Disclaimer: Nansen has produced the following report as part of its existing contract for services provided to Avalanche (the "Customer") at the time of publication. While Avalanche has the right to review and provide feedback to Nansen, Nansen maintains full editorial control over the publication of this report. All views expressed are the independent opinions of Nansen's research analyst(s) who are the author(s) named in this report. This report is intended for informational purposes only and does not serve as investment, financial, professional, or other advice. For more information, please refer to the disclaimer at the end of this report, as well as our Terms of Service.

Overview

Avalanche continued its evolution in Q3 2025, demonstrating considerable growth across institutional adoption, global expansion, and real-world applications. The quarter was characterized by significant milestones in government integration, major financial institution partnerships, and substantial ecosystem development across DeFi, entertainment, and enterprise sectors.

The network's architecture, featuring its three-chain design and customizable Layer 1s, proved particularly well-suited for diverse use cases ranging from Wyoming's state-issued stablecoin to K-pop fan engagement platforms. This versatility, combined with Avalanche's speed, security, and scalability, positioned the platform as a preferred choice for both traditional institutions and innovative Web3 applications.

Key Developments: Q3 2025

Institutional Adoption

One of the most significant developments of Q3 2025 was Wyoming's official launch of the Frontier Stable Token (FRNT) on Avalanche, marking the first fully backed, state-issued stablecoin in the United States designed for real-world use. FRNT represents a breakthrough in programmable public finance, being fully backed by short-duration U.S. Treasuries and dollars with a 102% reserve requirement under state law.

This initiative demonstrates how governments can innovate beyond regulation, with Wyoming successfully transitioning from passing blockchain legislation to delivering on its promise. The state piloted real-time contractor payments using FRNT through Avalanche-native protocol Hashfire, reducing traditional 45-day timelines to just a few seconds, setting a new benchmark for public-sector payments.

Other highlights for Avalanche in Q3 include surpassing $1.2B in onchain and fund-related momentum. Key drivers included AVAX One, a $550M fund led by Scaramucci’s SkyBridge and Hivemind, and Avalanche Treasury Co., a $675M SPAC with $460M in projected assets and a $200M AVAX allocation. Additionally, Bitwise filed for an Avalanche ETF and launched a staking ETP on Xetra, while Grayscale submitted an S-1 to convert its Avalanche Trust into a Nasdaq-listed ETF.

Major Financial Institution Partnerships

SkyBridge Capital announced a landmark $300 million tokenization of its flagship hedge funds on Avalanche, partnering with Tokeny (acquired by Apex Group) to use the ERC-3643 standard. This collaboration represents a significant step forward in modernizing the alternative investment landscape, with SkyBridge's Digital Macro Master Fund Ltd and Legion Strategies Ltd being tokenized. The partnership demonstrates how traditional finance and blockchain can work together to create more efficient investment solutions with improved transparency and liquidity.

Grove Finance launched on Avalanche with a $250M+ target investment, partnering with Centrifuge's JAAA to accelerate institutional onchain credit. The platform provides infrastructure for tokenized credit markets, enabling institutions to access and trade credit instruments on blockchain with improved liquidity and transparency. Dinari also launched its financial network as a Layer 1 omni-chain orderbook powered by Avalanche, enabling tokenized stock trading and traditional financial instrument access on blockchain with regulatory compliance and institutional-grade security.

Ecosystem

DeFi

Avalanche's DeFi ecosystem entered a transformative stage in Q3 2025, with three new major integrations representing the network's evolution to providing a foundational monetary infrastructure for all applications. Ethena's synthetic dollar (USDe and sUSDe) brought delta-neutral stablecoin strategies to Avalanche. Pendle Finance's infrastructure allows for cross-chain sophisticated fixed and variable yield strategies directly on Avalanche. With over $6.8 billion in TVL, Pendle allows for a suite of sophisticated DeFi products for managing risk and returns. Much of this TVL can be reused throughout other apps to partake in looping strategies or simply for hedging risk. Further, PayPal USD (PYUSD0) is now accessible on Avalanche, providing payment-ready stablecoins with 140+ blockchain distribution, effectively bridging mainstream fintech with the optimized rails of blockchain technology.

The institutional financial services sector saw remarkable growth, with SkyBridge Capital's $300 million hedge fund tokenization leading the charge. Grove Finance's $250M+ target investment for institutional credit, Dinari's Layer 1 omni-chain orderbook for tokenized stocks, and Re's new reinsurance yield products all contributed to Avalanche's position as a premier platform for institutional blockchain adoption. These integrations collectively represent DeFi's progression toward foundational monetary infrastructure, with Avalanche's TVL more than doubling to over $2.2 billion, signaling growing adoption across lending, trading, and payments.

Wyoming's official launch of the Frontier Stable Token (FRNT) on Avalanche marked the first fully backed, state-issued stablecoin in the United States designed for real-world use. FRNT represents a breakthrough in programmable public finance, being fully backed by short-duration U.S. Treasuries and dollars with a 102% reserve requirement under state law. Through a partnership with Rain, users can spend FRNT anywhere Visa is accepted, making it the first production-ready government-issued digital asset integrated into everyday financial tools.

- Ethena

- Synthetic dollar (USDe and sUSDe) brought delta-neutral stablecoin strategies to Avalanche. The integration enables sophisticated yield strategies while bringing the fastest growing stablecoin to Avalanche users.

- Pendle Finance

- Cross-chain Principal Tokens enabled sophisticated fixed and variable yield strategies. Pendle secures over $6.8 billion in TVL and roughly half represented by PTs used as collateral, which opens up a large growth opportunity for Avalanche’s DeFi activity to expand further upon these blue chip apps. This integration allows users to separate yield from underlying assets, creating new opportunities for yield trading and risk management while providing institutional-grade yield optimization tools.

- Blackhole - Is a DEX that launched in Q3 and is already a top 5 protocol by TVL with $185M and generated the most revenue of all protocols on Avalanche during Q3 with $9.9M.

- PayPal USD (PYUSD)

- Payment-ready stablecoins with 140+ blockchain distribution, effectively bridging mainstream fintech with blockchain technology. The integration represents a major milestone in mainstream adoption, enabling PayPal's 400+ million users to access blockchain-based payments and DeFi services through familiar interfaces and trusted infrastructure.

- SkyBridge Capital

- $300 million hedge fund tokenization using the ERC-3643 standard representing a major milestone in modernizing the alternative investment landscape.

- Grove Finance

- $250M+ target investment for institutional credit, partnering with Centrifuge's JAAA to accelerate institutional onchain credit. The platform provides infrastructure for tokenized credit markets, enabling institutions to access and trade credit instruments on blockchain with improved liquidity, transparency, and reduced counterparty risk through smart contract automation.

- Dinari

- Layer 1 omni-chain orderbook for tokenized stocks, enabling traditional financial instrument access on blockchain with regulatory compliance. The platform bridges traditional finance with DeFi, allowing users to trade tokenized stocks and traditional financial instruments with institutional-grade security, regulatory compliance, and 24/7 market access.

- Inversion - An upcoming institutional L1, it raised a $26.5m seed round in September. Private equity firm working on a new way for crypto distribution by acquiring web3 businesses like telecoms and neobanks and integrating blockchain and DePIN rails to bring more efficiency.

- Kite AI - Another L1 which raised $33m Series A co-led by PayPal and General Catalyst (AI agents and payments). It allows developers to create modular AI ecosystems with tailored incentives for contributors, including data providers, model builders, and agents.

- Re

- Reinsurance yield products expanding institutional DeFi offerings by providing insurance-backed yield opportunities. This integration brings traditional insurance products to the blockchain, creating new yield-generating opportunities while maintaining the security and reliability of established insurance infrastructure.

- Wyoming Frontier Stable Token (FRNT)

- Official launch marked the first fully backed, state-issued stablecoin in the United States designed for real-world use, fully backed by short-duration U.S. Treasuries and dollars with a 102% reserve requirement under state law. This represents a breakthrough in programmable public finance, demonstrating government-level blockchain adoption and creating a template for other states and nations.

- Rain Partnership

- FRNT Visa integration enables users to spend FRNT anywhere Visa is accepted. This integration bridges the gap with traditional payment systems, enabling seamless real-world usage of state-issued digital currencies.

NFTs and Gaming

The entertainment and consumer sectors continued to expand in Q3 2025, with Avalanche becoming the foundation for fan engagement, gaming, and digital ticketing. From NBA loyalty programs to major festivals, platforms increasingly turned to Avalanche to deliver secure, programmable, and scalable experiences.

- TITAN Content

- Built on TITAN, a custom Avalanche L1 developed with AvaCloud, 2GATHR enables fans to complete missions, unlock exclusive content, and collect digital items tied to artists like AtHeart. Studios can set supply, attach perks, and manage secondary-market behavior through a simple interface. The platform highlights Avalanche’s role in powering entertainment and consumer apps, combining cultural engagement with blockchain-based ownership.

- Uptop

- Extended its NBA loyalty program to the Detroit Pistons, bringing blockchain-based fan engagement and rewards to another team. It leverages Avalanche for digital collectibles, loyalty points, and interactive experiences that deepen fan relationships and demonstrate scalable real-world adoption of blockchain in sports entertainment. Further, Uptop also advanced into collegiate sports by partnering with LSU.

- Tixbase

- Partnered with Avalanche to deliver secure, digital-first ticketing for Copa América de Béisbol 2025, setting a precedent for blockchain-based ticketing in sports. The system introduces better security, fraud protection, and programmable resale and entry rules, demonstrating Avalanche’s utility in large-scale event operations.

- EXIT Festival

- Partnered with Tixbase to bring festival ticketing and secondary-market infrastructure onchain using Avalanche. This integration marks a step toward digitizing live entertainment, creating secure, transparent ticket sales and fraud-resistant entry systems while enabling new fan engagement models.

- ULTRA KOREA

- Integrated USDT and USDC payments with onchain invitation tickets, unifying checkout and access in one wallet. The setup enhances event management efficiency while ensuring fraud protection and programmable resale conditions, showcasing Avalanche’s advantages for high-volume event operations.

- Avalanche and Helika Gaming Accelerator

- New gaming accelerator program supporting blockchain gaming projects with funding, mentorship, and technical support for gaming developers building on Avalanche. The accelerator represents a significant commitment to growing the gaming ecosystem on Avalanche, providing comprehensive support for developers to create innovative blockchain-based gaming experiences and sustainable gaming economies.

- Bowmore

- Limited edition tokenized whisky bottles combining physical luxury goods with digital ownership, enabling provenance tracking, fractional ownership, and new forms of collectible trading. This integration demonstrates how blockchain technology can enhance luxury goods by providing immutable provenance records, enabling fractional ownership of high-value items, and creating new markets for collectible trading while maintaining the authenticity and value of physical products.

- FIFA launched its NFT-based Right To Buy (RTB) ticketing for the 2025 World Cup through its official digital collectibles platform powered by Avalanche.

Enterprise and RWAs

Avalanche's global enterprise expansion reached new heights in Q3 2025, with particularly strong growth in Asian markets. South Korea emerged as a key market, with Mirae Asset Global Investments ($316B AUM) signing a Memorandum of Understanding with Ava Labs to explore tokenized funds on Avalanche. The country's stablecoin market shifted from concept to real infrastructure, with KRW1 by BDACS and Woori Bank creating a won-backed stablecoin fully collateralized with escrowed KRW at bank level, INEX piloting onchain merchant settlement, and Danal Fintech developing regulatory compliant stablecoin solutions.

Japan's market development focused on bridging traditional business practices with innovative blockchain technology, with Avalanche's architecture aligning well with Japan's approach to technology adoption and financial innovation. The expansion included partnerships with Japanese companies and regulatory developments that positioned Avalanche as a preferred platform for Japanese enterprise adoption.

The institutional tokenization sector saw remarkable activity, with SkyBridge Capital's $300 million hedge fund tokenization using the ERC-3643 standard representing a major milestone in modernizing the alternative investment landscape. Grove Finance's institutional onchain credit platform, Dinari's tokenized stock trading infrastructure, and Re's reinsurance yield products all contributed to Avalanche's growing reputation as a premier platform for institutional blockchain adoption.

Real-world asset infrastructure received significant attention through WeBlock's partnership to co-develop Korea-focused RWA infrastructure on Avalanche, with a stablecoin pilot scheduled for late 2025 and the launch of South Korea's first Avalanche-based RWA product planned for 2026. NHN Cloud's integration provided finance-grade validator infrastructure, making it simple for banks, securities firms, and government agencies to participate in Avalanche networks with predictable cost and full compliance documentation. RWA asset value 4x'd Q/Q, now at $743M, making Avalanche a top 5 chain by RWA asset value

- Mirae Asset Global Investments

- $316B AUM Memorandum of Understanding with Ava Labs to explore tokenized funds on Avalanche, establishing South Korea as a key market for institutional blockchain adoption. This partnership represents one of the largest traditional financial institutions exploring blockchain technology, potentially unlocking significant institutional capital and creating new pathways for traditional finance to access blockchain-based investment opportunities.

- KRW1 by BDACS and Woori Bank

- Won-backed stablecoin fully collateralized with escrowed KRW at bank level, shifting South Korea's stablecoin market from concept to real infrastructure. This development represents a major milestone in South Korea's digital currency evolution, providing a government-backed digital currency alternative while maintaining traditional banking security and regulatory compliance.

- INEX

- Onchain merchant settlement pilot contributing to South Korea's stablecoin infrastructure development by enabling real-world merchant adoption of blockchain-based payments. This pilot program demonstrates the practical applications of blockchain technology in everyday commerce, creating a foundation for broader merchant adoption and consumer usage of digital currencies.

- Danal Fintech

- Regulatory compliant stablecoin solutions development for the Korean market, focusing on creating infrastructure that meets local regulatory requirements while enabling innovative financial services. This development ensures that blockchain-based financial services can operate within South Korea's regulatory framework, facilitating broader adoption and integration with traditional financial systems.

- Japan Market Development

- Traditional business integration with innovative blockchain technology, positioning Avalanche as a preferred platform for Japanese enterprise adoption. This expansion leverages Japan's strong technology adoption culture and regulatory clarity to create new opportunities for blockchain integration in traditional business processes and financial services. JPYC approved to issue Japan’s first yen stablecoin ($6.8B over 3 years), exploring nationwide issuance and settlement.

- WeBlock Partnership

- Korea-focused RWA infrastructure co-development with stablecoin pilot scheduled for late 2025 and South Korea's first Avalanche-based RWA product planned for 2026. This partnership represents a comprehensive approach to real-world asset tokenization, creating infrastructure for tokenizing traditional assets while maintaining regulatory compliance and institutional-grade security standards.

- NHN Cloud Integration

- Finance-grade validator infrastructure making it simple for banks, securities firms, and government agencies to participate in Avalanche networks with predictable cost and full compliance documentation. This integration provides enterprise-grade infrastructure for traditional financial institutions to participate in blockchain networks while maintaining the security, compliance, and operational standards required by regulated financial services.

Infrastructure and Development

Avalanche's infrastructure and development ecosystem experienced substantial growth in Q3 2025, with significant investments in validator services, security enhancements, and development tools. Suzaku raised $1.5 million to scale Avalanche Layer 1 decentralization by providing validator infrastructure and security services, helping expand validator operations, improve network security, and support the growth of Avalanche L1s through professional validator services and infrastructure development.

Security enhancements received considerable attention through Octane's integration with Avalanche to provide embedded security features in every build process. The integration enables developers to automatically include security checks, vulnerability scanning, and compliance verification as part of their development workflow on Avalanche, significantly improving the security posture of applications built on the network.

On the Layer 1 front, Avalanche saw considerable growth in 2025, driven by the Avalanche9000 initiative. The network now supports 80 active, interconnected L1s secured by 834 validators. A total of 83 new chains have launched year-to-date, already three times the total for 2024, with a full quarter remaining. In Q3 alone, 30 new chains went live, exceeding last year’s total, while 18 L1s reached all-time highs in transaction activity. Interchain messaging (ICM) volume surged 20x from Q1 to Q3, hitting 515,000 messages, the highest quarterly level on record (+38% quarter-over-quarter).

New L1 launches spanned several verticals: Institutional (Dinari, DComm, Hashfire, Watr), Consumer/Sports (Tixbase, PandaSea), Gaming (Artery, Blast, Bloodloop, Warp), and Infrastructure (Particle Network).

Development tools and infrastructure saw major improvements through Particle Network's launch of its custom Avalanche L1, bringing advanced account abstraction and user experience improvements to the Avalanche ecosystem. The integration enables seamless onboarding, gasless transactions, and enhanced developer tools for building consumer-friendly blockchain applications. Akave's sovereign data infrastructure provides decentralized data storage and management solutions, enabling data sovereignty, privacy, and control for users and organizations.

AI and emerging technology received significant attention through Youmio's selection of Avalanche to launch the first Layer 1 chain specifically designed for AI agents. The integration enables AI agents to interact with blockchain infrastructure, execute transactions, and participate in decentralized networks, opening new possibilities for AI-powered blockchain applications.

The Avalanche Foundation announced the second cohort of Retro9000, a retroactive grant program that recognizes teams building Avalanche L1s and infrastructure tooling live on mainnet. The program awards grants from a $40 million pool to projects that have already delivered impact, with over $250,000 in total funding for the second cohort. Governance and leadership received a boost through the appointment of Lord Chris Holmes, a UK blockchain advocate and former Paralympic swimmer, to the Avalanche Foundation board, strengthening Avalanche's presence in the UK and European markets.

- Suzaku

- $1.5 million funding to scale Avalanche Layer 1 decentralization by providing validator infrastructure and security services, helping expand validator operations and improve network security. This investment represents a commitment to network decentralization and security, providing professional-grade validator services that enhance network resilience and support the growth of Avalanche L1s through comprehensive infrastructure development.

- Octane

- Embedded security features integration with Avalanche to provide security checks, vulnerability scanning, and compliance verification as part of the development workflow. This integration significantly improves the security posture of applications built on Avalanche by automatically including security best practices in every build process, reducing vulnerabilities and ensuring compliance with security standards.

- Particle Network

- Custom Avalanche L1 launch bringing advanced account abstraction and user experience improvements, enabling seamless onboarding, gasless transactions, and enhanced developer tools. This integration represents a major advancement in blockchain user experience, making blockchain technology more accessible to mainstream users while providing developers with powerful tools for building consumer-friendly applications.

- Akave

- Sovereign data infrastructure providing decentralized data storage and management solutions, enabling data sovereignty, privacy, and control for users and organizations. This infrastructure addresses critical needs for data privacy and sovereignty in the blockchain ecosystem, providing secure, decentralized alternatives to traditional cloud storage while maintaining user control over their data.

- Youmio

- First Layer 1 chain specifically designed for AI agents to interact with blockchain infrastructure, execute transactions, and participate in decentralized networks. This groundbreaking development opens new possibilities for AI-powered blockchain applications, enabling autonomous agents to participate in decentralized economies and creating new use cases for AI and blockchain integration.

- Avalanche Foundation Retro9000

- Second cohort announcement of retroactive grant program recognizing teams building Avalanche L1s and infrastructure tooling live on mainnet, with grants from a $40 million pool and over $250,000 in total funding. This program demonstrates the Foundation's commitment to supporting ecosystem development by rewarding teams that have already delivered impact, encouraging continued innovation and development within the Avalanche ecosystem.

- Lord Chris Holmes

- Avalanche Foundation board appointment of UK blockchain advocate and former Paralympic swimmer, strengthening Avalanche's presence in the UK and European markets. This appointment brings valuable expertise in blockchain advocacy and international relations, helping to expand Avalanche's reach in European markets while leveraging Holmes' experience in technology adoption and regulatory engagement.

Onchain Data

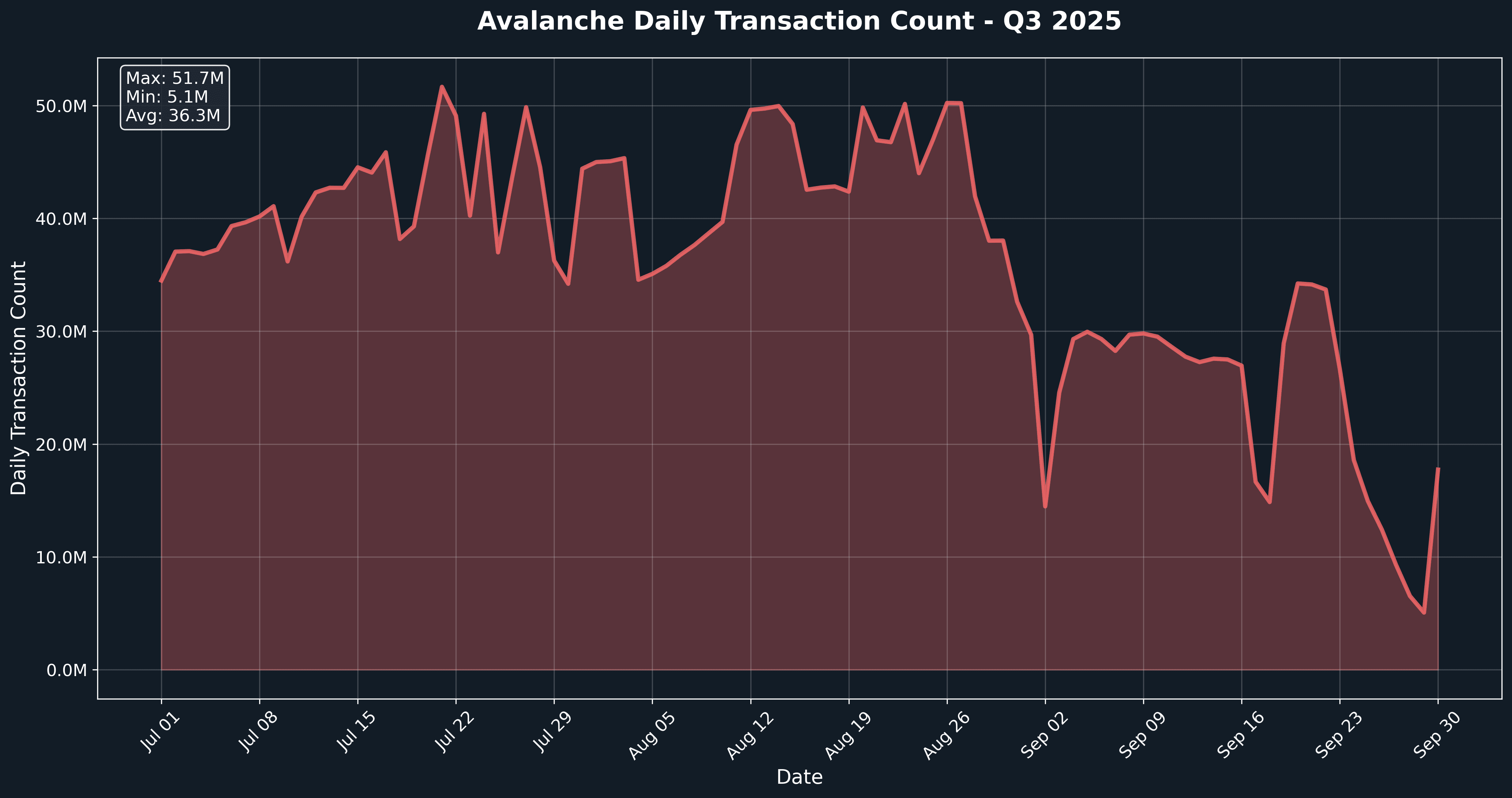

Daily Transactions

Avalanche demonstrated robust transactional throughput across Q3 2025, with daily transaction counts consistently exceeding 1 million transactions per day throughout the quarter. The network maintained strong activity levels with peak daily transactions reaching over 51.6m million, reflecting sustained protocol usage and growing dApp engagement. Transaction volumes showed resilience and consistency, with clear patterns of sustained activity across July, August, and September, signaling growing participation from users and developers as more applications go live and infrastructure matures.

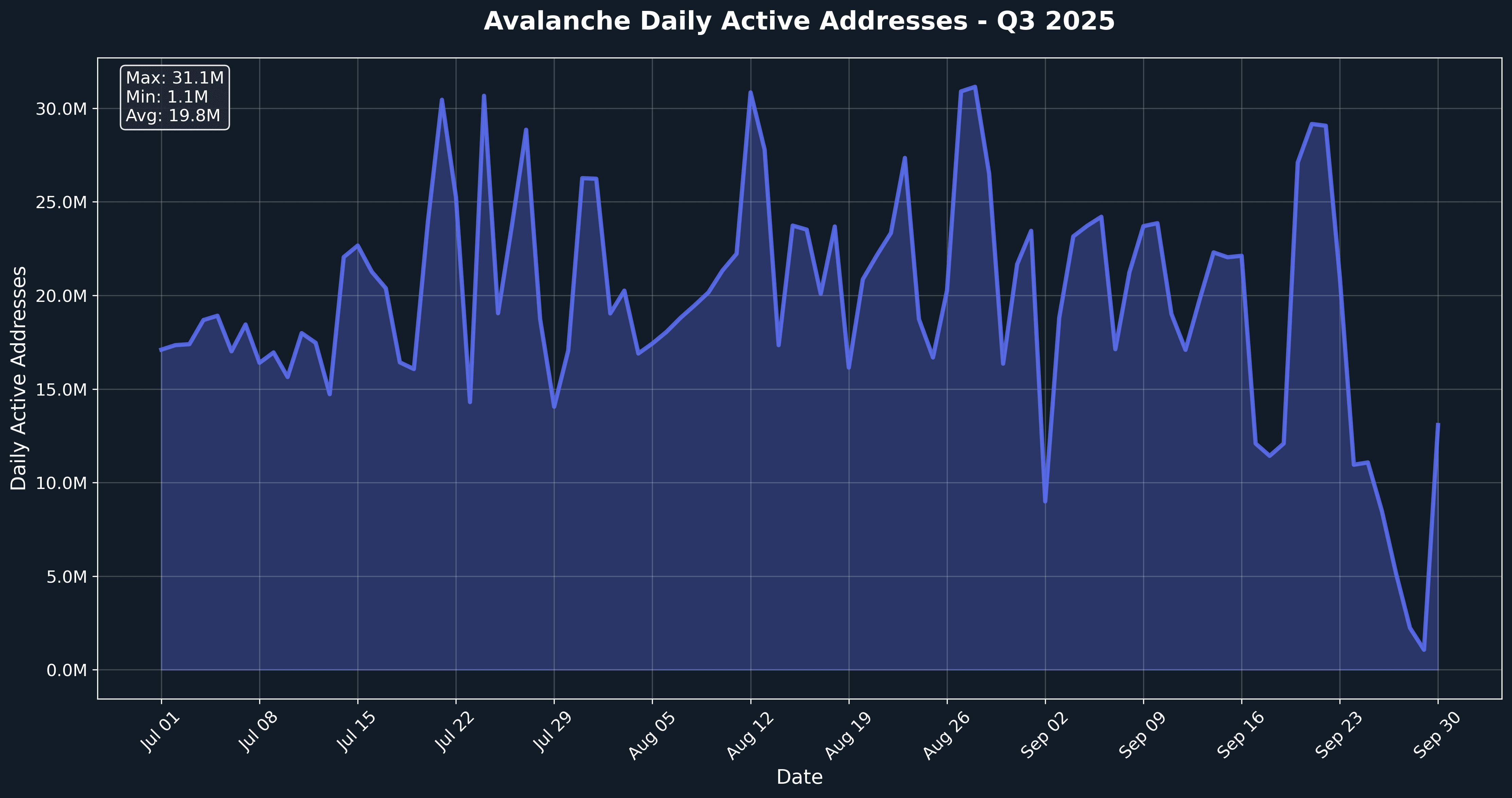

Avalanche maintained a consistent base of active addresses throughout Q3 2025, with daily active addresses ranging from approximately 1,100,000 to over 31,000,000 active addresses per day. The network demonstrated steady user engagement with periodic spikes reflecting sustained ecosystem activity and protocol launches. Activity trends remained strong through the quarter, with noticeable patterns of user adoption and retention.

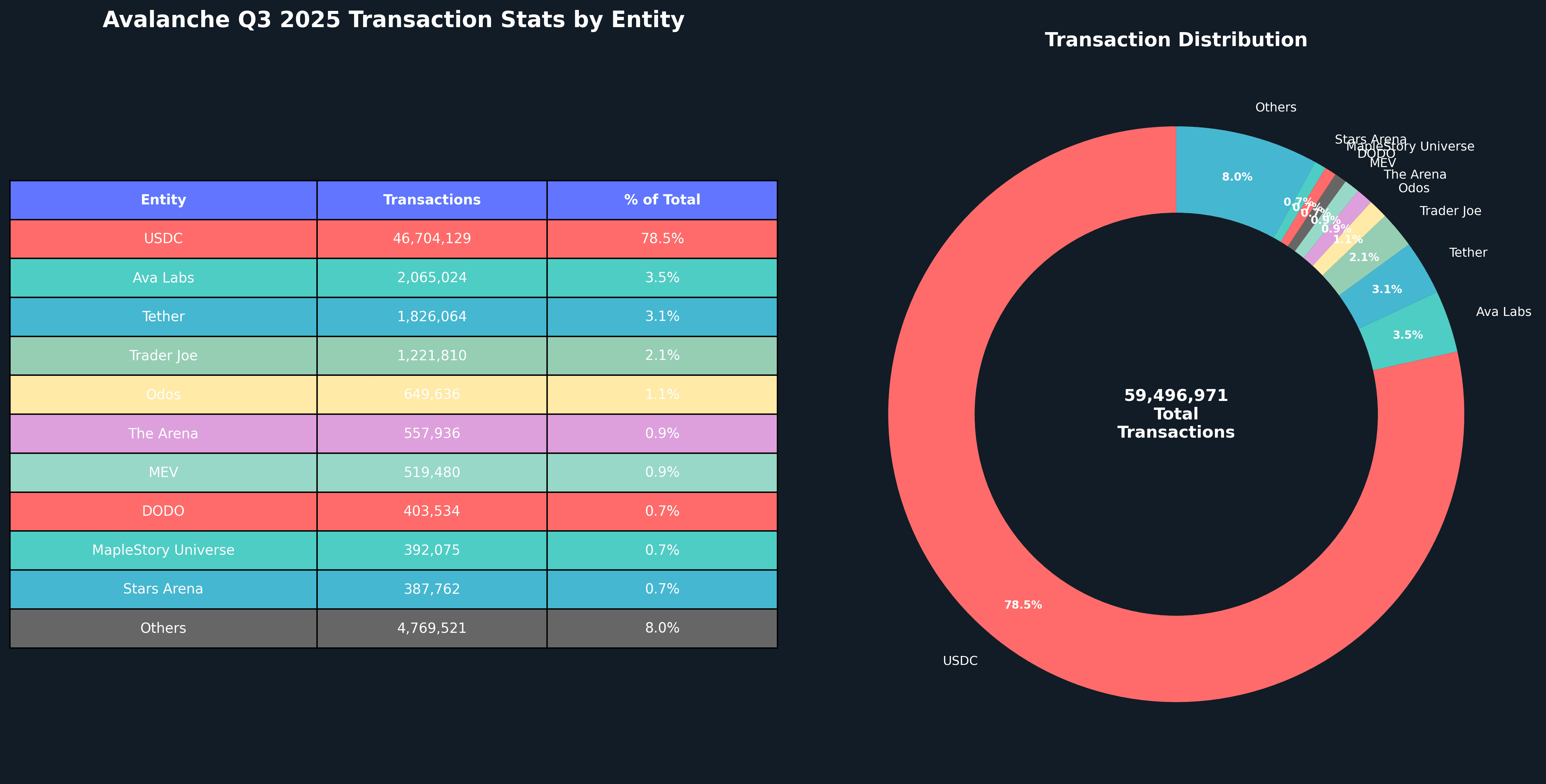

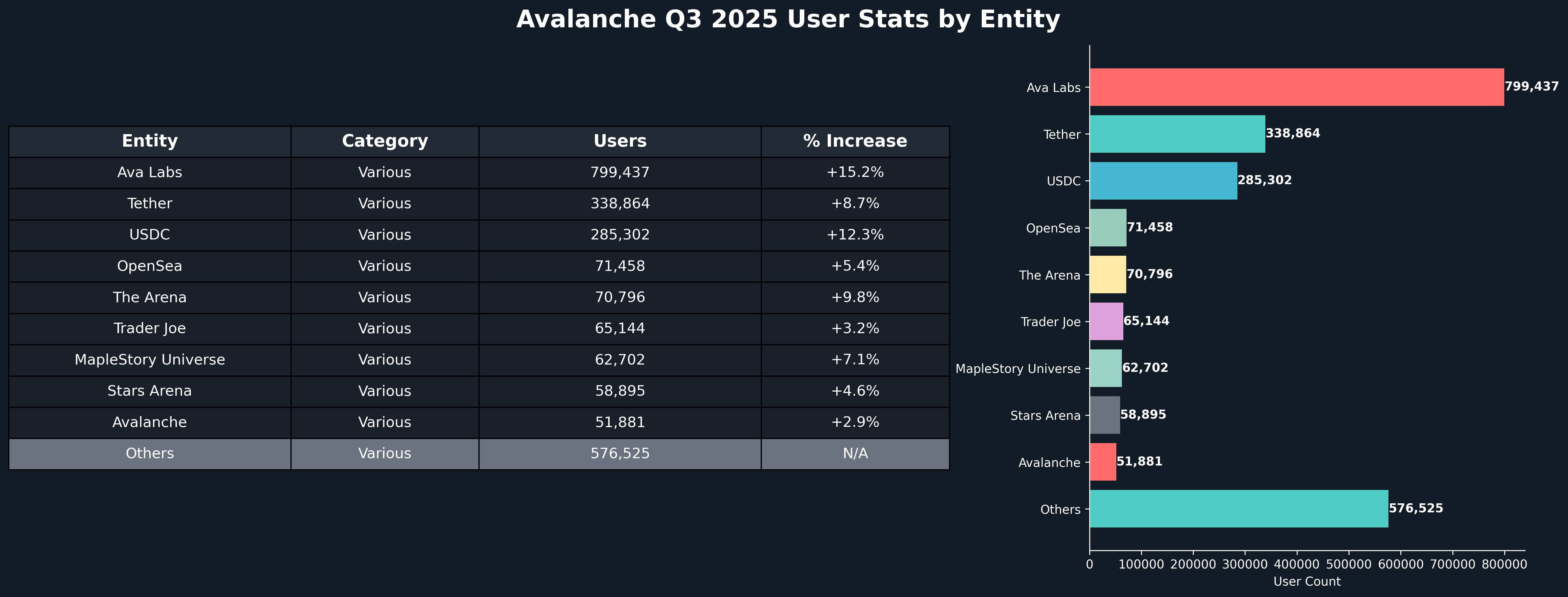

Top Entities by Users and Transactions on Avalanche C-Chain

Avalanche C-Chain’s top entities by users and transactions highlight a well-rounded ecosystem anchored by stablecoin infrastructure, DeFi protocols, and cross-chain interoperability. USDC led across both dimensions, accounting for 46.7 million transactions and 285,302 unique users, reflecting deep integration of stablecoin infrastructure within the ecosystem. Ava Labs operations secured second place with 2.1 million transactions and 799,437 users, demonstrating strong native protocol engagement. Tether followed with 1.8 million transactions and 338,864 users, while Trader Joe's DEX captured 1.2 million transactions and 65,144 users, showcasing significant DEX volumes to complement the growing demand for stablecoins.

The distribution reinforces Avalanche's growing utility across DeFi, stablecoin infrastructure, and cross-chain operations, with prominent entities like Odos (649K transactions), The Arena (558K transactions), and MapleStory Universe (392K transactions) representing diverse use cases from DeFi aggregation to gaming and social platforms. This ecosystem diversity positions Avalanche as a versatile platform supporting multiple sectors within the blockchain economy.

Closing Thoughts

As Q3 2025 comes to a close, Avalanche stands out as a leading force in blockchain adoption, demonstrating exceptional growth across institutional integration, global expansion, and real-world applications. From Wyoming's groundbreaking state-issued stablecoin to SkyBridge Capital's $300 million tokenization initiative, the network is proving its ability to serve both traditional institutions and innovative Web3 applications without compromising performance.

The combination of major financial integrations, global expansion into Asian markets, and entertainment applications positions Avalanche as a premier platform for mainstream blockchain adoption. The ecosystem's growth across DeFi, NFTs and Gaming, Enterprise and RWAs, and Infrastructure development showcases Avalanche's versatility and readiness for diverse use cases and industries.

With its vibrant ecosystem, growing institutional adoption, and expanding global footprint, Avalanche is not just enabling the next wave of decentralized innovation - it's shaping the future of mainstream blockchain adoption across finance, entertainment, and enterprise sectors.