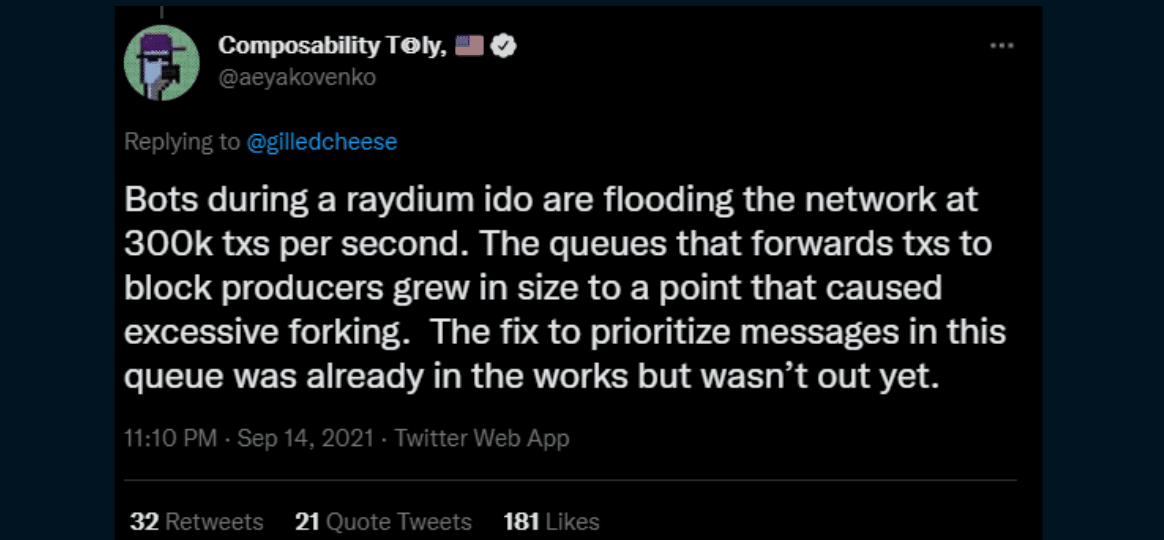

This network instability issue roughly began back in September 2021 during the Grape IDO on Raydium that sent the network down for 17 hours and caused the SOL token price to tumble by 16%. According to Solana’s founder Anatoly, this outage was caused by bots flooding the network trying to participate in the FCFS IDO on Raydium.

Since then, Solana went on to suffer a series of additional outages, and bot attacks which some have started taking it for granted nowadays. During these network outages, traders faced issues such as being unable to transact on the network, and these events can lead to significant losses when markets are extremely volatile and existing token holders are looking to de-risk their portfolios.

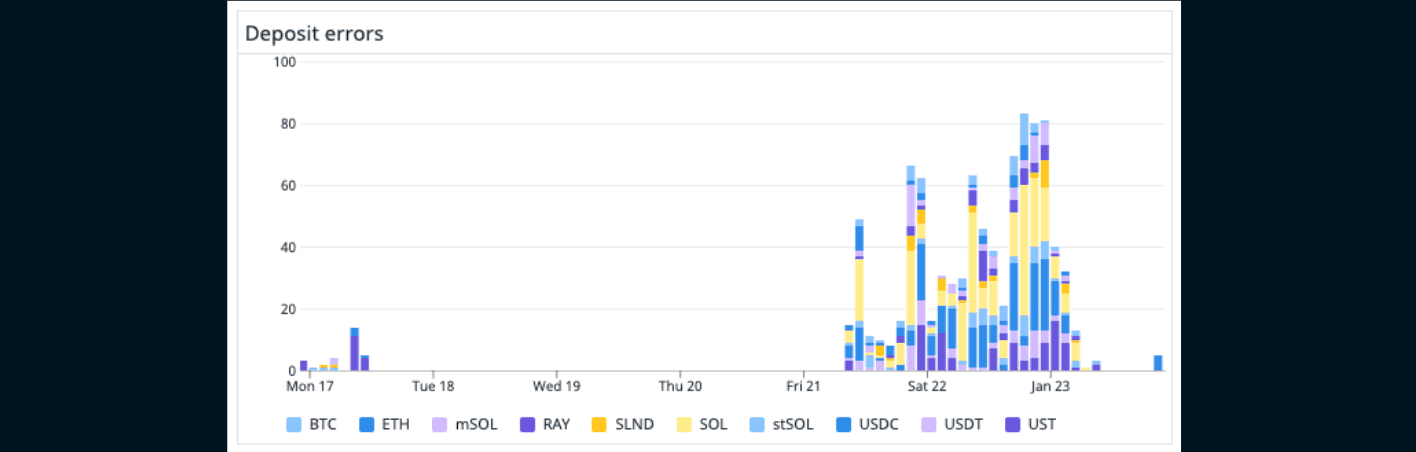

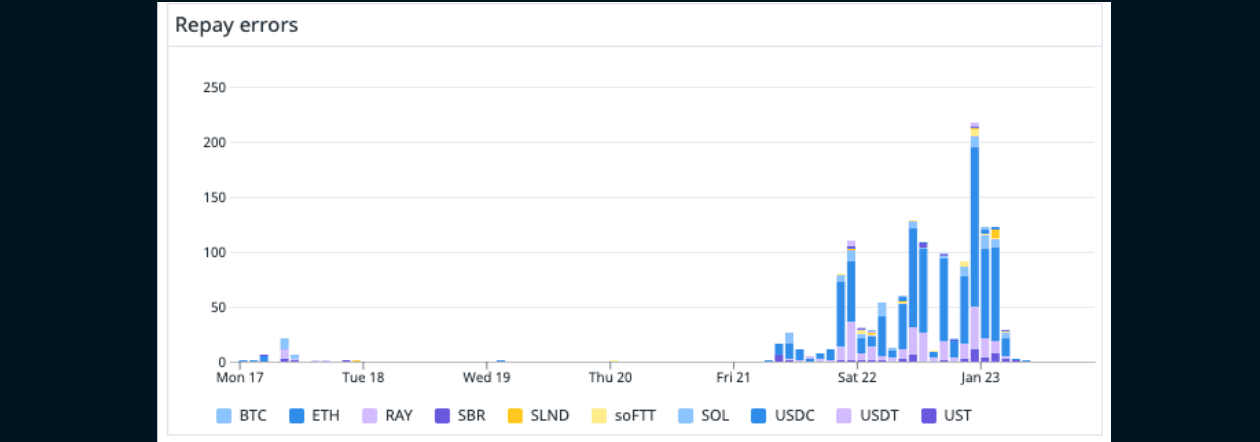

On 21 Jan 2022, the Solana network was in a state of instability, which Solana termed as “performance degradation”, and this instability caused many Solend transactions to fail. For those unfamiliar with Solend, it's basically a protocol for lending on borrowing on Solana, similar to other money market protocols like Aave or Compound. As a result of the network instability, it caused many failed user attempts at depositing and repaying which resulted in users having their positions liquidated.

To make matters worse, there were also issues with the Pyth oracle price feed causing many wrongful liquidations on Solend.

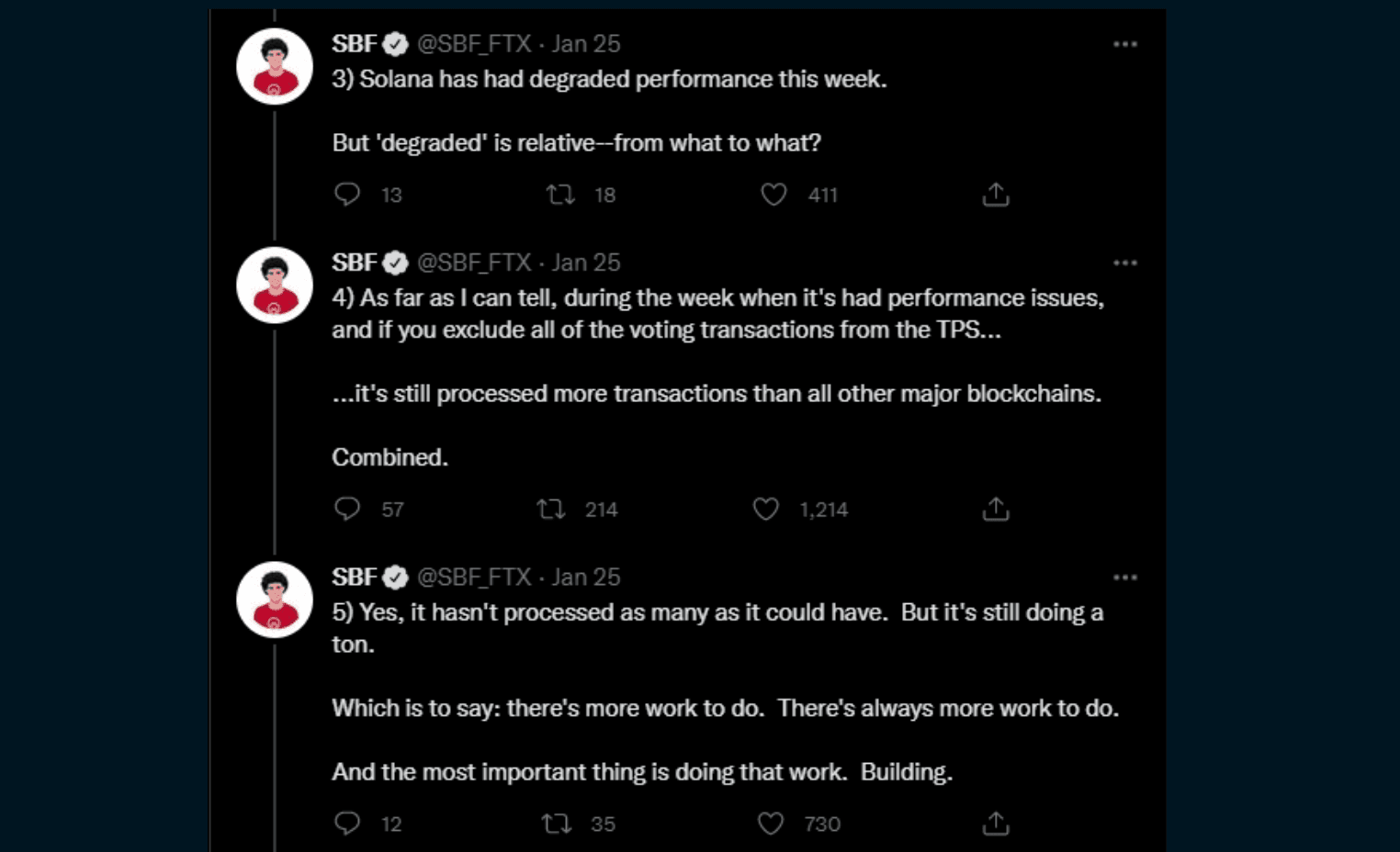

FTX's CEO SBF, however, remains optimistic about Solana despite the network stability difficulties and continues to be public about his support.

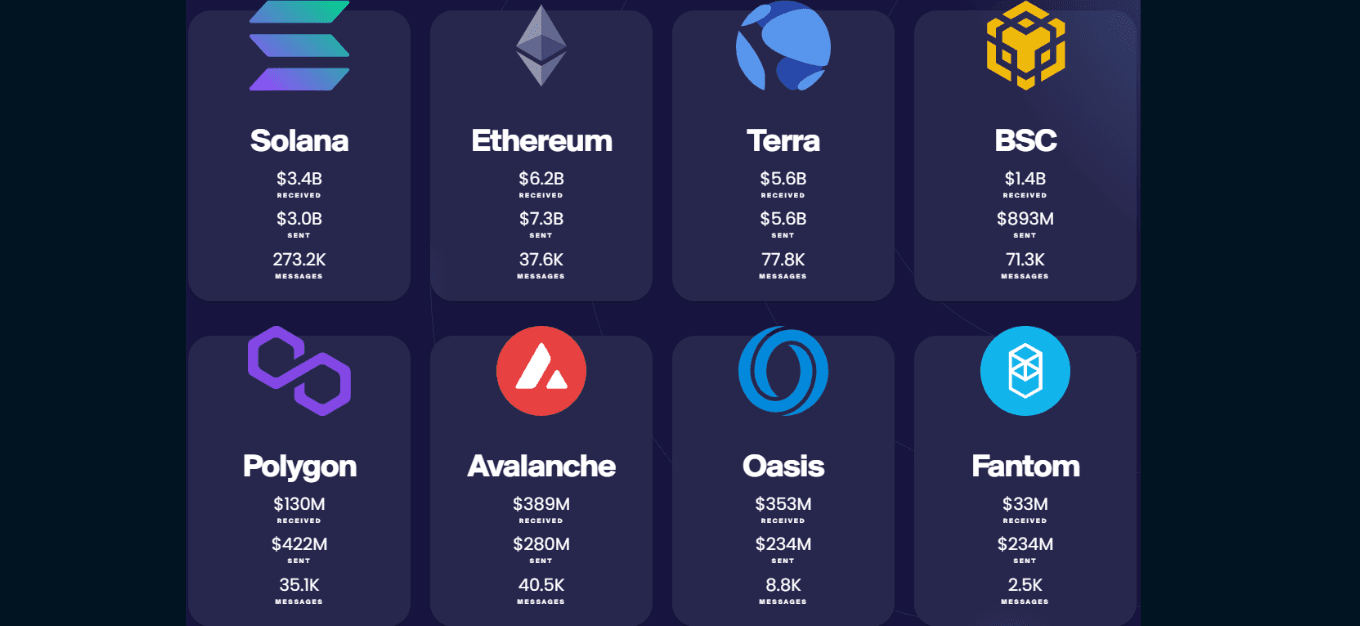

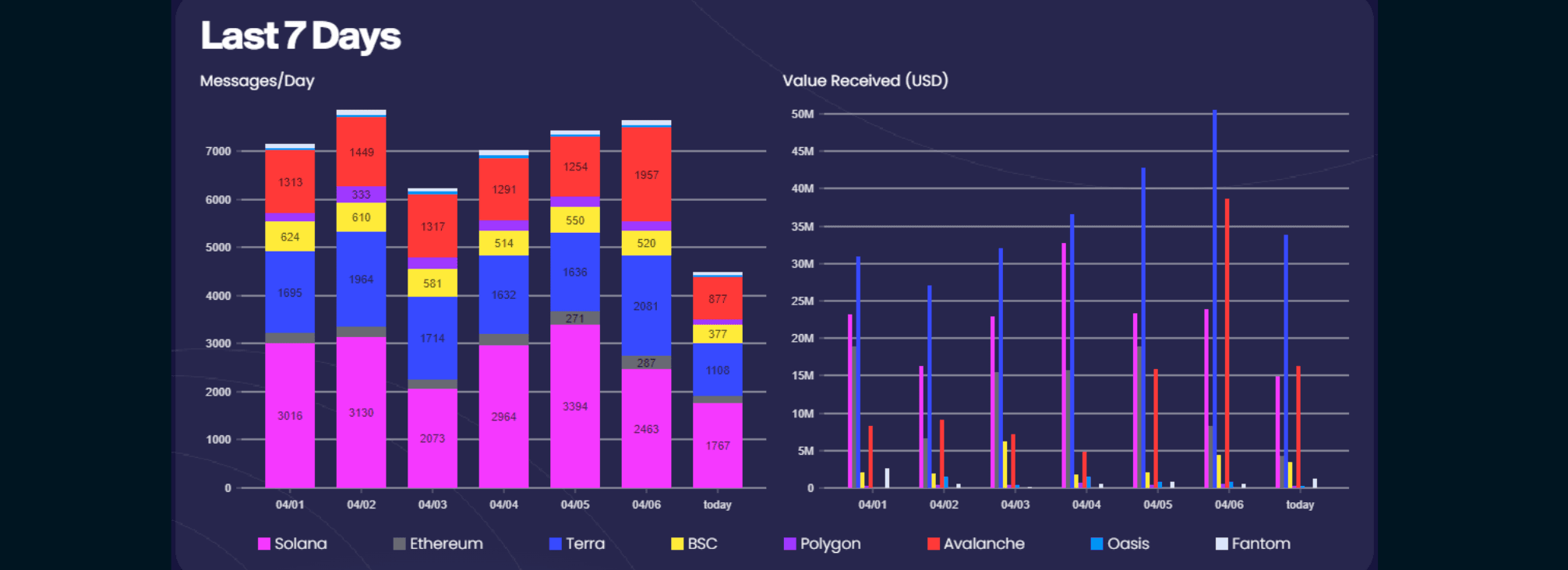

Bridging Activity

Looking at the bridging activity on Wormhole, it's clear that Ethereum-Solana transactions remain dominant. However, bridging activity to the Avalanche chain seems to be catching on as well.

Moving Forward

Roadmap

Looking at Solana's roadmap from 2019 we are still currently in its mainnet beta phase which was first launched in march 2020 with only one major event left: the launch of the mainnet. Although no official date for the release has been announced, it's probable that the final mainnet will only be launched once the network has been demonstrated to be more stable and reliable.

When comparing the "Beta" and "Mainnet" phases, however, they appear to be nearly identical, as the primary functions are also fully functioning in the beta phase.

Gaming & NFTs

With Solana’s thriving NFT marketplace as well as GameFi’s surge to popularity, it is likely that the Solana ecosystem will be booming with GameFi projects in 2022.

Popular Projects on Solana:

- Solice

- First cross-platform VR metaverse on Solana

- Star Atlas

- Triple A rated blockchain game. Arguably the most hyped-up game in 2021.

- Aurory

- Fantasy P2E game

Key Takeaways

Solana, like all alternative blockchains, has its own set of strengths and weaknesses. Solana's decision to achieve rapid scalability at the expense of decentralization has clearly resulted in massive growth in the company's formative stages. While decentralized purists may protest against this decision, data suggests that the majority of folks seem to agree with Solana’s focus on scalability.

Building a new ecosystem definitely comes with its own tradeoffs and pains. It is common for new chains to have degraded performance in times of high growth and before reaching full maturity. Ethereum for example had to fork itself into ETC and ETH due to the Dao hack. Hence it isn’t unusual for Solana to encounter similar issues during this phase.

The remainder of 2022 will definitely be an interesting time to observe whether Solana can improve its network stability and continuously compete with expanding incumbents like Near Protocol on its competitive advantages such as superior TPS and low transaction costs.