Introduction

The upcoming Ethereum Merge is arguably one of the biggest events in crypto since the Bitcoin genesis block. The Merge refers to Ethereum making a change at the consensus layer by moving from Proof of Work (PoW) consensus to Proof of Stake (PoS). With crypto now in a bear market, The Merge has been a hot topic over the past few months; but can it really live up to all the hype?

While everyone can agree that The Merge cutting Ethereum’s energy consumption by ~99.95% is a positive development for an industry marred by its poor environmental image, there are other implications of PoS that have made the community divided.

In the following report seeks to contribute to the discussion around The Merge give some perspective on two major questions:

- Will PoS introduce more censorship risk at the validator level?

- Does the shift to PoS lead to increased selling pressure on ETH from (un)stakers mid-term?

*All data in this report is as of September 9, 2022.

Merging to Proof-of-Stake and Centralization?

With Ethereum moving to PoS following The Merge, a key concern has been the centralization of staked Ether (ETH).

One of the original ideas for blockchains was to enable decentralization. However, economies of scale regarding energy costs and equipment ultimately resulted in large, centralized mining farms and pools. This, among other arguments, leads the discussion towards other technical solutions such as PoS.

However, some have argued that PoS also inherently results in centralization. Many tend to opt for liquid staking or staking via third parties out of convenience, and the market for staking providers is one that also benefits from economies of scale.

- In terms of additional yield from MEV procurement the larger entity can have an advantage.

- Additionally, the liquid staking derivative with the best liquidity and integrations into CEXs and DeFi has a strong competitive advantage. Liquidity begets liquidity.

The actual number of unique addresses participating in staking is very high (~80k). However, it is more nuanced when looking at the landscape of intermediary staking service providers that stake the ETH on behalf of their users. Consequently, although the stakers (as in ETH contributors) might be quite diverse, most of the staked ETH and validators could be (indirectly) controlled by a handful of entities or governing bodies.

In light of recent events regarding Tornado Cash, many concerns have been raised with the transition to PoS and the implications of the concentrated stake amongst a few actors. Any major validator that acts maliciously toward the network or is targeted directly by regulators could threaten Ethereum’s value proposition as a secure, decentralized, and censorship-resistant infrastructure.

Although they are not technically the same thing, comparing the hash rates of the largest mining pools and staked ETH of the largest staking entities or intermediaries can function as a rough indicator when looking at PoS vs. PoW centralization for Ethereum. At first glance the two seem almost equally (de)centralized at an entity level - the top 3 combining over half and the top 5 around two-thirds of the hash rate or stake respectively:

| PoW: Mining pool | % Hashrate | PoS: Staking entity | % Staked ETH |

|---|---|---|---|

| Ethermine | 28.80% | Lido | 31.00% |

| f2pool2 | 14.80% | Coinbase | 15.00% |

| Hiveon Pool | 9.80% | Kraken | 8.38% |

| 2miners | 7.60% | Binance | 6.64% |

| Flexpool.io | 4.70% | Staked.us | 2.98% |

| Total | 65.70% | 64.00% |

Sources: Etherchain, Nansen, as of September 9, 2022

Recent discussions: There has been an increase in concern regarding the potential for censorship following the US government sanctioning the Tornado Cash protocol (through OFAC) on August 8th 2022. This resulted in a number of protocols blocking addresses that had interacted with Tornado Cash and raised some valid concerns regarding the assumptions around permissionless participation on Ethereum. Despite a number of frontends censoring addresses, they are still accessible by interacting with their permissionless contracts. However, there is concern that if Ethereum itself becomes sufficiently centralized, certain users could be censored which would invalidate its core value proposition of being a decentralized and open infrastructure. This makes assessing the implications of The Merge and a deeper look into the top staking entities as important as ever.

How much ETH is staked, and when?

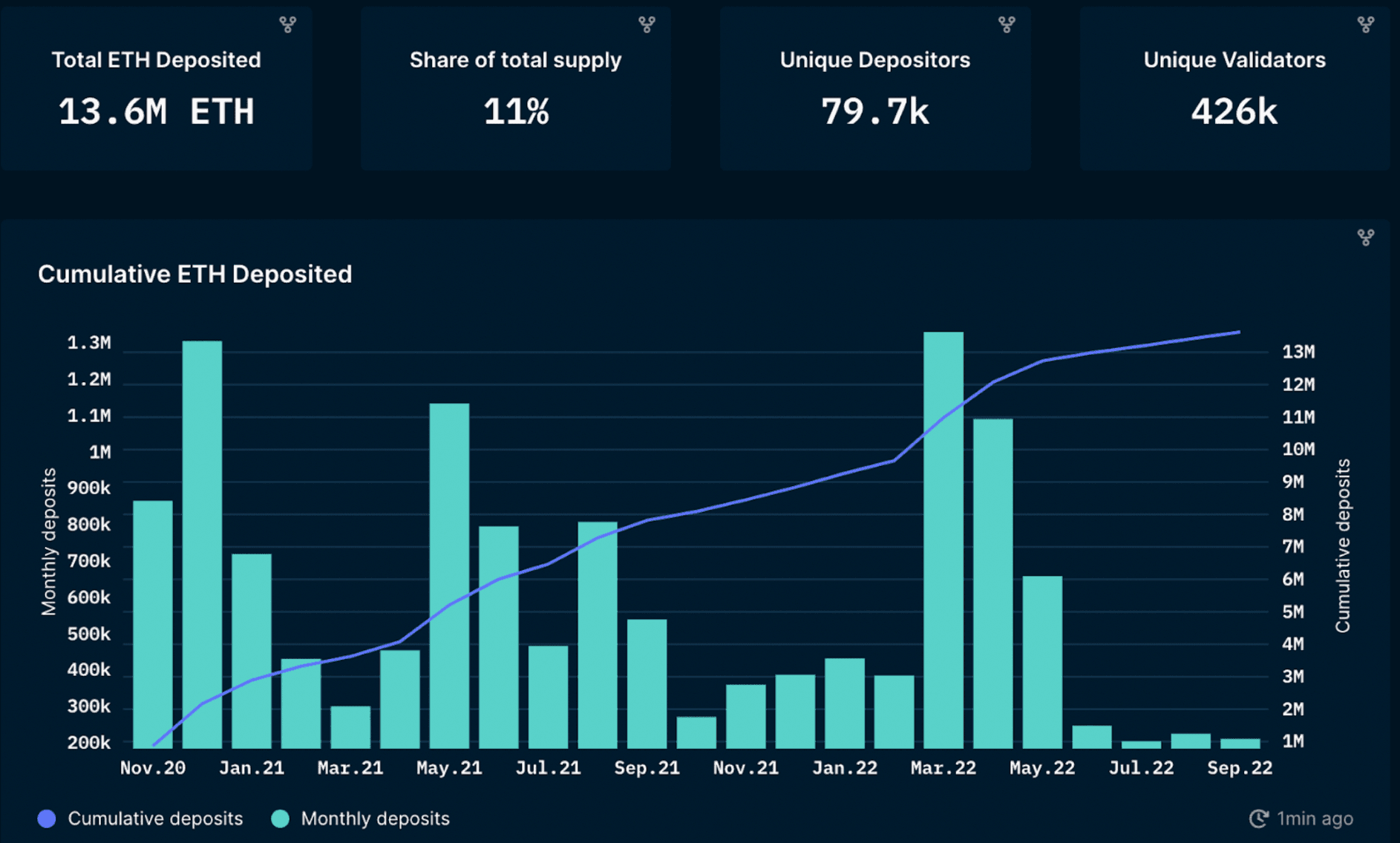

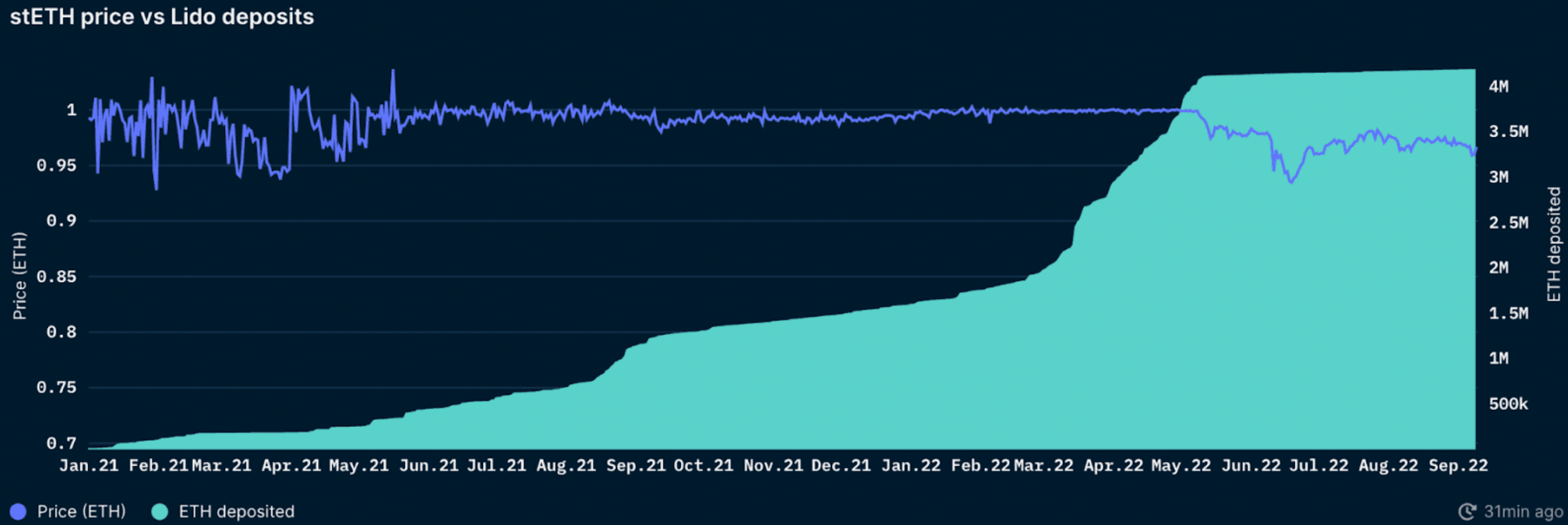

As the data shows, ETH deposited on a monthly basis has been highly volatile, and has recently seen a significant decrease. Note that total staked ETH is ‘up only’ as withdrawals are not yet enabled.

The significant decline following May can be attributed to the fallout from the LUNA crash and subsequent FUD and ‘de-peg’ of ETH and stETH. Check out Nansen’s articles here (UST) and here (stETH) covering these events. This ‘de-peg’ (along with bear market conditions) appears to have had a dampening effect on the appetite to stake ETH.

In total, 11.3% of the ETH supply has been staked.

This is compared to ~41% of MATIC staked (Polygon) and ~77% of SOL staked (Solana).

The relatively small proportion of ETH staked can be attributed to:

- High validator requirements (32 ETH) to run your own validator node.

- Illiquidity: If (when) The Merge occurs, staked ETH will still be locked until the Shanghai upgrade which is expected some time in 2023.

- Liquid staking providers such as Lido and Binance solve this liquidity issue by enabling users to receive a fungible derivative token representing their staked ETH position.

- A total of 65% of all ETH staked is with liquid staking service providers.

- Liquid staking providers also enable users to stake with less than 32 ETH.

- However, solving the illiquidity issue by using providers such as Lido and Binance introduces new risks, namely counterparty and smart contract risk.

- Technology Risk

- There has been ambiguity as to when (and if) The Merge would happen.

- Uncertainty whether The Merge will be properly executed and if the PoS chain will be adopted.

- Validators run the risk of receiving penalties or even slashing in the event of improper behavior.

- Minor penalties are given for inadvertent actions (or inactions) that hinder consensus (e.g. being offline for a few days).

- And major penalties – or slashings – are given for malicious actions (e.g. attesting to invalid or contradicting blocks). Source: ethereum.org

- To minimize the risk of slashing on stakers, Lido stakes ETH across multiple node operators (with heterogeneous setups). In the event that the operator you choose goes out of business, it will not be possible to re-delegate or switch to another operator until transactions are enabled on the new chain (meaning your ETH will be stuck earning no rewards). Additionally, as mentioned above node downtime is also subject to slashing although Lido applies a 10% fee on staking rewards that are split between node operators, the DAO, and an insurance fund to help cover such events.

- Low returns compared to other DeFi protocols: Many DeFi protocols have offered a higher yield than that offered from Ethereum staking which may contribute to less ETH being staked.

If The Merge goes as planned it is possible that there will be an increase in monthly staked ETH as Merge execution risks diminish. Given that a relatively small amount of ETH is staked at present, liquid staking derivative solutions should stand to gain from this increase in confidence. However, this is also dependent on market conditions, and if crypto sentiment further sours the positive impact could be negated.

Concerns have been raised regarding the risk of centralizing staked ETH with a small number of entities - a situation that appears to be somewhat materializing already.

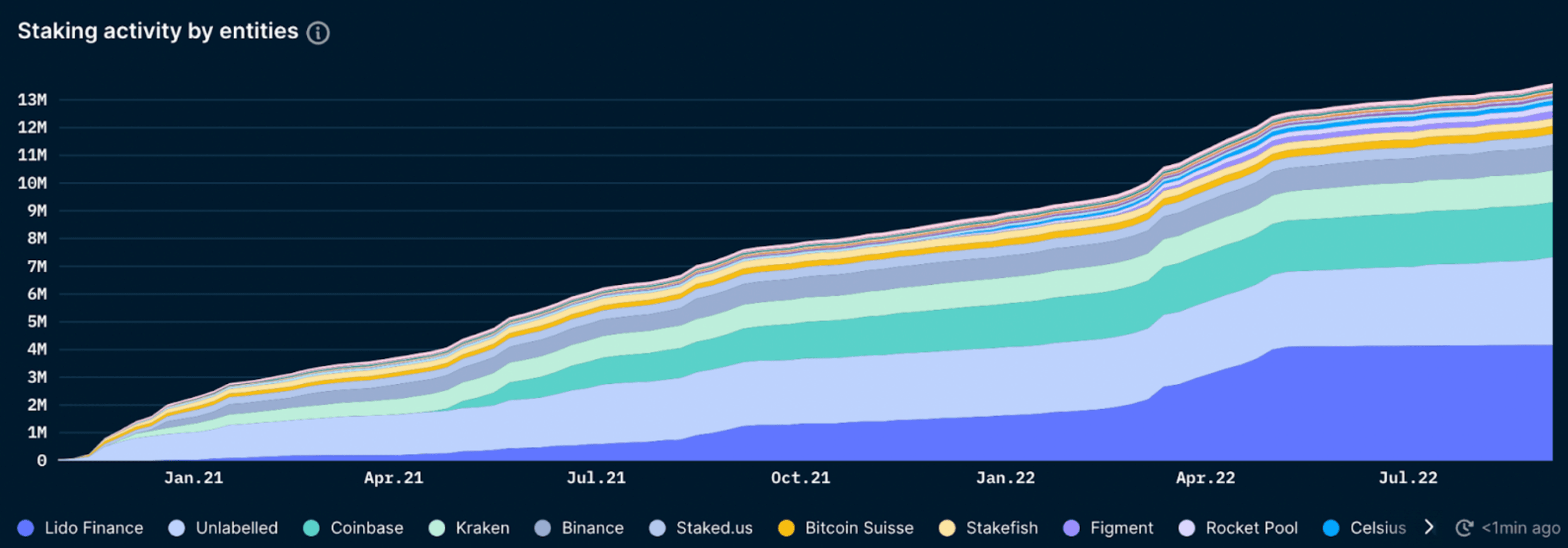

ETH Staked By Entity

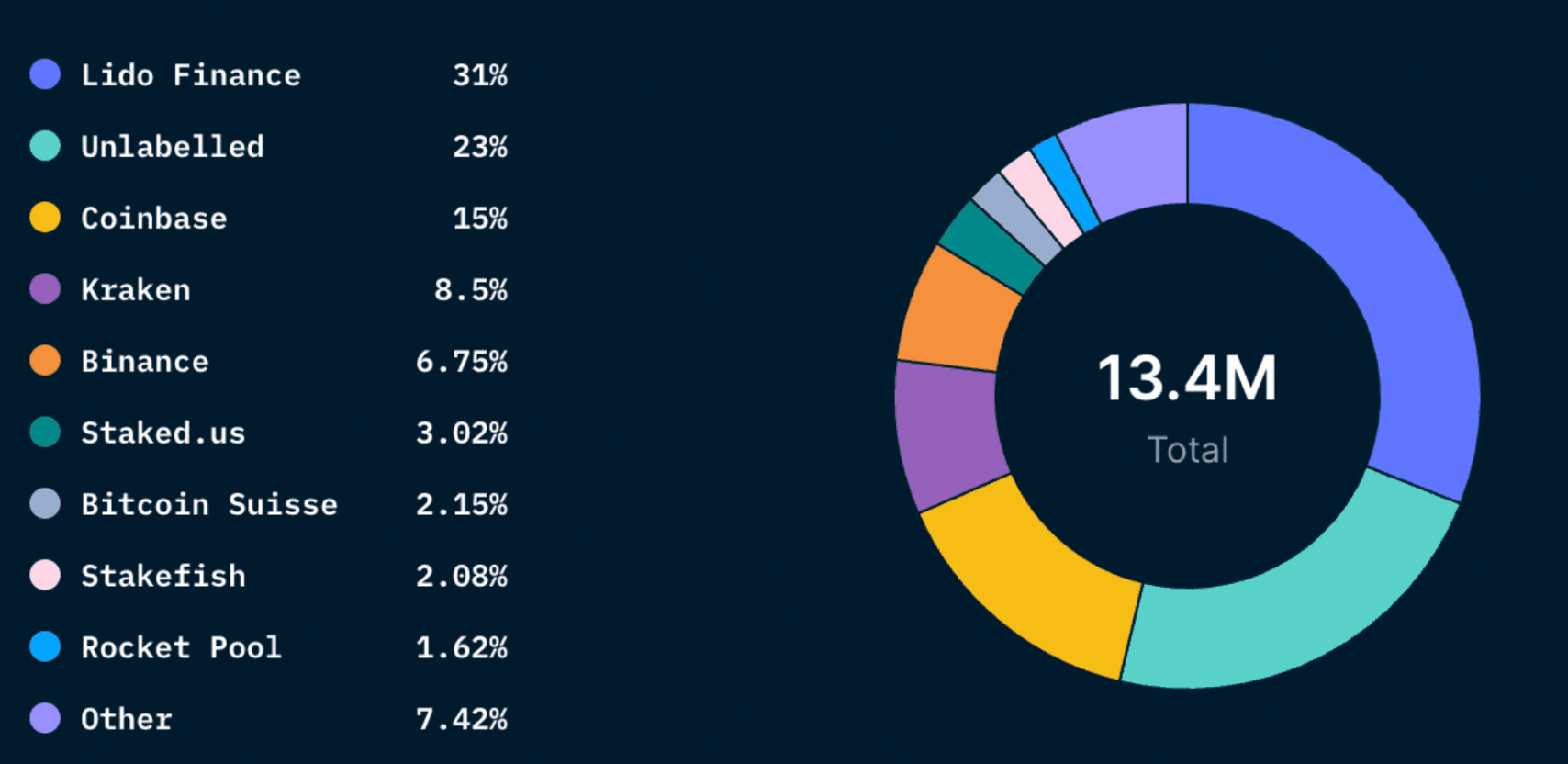

Lido (a decentralized on-chain liquid staking protocol) is the largest staker of ETH, boasting a total of ~31% of the total staked Ether. Following Lido; Coinbase, Kraken and Binance have ~30% of the total staked Ether, according to Nansen’s wallet labels and on-chain data.

These centralized exchanges are required to comply with regulators in the jurisdictions in which they operate. To address the significant risk of centralized exchanges accumulating the majority of staked ETH, liquid staking derivatives platforms such as Lido were set up to enable permissionless participation in staking. With Lido now being the largest staker of ETH, does its dominance present another risk in itself?

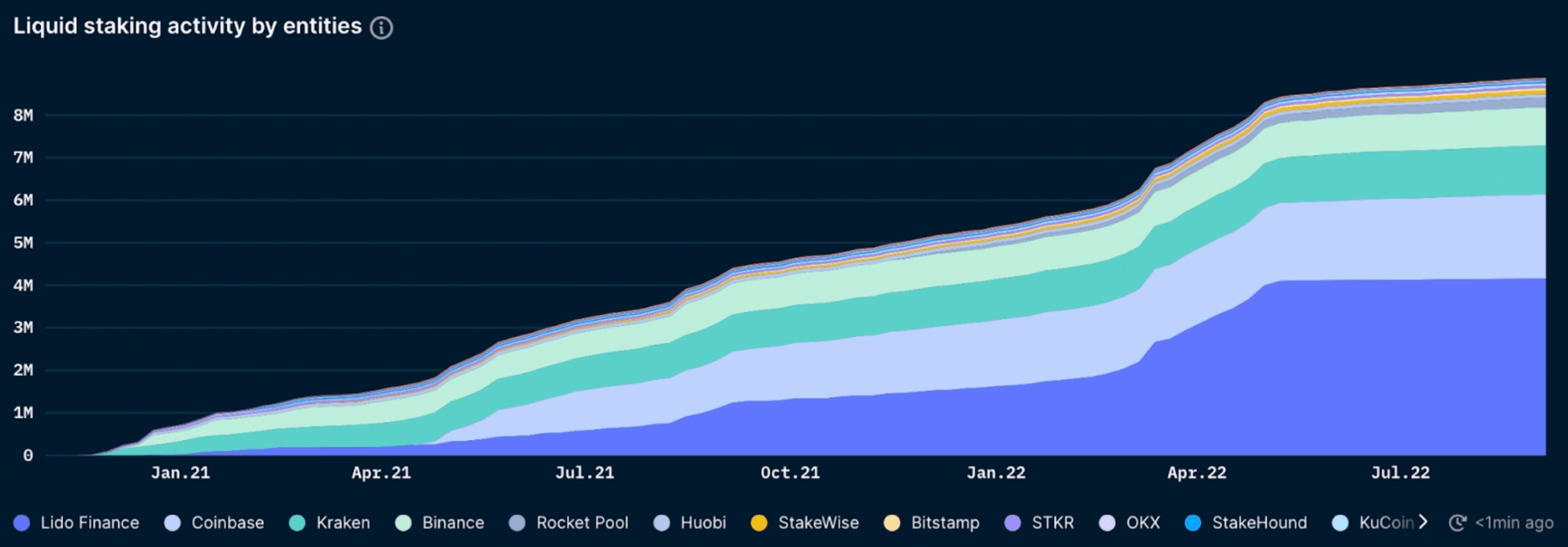

Liquid ETH Staking By Entity

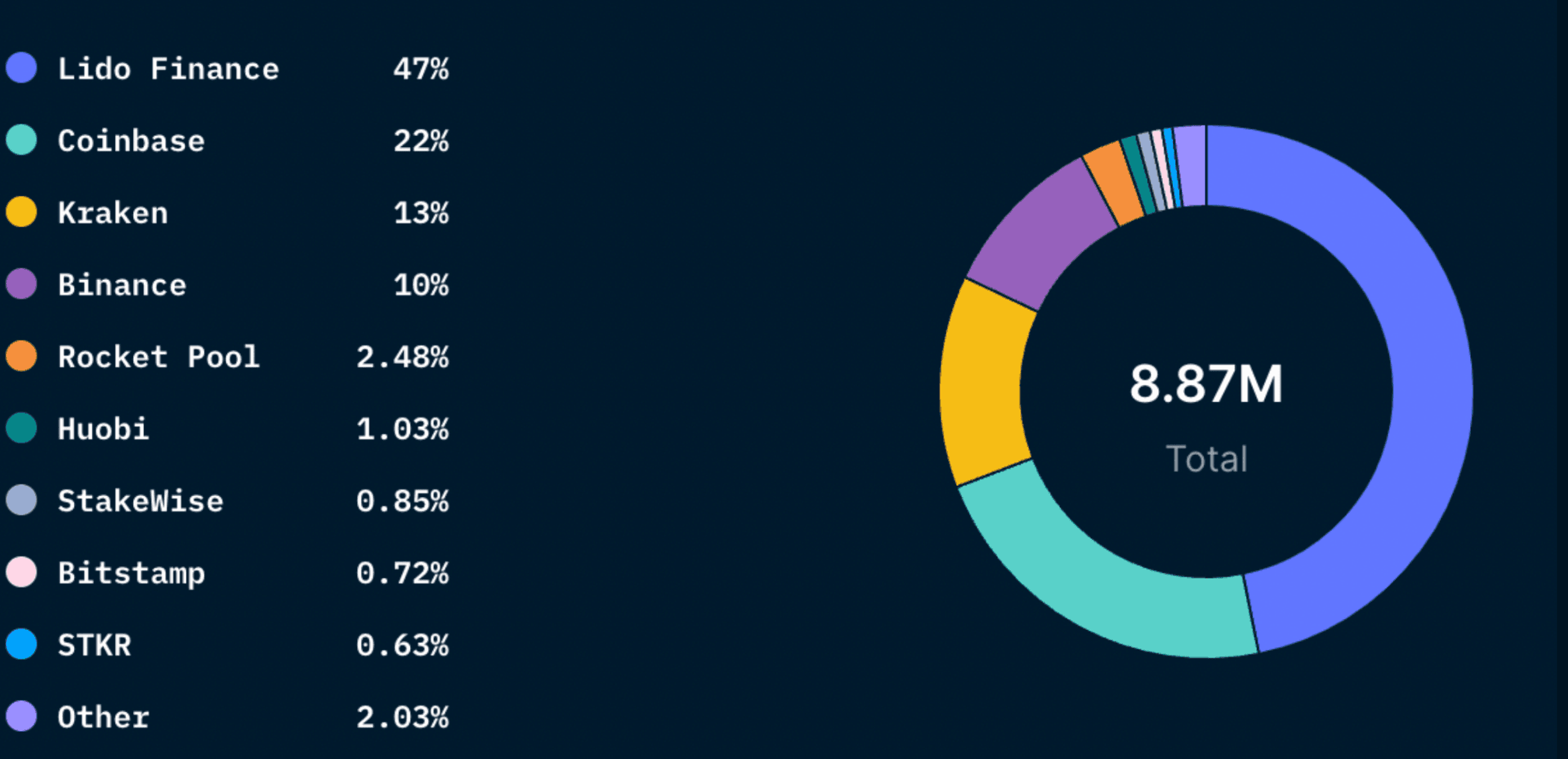

Zooming in on the liquid staking solution market, Lido is at ~47%, while the big 3 exchanges combined are at ~45%. This shows that although Lido has the dominant market share, it is essentially matched by the big 3 centralized exchanges. This lends weight to the argument that platforms such as Lido are important in mitigating the dominance of centralized exchanges with staked ETH.

Liquid ETH Staking Excluding CEXs

Zooming in further to the liquid staking providers excluding centralized exchanges, the extent of Lido’s dominance is apparent. Lido has over 90% of the market, with Rocket Pool in second with just under 5%.

Can Lido be censored?

Lido is a decentralized organization governed by the LDO token and it is set up in a way to allow multiple validator sets. While this structure is obviously more difficult to be targeted by regulators, some have raised concerns regarding the centralization of token ownership. This may leave Lido vulnerable and expose it to centralization risks. Let’s dive in.

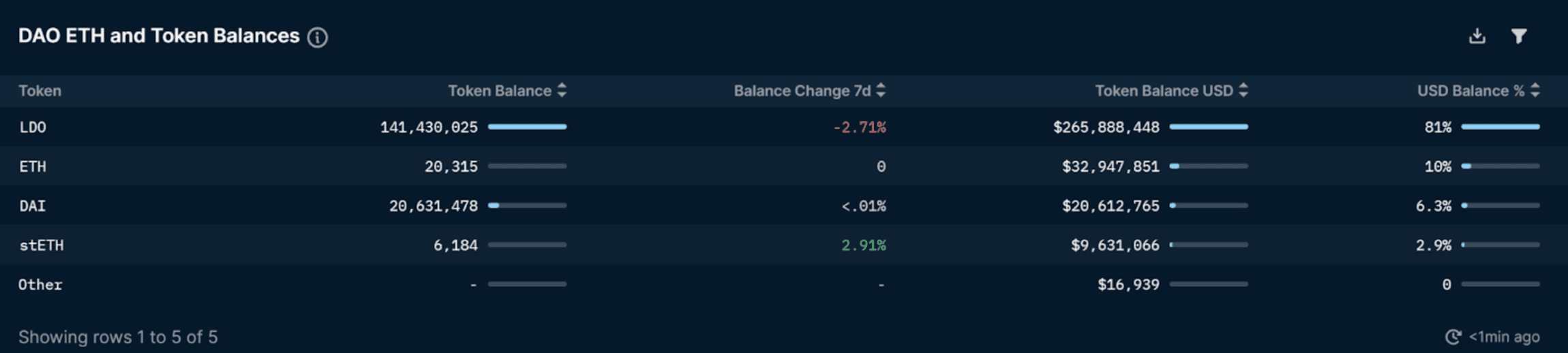

What is Lido DAO and who controls it?

LDO is the governance token of the Lido DAO. The Lido DAO is in charge of setting fees and other protocol parameters, selecting vetted node operators, designing incentives to improve/accelerate project development, implementing upgrades to the protocol and managing the DAO treasury. The chart below shows the breakdown of the assets owned by the treasury. It can be seen that the DAO controls a total amount of liquid assets of about ~$330m, which makes up around 3.3% of the total dollar value controlled by DAOs in the space (total DAO liquid assets for all DAOs covered by Nansen has been estimated to be around $9.99b). The main assets under management include LDO, ETH, DAI and stETH. However, note that 81% or ~$265m of its treasury is in the LDO token which remains subject to high volatility and its deployment for productive uses results in additional sell pressure on the token. Despite this, the DAO has over $20.6m in stablecoin and over $9m in stETH making it very well capitalized.

Looking at the price and volume chart below, it can be seen that the LDO price reached a high of over $6 towards the end of August 2021. Since then the price has been on an overall decline for almost a year (with a short recovery between March-April). After the lows of June, the price and volume started to pick up significantly only after early July 2022, as optimism about The Merge's implementation by the planned date began to grow.

In order to participate in Lido DAO governance, members must hold LDO tokens. Members’ votes are given a certain level of weight based on how much LDO they stake in the voting contract. An individual's influence increases proportionally with the amount of LDO tokens he/she has locked in their voting contract.

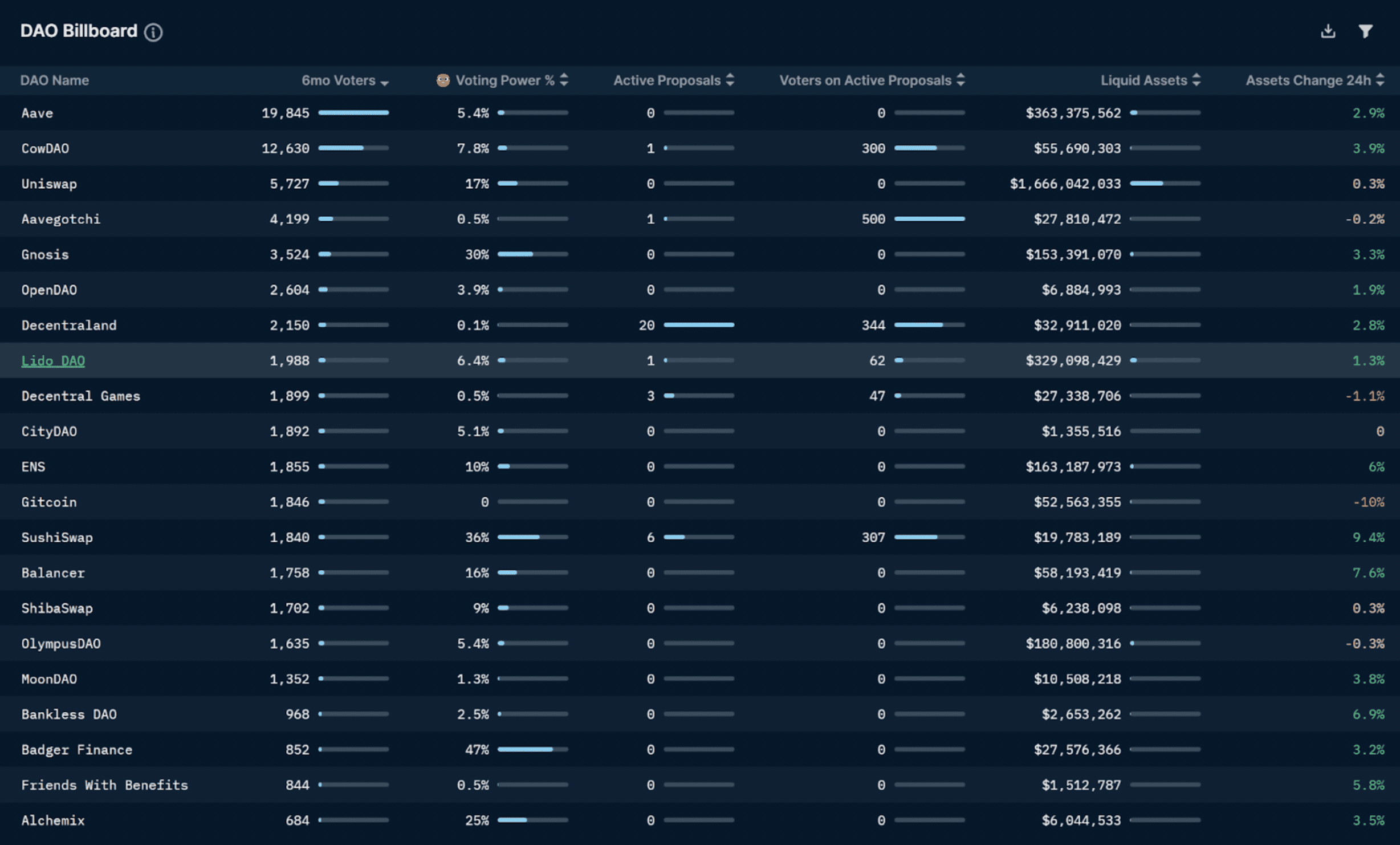

The table below gives core governance participation statistics for the past 6 months across all the DAOs. Lido had 1,988 unique wallets who voted on any proposal in the last 6 months, placing the DAO as one of the top active DAOs in the space (8th position). This number is dwarfed, however, in comparison to Aave’s 19,845 unique wallet participants which leads the rankings. However, the number of wallets participating in governance is not a true reflection of how decentralized governance is, as voting power is in relation to the number of tokens a wallet holds, not on a 1 wallet 1 vote basis.

Additionally, by analyzing the voting power across the participants, it can be seen that just 6.4% of the voting power is aggregated among tagged Smart Money wallets. This is a lot lower in comparison to the voting power Smart Money had in Perpetual Protocol (60%), Badger Finance (47%) or PleasrDAO (46%) which take first, second and third positions respectively. However, looking at the voting power exercised by Smart Money wallets over the last 30 days, the number jumps to 9.3%. This suggests that a number of Smart Money wallets have been actively taking part in governance more recently.

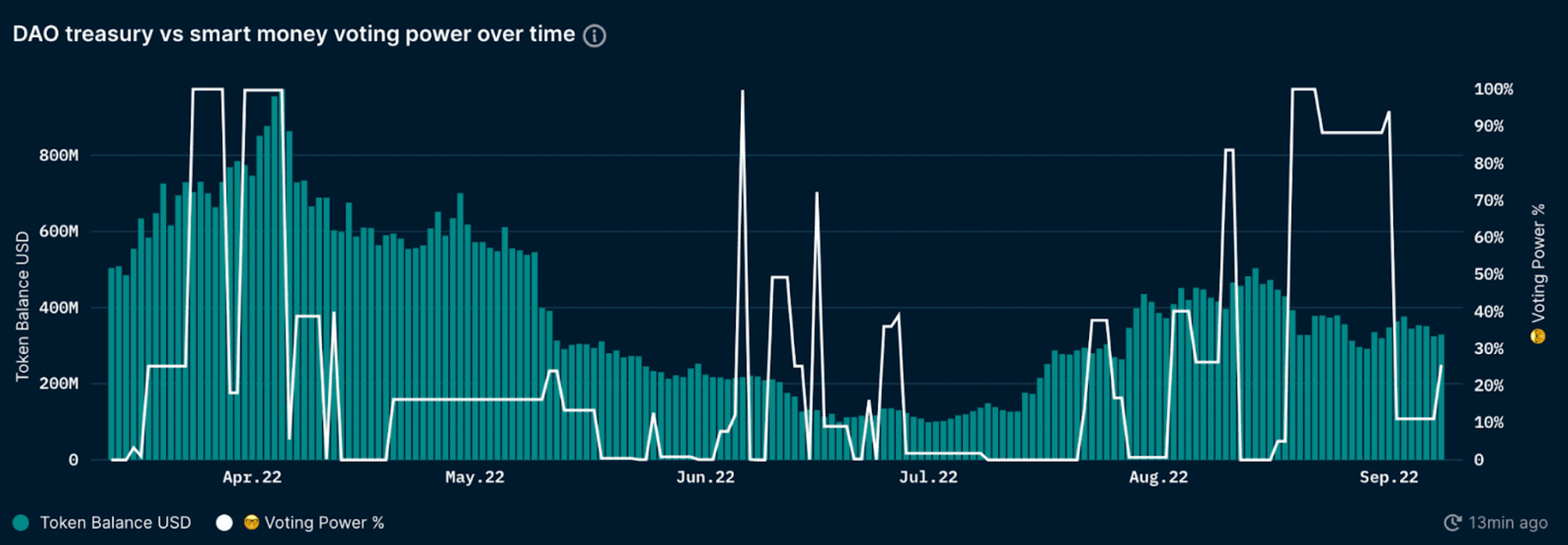

By analyzing the voting patterns of Smart Money over time, it’s possible to understand their participation and influence to a much greater extent. The figure below is a chart showing Smart Money voting power and the DAO treasury balance over time.

It can clearly be seen that the voting power of Smart Money wallets fluctuates significantly over time. This highlights that Smart Money wallets do not get involved in every single governance proposal, but vote only on the most important ones. It is important to note that in this report Voting Power refers to exercised voting power via Snapshot at any proposal, as opposed to governance token holdings.

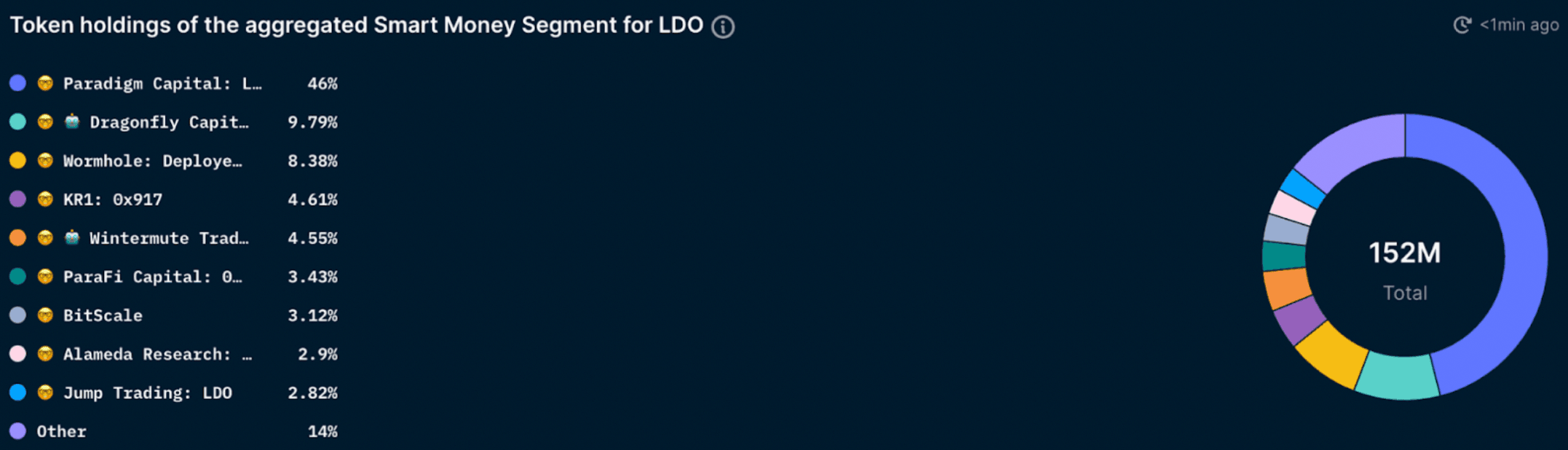

Zooming in, the breakdown of LDO holdings among Smart Money wallets is given in the figure below.

It can be seen that tagged Smart Money token wallets as a whole own 152m LDO tokens. This is a considerable amount compared to the total circulating LDO supply of ~996m. Among the Smart Money token wallets, Paradigm Capital owns 46% of the share followed by Dragonfly Capital at a distant second with ~9.8% (it is important to remember, however, that one entity could be behind multiple wallet addresses that haven’t been labeled yet). Nevertheless, this highlights that even among Smart Money wallets, token holdings are concentrated among very few wallet addresses.

The following graph shows the balance for the top wallets holding the LDO token (for all holders). Interestingly, Smart Money wallets are not that dominant (with the exception of Paradigm Capital).

For the purposes of the above graph, the Lido DAO Treasury wallet (with 14% of the total supply) has been removed as these tokens are not in circulation nor used in governance. As mentioned earlier, Lido DAO Treasury is used for liquidity incentives, advisory services, and further token sales. These distributions can have further centralizing effects.

As the graph shows, overall LDO ownership is relatively concentrated, which could pose a centralization risk to Ethereum if Lido establishes a dominant share of staked ETH. The top 9 addresses hold ~46% of governance power and could theoretically exert significant influence on the validators (given that they are vetted by the DAO and can be removed via governance).

If Lido's market share continues to rise, it is possible that the Lido DAO may hold the majority of the Ethereum validator set. This could allow Lido to take advantage of opportunities like multi-block MEV, carry out profitable block re-orgs, and in the worst case scenario censor certain transactions by enforcing or rewarding validators to operate in accordance with Lido's wishes (via governance). This could pose problems for the Ethereum network.

On the other hand, there is also the risk of a centralized exchange dominated staking derivative market if Lido were to self-limit, a scenario that could be more straightforward to censor than attempting Lido governance capture.

As an example of LDO concentration risk, 50% of the voting power for a proposal regarding the sale of tokens to Dragonfly consisted of only 2 wallets, and almost 80% of the voting power were exercised by the top 5 wallets. This points towards signs of governance centralization, which may become an issue if Lido continues to maintain its market share of staked ETH.

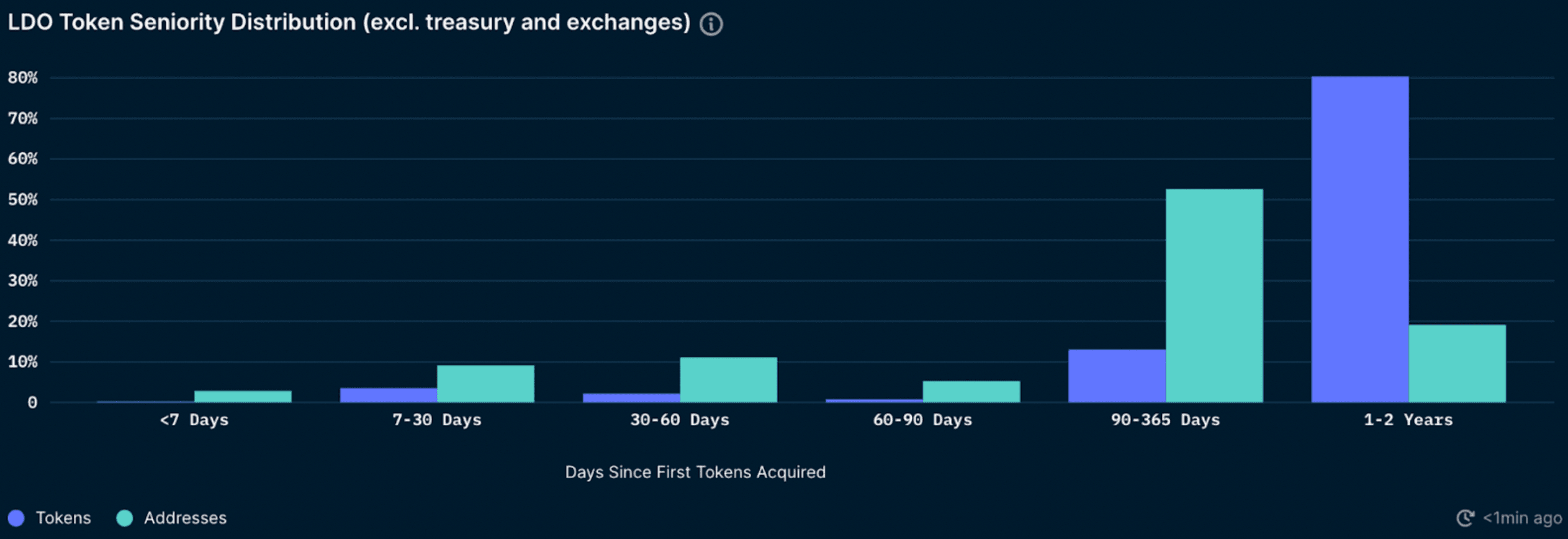

The chart above also gives us a better picture of LDO token holders. Over 81% of the tokens (representing 19% of the addresses) were acquired 1-2 years ago, signaling that these addresses have been hodling for a significant amount of time. Looking at the Token Seniority Distribution chart, a slight uptick for tokens acquired between 30-60 days and 7-30 days can be seen. The slight uptick in both cases, however, made up a relatively small percentage of the overall LDO tokens in circulation (only around ~2-3.5%).

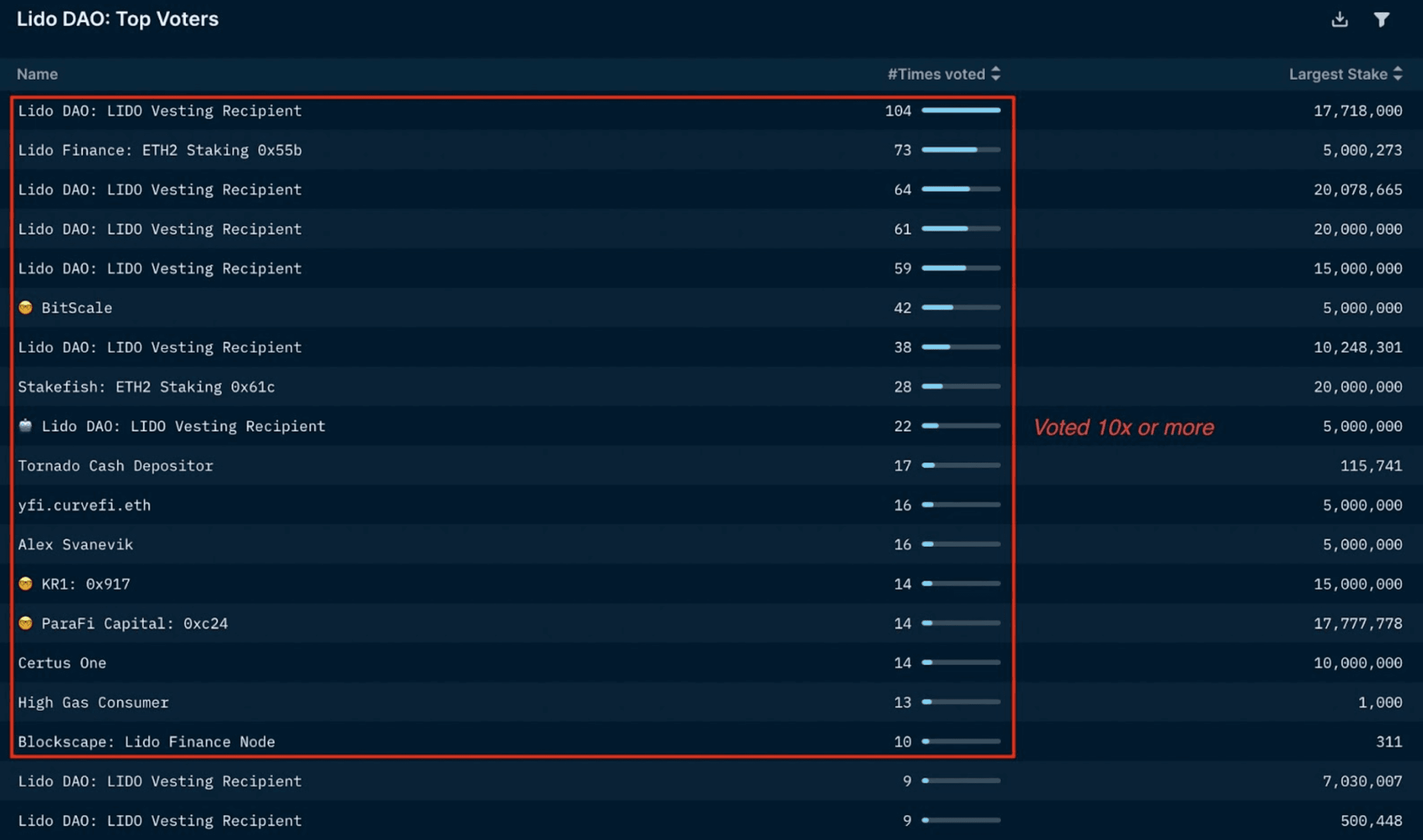

By looking at the historical votes it is also possible to determine the top voter and influencers in the DAO as seen in the following tables below.

Nansen data shows that there are a number of wallets with significant influence in DAO governance, most of which are investors in Lido. This makes sense and is not necessarily a critique of Lido as it remains a relatively new protocol. Early iInvestors will inevitably have a larger share of the voting power. However, it will be interesting to see if this voting power falls over time and becomes more dispersed.

"Voter turnout" for most proposals in the Lido DAO is low, with only 17 wallets participating in 10 or more proposals . There are also significant differences between the top active wallets in the DAO. While the wallet with the most number of votes participated 104 times, this number goes down to 17 for the 10th wallet with the most votes. Additionally, there are just three Smart Money wallets in the top 20 wallets with the most votes (notably all funds). BitScale comes in first with 42 votes followed by KR1 and Parafi Capital both with 14 votes each.

Moreover, by examining the maximum voting power each wallet had in a proposal (in the last 6 months), the top influencers in the DAO can be identified. Interestingly, historically the top token holders have not been the top influencers. The highest voting power exercised by an influencer in a proposal was 23.8m tokens which represented 31% of the total voting power in one proposal. On the other hand, the highest sway a wallet had in a proposal goes to Dragonfly Capital (38% of total voting power in a proposal). The proposal involved allocating 1% of LDO tokens to Dragonfly Capital in exchange for a total of 14,521,530 DAI.

By looking at the data from previous votes, it appears that some centralization risk in the Lido DAO does exist. Although some of the top token holders (including Smart Money) do not regularly exercise their voting power, on critical proposals that may affect them the most (directly or indirectly), their vote could have a large sway on the final decision.

It is also worth mentioning that some of the top token holders in the Lido DAO are doxxed entities, with a significant amount of capital off-chain. As a result, if put under pressure by external forces to comply with certain proposal votes (e.g censoring some transactions), they are more likely to comply (out of fear of retaliation/penalties) which would undermine the integrity of the vote.

Who Runs The Nodes?

Lido currently has 29 different node operators which some argue makes Lido decentralized, and the protocol aims to increase this validator set over time. However, one could also contest that the validator set will essentially act as one entity as they are unified by the LDO token. It is not permissionless to become a Lido node operator as the decision lies with the Lido DAO. This may potentially result in collusion between the validators and LDO holders. Furthermore, Lido’s node operator set is mostly concentrated in Europe and the US. Lido has acknowledged this and is working on reducing this reliance by aiming to have a validator set that is legally and physically distributed.

How are centralization risks being mitigated?

Lido Dual Governance ModelLido is considering a dual-governance model with LDO and stETH. While LDO would remain the governance token of Lido, stETH holders will be able to protect themselves by vetoing proposals that directly affect them. Rather than making stETH a governance token, it would be empowered to have a safety mechanism in the event there is a Lido proposal that could adversely affect them. This is to ensure that the interests of LDO and stETH holders can be better aligned while also ensuring that the general governance of Lido remains with LDO holders.

It is proposed that LDO holders must lock LDO for governance power. If the LDO voters favor a proposal that gets vetoed by stETH holders, their staked LDO gets slashed. While this would more closely align the interests of LDO and stETH holders, it could also result in stETH holders causing a governance gridlock. To prevent them from abusing their veto power, another option proposed is a significant timelock instead of outright slashing. If the stETH holders fail to resolve the situation that they vetoed, the timelock would be lifted. If this occurs, then the stETH that vetoed the proposal would also be seized.

There are many different permutations of how this dual governance model could be implemented and the nuances of a dual-governance model are beyond the scope of this piece. For example, the slashing mechanism for vetoed transactions could discourage ordinary community members from participating in governance. Note that a definitive solution has not been decided upon yet by the community.

Another point to consider is that most stETH is used in DeFi protocols and may not be available to vote, reducing its governance power. Nansen data shows that 21.2% of LDO holders also hold one or more of stETH, astETH, crvstETH and wstETH.

Given that this subset of LDO holders owns ~33% of the total LDO supply it will be interesting to see how this impacts potential vetoable decisions. One could take the view that what is good for Lido (and thus LDO) is good for Ethereum (and therefore ETH) and that the holders of both should take this into account when it comes to Lido governance. However, a potential situation could arise whereby the value and upside potential of their LDO holdings exceeds that of their ETH which would give these holders an incentive to protect the dominant part of their portfolio (LDO) at the potential expense of Ethereum. Lido is not exclusive to Ethereum, and if other blockchains become a major growth area then these holders could vote in such a way that may not be in the best interests of the Ethereum community.

Ultimately, a well designed dual governance system that helps align the interests of LDO holders with stETH will be important, especially if Lido maintains its leading market position. Another point to note is that if Lido can establish a dual governance system that the market accepts as safe, this could enable Lido to further consolidate its leading position. If this occurs, it will be extremely important that Lido remains secure and satisfactorily decentralized to be censorship-resistant.

Permissionless WithdrawalsAnother measure to reduce the risk of liquid staking derivative platforms is to enable depositors to permissionlessly withdraw their funds (following the Shanghai upgrade). Lido has indicated their preference for triggerable exits implemented at the protocol level (Ethereum) level rather than pre-signed exit messages which are a potential centralization vector and security concern. The risk is that the Node operator could defect during this withdrawal period.

How Powerful Is Lido’s Moat?

It will also be interesting to see if Lido depositors decide to withdraw their ETH from Lido and deposit it into a competitor such as Rocket Pool. Over the past 3 months, Rocket Pool’s growth in staked ETH almost matched that of Lido. Perhaps there will be a number of wallets that want to avoid a Lido monopoly and will re-stake their ETH with other platforms (once withdrawing ETH is enabled).

As shown above, Lido currently holds ~91% market share of liquid staking derivative platforms (excluding CEXs) and holds about ~30% of all staked ETH. Lido’s economies of scale can enable it to gain an advantage in procuring additional yield from MEV which could result in significant difficulties for other players to capture market share. This results in a situation where users will choose to stake with Lido because it offers the best yields (even if it is not in the best interests of Ethereum the network). This highlights the importance of ensuring that Lido can satisfactorily decentralize and remain decentralized.

Why use Lido and other liquid staking platforms?

Many users want to get yield on their ETH, and this has resulted in the massive growth of staking services offered by centralized exchanges. Without the existence of Lido and other liquid staking providers, CEX’s influence could be highly problematic for Ethereum. Liquid staking platforms offer an alternative and can be designed in ways that limit censorship risk. Protocols such as Lido remain in their infancy and include many community members that value decentralization and censorship resistance. If they can satisfactorily decentralize, they could play a key role in ensuring Ethereum remains secure, decentralized, and censorship-resistant. While PoS may by design enable a ‘winner takes most’ situation, if that winner can be anti-fragile, satisfactorily decentralized and censorship-resistant then Ethereum should be able to retain these same properties.

It could be rash to insist on Lido self-limiting. Nansen data shows that over the past 3 months, 41k ETH has been staked on Lido, compared to Coinbase (116k), Binance (59k) and Kraken (43.5k). To put this in perspective, the big 3 CEX stakers grew their stake by 218.5k over the past 3 months, compared to Lido’s 41k - approximately 5.3x. Furthermore, Rocket Pool grew by ~35k ETH in that period, almost matching that of Lido.

This shows that centralized exchanges have been receiving significantly more deposits than Lido recently. Limiting Lido - which has established itself as the favored liquid staking provider - would likely result in the centralized exchanges growing their share of staked ETH.

Unlabeled wallets are assumed to be illiquid staking, as they do not belong to an entity offering liquid staking.

Taking a look at the same graph and zooming out to see deposits over time of these liquid staking entities, it is interesting to see a general flat-lining starting when UST started depegging and the subsequent stETH ‘depeg’ and FUD (see Nansen’s report here). Furthermore, while staked ETH deposits have slowed significantly since then, Lido’s deposit growth has been particularly stagnant while the big 3 centralized exchanges have experienced higher growth.

This could be due to the fact that Lido’s stETH trades at a relative discount to ETH on the open market (e.g. Curve), whereas staking via Lido will always give you 1:1 stETH for ETH.

As a result, if a user wants exposure to stETH it makes more economical sense to just buy stETH instead of staking ETH via Lido. Lido also does not hide this fact and actively points their users to the cheapest option of acquiring stETH on their website.

Note that by now, most other liquid staked ETH tokens trade at a premium as well which likely contributed to the overall slow-down of staking activity for similar reasons as stated above.

Other less impactful reasons could be the easier access and higher perceived security when staking with a CEX, especially for retail or an increasing concern from the Ethereum community regarding Lido’s dominance.

How will The Merge affect staking behavior?

Will more people stake ETH?

While only a relatively small amount of circulating ETH is staked, this will increase if/when The Merge is successful (as mentioned above, the quantity of total staked ETH can only increase until the Shanghai upgrade enables unstaking).

In addition to the rewards that stakers earn from ETH issuance, they will also earn the transaction fees that miners are currently receiving, which can be quite substantial depending on market conditions. The transaction fees are paid out in liquid ETH after The Merge, and some estimates range around a 50% increase in staking APR. However, it is impossible to say with any certainty how much APR will increase as this is highly dependent on the amount of ETH staked and transaction activity. It is unlikely that this creates additional sell pressure, as these fees are just redirected from miners and are not additional issuance. On the contrary, this could make ETH a more attractive asset to stake.

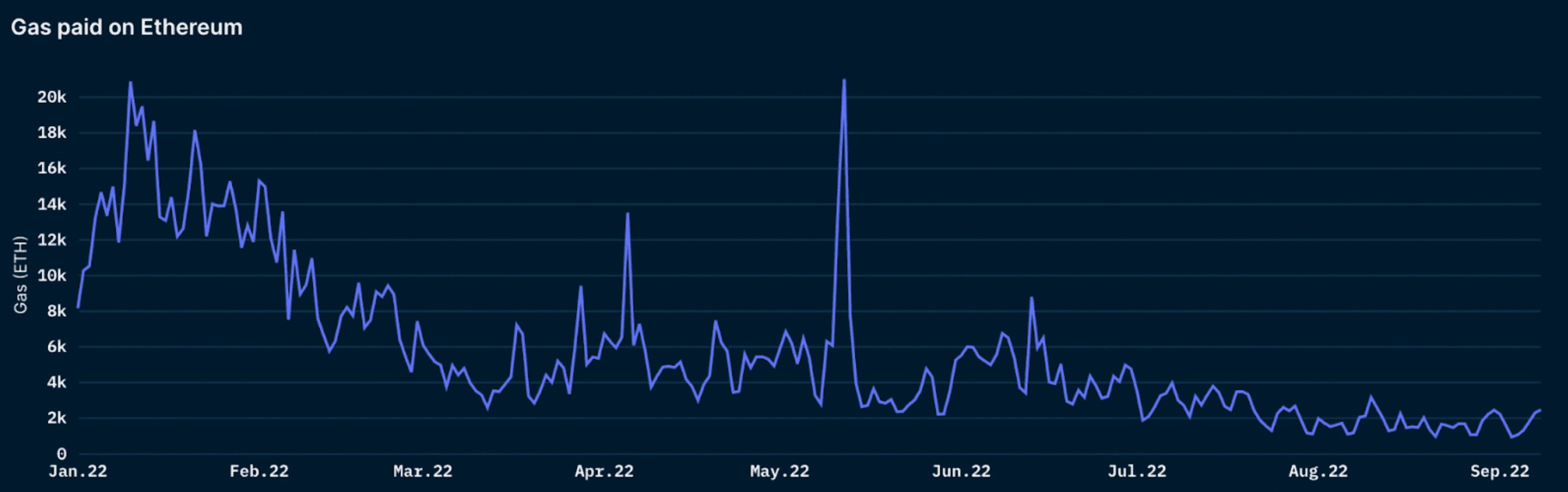

Furthermore, many believe that stakers, who own the underlying asset themselves, are less likely to sell mid-term compared to miners who do not necessarily hold ETH. However, note that gas fees are highly variable and are dependent on network activity on Ethereum. As Nansen data shows below, this has been decreasing over the course of the year.

*Note that the large spike due to the Otherdeeds land sale on May 1, 2022, was omitted for better readability of the chart.

Will stakers dump after The Merge?

The short answer is “no, they can’t”. Withdrawing ETH will only be possible after the Shanghai upgrade, scheduled around 6-12 months after The Merge.

Will stakers dump after the Shanghai upgrade then?

Even then, not everyone can withdraw their stake at once as there is an exit queue in place for validators similar to the activation queue of around 6 validators (usually 32 ETH each) per epoch (~6.4 mins). Everyone withdrawing their stake and exiting as a validator would currently take around 300 days with over 13m ETH staked. Validators can however withdraw the rewards above their 32 ETH required stake they earned until then, as this will not require the validator to exit completely.

What about the rewards?

Using Polygon as a comparison, most of the earned rewards are withdrawn. However, this is generally seen more with institutions rather than for the anonymous and private stakers and could be due to their internal processes of redistributing the rewards or for liquidity purposes (complete unstaking on Polygon can take ~3-4 days). Therefore, this is not a clear indication of selling but can definitely point towards it.

According to the data of the 15 top validators, accounting for ~80% of all staked MATIC, 85% of the earned rewards have been withdrawn:

| Operator | Stake (MATIC) | Withdrawn rewards (MATIC) | Received Rewards (MATIC) | % rewards withdrawn |

|---|---|---|---|---|

| Binance Node | 348,416,722 | 4,792,962 | 4,893,275 | 97.95% |

| Allnodes.com | 329,559,992 | 5,537,950 | 5,541,563 | 99.93% |

| Luganodes | 293,797,819 | 245,773 | 254,980 | 96.39% |

| Web3Nodes Validator | 226,552,666 | 644,356 | 2,757,717 | 23.37% |

| Vault Staking | 196,655,840 | 99,193 | 110,038 | 90.14% |

| Matic Fans | 150,628,007 | 1,072,150 | 1,306,608 | 82.06% |

| Anonymous 93 | 132,600,927 | 0 | 43,728 | 0.00% |

| Anonymous 91 | 122,805,624 | 220,412 | 622,770 | 35.39% |

| Anonymous 94 | 116,495,158 | 0 | 651,971 | 0.00% |

| Anonymous 92 | 116,101,628 | 0 | 42,940 | 0.00% |

| Staked | 115,334,197 | 241,728 | 252,017 | 95.92% |

| Figment | 100,109,937 | 11,198 | 117,493 | 9.53% |

| Stakin | 82,140,502 | 8,035,874 | 8,046,475 | 99.87% |

| Staking4all | 55,484,152 | 894,253 | 910,875 | 98.18% |

| DraftKings Node | 55,091,751 | 133,255 | 138,356 | 96.31% |

| Total | 2,441,774,921 | 21,929,105 | 25,690,805 | 85.36% |

Source: Polygon, as of September 9, 2022

But when ETH stakers can finally withdraw, will they dump?

To answer this question, let’s first set a number of assumptions:

- Most selling will occur from profit taking a) The market is at least stable, meaning no major de-risking is going on. b) The Shanghai upgrade was successful and Ethereum is in a good spot, the overall sentiment towards ETH as an asset is neutral to bullish.

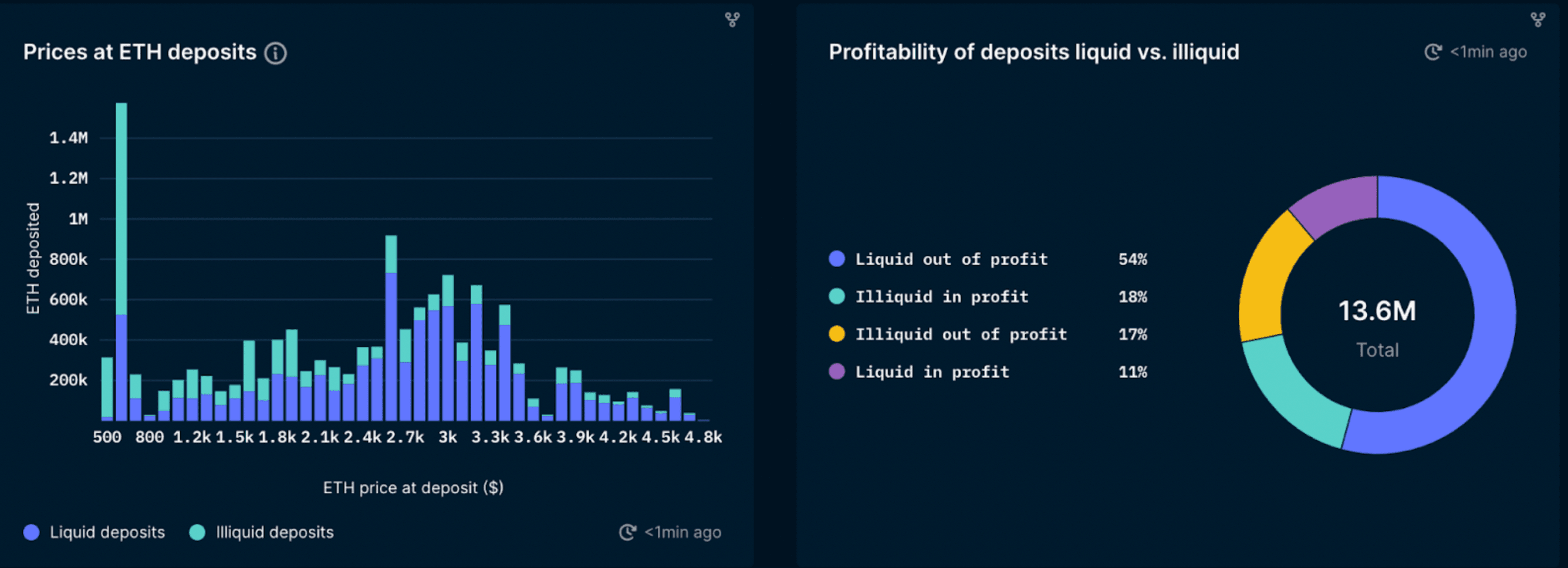

- Mostly illiquid stakers will unstake and sell, as liquid stakers could already get out of their position all along. a) Liquid stakers that want to sell are insensitive to the penalty they might incur by selling their liquid token at a slight discount (e.g. stETH currently trades at ~0.97 ETH). b) Assuming “unlabeled” addresses are illiquid (do not belong to a public project or entity and do not offer liquid staking). Following these assumptions, a deeper look into how much was staked at which prices and whether it was illiquid or liquid staking can give some insights and help us monitor the group that is most likely to sell - illiquid stakers that are in profit:

Looking at the very obvious part first, the data shows that a large amount of ETH was staked at around $600, from the earliest stakers in November and early December 2020 (this is the only time you could stake ETH at these prices). This cohort could be a group of early adopters and supporters of ETH2.0 (as it was called at the time) that proceeded to stake as soon as the Beacon Chain went live.

Unsurprisingly, the majority of these early staked ETH is illiquid as the services of the now established liquid staking providers were less known and it is likely that a number of the early stakers preferred to do so themselves. In addition, people might have been hesitant to stake with the big CEXs at this time, as most did not introduce liquid staking until much later, so staking meant locking your tokens for an undefined time period in the face of an upcoming bull market.

Consequently, when withdrawals are enabled following the Shanghai upgrade, the ETH which got staked at ~$600 would be in profit (should prices remain above this level). The approximately 1m locked ETH at this price level could be dripped into the market if they are withdrawn via the unlock queue. However, it should be noted that among these early stakers are strong Ethereum believers and may not necessarily wish to sell their stake (e.g. the likes of Vitalik).

Looking at the overall picture, however, most of the staked ETH (around 71%) is not in profit at current prices.

Only 18% of all staked ETH at present belongs to illiquid stakers that are in profit, the category most likely to sell once they are able to unstake.

Taking this number as well as the validator exit queue into account, even the Shanghai upgrade is unlikely to lead to a massive dump caused by stakers. Note, however, that this analysis is at current price levels and has to be adjusted accordingly closer to the actual date of the Shanghai upgrade.

So how are smart money segments handling this?

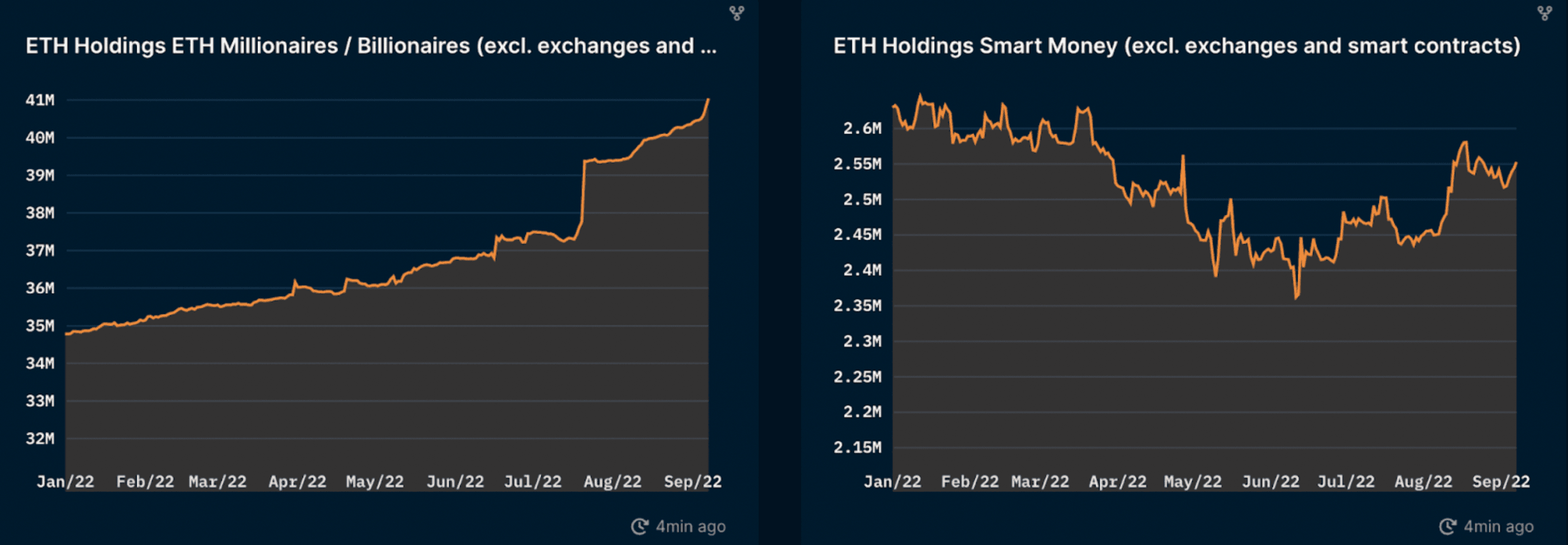

How are ETH Millionaires/Billionaires and Smart Money wallets handling this with respect to their ETH holdings?

Looking at Nansen’s tagged addresses, which are not labeled as exchanges or smart contracts, can give some insight into that.

Looking at the ETH holdings of ETH Millionaires and Billionaires, a clear trajectory is visible: up only.

- Overall, ETH Millionaires and Billionaires have consistently been stacking Ethereum since the beginning of this year, seemingly unphased by volatile markets.

Smart money on the other hand leaves a much more dynamic impression, clearly scaling partially in and out of the market depending on the prevalent conditions.

- Interestingly, Smart Money seems to be scaling in again after a low in early/mid-June.

Conclusion

- A relatively low proportion of ETH is currently staked. The risk of staking ETH will be reduced if The Merge is implemented as expected which may encourage further ETH staking. Withdrawals will not be enabled until the Shanghai upgrade in ~2023 meaning that staked ETH is up only until then and depending on market conditions there could be an additional bump after Merge Execution risks fall away.

- Contrary to what some may think, the Shanghai upgrade is arguably not likely to cause a major ETH sell-off. Firstly, the majority of staked ETH is out of profit. Secondly, ~65% of staked ETH is already liquid (liquid staking derivatives) which gives little incentive to redeem and sell ETH. Thirdly, illiquid staked ETH that is in profit (the cohort most likely to sell) only makes up 18% of total staked ETH. In addition, it will not unlock all at once and there will likely be a multi-week exit queue. Note that all these figures and corresponding assumptions may change by the time the Shanghai upgrade occurs.

- Decentralized liquid staking providers such as Lido and Rocket Pool will likely play a critical role in ensuring whether or not Ethereum can remain a decentralized, censorship-resistant, and open network. They were in part set up to avoid the outcome of the majority of staked ETH being controlled by centralized entities like CEXs (the top 3 CEXs own ~30% of total staked ETH). It will be essential for such entities to be sufficiently decentralized so as to remain censorship-resistant and thus ensure the integrity of the Ethereum network.

- The liquid staking market appears to be trending towards a “winner-takes-all” scenario. However, this outcome should not damage Ethereum’s core value proposition if the incumbent players are satisfactorily decentralized and properly aligned with the Ethereum community.

- Lido governance is relatively centralized at the time of writing. However, the community is aware of the risks that this poses and is actively seeking solutions. Initiatives include dual governance (to better align LDO and stETH holders), and a legally and physically distributed validator set.

- ETH whales have been consistently accumulating over the past few months. This makes sense as these addresses likely maintain a high ETH balance due to their high conviction in the project.

- Smart Money has been more actively trading ETH but has been steadily accumulating since June. This suggests that they are anticipating some positive price action around The Merge. ##